Fillable Printable Commercial Lease Agreement - New York

Fillable Printable Commercial Lease Agreement - New York

Commercial Lease Agreement - New York

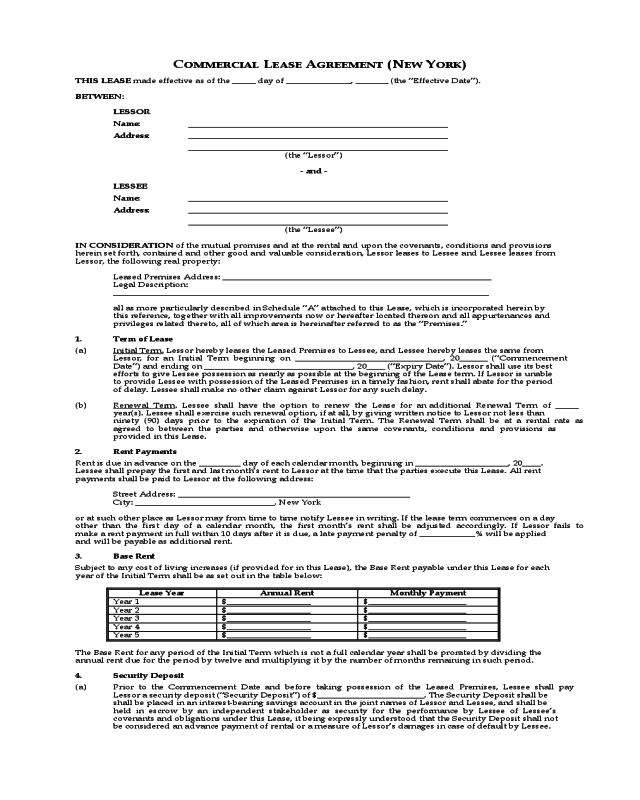

COMMERCIAL LEASE AGREEMENT (NEW YORK)

THIS LEASE made effective as of the _____ day of ______________, _______ (the “Effective Date”).

BETWEEN:

LESSOR

Name:

________________________________________________________

Address: ________________________________________________________

________________________________________________________

(the “Lessor”)

- and -

LESSEE

Name:

________________________________________________________

Address: ________________________________________________________

________________________________________________________

(the “Lessee”)

IN CONSIDERATION of the mutual promises and at the rental and upon the covenants, conditions and provisions

herein set forth, contained and other good and valuable consideration, Lessor leases to Lessee and Lessee leases from

Lessor, the following real property:

Leased Premises Address: __________________________________________________________

Legal Description:

_________________________________________________________________________________

all as more particularly described in Schedule “A” attached to this Lease, which is incorporated herein by

this reference, together with all improvements now or hereafter located thereon and all appurtenances and

privileges related thereto, all of which area is hereinafter referred to as the “Premises.”

1.

Term of Lease

(a) Initial Term. Lessor hereby leases the Leased Premises to Lessee, and Lessee hereby leases the same from

Lessor, for an Initial Term beginning on ________________________________, 20______ (“Commencement

Date”) and ending on ________________________________, 20____ (“Expiry Date”). Lessor shall use its best

efforts to give Lessee possession as nearly as possible at the beginning of the Lease term. If Lessor is unable

to provide Lessee with possession of the Leased Premises in a timely fashion, rent shall abate for the period

of delay. Lessee shall make no other claim against Lessor for any such delay.

(b) Renewal Term. Lessee shall have the option to renew the Lease for an additional Renewal Term of _____

year(s). Lessee shall exercise such renewal option, if at all, by giving written notice to Lessor not less than

ninety (90) days prior to the expiration of the Initial Term. The Renewal Term shall be at a rental rate as

agreed to between the parties and otherwise upon the same covenants, conditions and provisions as

provided in this Lease.

2.

Rent Payments

Rent is due in advance on the _________ day of each calendar month, beginning in ____________________, 20____.

Lessee shall prepay the first and last month’s rent to Lessor at the time that the parties execute this Lease. All rent

payments shall be paid to Lessor at the following address:

Street Address: __________________________________________________

City: ______________________________. New York

or at such other place as Lessor may from time to time notify Lessee in writing. If the lease term commences on a day

other than the first day of a calendar month, the first month’s rent shall be adjusted accordingly. If Lessor fails to

make a rent payment in full within 10 days after it is due, a late payment penalty of ____________% will be applied

and will be payable as additional rent.

3.

Base Rent

Subject to any cost of living increases (if provided for in this Lease), the Base Rent payable under this Lease for each

year of the Initial Term shall be as set out in the table below:

Lease Year Annual Rent Monthly Payment

Year 1 $__________________ $_____________________

Year 2 $__________________ $_____________________

Year 3 $__________________ $_____________________

Year 4 $__________________ $_____________________

Year 5 $__________________ $_____________________

The Base Rent for any period of the Initial Term which is not a full calendar year shall be prorated by dividing the

annual rent due for the period by twelve and multiplying it by the number of months remaining in such period.

4.

Security Deposit

(a) Prior to the Commencement Date and before taking possession of the Leased Premises, Lessee shall pay

Lessor a security deposit (“Security Deposit”) of $_______________________. The Security Deposit shall be

shall be placed in an interest-bearing savings account in the joint names of Lessor and Lessee, and shall be

held in escrow by an independent stakeholder as security for the performance by Lessee of Lessee’s

covenants and obligations under this Lease, it being expressly understood that the Security Deposit shall not

be considered an advance payment of rental or a measure of Lessor’s damages in case of default by Lessee.

- 2 -

(b) Lessor may, from time to time, without prejudice to any other remedy, use the Security Deposit to the extent

necessary to make good any arrears of rent or to satisfy any other covenant or obligation of Lessee

hereunder. Following any such application of the Security Deposit, Lessee shall pay to Lessor on demand

the amount so applied in order to restore the Security Deposit to its original amount.

(c) If Lessee is not in default at the Expiry Date or earlier termination of this Lease or any extension or renewal

thereof, the Security Deposit (or remaining balance after deductions for arrears of rent or other amounts

owing by Lessee, if any) shall be returned by Lessor to Lessee. The party who is eventually entitled to the

fund in whole or in part shall also be entitled to the interest accrued or its pro rata share of the interest

accrued.

(d) If Lessor transfers its interest in the Premises during the term of this Lease, Lessor may assign the Security

Deposit to the transferee and thereafter shall have no further liability for the return of such Security Deposit.

(Delete the following section if it is not applicable.)

5.

Percentage Rent

Lessee shall pay, as additional rent, a percentage rent (“Percentage Rent”) calculated as set out below.

(a) Within 45 days following the end of each Lease Year (as hereinafter defined), Lessee shall provide Lessor

with a written statement certified by Lessee setting out Lessee’s total gross sales for the preceding Lease

Year, together with a check for a sum equal to five percent (5%) of such gross sales, less the Base Rent for

such Lease Year (if previously paid), and copies of the monthly state sales tax returns.

(b) “Lease Year” shall mean each period of 12 consecutive calendar months during the term of the Lease,

commencing on the Commencement Date, provided that if the term shall commence on a day between the

1

st

of the month and the 14

th

of the month, the Lease Year shall be deemed to start on the 1

st

of the then

current month. If the term shall commence on a day between the 15

th

and the end of the month, the Lease

Year shall be deemed to start on the 1

st

day of the following month. Gross sales for the period falling outside

of that period shall be adjusted and calculated pro rata on a daily basis.

(c)

The term “gross sales” as used herein shall mean the total amounts received, whether for cash or on credit,

for sales and services of every kind made upon the Leased Premises, less the amount Lessee is obligated to

pay on account of all retail sales taxes.

(d) Lessee shall keep complete and accurate books and accounts of its daily gross sales in every part of its

business operating at any time during the currency of this Lease in any part of the Leased Premises. Lessor

and its agents and employees shall have the right at any time during regular business hours to examine and

inspect all the books and accounts of Lessee related to gross sales, including sales tax reports, tax returns, or

other reports to any governmental agency, for the purpose of verifying the accuracy of any statement of

gross sales provided under sub-clause (a) hereof. Lessor may, at its option and no more than once in any

consecutive 12-month period, cause an audit of Lessee’s business to be performed by a certified public

accountant of Lessor’s choice. If such audit shows that any statement of gross sales previously made by

Lessee is more than ten percent (10%) less than the amount of gross sales determined by such audit, the cost

of such audit shall be borne by Lessee; otherwise it shall be borne by Lessor.

(Delete the following section if it is not applicable.)

6.

Cost of Living Increases

Since the Base Rent is predicated upon the retail cost of living index remaining constant, then, should this Lease be

for more than one year, and should the Statistical Abstract of the United States, as published by the United States

Government, evidence that on the January next following the first year of this Lease the retail cost of living index has

increased, then the amount of each monthly rent payment hereunder shall be increased by the same percentage,

beginning with the first rent payment due following the date that Lessor serves written notice on Lessee of such

increase, with a copy or citation of the governmental reference reflecting and verifying the increase. Any increase in

Base Rent from a cost of living increase shall be retroactive to the date that such cost of living increase first became

effective according to the government publication.

7.

Use of Premises

The Leased Premises shall be used solely for the purpose of Lessee’s business, specifically:

_____________________________________________________________________________________

Lessee agrees to use the Leased Premises for reasonable business, commercial, retail, warehousing or industrial uses

which do not materially damage the Leased Premises. Lessee’s use of the Leased Premises shall be in a lawful,

careful, safe, and proper manner, and Lessee shall carefully preserve, protect, control and guard the same from

damage, at Lessee’s sole expense. Lessee shall not use the parking area or the ingress and egress area of the Premises

in an unreasonable manner so as to interfere with the normal flow of traffic or the use of such areas by occupants of

properties adjacent to the Leased Premises. Lessee shall not use the Leased Premises for the purposes of storing,

manufacturing or selling any explosives, flammables or other inherently dangerous substance, chemical, thing or

device. Lessee shall, on the Expiry Date or, if earlier terminated upon such termination, surrender possession of the

Leased Premises without further notice to quit, in as good condition as reasonable use will permit. Lessee shall not

use the Leased Premises for living quarters or as a residence. Lessee shall not use the Leased Premises for any

unlawful, immoral or improper purpose, or in any manner which is contrary to law or to any directions, rules,

regulations, regulatory bodies, or officials having jurisdiction thereof or which shall be injurious to any person or

property.

8.

Absolutely Net Net Net Lease

This Lease shall at all times be construed as a triple net lease, and accordingly all taxes, charges, levies, costs and

expenses assessed in respect of the Leased Premises, the subject tenancy, the revenue derived therefrom and the

improvements shall be borne by Lessee, including but not limited to: realty taxes; sales taxes; fire, casualty, theft and

liability insurance; water, gas, electricity and other utilities; trash removal; repairs and maintenance, and all

improvements. SAVE AND EXCEPT ONLY THAT Lessor shall be solely responsible for Lessor’s own income taxes

and any other charges which may be expressly stipulated herein to be the sole responsibility of Lessor. All operating

expenses of Lessee, of whatever nature, are the sole obligation of Lessee.

- 3 -

9.

Sublease and Assignment

Lessee shall have the right without Lessor’s consent, to assign this Lease to a corporation with which Lessee may

merge or consolidate, to any subsidiary of Lessee, to any corporation under common control with Lessee, or to a

purchaser of substantially all of Lessee’s assets. Except as set forth above, Lessee shall not sublease all or any part of

the Leased Premises, or assign this Lease in whole or in part without Lessor’s written consent, such consent not to be

unreasonably withheld or delayed. Provided, however, that no assignment of this Lease, whether by act of Lessee or

by operation of law, and no sublease of the Leased Premises, or any part thereof, by or from Lessee, shall relieve or

release Lessee from any of its obligations hereunder.

10.

Maintenance and Repairs

(a) Subject to anything contained herein with respect to destruction of, damage to or condemnation of the

Leased Premises, Lessee shall, at its sole cost and expense, keep and maintain the Leased Premises,

including without limitation, the roof, exterior, foundation, structural and operational parts (cooling,

heating, air conditioning, plumbing equipment and fixtures), windows, doors, locks and security systems,

paving and landscaping, snow and ice removal, interior maintenance (floors, doors, toilets, light

replacement, etc.), and all other elements or systems of the Leased Premises, in a condition and repair

similar to its original condition and repair, reasonable wear and tear excepted.

(b) Except as otherwise hereinafter provided, Lessor shall have no obligation whatsoever with respect to the

maintenance and repair of the Leased Premises.

(c) Replacement and repair parts, materials, and equipment used by Lessee to fulfill its obligations hereunder

shall be of a quality equivalent to those initially installed within the Leased Premises. All repair and

maintenance work shall be done in compliance with the then existing federal, state, and local laws,

regulations and ordinances pertaining thereto.

(d) If Lessee refuses or neglects to commence repairs within ten (10) days after receipt of written demand from

Lessor, or fails to adequately complete such repairs without liability to lessor for any loss or damage that

may accrue to Lessee’s stock or business by reason thereof, Lessor may at its option make such repairs and

Lessor shall pay to Lessor, on demand as additional rent, the costs thereof with interest at the maximum rate

allowable by law calculated from the date such repairs commenced until the date Lessee pays Lessor in full

for such repairs.

11.

Alterations and Improvements

Lessee shall have the right to make, at no expense to Lessor, improvements, alterations, or additions (hereinafter

collectively referred to as “Alteration”) to the Leased Premises, whether structural or nonstructural, interior or

exterior, provided that:

(a) no Alteration shall be made without the prior written consent of Lessor, which consent shall not be

unreasonably withheld;

(b) no structural Alteration shall be made without first obtaining Lessor’s written approval of plans and

specifications;

(c) no Alteration shall materially alter the character or substantially lessen the value of the Leased Premises;

(d) no Alteration shall be commenced until Lessee has first obtained and paid for all required permits and

authorizations of all regulatory bodies with respect to such Alteration;

(e) any Alteration shall be made in a good workmanlike manner and in compliance with all laws, ordinances,

regulations, codes, and permits;

(f) Lessee shall not decorate or paint the exterior of the Leased Premises, or any part thereof, except in such

manner and of such color(s) as are approved by Lessor;

(g) any Alteration shall become and remain the property of Lessor unless Lessor otherwise agrees in writing.

12.

Liens

Lessee shall keep the Leased Premises and the improvements thereon, at all times during the currency of this Lease,

free of mechanics and materialmen’s liens and other liens of like nature, except for liens created and claimed by

reason of any work done by or at the direction of Lessor, and shall indemnify and hold Lessor harmless from and

against any mechanics or materialmen’s liens and claims for work, labor, or materials supplied to the Leased

Premises at the direction of Lessee and against all attorneys’ fees and other costs and expenses arising out of or

incurred by reason or on account of any such liens and claims. In the event that any such liens or claims shall be filed

for work, labor or materials supplied to the Leased Premises at the direction of Lessee, Lessee shall, at Lessor’s

option, either escrow an amount equal to the amount of the lien or claim being filed, or obtain a bond for the

protection of Lessor in an amount not less than the amount of the lien or claim being filed

13.

Taxes and Assessments

(a) Lessee shall pay all real estate taxes and assessments becoming due and payable with respect to the Leased

Premises and improvements thereon during the Initial Term and any extension or renewal thereof, and all

taxes or other charges imposed during the Initial Term and any extension or renewal thereof with respect to

any business conducted on the Leased Premises by Lessee or any personal property used by Lessee in

connection therewith. Taxes, assessments or other charges which Lessee is obligated to pay or cause to be

paid hereunder and which relate to any fraction of a tax year at the commencement or termination of this

Lease shall be prorated based upon the ratio that the number of days in such fractional tax year bears to 365.

(b) If Lessee shall fail to pay any tax or assessment set out in subclause (a) hereof, Lessor may pay the same on

Lessee’s behalf, and Lessee shall reimburse Lessor for the same. Lessee shall hold Lessor harmless on

account of any of such taxes and assessments.

(c) If at any time during the currency of this Lease, the method of taxation prevailing at the commencement of

the Initial Term shall be altered so as to cause the whole or any part of the taxes, assessments, or charges

now or hereafter levied, assessed or imposed on real estate and improvement thereon to be levied, assessed

- 4 -

or imposed wholly or partially as a capital levy, or otherwise, on the rents received therefrom, Lessee shall

pay and discharge the same with respect to the rents due hereunder.

(d) Nothing contained in this Lease shall require Lessee to pay any franchise, estate, inheritance, succession,

capital levy or transfer tax of Lessor, or Lessor’s federal income tax, state income tax, or excess profits or

revenue tax, unless such taxes are in substitution for real property taxes as a result of a change in the

method of taxation described in subclause (c) above.

(e) If Lessee wishes to contest any assessment or levy of taxes on the Leased Premises, Lessor covenants and

agrees that it will execute such documents and do all such things as are necessary to aid Lessee in contesting

or litigating said assessment, provided, however, that such contest or litigation shall be at the sole cost and

expense of Lessee. Any resulting reduction or rebate of taxes paid or to be paid by Lessee shall belong to

Lessee.

14.

Sales and Transaction Tax

Lessee shall pay with each rent payment the amount of any sales or transaction tax on the rental transaction. If any

sales or similar tax shall be levied or assessed by the United States Government, any state, county, municipality,

district or agency or instrumentality thereof, upon or against Lessor by reason of the execution of this Lease, or upon

the rentals reserved thereby, then in such case Lessee shall forthwith, upon demand, reimburse Lessor for the amount

of any such taxes or assessments paid by Lessor.

15.

Insurance

(a) Lessee shall, at its sole cost and expense, obtain and thereafter maintain in full force and effect, at all times

during the Initial Term and any extension or renewal thereof, fire and extended coverage insurance in the

amount of no less than eighty percent (80%) of the full insurable value of the Leased Premises. Lessee shall

maintain fire insurance coverage on all of Lessee’s stock in trade, furniture, fixtures and other property

within the Leased Premises, in an amount equal to the full insurable value thereof. Lessee shall promptly

deliver to Lessor copies of any and all such policies of insurance. Lessee covenants that any insurance

coverage in this regard shall contain a waiver of the insurer’s right of subornation against Lessor.

(b) Lessor hereby releases Lessee, to the extent of its insurance coverage, from any and all liability for loss or

damage caused by fire or any of the extended coverage casualties, notwithstanding such fire or other

casualty shall be due to the fault or negligence of Lessee or its agents or employees, provided, however, that

this release shall be in full force and effect only with respect to loss or damage occurring during such time as

the policies for such fire and extended coverage insurance shall contain a clause to the effect that this release

shall not affect such policies or the right of Lessor to recover thereunder. Lessee agrees that such insurance

policies shall include such clause as long as the same can be included without extra costs.

(c) If Lessee shall fail at any time to maintain the insurance coverage required under this Section, Lessor may at

its option pay for the same on Lessee’s behalf, and Lessee shall reimburse Lessor for the same.

(d) Lessee shall not carry any item of inventory, or do any act, or fail to do any act in or about the Leased

Premises which will in any way impair or invalidate any policy of insurance on or in reference to the Leased

Premises.

(e) The parties shall use good faith efforts to have any and all fire, extended coverage, and material damage

insurance which may be carried on the Leased Premises endorsed with the following subornation clause:

“This insurance shall not be invalid should the insured waive in writing, prior to a loss, any and all

right of the coverage against any party for a loss occurring to the property described herein.”

(f) The parties mutually agree that any right of subornation afforded to the insurance carriers of their

respective property insurance policies with respect to real or personal property situated in or on the Leased

Premises is waived, and the parties undertake to give their respective insurance carriers notice of this

waiver.

(g) Lessee shall, at its sole cost and expense, obtain and thereafter maintain in full force and effect, at all times

during the Initial Term and any extension or renewal thereof, procure and maintain in force policies of

liability insurance, with Lessor as an additional insured thereunder, insuring Lessee:

(i) to the amount of $_____________________ against any loss or damage, or any claim thereof,

resulting from injury or death of any one person, and

(ii) to the amount of $___________________ against any loss or damage, or any claim thereof, resulting

from injury or death of any number of persons from any one accident,

as a result of or by reason of the ownership by Lessor of the Leased Premises, parking area and adjacent

areas owned by Lessor or the use and occupancy thereof by Lessee; and to procure and maintain in full force

and effect, during the term specified, a policy or policies of insurance, with Lessor as additional insured

thereunder, in an amount not less than $_____________________, insuring Lessor against any loss or damage

or any claim thereof resulting from the damage to or destruction of any property belonging to any person

whomsoever as a result or by reason of the ownership by Lessor of the Leased Premises, parking area and

adjacent areas owned by Lessor or the use and occupancy thereof by Lessee.

(h) All insurance policies required under this Section shall contain a written obligation of the insurer to notify

Lessor in writing at least ten (10) days prior to any cancellation thereof.

THIS IS A 13-PAGE DOCUMENT, including Table of Contents and

attachments.