Fillable Printable Form 8959

What is a Form 8959 ?

Form 8959 is an Internal Revenue Service form used for figuring the amount of Additional Medicare Tax you owe and, if any, the amount of Additional Medicare Tax withheld by your employer. Consequently, just fill the fillable form 8959 online or download a blank one, sign it, then print it, all at our website - Handypdf.com.

Fillable Printable Form 8959

What is a Form 8959 ?

Form 8959 is an Internal Revenue Service form used for figuring the amount of Additional Medicare Tax you owe and, if any, the amount of Additional Medicare Tax withheld by your employer. Consequently, just fill the fillable form 8959 online or download a blank one, sign it, then print it, all at our website - Handypdf.com.

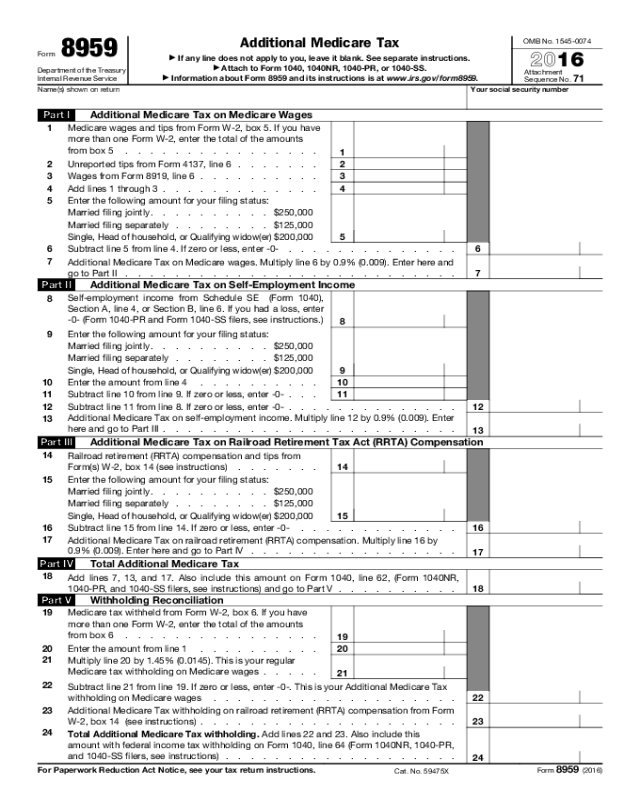

Form 8959

Form 8959

Department of the Treasury

Internal Revenue Service

Additional Medicare Tax

▶

If any line does not apply to you, leave it blank. See separate instructions.

▶

Attach to Form 1040, 1040NR, 1040-PR, or 1040-SS.

▶

Information about Form 8959 and its instructions is at www.irs.gov/form8959.

OMB No. 1545-0074

2016

Attachment

Sequence No.

71

Name(s) shown on return Your social security number

Part I Additional Medicare Tax on Medicare Wages

1

Medicare wages and tips from Form W-2, box 5. If you have

more than one Form W-2, enter the total of the amounts

from box 5 . . . . . . . . . . . . . . . .

1

2 Unreported tips from Form 4137, line 6 . . . . . . . 2

3 Wages from Form 8919, line 6 . . . . . . . . . . 3

4 Add lines 1 through 3 . . . . . . . . . . . . .

4

5 Enter the following amount for your filing status:

Married filing jointly. . . . . . . . . . $250,000

Married filing separately . . . . . . . . $125,000

Single, Head of household, or Qualifying widow(er)

$200,000 5

6 Subtract line 5 from line 4. If zero or less, enter -0- . . . . . . . . . . . . . . 6

7

Additional Medicare Tax on Medicare wages. Multiply line 6 by 0.9% (0.009). Enter here and

go to Part II . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

Part II Additional Medicare Tax on Self-Employment Income

8

Self-employment income from Schedule SE (Form 1040),

Section A, line 4, or Section B, line 6. If you had a loss, enter

-0- (Form 1040-PR and Form 1040-SS filers, see instructions.)

8

9 Enter the following amount for your filing status:

Married filing jointly. . . . . . . . . . $250,000

Married filing separately . . . . . . . . $125,000

Single, Head of household, or Qualifying widow(er)

$200,000 9

10 Enter the amount from line 4 . . . . . . . . . . 10

11 Subtract line 10 from line 9. If zero or less, enter -0- . . . 11

12 Subtract line 11 from line 8. If zero or less, enter -0- . . . . . . . . . . . . . .

12

13

Additional Medicare Tax on self-employment income. Multiply line 12 by 0.9% (0.009). Enter

here and go to Part III . . . . . . . . . . . . . . . . . . . . . . . .

13

Part III Additional Medicare Tax on Railroad Retirement Tax Act (RRTA) Compensation

14

Railroad retirement (RRTA) compensation and tips from

Form(s) W-2, box 14 (see instructions) . . . . . . .

14

15 Enter the following amount for your filing status:

Married filing jointly. . . . . . . . . . $250,000

Married filing separately . . . . . . . . $125,000

Single, Head of household, or Qualifying widow(er)

$200,000 15

16 Subtract line 15 from line 14. If zero or less, enter -0- . . . . . . . . . . . . .

16

17

Additional Medicare Tax on railroad retirement (RRTA) compensation. Multiply line 16 by

0.9% (0.009). Enter here and go to Part IV . . . . . . . . . . . . . . . . .

17

Part IV Total Additional Medicare Tax

18

Add lines 7, 13, and 17. Also include this amount on Form 1040, line 62, (Form 1040NR,

1040-PR, and 1040-SS filers, see instructions) and go to Part V . . . . . . . . . .

18

Part V Withholding Reconciliation

19

Medicare tax withheld from Form W-2, box 6. If you have

more than one Form W-2, enter the total of the amounts

from box 6 . . . . . . . . . . . . . . . .

19

20 Enter the amount from line 1 . . . . . . . . . . 20

21

Multiply line 20 by 1.45% (0.0145). This is your regular

Medicare tax withholding on Medicare wages . . . . .

21

22

Subtract line 21 from line 19. If zero or less, enter -0-. This is your Additional Medicare Tax

withholding on Medicare wages . . . . . . . . . . . . . . . . . . . .

22

23 Additional Medicare Tax withholding on railroad retirement (RRTA) compensation from Form

W-2, box 14 (see instructions) . . . . . . . . . . . . . . . . . . . . .

23

24

Total Additional Medicare Tax withholding. Add lines 22 and 23. Also include this

amount with federal income tax withholding on Form 1040, line 64 (Form 1040NR, 1040-PR,

and 1040-SS filers, see instructions) . . . . . . . . . . . . . . . . . . .

24

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 59475X

Form 8959 (2016)