Fillable Printable Discretionary Trust Deed

Fillable Printable Discretionary Trust Deed

Discretionary Trust Deed

July 2015

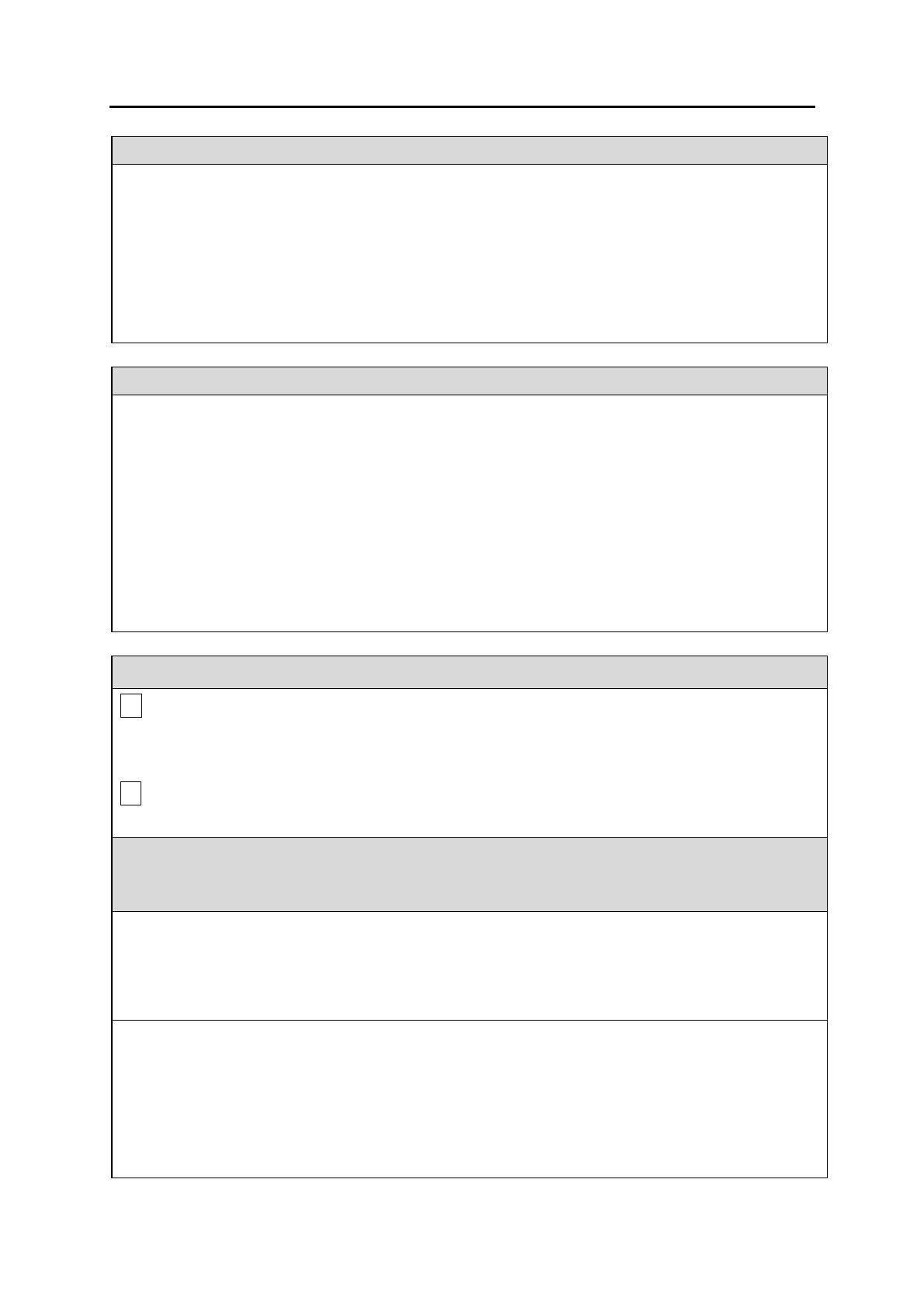

ORDER FORM – DISCRETIONARY TRUST DEED

Firm / Person Placing Order

Firm Name: ........................................... Contact Name: ………………………………………

Delivery Address

(no PO boxes):

…………………………………………………………………………

Suburb: …………………………………. State: …………… Postcode:……………………

Phone: ………………………………… Email:…………………………………………………

Desired Name of Trust ………………………………..................................................................

How Will Payment Be Made

Account number: …………………..

Direct Deposit:

BSB: 062 210 Acct. 1036 0658 (Please use desired Trust Name as reference)

Cheque

(Must be cleared before processing and made payable to Patricia Holdings)

Credit Card Number ………………………………..…… Expiry Date ……………….............

Card Holder Name ……………………………………………...

Type of Card: MasterCard

Visa

Amex

(NB: Amex will incur 3.03% incl. GST fee)

Signature:……………………………………………

Trust - Delivery Type

A

$324.50

A quality bound Trust Register delivered to you via courier.

Please choose either

Grey or

White

Deluxe Black Folder ($33.00 extra)

B

$280.50

A PDF version of the Trust Register delivered to you via email.

Package Deals

(leave blank if not in a package)

NB: Our stamping fee does not include cost of OSR (NSW) or SRO (VIC) Stamp Duty

OSR and SOR Stamping Fees subject to change without notice

Company + Deed

Couriered $1073.50

Company + Deed

Emailed $908.50

Company + Deed + our stamping fee*

Couriered $1139.50

Company + Deed + our stamping fee*

Emailed $974.50

*If selecting Deed Stamping in addition to your Trust or Package, please select

Trust /Package fee +OSR fee for

Original $500.00

Plus 1 Duplicate $510.00

Or 2 Duplicates $520.00

Or 3 Duplicates $530.00

Trust/ Package fee + SRO fee $200 (Fixed Trust

price for VIC)

Trust/Package fee + Your own cheque for the

OSR or SRO Fee

July 2015

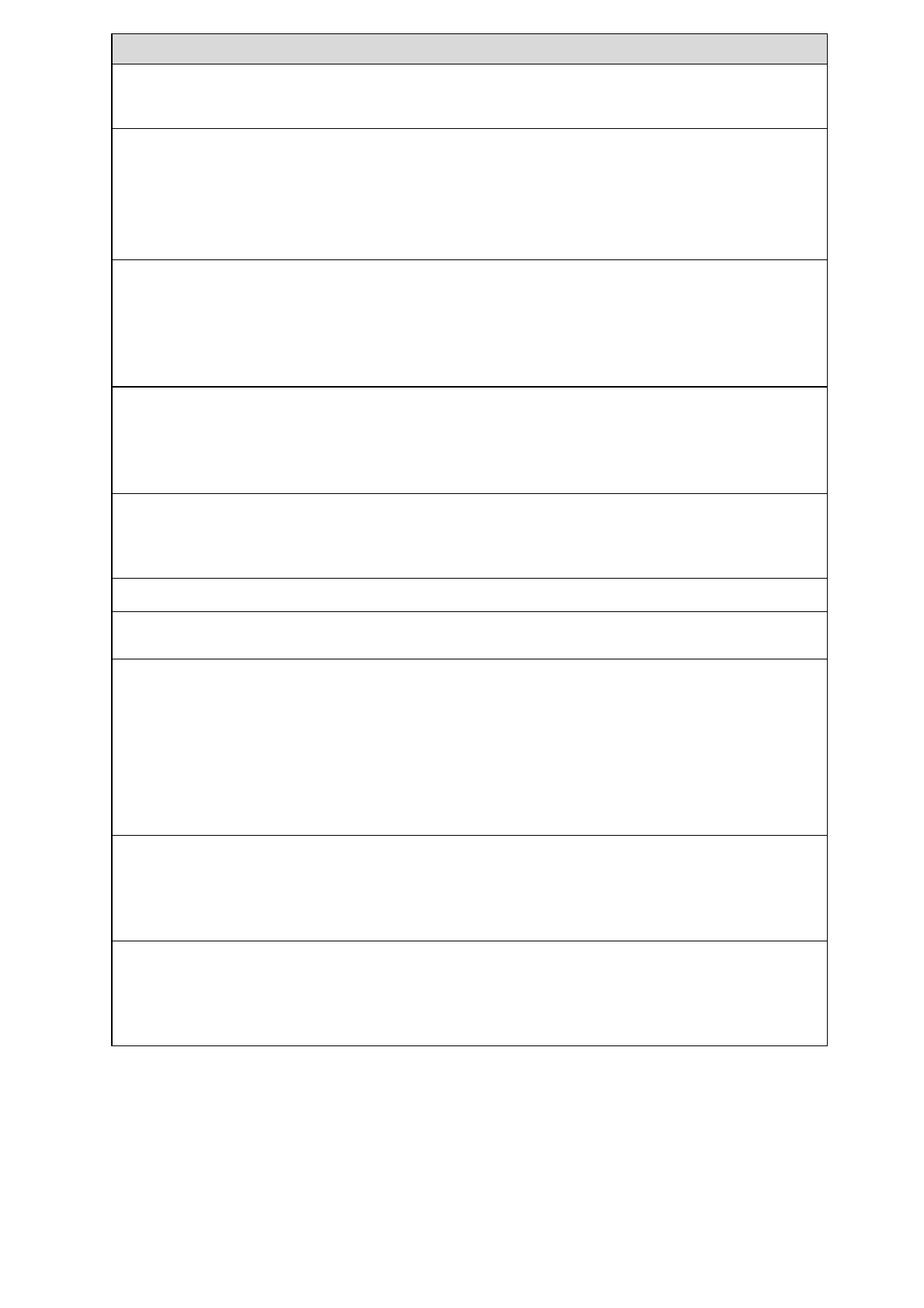

Trust Details

State of Jurisdiction ……………………………………………………………………………...

Is a charity to be a Beneficiary of this Trust? Yes No

First

Trustee

Name:……………………………………………………………………………….

Address:……………………………………………………………………………..

………………………………………………………………………………...

A.C.N. (if company):…………………………………………………………………..

Second

Trustee

Name:………………………………………………………………………………...

Address:……………………………………………………………………………..

……………………………………………………………………

A.C.N. (if company):……………………………………………………………………

Settlor

(non-related*)

Name:………………………………………..

Settled

Sum ……………………….

Address:……………………………………………………………………………..

………………………………………………………………………………………

Specific

Exclusions

(*must be the

settlor if related)

………………………………………………………………………………………..

……………………………………………………………………………………..…

Appointor Name:………………………………………………………………………………...

Guardian

(Optional)

Name:………………………………………………………………………………...

Specified

Beneficiaries

(Include A.C.N.

if company)

Name:………………………………………………………………………………...

Name:………………………………………………………………………………...

Name:………………………………………………………………………………...

Name:………………………………………………………………………………...

Name:………………………………………………………………………………...

Additional

Beneficiaries

(Include A.C.N.

if company)

Name:………………………………………………………………………………...

Name:………………………………………………………………………………...

Name:………………………………………………………………………………...

Is there to be any limitation on the amount or percentage of income and/or capital that can be

paid to any one beneficiary?

Yes (If yes, state the amount or percentage of income or capital limitation)….………………...

No

July 2015

THINGS TO KNOW

1.

NO LEGAL, FINANCIAL OR TAX ADVICE

We do not provide legal, financial or taxation advice and therefore take no responsibility for these

matters. You should consult your lawyer, accountant or financial advisor before placing an order

with us.

2.

NAME ON TAX INVOICE (for Clients with Accounts)

Please note that you are our client and tax invoices are in your name and it is you we extend credit

to, not your client. We cannot and will not alter the tax invoice from you to your client after your

order has been processed. Should you want the tax invoice in the name of your client

please advise

us beforehand

so it is not on your account. We shall require cleared funds in payment prior to

processing your order as we do not extend credit to clients of our clients. The name on the tax

invoice determines the debtor.

3.

TERMS OF TRADE (for Clients with Accounts)

We extend thirty days terms of trade to practising solicitors, financial planners and accountants but

not to their clients. We require cleared funds from private clients before we process the order. See 2

above re name on Tax Invoice. Where accounts are paid after the time of order using credit card,

we charge an admin fee of 2.5% (incl. GST) on Visa and MasterCard and 3.03% (incl. GST) on

Amex.

Whilst most of our clients observe the 30 days terms of trade we extend, please be aware it is

company policy to suspend further credit at 45 days.

4. TERMS OF TRADE (for Private Clients)

We require cleared funds from private clients before we process the order. American Express

(subject to surcharge of 3.03% incl. GST), MasterCard and Visa (not subject to surcharges)

accepted. Non-bank cheques are accepted but need to be cleared before your order is processed

which may take four business days.