- In-home Supportive Services Provider Direct Deposit Enrollment/Change/Cancellation Form - California

- Direct Deposit Authorization - Florida State University

- Direct Deposit of Annuity Payments - Pennsylvania

- Direct Deposit Authorization Sample Form - Indiana

- Direct Deposit Authorization - Arizona

- Direct Deposit Authorization Agreement - Alabama

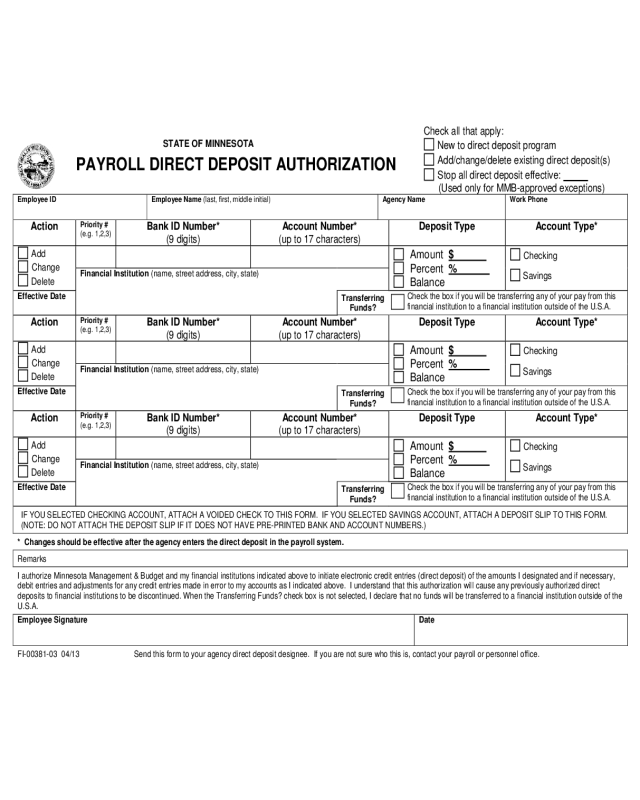

Fillable Printable Authorization for Direct Deposit - Minnesota

Fillable Printable Authorization for Direct Deposit - Minnesota

Authorization for Direct Deposit - Minnesota

Check all that apply:

STATE OF MINNESOTA

PAYROLL DIRECT DE P OSIT AUTHO RIZATIO N

New to direct deposit program

Add/change/ delete existing direct deposit(s)

Stop all direct deposit ef fective:

(Used only for MMB-approved exceptions)

Empl oyee I D

Empl oyee Name (last, first, midd le initial)

Agency Name

Work Phone

Action

Priority #

(e.g. 1, 2,3)

Bank ID Number*

(9 digits)

Ac count Number *

(up to 17 characters)

Deposit Type

Ac count Type*

Add

Change

Delete

Amount $

Percent %

Balance

Checking

Savings

Financial Ins titution (name, street address, city, state)

Effective Date

Transferring

Funds?

Check the box if you will be transferring any of your pay from this

financial institution to a financial institution outside of the U.S.A.

Action

Priority #

(e.g. 1, 2,3)

Bank ID Number*

(9 digits)

Ac count Number *

(up to 17 characters)

Deposit Type

Ac count Type*

Add

Change

Delete

Amount $

Percent %

Balance

Checking

Savings

Financial Ins titution (name, street address, city, state)

Effective Date

Transferring

Funds?

Check the box if you will be transferring any of your pay from this

financial institution to a financial institution outside of the U.S.A.

Action

Priority #

(e.g. 1, 2,3)

Bank ID Number*

(9 digits)

Ac count Number *

(up to 17 characters)

Deposit Type

Ac count Type*

Add

Change

Delete

Amount

$

Percent %

Balance

Checking

Savings

Financial Ins titution (name, street address, city, state)

Effective Date

Transferring

Funds?

Check the box if you will be transferring any of your pay from this

financial institution to a financial institution outside of the U.S.A.

IF YOU SELECTED CHECKING ACCOUNT, ATTACH A VOIDED CHE CK TO THIS FORM. IF YOU SELECTED SAVINGS ACCOUNT, ATTACH A DEPOSIT SLIP TO THIS FORM.

(NOTE: DO NOT ATTACH THE DEPOSIT SLIP IF IT DOES NOT HAVE PRE-PRINTED BANK A ND A CCOUNT NUMBERS.)

* Changes should be effective after the agency enters the direct deposit in the payroll system.

Remarks

I authorize Minnesota Management & Budget and my financial ins titutions indicated above to initiate electronic credit entries (direct deposit) of the amounts I designated and if necessary,

debit entries and adjustments for any credit entries made in error to m y accounts as I indicated above. I understand that this authorization will cause any previously authorized direct

deposit s to financ ial ins titu t ion s to be dis cont inu ed. When th e Tr ansferr ing Funds? check box is not selected, I declare that no funds will be trans ferred to a financial institution outside of the

U.S.A.

Employee Signature

Date

FI-00381-03 04/13 Send this form to your agency direct deposit designee. If you are not sure who this is, contact your payroll or pers onnel office.

Payrol l Di re c t Deposi t Author iz a ti on Form Instr uc t ions

Boxes In The Upper Right-Hand Corner Of Form: Check all ap pl icab le box es. Note: If you have arranged to have funds transferred to a foreign financial institution

check the correct box. To stop all direct deposits based on a MMB approved exception, check the Stop box and sign and date the form.

Action: Check one box per row. Indicate if the direct deposit record is being added, changed or deleted.

Priority Number: Indicate which direct deposit account should receive funds first, second, or third.

Bank ID Number and Account Number: If you are not sure what these numbers are, contact your financial institution. Credit unions may not have the correct bank ID

number and account number needed for direct deposit printed on their checks. If applying for direct deposit to a credit union, contact the credit union for the numbers and

for the ty pe of account to select. (These numbers are correct on Affinity Plus Federal Credit Union and Hiway Federal Credit Union checks.)

Deposit Typ e: Select amount, perc ent or balance. Fill in the amount ($) or percent (%). There must be one distribution with balance selected, or a distribution of 100%.

Each direct dep os it must have either a dollar amount or a percent of net pay except for Deposit Type Balance.

A cco u n t Type: If you have accounts other than checking or savings (such as a loan), ask your financial institution which type of account to select.

Effective Date: If the information you provide is correct, your direct deposit will be effective after the agency enters the direct deposit in the payroll system. Deposits will

be in accounts sometime on the check’s issue date. The financial institution must post the deposit on the issue date, but may do so anytime on that day. Even if the

financial institution posts it early in the day, a few automatic teller machines (ATMs) may not register the deposit until the next day. Ask your financial institution when the

deposit will be available. If you have a problem with a deposit on the check’s issue date (for example, the ATM does not reflect the deposit), ask the direct deposit

representative at your financial institution when the deposit will be posted.

Financial Institution: Enter the name and full address of your U.S.A. f in a nc ial in st itution.

Transferring Funds?: Select the check box if an y of your pay will be transferred from this financial institution to a financial institution outside of the U.S.A.

Direct Deposit Distribution Examples:

Example 1: Priority 1 - 75% of ne t pay to checking, Priority 2 - 25% of net pay to saving s, Priority 3 – Balance to same account as savings.

• If net pay is $500.00, the checking deposit will be $375.00 and the savings deposit will be $125.00.

• Any excess balance will be deposited into the savings account.

Example 2: Pri o ri ty 1 - $300.00 to checking, Priority 2 - $ 200. 00 sav i ngs, Prio rit y 3 – Balance to same account as checking.

• If net pay is $500.00, the checking deposit will be $300.00 and the savings deposit will be $200.00.

• If net pay is $550.00, the checking deposit will be $350.00 and the savings deposit will be $200.00.

• If net pay is $100.00, the checking deposit will be $100, and there will be no savings deposit.

Notice: All data on this form is private data, in accordance with Minnesota Statute 13.43, except for employee name, employee ID number, agency name and work

phone. The private data is not legall y require d; however, by not providing it, your direct dep osit tr ansact ion wil l not be ass ured of going t o the cor rect f inanc ial institution,

to the correct account or that the correct amount will be posted accurately. The private data listed on this form is available to representatives of your agency and

em plo yees of the Stat e who per f orm per sonnel or payroll relat ed f unc tio ns , provid ed suc h in di vidu als ha ve a bus in ess r eason to ac c es s the data. Oth er s w ho may l ega lly

access this information are representatives of the Attorney General and Legislative Auditor, enforcement agencies with statutory authority and persons/entities authorized

by law or court order.