Fillable Printable 5184 - Oic Schedule 2B - State Of Michigan

Fillable Printable 5184 - Oic Schedule 2B - State Of Michigan

5184 - Oic Schedule 2B - State Of Michigan

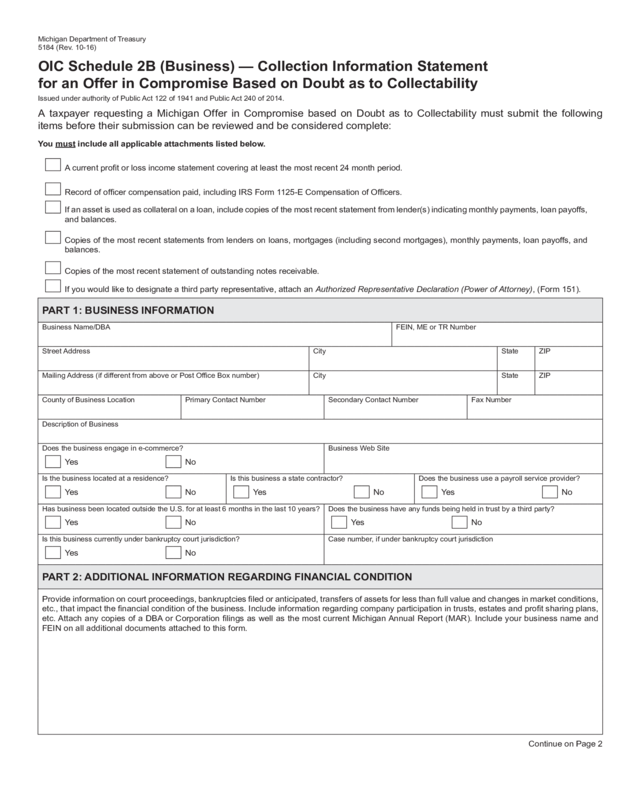

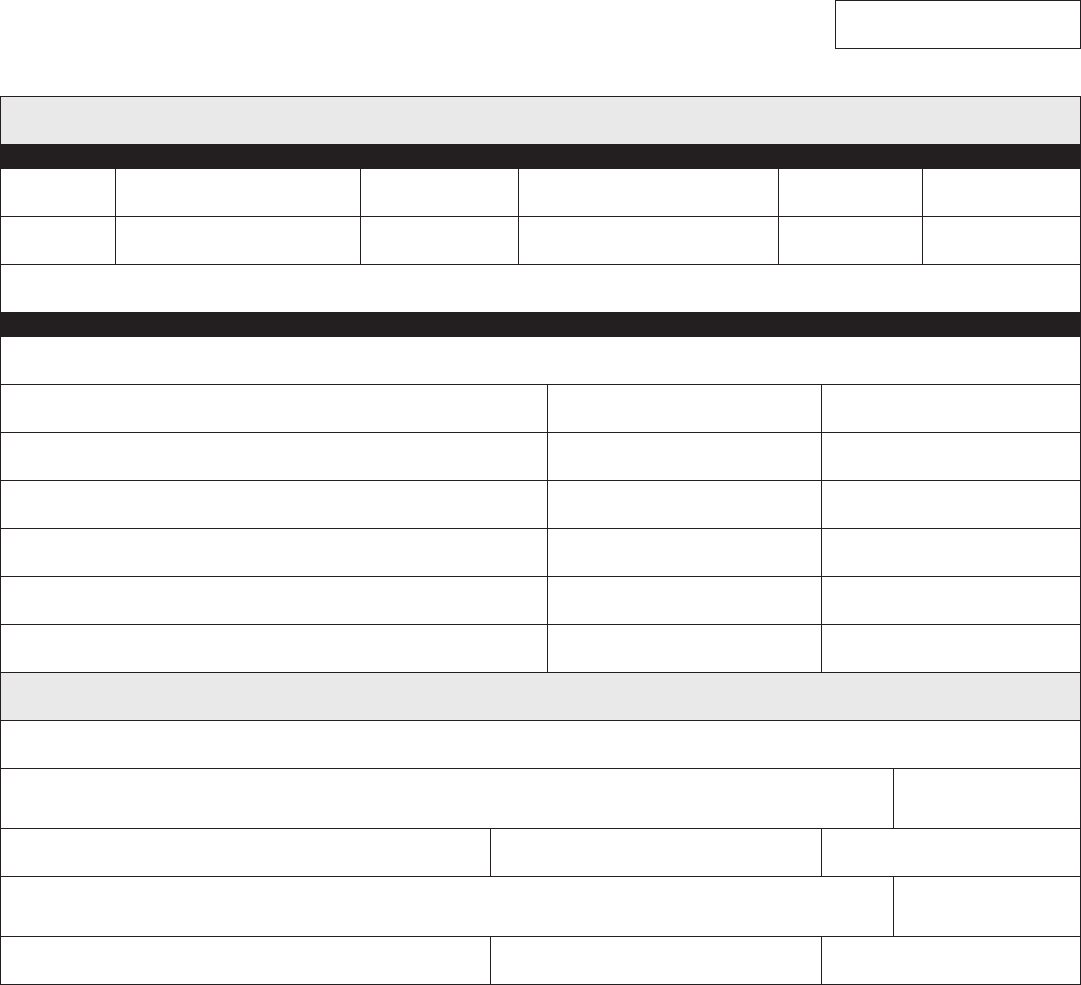

Michigan Department of Treasury

5184 (Rev. 10-16)

OIC Schedule 2B (Business) — Collection Information Statement

for an Offer in Compromise Based on Doubt as to Collectability

Issued under authority of Public Act 122 of 1941 and Public Act 240 of 2014.

A taxpayer requesting a Michigan Offer in Compromise based on Doubt as to Collectability must submit the following

items before their submission can be reviewed and be considered complete:

You must include all applicable attachments listed below.

A current prot or loss income statement covering at least the most recent 24 month period.

Record of ofcer compensation paid, including IRS Form 1125-E Compensation of Ofcers.

If an asset is used as collateral on a loan, include copies of the most recent statement from lender(s) indicating monthly payments, loan payoffs,

and balances.

Copies of the most recent statements from lenders on loans, mortgages (including second mortgages), monthly payments, loan payoffs, and

balances.

Copies of the most recent statement of outstanding notes receivable.

If you would like to designate a third party representative, attach an Authorized Representative Declaration (Power of Attorney), (Form 151).

PART 1: BUSINESS INFORMA

TION

Business Name/DBA FEIN, ME or TR Number

Street Address City State ZIP

Mailing Address (if different from above or Post Ofce Box number) City State ZIP

County of Business Location Primary Contact Number Secondary Contact Number Fax Number

Description of Business

Does the business engage in e-commerce? Business Web Site

Yes No

Is the business located at a residence?

Yes Ye

, if under bankruptcy court jurisdiction

s No

Is this business a state contractor? Does the business use a payroll service provider?

No s No Yes No

Has business been located outside the U.S. for at least 6 months in the last 10 years? Does the business have any funds being held in trust by a third party?

Yes No Yes No

Is this business currently under bankruptcy court jurisdiction? Case number

Ye

PART 2: ADDITIONAL INFORMATION REGARDING FINANCIAL CONDITION

Provide information on court proceedings, bankruptcies led or anticipated, transfers of assets for less than full value and changes in market conditions,

etc., that impact the nancial condition of the business. Include information regarding company participation in trusts, estates and prot sharing plans,

etc. Attach any copies of a DBA or Corporation lings as well as the most current Michigan Annual Report (MAR). Include your business name and

FEIN on all additional documents attached to this form.

Continue on Page 2

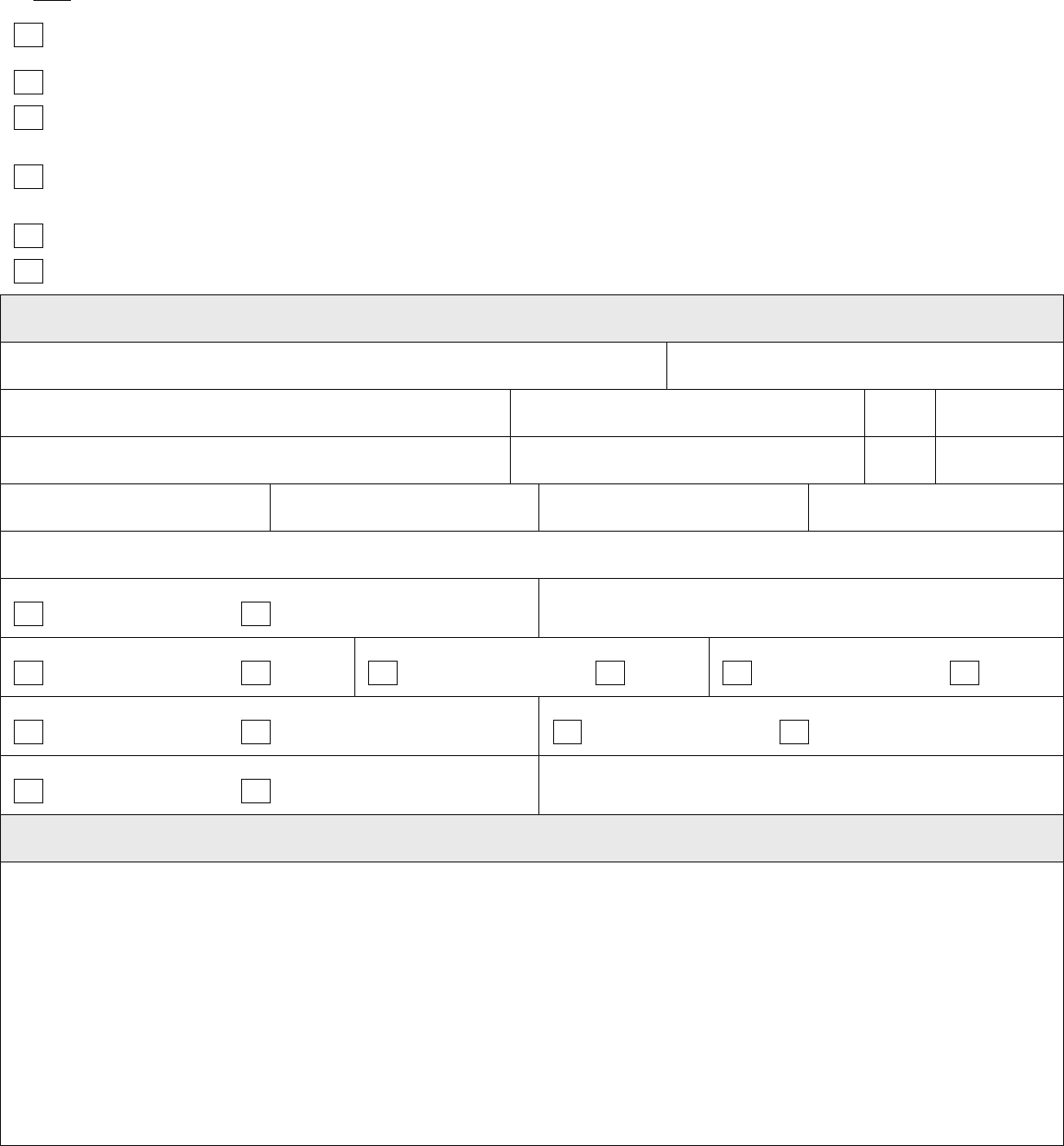

Reset Form

5184, Page 2

FEIN, ME or TR Number

PART 3: ASSET AND LIABILITY ANALYSIS

Attach the most current statement for each type of account, such as checking, savings, money market, online accounts, investment accounts, and life

insurance policies that have a cash value. Also, include statements of mortgages (including second mortgages), monthly payments, loan balances,

and accountant’s depreciation schedules, make/model/year of vehicles and current value of business assets. Asset value is subject to adjustment by

Treasury based on individual circumstances. Enter the total amount available for each of the following.

* Loan Balance: For certain items in Part 3, “Loan Balance” refers to an amount owed to pay back a loan.

BUSINESS CASH/BANK ACCOUNTS

Type of account

Checking Savings Money Market/CD Online Account Stored Value Card Cash on Hand

Financial Institution Name Account Number Account Balance/Value

Type of account

Checking Savings Money Market/CD Online Account Stored Value Card Cash on Hand

Financial Institution Name Account Number Account Balance/Value

If attaching a separate sheet listing additional bank accounts, record the total of those accounts here.

INVESTMENT ACCOUNTS

Type of account *Loan Balance

Stocks Bonds Other _____________________________

alue Financial Institution Name Account Number Current Market V

Type of account *Loan Balance

Stocks Bonds Other _____________________________

Financial Institution Name Account Number Current Market Value

If attaching a separate sheet listing additional investment accounts, record the total of the current market value of those accounts here.

Do you have notes receivable?

Do you have accounts receivable, including e-payment, factoring companies, and any bartering or online auction accounts?

Yes No Yes No

If yes, attach current listing which includes If yes, attach a list of names, age and amount of the account(s) receivable.

name, age & amount of note(s) receivable.

BANK CREDIT AVAILABLE (LINES OF CREDIT, ETC.)

Name of Institution Credit Limit Amount Owed Credit Available

Address City State ZIP Monthly Payments

Name of Institution Credit Limit Amount Owed Credit Available

Address City State ZIP Monthly Payments

Check here if listing additional bank credit on an attached document. The lines below must reect combined totals of ALL bank credits.

Total Credit Limit Total Amount Owed Total Credit Available Total Monthly Payments

Continue on Page 3

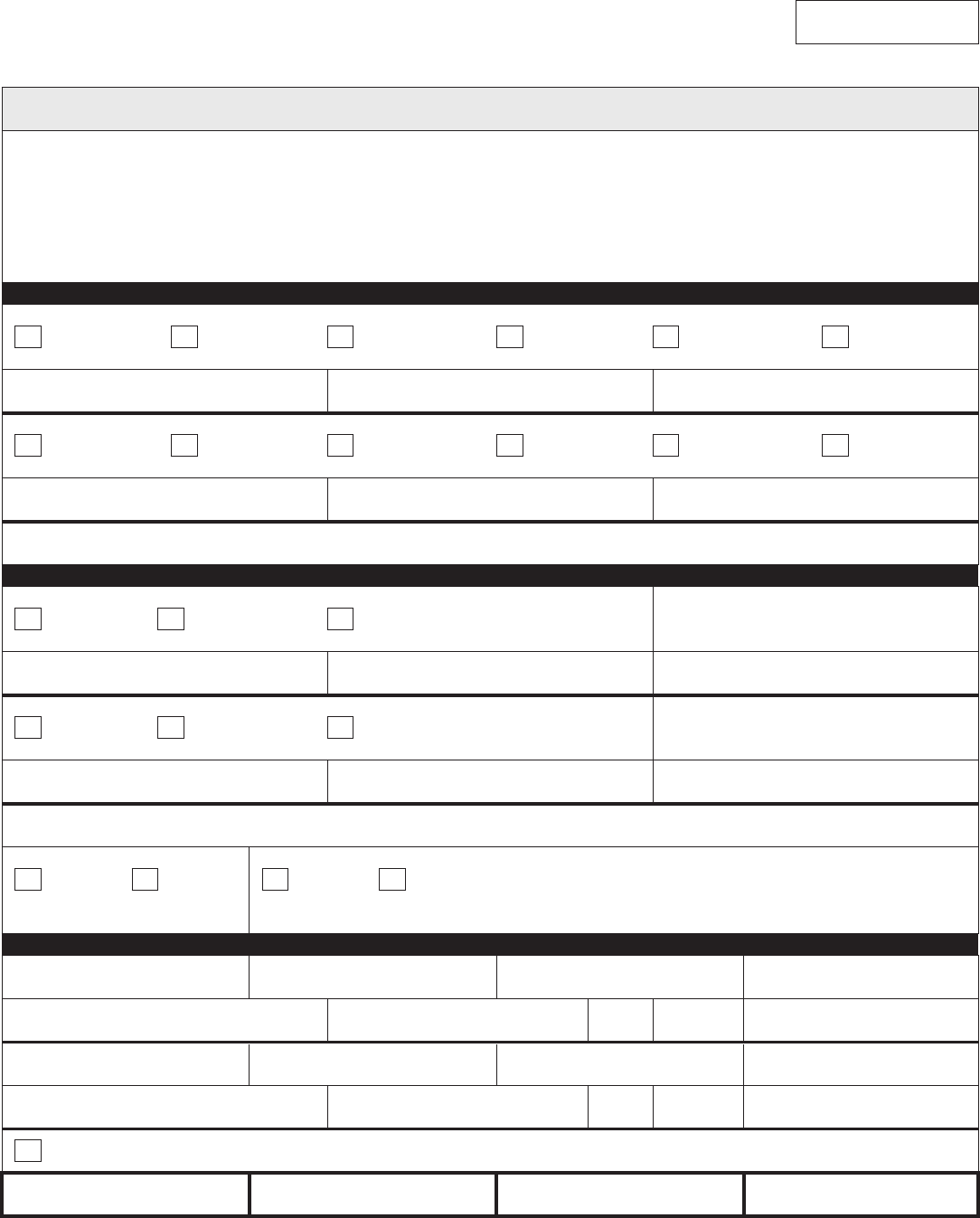

RS

nship

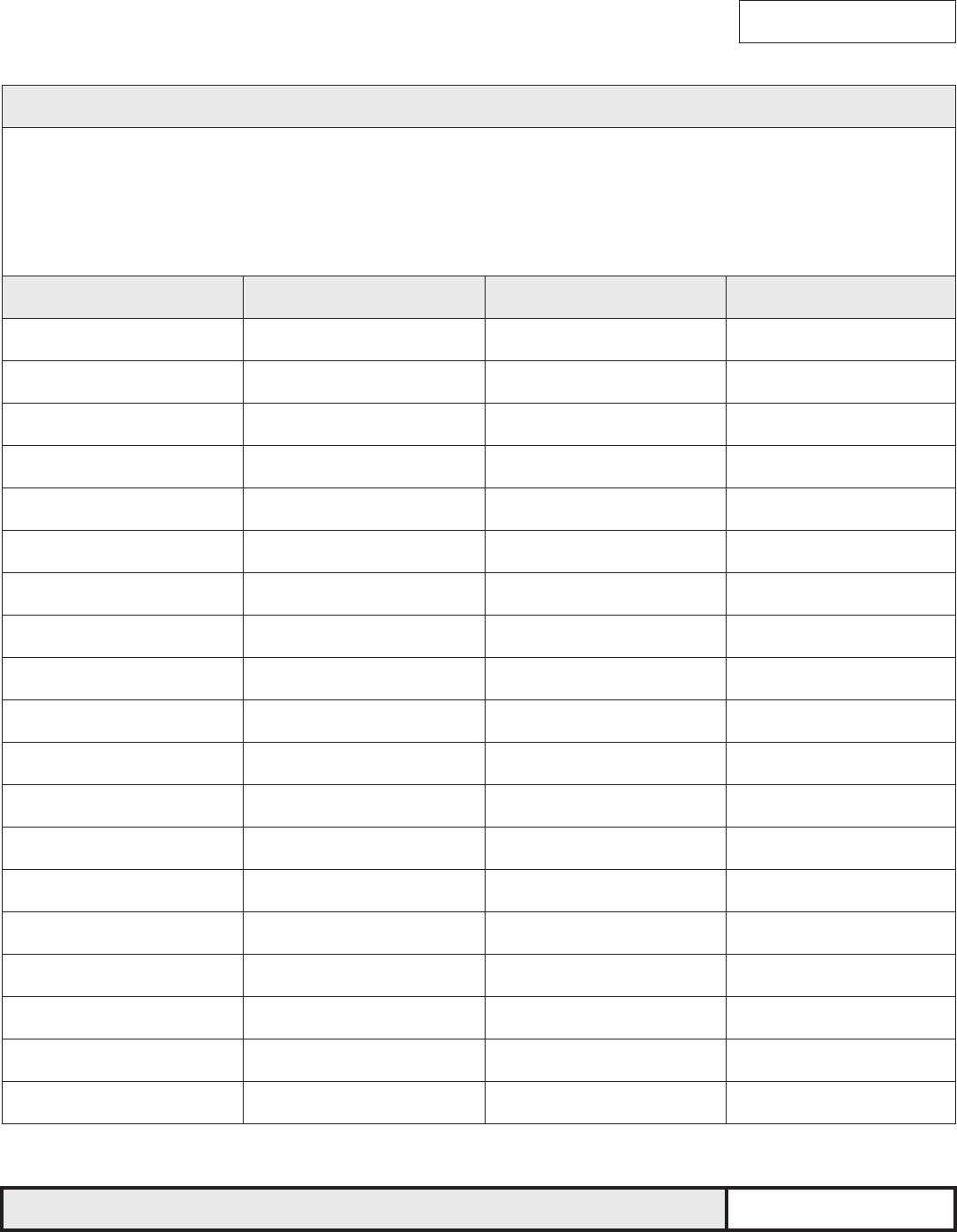

5184, Page 3

FEIN, ME or TR Number

PART 3: ASSET AND LIABILITY ANALYSIS (CONTINUED)

CASH VALUE OF LIFE INSURANCE POLICIES

Name of Insured Title of Insured Insurance

Policy Number Type Face Amount Available Loan Value

Name of Insured Title of Insured Insurance

Policy Number Type Face Amount Available Loan Value

If attaching a separate sheet listing additional life insurance policies, record the combined balance of those policies here.

REAL ESTATE

Property Address City State ZIP

City

County Country Date Purchased Date of Final Payment

Description of Property Ownership (mortgage, land contract) Current Market Value *Loan Balance

Property Address State ZIP

County Country Date Purchased Date of Final Payment

Description of Property Ownership (mortgage, land contract) Current Market Value *Loan Balance

If attaching a separate sheet listing additional real estate, record the combined current market value of that real estate here.

LOANS FROM THE BUSINESS TO PROPRIETOR, PARTNERS, OFFICERS, SHAREHOLDERS OR OTHE

Name of Loan Recipient Relatio

Payoff Date Status Amount Due

Name of Loan Recipient Relationship

Payoff Date Status Amount Due

Name of Loan Recipient Relationship

Payoff Date Status Amount Due

If attaching a separate sheet listing additional loans from the business, record the combined amount due on those loans.

Continue on Page 4

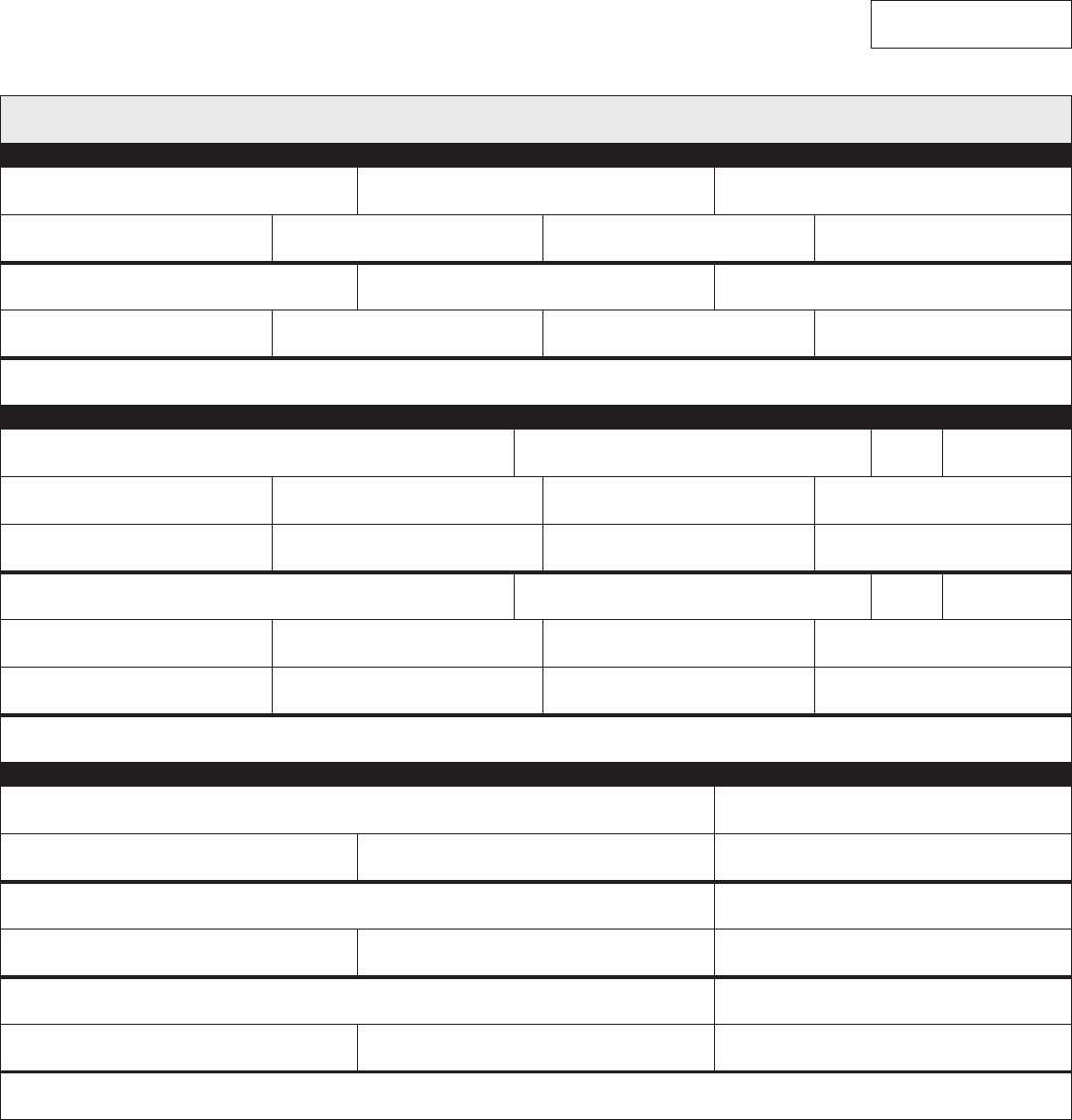

5184, Page 4

FEIN, ME or TR Number

PART 3: ASSET AND LIABILITY ANALYSIS (CONTINUED)

BUSINESS VEHICLES — Complete if owning or leasing a vehicle

Year Make License Number Vehicle ID Number Value Balance Owed

Year Make License Number Vehicle ID Number Value Balance Owed

If attaching a separate sheet listing additional motor vehicles, record the combined value of those motor vehicles here.

OTHER BUSINESS ASSETS

Enter information about other business assets, including machinery, equipment, merchandise inventory and other assets. Be specic. If needing more

space than provided below, attach a separate sheet listing additional assets. Include your business name and FEIN on all attachments.

Asset Current Market Value *Loan Balance

Asset Current Market Value *Loan Balance

Asset Current Market Value *Loan Balance

Asset Current Market Value *Loan Balance

Asset Current Market Value *Loan Balance

Asset Current Market Value *Loan Balance

PART 4: CERTIFICATION

Under penalty of perjury, I declare that I have examined this information, including accompanying documents, and to the best of my knowledge it is

true, correct, and complete.

Authorized Signature for Tax Matters Date

Authorized Signer’s Name (Print or Type) Title/Position Telephone Number

Authorized Signature for Tax Matters Date

Authorized Signer’s Name (Print or Type) Title/Position Telephone Number

Continue on Page 5

5184, Page 5

FEIN, ME or TR Number

PART 5: INDIVIDUAL ASSESSMENTS RELATING TO DOUBT AS TO COLLECTABILITY (BUSINESS)

List all outstanding tax assessments to be considered in the Offer in Compromise as they apply to doubt as to collectability. Use

additional copies of this page if needed and submit with the Offer in Compromise.

Use assessment numbers and related information from the most recent Final Assessment (Bill for Taxes Due) notice or the most recent

Final Demand notice received from the Michigan Department of Treasury, Ofce of Collections. Your assessment numbers can be

located by looking at the “ASSESSMENT NUMBER” column of any correspondence received in reference to your collections account.

Valid assessment numbers are 7 characters in length and begin with a letter.

ASSESSMENT NUMBER TAX TYPE TAX YEAR/PERIOD BALANCE DUE

Total Balance Due. Enter here the total of all lines in the Balance Due column below. If multiple pages are

included, this line on each copy of the page will reect the total for all pages.

Complete and attach additional copies of this page if needed.