Fillable Printable Affidavit of Heirship Form Sample

Fillable Printable Affidavit of Heirship Form Sample

Affidavit of Heirship Form Sample

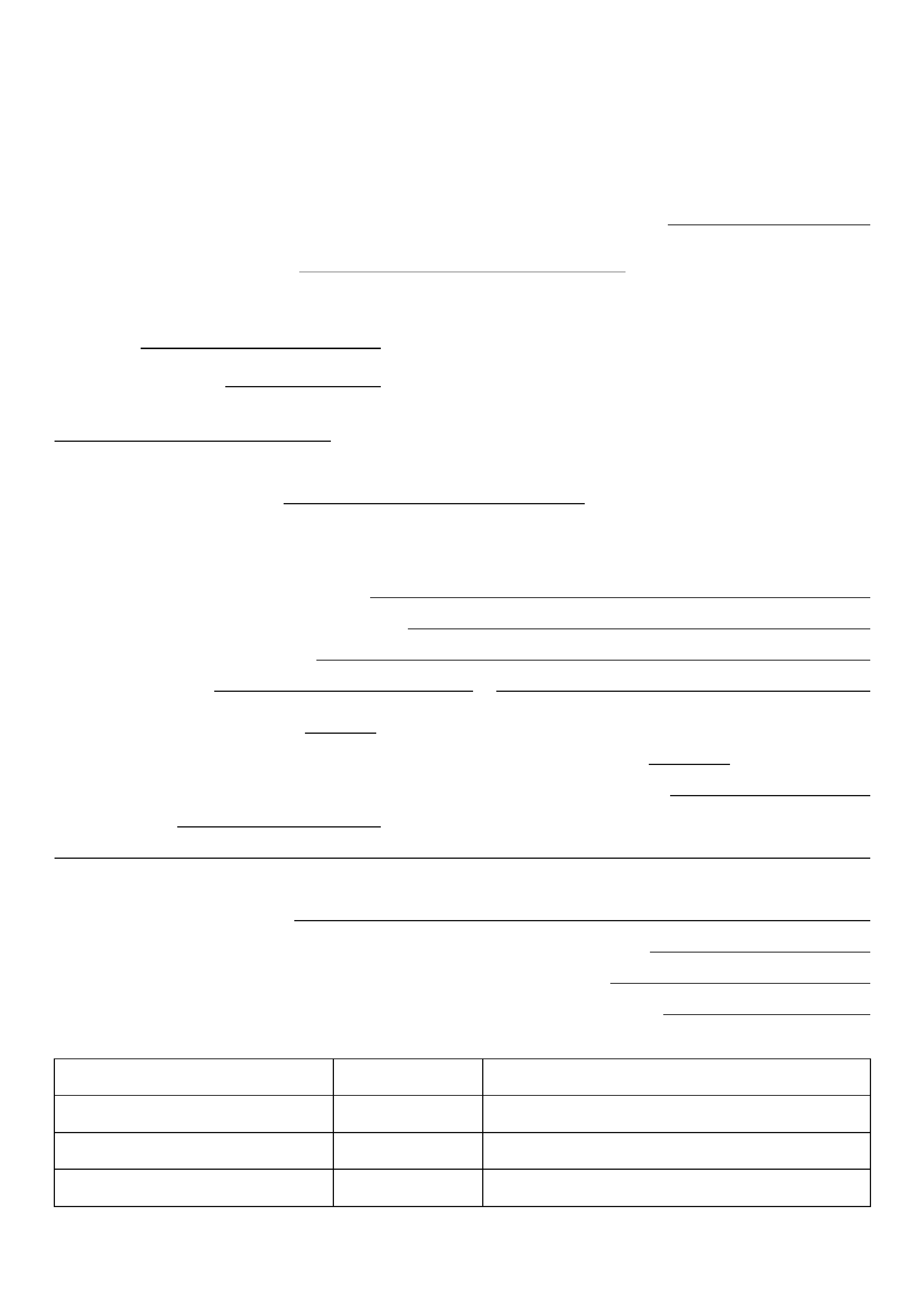

AFFIDAVIT OF HEIRSHIP

UNIT :

LEGAL DESCRIPTION

(Decedent)

STATE OF

COUNTY/PARISH OF

, whose address is ____________________________________________

hereinafter referred to as "Affiant," being of lawful age and being duly sworn, upon oath deposes and says that

(s)he was well acquainted with , hereinafter referred to as "the

Decedent," and that the answers and statements given in the following questionnaire are based upon Affiant's

personal knowledge and are true and correct:

1. How long did you know the Decedent?

2. What was your relationship to the Decedent?

3. The Decedent's residence was at

The decedent died on in

(DATE) (CITY, STATE)

4. Did the Decedent leave a will? If the Decedent did leave a will, please attach copy of same hereto.

5. Have any proceedings been commenced with respect to the Decedent's estate? If so, complete the

following sentence to the best of your knowledge: Proceedings were commenced in

County, State of , and the name and address of the executor or administrator is

6. Are there any debts still owing by the Decedent's estate and if so, will the size of the estate be sufficient in

your opinion to pay such debts?

7. Have all Federal and State Inheritance taxes been paid? (If none due, so state.)

8. Was the interest in the above described property community or separate?

9. Was the property of the decedent in the legal description above their homestead?

10. Give the names of all spouses of the decedent and their address or date of death/divorce:

NAME OF SPOUSE(S)

DATE OF

MARRIAGE

CURRENT ADDRESS OR

DATE OF DEATH/DIVORCE

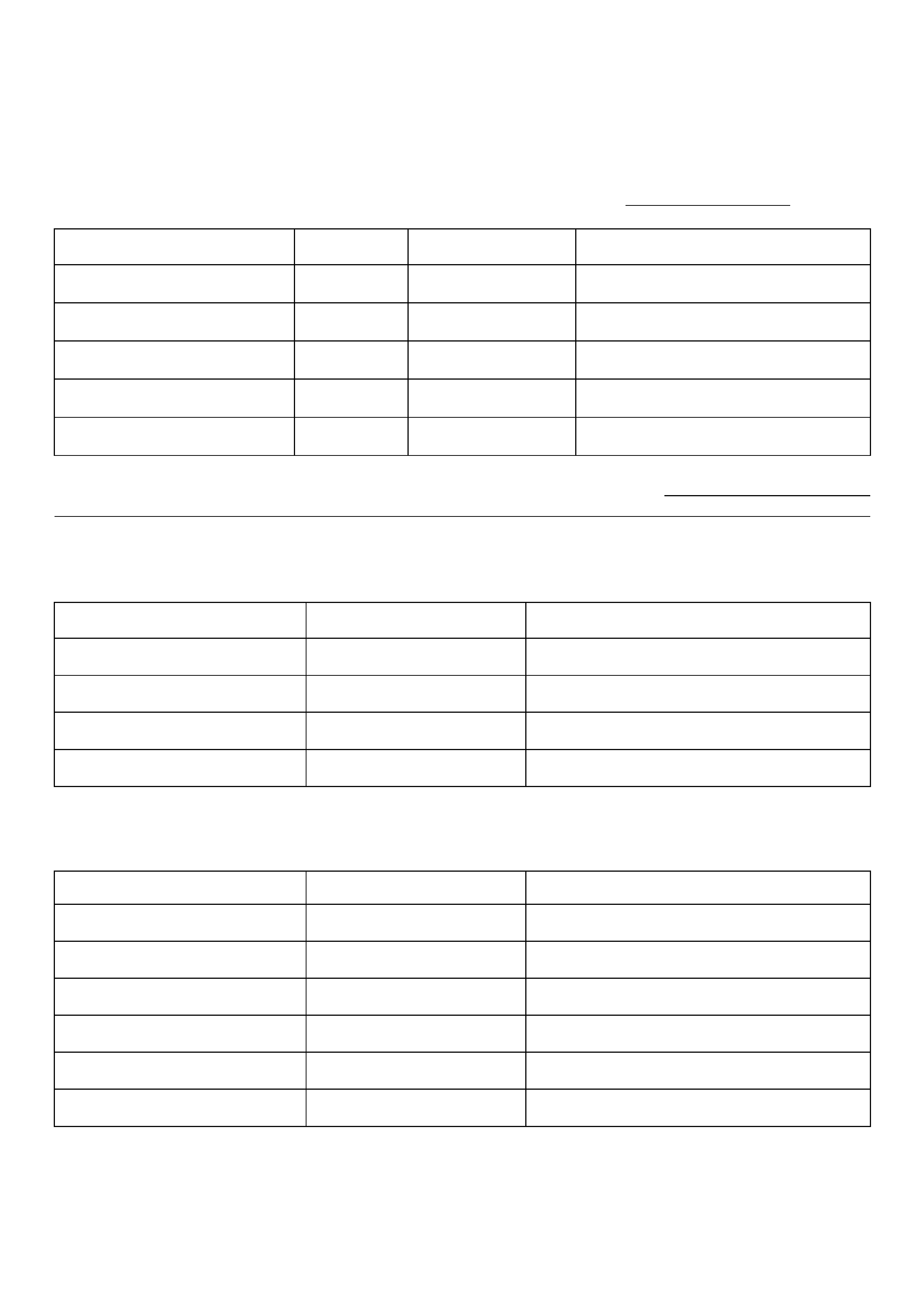

11. Complete the following table with respect to all children of the Decedent, whether living or dead, natural or

adopted.

NAME OF CHILD

BIRTH DATE

NAME OF CHILD’S

OTHER PARENT

CURRENT ADDRESS

OR DATE OF DEATH

12. Were any of the Decedent's children adopted and if so, which one(s) and when?

13. Provide the following information on the Decedent’s grandchildren, born only to the deceased children in

item 11 above. If there are none, please state that below.

NAME OF GRANDCHILD’S

DECEASED PARENT (FROM #11)

NAME OF GRANDCHILD

ADDRESS OF GRANDCHILD

OR DATE OF DEATH

14. If the Decedent was not survived by any children or grandchildren, provide the following information on the

Decedent’s parents (if living) and all brothers and sisters:

NAME OF RELATIVE RELATIONSHIP ADDRESS OR DATE OF DEATH

15. If any of decedent’s brothers or sisters listed in #14 are deceased, give the name and address of their

children.

NAME OF NIECE OR NEPHEW’S

DECEASED PARENT (FROM #14)

NAME OF NIECE OR

NEPHEW

ADDRESS OR DATE OF DEATH

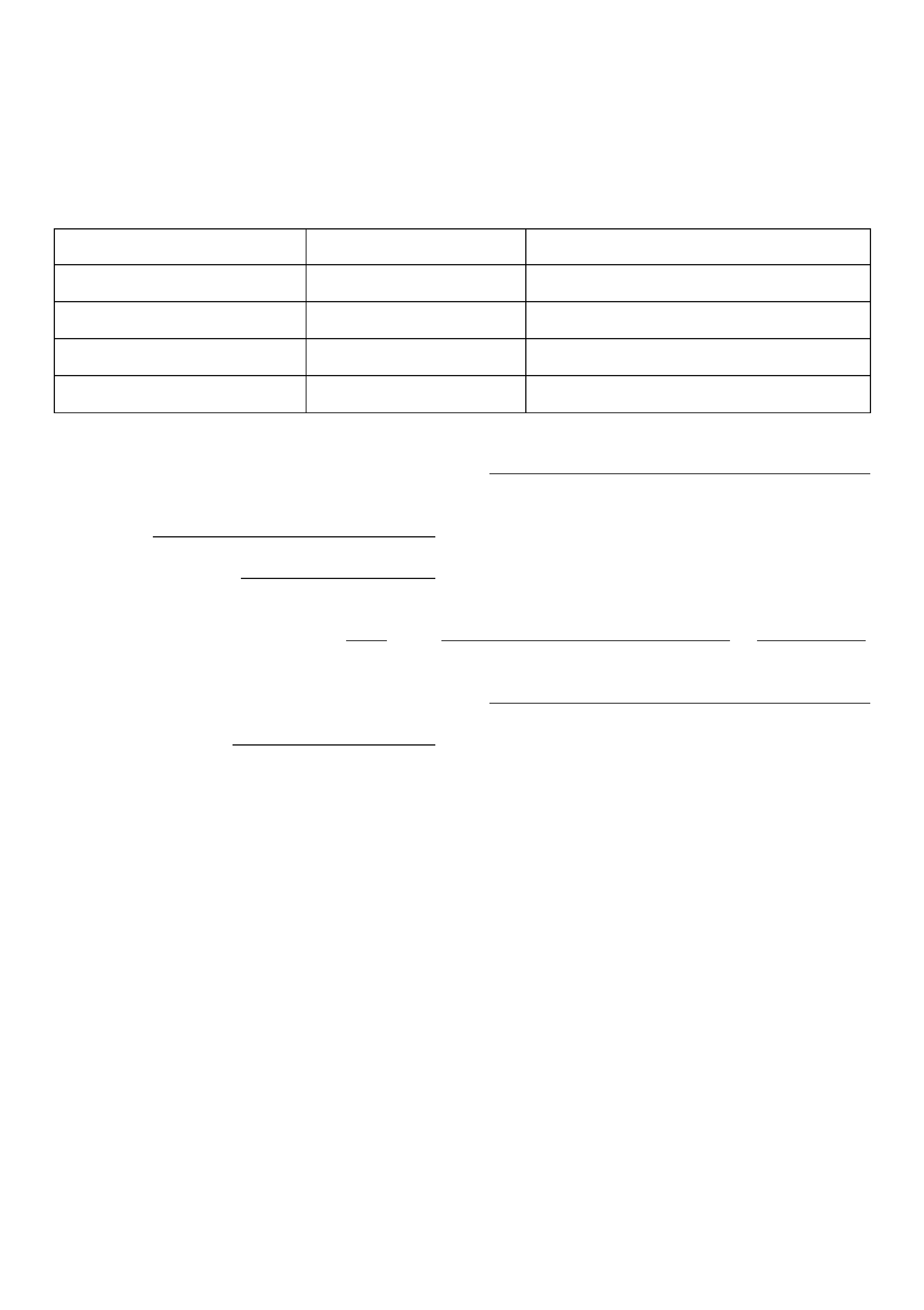

Affiant's Signature

STATE OF

COUNTY/PARISH OF

Subscribed and sworn to before me this day of , 20 .

Notary Public

My Commission expires

INSTRUCTIONS FOR AFFIDAVITS OF HEIRSHIP

When someone passes away (also known as the Decedent) without a will or if the will is not probated in the state where

the property is located and the estate is rather small, an Affidavit of Heirship may be used to determine who to pay

based on the laws of descent and distribution for that state. Texas is the only state that we operate in that allows

foreign probate to be filed for record in the county where the property is located without opening ancillary proceedings.

The form should be completed by someone other than an heir, who is familiar with the family history of the

decedent, and who will obtain no benefit from the Estate. This person may be a family friend, a distant relative, the

family attorney or perhaps a religious acquaintance such as the decedent’s pastor. Specifically ineligible to fill out the

Affidavit are the surviving spouse and the children of the decedent. The disinterested party filling out the form is also

known as the Affiant.

All questions should be answered and current addresses, including the street address, city, state and zip

code should be provided for each party listed on the Affidavit. If the current address of one of the decedent’s

relatives is not known, put “Unknown” in that blank.

N/A or Unknown is not an answer to any question on page one of the Affidavit. If the Affiant does not

understand how to accurately answer any of the questions on the first page, do not leave it blank. Contact Us on our

Owner Relations line at (903) 581-4382, or email us at ownerrelations@vefinc.com.

Upon completion, the Affiant should sign the Affidavit, have their signature notarized, and then the instrument

should be filed for record in the county/parish and state in which the interest is located. See below for recording

instructions.

Affidavits that are incomplete, incorrect or filled out by an ineligible Affiant will be returned to

the sender for correction and cannot be used to transfer the interest to the heirs at law.

RECORDING INSTRUCTIONS:

If the annual income for the owner for the property(ies) that we operate is more than $300, the Affidavit has to be

filed for record in the county/parish and state that the real estate is located in.

Go to www.courthousedirect.com to obtain the County/Parish Clerk's address. You must request that the clerk

return a certified copy of the Affidavit to you. Please contact the clerk concerning the filing fees or any additional

information concerning filing.

When you receive the certified copy of the Affidavit from the clerk, please forward a photocopy of the certified

instrument along with a photocopy of the certified death certificate of the decedent to this office. Upon receipt, the

interest will be transferred by the laws of descent and distribution for the state where the property is located and Division

Orders will be issued to each heir.

If the annual income for the owner for the property(ies) that we operate is less than $300, the Affidavit does not

have to be filed for record for our purposes. However, it is advisable to file the Affidavit for record in the appropriate

county/parish as it puts third parties on notice as to the names and addresses of the heirs at law.

After the Affidavit has been filled out completely and correctly and the Affiant's signature is notarized, please

return the Affidavit to our office along with a photocopy of the certified Death Certificate.

When we receive the Affidavit and Certified Death Certificate, we will make the transfer in accordance with the

laws of the state where the property is located. Please note that the law may not necessarily follow the terms of the will.

HELPFUL HINTS

The legal description in the top right corner is the Section-Township-Range where the property is located and is

necessary if the Affidavit is being filed for record, particularly in Oklahoma.

The County/Parish and State in the top left corner of page one is the County and State where the property is

located.

The “Decedent” is the owner that our company is paying who has passed away.

The “Affiant” is the person who is filling out the form and swearing to their knowledge of the facts stated.

Question #7 regards Federal and State Estate taxes, not income taxes or property taxes. The Estate Tax is a tax

on your right to transfer property at your death. It consists of an accounting of everything the decedent owned or had an

interest in at the date of death. As of 2014, a filing for federal inheritance taxes is required for estates with combined

gross assets and prior taxable gifts exceeding

$1,500,000 in 2004 – 2005

$2,000,000 in 2006 – 2008

$3,500,000 for decedents dying in 2009

$5,000,000 for decedent's dying in 2010-11

$5,120,000 in 2012

$5,250,000 in 2013 and

$5,340,000 in 2014.

If the decedent’s estate did not meet this criterion, no Federal Estate taxes are due.

Regarding Question #8 on page one use the following definition to determine if the property is the decedent’s

separate property:

"In a marriage, separate property means that which is owned individually by the husband

or by the wife, as opposed to their community property, which is owned by both. There

are four main sources of separate property: (1). Acquisition prior to marriage, (2). Devise

under a will, (3). Gift, (4). Inheritance.”

Regarding Question #9 on page one use the following definition to determine if the property that the decedent is

being paid on by our company is their homestead:

A homestead is “a person's or family's residence, which comprises the land, house, and

outbuildings, and in most states is exempt from forced sale for collection of debt.”