Fillable Printable Form 800-053-000

Fillable Printable Form 800-053-000

Form 800-053-000

F800-053-000 Cover letter 5-2011

STATE OF WASHINGTON

DEPARTMENT OF LABOR AND INDUSTRIES

Crime Victims Compensation Progra m

PO Box 44520 •Olympia, Washington 98504-4520

Dear Provider:

If you choose to become an established provider with us, please complete the enclosed

provider application and return it to us at your earliest convenience. Upon registration,

you will receive your provider account number and a packet of information related to

billing our program for your services. We have published a mental health fee schedule

which is available on our website, www.CrimeVictims.Lni.wa.gov. If you have any

questions related to our reimbursement rate you may contact our toll free number.

The Crime Victims Compensation Program (CVCP) is currently reimbursing providers a

percentage of the billing rates used by the Department of Labor and Industries. Our

program is the last payer of benefits. Crime victims must first use any private or public

insurance they have before the CVCP can pay.

If you are currently treating a crime victim with an allowed claim and choose not to

conduct further business with us, you cannot bill the victim for services you have

provided thus far. To be paid for treatment provided to date, you will need to complete

the enclosed provider application agreement and submit it along with your bills to the

CVCP for payment consideration. We will assign a provider account number for bill

processing purposes. After the bills have been processed and you receive your remittance

advice, you may contact us to terminate your account.

If at any time you decide not to accept crime victims as patients, please refer them to our

toll free number (1-800-762-3716) for a listing of CVC registered providers located in

their area.

Sincerely,

The Crime Victims Compensation Program

F800-053-000 Provider Application & Notice 6-2009

MASTER LEVEL COUNSELOR

APPLICATION INSTRUCTIONS

NOTICE:

Each applicant must complete an application. A number will be issued to each individual provider.

If additional copies are needed, copy all portions of the application from the internet or call (360) 902-5377.

Photo copies can be made of this application for completion.

SECTION I: TO BE COMPLETED BY ALL PROVIDERS

Enter the Tax Payer Identification Number (EIN or SSN). The number you will use to report earnings to the

IRS - This must match the information on the W-9.

SECTION II: TO BE COMPLETED BY ALL PROVIDERS

A.

Administrative Information

1.Enter the name of the business you wish to submit your bills and have your account set up as, (DBA).

2.Enter the phone number of the business.

2a. Enter the fax number of the business.

3.Enter the billing address as it appears on your bills submitted to Crime Victims Compensation Program and where payments

should be mailed.

4.Enter the physical address of the business.

5.Enter the contact person's name – person who can answer questions regarding your bills or your account.

6.Enter the billing phone number where we may call to ask questions regarding your bills or your account.

7.If you will be attached to a group, please provide group number (for billing purposes).

B.

Individual or Organization Information – Complete all applicable information

1.Enter the name of the individual or organization providing services to injured workers.

2.Enter the type of service(s) provided.

3.Enter your license, certification or registration number.

4.Enter the date the license, certification or registration was issued (month, day and year).

ATTACH COPY

5.Enter the date the license, certification or registration will expire (month, day and year).

6.Enter the state where the license, certification or registration was issu ed.

C.

National Provider Identifier (NPI) Information

1.Enter the individual or organization name.

2.If application is for a subpart, enter subpart name.

3.Check one. Type I – individual counselor

Type II – mental health clinics.

4.Enter the address associated with the NPI number you have provided.

5.Enter the NPI 10-digit identifier.

6.If application is for a subpart, enter the subpart NPI 10-digit identifier.

7.Enter the taxonomy codes of the individual, organization or subpart. If more than six, please list on a separate sheet of paper.

* Each January the Internal Revenue Service requires us to send a completed Form 1099 MISC reporting payments of

$600.00 or more made to a Federal Tax Identification Number (EIN or SSN) during the last calendar year. If you received

payments from more than one department program, you may receive more than one Form 1099 Misc.

Please Do Not Forget To Read and Sign The "Provider Agreement”

F800-053-000 Provider Application & Notice 6-2009

Master Level Counselor

Provider Account Application

Return To:

Provider Registration

Crime Victims Compensation Program

Department of Labor and Industries

PO Box 44520

Olympia WA 98504-4520

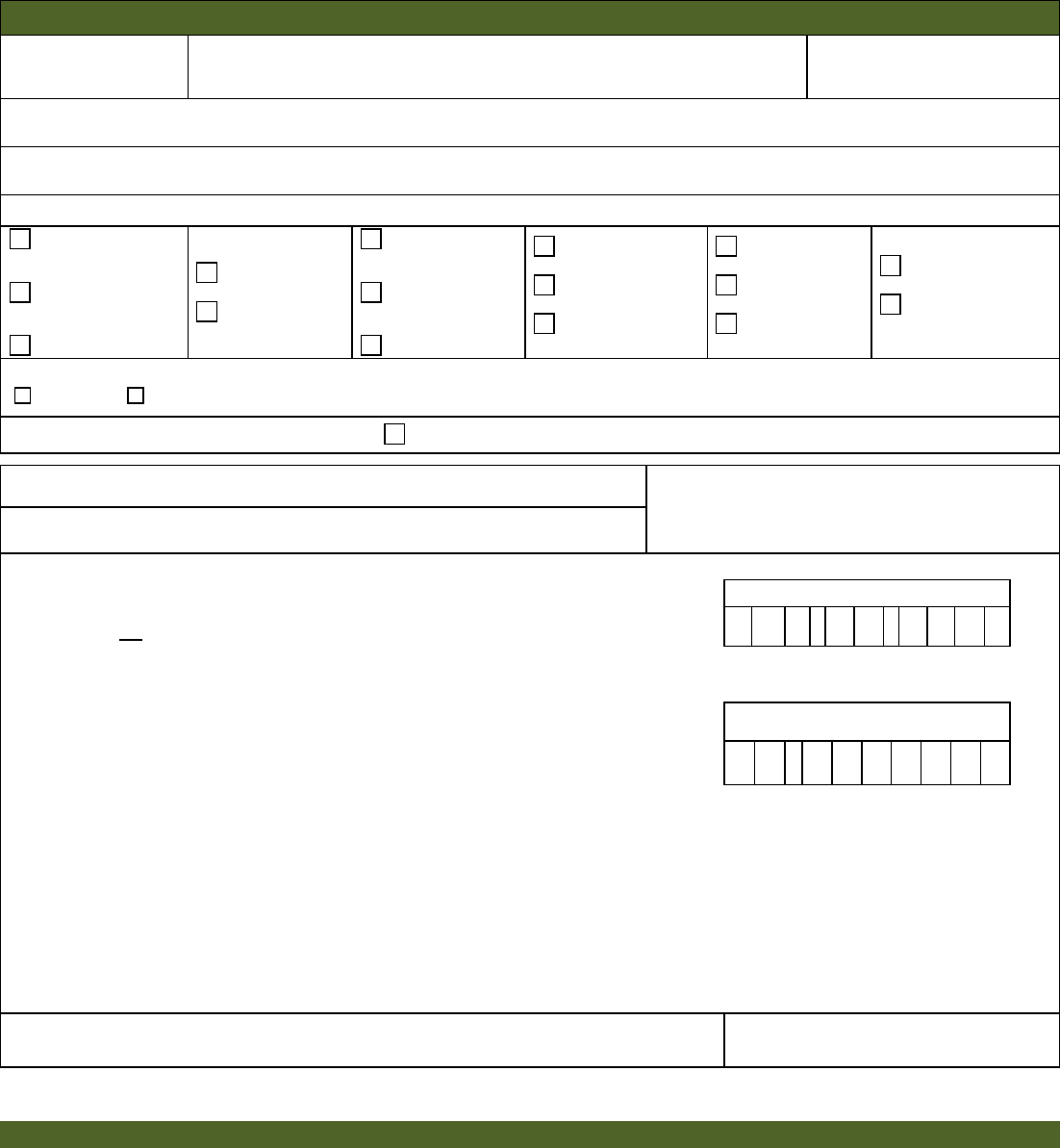

I.TAX REPORTING INFORMATION

A.Administrative Information

1.Business name (as you wish to submit your bills and have your account set up, DBA) 2.Business phone# 2a. Business FAX#

3.Billing address (as it appears on your bills submitted to CVC and where payments should be mailed) 4.Business address (the physical location of the business)

5.Contact person’s name

6.

Billing phone# (where we may call regarding your account/bills)

7.CVC group payee provider #

B.Individual or Organization Information – Attach copy of current license

1.Provider’s name (Last, First, MI) 2.Specialty / Services provided

3.Professional license/certification/registration number 4.License issue date 5. License expiration date6. State where issued

C. National Provider Identifier (NPI) Information

1. Individual or Organization name 2. If for Subpart, provide Subpart name 3. Please check one

Type I Individual Type II Organization

4. NPI address

5. NPI 10-digit Identifier 6. If for Subpart, provider Subpart NPI 10-digit identifier

__ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __

7. Taxonomy Codes

__ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __

__ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __

(Please type or print clearly on all sections)

Please

check:

New Provider

Address Updates for Reactivation of Provider Account

Tax ID Change – Effective Date _______________

Required

(360) 902-5377 FAX (360) 902-5333

Internet address: //www.lni.wa.gov/FormPub

Tax Payer Identification Number (EIN or SSN)

THIS NUMBER MUST MATCH THE W-9 FORM YOU SUBMIT

Unless otherwise notified, your claims

related correspondence will go to your

business (physical) address.

Please check if you would like all

mail to go to the billing address.

II.ACCOUNT AND BI LLING INFORMATION

*****

Mental health counselors must have a master’s degree in a field of study related to me ntal health services

including, but not limited to, social work, marriage and family therapy or mental health counseling.

F800-053-000 Provider Application & Notice 6-2009

PROVIDER APPLICATION

The Crime Victims Compensation Program (CVC) is authorized by Washington State law, Title 7, Chapter 68, Revised Code of Washington

(RCW), and is administered by the Department of Labor and Industries. Health care and other services are provided to CVC clients pursuant to

Title 7, Chapter 68 RCW, Washington Administrative Code (WAC) Chapters 296-30, and 296-31, and policies adopted by the department,

including medical coverage decisions. To qualify for payment, a provider must have an active provider account number assigned by CVC.

To receive a provider account number, the provider must submit a signed CVC Provider Application to CVC, including all required supporting

information. For group practices, a separate Provider Application is required for each

provider who will be providing services to CVC clients.

The following information must be submitte d with the Provider Applic ation, a:

•current copy of the provider's current professional license, certification or registration. Master level counselors must

include a copy of academic degree;

•completed W-9 Form.

A provider's account number will become inactive if CVC does not receive any bills from the provider for a consecutive 18-month period. If the

provider's account becomes inactive, the provider must reactivate the account prior to submitting bills by calling the CVC Provider Registration

Section at 360-902-5377. A new W-9 Form is needed to reactivate an account, only if information on that form has changed. Providers with

inactive accounts will not automatically receive department publications, such as Provider Bulletins, Provider Updates, rules. Issuance

ofa

provider number does not guarantee that all services billed by a provider will be paid by CVC. The department will purchase only

covered services, provided by covered professionals.

The provider agrees:

1.To meet and maintain all applicable state and/or federal licensing, certification or registration requirements to assure the department of the

provider's qualifications to perform services.

2.To comply with Washington State Law Title 7, Chapter 68 RCW, and WACs, including but not limited to, Chapters 296-30, and 296-31, and

policies adopted by the department, including fee schedules and medical coverage decisions.

3.That providing services to or filing an application for benefits on behalf of a crime victim who is covered under the department's jurisdiction,

constitutes acceptance of the requirements of Title 7, Chapter 68 RCW, and WACs, including but not limited to, Chapters 296-30, and

296-31, and policies adopted by the department, including fee schedules and medical coverage decisions.

4. To bill CVC the provider’s usual and customary chargesfor services rendered to CVC clients as required by Washington State law.

5.To bill primary or public insurance prior to billing CVC.

6.To accept the department's payment after primary or public insurance has been billed as complete renumeration for services provided to the

CVC client as required by Washington State law. The provider agrees not to bill a CVC client for:

a)services covered by CVC which are related to the crime victim’s claim.

b)the difference between the billed and paid charges; or

c)the difference between the provider's customary fee and the department's fee schedule.

In the event a provider believes additional funds are due, the provider may submit a Provider's Request for Adjustment Form to the

department for consideration in accordance with the instructions contained on the Remittance Advice.

7.That if the provider receives payment from the department in error or in excess of the amount properly due under the applicable rules and

procedures the provider will promptly return to the department any excess monies received. The department may audit the provider's records

to determine compliance with the rules and regulations of the department as provided in Washington State law.

8.To maintain documentation and records for a minimum of five years to support the services and levels of services billed. The provider agrees

that these records and supportive materials will be made available to the department upon request as provided in Washington State law.

9.To notify CVC immediately of any changes to information in this application or provider status (e.g., federal tax identification number,

ownership, incorporation, address, etc.). A change in ownership or fede r al tax ID numbe r may require a new provider account number

A provider will be held to all the terms of this application even though a third party may be involved in billing claims to the

department. The

department reserves the right to deny, revoke, suspend or condition a provider's authorization to treat CVC clients in accordance with Washington

law.

Provider's Statement of Agreement

I (the provider), _____________________________________, (print or type) agree to abide by the terms of this application and by all applicable

federal and Washington State statutes, rules and policies. I have enclosed with my application all

required supporting information to establish a

provider account, including: a current copy of my current license, certification or registration (if I am required to be licensed, certified or

registered by my state licensing authority); and a completed W-9 Form.

Date Title Signature

Statewide Payee Registration for

Washington StateDepartment of Labor and Industries

STEP 1: Is this a NEW registration or CHANGE to an existing registration (check one)?

NEW REGISTRATION― complete the ENTIREform (STEPS 1 ― 6)

EXISTING REGISTRATION – comp lete t he ENTIREform (STEPS 1 – 6) and check below what is updated:

Adding a New Provider Name/DBA Address Contact Information EmailPayment Options

Direct Deposit Additional Information

If you know your Statewide Vendor Number, enter it here:

SWV

STEP 2: Enter information about the payee and contact person

Legal Name (a s show n on your income tax ret urn)

SSN OR EIN

Busines s Nam e, if dif f er e nt from Lega l Na m e abov e – e.g. Doing Busi ne s s As (DBA) Name

Contact Person

PaymentAddress(where payme nts wil l be sent)

Contact Telephone Num ber

City, Sta t e, and Zip Code

Contact Fa x Number

Email to recei v e St ate wi de Ve ndor Num be r a nd payment noti f ic ations

For L&I Use Only:

2350 / MIPS / O /

Type of Busine s s

L&I #/ System / Ownership / L&I Provider #

STEP 3: Select Payment Option:

Direct Deposit to bank (recommended)

Check in US mail (terminates any previous banking information on file)

If dir e ct deposit is checked, complete STEP 4.

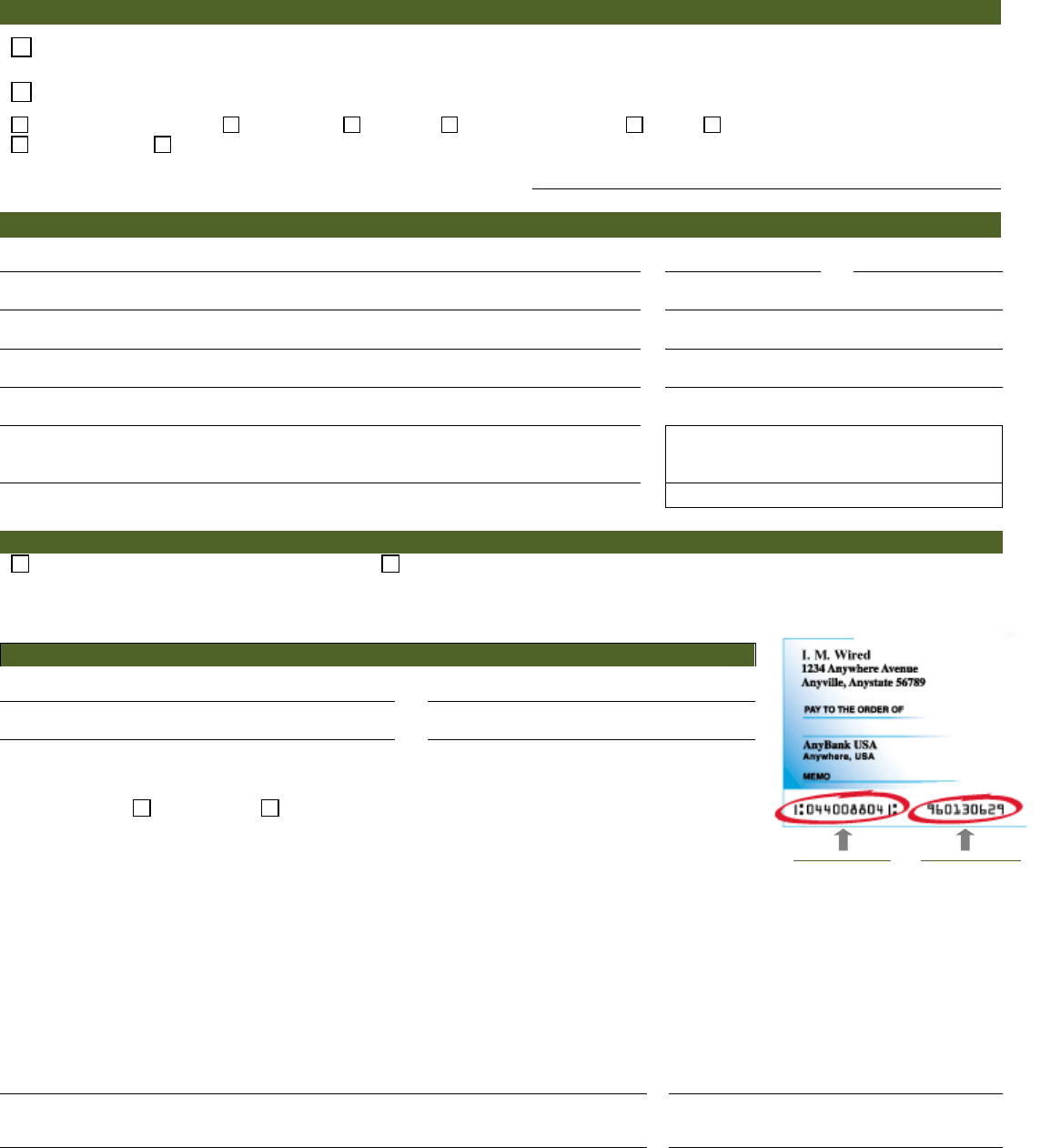

STEP 4: For Direct Deposit, complete all fields below and sign

Financial Instit ution Name – must be a US institution

Financial Instit ution Phone Number

Routing Numbe r – see example at right

Account Numbe r – see example at right

In addition to providing your banking information on this form, you may attach a voide d che ck .

Account Type: Checking or Savings (Checking will be used if neither box is marked.)

Aut

horization for Direct Deposit:

I hereby authorize and request the Consolidated Technology Services (CTS) and the Office of the State Treasurer (OST)

to initiate credit entries for payee pay ments to the account indicated above, and the financial institution named above is

authorized to credit such account. I agree to abide by the National Automated Clearing House Association (NACHA) rules

with regard to these entries. Pursuant to the NACHA rules, CTS and OST may initiate a reversing entry to recall a

duplicate or erroneous entry that theypreviously initiated. I understand that if a reversal action is required, CTS will notify

this office of the error and the reason for the reversal. This authority will continue until such time CTS and OST have had

a reasonable opportunity to act upon written request to terminate or change the direct deposit service initiated herein.

Authorized Representative (Please Print)

Title

SI GNA T U R E of Aut hor ized R epresentat ive

Date

Page 1 of 2

Routing Number

(Nine Digits)

Account Number

can vary in length

Continue to STEP 5

F800-065-000 Substitute Statewide Payee and W-902-2016

STEP 5: REQUIRED – Completeand sign the Reques t for Taxpaye r Identification Number (W-9)

Substitute

Form

W-9

Request for Taxpayer

Identification Number and Certification

1.Legal Name (as shown on your income tax return)

2.Business Name, if different from Legal Name above – eg. Doing Business As (DBA) Name

3.Check ONLY ONE box below (see W-9 instructions for additional information)

Individual or

Sole Proprietor

LLC filing as a sole

proprietor

Partnership

Corporation

S-Corp

LLC filing as

Corporation

LLC filing as

Partnership

LLC filing as S-Corp

Non Profit Organization

Volunteer

Board /Committee

Member

Local Government

State Government

Federal Government

(including tribal)

Tax-exempt organization

Trust/Estate

4.For Corporation, S-Corp, Partnership or LLC, check one box below if applicable:

Medical Attorney/Legal

5.If exempt from backup withholding, check here:(See instructions for W-9 to determine if you are exempt from backup withholding.)

6.Ad d ress (n u mber, street, and apt. or suite no.)

Department of Labor and Industries

Attn: Provider Credentialing and Compliance

PO Box 44261

Olympia Wa98504-4261

7.Cit y, State, and ZIP code

8.Taxpayer Identifi cation Number (TIN)

Enter your EIN ORSSN in the appropriate box to the right (do not enter both)

For individuals, this is your soc i al security number (SSN).

For other entities, it is your empl oyer identification number (EIN).

N

OTE: The EIN or SSN must match the Legal Nameas reported to the IRS. For a resident alien, sole

proprietor, or disregarded ent i ty , or to find out how to get a Taxpayer Identificati on Number, see the W9

Instructions.If the account is in more than one name, see the W9 Instructions for gui del i nes on whose

number to enter.

Social security number

-

-

Employer ident ification number

-

9.Certification

Under penalty of perjury, I certify that:

•

The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and

•

I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the

Internal Revenue Service (IRS) that I am subject to backup withholding as a resultof a failure to report all interest or dividends, or

(c) the IRS has notified me that I am no longer subject to backup withholding, and

•

I am a U.S. person (including a U.S. resident alien).

(For additional information about the W-9 see the W-9 Instructions.)

SIGNATURE of U.S. PERSON

Date

STEP 6: Submit to ONE of the following

For Medical Provider

Provider Account Application & Pay Hold Releases:

FAX:360-902-4484

Provider Network Application (WPA):

FAX:360-902-4563

Crime VictimsCompensation:

FAX: 360-902-5333

Or mail to:

Provider Credentialing & Compliance

PO Box 44261

Olympia, WA 98504-4261

For quest ions cont ac t Prov ider Credent i a l ing: 3 60-902-5140and select optio n 4

Page 2 of 2

F800-065-000 Substitute Statewide Payee and W-902-2016

Instructions f or t he St a t ewidePayee Regi s tr a t ion Form

The term ‘payee’ refers to an individual or business that received payments from the State of

W ashington. This form is intended to be used for payees to register with the State of Washington,

indicate how they would like to receive payments, and change their registration information.

For prompt payment, it is important that we receive complete and accurate information. We must

return any form tha t is not com pl ete, so please be sure to read and follow these i nstructions

carefully.

Step 1: Is this a new regis tration or a change to an existing registration?

Select NEW REGISTRATION if:

•You have never completed the Statewide Payee Registration Form.

•You are changing the legal name of a payee already registered.

•You are changing the EIN (Employer Identification Number) or SSN (Social Security

Number) of a payee already registered

•You are changing the reporting type (sole proprietor, corporation, etc) on an existing

registration.

Select CHANGE TO EXISTING REGISTRAT ION for all other changes to an exi st ing

registration, and check the items that have changed. Be sure toCOMPLETE the ENTIRE

form, even if you are only changing one item. This will help us keep your account up to date

and accurate. If you know your SWVnumber, please enter it on the form.

Step 2: Payee & contact information

Legal name of payee – enter the name as it appears on federal tax forms.

Business name– “doing business as” name. Enter only if different from legal name.

Paymentaddress – enter the PO Box or street address where you want information sent to

you. If you choose to have checks mailed to you, this is the address where they will be sent.

Email for contact person - enter the email address we should use to communicate with you

about your registration and your payments. We will use the email address to:

•Notify you when your account has been set up.

•Notify you when changes you submitted have been made.

•Notify you when your payment has been processed, if you have signed up for direct

deposit.

Type ofbusiness– enter the primary occupation of the payee.

SSNor EIN– enter the SSNor EIN you use with the IRS for the legal name entered.

Contact person –the per son w ecan contact with questions about your registration.

Contact telephone number–telep ho ne number of the con tact person.

Contact fax number – fax number of the contact person.

NOTE: For larger organizations we recommend that you use the email address for a

distribution list to ensure that our notifications are received and processed quickly.

Step 3: Payment options

Indicate if you want to receive your payments via Direct Deposit o r via US Mail.

F800-065-000 Substitute Statewide Payee and W-902-2016

Step 4: Direct depos it informa tion

Financial ins ti tution name & phone number – enter the name and phone number of the

financial institution where you want your funds deposited. Thismustbe a US institution.

Routing number – this is the 9 digit Bank Identification Number assigned by the American

Banking Association. The routing number is the first 9 numbers at the bottom of your check.

See example on form. Do not use the routing number from a generic deposit slip – thes e be g i n

with the number ‘5.’

Account number – this is your bank account number, and can vary in length. It usually follows

the routing number on the check

Account type – select the kind of account your payment will be deposited into. If you do not

make a selection, funds will be transferred into the checking account.

Authorization Signa ture– in order for us to process the Direct Deposit, we need the

signature of the person on file with the bank.

Ste p 5: W-9

The IRS has issued new regulations governing how we report payments and calculate

withholding. We need thiscomplete, signed W-9 in order to proces s your registration and

verify any ch ang es to it.

1.Legal name of payee – enter the name as it appears on feder al t ax forms.

2.Business name – “doing business as” name. Enter only if different from legal name.

3.Check one box for your IRS reporting type – you must check ONLY one box to indicate if

you are an individual, corporation, non-profit organization,etc.

4.Check if the business is medical or legal - If you are a corporation, S-corporation,

partnership or LLC, and your business is medical or legal, you must check the appropriate box.

See the W-9 instructions for more information about reporting types.

5.Select if you are exempt from backup withholding.

6.Address – enter the PO Box or street addresswhere you would like your 1099 mailed.

7.City, State and ZIP

8.Taxpayer Identification Number – enter the Employer Identification Number (EIN)OR

Social Security Number (SSN) you use with the IRS for the legal name entered. DO NOT

ENTER BOTH. Enter ONLY the one that you use with the IRS for the legal name.

9.SIGN the W-9

Step 6 : Submit to one of the following:

Provider Network Applic ation (WPA)

FAX:360-902-4563

Non-Network Provider Application

FAX:360-902-4484

Crime Victims Compensation

FAX:360-902-5333

Or mail application to: Provider Credentialing & Compliance

PO Box 44261

Oly mpia, WA 9850 4-4261

For questions, contact Provider Credentialing at 360-902-5140 and select option 4.

F800-065-000 Substitute Statewide Payee and W-902-2016