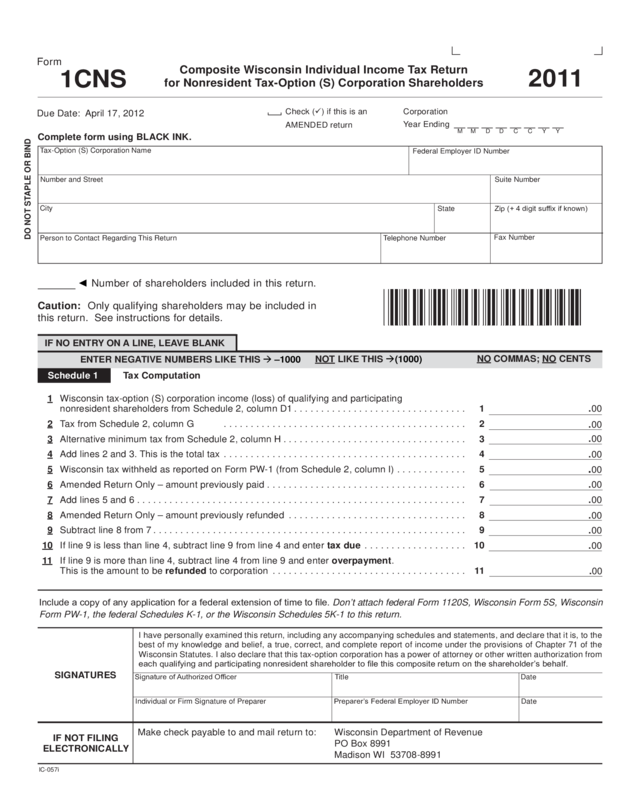

Fillable Printable 2011 Form 1Cns - Wisconsin Department Of Revenue

Fillable Printable 2011 Form 1Cns - Wisconsin Department Of Revenue

2011 Form 1Cns - Wisconsin Department Of Revenue

2011

Composite Wisconsin Individual Income Tax Return

for Nonresident Tax-Option (S) Corporation Shareholders

Form

1CNS

IF NOT FILING

ELECTRONICALLY

Make check payable to and mail return to: Wisconsin Department of Revenue

PO Box 8991

Madison WI 53708-8991

Due Date: April 17, 2012

Corporation

Year Ending

Y C C D D Y M M

Check (ü) if this is an

AMENDED return

SIGNATURES

I have personally examined this return, including any accompanying schedules and statements, and declare that it is, to the

best of my knowledge and belief, a true, correct, and complete report of income under the provisions of Chapter 71 of the

Wisconsin Statutes. I also declare that this tax-option corporation has a power of attorney or other written authorization from

each qualifying and participating nonresident shareholder to le this composite return on the shareholder’s behalf.

Signature of Authorized Ofcer

Title

Date

Individual or Firm Signature of PreparerPreparer’s Federal Employer ID NumberDate

DO NOT STAPLE OR BIND

Tax-Option (S) Corporation Name

Number and Street

City

Telephone Number

Fax Number

Zip (+ 4 digit sufx if known)

Person to Contact Regarding This Return

Complete form using BLACK INK.

State

Suite Number

Federal Employer ID Number

IC-057i

Caution: Only qualifying shareholders may be included in

this return. See instructions for details.

◄Number of shareholders included in this return.

Schedule 1Tax Computation

NOT LIKE THIS (1000)

ENTER NEGATIVE NUMBERS LIKE THIS

–1000

IF NO ENTRY ON A LINE, LEAVE BLANK

Include a copy of any application for a federal extension of time to le. Don’t attach federal Form 1120S, Wisconsin Form 5S, Wisconsin

Form PW-1, the federal Schedules K-1, or the Wisconsin Schedules 5K-1 to this return.

1Wisconsin tax-option (S) corporation income (loss) of qualifying and participating

nonresident shareholders from Schedule 2, column D1................................1

2Tax from Schedule 2, column G .............................................2

3Alternative minimum tax from Schedule 2, column H..................................3

4Add lines 2 and 3. This is the total tax .............................................4

5Wisconsin tax withheld as reported on Form PW-1 (from Schedule 2, column I) .............5

6 Amended Return Only – amount previously paid..................................... 6

7 Add lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Amended Return Only – amount previously refunded ................................. 8

9 Subtract line 8 from 7.......................................................... 9

10If line 9 is less than line 4, subtract line 9 from line 4 and enter tax due...................10

11

If line 9 is more than line 4, subtract line 4 from line 9 and enter overpayment.

This is the amount to be refunded to corporation ....................................11

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

NO COMMAS; NO CENTS

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or press Enter.

Save

Print

Clear

Go to Page 2

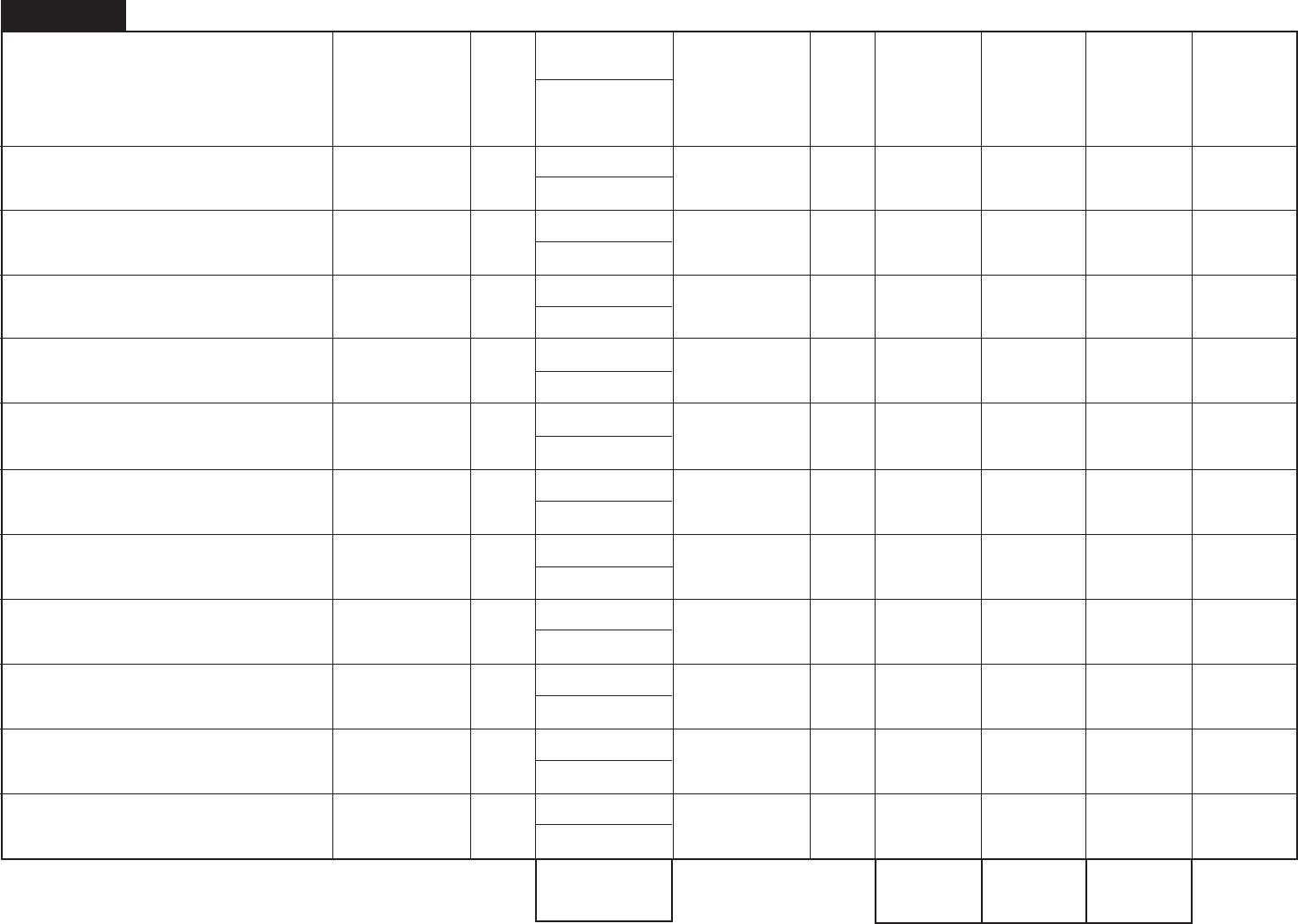

2011 Form 1CNS Page 2

a.

b.

c.

d.

e.

f.

g.

h.

i.

j.

k.

(A)

Name and Address of

Nonresident Shareholder (and Spouse

if Married Filing Jointly)

(B)

Social

Security

Number

(C)

Pro

Rata

Share

(%)

(D1) Shareholder’s

Share of WI Net

Income (Loss)

(J)

Balance

Due

(Overpay-

ment)

(H)

Alternative

Minimum

Tax

(G)

Tax From

Worksheet

or 7.75% of

(D1)

(F)

Filing

Status

(S, H,

MFJ,

MFS)

(E)

Federal

Adjusted

Gross

Income From

Form 1040

TOTALS (enter on appropriate line on Schedule 1) ..........

Schedule 2Nonresident Shareholders Qualifying and Participating in Composite Return (Attach a separate schedule, if necessary.)

D1

D2

D1

D2

D1

D2

D1

D2

D1

D2

D1

D2

D1

D2

D1

D2

D1

D2

D1

D2

D1

D2

D1 total only

(D2) Shareholder’s

Share of WI Gross

Income (from Sch.

5K-1, line 19)

(I)

Tax

Withheld

from

Form PW-1

Return to Page 1