Fillable Printable Application For Pretax Transportation Fringe Benefits

Fillable Printable Application For Pretax Transportation Fringe Benefits

Application For Pretax Transportation Fringe Benefits

Sensitive, but Unclassified

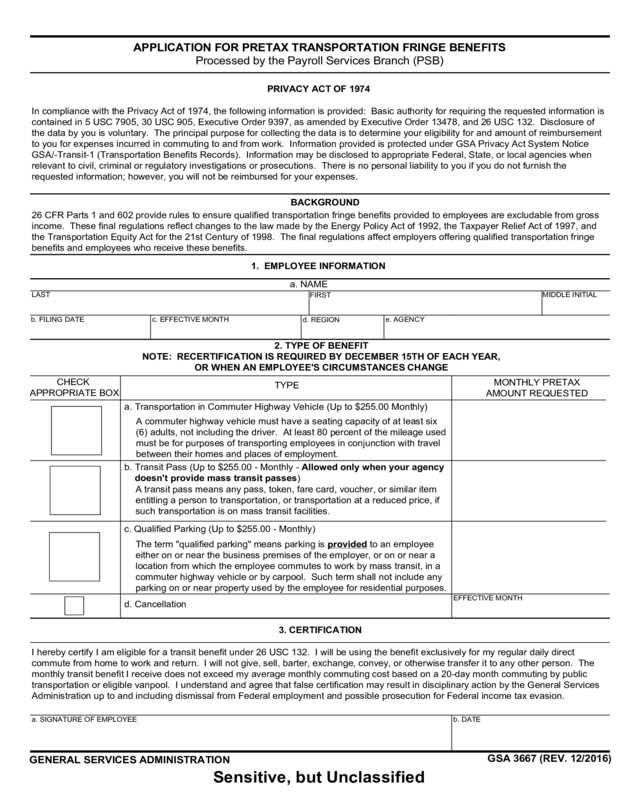

APPLICATION FOR PRETAX TRANSPORTATION FRINGE BENEFITS

Processed by the Payroll Services Branch (PSB)

PRIVACY ACT OF 1974

In compliance with the Privacy Act of 1974, the following information is provided: Basic authority for requiring the requested information is

contained in 5 USC 7905, 30 USC 905, Executive Order 9397, as amended by Executive Order 13478, and 26 USC 132. Disclosure of

the data by you is voluntary. The principal purpose for collecting the data is to determine your eligibility for and amount of reimbursement

to you for expenses incurred in commuting to and from work. Information provided is protected under GSA Privacy Act System Notice

GSA/-Transit-1 (Transportation Benefits Records). Information may be disclosed to appropriate Federal, State, or local agencies when

relevant to civil, criminal or regulatory investigations or prosecutions. There is no personal liability to you if you do not furnish the

requested information; however, you will not be reimbursed for your expenses.

I hereby certify I am eligible for a transit benefit under 26 USC 132. I will be using the benefit exclusively for my regular daily direct

commute from home to work and return. I will not give, sell, barter, exchange, convey, or otherwise transfer it to any other person. The

monthly transit benefit I receive does not exceed my average monthly commuting cost based on a 20-day month commuting by public

transportation or eligible vanpool. I understand and agree that false certification may result in disciplinary action by the General Services

Administration up to and including dismissal from Federal employment and possible prosecution for Federal income tax evasion.

3. CERTIFICATION

a. SIGNATURE OF EMPLOYEEb. DATE

a. NAME

LAST

FIRST

MIDDLE INITIAL

b. FILING DATE

c. EFFECTIVE MONTH

d. REGION

2. TYPE OF BENEFIT

NOTE: RECERTIFICATION IS REQUIRED BY DECEMBER 15TH OF EACH YEAR,

OR WHEN AN EMPLOYEE'S CIRCUMSTANCES CHANGE

CHECK

APPROPRIATE BOX

TYPE

MONTHLY PRETAX

AMOUNT REQUESTED

EFFECTIVE MONTH

d. Cancellation

c. Qualified Parking (Up to $255.00 - Monthly)

The term "qualified parking" means parking is provided to an employee

either on or near the business premises of the employer, or on or near a

location from which the employee commutes to work by mass transit, in a

commuter highway vehicle or by carpool. Such term shall not include any

parking on or near property used by the employee for residential purposes.

b. Transit Pass (Up to $255.00 - Monthly - Allowed only when your agency

doesn't provide mass transit passes)

A transit pass means any pass, token, fare card, voucher, or similar item

entitling a person to transportation, or transportation at a reduced price, if

such transportation is on mass transit facilities.

a. Transportation in Commuter Highway Vehicle (Up to $255.00 Monthly)

A commuter highway vehicle must have a seating capacity of at least six

(6) adults, not including the driver. At least 80 percent of the mileage used

must be for purposes of transporting employees in conjunction with travel

between their homes and places of employment.

e. AGENCY

BACKGROUND

26 CFR Parts 1 and 602 provide rules to ensure qualified transportation fringe benefits provided to employees are excludable from gross

income. These final regulations reflect changes to the law made by the Energy Policy Act of 1992, the Taxpayer Relief Act of 1997, and

the Transportation Equity Act for the 21st Century of 1998. The final regulations affect employers offering qualified transportation fringe

benefits and employees who receive these benefits.

1. EMPLOYEE INFORMATION

GSA 3667 (REV. 12/2016)

GENERAL SERVICES ADMINISTRATION

Sensitive, but Unclassified

The "Transportation Equity Act of the 21st Century (TEA-21) Benefit Program" is a provision of the Internal

Revenue Code (26 USC 132), permitting an employer to pay for an employee's cost of commuting to work, in

other than a single occupancy vehicle. Employees do not report this as income for tax purposes. The TEA-21

benefit program is considered a "qualified transportation" fringe benefit and is offered to employees as a pretax

payroll deduction. The benefit is designed to improve air quality, reduce traffic congestion and conserve energy

by encouraging employees to commute by transit or vanpool.

The purpose of this form is to provide the necessary data to qualify for the Transportation Equity Act for the 21st

century, 1998, Public Law Number 105-178. An employee's decision to receive the transportation fringe benefit

will not affect the employee's basic rate of pay, which is the rate of pay fixed by law or by administrative action,

5 CFR 550.103.

§

1. EMPLOYEE INFORMATION. Items a - f must be completed.

2. TYPE OF BENEFIT. Check the appropriate box. All benefits are indexed for inflation.

a. Transportation in a Commuter Highway Vehicle.

Tax year 2017, monthly benefit for vanpools is $255.

b. Transit Pass (Allowed only when your agency doesn't provide mass transit passes).

Tax year 2017, monthly benefit is $255.

c. Qualified Parking.

Tax year 2017, monthly benefit is $255.

d.Cancellation. Use this only if you are cancelling. The effective month must be entered when

circumstances change.

3. CERTIFICATION. Please read carefully. Sign and date the form.

NOTE:

Benefits will be activated the month following the receipt of the election form.

This form can be obtained from the GSA Payroll Services Branch (PSB), your servicing Human Resources

Office or the GSA forms website at www.gsa.gov/forms.

You may fax this form to the GSA PSB, Customer Service at (816) 823-5435 (primary) or (816) 823-5533 (alternate).

INSTRUCTIONS

GSA 3667 (REV. 12/2016) BACK