Fillable Printable 2017 Federal And State Payroll Taxes (De 202)

Fillable Printable 2017 Federal And State Payroll Taxes (De 202)

2017 Federal And State Payroll Taxes (De 202)

DE 202 Rev. 5 (2-17) (INTERNET) Page 1 of 1 CU

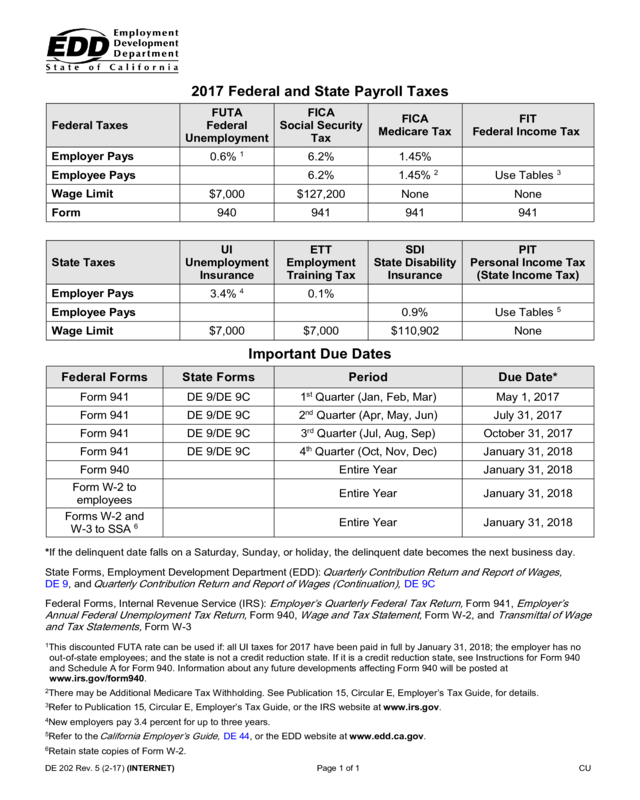

2017 Federal and State Payroll Taxes

Federal Taxes

FUTA

Federal

Unemployment

FICA

Social Security

Tax

FICA

Medicare Tax

FIT

Federal Income Tax

Employer Pays

0.6%

1

6.2% 1.45%

Employee Pays

6.2%

1.45%

2

Use Tables

3

Wage Limit

$7,000 $127,200 None None

Form

940 941 941 941

State Taxes

UI

Unemployment

Insurance

ETT

Employment

Training Tax

SDI

State Disability

Insurance

PIT

Personal Income Tax

(State Income Tax)

Employer Pays

3.4%

4

0.1%

Employee Pays

0.

9% Use Tables

5

Wage Limit

$7,000 $7,000 $110,902 None

Important Due Dates

Federal Forms State Forms Period Due Date*

Form 941 DE 9/DE 9C 1

st

Quarter (Jan, Feb, Mar) May 1, 2017

Form 941 DE 9/DE 9C 2

nd

Quarter (Apr, May, Jun) July 31, 2017

Form 941 DE 9/DE 9C 3

rd

Quarter (Jul, Aug, Sep) October 31, 2017

Form 941 DE 9/DE 9C 4

th

Quarter (Oct, Nov, Dec) January 31, 2018

Form 940 Entire Year January 31, 2018

Form W-2 to

employees

Entire Year January 31, 2018

Forms W-2 and

W-3 to SSA

6

Entire Year January 31, 2018

*If the delinquent date falls on a Saturday, Sunday, or holiday, the delinquent date becomes the next business day.

State Forms, Employment Development Department (EDD):

Quarterly Contribution Return and Report of Wages,

DE 9, and

Quarterly Contribution Return and Report of Wages (Continuation),

DE 9C

Federal Forms, Internal Revenue Service (IRS):

Employer’s Quarterly Federal Tax Return,

Form 941,

Employer’s

Annual Federal Unemployment Tax Return,

Form 940,

Wage and Tax Statement,

Form W-2, and

Transmittal of Wage

and Tax Statements,

Form W-3

1

This discounted FUTA rate can be used if: all UI taxes for 2017 have been paid in full by January 31, 2018; the employer has no

out-of-state employees; and the state is not a credit reduction state. If it is a credit reduction state, see Instructions for Form 940

and Schedule A for Form 940. Information about any future developments affecting Form 940 will be posted at

www.irs.gov/form940.

2

There may be Additional Medicare Tax Withholding. See Publication 15, Circular E, Employer’s Tax Guide, for details.

3

Refer to Publication 15, Circular E, Employer’s Tax Guide, or the IRS website at www.irs.gov.

4

New employers pay 3.4 percent for up to three years.

5

Refer to the

California Employer’s Guide,

DE 44, or the EDD website at www.edd.ca.gov.

6

Retain state copies of Form W-2.