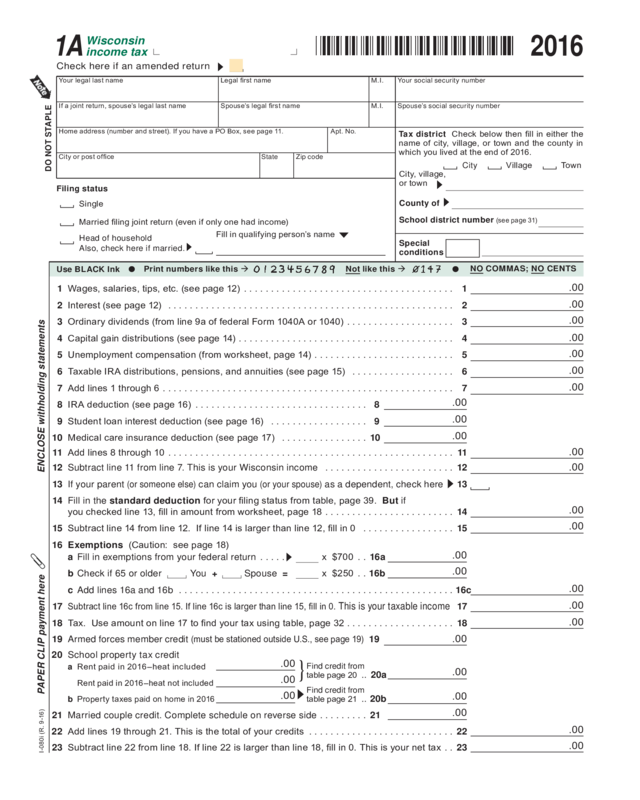

Fillable Printable 2016 I-080 Form 1A, Wisconsin Income Tax (Fillable)

Fillable Printable 2016 I-080 Form 1A, Wisconsin Income Tax (Fillable)

2016 I-080 Form 1A, Wisconsin Income Tax (Fillable)

PAPER CLIP payment here

12 Subtr ac t l in e 11 fro m li ne 7. This is your Wisconsin i ncome ........................ 12

13 If your p a r e nt

(or someone else)

ca n claim you

(or your spouse)

as a dependent, check here 13

14 Fill in t he st andard deduct ion for your ling status from table, page 39. But if

you checked line 13, ll in amount from worksheet, page 18 ........................ 14

15 Subtract line 14 from line 12. If line 14 is larger than line 12, ll in 0 ................. 15

16 Exemptions (Caution: see page 18)

a Fill in exemptio n s f r o m your f e de r a l ret urn ..... x $700 ..16a

b C h eck if 6 5 o r o ld e r You + Spouse = x $250 ..16b

c Add line s 16a and 16b ................................................... 16c

17

Subtract line 16c from line 15. If line 16c is larger than line 15, ll in 0.

This is your taxable income

17

18 Tax. Use amount on line 17 to nd your tax using table, page 32 .................... 18

NO COMM AS; NO CENTS

19 Armed forces member credit

(

must be stationed outside U.S., see page 19

)

19

20 School property tax credit

a Rent paid in 2016–heat included

Rent paid in 2016–heat not included

b

Property taxes paid on home in 2016

21 Marri ed coup l e c r e dit. Com p l ete sc h e du l e o n rever s e si d e ......... 21

22 Add lines 19 through 21. This is the total of your credits ........................... 22

23 Subtract line 22 from line 18. If line 22 is larger than line 18, ll in 0. This is your net tax .. 23

1 Wages, salaries, tips, etc. (see page 12) ....................................... 1

2 Interest (see page 12) ..................................................... 2

3 Ordinary dividends (from line 9a of federal Form 1040A or 1040) .................... 3

4 Capital gain distributions (see page 14) ........................................ 4

5 Unemployment compensation (from worksheet, page 14) .......................... 5

6 Taxable IRA distributions, pensions, and annuities (see page 15) ................... 6

7 Add lines 1 through 6 ...................................................... 7

8 IRA deduction (see page 16) ................................ 8

9 Student loan interest deduction (see page 16) .................. 9

10 Medical care insurance deduction (see page 17) ................ 10

11 Add lines 8 through 10 ..................................................... 11

}

Find credit from

table page 20 .. 20a

Find credit from

table page 21 .. 20b

I-080i (R. 9-16)

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

ENC LOSE withholding stat e me nt s

.00

.00

.00

.00

2016

Wisconsin

income ta x

1A

Legal rst nameYour legal last name

Spouse’s legal rst nameIf a joint return, spouse’s legal last name

Home address (number and street). If you have a PO Box, see page 11. Apt. No.

StateCity or post ofce Zip code

Tax district Check below then ll in either the

name of city, village, or town and the county in

which you lived at the end of 2016.

School district number

(see page 31)

Spouse’s social securit y number

Yo u r social sec u rity nu mber

M.I.

M.I.

City, village,

or town

Special

conditions

County of

Village TownCity

Head of household

Also, check here if married.

Single

Fill in qualifying person’s name

Married ling joint return (even if only one had income)

Fili ng st atu s

.00

.00

.00

.00

.00

.00

DO N OT S TAPLE

Pri nt nu m bers li ke thi s Not like t his

Use B LACK I nk

Chec k her e if an am end ed retu rn

Tab to navigate within form. Use mouse to

check applicable boxes or press Enter.

Save

Print

Clear

Go to Page 2

Und e r p e n a lties o f l aw, I declare that t h i s return and a ll attac h m e n ts a re tr u e , cor rect, and c omplete to th e best of my k n o w l e dge an d b e lief.

Do you want to allow another person to discuss this return with the department (see pa ge 3 0 )? Yes Complete the following. No

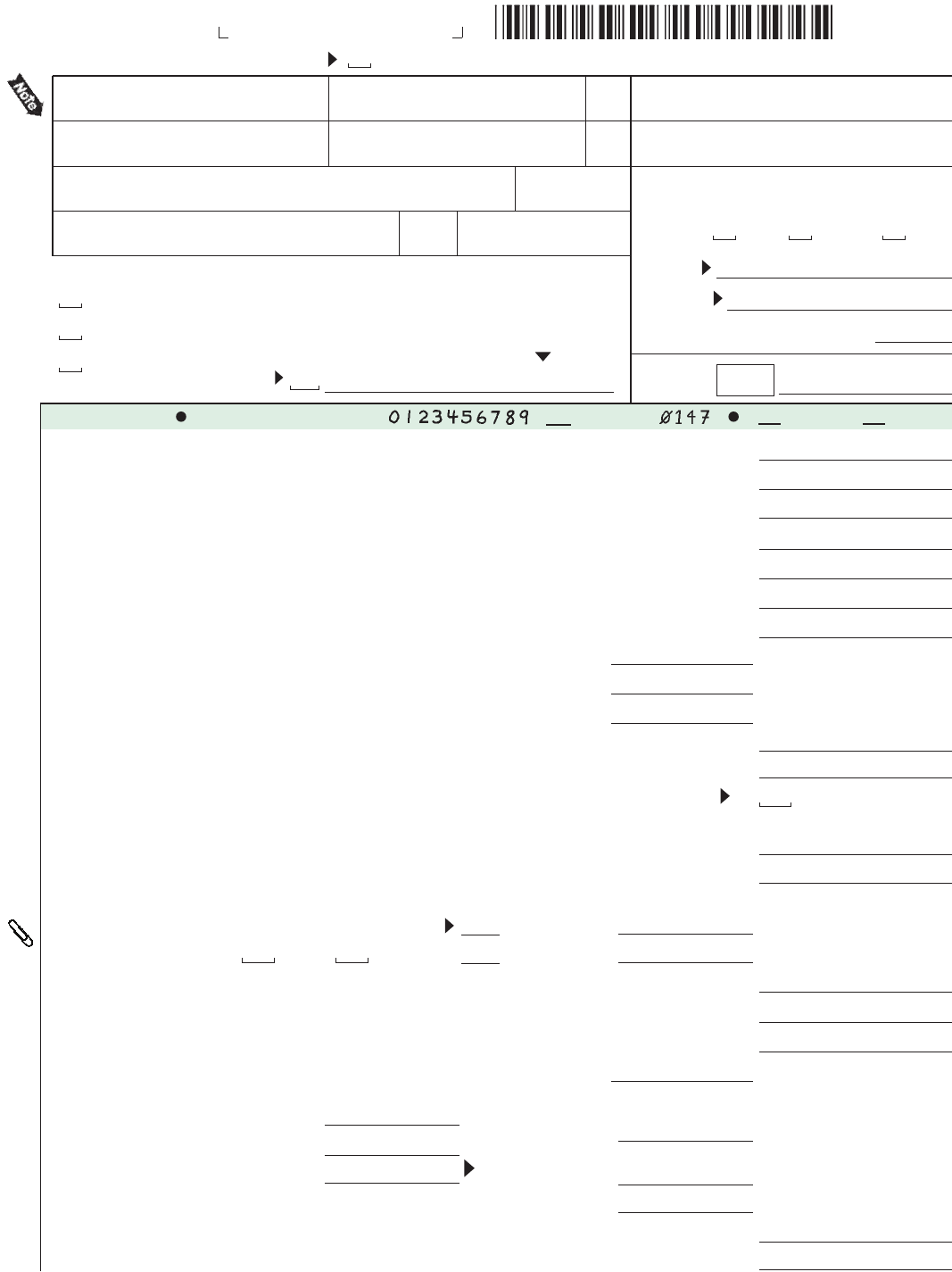

24 Fill in net tax from line 23 .................................................... 24

25 Sales and use tax due on I nte rnet, m ail order, or other out-of-state pu r chase s

(see page 22)

25

If you certi fy t h at no s a l e s o r us e tax i s du e, c he ck here ..........................

26 Donations (decreases refund or increases amount owed)

a Endangered resources e Military family relief ......

b C anc er researc h .... f

Second Harvest/Feeding Amer.

c Veter a ns t rust f un d ... g Re d Cr o ss WI Di sa ste r Rel i ef

d M ultiple sclerosis .... h Special Olympics Wisc onsin

Total (add lines a through h) ... 26i

27 Add lin e s 24, 25, an d 2 6 i .................................................... 27

28 Wisconsin income tax withheld. Enclose withholding statements ...... 28

29 2016 estimated tax payments and amount applied from 2015 return ... 29

30 Earned income credit (see page 24)

Qualifying Federal

children credit .. x % = .. 30

31 Homeste ad credit . A ttach Sc he d ul e H o r H-E Z .................... 31

32 Eligible veterans and surviving spouses property tax credit (see page 25) 32

33 AMENDED RETURN ONLY – amount previously paid (see page 27) ... 33

34 Add lines 28 through 33 ...................................... 34

35 AMENDED RETURN ONLY – amount previously refunded (see page 27) 35

36 Subtract line 35 from line 34 ................................................. 36

37

If line 36 is more than line 27, subtract line 27 from line 36.

This is the

AMOUNT YOU OVERPAID

.. 37

38 Amount of line 37 you want

REFUNDED TO YOU

.................................. 38

39 Amount of line 37 you want ap p l ied to you r 2017 es timate d ta x ..... 39

40 If line 36 is less than line 27, subtract line 36 from line 27. This is the

AM O U NT YOU OWE

.. 40

41 Underpayment interest. Fill in exception code – See Sch. U 41

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Mail your retur n to:

Wisconsin Department of Revenue

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Sign below

Third

Party

Designee

Designee’s

name

Phone

no. ( )

Personal

identication

number (PIN)

.00

1 Wages, salaries, tips, and other employee compensation from

line 1 of For m 1A . D o n ot i nclude d eferred comp e ns at i o n o r

scholarships and fellowships that are not reported on a W-2 ..... 1

2 IRA deduction, if any, from line 8 of Form 1A ................. 2

3 Subtrac t l in e 2 f r o m l in e 1 ................................ 3

4 Compare amounts in columns (A) and (B) of line 3. Fill in the

smaller amount here. If more than $16,000, ll in $16,000 .................. 4

5 Rate of cre dit i s .03 (3%) ........................................... 5

6 Multiply line 4 by line 5. Round the result and ll in here and on line 21

of Form 1A .............................Do NOT ll in more than $480 6

Married Cou p l e Cre d i t When Bo t h S p o u se s Are Em p l oyed

(B) YOUR SPOUSE

X .03

.00

.00

.00

.00

.00

.00

.00

(A) YOURSELF

Your signature Spouse’s signature (if ling jointly, BOTH must sign) Date Daytime phone

( )

2016

Form 1A

Page 2 of 2

.00

Name SSN

.00

If tax due .................................PO Box 268, Madison WI 53790-0001

If homestead credit claimed

...PO Box 34, Madison WI 53786-0001

If refu nd or no tax due

....PO Box 59

Madison WI 53785-0001

.00

.00

.00

Return to Page 1