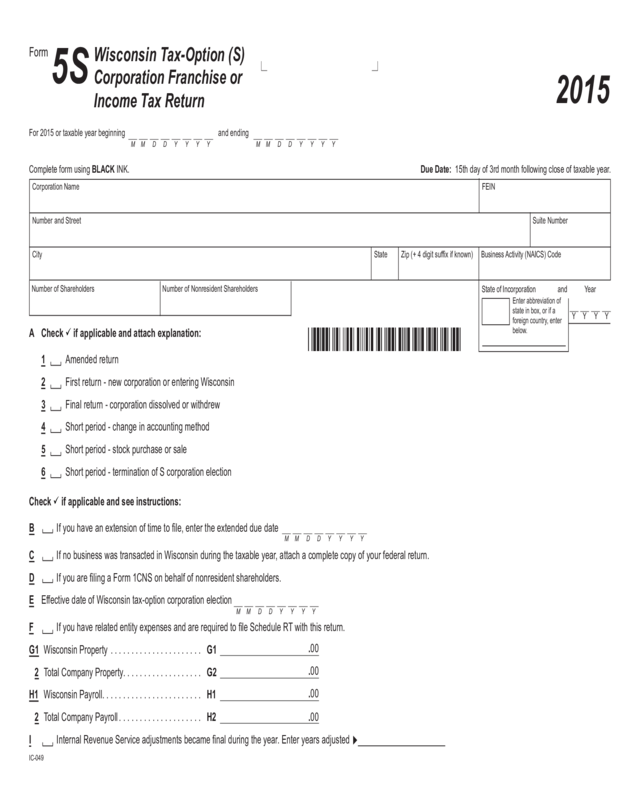

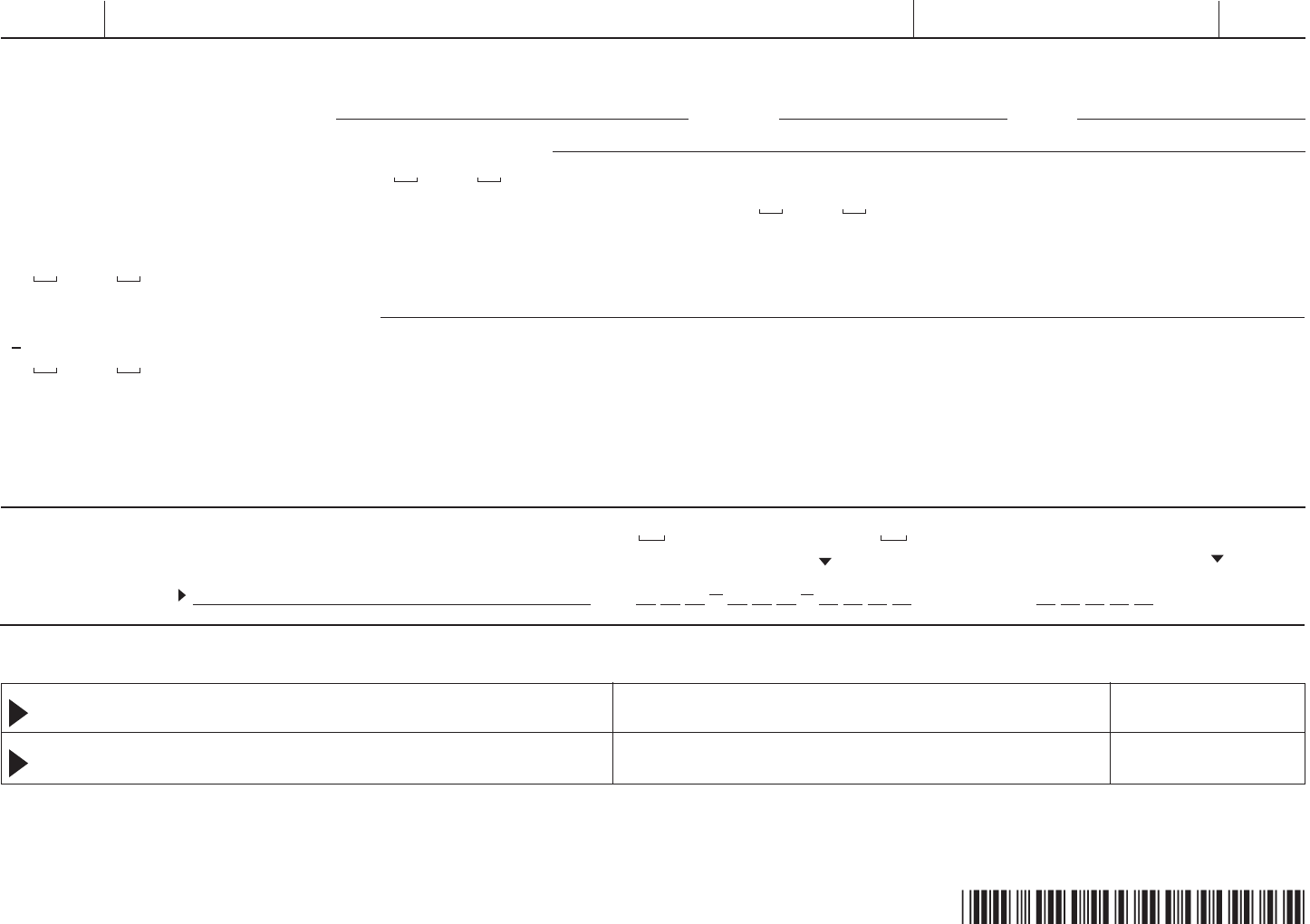

Fillable Printable 2015 Ic-049 Form 5S Wisconsin Tax-Option (S) Corporation Franchise Or Income Tax Return

Fillable Printable 2015 Ic-049 Form 5S Wisconsin Tax-Option (S) Corporation Franchise Or Income Tax Return

2015 Ic-049 Form 5S Wisconsin Tax-Option (S) Corporation Franchise Or Income Tax Return

Check if applicable and see instructions:

BIf you have an extension of time to le, enter the extended due date

CIf no business was transacted in Wisconsin during the taxable year, attach a complete copy of your federal return.

DIf you are ling a Form 1CNS on behalf of nonresident shareholders.

EEffective date of Wisconsin tax-option corporation election

FIf you have related entity expenses and are required to le Schedule RT with this return.

G1Wisconsin Property......................G1

2Total Company Property...................G2

H1Wisconsin Payroll........................H1

2Total Company Payroll....................H2

IInternal Revenue Service adjustments became nal during the year. Enter years adjusted

2015

5S

Wisconsin Tax-Option (S)

Corporation Franchise or

Income Tax Return

Form

A Check if applicable and attach explanation:

1 Amended return

2First return - new corporation or entering Wisconsin

3Final return - corporation dissolved or withdrew

4Short period - change in accounting method

5Short period - stock purchase or sale

6 Short period - termination of S corporation election

M Y Y YYM D D

State of Incorporation and Year

Enter abbreviation of

state in box, or if a

foreign country, enter

below.

Y

YYY

For 2015 or taxable year beginning and ending

M Y Y Y Y M D D M Y Y YYM D D

Corporation NameFEIN

CityState

Zip (+ 4 digit sufx if known)

Number and Street

Suite Number

Number of Nonresident Shareholders

Number of Shareholders

Business Activity (NAICS) Code

IC-049

Due Date: 15th day of 3rd month following close of taxable year.Complete form using BLACK INK.

M Y Y YYM D D

.00

.00

.00

.00

NOT LIKE THIS(1000)

ENTER NEGATIVE NUMBERS LIKE THIS–1000

NO COMMAS; NO CENTS

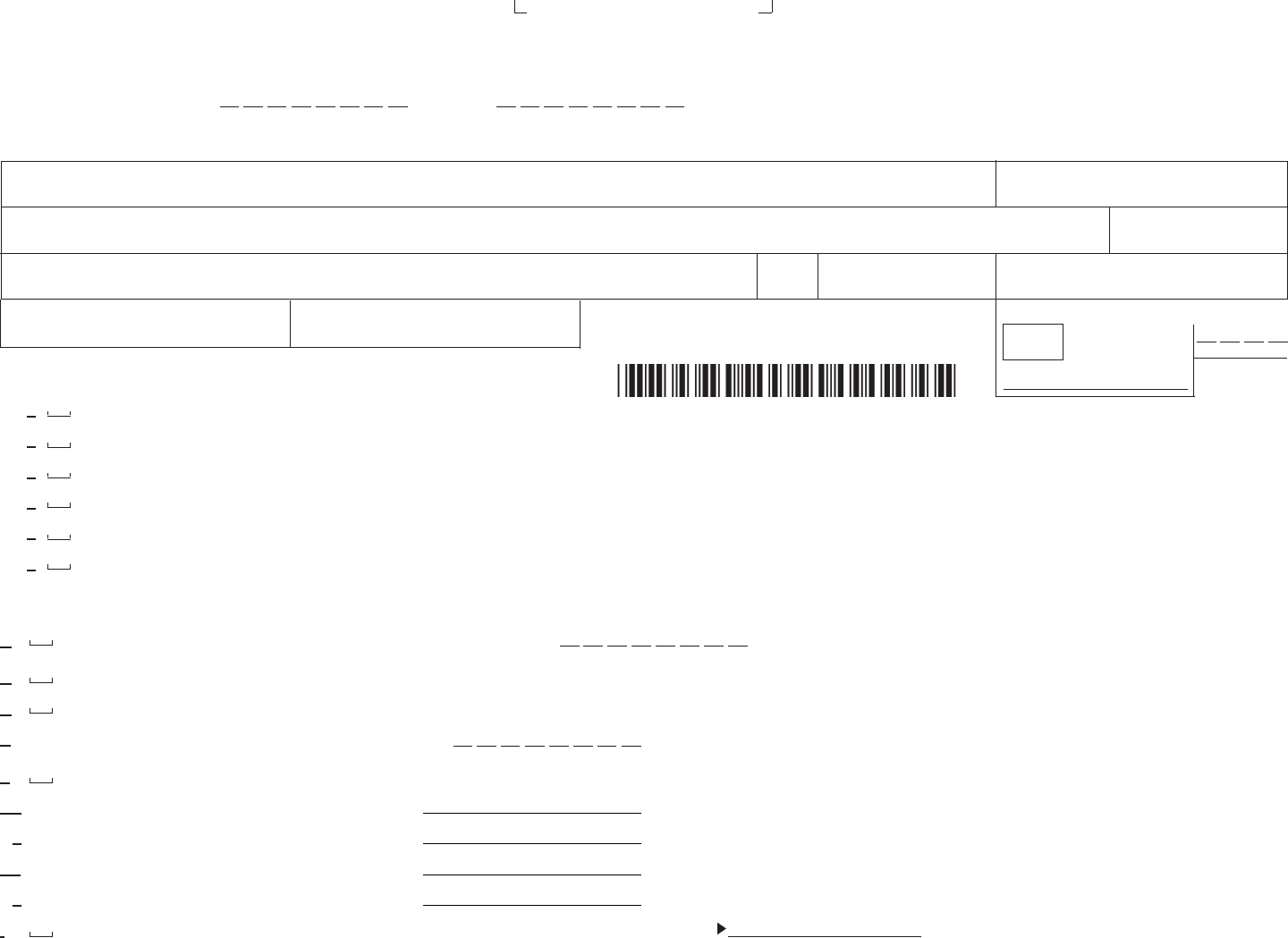

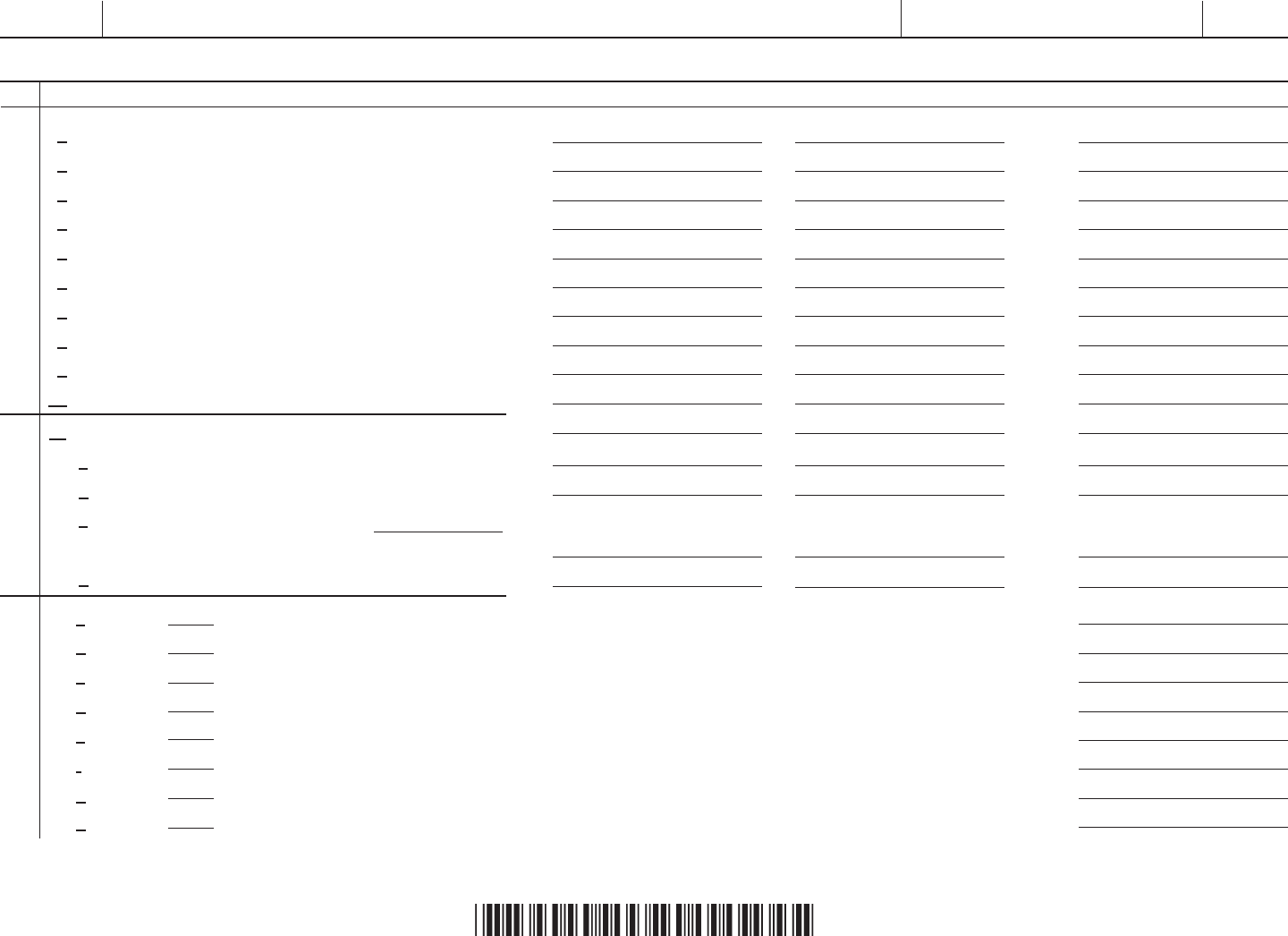

Part I

IF NO ENTRY, LEAVE BLANK

2015 Form 5S

NamePage 2 of 9ID Number

1Federal, state, and municipal government interest (see instructions) .........................................................1

2Wisconsin apportionment percentage (from Form A-1 or Form A-2). This is a required eld.

If percentage is from Form A-2, check () the space after the arrow...................................................2

If 100% apportionment, check () the space after the arrow.........................................................

If using separate accounting, check () the space after the arrow. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3Multiply line 1 by line 2.............................................................................................3

4Enter 7.9% (0.079) of the amount on line 3. This is gross tax ...............................................................4

5Manufacturer’s sales tax credit (from Sch. MS, line 3).....................................................................5

6Subtract line 5 from line 4. If line 5 is more than line 4, enter zero (0). This is net tax.............................................6

7Additional tax on tax-option (S) corporations (from page 3, Schedule Q, line 8)................................................. 7

8Economic development surcharge (from page 3, Schedule S, line 6).........................................................8

9Endangered resources donation (decreases refund or increases amount owed) ................................................9

10Veterans trust fund donation (decreases refund or increases amount owed) ...................................................10

11Add lines 6 through 10.............................................................................................11

12Estimated tax payments less refund from Form 4466W......................................12

13Wisconsin tax withheld on amount on line 1...............................................13

14 Amended Return Only – amount previously paid........................................... 14

15 Add lines 12 through 14.............................................................. 15

16 Amended Return Only – amount previously refunded....................................... 16

17Subtract line 16 from 15...........................................................................................17

18 Interest, penalty, and late fee due (from Form U, line 17 or 26). If you annualized income on Form U, check () the space

after the arrow............................................................................................18

19 Tax due. If the total of lines 11 and 18 is larger than line 17, enter amount owed............................................... 19

.00

%

.

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

2015 Form 5S

NamePage 3 of 9ID Number

20 Overpayment. If line 17 is larger than the total of lines 11 and 18, enter amount overpaid ........................................20

21Enter amount of line 20 you want credited to 2016 estimated tax...............................21

22Subtract line 21 from line 20. This is your refund ...................................................................... 22

23 Enter total company gross receipts from all activities (see instructions) ....................................................... 23

24 Enter total company assets from federal Form 1120S, item F............................................................... 24

25 If the tax-option corporation paid withholding tax on income distributable to nonresident shareholders, enter total amount paid for all

shareholders for the taxable year.....................................................................................25

Schedule Q - Additional Tax on Certain Built-In Gains

1 Excess of recognized built-in gains over recognized built-in losses (attach schedule)............................................1

2Wisconsin taxable income before apportionment (attach computation schedule)............................................... 2

3 Enter the smaller of line 1 or line 2. This is the net recognized built-in gain (see instructions)......................................3

4 Wisconsin apportionment percentage (from Form A-1 or Form A-2). This is arequired eld.

If percentage is from Form A-2, check () the space after the arrow.................................................4

5 Multiply line 3 by line 4............................................................................................5

6 Wisconsin net business loss carryforward (attach schedule)............................................................... 6

7 Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Enter 7.9% (0.079) of the amount on line 7. Enter on Form 5S, page 2, line 7 .................................................8

.00

.00

%

.

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Schedule S - Economic Development Surcharge

1 Enter net income (loss) (see instructions)..............................................................................1

2Wisconsin apportionment percentage (from Form A-1 or Form A-2). This is arequired eld.

If percentage is from Form A-2, check () the space after the arrow.................................................2

3 Multiply line 1by line 2............................................................................................3

4 Nonapportionable and separately apportioned income.................................................................... 4

5 Add lines 3 and 4................................................................................................. 5

6 Enter the greater of $25 or 0.2% (0.002) of the amount on line 5, but not more than $9,800.

This is the economic development surcharge to enter on Form 5S, page 2, line 8.............................................. 6

.00

.00

.00

%

.

.00

.00

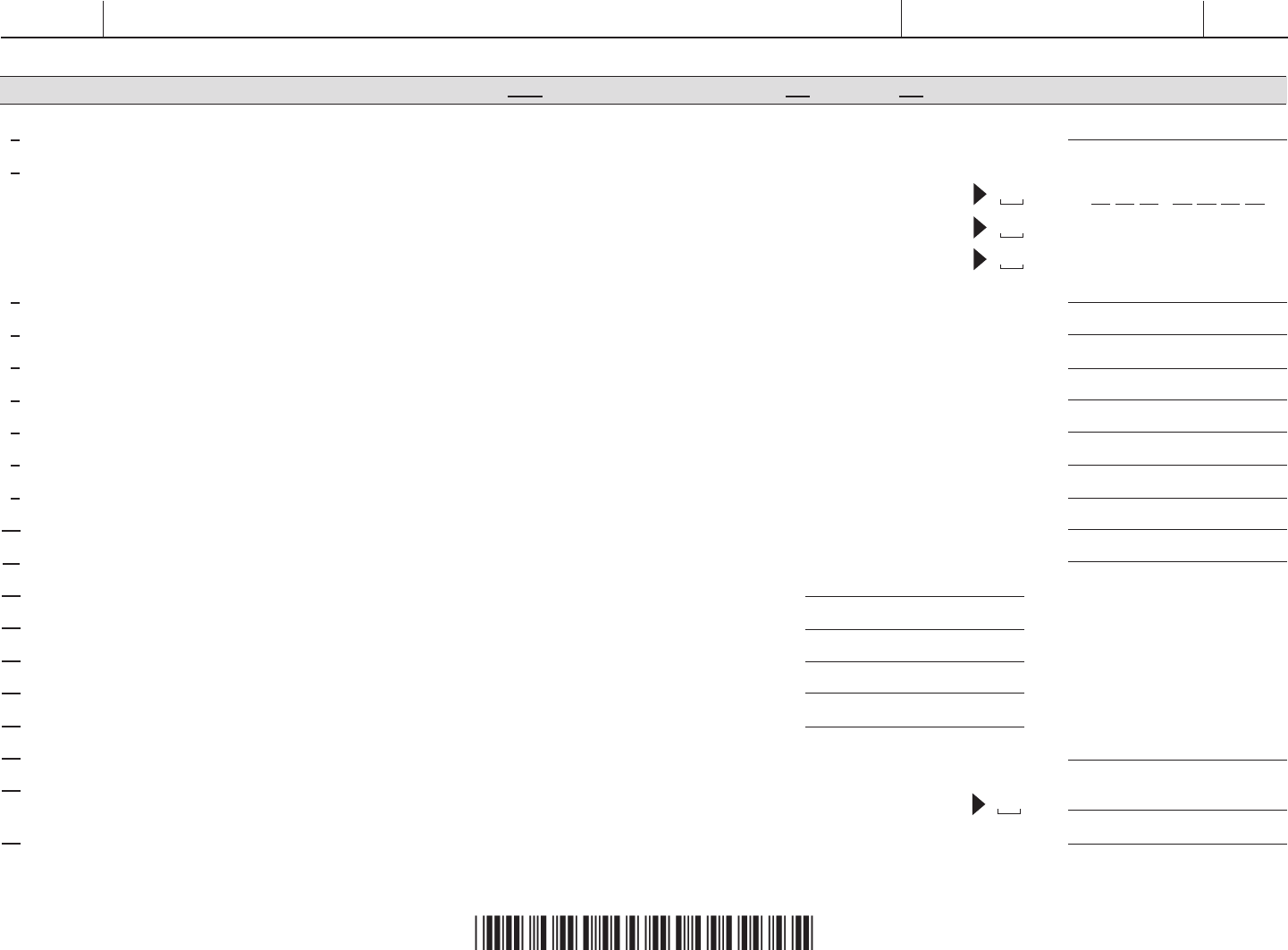

Additional Information Required

1 Person to contact concerning this return: Phone #: Fax #:

2City and state where books and records are located for audit purposes:

3Are you the sole owner of any QSubs or LLCs? Yes No If yes, attach a list of the names and federal EINs of your solely owned QSubs and LLCs.

Enclose Schedule DE with this return. Did you include the incomes of these entities in this return? Yes No

4Did you purchase any taxable tangible personal property or taxable services for storage, use, or consumption in Wisconsin without payment of a state sales or use tax?

Yes No If yes, you owe Wisconsin use tax. See instructions for how to report use tax.

5 List the locations of your Wisconsin operations:

6Did you le federal Form 8886 – Reportable Transaction Disclosure Statement with the Internal Revenue Service?

Yes No If yes, enclose federal Form 8886 with your Wisconsin return.

2015 Form 5S

NamePage 4 of 9ID Number

You must le a copy of your federal Form 1120S with Form 5S, even if no Wisconsin activity.

If you are not ling electronically, make your check payable to and mail your return to:

Wisconsin Department of Revenue

PO Box 8908

Madison WI 53708-8908

Third

Party

Designee

Print

Designee’s

Name

Do you want to allow another person to discuss this return with the department? YesComplete the following. No

Phone Number

Personal Identication Number (PIN)

Date

Under penalties of law, I declare that this return and all attachments are true, correct, and complete to the best of my knowledge and belief.

Signature of Ofcer

Title

DatePreparer’s SignaturePreparer’s Federal Employer ID Number

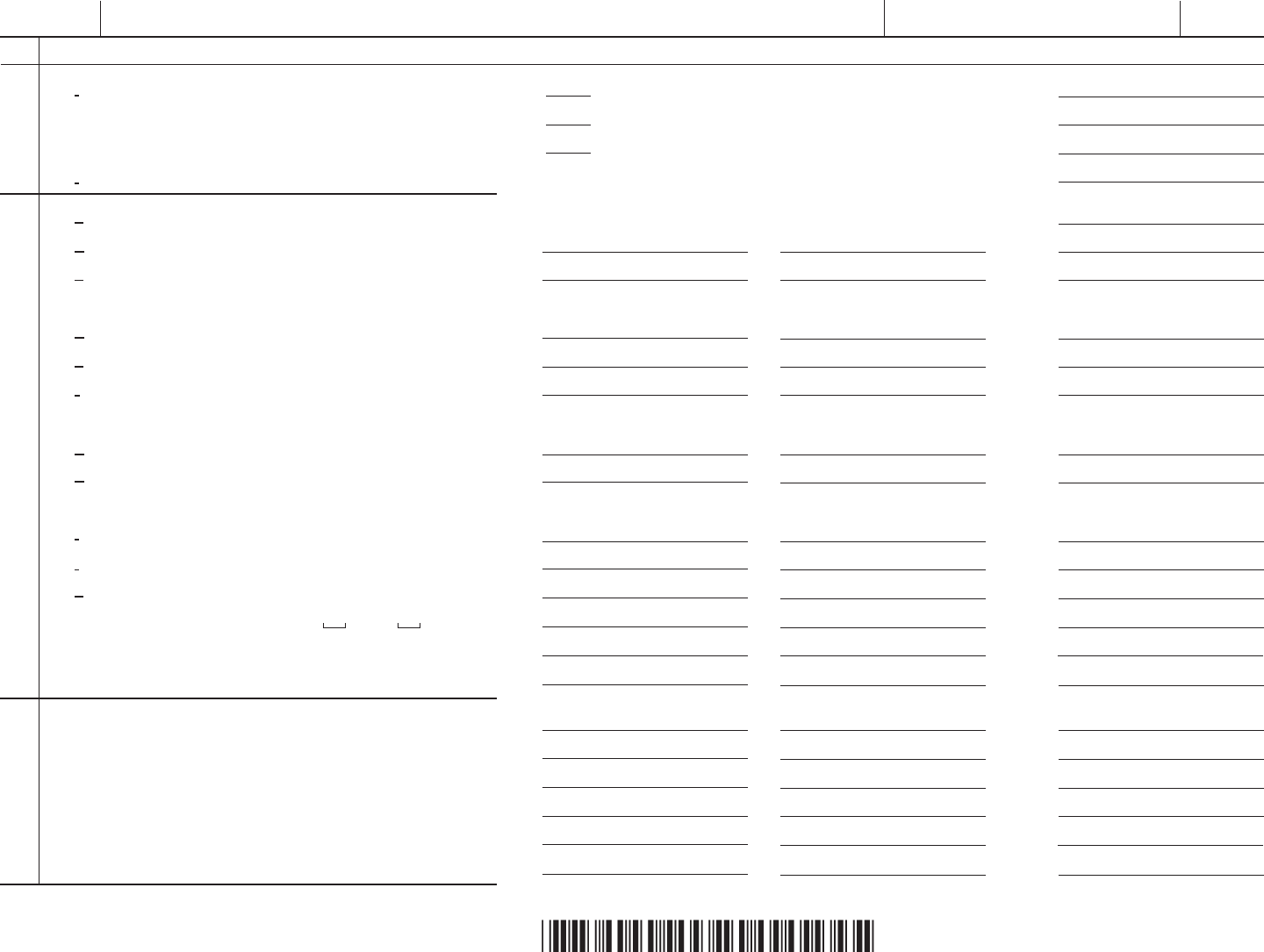

Schedule 5K – Shareholder’s Pro Rata Share Items

(a) Pro rata share items

(d)Amount under Wis. law(b)Federal amount

(c)Adjustment

1Ordinary business income (loss)......................1

2Net rental real estate income (loss) (attach Form 8825)...2

3Other net rental income (loss) (attach schedule)......... 3

4Interest income...................................4

5Ordinary dividends................................5

6Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6

7Net short-term capital gain (loss).....................7

8Net long-term capital gain (loss) ......................8

9Net section 1231 gain (loss) (attach Form 4797) .........9

10Other income (loss) (attach schedule).................10

Income (Loss)

13aSchedule ........................................................................................

bSchedule ........................................................................................

cSchedule ........................................................................................

dSchedule ........................................................................................

eSchedule ........................................................................................

fSchedule ........................................................................................

gSchedule ........................................................................................

hSchedule ........................................................................................

11Section 179 deduction (attach Form 4562).............11

12aContributions ..................................12a

bInvestment interest expense ......................12b

c Section 59(e)(2) expenditures (1) Type

(2) Amount ....................................12c

d Other deductions (attach schedule) .................12d

Deductions

Credits

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

1

2

3

4

5

6

7

8

10

9

11

.00

.00

.00

.00

.00

.00

12a

12b

.00

.00

.00

.00

.00

.00

13a

13c

13d

13e

13f

.00

.00

13g

13h

.00

.00

.00

.00

.00

12c

12d

.00

13b

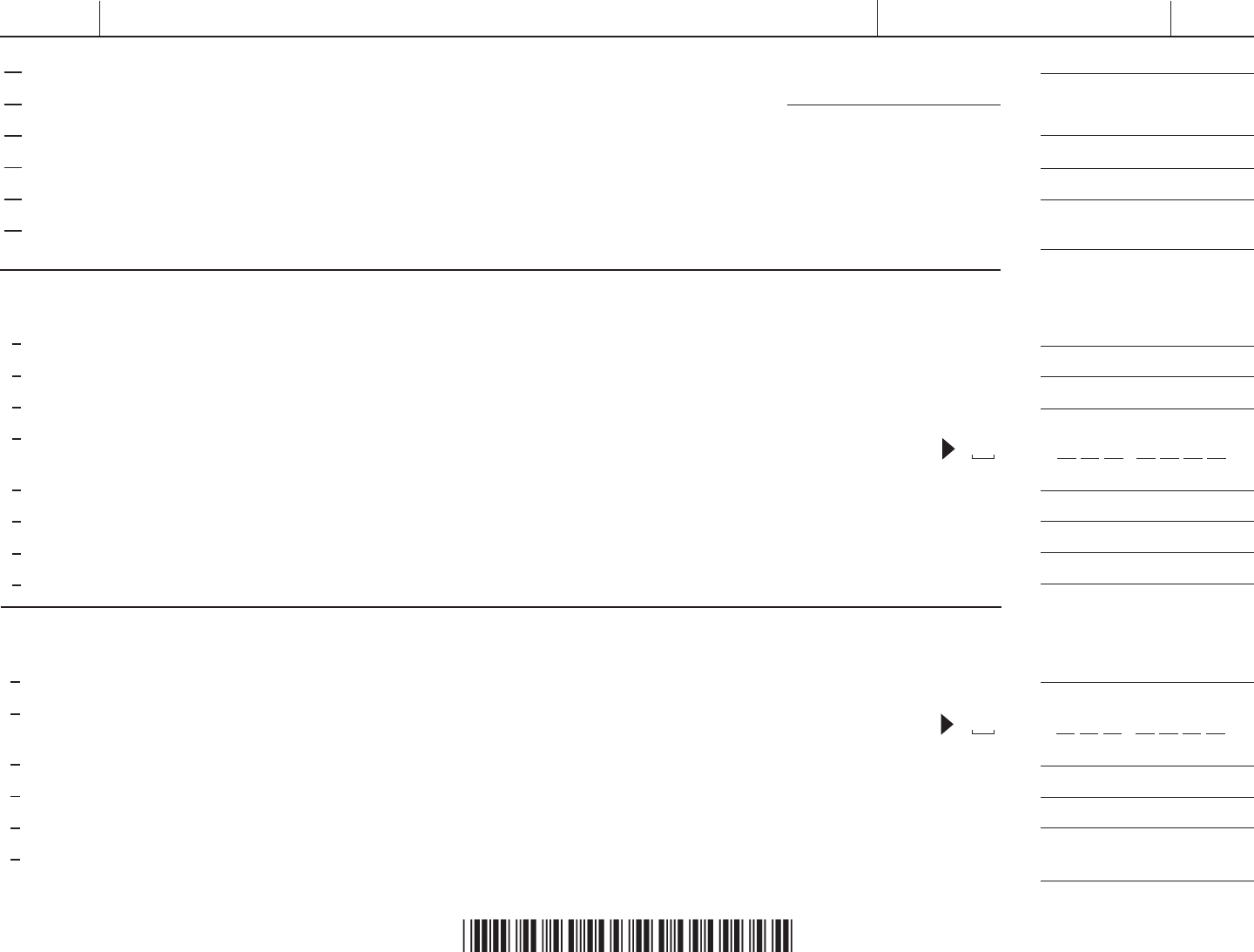

2015 Form 5S

NamePage 5 of 9ID Number

2015 Form 5S

NamePage 6 of 9ID Number

(a) Pro rata share items

(d)Amount under Wis. law(b)Federal amount

(c)Adjustment

14aName of country or U.S. possession.........................................................................14a

bGross income from all sources.....................14b 14b

cGross income sourced at shareholder level...........14c 14c

Foreign gross income sourced at corporate level:

dPassive category ...............................14d 14d

eGeneral category ...............................14e 14e

fOther (attach statement)..........................14f 14f

Deductions allocated and apportioned at shareholder level:

gInterest expense ...............................14g 14g

hOther ........................................14h 14h

Deductions allocated and apportioned at corporate level to foreign source income:

iPassive category...............................14i 14i

jGeneral category...............................14j 14j

kOther (attach statement)..........................14k 14k

lTotal foreign taxes (check one): Paid Accrued.14l 14l

mReduction in taxes available for credit (attach statement) 14m 14m

nOther foreign tax information (attach statement).......14n 14n

15aPost-1986 depreciation adjustment.................15a 15a

bAdjusted gain or loss............................15b 15b

cDepletion (other than oil and gas)...................15c 15c

dOil, gas, and geothermal properties – gross income....15d 15d

eOil, gas, and geothermal properties – deductions......15e 15e

fOther AMT items (attach schedule).................15f 15f

Foreign Transactions

Alternative

Minimum

Tax (AMT) Items

13 i Tax paid to other states (enter postal abbreviation of state) 13i-1............................................

13i-2 ............................................

13i-3 ............................................

jWisconsin tax withheld (do not include tax properly claimed on page 2, line 13).......................................

Credits (con’t)

.00

.00

.00

.00

13i-1

13i-2

13j

13i-3

.00

.00

.00

.00

.00

.00

.00.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00.00

.00

.00.00

.00

.00.00

.00

.00

.00

.00

.00

.00

.00

.00.00

.00

.00.00

.00

.00.00

.00

.00.00

.00

(a) Pro rata share items

(d)Amount under Wis. law(b)Federal amount(c)Adjustment

2015 Form 5S

NamePage 7 of 9ID Number

16aTax-exempt interest income ....................... 16a 16a

bOther tax-exempt income ........................16b 16b

cNondeductible expenses .........................16c 16c

dProperty distributions ............................16d 16d

eRepayment of loans from shareholders..............16e 16e

17aInvestment income ..............................17a 17a

bInvestment expenses ............................17b 17b

c Dividend distributions paid from accumulated earnings

and prots ....................................17c 17c

dOther items and amounts (attach schedule) ..........17d 17d

18 aRelated entity expense addback ........................................................................... 18a

bRelated entity expense allowable .......................................................................... 18b

19Income (loss) reconciliation (see instructions) .........19 .......................... 19

20 Gross income (before deducting expenses) from all activities.......................................................20

Other

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

1Balance at beginning of taxable year......................................................1 1

2Ordinary income from Schedule 5K, line 1, column d . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2

3Other additions (including separately stated items which increase income) (attach schedule) .........3 3

4Loss from Schedule 5K, line 1, column d (enter as positive)....................................4

5Other reductions (including separately stated items) (enter as positive) (attach schedule)............5 5

6Combine lines 1 through 3, and subtract lines 4 and 5 from the total .............................6 6

7Distributions other than dividend distributions...............................................7 7

8Subtract line 7 from line 6. This is balance at end of taxable year ...............................8 8

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Schedule 5M – Analysis of Wisconsin Accumulated Adjustments Account and Other Adjustments Account

(b) Other Adjustments

Account

(a) Accumulated

Adjustments Account

.00

.00

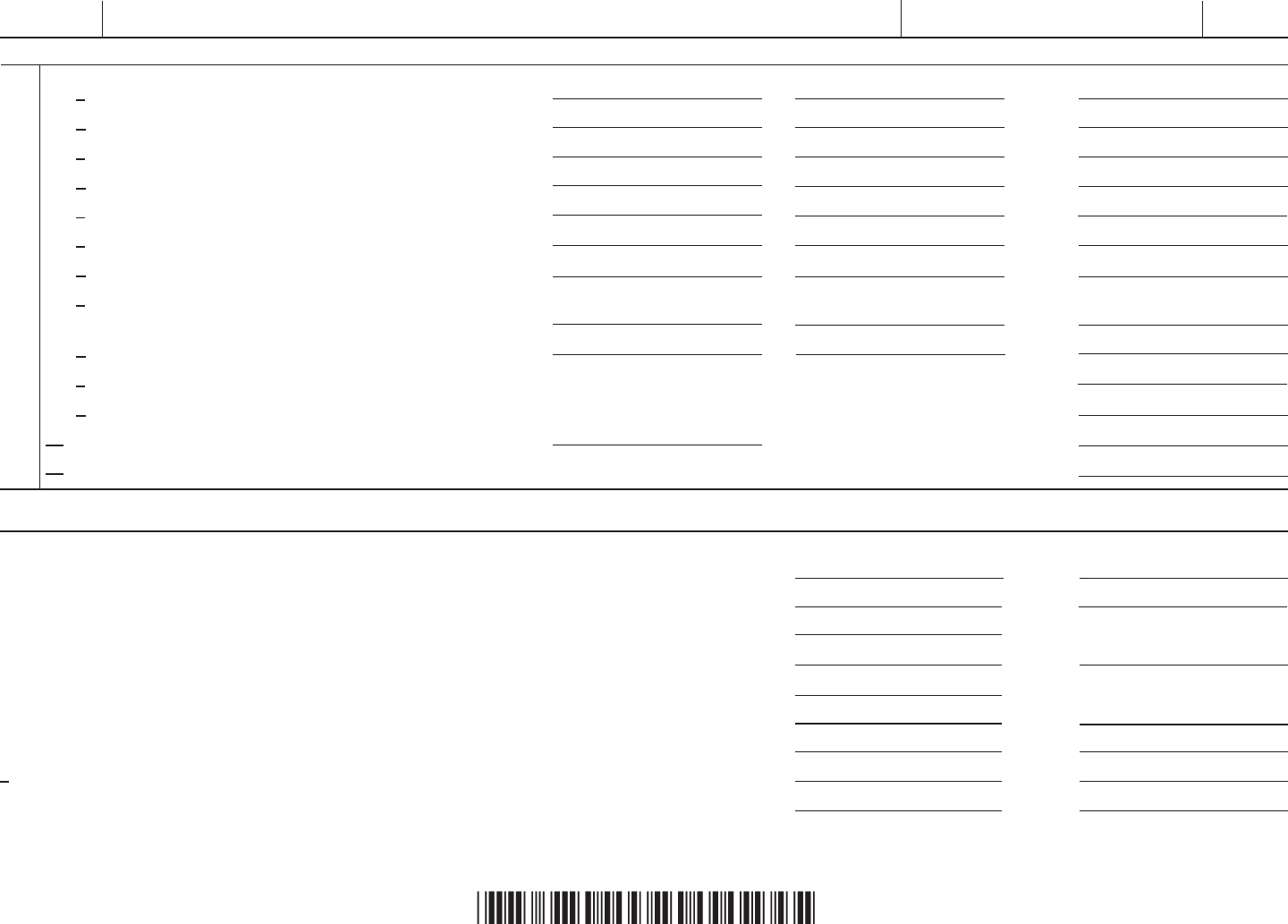

2015 Form 5S

NamePage 8 of 9ID Number

Schedule 5K – Shareholder’s Pro Rata Share of Additions

Additions:

1State taxes accrued or paid .....................................................................................1

2Related entity expenses (from Schedule RT, Part I)...................................................................2

3Expenses related to nontaxable income ............................................................................3

4Basis, section 179, depreciation, amortization difference (attach schedule).................................................4

5Amount by which the federal basis of assets disposed of exceeds the Wisconsin basis (attach schedule) .........................5

6Total additions for certain credits computed:

aCommunity rehabilitation program credit ...........................................6a

bDevelopment zones credits .....................................................6b

cEconomic development tax credit .................................................6c

dEnterprise zone jobs credit ......................................................6d

eJobs tax credit ...............................................................6e

fManufacturing and agriculture credit (computed in 2014) ...............................6f

gManufacturing investment credit ..................................................6g

hResearch credits ..............................................................6h

iTechnology zone credit .........................................................6i

jTotal credits (add lines 6a through 6i) ...........................................................................6j

7 IRC provisions not adopted for Wisconsin purposes...................................................................7

8 Adjustment for built-in gains tax..................................................................................8

9 Additions for federal capital gains and excess net passive income taxes ...................................................9

10 Other additions:

a.................................10a

b.................................10b

c.................................10c

d.................................10d

e Total other additions (add lines 10a through 10d) ..................................................................10e

11Total additions (add lines 1 through 10e) .........................................................................11

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

2015 Form 5S

NamePage 9 of 9ID Number

Subtractions:

12 Related entity expenses eligible for subtraction (from Schedule RT, Part II) ................................................12

13 Income from related entities whose expenses were disallowed (obtain Schedule RT-1 from related entity and submit with your return) ..13

14 Basis, section 179, depreciation/amortization of assets (attach schedule) .................................................14

15 Amount by which the Wisconsin basis of assets disposed of exceeds the federal basis (attach schedule) ........................15

16 IRC provisions not adopted for Wisconsin purposes..................................................................16

17 Adjustment for built-in gains tax..................................................................................17

18 Federal work opportunity credit wages.............................................................................18

19 Federal research credit expenses................................................................................19

20 Other subtractions:

a ..................................20a

b ..................................20b

c..................................20c

d..................................20d

eTotal other subtractions (add lines 20a through 20d) ..............................................................20e

21Total subtractions (add lines 12 through 20e) ....................................................................21

22Total adjustment. (Subtract line 21 from line 11. See instructions) ................................................... 22

Schedule 5K – Shareholder’s Pro Rata Share of Subtractions

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00