Fillable Printable 2011 Form 4H - Wisconsin Department Of Revenue

Fillable Printable 2011 Form 4H - Wisconsin Department Of Revenue

2011 Form 4H - Wisconsin Department Of Revenue

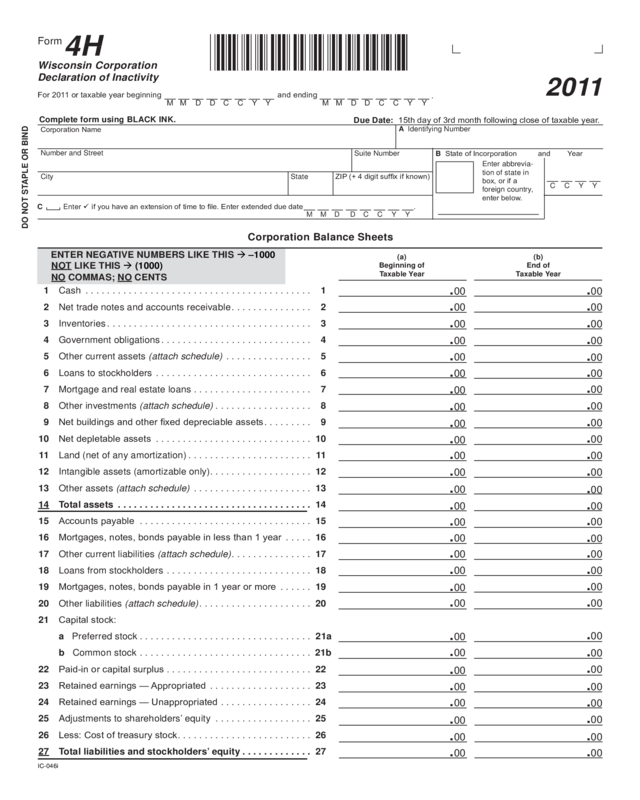

Corporation Balance Sheets

2011

4H

Wisconsin Corporation

Declaration of Inactivity

Form

1 Cash ..........................................1

2Net trade notes and accounts receivable ...............2

3 Inventories ...................................... 3

4Government obligations ............................4

5Other current assets (attach schedule) ................5

6Loans to stockholders .............................6

7Mortgage and real estate loans ......................7

8Other investments (attach schedule) ..................8

9Netbuildingsandotherxeddepreciableassets .........9

10Netdepletableassets .............................10

11Land (net of any amortization) .......................11

12Intangible assets (amortizable only). . . . . . . . . . . . . . . . . . .12

13Other assets (attach schedule) ......................13

14Total assets ....................................14

15Accountspayable ................................15

16Mortgages,notes,bondspayableinlessthan1year .....16

17Other current liabilities (attach schedule) ...............17

18Loans from stockholders ...........................18

19Mortgages,notes,bondspayablein1yearormore ......19

20Other liabilities (attach schedule) .....................20

21Capitalstock:

a Preferred stock ................................21a

b Common stock ................................ 21b

22Paid-inorcapitalsurplus ...........................22

23Retainedearnings—Appropriated ...................23

24Retainedearnings—Unappropriated .................24

25Adjustments to shareholders’ equity ..................25

26Less:Costoftreasurystock .........................26

27Total liabilities and stockholders’ equity .............27

(a)

Beginning of

Taxable Year

(b)

End of

Taxable Year

IC-046i

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

DO NOT STAPLE OR BIND

NO COMMAS; NO CENTS

ENTER NEGATIVE NUMBERS LIKE THIS

–1000

NOT LIKE THIS(1000)

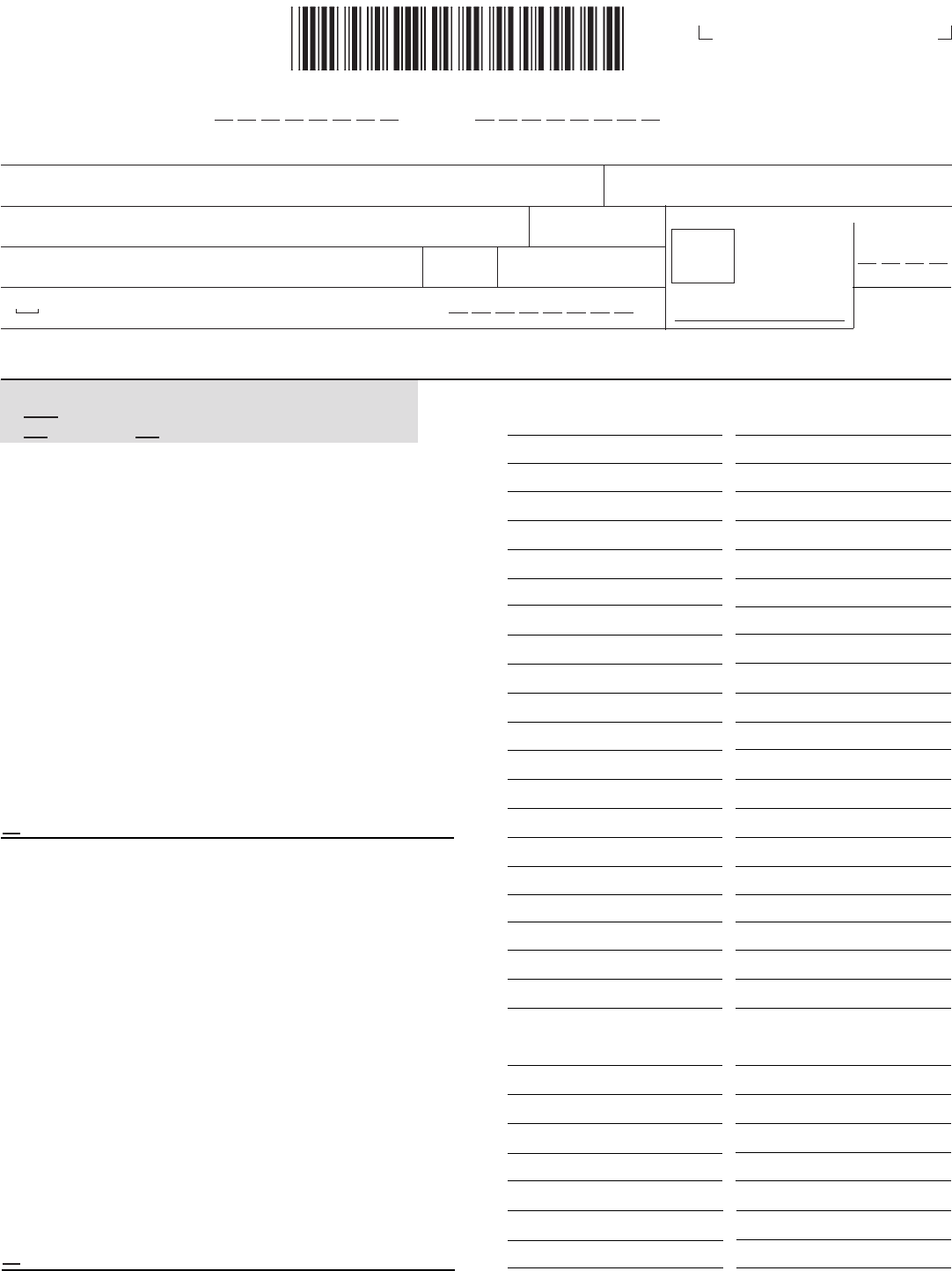

For2011ortaxableyearbeginningandending

MY Y C C MY Y C C

.

MDDMDD

Complete form using BLACK INK.

CorporationName

Number and Street

City State

Due Date: 15thdayof3rdmonthfollowingcloseoftaxableyear.

BStateofIncorporationandYear

AIdentifying Number

C Enter ifyouhaveanextensionoftimetole.Enterextendedduedate.

M D M D Y C C Y

Enter abbrevia-

tion of state in

box,orifa

foreign country,

enterbelow.

ZIP(+4digitsufxifknown)

Y C C Y

Suite Number

Instructions

Tab to navigate within form. Use mouse to check

applicable boxes, press spacebar or press Enter.

Save

Print

Clear

Go to Page 2

28Persontocontactconcerningthisreturn:Name

Telephonenumber()Faxnumber()

General Instructions

Purpose of Form 4H

Acorporationthathasbeencompletelyinactiveboth

in and outside Wisconsin

foranentiretaxable

yearmayleForm4Hinsteadoflingacorporate

franchiseorincometaxreturn.Ifthecorporationisa

combinedgroupmember,itmayleForm4Hinstead

of being included in the combined return. Thereafter,

thecorporationneednotleacorporatefranchiseor

incometaxreturn,beincludedinacombinedreturn,or

leForm4Hforanysubsequentyearunlessrequested

todosobytheDepartmentofRevenueorunless,

inasubsequentyear,thecorporationisactivatedor

reactivated.

Note:BylingForm4H,acorporationisrelievedofthe

requirementtoleanannualfranchiseorincometax

returnwiththeDepartmentofRevenue.Thisexemption

does not extendtoreportsrequiredbyotheragencies.

Inorderforthecorporationtocontinueingoodstanding,

itmustcontinuetoleaWisconsinCorporationAnnual

ReporteachyearwiththeCorporationsBureau,

DivisionofCorporateandConsumerServices,

WisconsinDepartmentofFinancialInstitutions.Failure

tolethisreportwithinaspeciedperiodoftimemay

subjectthecorporationtoadministrativedissolution.

Who May Not File Form 4H

Acorporationmustleacorporatefranchiseorincome

taxreturninsteadofForm4Hineitherofthefollowing

cases:

•Thecorporation’sbalancesheetfortheendofthe

taxableyeardiffersfromitsbalancesheetforthe

beginningofthetaxableyear.

•Thecorporationliquidatesduringthetaxableyear.

Instructions for 2011 Form 4H

When to File

FileForm4Honorbeforethe15thdayofthethirdmonth

followingthecloseofthetaxableyear.Anyextensionof

timeallowedbyeithertheInternalRevenueServiceor

theDepartmentofRevenuetoleyourreturnextends

theduedateforlingForm4H,providedyoucheckline

C,entertheextendedduedate,andattachacopyof

yourextensiontoForm4H.IfForm4Hisnotledon

orbeforetheduedateorextendedduedate,a$150

latelingfeeapplies.

Specic Instructions

Identifying Number

Entereitherofthefollowing:federalemployer

identicationnumber(EIN)orWisconsintaxnumber

(WTN).AfederalEINisnotrequiredtolethisformif

youhaveaWTN.

Balance Sheets

Completethebalancesheetsfortherstdayandlast

dayofthetaxableyearindicatedatthetopofForm4H.

Ifthecorporationhadnoassetsorliabilitiesandcapital

oneithertherstdayorthelastdayofthetaxableyear,

enterzero(0)online14andonline27.

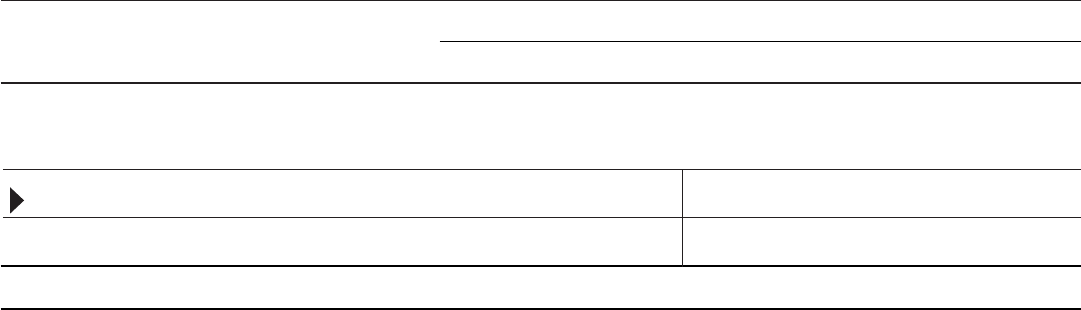

Signature on Form 4H

ThecorporationpresidentmustsignForm4Hifthe

presidentisaresidentofWisconsin.Otherwise,another

ofcerwhoisaWisconsinresidentshouldsignForm

4H.IfnoneoftheofcersareresidentsofWisconsin,

Form4Hmaybesignedbyanydulyauthorizedofcer.

I,theundersignedauthorizedofcer,declarethattheabovenamedcorporationhashadnoincomeorexpenseandhasbeencompletely

inactivefortheentiretaxableyearshownabove.Ialsodeclarethattheabovecorporationbalancesheetsaretrueandcorrect.

Mail to:WisconsinDepartmentofRevenue,POBox8908,Madison,WI53708-8908.

SignatureofOfcer

Title

Date

Ofcer’sStateofResidence

Page 2 of 2

2011Form4H

Return to Page 1