Fillable Printable 2016 CCA Fax Cover Doc Requirements

Fillable Printable 2016 CCA Fax Cover Doc Requirements

2016 CCA Fax Cover Doc Requirements

FAX COVER SHEET

To: Winston Benefits

Fax: 1-732-903-1158

Attached: Dependent Verification Documents

Employee Name: ______________________________________________

Employee ID: _____________ Contact phone: _____________________

Total number of pages including this cover sheet: _______

All previously unverified and newly added dependents covered by the medical, dental, and/or vision

plans must be verified with supporting documentation. Please refer to the Required Documentation grid for

complete documentation details.

For each unverified or newly added dependent, you must fax, email or upload this form along with the

required supporting documentation to Winston Benefits.

IMPORTANT: If you are faxing documentation you should retain a copy of the fax confirmation page for your

records.

Fax number:

1-732-903-1158

E-Mail Address:

ccabenefits@winstonbenefits.com

Upload Documents:

Dependent Audit tab of

www.myccabenefits.com

Open Enrollment Elections: Complete verification documentation must be received no later than Monday,

February 15, 2016 or your unverified dependent(s) will not be covered and if applicable, your benefit coverage

tier will automatically be reduced.

New Hire/Life Event Elections: Complete verification documentation must be received within 15 days of

making your new hire/life event election or your unverified dependent(s) will not be covered and if applicable,

your benefit coverage tier will automatically be reduced.

NOTE: You are responsible for submitting all documentation to WB and for confirming with WB that all

documentation has been received, approved, and processed.

Refer to the Dependent Verification Required Documentation Chart for a list of acceptable documentation.

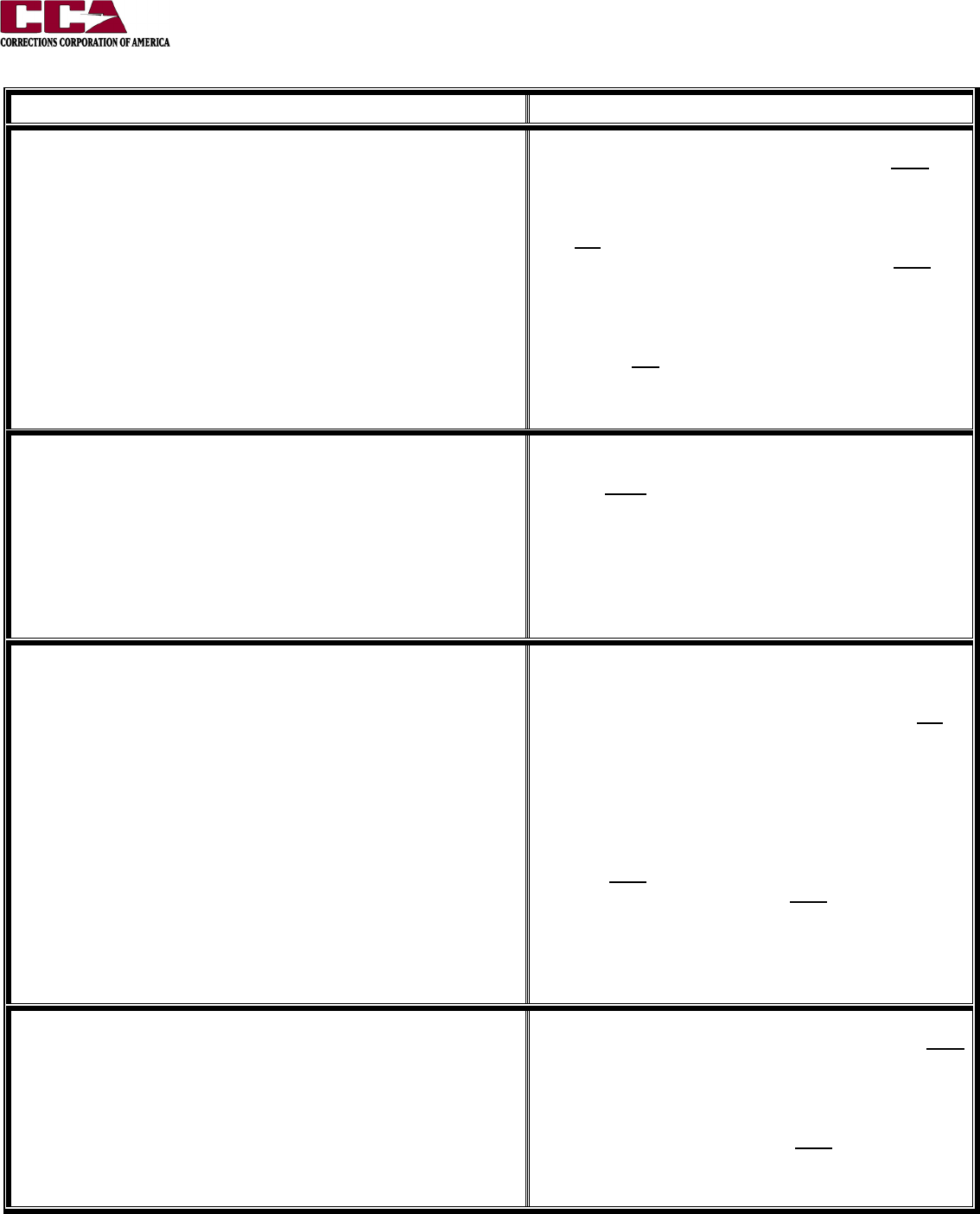

DEPENDENT VERIFICATION REQUIRED DOCUMENTATION CHART

DEPENDENTS REQUIRED DOCUMENTATION

LAWFUL SPOUSE

Your spouse as defined by the law of the jurisdiction in which you were

legally married, regardless of where you currently reside

The choice of option 1 or 2:

1. Copy of your state issued marriage certificate AND

Copy of the first page of your most current federal tax

return that includes your spouse (you may conceal all

financial information)

OR

Copy of your state issued marriage certificate AND

Current dated (within last 90 days) proof of common

residency such as a shared utility bill or bank statement

with the common address indicated

2. The first and signature pages (or e-file confirmation

page) of your most current federal tax return showing

marital status that includes your spouse (you may

conceal all financial information)

COMMON LAW SPOUSE

Common law applies in Alabama, Colorado, Iowa, Kansas, Montana,

Oklahoma, Pennsylvania, Rhode Island, South Carolina, Texas, Utah

and Washington, D.C.

* Georgia - common law relationship created prior to 1/1/97

* Idaho - common law relationship created prior to 1/1/96

* Ohio - common law relationship created prior to 10/10/91

* Pennsylvania - common law relationship created prior to

1/1/05

Notarized copy of the CCA – Affidavit of Common Law

Marriage AND Current dated (within last 90 days) proof of

common residency such as a shared utility bill or bank

statement with the common address indicated.

CHILDREN

Your dependent child up to the age of 26, including:

o Natural born child

o Legally adopted child (including children placed for the

purpose of adoption)

o Stepchild who resides in your home

o Child related by blood or marriage for whom you or your

lawful Spouse is the legal guardian

o Child for whom you or your lawful Spouse are financially

responsible for health care coverage under the terms of a

Qualified Medical Child Support Order or other

administrative order

Copy of the first and signature pages (or e-file confirmations

page) of your most current federal tax return that includes

your child (you may conceal all financial information) OR

Natural Child – Copy of the child’s state issued birth

certificate showing the employee’s name as parent.

(Hospital birth certificate will be accepted for newborns

up to age 6 months).

Stepchild - Copy of the child’s state issued birth

certificate showing the employee’s spouse’s name as a

parent AND a copy of the marriage certificate showing

the employee and parent’s name AND a signed and

notarized CCA Stepchild Affidavit

Legal Guardian, Adoption or Foster Child – Copy of

Affidavits of Dependency, Final Court Order with

presiding judge’s signature and seal, or Adoption Final

Decree with presiding judge’s signature and seal.

DEPENDENT CHILDREN WITH DISABILITIES

Dependent children who are incapable of self-sustaining employment

because of mental or physical disability, and became so prior to age 26,

and is dependent on the employee for financial support and care

Documentation as noted for the “Child” dependent type AND

Notice of Award Letter from Social Security (SSI) of

Supplemental Security Disability (SSDI) of child being

found disabled. Please note that this documentation

only verifies the child’s eligibility as a dependent, not

the disability status of the child AND

Proof that the child resides with the employee.

Updated 12.01.2015