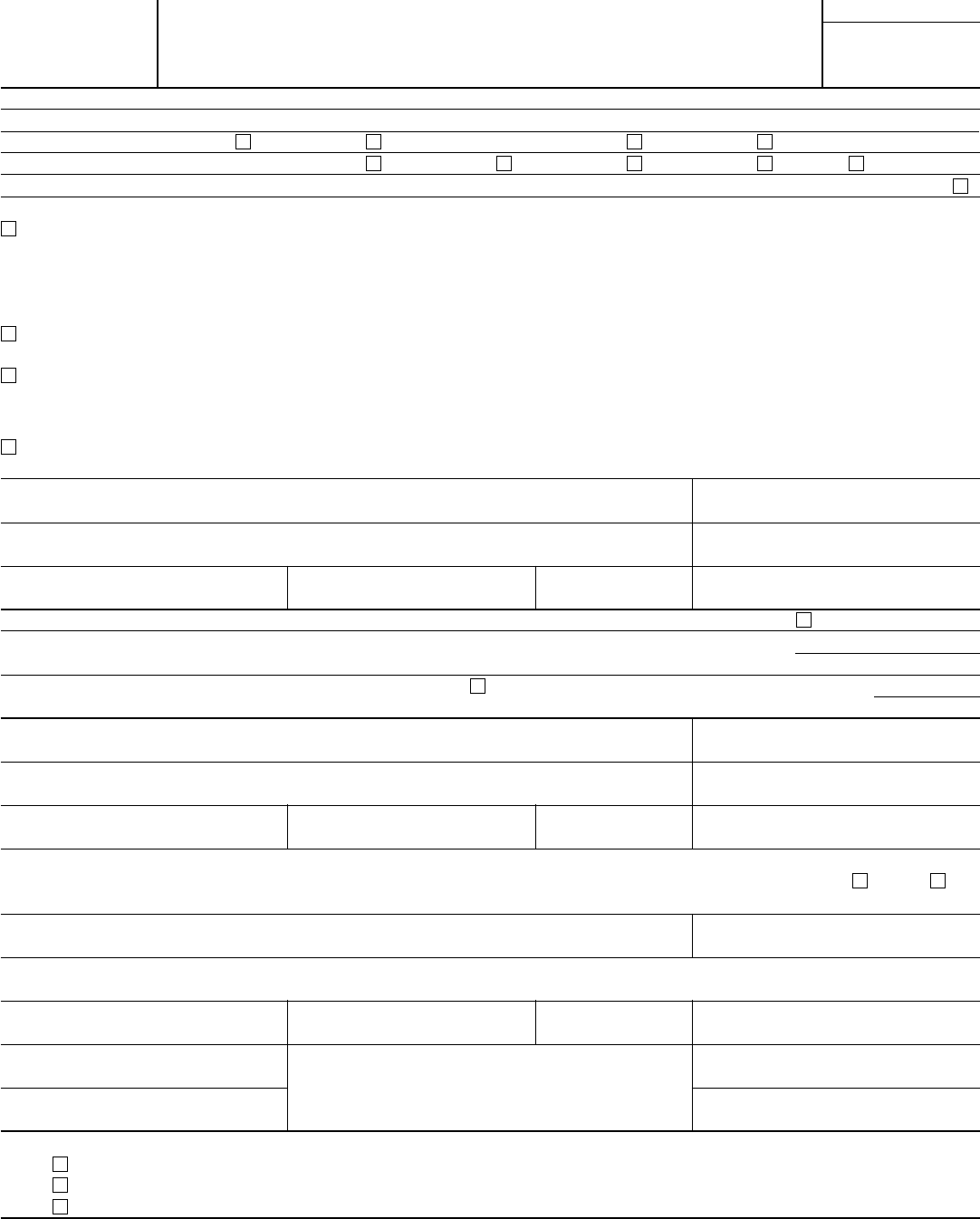

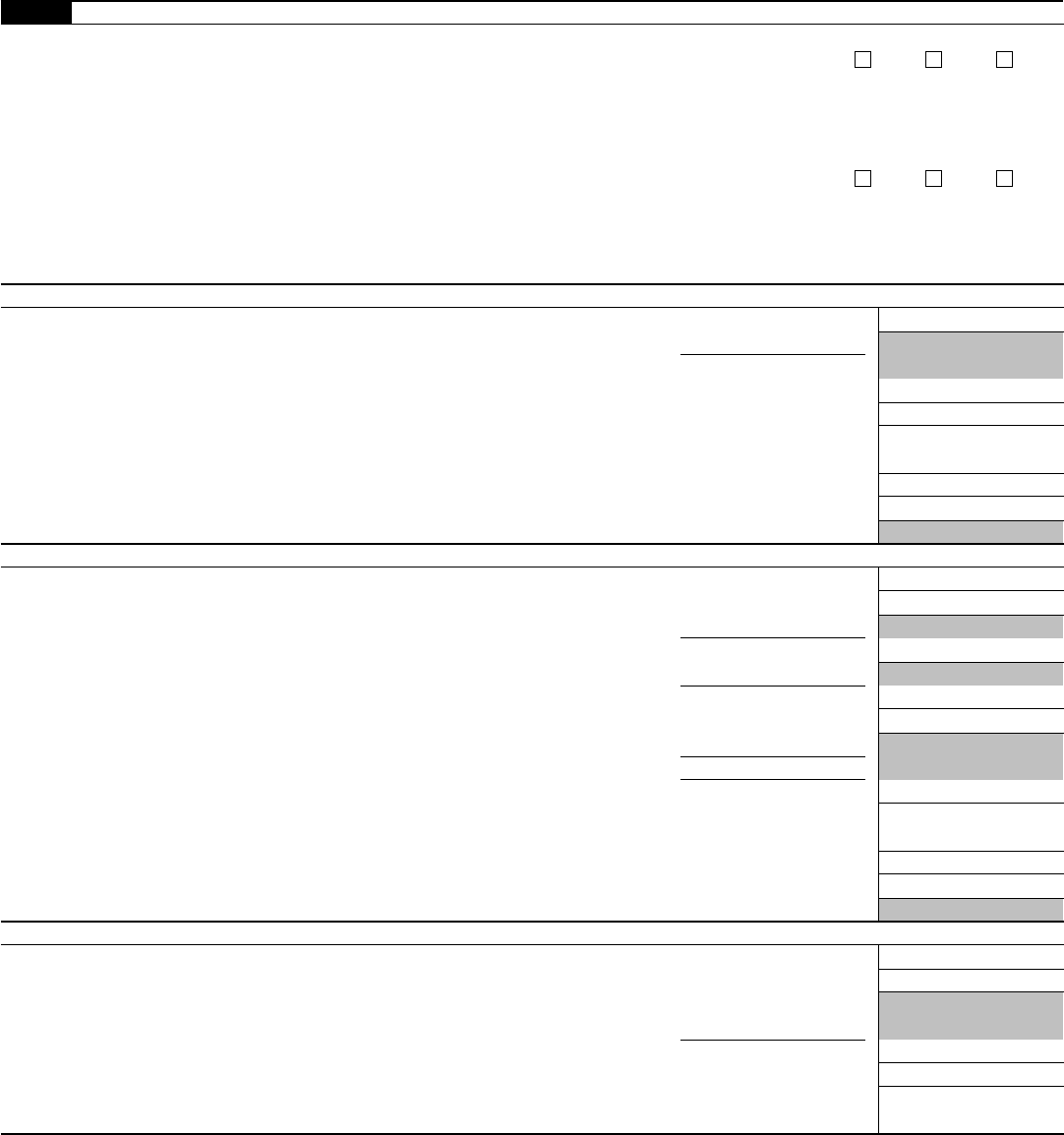

Form 3520

Department of the Treasury

Internal Revenue Service

Annual Return To Report Transactions With

Foreign Trusts and Receipt of Certain Foreign Gifts

▶

Information about Form 3520 and its separate instructions is at www.irs.gov/form3520.

OMB No. 1545-0159

2016

Note: All information must be in English. Show all amounts in U.S. dollars. File a separate Form 3520 for each foreign trust.

For calendar year 2016, or tax year beginning , 2016, ending , 20

A Check appropriate boxes: Initial return Initial return (extension filed) Final return Amended return

B Check box that applies to person filing return: Individual Partnership Corporation Trust Executor

C Check if any excepted specified foreign financial assets are reported on this form (see instructions) . . . . . . . . .

Check all applicable boxes.

(a) You are a U.S. transferor who, directly or indirectly, transferred money or other property during the current tax year to a foreign trust,

(b) You held an outstanding obligation of a related foreign trust (or a person related to the trust) issued during the current tax year, that you

reported as a “qualified obligation” (defined in the instructions) during the current tax year, or (c) You are the executor of the estate of a U.S.

decedent and (1) the decedent made a transfer to a foreign trust by reason of death, (2) the decedent was treated as the owner of any portion of a

foreign trust immediately prior to death, or (3) the decedent’s estate included any portion of the assets of a foreign trust. Complete all applicable

identifying information requested below and Part I of the form and see the instructions for Part I.

You are a U.S. owner of all or any portion of a foreign trust at any time during the tax year. Complete all applicable identifying information

requested below and Part II of the form and see the instructions for Part II.

(a) You are a U.S. person who, during the current tax year, received a distribution from a foreign trust, or (b) You are a U.S. person who is also a

grantor or beneficiary of a foreign trust (1) that has made a loan of cash or marketable securities, directly or indirectly, to you or a U.S. person

related to you during the current tax year, or (2) from which you or a U.S. person related to you received the uncompensated use of trust property.

Complete all applicable identifying information requested below and Part III of the form and see the instructions for Part III.

You are a U.S. person who, during the current tax year, received certain gifts or bequests from a foreign person. Complete all applicable

identifying information requested below and Part IV of the form and see the instructions for Part IV.

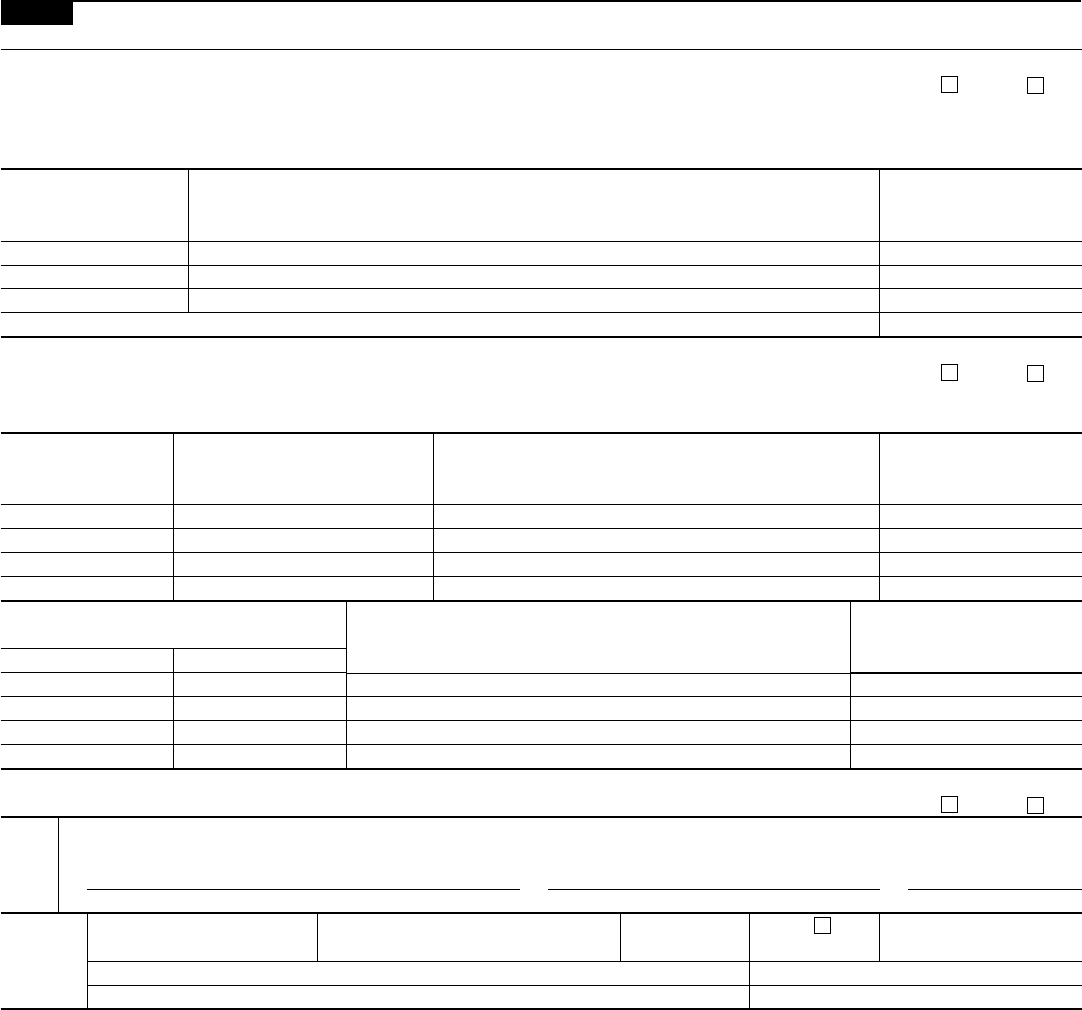

1a Name of U.S. person(s) with respect to whom this Form 3520 is being filed (see instructions)

b Identification number

c Number, street, and room or suite no. (if a P.O. box, see instructions) d Spouse’s identification number

e City or town f State or province

g

ZIP or foreign postal code

h Country

i Check the box if you are married and filing a joint 2016 income tax return, but you are filing separate Forms 3520.

j

Service center where U.S. person's tax return is filed . . . . . . . . . . . . . . . . .

▶

k

If an extension was requested for the tax return, check this box

and enter the form number of the tax return to be filed.

▶

2a Name of foreign trust (if applicable)

b(1) Employer identification number (if any)

b(2) Reference ID number (see instructions)c Number, street, and room or suite no. (if a P.O. box, see instructions)

d City or town e State or province

f ZIP or foreign postal code

g Country

3 Did the foreign trust appoint a U.S. agent (defined in the instructions) who can provide the IRS with all relevant trust

information? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

If “Yes,” complete lines 3a through 3g. If “No,” be sure to complete Part I, lines 15 through 18.

3a Name of U.S. agent b Identification number (if any)

c Number, street, and room or suite no. (if a P.O. box, see instructions)

d City or town e State or province

f ZIP or postal code

g Country

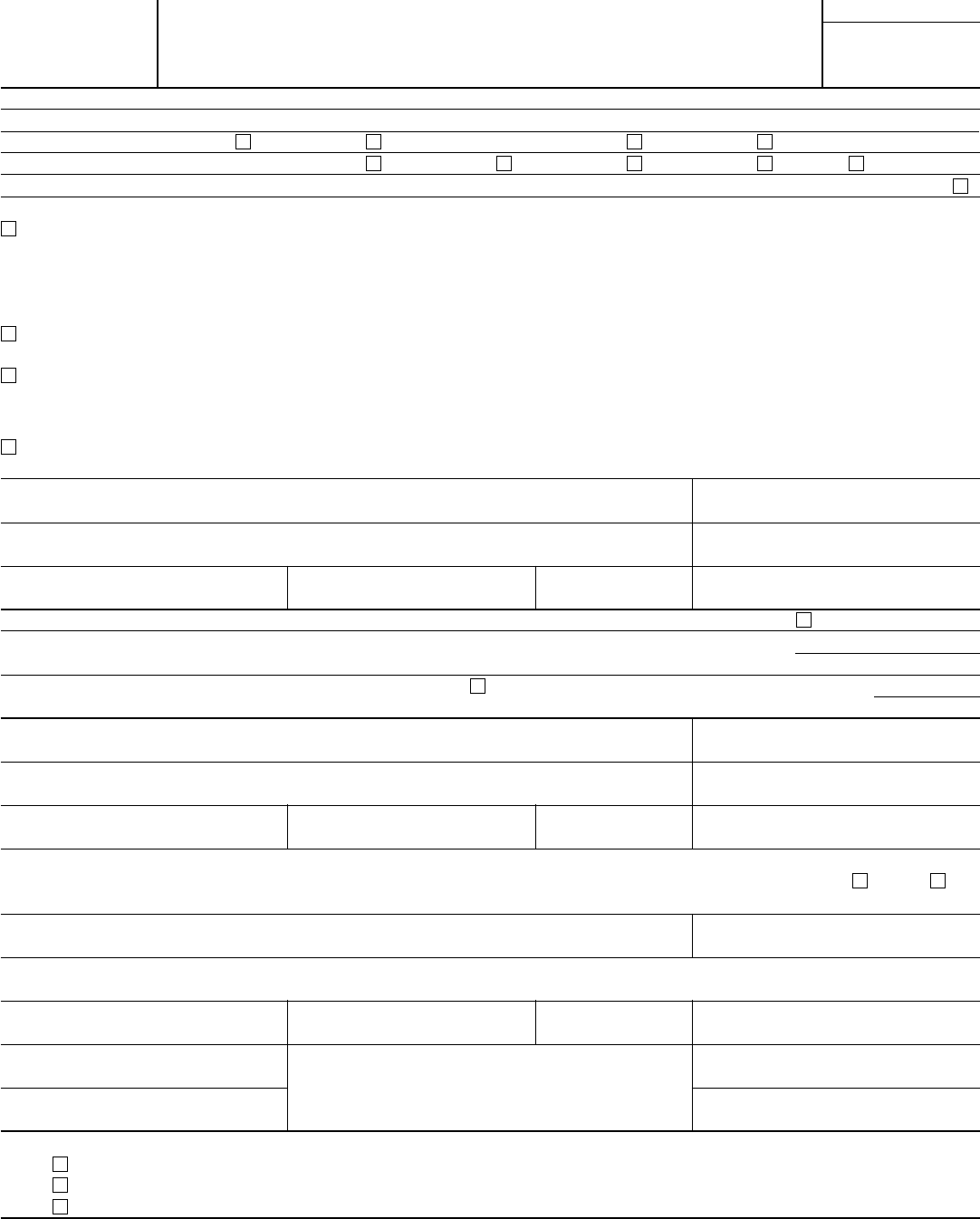

4a Name of U.S. decedent (see instr.)

b Address

c TIN of decedent

d Date of death e EIN of estate

f Check applicable box.

U.S. decedent made transfer to a foreign trust by reason of death.

U.S. decedent treated as owner of foreign trust immediately prior to death.

Assets of foreign trust were included in estate of U.S. decedent.

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Cat. No. 19594V

Form 3520 (2016)