- Contract of Purchase and Sale for the Province of British Columbia

- Real Estate Purchase Contract - Alberta

- Purchase Agreement for Residential Real Estate in Ohio - Ohio

- Offer to Purchase and Sale Agreement - New Mexico

- Contract for Sale and Puchase of Real Estate - Virginia

- Offer to Purchase Real Property - California

Fillable Printable Contract to Buy And Sell Real Estate - Colorado

Fillable Printable Contract to Buy And Sell Real Estate - Colorado

Contract to Buy And Sell Real Estate - Colorado

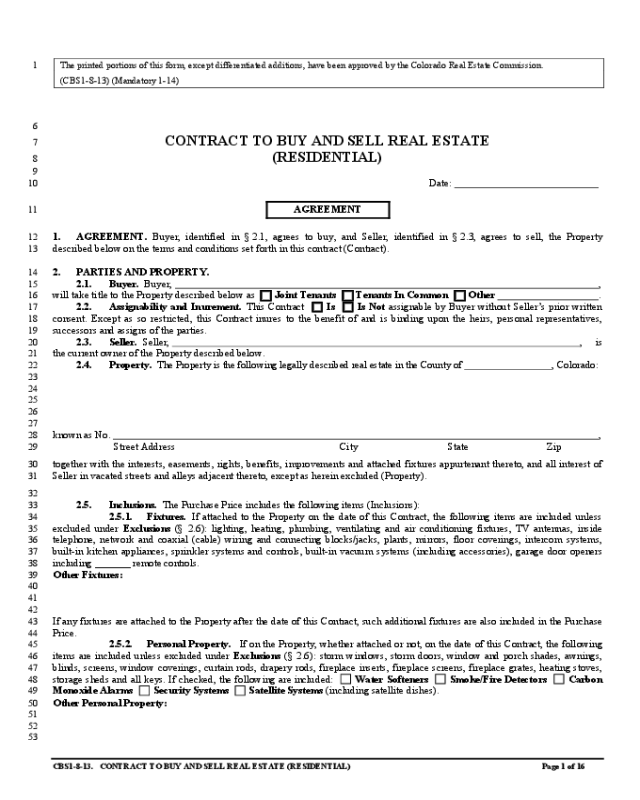

CBS1-8-13. CONTRACT TO BUY AND SELL REAL ESTATE (RESIDENTIAL) Page 1 of 16

The printed portions of this form, except differentiated additions, have been approved by the Colorado Real Estate Commission. 1

(CBS1-8-13) (Mandatory 1-14)

2

3

THIS FORM HAS IMPORTANT LEGAL CONSEQUENCES AND THE PARTIES SHOULD CONSULT LEGAL AND TAX OR 4

OTHER COUNSEL BEFORE SIGNING. 5

6

CONTRACT TO BUY AND SELL REAL ESTATE 7

(RESIDENTIAL) 8

9

Date: 10

AGREEMENT 11

1. AGREEMENT. Buyer, identified in § 2.1, agrees to buy, and Seller, identified in § 2.3, agrees to sell, the Property 12

described below on the terms and conditions set forth in this contract (Contract). 13

2. PARTIES AND PROPERTY. 14

2.1. Buyer. Buyer, , 15

will take title to the Property described below as Joint Tenants Tenants In Common Other . 16

2.2. Assignability and Inurement. This Contract Is Is Not assignable by Buyer without Seller’s prior written 17

consent. Except as so restricted, this Contract inures to the benefit of and is binding upon the heirs, personal representatives, 18

successors and assigns of the parties. 19

2.3. Seller. Seller, , is 20

the current owner of the Property described below. 21

2.4. Property. The Property is the following legally described real estate in the County of , Colorado: 22

23

24

25

26

27

known as No. , 28

Street Address City State Zip 29

together with the interests, easements, rights, benefits, improvements and attached fixtures appurtenant thereto, and all interest of 30

Seller in vacated streets and alleys adjacent thereto, except as herein excluded (Property). 31

32

2.5. Inclusions. The Purchase Price includes the following items (Inclusions): 33

2.5.1. Fixtures. If attached to the Property on the date of this Contract, the following items are included unless 34

excluded under Exclusions (§ 2.6): lighting, heating, plumbing, ventilating and air conditioning fixtures, TV antennas, inside 35

telephone, network and coaxial (cable) wiring and connecting blocks/jacks, plants, mirrors, floor coverings, intercom systems, 36

built-in kitchen appliances, sprinkler systems and controls, built-in vacuum systems (including accessories), garage door openers 37

including _______ remote controls. 38

Other Fixtures: 39

40

41

42

If any fixtures are attached to the Property after the date of this Contract, such additional fixtures are also included in the Purchase 43

Price. 44

2.5.2. Personal Property. If on the Property, whether attached or not, on the date of this Contract, the following 45

items are included unless excluded under Exclusions (§ 2.6): storm windows, storm doors, window and porch shades, awnings, 46

blinds, screens, window coverings, curtain rods, drapery rods, fireplace inserts, fireplace screens, fireplace grates, heating stoves, 47

storage sheds and all keys. If checked, the following are included: Water Softeners Smoke/Fire Detectors Carbon 48

Monoxide Alarms Security Systems Satellite Systems (including satellite dishes). 49

Other Personal Property: 50

51

52

53

CBS1-8-13. CONTRACT TO BUY AND SELL REAL ESTATE (RESIDENTIAL) Page 2 of 16

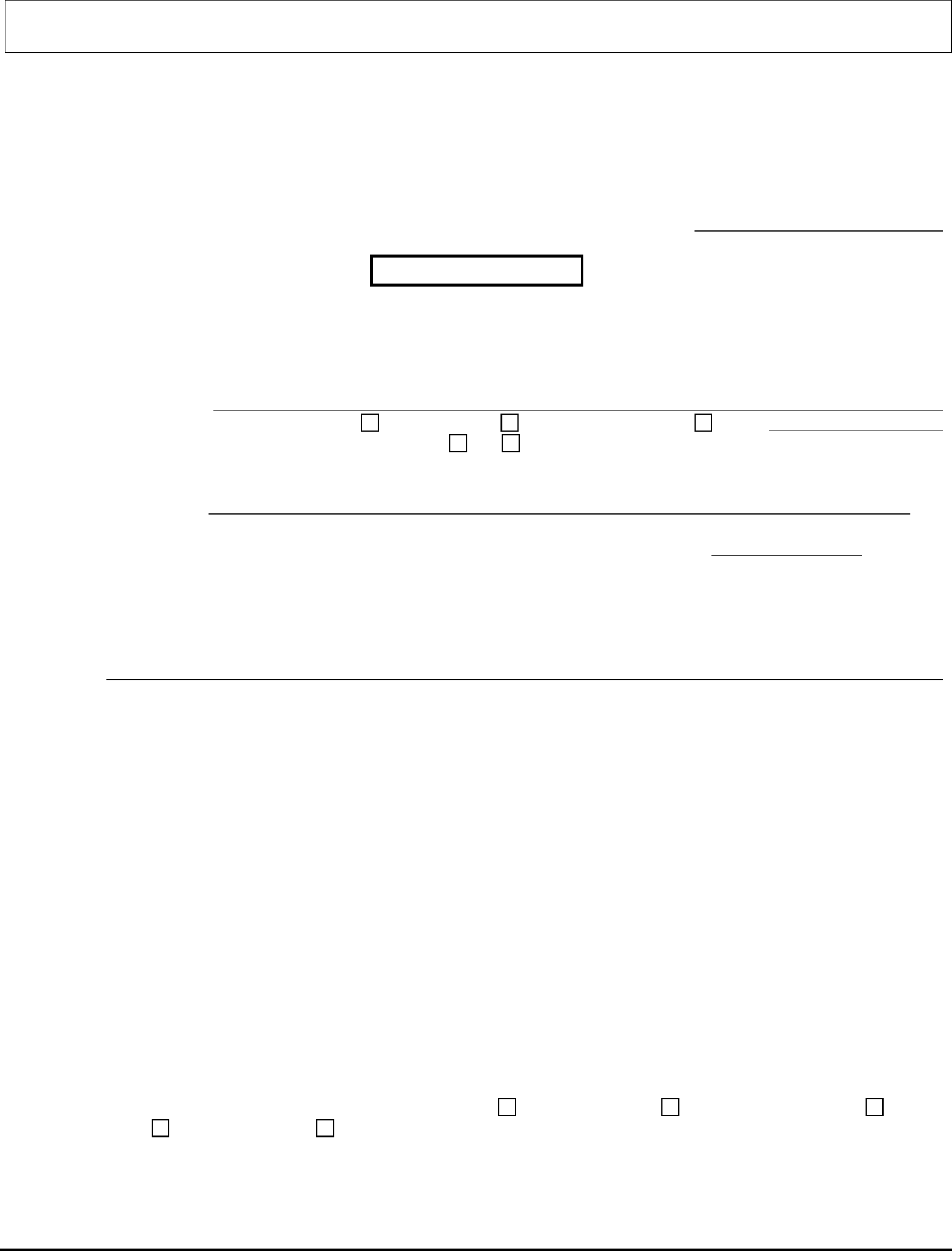

The Personal Property to be conveyed at Closing must be conveyed by Seller free and clear of all taxes (except 54

personal property taxes for the year of Closing), liens and encumbrances, except . 55

Conveyance will be by bill of sale or other applicable legal instrument. 56

2.5.3. Parking and Storage Facilities. Use Only Ownership of the following parking facilities: 57

; and Use Only Ownership of the following storage facilities: . 58

2.6. Exclusions. The following items are excluded (Exclusions): 59

60

61

2.7. Water Rights, Well Rights, Water and Sewer Taps. 62

2.7.1. Deeded Water Rights. The following legally described water rights: 63

64

65

Any deeded water rights will be conveyed by a good and sufficient deed at Closing. 66

2.7.2. Other Rights Relating to Water. The following rights relating to water not included in §§ 2.7.1, 2.7.3, 67

2.7.4 and 2.7.5, will be transferred to Buyer at Closing: 68

69

70

2.7.3. Well Rights. Seller agrees to supply required information to Buyer about the well. Buyer understands that 71

if the well to be transferred is a “Small Capacity Well” or a “Domestic Exempt Water Well,” used for ordinary household 72

purposes, Buyer must, prior to or at Closing, complete a Change in Ownership form for the well. If an existing well has not been 73

registered with the Colorado Division of Water Resources in the Department of Natural Resources (Division), Buyer must 74

complete a registration of existing well form for the well and pay the cost of registration. If no person will be providing a closing 75

service in connection with the transaction, Buyer must file the form with the Division within sixty days after Closing. The Well 76

Permit # is . 77

2.7.4. Water Stock Certificates. The water stock certificates to be transferred at Closing are as follows: 78

79

80

81

2.7.5. Water and Sewer Taps. Note: Buyer is advised to obtain, from the provider, written confirmation of 82

the amount remaining to be paid, if any, time and other restrictions for transfer and use of the taps. 83

2.7.6. Conveyance. If Buyer is to receive any rights to water pursuant to § 2.7.2 (Other Rights Relating to Water), 84

§ 2.7.3 (Well Rights), or § 2.7.4 (Water Stock Certificates), Seller agrees to convey such rights to Buyer by executing the 85

applicable legal instrument at Closing. 86

3. DATES AND DEADLINES. 87

Item No. Reference Event Date or Deadline

1 § 4.3 Alternative Earnest Money Deadline

Title

2 § 8.1 Record Title Deadline

3 § 8.2 Record Title Objection Deadline

4 § 8.3 Off-Record Title Deadline

5 § 8.3 Off-Record Title Objection Deadline

6 § 8.4 Title Resolution Deadline

7 § 8.6 Right of First Refusal Deadline

Owners’ Association

8 § 7.3 Association Documents Deadline

9 § 7.4 Association Documents Objection Deadline

Seller’s Property Disclosure

10 § 10.1 Seller’s Property Disclosure Deadline

Loan and Credit

11 § 5.1 Loan Application Deadline

12 § 5.2 Loan Objection Deadline

13 § 5.3 Buyer’s Credit Information Deadline

14 § 5.3 Disapproval of Buyer’s Credit Information Deadline

15 § 5.4 Existing Loan Documents Deadline

16 § 5.4 Existing Loan Documents Objection Deadline

17 § 5.4 Loan Transfer Approval Deadline

CBS1-8-13. CONTRACT TO BUY AND SELL REAL ESTATE (RESIDENTIAL) Page 3 of 16

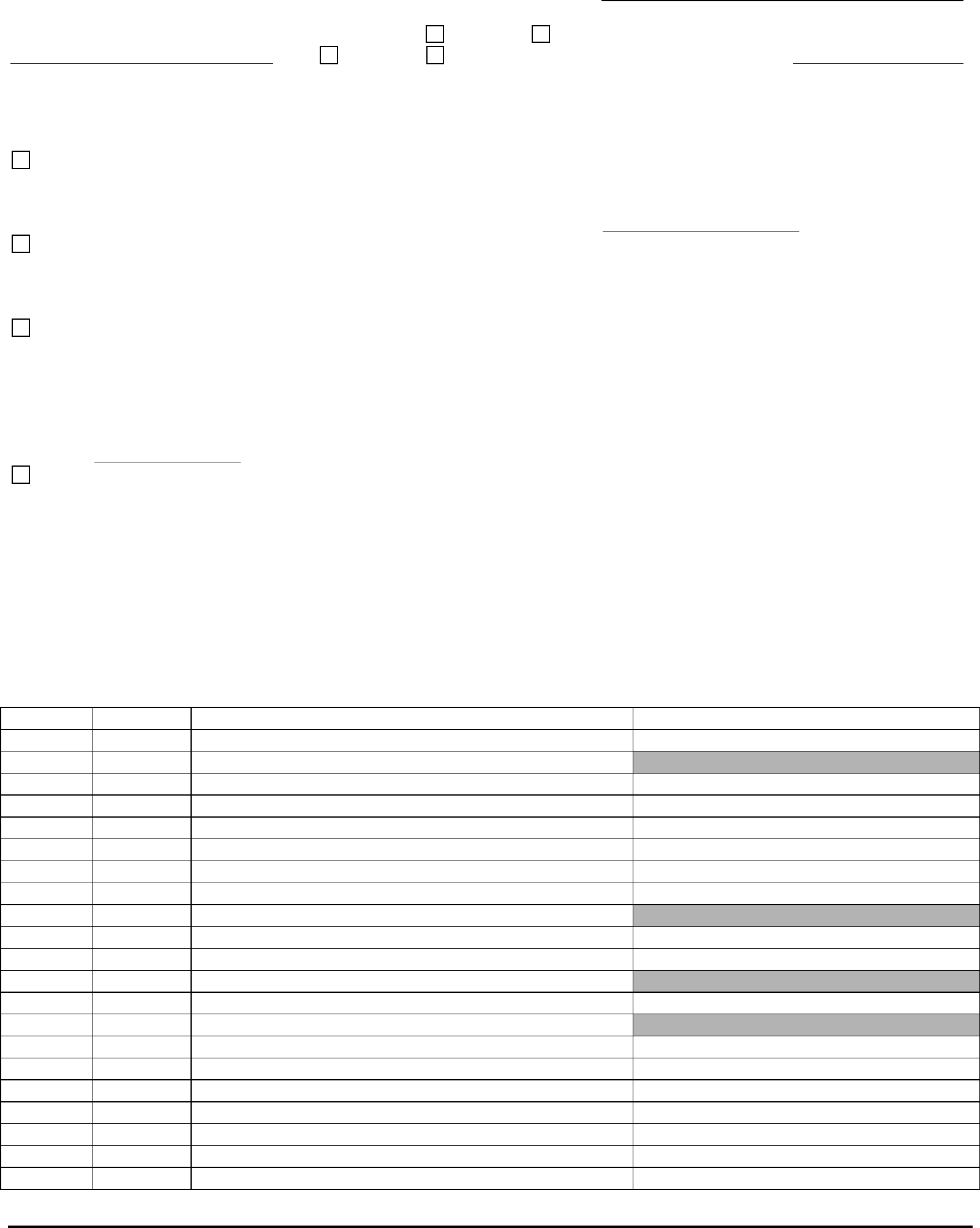

18 § 4.7 Seller or Private Financing Deadline

Appraisal

19 § 6.2 Appraisal Deadline

20 § 6.2 Appraisal Objection Deadline

Survey

21 § 9.1 Current Survey Deadline

22 § 9.2 Current Survey Objection Deadline

23 § 9.3 Current Survey Resolution Deadline

Inspection and Due Diligence

24 § 10.2 Inspection Objection Deadline

25 § 10.3 Inspection Resolution Deadline

26 § 10.5 Property Insurance Objection Deadline

27 § 10.6 Due Diligence Documents Delivery Deadline

28 § 10.6 Due Diligence Documents Objection Deadline

29 § 10.6 Due Diligence Documents Resolution Deadline

30 § 10.7 Conditional Sale Deadline

Closing and Possession

31 § 12.3

Closing Date

32 § 17 Possession Date

33 § 17 Possession Time

34 § 28

Acceptance Deadline Date

35 § 28

Acceptance Deadline Time

Note: If FHA or VA loan boxes are checked in § 4.5.3 (Loan Limitations), the Appraisal Deadline (§ 3) does Not apply to FHA 88

insured or VA guaranteed loans. 89

3.1. Applicability of Terms. Any box checked in this Contract means the corresponding provision applies. Any box, 90

blank or line in this Contract left blank or completed with the abbreviation “N/A”, or the word “Deleted” means such provision, 91

including any deadline, is not applicable and the corresponding provision of this Contract to which reference is made is deleted. 92

The abbreviation “MEC” (mutual execution of this Contract) means the date upon which both parties have signed this Contract. 93

94

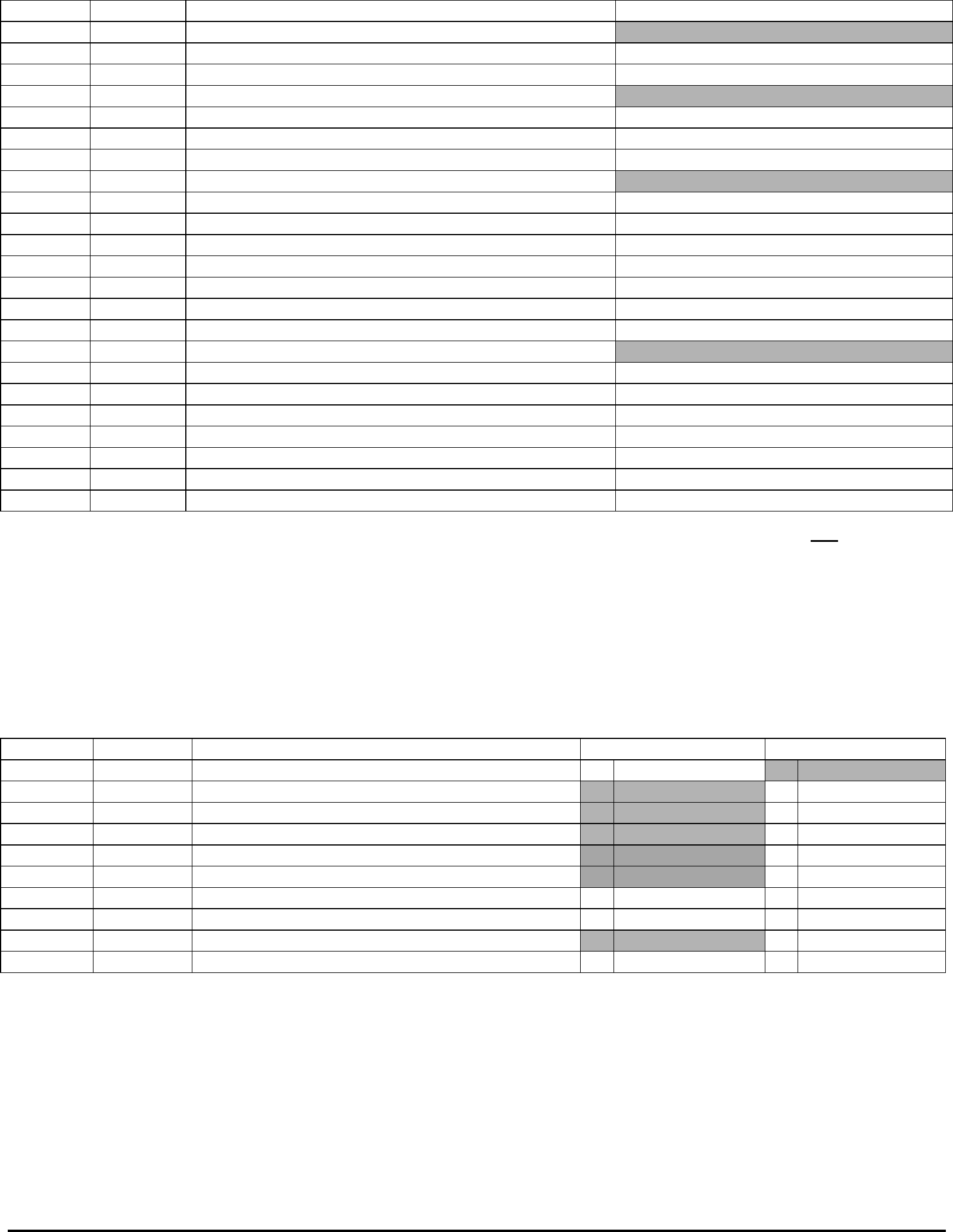

4. PURCHASE PRICE AND TERMS. 95

4.1. Price and Terms. The Purchase Price set forth below is payable in U.S. Dollars by Buyer as follows: 96

Item No. Reference Item Amount Amount

1 § 4.1 Purchase Price $

2 § 4.3 Earnest Money $

3 § 4.5 New Loan $

4 § 4.6 Assumption Balance $

5 § 4.7 Private Financing $

6 § 4.7 Seller Financing $

7

8

9 § 4.4 Cash at Closing $

10

TOTAL

$ $

4.2. Seller Concession. Seller, at Closing, will credit, as directed by Buyer, an amount of $______________ to assist 97

with any or all of the following: Buyer’s closing costs, loan discount points, loan origination fees, prepaid items (including any 98

amounts that Seller agrees to pay because Buyer is not allowed to pay due to FHA, CHFA, VA, etc.), and any other fee, cost, 99

charge, expense or expenditure related to Buyer’s New Loan or other allowable Seller concession (collectively, Seller 100

Concession). Seller Concession is in addition to any sum Seller has agreed to pay or credit Buyer elsewhere in this Contract. Seller 101

Concession will be reduced to the extent it exceeds the aggregate of what is allowed by Buyer’s lender as set forth in the Closing 102

Statement, Closing Disclosure or HUD-1, at Closing. 103

4.3. Earnest Money. The Earnest Money set forth in this section, in the form of ______________________, will be 104

payable to and held by ________________________________________ (Earnest Money Holder), in its trust account, on behalf of 105

both Seller and Buyer. The Earnest Money deposit must be tendered, by Buyer, with this Contract unless the parties mutually 106

agree to an Alternative Earnest Money Deadline (§ 3) for its payment. The parties authorize delivery of the Earnest Money 107

CBS1-8-13. CONTRACT TO BUY AND SELL REAL ESTATE (RESIDENTIAL) Page 4 of 16

deposit to the company conducting the Closing (Closing Company), if any, at or before Closing. In the event Earnest Money 108

Holder has agreed to have interest on Earnest Money deposits transferred to a fund established for the purpose of providing 109

affordable housing to Colorado residents, Seller and Buyer acknowledge and agree that any interest accruing on the Earnest 110

Money deposited with the Earnest Money Holder in this transaction will be transferred to such fund. 111

4.3.1. Alternative Earnest Money Deadline. The deadline for delivering the Earnest Money, if other than at the 112

time of tender of this Contract, is as set forth as the Alternative Earnest Money Deadline (§ 3). 113

4.3.2. Return of Earnest Money. If Buyer has a Right to Terminate and timely terminates, Buyer is entitled to 114

the return of Earnest Money as provided in this Contract. If this Contract is terminated as set forth in § 25 and, except as provided 115

in § 24, if the Earnest Money has not already been returned following receipt of a Notice to Terminate, Seller agrees to execute 116

and return to Buyer or Broker working with Buyer, written mutual instructions (e.g., Earnest Money Release form), within three 117

days of Seller’s receipt of such form. 118

4.4. Form of Funds; Time of Payment; Available Funds. 119

4.4.1. Good Funds. All amounts payable by the parties at Closing, including any loan proceeds, Cash at Closing 120

and closing costs, must be in funds that comply with all applicable Colorado laws, including electronic transfer funds, certified 121

check, savings and loan teller’s check and cashier’s check (Good Funds). 122

4.4.2. Time of Payment; Available Funds. All funds, including the Purchase Price to be paid by Buyer, must be 123

paid before or at Closing or as otherwise agreed in writing between the parties to allow disbursement by Closing Company at 124

Closing OR SUCH NONPAYING PARTY WILL BE IN DEFAULT. Buyer represents that Buyer, as of the date of this 125

Contract, Does Does Not have funds that are immediately verifiable and available in an amount not less than the amount 126

stated as Cash at Closing in § 4.1. 127

4.5. New Loan. 128

4.5.1. Buyer to Pay Loan Costs. Buyer, except as provided in § 4.2, if applicable, must timely pay Buyer’s loan 129

costs, loan discount points, prepaid items and loan origination fees, as required by lender. 130

4.5.2. Buyer May Select Financing. Buyer may pay in cash or select financing appropriate and acceptable to 131

Buyer, including a different loan than initially sought, except as restricted in § 4.5.3 or § 30 (Additional Provisions). 132

4.5.3. Loan Limitations. Buyer may purchase the Property using any of the following types of loans: 133

Conventional FHA VA Bond Other . 134

4.5.4. Good Faith Estimate – Monthly Payment and Loan Costs. Buyer is advised to review the terms, conditions 135

and costs of Buyer’s New Loan carefully. If Buyer is applying for a residential loan, the lender generally must provide Buyer with 136

a good faith estimate of Buyer’s closing costs within three days after Buyer completes a loan application. Buyer also should obtain 137

an estimate of the amount of Buyer’s monthly mortgage payment. 138

4.6. Assumption. Buyer agrees to assume and pay an existing loan in the approximate amount of the Assumption 139

Balance set forth in § 4.1, presently payable at $______________ per ________________ including principal and interest 140

presently at the rate of ________% per annum, and also including escrow for the following as indicated: Real Estate Taxes 141

Property Insurance Premium Mortgage Insurance Premium and . 142

Buyer agrees to pay a loan transfer fee not to exceed $_____________. At the time of assumption, the new interest rate will 143

not exceed ________% per annum and the new payment will not exceed $_____________ per ________________ principal and 144

interest, plus escrow, if any. If the actual principal balance of the existing loan at Closing is less than the Assumption Balance, 145

which causes the amount of cash required from Buyer at Closing to be increased by more than $_____________, then Buyer has 146

the Right to Terminate under § 25.1, on or before Closing Date (§ 3), based on the reduced amount of the actual principal balance. 147

Seller Will Will Not be released from liability on said loan. If applicable, compliance with the requirements for 148

release from liability will be evidenced by delivery on or before Loan Transfer Approval Deadline (§ 3) at Closing of 149

an appropriate letter of commitment from lender. Any cost payable for release of liability will be paid by 150

in an amount not to exceed $_____________. 151

4.7. Seller or Private Financing. 152

WARNING: Unless the transaction is exempt, federal and state laws impose licensing, other requirements and restrictions on 153

sellers and private financiers. Contract provisions on financing and financing documents, unless exempt, should be prepared by a 154

licensed Colorado attorney or licensed mortgage loan originator. Brokers should not prepare or advise the parties on the specifics 155

of financing, including whether or not a party is exempt from the law. 156

4.7.1. Seller Financing. If Buyer is to pay all or any portion of the Purchase Price with Seller financing (§ 4.1), 157

Buyer Seller will deliver the proposed Seller financing documents to the other party on or before _________ days before 158

Seller or Private Financing Deadline (§ 3). 159

4.7.1.1. Seller May Terminate. If Seller is to provide Seller financing (§ 4.1), this Contract is 160

conditional upon Seller determining whether such financing is satisfactory to the Seller, including its payments, interest rate, 161

terms, conditions, cost and compliance with the law. Seller has the Right to Terminate under § 25.1, on or before Seller or Private 162

Financing Deadline (§ 3), if such Seller financing is not satisfactory to the Seller, in Seller’s sole subjective discretion. 163

4.7.2. Buyer May Terminate. If Buyer is to pay all or any portion of the Purchase Price with Seller or private 164

financing (§ 4.1), this Contract is conditional upon Buyer determining whether such financing is satisfactory to the Buyer, 165

including its availability, payments, interest rate, terms, conditions and cost. Buyer has the Right to Terminate under § 25.1, on or 166

CBS1-8-13. CONTRACT TO BUY AND SELL REAL ESTATE (RESIDENTIAL) Page 5 of 16

before Seller or Private Financing Deadline (§ 3), if such Seller or private financing is not satisfactory to Buyer, in Buyer’s sole 167

subjective discretion. 168

169

TRANSACTION PROVISIONS 170

5. FINANCING CONDITIONS AND OBLIGATIONS. 171

5.1. Loan Application. If Buyer is to pay all or part of the Purchase Price by obtaining one or more new loans (New 172

Loan), or if an existing loan is not to be released at Closing, Buyer, if required by such lender, must make an application verifiable 173

by such lender, on or before Loan Application Deadline (§ 3) and exercise reasonable efforts to obtain such loan or approval. 174

5.2. Loan Objection. If Buyer is to pay all or part of the Purchase Price with a New Loan, this Contract is conditional 175

upon Buyer determining, in Buyer’s sole subjective discretion, whether the New Loan is satisfactory to Buyer, including its 176

availability, payments, interest rate, terms, conditions, and cost of such New Loan. This condition is for the sole benefit of Buyer. 177

Buyer has the Right to Terminate under § 25.1, on or before Loan Objection Deadline (§ 3), if the New Loan is not satisfactory to 178

Buyer, in Buyer’s sole subjective discretion. IF SELLER IS NOT IN DEFAULT AND DOES NOT TIMELY RECEIVE 179

BUYER’S WRITTEN NOTICE TO TERMINATE, BUYER’S EARNEST MONEY WILL BE NONREFUNDABLE, except 180

as otherwise provided in this Contract (e.g., Appraisal, Title, Survey). 181

5.3. Credit Information. If an existing loan is not to be released at Closing, this Contract is conditional (for the sole 182

benefit of Seller) upon Seller’s approval of Buyer’s financial ability and creditworthiness, which approval will be at Seller’s sole 183

subjective discretion. Accordingly: (1) Buyer must supply to Seller by Buyer’s Credit Information Deadline (§ 3), at Buyer’s 184

expense, information and documents (including a current credit report) concerning Buyer’s financial, employment and credit 185

condition; (2) Buyer consents that Seller may verify Buyer’s financial ability and creditworthiness; and (3) any such information 186

and documents received by Seller must be held by Seller in confidence, and not released to others except to protect Seller’s interest 187

in this transaction. If the Cash at Closing is less than as set forth in § 4.1 of this Contract, Seller has the Right to Terminate under 188

§ 25.1, on or before Closing. If Seller disapproves of Buyer’s financial ability or creditworthiness, in Seller’s sole subjective 189

discretion, Seller has the Right to Terminate under § 25.1, on or before Disapproval of Buyer’s Credit Information Deadline 190

(§ 3). 191

5.4. Existing Loan Review. If an existing loan is not to be released at Closing, Seller must deliver copies of the loan 192

documents (including note, deed of trust, and any modifications) to Buyer by Existing Loan Documents Deadline (§ 3). For the 193

sole benefit of Buyer, this Contract is conditional upon Buyer’s review and approval of the provisions of such loan documents. 194

Buyer has the Right to Terminate under § 25.1, on or before Existing Loan Documents Objection Deadline (§ 3), based on any 195

unsatisfactory provision of such loan documents, in Buyer’s sole subjective discretion. If the lender’s approval of a transfer of the 196

Property is required, this Contract is conditional upon Buyer’s obtaining such approval without change in the terms of such loan, 197

except as set forth in § 4.6. If lender’s approval is not obtained by Loan Transfer Approval Deadline (§ 3), this Contract will 198

terminate on such deadline. Seller has the Right to Terminate under § 25.1, on or before Closing, in Seller’s sole subjective 199

discretion, if Seller is to be released from liability under such existing loan and Buyer does not obtain such compliance as set forth 200

in § 4.6. 201

6. APPRAISAL PROVISIONS. 202

6.1. Lender Property Requirements. If the lender imposes any requirements or repairs (Requirements) to be made to 203

the Property (e.g., roof repair, repainting), beyond those matters already agreed to by Seller in this Contract, Seller has the Right to 204

Terminate under § 25.1, (notwithstanding § 10 of this Contract), on or before three days following Seller’s receipt of the 205

Requirements, based on any unsatisfactory Requirements, in Seller’s sole subjective discretion. Seller’s Right to Terminate in this 206

§ 6.1 does not apply if, on or before any termination by Seller pursuant to this § 6.1: (1) the parties enter into a written agreement 207

regarding the Requirements; or (2) the Requirements have been completed; or (3) the satisfaction of the Requirements is waived in 208

writing by Buyer. 209

6.2. Appraisal Condition. The applicable Appraisal provision set forth below applies to the respective loan type set 210

forth in § 4.5.3, or if a cash transaction (i.e. no financing), § 6.2.1 applies. 211

6.2.1. Conventional/Other. Buyer has the sole option and election to terminate this Contract if the Property’s 212

valuation, determined by an appraiser engaged on behalf of_______________________, is less than the Purchase Price. The 213

appraisal must be received by Buyer or Buyer’s lender on or before Appraisal Deadline (§ 3). Buyer has the Right to Terminate 214

under § 25.1, on or before Appraisal Objection Deadline (§ 3), if the Property’s valuation is less than the Purchase Price and 215

Seller’s receipt of either a copy of such appraisal or written notice from lender that confirms the Property’s valuation is less than 216

the Purchase Price. This § 6.2.1 is for the sole benefit of Buyer. 217

6.2.2. FHA. It is expressly agreed that, notwithstanding any other provisions of this Contract, the Purchaser 218

(Buyer) shall not be obligated to complete the purchase of the Property described herein or to incur any penalty by forfeiture of 219

Earnest Money deposits or otherwise unless the Purchaser (Buyer) has been given, in accordance with HUD/FHA or VA 220

requirements, a written statement issued by the Federal Housing Commissioner, Department of Veterans Affairs, or a Direct 221

CBS1-8-13. CONTRACT TO BUY AND SELL REAL ESTATE (RESIDENTIAL) Page 6 of 16

Endorsement lender, setting forth the appraised value of the Property of not less than $______________. The Purchaser (Buyer) 222

shall have the privilege and option of proceeding with the consummation of this Contract without regard to the amount of the 223

appraised valuation. The appraised valuation is arrived at to determine the maximum mortgage the Department of Housing and 224

Urban Development will insure. HUD does not warrant the value nor the condition of the Property. The Purchaser (Buyer) should 225

satisfy himself/herself that the price and condition of the Property are acceptable. 226

6.2.3. VA. It is expressly agreed that, notwithstanding any other provisions of this Contract, the purchaser (Buyer) 227

shall not incur any penalty by forfeiture of Earnest Money or otherwise or be obligated to complete the purchase of the Property 228

described herein, if the Contract Purchase Price or cost exceeds the reasonable value of the Property established by the Department 229

of Veterans Affairs. The purchaser (Buyer) shall, however, have the privilege and option of proceeding with the consummation of 230

this Contract without regard to the amount of the reasonable value established by the Department of Veterans Affairs. 231

6.3. Cost of Appraisal. Cost of any appraisal to be obtained after the date of this Contract must be timely paid by 232

Buyer Seller. The cost of the appraisal may include any and all fees paid to the appraiser, appraisal management 233

company, lender's agent or all three. 234

235

7. OWNERS’ ASSOCIATION. This Section is applicable if the Property is located within a Common Interest 236

Community and subject to such declaration. 237

7.1. Owners’ Association Documents. Owners’ Association Documents (Association Documents) consist of the 238

following: 239

7.1.1. All Owners’ Association declarations, articles of incorporation, bylaws, articles of organization, operating 240

agreements, rules and regulations, party wall agreements; 241

7.1.2. Minutes of most recent annual owners’ meeting; 242

7.1.3. Minutes of any directors’ or managers’ meetings during the six-month period immediately preceding the 243

date of this Contract. If none of the preceding minutes exist, then the most recent minutes, if any (§§ 7.1.1, 7.1.2 and 7.1.3, 244

collectively, Governing Documents); and 245

7.1.4. The most recent financial documents which consist of: (1) annual and most recent balance sheet, (2) annual 246

and most recent income and expenditures statement, (3) annual budget, (4) reserve study, and (5) notice of unpaid assessments, if 247

any (collectively, Financial Documents). 248

7.2. Common Interest Community Disclosure. THE PROPERTY IS LOCATED WITHIN A COMMON 249

INTEREST COMMUNITY AND IS SUBJECT TO THE DECLARATION FOR SUCH COMMUNITY. THE OWNER 250

OF THE PROPERTY WILL BE REQUIRED TO BE A MEMBER OF THE OWNERS’ ASSOCIATION FOR THE 251

COMMUNITY AND WILL BE SUBJECT TO THE BYLAWS AND RULES AND REGULATIONS OF THE 252

ASSOCIATION. THE DECLARATION, BYLAWS, AND RULES AND REGULATIONS WILL IMPOSE FINANCIAL 253

OBLIGATIONS UPON THE OWNER OF THE PROPERTY, INCLUDING AN OBLIGATION TO PAY 254

ASSESSMENTS OF THE ASSOCIATION. IF THE OWNER DOES NOT PAY THESE ASSESSMENTS, THE 255

ASSOCIATION COULD PLACE A LIEN ON THE PROPERTY AND POSSIBLY SELL IT TO PAY THE DEBT. THE 256

DECLARATION, BYLAWS, AND RULES AND REGULATIONS OF THE COMMUNITY MAY PROHIBIT THE 257

OWNER FROM MAKING CHANGES TO THE PROPERTY WITHOUT AN ARCHITECTURAL REVIEW BY THE 258

ASSOCIATION (OR A COMMITTEE OF THE ASSOCIATION) AND THE APPROVAL OF THE ASSOCIATION. 259

PURCHASERS OF PROPERTY WITHIN THE COMMON INTEREST COMMUNITY SHOULD INVESTIGATE THE 260

FINANCIAL OBLIGATIONS OF MEMBERS OF THE ASSOCIATION. PURCHASERS SHOULD CAREFULLY 261

READ THE DECLARATION FOR THE COMMUNITY AND THE BYLAWS AND RULES AND REGULATIONS OF 262

THE ASSOCIATION. 263

7.3. Association Documents to Buyer. 264

7.3.1. Seller to Provide Association Documents. Seller will cause the Association Documents to be provided to 265

Buyer, at Seller’s expense, on or before Association Documents Deadline (§ 3). 266

7.3.2. Seller Authorizes Association. Seller authorizes the Association to provide the Association Documents to 267

Buyer, at Seller’s expense. 268

7.3.3. Seller’s Obligation. Seller’s obligation to provide the Association Documents is fulfilled upon Buyer’s 269

receipt of the Association Documents, regardless of who provides such documents. 270

Note: If neither box in this § 7.3 is checked, the provisions of § 7.3.1 apply. 271

7.4. Conditional on Buyer’s Review. Buyer has the right to review the Association Documents. Buyer has the Right to 272

Terminate under § 25.1, on or before Association Documents Objection Deadline (§ 3), based on any unsatisfactory provision in 273

any of the Association Documents, in Buyer’s sole subjective discretion. Should Buyer receive the Association Documents after 274

Association Documents Deadline (§ 3), Buyer, at Buyer’s option, has the Right to Terminate under § 25.1 by Buyer’s Notice to 275

Terminate received by Seller on or before ten days after Buyer’s receipt of the Association Documents. If Buyer does not receive 276

the Association Documents, or if Buyer’s Notice to Terminate would otherwise be required to be received by Seller after Closing 277

Date (§ 3), Buyer’s Notice to Terminate must be received by Seller on or before Closing. If Seller does not receive Buyer’s Notice 278

to Terminate within such time, Buyer accepts the provisions of the Association Documents as satisfactory, and Buyer waives any 279

Right to Terminate under this provision, notwithstanding the provisions of § 8.6 (Right of First Refusal or Contract Approval). 280

CBS1-8-13. CONTRACT TO BUY AND SELL REAL ESTATE (RESIDENTIAL) Page 7 of 16

8. TITLE INSURANCE, RECORD TITLE AND OFF-RECORD TITLE. 281

8.1. Evidence of Record Title. 282

8.1.1. Seller Selects Title Insurance Company. If this box is checked, Seller will select the title insurance 283

company to furnish the owner’s title insurance policy at Seller’s expense. On or before Record Title Deadline (§ 3), Seller must 284

furnish to Buyer, a current commitment for an owner’s title insurance policy (Title Commitment), in an amount equal to the 285

Purchase Price, or if this box is checked, an Abstract of Title certified to a current date. Seller will cause the title insurance 286

policy to be issued and delivered to Buyer as soon as practicable at or after Closing. 287

8.1.2. Buyer Selects Title Insurance Company. If this box is checked, Buyer will select the title insurance 288

company to furnish the owner’s title insurance policy at Buyer’s expense. On or before Record Title Deadline (§ 3), Buyer must 289

furnish to Seller, a current commitment for owner’s title insurance policy (Title Commitment), in an amount equal to the Purchase 290

Price. 291

If neither box in § 8.1.1 or § 8.1.2 is checked, § 8.1.1 applies. 292

8.1.3. Owner's Extended Coverage (OEC). The Title Commitment Will Will Not commit to delete or 293

insure over the standard exceptions which relate to: (1) parties in possession, (2) unrecorded easements, (3) survey matters, (4) 294

unrecorded mechanics’ liens, (5) gap period (effective date of commitment to date deed is recorded), and (6) unpaid taxes, 295

assessments and unredeemed tax sales prior to the year of Closing (OEC). If the title insurance company agrees to provide an 296

endorsement for OEC, any additional premium expense to obtain an endorsement for OEC will be paid by Buyer Seller 297

One-Half by Buyer and One-Half by Seller Other______________________________________. 298

Note: The title insurance company may not agree to delete or insure over any or all of the standard exceptions. 299

8.1.4. Title Documents. Title Documents consist of the following: (1) copies of any plats, declarations, 300

covenants, conditions and restrictions burdening the Property, and (2) copies of any other documents (or, if illegible, summaries of 301

such documents) listed in the schedule of exceptions (Exceptions) in the Title Commitment furnished to Buyer (collectively, Title 302

Documents). 303

8.1.5. Copies of Title Documents. Buyer must receive, on or before Record Title Deadline (§ 3), copies of all 304

Title Documents. This requirement pertains only to documents as shown of record in the office of the clerk and recorder in the 305

county where the Property is located. The cost of furnishing copies of the documents required in this Section will be at the expense 306

of the party or parties obligated to pay for the owner’s title insurance policy. 307

8.1.6. Existing Abstracts of Title. Seller must deliver to Buyer copies of any abstracts of title covering all or any 308

portion of the Property (Abstract of Title) in Seller’s possession on or before Record Title Deadline (§ 3). 309

8.2. Record Title. Buyer has the right to review and object to the Abstract of Title or Title Commitment and any of the 310

Title Documents as set forth in § 8.4 (Right to Object to Title, Resolution) on or before Record Title Objection Deadline (§ 3). 311

Buyer’s objection may be based on any unsatisfactory form or content of Title Commitment or Abstract of Title, notwithstanding 312

§ 13, or any other unsatisfactory title condition, in Buyer’s sole subjective discretion. If the Abstract of Title, Title Commitment or 313

Title Documents are not received by Buyer on or before the Record Title Deadline (§ 3), or if there is an endorsement to the Title 314

Commitment that adds a new Exception to title, a copy of the new Exception to title and the modified Title Commitment will be 315

delivered to Buyer. Buyer has until the earlier of Closing or ten days after receipt of such documents by Buyer to review and object 316

to: (1) any required Title Document not timely received by Buyer, (2) any change to the Abstract of Title, Title Commitment or 317

Title Documents, or (3) any endorsement to the Title Commitment. If Seller receives Buyer’s Notice to Terminate or Notice of 318

Title Objection, pursuant to this § 8.2 (Record Title), any title objection by Buyer is governed by the provisions set forth in § 8.4 319

(Right to Object to Title, Resolution). If Seller has fulfilled all Seller's obligations, if any, to deliver to Buyer all documents 320

required by §8.1 (Evidence of Record Title) and Seller does not receive Buyer’s Notice to Terminate or Notice of Title Objection 321

by the applicable deadline specified above, Buyer accepts the condition of title as disclosed by the Abstract of Title, Title 322

Commitment and Title Documents as satisfactory. 323

8.3. Off-Record Title. Seller must deliver to Buyer, on or before Off-Record Title Deadline (§ 3), true copies of all 324

existing surveys in Seller’s possession pertaining to the Property and must disclose to Buyer all easements, liens (including, 325

without limitation, governmental improvements approved, but not yet installed) or other title matters (including, without 326

limitation, rights of first refusal and options) not shown by public records, of which Seller has actual knowledge (Off-Record 327

Matters). Buyer has the right to inspect the Property to investigate if any third party has any right in the Property not shown by 328

public records (e.g., unrecorded easement, boundary line discrepancy or water rights). Buyer’s Notice to Terminate or Notice of 329

Title Objection of any unsatisfactory condition (whether disclosed by Seller or revealed by such inspection, notwithstanding § 8.2 330

and § 13), in Buyer’s sole subjective discretion, must be received by Seller on or before Off-Record Title Objection Deadline 331

(§ 3). If an Off-Record Matter is received by Buyer after the Off-Record Title Deadline (§ 3), Buyer has until the earlier of 332

Closing or ten days after receipt by Buyer to review and object to such Off-Record Matter. If Seller receives Buyer’s Notice to 333

Terminate or Notice of Title Objection pursuant to this § 8.3 (Off-Record Title), any title objection by Buyer and this Contract are 334

governed by the provisions set forth in § 8.4 (Right to Object to Title, Resolution). If Seller does not receive Buyer’s Notice to 335

Terminate or Notice of Title Objection by the applicable deadline specified above, Buyer accepts title subject to such rights, if any, 336

of third parties of which Buyer has actual knowledge. 337

CBS1-8-13. CONTRACT TO BUY AND SELL REAL ESTATE (RESIDENTIAL) Page 8 of 16

8.4. Right to Object to Title, Resolution. Buyer’s right to object to any title matters includes, but is not limited to those 338

matters set forth in §§ 8.2 (Record Title), 8.3 (Off-Record Title) and 13 (Transfer of Title), in Buyer’s sole subjective discretion. If 339

Buyer objects to any title matter, on or before the applicable deadline, Buyer has the following options: 340

8.4.1. Title Objection, Resolution. If Seller receives Buyer’s written notice objecting to any title matter (Notice 341

of Title Objection) on or before the applicable deadline, and if Buyer and Seller have not agreed to a written settlement thereof on 342

or before Title Resolution Deadline (§ 3), this Contract will terminate on the expiration of Title Resolution Deadline (§ 3), 343

unless Seller receives Buyer’s written withdrawal of Buyer’s Notice of Title Objection (i.e., Buyer’s written notice to waive 344

objection to such items and waives the Right to Terminate for that reason), on or before expiration of Title Resolution Deadline 345

(§ 3). If either the Record Title Deadline or the Off-Record Title Deadline, or both, are extended to the earlier of Closing or ten 346

days after receipt of the applicable documents by Buyer, pursuant to § 8.2 (Record Title) or § 8.3 (Off-Record Title), the Title 347

Resolution Deadline also will be automatically extended to the earlier of Closing or fifteen days after Buyer's receipt of the 348

applicable documents; or 349

8.4.2. Title Objection, Right to Terminate. Buyer may exercise the Right to Terminate under § 25.1, on or 350

before the applicable deadline, based on any unsatisfactory title matter, in Buyer’s sole subjective discretion. 351

8.5. Special Taxing Districts. SPECIAL TAXING DISTRICTS MAY BE SUBJECT TO GENERAL OBLIGATION 352

INDEBTEDNESS THAT IS PAID BY REVENUES PRODUCED FROM ANNUAL TAX LEVIES ON THE TAXABLE 353

PROPERTY WITHIN SUCH DISTRICTS. PROPERTY OWNERS IN SUCH DISTRICTS MAY BE PLACED AT RISK 354

FOR INCREASED MILL LEVIES AND TAX TO SUPPORT THE SERVICING OF SUCH DEBT WHERE 355

CIRCUMSTANCES ARISE RESULTING IN THE INABILITY OF SUCH A DISTRICT TO DISCHARGE SUCH 356

INDEBTEDNESS WITHOUT SUCH AN INCREASE IN MILL LEVIES. BUYERS SHOULD INVESTIGATE THE 357

SPECIAL TAXING DISTRICTS IN WHICH THE PROPERTY IS LOCATED BY CONTACTING THE COUNTY 358

TREASURER, BY REVIEWING THE CERTIFICATE OF TAXES DUE FOR THE PROPERTY, AND BY OBTAINING 359

FURTHER INFORMATION FROM THE BOARD OF COUNTY COMMISSIONERS, THE COUNTY CLERK AND 360

RECORDER, OR THE COUNTY ASSESSOR. 361

Buyer has the Right to Terminate under § 25.1, on or before Off-Record Title Objection Deadline (§ 3), based on any 362

unsatisfactory effect of the Property being located within a special taxing district, in Buyer’s sole subjective discretion. 363

8.6. Right of First Refusal or Contract Approval. If there is a right of first refusal on the Property or a right to approve 364

this Contract, Seller must promptly submit this Contract according to the terms and conditions of such right. If the holder of the 365

right of first refusal exercises such right or the holder of a right to approve disapproves this Contract, this Contract will terminate. 366

If the right of first refusal is waived explicitly or expires, or the Contract is approved, this Contract will remain in full force and 367

effect. Seller must promptly notify Buyer in writing of the foregoing. If expiration or waiver of the right of first refusal or approval 368

of this Contract has not occurred on or before Right of First Refusal Deadline (§ 3), this Contract will then terminate. 369

8.7. Title Advisory. The Title Documents affect the title, ownership and use of the Property and should be reviewed 370

carefully. Additionally, other matters not reflected in the Title Documents may affect the title, ownership and use of the Property, 371

including, without limitation, boundary lines and encroachments, set-back requirements, area, zoning, building code violations, 372

unrecorded easements and claims of easements, leases and other unrecorded agreements, water on or under the Property, and 373

various laws and governmental regulations concerning land use, development and environmental matters. The surface estate may 374

be owned separately from the underlying mineral estate, and transfer of the surface estate does not necessarily include 375

transfer of the mineral rights or water rights. Third parties may hold interests in oil, gas, other minerals, geothermal 376

energy or water on or under the Property, which interests may give them rights to enter and use the Property. Such matters, 377

and others, may be excluded from or not covered by the owner’s title insurance policy. Buyer is advised to timely consult legal 378

counsel with respect to all such matters as there are strict time limits provided in this Contract [e.g., Record Title Objection 379

Deadline (§ 3) and Off-Record Title Objection Deadline (§ 3)]. 380

9. CURRENT SURVEY REVIEW. 381

9.1. Current Survey Conditions. If the box in § 9.1.1 or § 9.1.2 is checked, Buyer, the issuer of the Title Commitment 382

or the provider of the opinion of title if an Abstract of Title, and _____________________ will receive an Improvement Location 383

Certificate, Improvement Survey Plat or other form of survey set forth in § 9.1.2 (collectively, Current Survey), on or before 384

Current Survey Deadline (§ 3). The Current Survey will be certified by the surveyor to all those who are to receive the Current 385

Survey. 386

9.1.1. Improvement Location Certificate. If the box in this § 9.1.1 is checked, Seller Buyer will order 387

or provide, and pay, on or before Closing, the cost of an Improvement Location Certificate. 388

9.1.2. Other Survey. If the box in this § 9.1.2 is checked, a Current Survey, other than an Improvement Location 389

Certificate, will be an Improvement Survey Plat or ___________________. The parties agree that payment of the cost of 390

the Current Survey and obligation to order or provide the Current Survey are as follows: 391

392

393

394

CBS1-8-13. CONTRACT TO BUY AND SELL REAL ESTATE (RESIDENTIAL) Page 9 of 16

9.2. Current Survey Objection. Buyer has the right to review and object to the Current Survey. If the Current Survey is 395

not timely received by Buyer or is unsatisfactory to Buyer, in Buyer’s sole subjective discretion, Buyer may, on or before Current 396

Survey Objection Deadline (§ 3), notwithstanding § 8.3 or § 13: 397

9.2.1. Notice to Terminate. Notify Seller in writing that this Contract is terminated; or 398

9.2.2. Current Survey Objection. Deliver to Seller a written description of any matter that was to be shown or is 399

shown in the Current Survey that is unsatisfactory and that Buyer requires Seller to correct. 400

9.3. Current Survey Resolution. If a Current Survey Objection is received by Seller, on or before Current Survey 401

Objection Deadline (§ 3), and if Buyer and Seller have not agreed in writing to a settlement thereof on or before Current Survey 402

Resolution Deadline (§ 3), this Contract will terminate on the Current Survey Resolution Deadline (§ 3), unless Seller receives 403

Buyer’s written withdrawal of the Current Survey Objection before such termination, i.e., on or before expiration of Current 404

Survey Resolution Deadline (§ 3). 405

406

DISCLOSURE, INSPECTION AND DUE DILIGENCE 407

10. PROPERTY DISCLOSURE, INSPECTION, INDEMNITY, INSURABILITY, DUE DILIGENCE, BUYER 408

DISCLOSURE AND SOURCE OF WATER. 409

10.1. Seller’s Property Disclosure. On or before Seller’s Property Disclosure Deadline (§ 3), Seller agrees to deliver to 410

Buyer the most current version of the applicable Colorado Real Estate Commission’s Seller’s Property Disclosure form completed 411

by Seller to Seller’s actual knowledge, current as of the date of this Contract. 412

10.2. Inspection Objection. Unless otherwise provided in this Contract, Buyer acknowledges that Seller is conveying the 413

Property to Buyer in an “as is” condition, “where is” and “with all faults.” Colorado law requires that Seller disclose to Buyer any 414

latent defects actually known by Seller. Disclosure of latent defects must be in writing. Buyer, acting in good faith, has the right to 415

have inspections (by one or more third parties, personally or both) of the Property and Inclusions (Inspection), at Buyer’s expense. 416

If (1) the physical condition of the Property, including, but not limited to, the roof, walls, structural integrity of the Property, the 417

electrical, plumbing, HVAC and other mechanical systems of the Property, (2) the physical condition of the Inclusions, (3) service 418

to the Property (including utilities and communication services), systems and components of the Property (e.g. heating and 419

plumbing), (4) any proposed or existing transportation project, road, street or highway, or (5) any other activity, odor or noise 420

(whether on or off the Property) and its effect or expected effect on the Property or its occupants is unsatisfactory, in Buyer’s sole 421

subjective discretion, Buyer may, on or before Inspection Objection Deadline (§ 3): 422

10.2.1. Notice to Terminate. Notify Seller in writing that this Contract is terminated; or 423

10.2.2. Inspection Objection. Deliver to Seller a written description of any unsatisfactory physical condition that 424

Buyer requires Seller to correct. 425

10.3. Inspection Resolution. If an Inspection Objection is received by Seller, on or before Inspection Objection 426

Deadline (§ 3), and if Buyer and Seller have not agreed in writing to a settlement thereof on or before Inspection Resolution 427

Deadline (§ 3), this Contract will terminate on Inspection Resolution Deadline (§ 3) unless Seller receives Buyer’s written 428

withdrawal of the Inspection Objection before such termination, i.e., on or before expiration of Inspection Resolution Deadline 429

(§ 3). 430

10.4. Damage, Liens and Indemnity. Buyer, except as otherwise provided in this Contract or other written agreement 431

between the parties, is responsible for payment for all inspections, tests, surveys, engineering reports, or other reports performed at 432

Buyer’s request (Work) and must pay for any damage that occurs to the Property and Inclusions as a result of such Work. Buyer 433

must not permit claims or liens of any kind against the Property for Work performed on the Property. Buyer agrees to indemnify, 434

protect and hold Seller harmless from and against any liability, damage, cost or expense incurred by Seller and caused by any such 435

Work, claim, or lien. This indemnity includes Seller’s right to recover all costs and expenses incurred by Seller to defend against 436

any such liability, damage, cost or expense, or to enforce this section, including Seller’s reasonable attorney fees, legal fees and 437

expenses. The provisions of this section survive the termination of this Contract. This § 10.4 does not apply to items performed 438

pursuant to an Inspection Resolution. 439

10.5. Insurability. Buyer has the right to review and object to the availability, terms and conditions of and premium for 440

property insurance (Property Insurance). Buyer has the Right to Terminate under § 25.1, on or before Property Insurance 441

Objection Deadline (§ 3), based on any unsatisfactory provision of the Property Insurance, in Buyer’s sole subjective discretion. 442

10.6. Due Diligence. 443

10.6.1. Due Diligence Documents. If the respective box is checked, Seller agrees to deliver copies of the following 444

documents and information pertaining to the Property (Due Diligence Documents) to Buyer on or before Due Diligence 445

Documents Delivery Deadline (§ 3): 446

10.6.1.1. All current leases, including any amendments or other occupancy agreements, pertaining to the 447

Property. Those leases or other occupancy agreements pertaining to the Property that survive Closing are as follows (Leases): 448

449

450

CBS1-8-13. CONTRACT TO BUY AND SELL REAL ESTATE (RESIDENTIAL) Page 10 of 16

10.6.1.2. Other documents and information: 451

452

453

454

455

10.6.2. Due Diligence Documents Review and Objection. Buyer has the right to review and object to Due 456

Diligence Documents. If the Due Diligence Documents are not supplied to Buyer or are unsatisfactory in Buyer’s sole subjective 457

discretion, Buyer may, on or before Due Diligence Documents Objection Deadline (§ 3): 458

10.6.2.1. Notice to Terminate. Notify Seller in writing that this Contract is terminated; or 459

10.6.2.2. Due Diligence Documents Objection. Deliver to Seller a written description of any 460

unsatisfactory Due Diligence Documents that Buyer requires Seller to correct. 461

10.6.3. Due Diligence Documents Resolution. If a Due Diligence Documents Objection is received by Seller, on 462

or before Due Diligence Documents Objection Deadline (§ 3), and if Buyer and Seller have not agreed in writing to a settlement 463

thereof on or before Due Diligence Documents Resolution Deadline (§ 3), this Contract will terminate on Due Diligence 464

Documents Resolution Deadline (§ 3) unless Seller receives Buyer’s written withdrawal of the Due Diligence Documents 465

Objection before such termination, i.e., on or before expiration of Due Diligence Documents Resolution Deadline (§ 3). 466

10.7. Conditional Upon Sale of Property. This Contract is conditional upon the sale and closing of that certain property 467

owned by Buyer and commonly known as ___________________________________________. Buyer has the Right to Terminate 468

under § 25.1 effective upon Seller's receipt of Buyer’s Notice to Terminate on or before Conditional Sale Deadline (§ 3) if such 469

property is not sold and closed by such deadline. This § 10.7 is for the sole benefit of Buyer. If Seller does not receive Buyer’s 470

Notice to Terminate on or before Conditional Sale Deadline (§ 3), Buyer waives any Right to Terminate under this provision. 471

10.8. Source of Potable Water (Residential Land and Residential Improvements Only). Buyer Does Does Not 472

acknowledge receipt of a copy of Seller’s Property Disclosure or Source of Water Addendum disclosing the source of potable water 473

for the Property. Buyer Does Does Not acknowledge receipt of a copy of the current well permit. There is No Well. 474

Note to Buyer: SOME WATER PROVIDERS RELY, TO VARYING DEGREES, ON NONRENEWABLE GROUND 475

WATER. YOU MAY WISH TO CONTACT YOUR PROVIDER (OR INVESTIGATE THE DESCRIBED SOURCE) TO 476

DETERMINE THE LONG-TERM SUFFICIENCY OF THE PROVIDER’S WATER SUPPLIES. 477

10.9. Carbon Monoxide Alarms. Note: If the improvements on the Property have a fuel-fired heater or appliance, a 478

fireplace, or an attached garage and include one or more rooms lawfully used for sleeping purposes (Bedroom), the parties 479

acknowledge that Colorado law requires that Seller assure the Property has an operational carbon monoxide alarm installed within 480

fifteen feet of the entrance to each Bedroom or in a location as required by the applicable building code. 481

10.10. Lead-Based Paint. Unless exempt, if the improvements on the Property include one or more residential dwellings 482

for which a building permit was issued prior to January 1, 1978, this Contract is void unless (1) a completed Lead-Based Paint 483

Disclosure (Sales) form is signed by Seller, the required real estate licensees and Buyer, and (2) Seller receives the completed and 484

fully executed form prior to the time when this Contract is signed by all parties. Buyer acknowledges timely receipt of a completed 485

Lead-Based Paint Disclosure (Sales) form signed by Seller and the real estate licensees. 486

10.11. Methamphetamine Disclosure. If Seller knows that methamphetamine was ever manufactured, processed, cooked, 487

disposed of, used or stored at the Property, Seller is required to disclose such fact. No disclosure is required if the Property was 488

remediated in accordance with state standards and other requirements are fulfilled pursuant to § 25-18.5-102, C.R.S. Buyer further 489

acknowledges that Buyer has the right to engage a certified hygienist or industrial hygienist to test whether the Property has ever 490

been used as a methamphetamine laboratory. Buyer has the Right to Terminate under § 25.1, upon Seller’s receipt of Buyer’s 491

written Notice to Terminate, notwithstanding any other provision of this Contract, based on Buyer’s test results that indicate the 492

Property has been contaminated with methamphetamine, but has not been remediated to meet the standards established by rules of 493

the State Board of Health promulgated pursuant to § 25-18.5-102, C.R.S. Buyer must promptly give written notice to Seller of the 494

results of the test. 495

11. TENANT ESTOPPEL STATEMENTS. [Intentionally Deleted] 496

497

CLOSING PROVISIONS 498

12. CLOSING DOCUMENTS, INSTRUCTIONS AND CLOSING. 499

12.1. Closing Documents and Closing Information. Seller and Buyer will cooperate with the Closing Company to 500

enable the Closing Company to prepare and deliver documents required for Closing to Buyer and Seller and their designees. If 501

Buyer is obtaining a new loan to purchase the Property, Buyer acknowledges Buyer’s lender is required to provide the Closing 502

Company, in a timely manner, all required loan documents and financial information concerning Buyer’s new loan. Buyer and 503

Seller will furnish any additional information and documents required by Closing Company that will be necessary to complete this 504

transaction. Buyer and Seller will sign and complete all customary or reasonably required documents at or before Closing. 505

CBS1-8-13. CONTRACT TO BUY AND SELL REAL ESTATE (RESIDENTIAL) Page 11 of 16

12.2. Closing Instructions. Colorado Real Estate Commission’s Closing Instructions Are Are Not executed with 506

this Contract. 507

12.3. Closing. Delivery of deed from Seller to Buyer will be at closing (Closing). Closing will be on the date specified as 508

the Closing Date (§ 3) or by mutual agreement at an earlier date. The hour and place of Closing will be as designated by 509

________________________________________. 510

12.4. Disclosure of Settlement Costs. Buyer and Seller acknowledge that costs, quality, and extent of service vary 511

between different settlement service providers (e.g., attorneys, lenders, inspectors and title companies). 512

13. TRANSFER OF TITLE. Subject to tender of payment at Closing as required herein and compliance by Buyer with the 513

other terms and provisions hereof, Seller must execute and deliver a good and sufficient ______________________________ deed 514

to Buyer, at Closing, conveying the Property free and clear of all taxes except the general taxes for the year of Closing. Except as 515

provided herein, title will be conveyed free and clear of all liens, including any governmental liens for special improvements 516

installed as of the date of Buyer’s signature hereon, whether assessed or not. Title will be conveyed subject to: 517

13.1. Those specific Exceptions described by reference to recorded documents as reflected in the Title Documents 518

accepted by Buyer in accordance with Record Title (§ 8.2), 519

13.2. Distribution utility easements (including cable TV), 520

13.3. Those specifically described rights of third parties not shown by the public records of which Buyer has actual 521

knowledge and which were accepted by Buyer in accordance with Off-Record Title (§ 8.3) and Current Survey Review (§ 9), 522

13.4 Inclusion of the Property within any special taxing district, and 523

13.5. Other _______________________________________. 524

14. PAYMENT OF ENCUMBRANCES. Any encumbrance required to be paid will be paid at or before Closing from the 525

proceeds of this transaction or from any other source. 526

15. CLOSING COSTS, CLOSING FEE, ASSOCIATION FEES AND TAXES. 527

15.1. Closing Costs. Buyer and Seller must pay, in Good Funds, their respective closing costs and all other items required 528

to be paid at Closing, except as otherwise provided herein. 529

15.2. Closing Services Fee. The fee for real estate closing services must be paid at Closing by Buyer Seller 530

One-Half by Buyer and One-Half by Seller Other _______________________________________. 531

15.3. Status Letter and Record Change Fees. Any fees incident to the issuance of Association’s statement of 532

assessments (Status Letter) must be paid by Buyer Seller One-Half by Buyer and One-Half by Seller None. 533

Any record change fee assessed by the Association including, but not limited to, ownership record transfer fees regardless of name 534

or title of such fee (Association’s Record Change Fee) must be paid by Buyer Seller One-Half by Buyer and One-535

Half by Seller None. 536

15.4. Local Transfer Tax. The Local Transfer Tax of ________% of the Purchase Price must be paid at Closing by 537

Buyer Seller One-Half by Buyer and One-Half by Seller None. 538

15.5. Private Transfer Fee. Private transfer fees and other fees due to a transfer of the Property, payable at Closing, such 539

as community association fees, developer fees and foundation fees, must be paid at Closing by Buyer Seller One-540

Half by Buyer and One-Half by Seller None. The Private Transfer fee, whether one or more, is for the following 541

association(s): in the total amount of % of the Purchase 542

Price or $_________________. 543

15.6. Water Transfer Fees. The Water Transfer Fees can change. The fees, as of the date of this Contract, do not exceed 544

$____________ for: 545

Water Stock/Certificates Water District 546

Augmentation Membership Small Domestic Water Company __________ 547

and must be paid at Closing by Buyer Seller One-Half by Buyer and One-Half by Seller None. 548

15.7. Sales and Use Tax. Any sales and use tax that may accrue because of this transaction must be paid when due by 549

Buyer Seller One-Half by Buyer and One-Half by Seller None. 550

16. PRORATIONS. The following will be prorated to the Closing Date (§ 3), except as otherwise provided: 551

16.1. Taxes. Personal property taxes, if any, special taxing district assessments, if any, and general real estate taxes for the 552

year of Closing, based on Taxes for the Calendar Year Immediately Preceding Closing Most Recent Mill Levy and 553

Most Recent Assessed Valuation, adjusted by any applicable qualifying seniors property tax exemption, qualifying disabled 554

veteran exemption or Other . 555

16.2. Rents. Rents based on Rents Actually Received Accrued. At Closing, Seller will transfer or credit to 556

Buyer the security deposits for all Leases assigned, or any remainder after lawful deductions, and notify all tenants in writing of 557

such transfer and of the transferee’s name and address. Seller must assign to Buyer all Leases in effect at Closing and Buyer must 558

assume Seller’s obligations under such Leases. 559