Fillable Printable Form Mo-1065 2013 Partnership Return Of Income

Fillable Printable Form Mo-1065 2013 Partnership Return Of Income

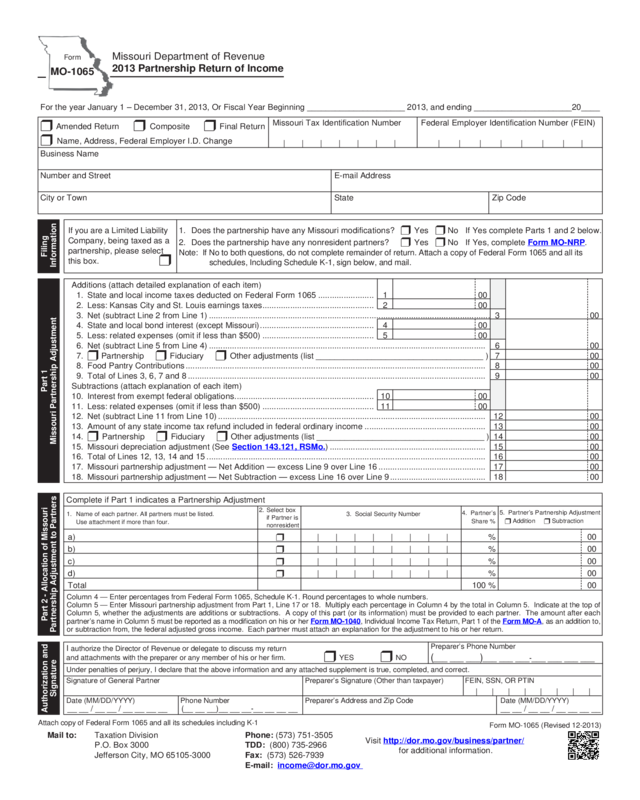

Form Mo-1065 2013 Partnership Return Of Income

| | | | | | | |

Missouri Tax Identification Number Federal Employer Identification Number (FEIN)

Business Name

Number and Street E-mail Address

City or Town State Zip Code

Attach copy of Federal Form 1065 and all its schedules including K-1

Form

MO-1065

Missouri Department of Revenue

2013 Partnership Return of Income

If you are a Limited Liability

Company, being taxed as a

partnership, please select

this box. r

1. Does the partnership have any Missouri modifications? r Yes r No If Yes complete Parts 1 and 2 below.

2. Does the partnership have any nonresident partners? r Yes r No If Yes, complete Form MO-NRP.

Note: If No to both questions, do not complete remainder of return. Attach a copy of Federal Form 1065 and all its

schedules, Including Schedule K-1, sign below, and mail.

Filing

Information

Additions (attach detailed explanation of each item)

1. State and local income taxes deducted on Federal Form 1065 ........................ 1 00

2. Less: Kansas City and St. Louis earnings taxes ................................................ 2 00

3. Net (subtract Line 2 from Line 1) ......................................................................................................................... 3 00

4. State and local bond interest (except Missouri) ................................................. 4 00

5. Less: related expenses (omit if less than $500) ................................................ 5 00

6. Net (subtract Line 5 from Line 4) ....................................................................................................................... 6 00

7. r Partnership r Fiduciary r Other adjustments (list ____________________________________ ) 7 00

8. Food Pantry Contributions ................................................................................................................................. 8 00

9. Total of Lines 3, 6, 7 and 8 ................................................................................................................................ 9 00

Subtractions (attach explanation of each item)

10. Interest from exempt federal obligations ............................................................ 10 00

11. Less: related expenses (omit if less than $500) ................................................ 11 00

12. Net (subtract Line 11 from Line 10) ................................................................................................................... 12 00

13. Amount of any state income tax refund included in federal ordinary income .................................................... 13 00

14. r Partnership r Fiduciary r Other adjustments (list ____________________________________ ) 14 00

15. Missouri depreciation adjustment (See Section 143.121, RSMo.) ................................................................... 15 00

16. Total of Lines 12, 13, 14 and 15 ........................................................................................................................ 16 00

17. Missouri partnership adjustment — Net Addition — excess Line 9 over Line 16 .............................................. 17 00

18. Missouri partnership adjustment — Net Subtraction — excess Line 16 over Line 9 ......................................... 18 00

Part 1

Missouri Partnership Adjustment

For the year January 1 – December 31, 2013, Or Fiscal Year Beginning _____________________ 2013, and ending _____________________20____

r Amended Return r Composite r Final Return

r Name, Address, Federal Employer I.D. Change

1. Name of each partner. All partners must be listed.

Use attachment if more than four.

3. Social Security Number

4. Partner’s

Share %

Complete if Part 1 indicates a Partnership Adjustment

Column 4 — Enter percentages from Federal Form 1065, Schedule K-1. Round percentages to whole numbers.

Column 5 — Enter Missouri partnership adjustment from Part 1, Line 17 or 18. Multiply each percentage in Column 4 by the total in Column 5. Indicate at the top of

Column 5, whether the adjustments are additions or subtractions. A copy of this part (or its information) must be provided to each partner. The amount after each

partner’s name in Column 5 must be reported as a modification on his or her Form MO-1040, Individual Income Tax Return, Part 1 of the Form MO-A, as an addition to,

or subtraction from, the federal adjusted gross income. Each partner must attach an explanation for the adjustment to his or her return.

a) r | | | | | | | | % 00

b) r | | | | | | | | % 00

c) r | | | | | | | | % 00

d) r | | | | | | | | % 00

Total 100 % 00

Part 2 - Allocation of Missouri

Partnership Adjustment to Partners

2. Select box

if Partner is

nonresident

5. Partner’s Partnership Adjustment

r Addition r Subtraction

Visit http://dor.mo.gov/business/partner/

for additional information.

Mail to: Taxation Division Phone: (573) 751-3505

P.O. Box 3000 TDD: (800) 735-2966

Jefferson City, MO 65105-3000 Fax: (573) 526-7939

E-mail: [email protected]

Form MO-1065 (Revised 12-2013)

I authorize the Director of Revenue or delegate to discuss my return

and attachments with the preparer or any member of his or her firm. r YES r NO

Under penalties of perjury, I declare that the above information and any attached supplement is true, completed, and correct.

Signature of General Partner Preparer’s Signature (Other than taxpayer) FEIN, SSN, OR PTIN

Date (MM/DD/YYYY) Phone Number Preparer’s Address and Zip Code Date (MM/DD/YYYY)

Authorization and

Signature

Preparer’s Phone Number

(___ ___ ___)___ ___ ___-___ ___ ___ ___

| | | | | | | |

__ __ / __ __ / __ __ __ __ (__ __ __)__ __ __-__ __ __ __ __ __ / __ __ / __ __ __ __

| | | | | | |

Reset Form

Print Form

General Information

This information is for guidance only and does not state the complete law.

Who Must File Form MO-1065

Form MO-1065 must be filed, if Federal Form 1065 is required to be filed and the

partnership has (1) a partner that is a Missouri resident or (2) any income derived from

Missouri sources, Section 143.581, RSMo. Items of income, gain, loss, and deduction

derived from, or connected with, sources within Missouri are those items attributable to (1)

the ownership or disposition of any interest in real or tangible personal property in Missouri

or (2) a business, trade, profession, or occupation carried on in Missouri. Income from

intangible personal property, to the extent that such property is employed in a business,

trade, profession, or occupation carried on in Missouri, constitutes income derived from

sources within Missouri.

Short Form — Form MO-1065

If you select “No” on both questions 1 and 2 on Form MO-1065, attach a copy of Federal

Form 1065 and all its schedules, including Schedule K-1. Sign Form MO-1065 and mail

the return.

If you select “Yes” on question 1 on Form MO-1065, Parts 1 and 2 must be completed. If

you select “Yes” on question 2, Form MO-1065, complete Form MO-NRP. Attach a copy

of Federal Form 1065 and all its schedules, including Schedule K-1. Sign Form MO-1065

and mail the return.

When and Where to File

A Missouri partnership return should be completed after the federal partnership return is

completed. The Missouri partnership return is due no later than the 15th day of the 4th

month fol low ing the close of the taxable year. For partnerships operating on a calendar

year basis, the partnership return is due on or before April 15. When the due date falls on

a Saturday, Sunday, or legal holiday, the return will be considered timely if filed on the next

business day. Please mail the return to: Missouri Department of Revenue, P.O. Box 3000,

Jefferson City, MO 65105-3000.

Period Covered by the Return

Form MO-1065, Partnership Return of Income, must cover the same period as the

corresponding Federal Form 1065. Indicate the period covered on the front of the return if

other than a calendar year.

Rounding on Missouri Returns

You must round all cents to the nearest whole dollar on your return. For cents .01 through

.49, round down to the previous whole dollar amount. For cents .50 through .99, round

up to the next whole dollar amount. For your convenience, the zeros have already been

placed in the cent columns on the returns.

Credits

Partners may be entitled to tax credits. These credits must be allocated to the partners’

percentage of ownership and reported on the Form MO-1040, Individual Income Tax

Return. See Form MO-1040 and Form MO-TC instructions for further information. You

may also access the information at http://dor.mo.gov/taxcredit/.

Nonresident Partners

Every partnership, including limited liability companies that are treated as a partnership

by the Internal Revenue Service (IRS), must file Form MO-1NR, Income Tax Withheld

for Nonresident Individual Partners or S Corporation Shareholders and send in copies of

Form MO-2NR, Statement of Income Tax Payments for Nonresident Individual Partners

or S Corporation Shareholders, if it has non resident individual partners who do not meet

one of the fol low ing exceptions:

• the nonresident partner, not otherwise required to file a return, elects to have the

Missouri income tax due paid as part of the partnership’s composite return;

• the nonresident partner, not otherwise required to file a return, had Missouri

assignable federal adjusted gross income from the partnership of less than twelve

hundred ($1,200) dollars;

• the partnership is liquidated or terminated, income was generated by a transaction

related to termination or liquidation, and no cash or prop erty was distributed in the

current or prior taxable year.

A nonresident partner can re quest the partnership be exempt from withholding by filing

a com pleted Form MO-3NR, Partnership or S Corporation Withholding Exemption or

Revocation Agree ment.

Form MO-1NR must be filed by the due date or extended due date for filing the partnership

income tax return. Form MO-3NR must be filed by the due date for filing the partnership

income tax return without regard to an extension of time to file. Forms may be obtained by

contacting: Missouri Department of Revenue, Taxation Division, P.O. Box 3022, Jefferson

City, MO 65105-3022, calling (800) 877-6881 (TDD (800) 735-2966), or visiting the

Department’s website at http://dor.mo.gov/forms/.

If you have technical questions concerning the filing of Form MO-1NR and Form MO-3NR,

you may contact the Taxation Division at (573) 751-1467.

Partnerships filing a composite return on behalf of their nonresident partners should mark

the composite return box on Page 1 of the return. The composite return is filed on the

Form MO-1040. Complete instructions can be found on the Department’s website at

http://dor.mo.gov/forms/Composite_Return_2013.pdf.

Authorization

Select the “yes” box for authorization of release of confidential information for the Director

of Revenue or delegate to discuss this return and attachments with the preparer whose

signature appears on the Form MO-1065 or to any member of his or her firm. If the

authorization box is selected “no”, or if no box is selected, the Department of Revenue can

only discuss this return with a partner. Refer to Section 32.057(1), RSMo.

Sign the Return

Form MO-1065, Partnership Return of Income, must be signed by one of the partners

of the partnership or one of the members of the joint venture or other enterprise. Any

member or partner, regardless of position, may sign the return.

Internet

To obtain information and Missouri tax forms, access our web site at: http://dor.mo.gov/.

Americans With Disabilities Act (ADA)

The state of Missouri offers a Dual Party Relay Service (DPRS) for speech or hearing

impaired individuals in accordance with the Americans with Disabilities Act (ADA). An

individual with a speech or hearing impairment may call a voice user at TDD (800)

735-2966 or fax (573) 526-1881.

Form MO-1065, Partnership

Return of Income Instructions

Part 1 — Missouri Partnership Adjustment

The addition and subtraction items listed on Part 1 are necessary Missouri

modifications. Completion of Part 1 will result in the net Missouri partnership adjustment

that will be allocated to the partners in Part 2. The partner’s adjustment can only be made

from information available from the partnership. It is necessary for each partnership

having modifications to complete Form MO-1065, Parts 1 and 2, and notify each partner of

the adjustment to which he or she is entitled.

Interest on Exempt Federal Obligations — Interest from direct obligations of the U.S.

Government, such as U.S. savings bonds, U.S. treasury bills, bonds, and notes is

exempt from state taxation under the laws of the United States. Attach a detailed list

or all Federal Form 1099(s). Partnerships that claim an exclusion for interest from

U.S. obligations must identify the specific securities owned, (e.g., U.S. savings bond).

A general description, such as “interest on U.S. obligation” or “U.S. Government

securities” is not acceptable. (See 12 CSR 10-2.150 for the taxability of various U.S.

Government-related obligations.) A list of exempt U.S. obligations must be provided

to each partner by the partnership. This list will allow the partner to report the

modification on his or her Form MO-1040, Individual Income Tax Return.

A federally taxed distribution received from a mutual fund investing exclusively

in direct U.S. Government obligations is exempt. If the mutual fund invests in both

exempt (direct) and nonexempt (indirect) federal obligations, the deduction allowed

will be the distribution received from the mutual fund attributable to the direct U.S.

Government obligations, as determined by the mutual fund. A copy of the year-end

statement received from the mutual fund showing the amount of monies received

or the percentage of funds received from direct U.S. Government obligations or a

summary statement received from the mutual fund which clearly identifies the exempt

and nonexempt por tions of the U.S. Government obligations interest, must be pro vided

to each partner by the partnership. Note: Failure to attach a copy of the notification

furnished to you that specifically details the amount of the subtraction being claimed as

the distributive share will result in the disallowance of the deduction.

In arriving at the amount of related expenses, the taxpayer may use actual expenses or a

reasonable estimate. In general, the taxpayer should use the same or similar method to

that used to compute related expenses for federal income tax purposes, provided that the

method reasonably reflects related expenses for Missouri-exempt income.

If a taxpayer fails to compute reasonable related expenses, the Director of Revenue will

make an adjustment based on the best information made available. If sufficient information

is not made available or if the taxpayer’s records do not provide sufficient information, the

Director of Revenue will use the fol low ing formula to compute related expenses:

Exempt income x Expense items = Reduction to exempt income

Total income

The principal expense item in this formula is interest expense; however, the Direc tor of

Revenue may include other expense items because of the direct re la tionship to the

production of exempt income. The taxpayer may propose an al ter na tive method provided

that it properly reflects the amount of related expenses.

Part 2 — Allocation of Missouri Partnership

Adjustment to Partners

Part 2 indicates the portion of the Missouri adjustment from Part 1 that is allocated to each

partner. Column 4 and the instructions for Column 5 are based upon the usual situation

that a single general profit and loss sharing percentage applies to all partnership items

and related modifications. Attach a detailed explanation (including extracts from the

partnership agreement) if the Column 5 amounts are not based upon the same single

percentage allocation indicated on Federal Form 1065, Schedule K-1. The explanation

must include the non tax purposes and effects of the special allocation method.