- Durable General Power of Attorney New York Statutory Short Form

- Durable Power of Attorney for Health Care - Oklahoma

- Form 2484 - Alabama Power of Attorney and Declaration of Representative

- Durable Power of Attorney Example - Massachusetts

- BMV 3771 - Power of Attorney Form - Ohio Bureau of Motor Vehicles

- Durable Power of Attorney - Kentucky

Fillable Printable BOE-392 - California Power of Attorney Form

Fillable Printable BOE-392 - California Power of Attorney Form

BOE-392 - California Power of Attorney Form

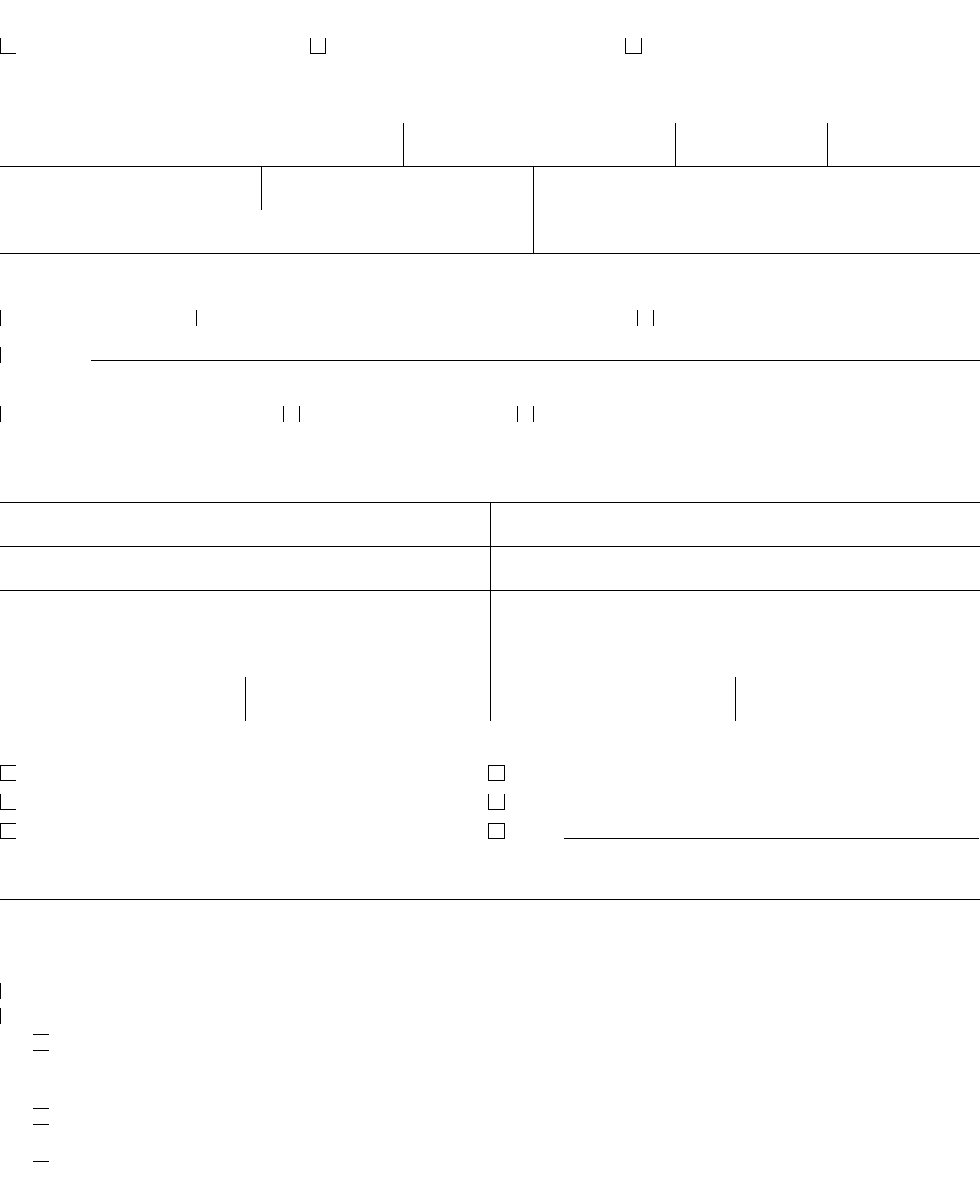

BOE-392 (FRONT) REV. 9 (3-11)

POWER OF ATTORNEY

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

FRANCHISE TAX BOARD

EMPLOYMENT DEVELOPMENT DEPARTMENT

Check below to indicate the appropriate agency. Please note that a separate form must be completed and provided to each agency checked.

STATE BOARD OF EQUALIZATION

PO BOx 942879

SACRAMENTO CA 94279-0001

800-400-7115

FRANCHISE TAx BOARD

PO BOx 2828 MS F283

RANCHO CORDOVA CA 95741-2828

FAx 916-843-5440

EMPLOYMENT DEVELOPMENT DEPARTMENT

PO BOx 826880 MIC 28

SACRAMENTO CA 94280-0001

916-654-7263 • FAx 916-654-9211

TAXPAYER’S NAME

BUSINESS OR CORPORATION NAME

TELEPHONE NUMBER

( )

FAX NUMBER

( )

SOCIAL SECURITY NUMBER FEDERAL EMPLOYER IDENTIFICATION NUMBER(S) CALIFORNIA SECRETARY OF STATE NUMBER(S)

BOARD OF EQUALIZATION ACCOUNT/PERMIT(S) EDD EMPLOYER ACCOUNT NUMBER

MAILING ADDRESS (Number and Street, City, State, ZIP Code)

INDIVIDUAL PARTNERSHIP CORPORATION LIMITED LIABILITY COMPANY

OTHER

As owner, officer, receiver, administrator, or trustee for the taxpayer, or as a party to the tax or fee matter before the:

State Board of Equalization Franchise Tax Board Employment Development Department

I hereby appoint: [enter below the individual appointee(s) name(s), address(es) (including ZIP Code), telephone number(s) and fax number(s)

– do not enter names of accounting or law firms, partnerships, corporations, etc., as the appointee name] �

APPOINTEE NAME

APPOINTEE BUSINESS NAME (If applicable)

APPOINTEE ADDRESS (Number and Street)

(City) (State) (ZIP Code)

TELEPHONE NUMBER

( )

FAX NUMBER

( )

APPOINTEE NAME

APPOINTEE BUSINESS NAME (If applicable)

APPOINTEE ADDRESS (Number and Street)

(City) (State) (ZIP Code)

TELEPHONE NUMBER

( )

FAX NUMBER

( )

As attorney(s)-in-fact to represent the taxpayer(s) for the following tax or fee matters: [specify type(s) of tax]

Franchise and Income Tax Law

Sales and Use Tax Law

Use Fuel Tax Law

Payroll Tax Law

Benefit Reporting

Other

:

SPECIFY THE TAx OR FEE YEAR(S) OR PERIOD(S) [IF ESTATE TAx, INDICATE DATE OF DEATH] (for Board of Equalization and Franchise Tax Board purposes)

The attorney(s)-in-fact (or any of them) are authorized, subject to revocation, to receive confidential tax information and to

perform on behalf of the taxpayer(s) the following acts for the tax or fee matters described above: [check the box(es) for the

powers granted]

General Authorization (including all acts described below).

Specific Authorization (selected acts described below).

To confer and resolve any assessment, claim or collection of a deficiency or other tax or fee matter pending before the �

identified agency and attend any meetings or hearings thereto for the specified law identified above. �

To receive, but not to endorse and collect, checks in payment of any refund of taxes, penalties or interest. �

To execute petitions, claims for refund and/or amendments thereto. �

To execute consents extending the statutory period for assessment or determination of taxes. �

To execute closing agreements under section 19441 of the California Revenue and Taxation Code. �

To execute settlement agreements under section 19442 of the California Revenue and Taxation Code. �

(The back of this form must be completed)

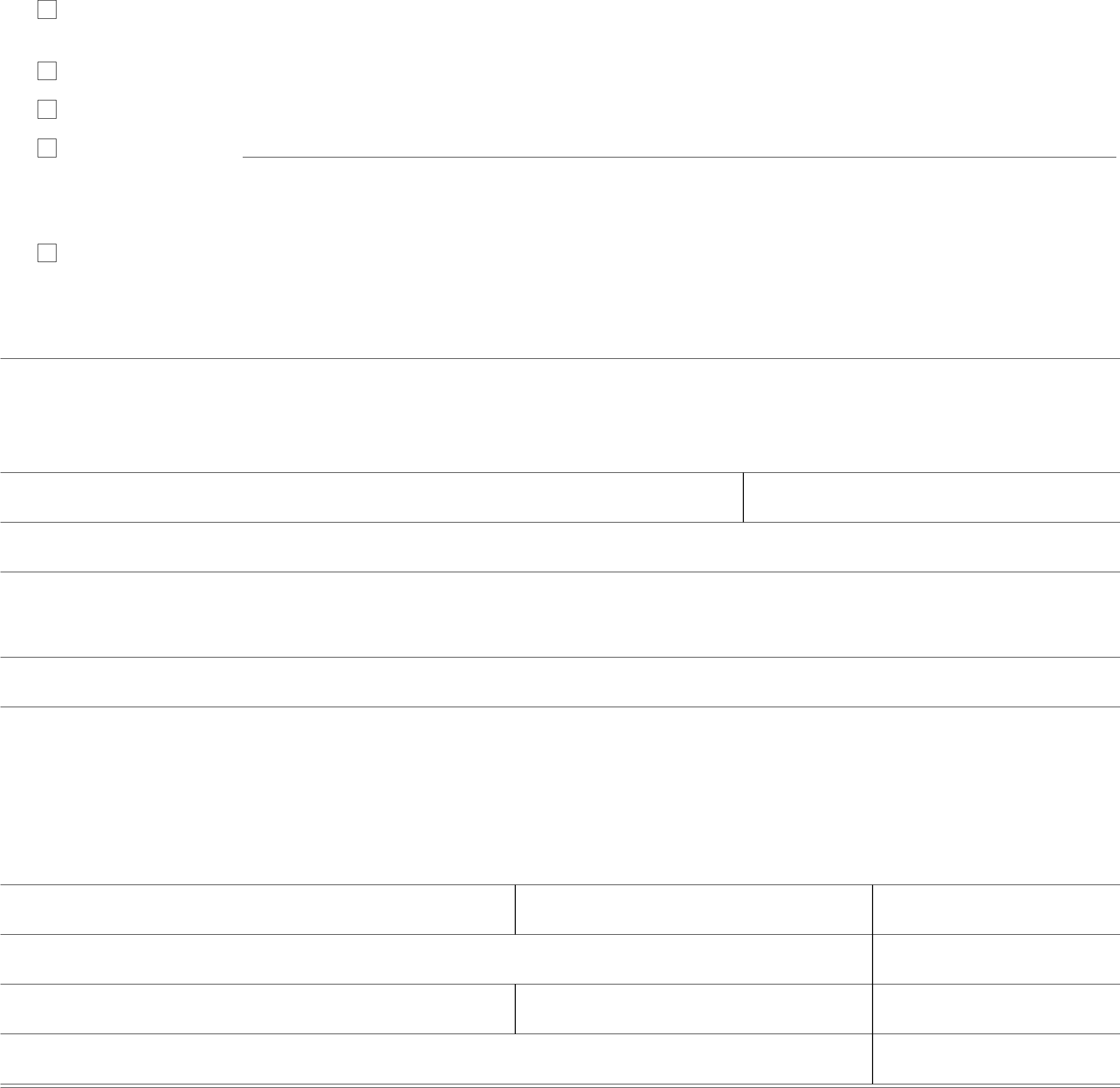

BOE-392 (BACK) REV. 9 (3-11)

To represent the taxpayer for changes to their mailing address for any and all Payroll Tax Law, Benefit Reporting, both

Payroll Tax Law and Benefit Reporting. �

To execute settlement agreements under section 1236 of the California Unemployment Insurance Code. �

To delegate authority or to substitute another representative. �

Other acts (specify):

Franchise Tax Board (FTB) will send you and your first representative listed a copy of FTB computer generated notices as they

become available.

Check this box if you do

not want FTB to send copies of available FTB computer generated notices to your first

representative listed.

(Note: Not all FTB processing systems are capable of generating representative copies at this time.)

This Power of Attorney revokes all earlier Power(s) of Attorney on file with the California State Board of Equalization,

the Employment Development Department, or the Franchise Tax Board as identified above for the same matters and years or

periods covered by this form, except for the following: [specify to whom granted, date and address, or refer to attached copies of

earlier power(s)]

NAME DATE POWER OF ATTORNEY GRANTED

ADDRESS (Number and Street, City, State, ZIP Code)

Unless limited, this Power of Attorney will remain in effect until the final resolution of all tax matters specified herein.

[specify expiration date if limited term]

TIME LIMIT/ExPIRATION DATE (for Board of Equalization and Franchise Tax Board purposes)

Signature of Taxpayer(s)—If a tax matter concerns a joint return, both spouses must sign if joint representation is requested. If you

are a corporate officer, partner, guardian, tax matters partner/person, executor, receiver, registered domestic partner, administrator,

or trustee on behalf of the taxpayer, by signing this Power of Attorney you are certifying that you have the authority to execute this

form on behalf of the taxpayer.

s

IF THIS POWER OF ATTORNEY IS NOT SIGNED AND DATED BY AN AUTHORIZED INDIVIDUAL, IT WILL BE RETURNED AS INVALID.

SIGNATURE

-

TITLE (If applicable) DATE

PRINT NAME TELEPHONE

( )

-

SIGNATURE TITLE (If applicable) DATE

PRINT NAME TELEPHONE

( )