Fillable Printable Ccc75 Form 0206 3

Fillable Printable Ccc75 Form 0206 3

Ccc75 Form 0206 3

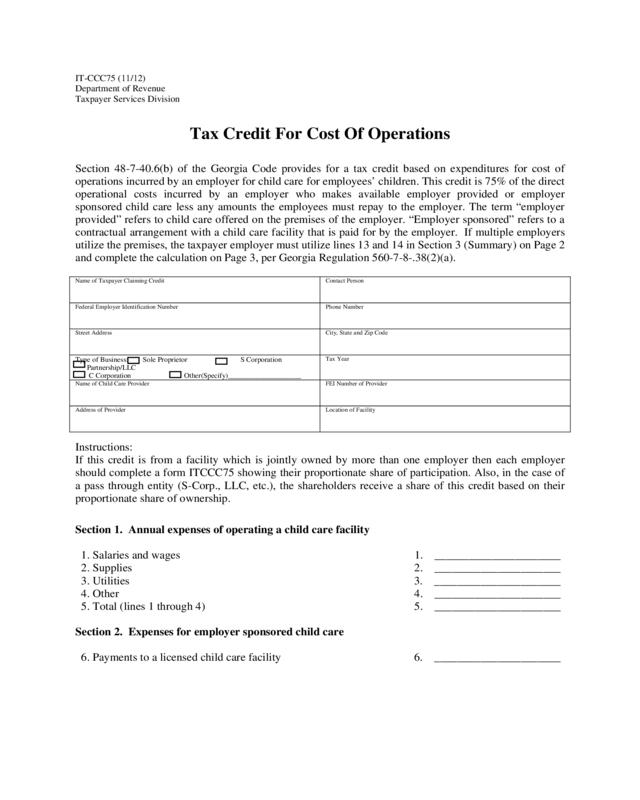

Department of Revenue

Taxpayer Services Division

Tax Credit For Cost Of Operations

Section 48-7-40.6(b) of the Georgia Code provides for a tax credit based on expenditures for cost of

operations incurred by an employer for child care for employees’ children. This credit is 75% of the direc t

operational costs incurred by an employer who makes available employer provided or employer

sponsored child care less any amounts the employees must repay to the employer. The term “employer

provided” refers to child care offered on the premises of the employer. “Employer sponsored” refers to a

contractual arrangement with a child care facility that is paid for by the employer. If multiple employers

utilize the premises, the taxpayer employer must utilize lines 13 and 14 in Section 3 (Summary) on Page 2

and complete the calculation on Page 3, per Georgia Regulation 560-7-8-.38(2)(a).

Name of Taxpayer Claiming Credit

Contact Person

Federal Employer Identification Number

Phone Number

Street Address

City, State and Zip Code

Tax Year

Name of Child Care Provider

FEI Number of Provider

Address of Provider

Location of Facility

Instructions:

If this credit is from a facility which is jointly owned by more than one employer then each employer

should complete a form ITCCC75 showing their proportionate share of participation. Also, in the case of

a pass through entity (S-Corp., LLC, etc.), the shareholders receive a share of this credit based on their

proportionate share of ownership.

Section 1. Annual expenses of operating a child care facility

1. Salaries and wages 1. ______________________

2. Supplies 2. ______________________

3. Utilities 3. ______________________

4. Other 4. ______________________

5. Total (lines 1 through 4) 5. ______________________

Section 2. Expenses for employer sponsored child care

6. Payments to a licensed child care facility 6. ______________________

Type of Business: Sole Proprietor S Co rporation

Partnership/LLC

C Corporation Other(Specify)____________________

IT-CCC75 (11/12)

PRINT

CLEAR

Georgia Department of Revenue

Taxpayer Services Division

Page 2

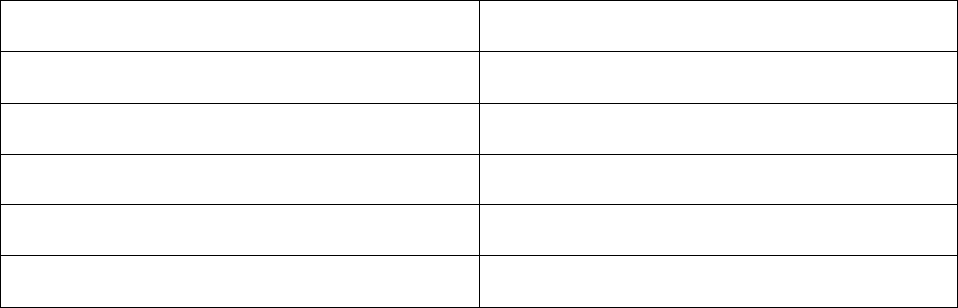

Section 3. Summary

7. Add lines 5 and 6 7. ______________________

8. Deduct: Reimbursed expenditures* 8. ______________________

9. Cost to employer (Line 7 minus Line 8) 9. ______________________

10. Enter amounts paid by employees to employer 10. ______________________

11. Subtract line 10 from line 9 11. ______________________

12. Multiply line 11 by 75% 12. ______________________

13. Enter percentage of employees children to total ** 13. ______________________

16. Add line 14 and line 15 (total available credit) 16. ______________________

17. Enter tax liability 17. ______________________

18. Maximum Possible Credit (50% of line 17) 18. ______________________

19. Enter the lesser of line 16 or 18 19. ______________________

The amount on line 18 is the maximum amount allowable for the current tax year. Enter the amount from

line 19 on the Income Tax Return other credit line.

20. Subtract line 19 from line 16, if less than zero enter none or zero. This amount is your carry over

credit and may be carried over for five (5) years or until exhausted, which ever occurs first. However, the

portion of line 15 that includes prior carryover amounts that exceed the five (5) year carryover limitation

shall be excluded. (Attach schedule).

20. ______________________

*Deduct reimbursed expenses only if included in the expense amounts from Page 1. This includes

amounts for the State-funded Pre-K program or any subsidies received for the costs included on Page 1.

**Calculation for percentage of employees’ children to total should be calculated on Page 3. This applies

only to employers who must prorate the expenses based on Georgia Regulation 560-7-8-.38(2)(a) (i.e.

NOTE: If you are claiming the 100% credit for the Cost of Qualified Child Care Property use

form IT-CCC100.

multiple employers jointly owning the child care facility). If line 13 does not apply, enter 100%.

IT-CCC75 (11/12)

15. Enter carry over (if any) from prior year (See Section 4.) 15. ______________________

Section 4. Carry Over Credit

14. Multiply line 12 by line 13 14. ______________________

PRINT

CLEAR

Georgia Department of Revenue

Taxpayer Services Division

Page 3

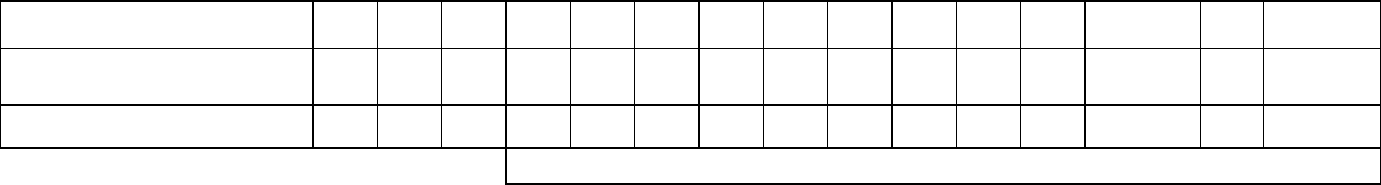

Tax Credit for Cost of Operations Taxpayer Name _____________________________

Computation of Employees’ Children to Total Enrollment Tax Year ___________

This page is to be used only by employers who must prorate the expenses.

JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC

MONTHLY

TOTAL

DIVIDE

BY 12

MONTHLY

AVERAGE

Number of Employees’

Children

12

Total Enrollment * 12

Divide avg. Employees’ Children by avg. Total Enrollment to arrive at percentage

Note:

1. Please use the average number of children per month. It is understood that there may be week-to-week fluctuations.

2. For the Monthly Total column, add together the numbers in the Jan through Dec columns.

3. For the Monthly Average column, take the Monthly Total column and divide by 12.

4. In the bottom right-hand box, divide the Monthly Average Employees’ Children by the Monthly Average Total Enrollment

to arrive at the percentage to enter in this space. This figure will be used to compute the child care tax credit.

* Total enrollment should include all children using facility, regardless of

employer.

1 12IT-CCC75 ( 1/ )

PRINT

CLEAR