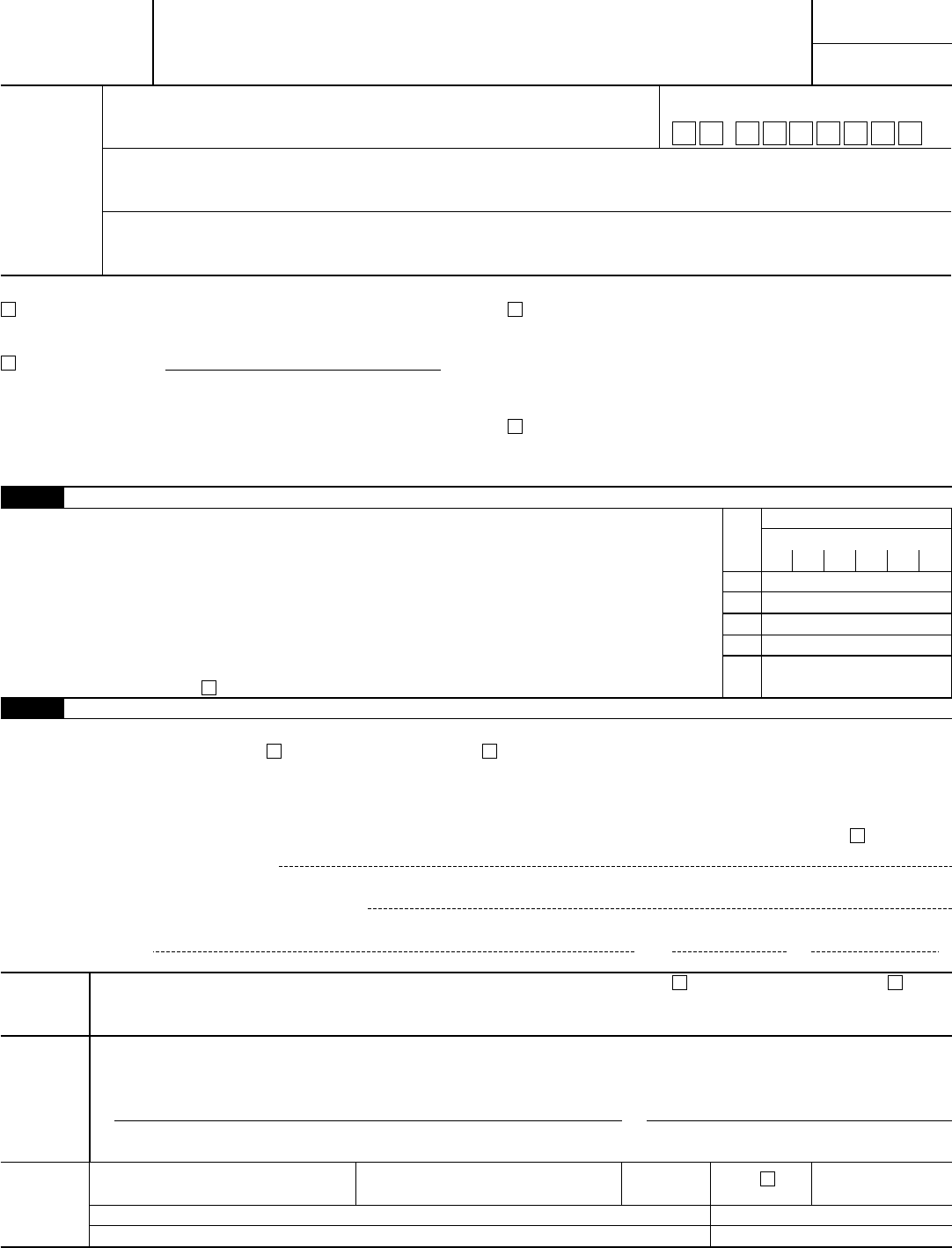

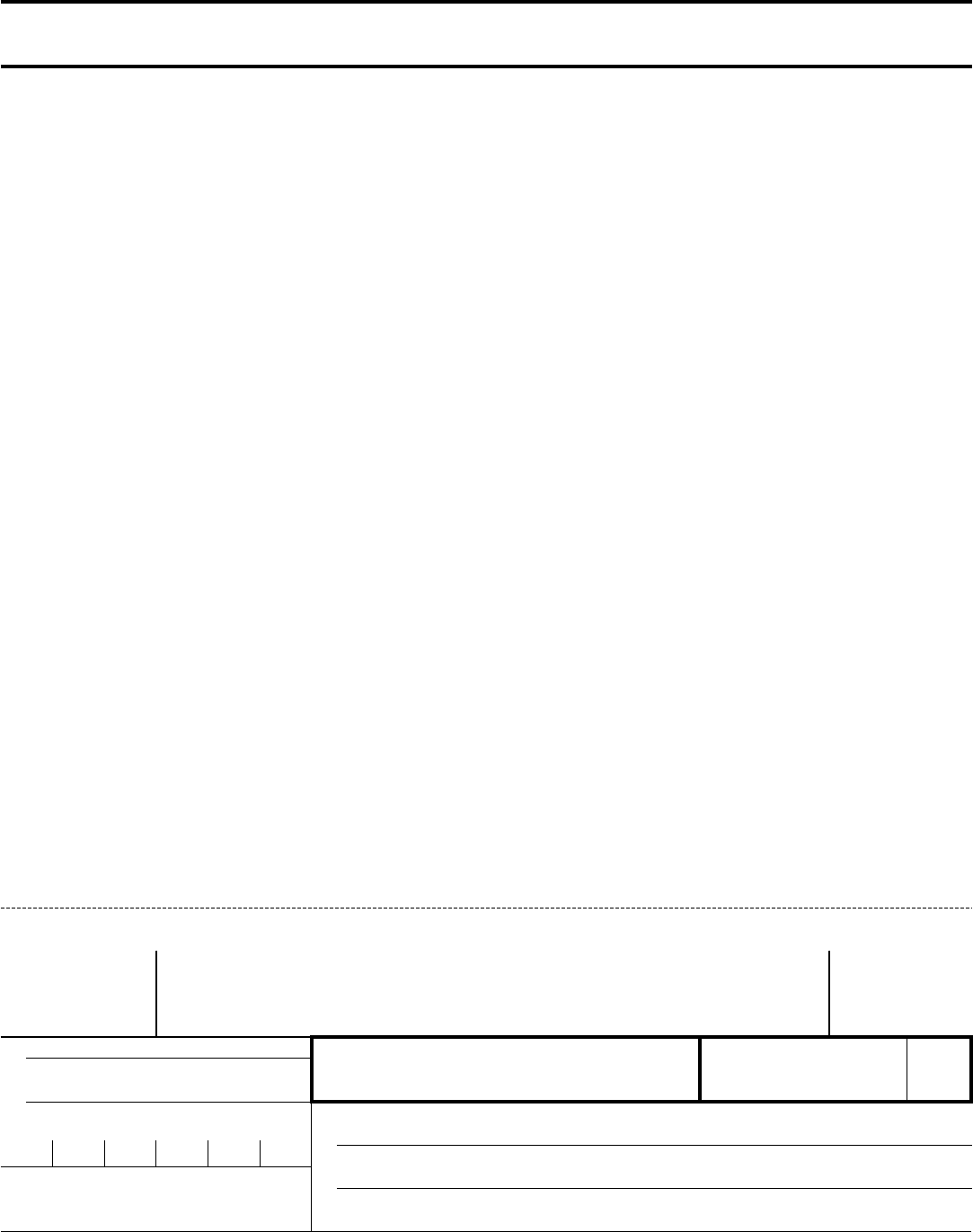

Form 2290

(Rev. July 2017)

Department of the Treasury

Internal Revenue Service (99)

Heavy Highway Vehicle Use Tax Return

For the period July 1, 2017, through June 30, 2018

▶

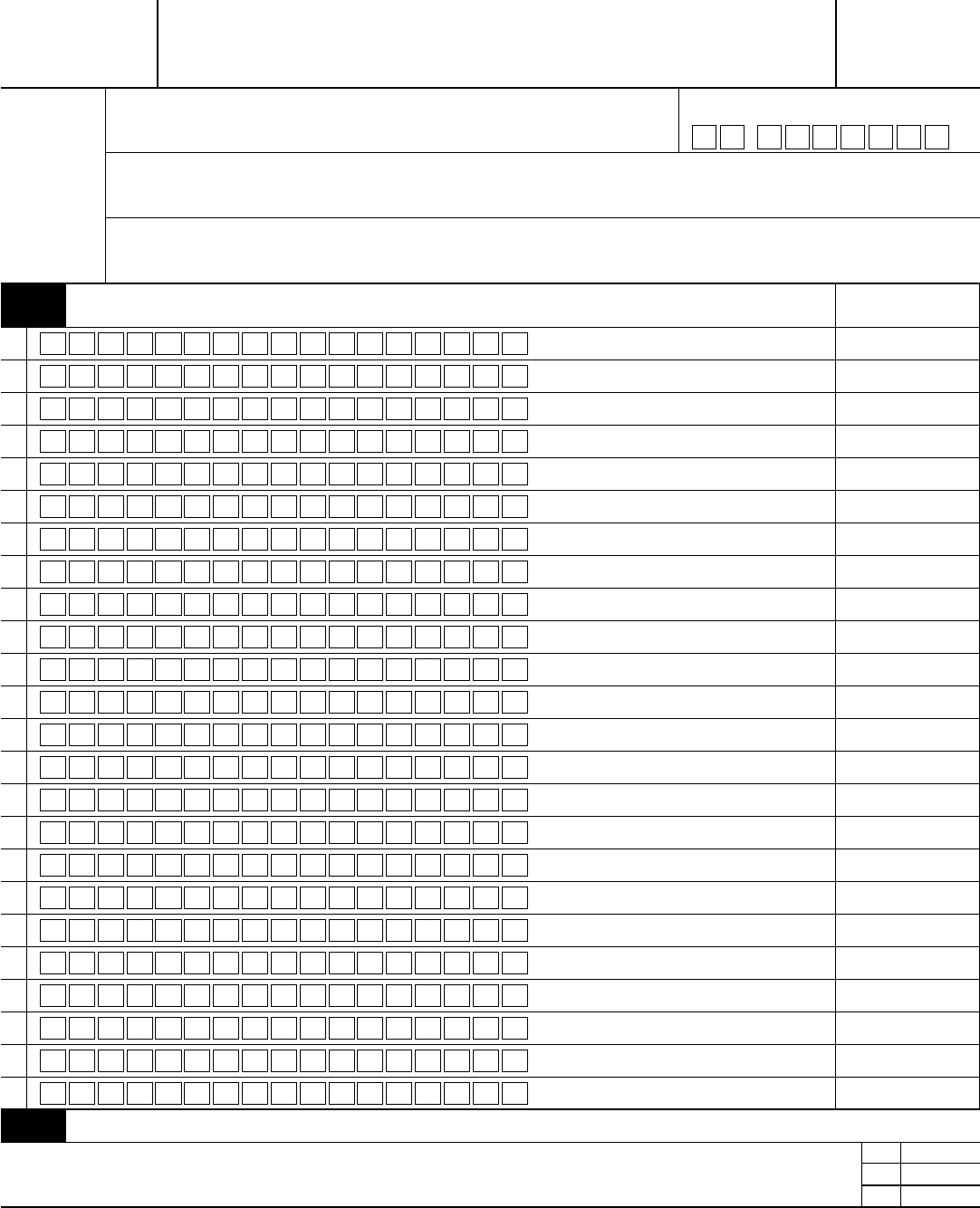

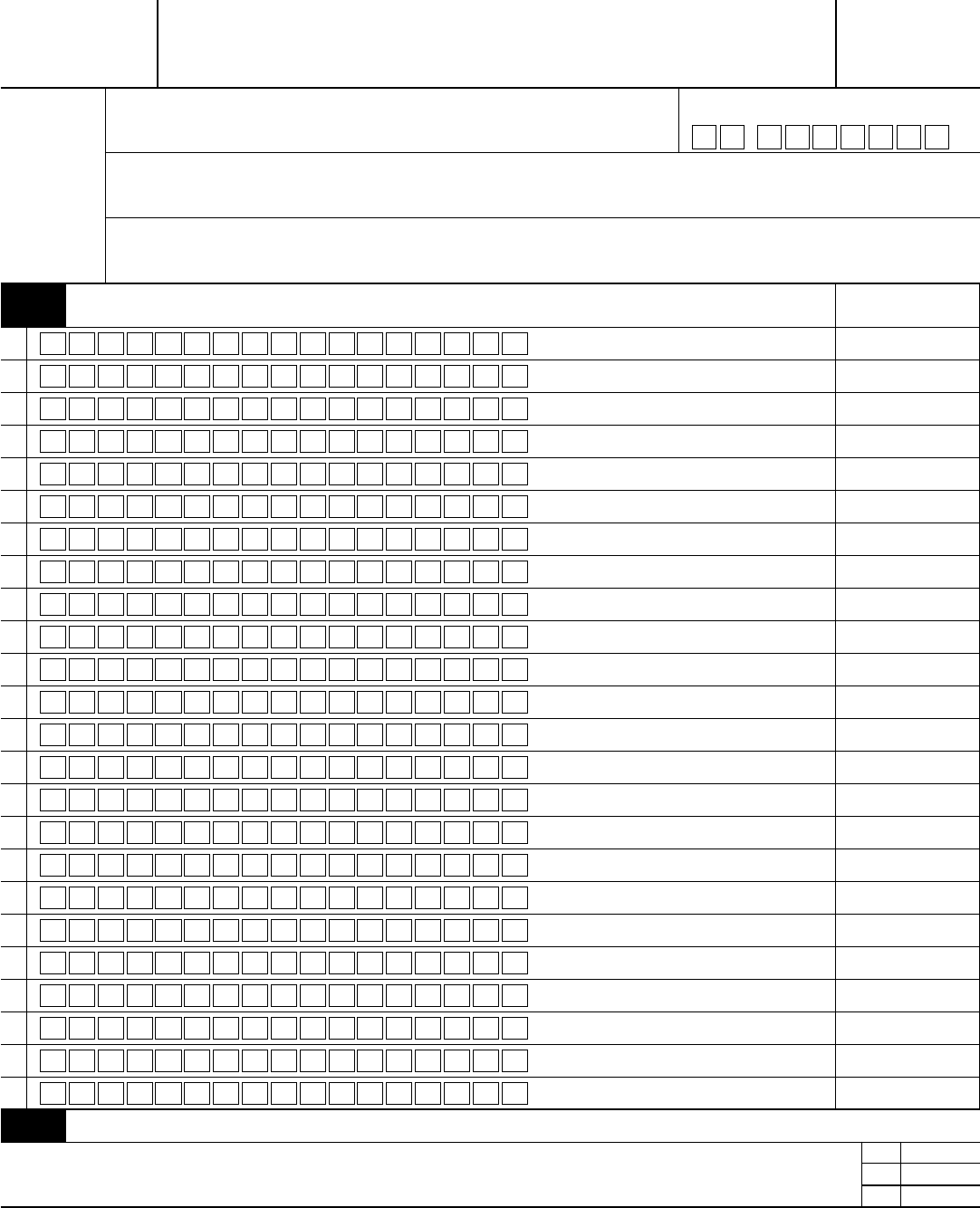

Attach both copies of Schedule 1 to this return.

▶

Information about Form 2290 and its separate instructions is at www.irs.gov/form2290.

Keep a copy of this

return for your records.

OMB No. 1545-0143

Type

or Print

Name

Employer identification number

–

Address (number, street, and room or suite no.)

City or town, state or province, country, and ZIP or foreign postal code

Check if applicable:

Address Change

VIN Correction

Check this box if you are correcting a vehicle

identification number (VIN) listed on a previously filed

Schedule 1 (Form 2290). Attach an explanation to the

return. Don’t check this box for any other reason.

Amended Return

Check this box if reporting (a) additional tax from an

increase in taxable gross vehicle weight or (b) suspended

vehicles exceeding the mileage use limit. Don’t check

this box for any other reason.

Final Return

Check this box if you no longer have taxable vehicles to

report.

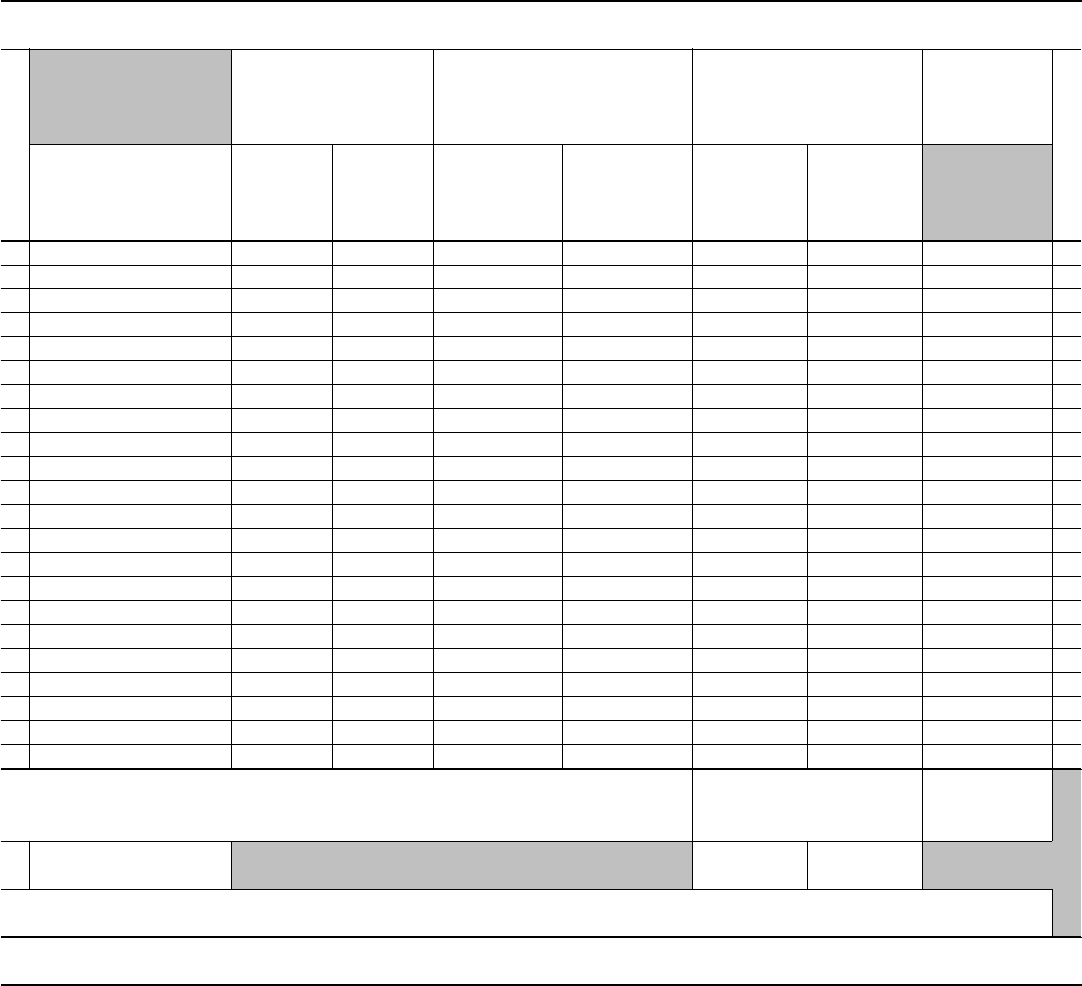

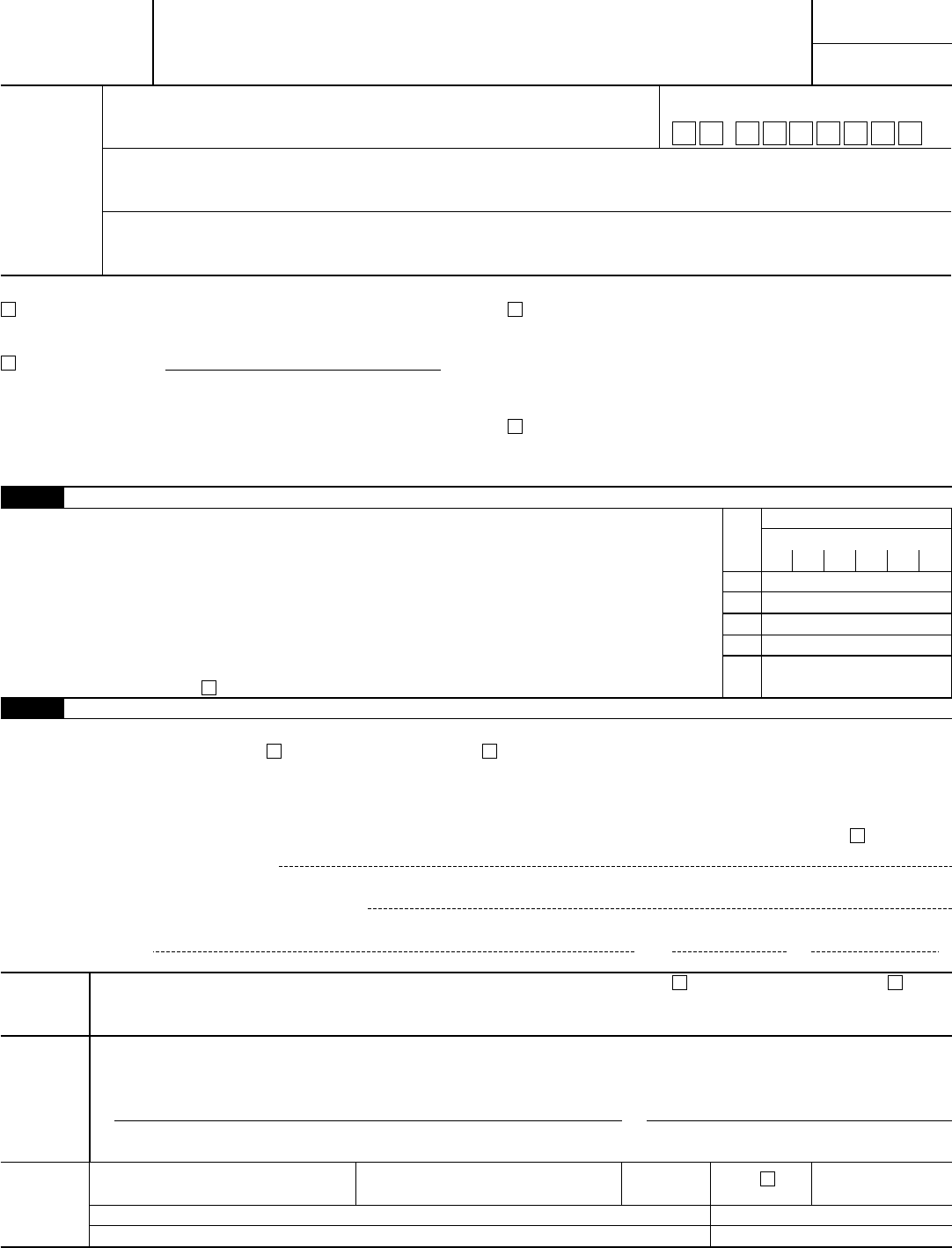

Part I

Figuring the Tax

Caution: If you purchased a used vehicle from a private seller, see instructions.

1

Was the vehicle(s) reported on this return used on public highways during July 2017? If “YES,”

enter 201707 in the boxes to the right. If

“NO,” see the table on page 3 of the instructions .

▶

1

Y Y Y Y M M

2 Tax. Enter the Total from Form 2290, page 2, column (4) . . . . . . . . . . .

▶

2 .

3 Additional tax from increase in taxable gross weight (see instructions) . . . . . . .

▶

3 .

4 Total tax. Add lines 2 and 3 . . . . . . . . . . . . . . . . . . . . .

▶

4 .

5 Credits (Attach supporting documentation. See instructions.) . . . . . . . . .

▶

5 .

6

Balance due. Subtract line 5 from line 4. This is the amount you owe. If payment through

EFTPS, check here . . . . . . . . . . . . . . . . . . . . . .

▶

6 .

Part II

Statement in Support of Suspension (Complete the statements that apply. Attach additional sheets if needed.)

7

I declare that the vehicles reported on Schedule 1 as suspended (category W) are expected to be used on public highways

(check the boxes that apply):

5,000 miles or less 7,500 miles or less for agricultural vehicles

during the period July 1, 2017, through June 30, 2018, and are suspended from the tax. Complete and attach Schedule 1.

8

a

I declare that the vehicles listed as suspended on the Form 2290 filed for the period July 1, 2016, through June 30, 2017, were

not subject to the tax for that period except for any vehicles listed on line 8b. Check this box if applicable.

▶

b

Vehicle identification numbers

9

I declare that vehicle identification numbers

were listed as suspended on the Form 2290 filed for the period July 1, 2016, through June 30, 2017. These vehicles were sold or

transferred to

on

,

.

At the time of the transfer, the vehicles were still eligible for the suspension of the tax. Attach a separate list if needed.

Third

Party

Designee

Do you want to allow another person to discuss this return with the IRS (see instructions)?

Yes. Complete the following. No

Designee’s

name

▶

Phone

no.

▶

Personal identification

number (PIN)

▶

Sign

Here

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements and to the best of my knowledge

and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

▲

Signature

▲

Date

Type or print name below signature. Telephone number

Paid

Preparer

Use Only

Print/Type preparer’s name

Preparer’s signature Date

Check if

self-employed

PTIN

Firm’s name

▶

Firm’s EIN

▶

Firm’s address

▶

Phone no.

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions.

Cat. No. 11250O

Form 2290 (Rev. 7-2017)