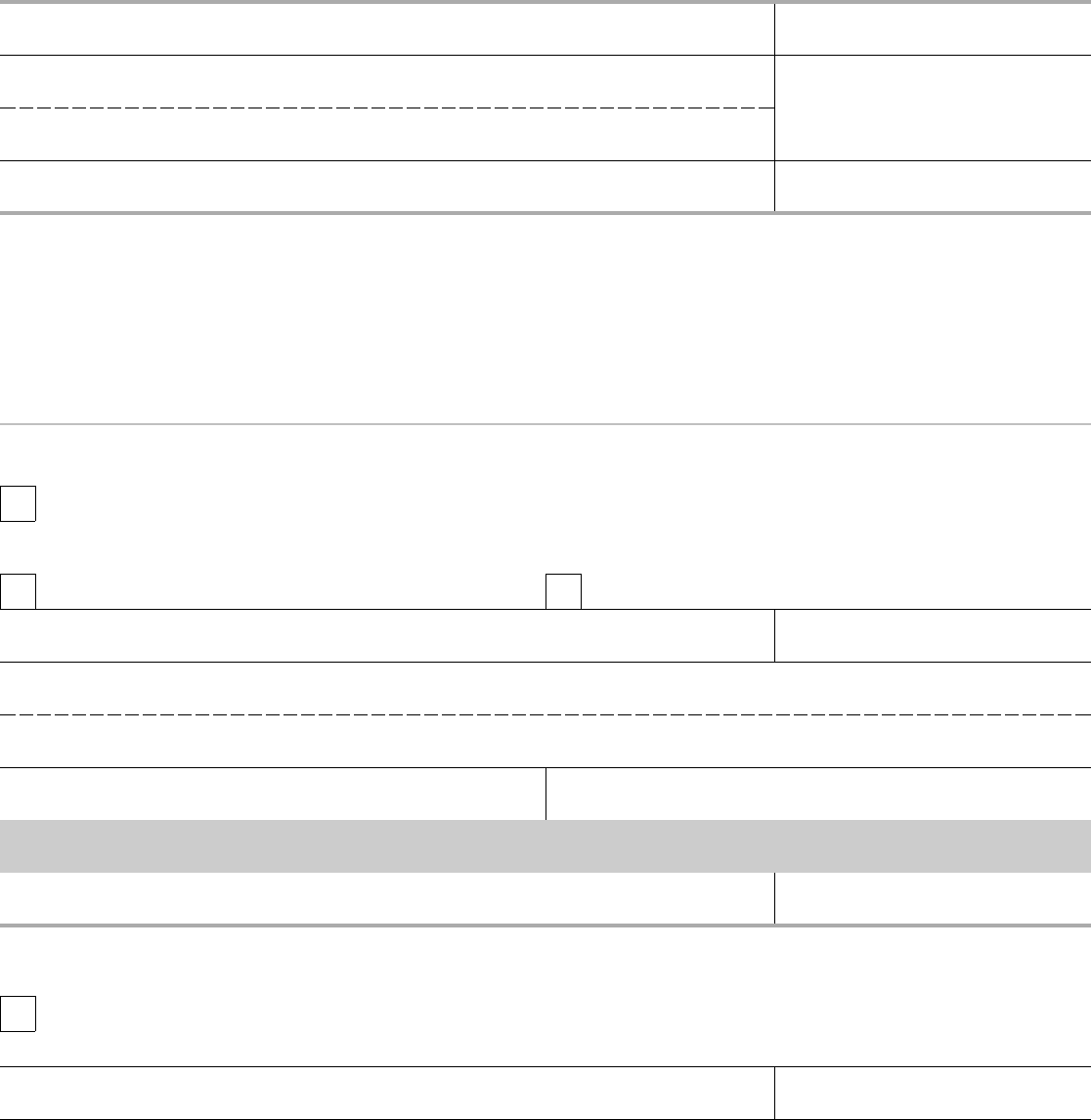

Fillable Printable Form RI 38-124

Fillable Printable Form RI 38-124

Form RI 38-124

Voluntary Contributions Election

Before you make your election, please read all of the information about refunds of voluntary contributions in the Voluntary

Contributions Notice, RI 38-125, and the Special Tax Notice Regarding Rollovers, RI 37-22. For more information about voluntary

contributions or this election, call 1-888-828-9451.

Please print clearly when you provide the following information:

Your name (last, first, middle)

Your address

Your Voluntary Contributions Account Number

VC

Date of birth (mm/dd/yyyy)

Daytime telephone number

(including area code)

Your Social Security Number

Date of Retirement or Separation (if applicable) _________________________

Give us your election by selecting item 1, 2, or 3.

To receive a refund by selecting item 3, please send this form to the Office of Personnel Management, Retirement Operations Center, PO

Box 45, Boyers, PA 16017-0045, Attn: Refund Section. If you are retiring, send this form at least 60 days before your separation date. If

you are making voluntary contribution payments via Pre-Authorized Debit (PAD), you must contact OPM, P.O. Box 979062, St. Louis, MO

63197-9000, in writing or call 888-828-9451 to have the debits discontinued. To purchase additional annuity by selecting item 1, return this

form to your personnel office with your application for retirement.

1. Additional Annuity

I want to use my voluntary contributions (VC), plus interest, to purchase additional annuity.

Please check () one of the following options.

I want to provide a VC survivor annuity for the person named

I do not want to provide a VC survivor annuity.

below.

His/Her date of birth (mm/dd/yyyy)

Name of person (last, first, middle)

His/Her address

His/Her Social Security Number His/Her relationship to you, if any

Warning: Any intentionally false or willfully misleading response you provide in this election is a violation of the law and

punishable by a fine of not more than $10,000 or imprisonment of not more than 5 years or both. (18 USC 1001)

Signature Date (mm/dd/yyyy)

2. Send Me Additional Information After I Retire

I do not want to make an election at this time. I want the Office of Personnel Management (OPM) to send me information that is

specific to my case. I understand this information will be sent after OPM receives my application for retirement.

Signature Date (mm/dd/yyyy)

(continued on Page 2)

RI 38-124

Revised July 2010

This form may be locally reproduced

Previous edition is not usable

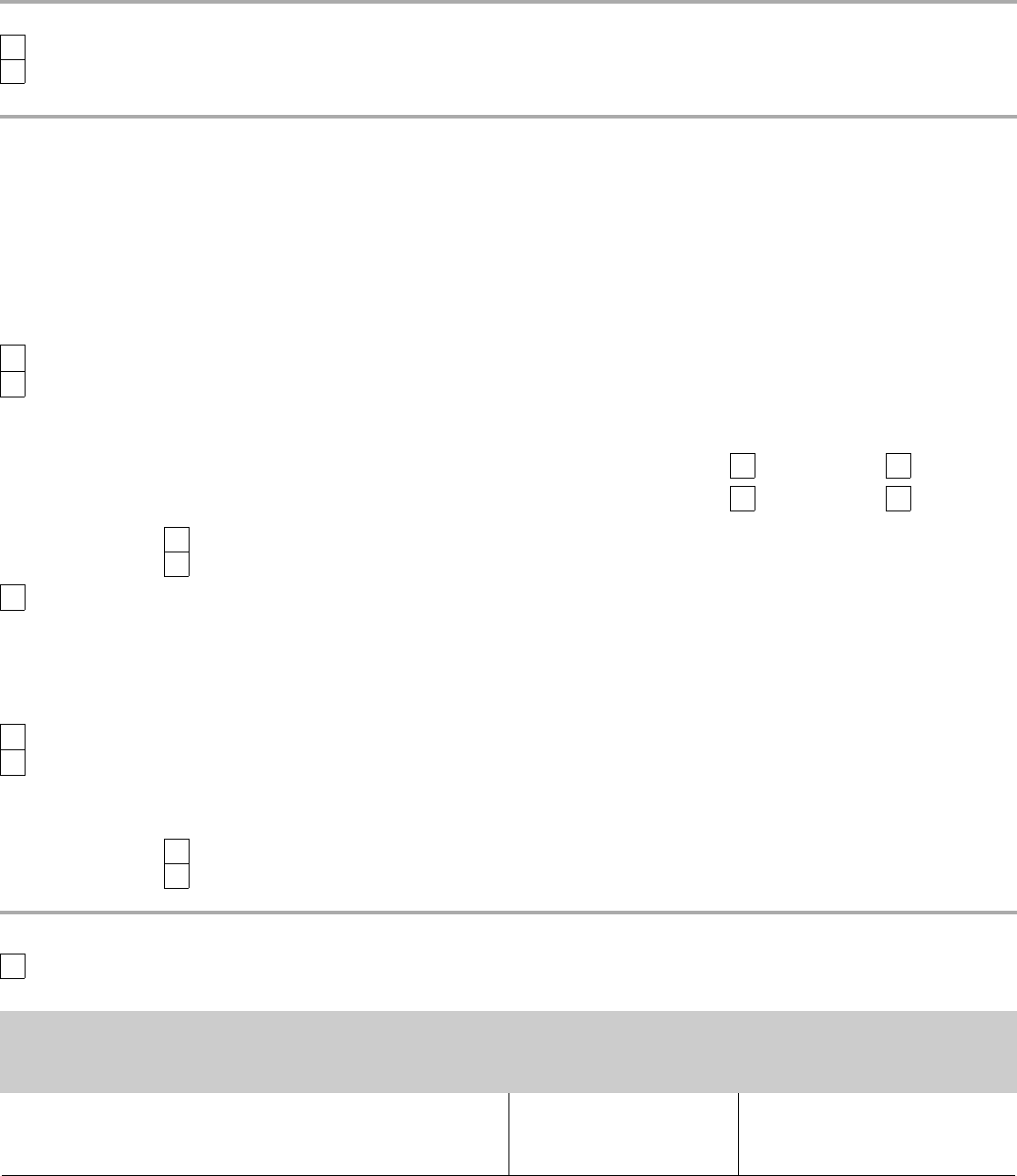

3. Lump Sum Refund of Voluntary Contributions (VC)

Use this form to elect how you want your lump sum paid. Please carefully read all of the information provided with this form before you

make your election. A mistake in completing this form could prevent the Office of Personnel Management (OPM) from paying as you wish

or could cause delay in processing your payment.

Payment options — (Please check one option.)

Pay my VC refund on the date I separate for retirement.

Pay my VC refund as soon as possible.

Rollover Options — (Please tell us how to pay your contributions and interest by checking the blocks

below.)

If your VC refund is less than $200, we cannot roll it over. We will pay it directly to you. Indicate below how you wish to have your VC refund

paid if it is $200 or more. If you elect to roll over less than 100% of your VC refund, the total amount you roll over to any one IRA or eligible

employer plan must be at least $500. If any choice you make below results in a rollover amount of less than $500, we will not perform the

rollover. Instead, we will make the payment to you. To avoid this situation, you may check the last block and ask for additional information.

(Make one choice in each section below, unless you need additional information. If you need additional information before making this

election, check the block in the last section.)

If my total refund is $200 or greater --

Interest Portion (taxable portion) of my VC refund --

Pay ALL by check made payable to me, with 20% Federal income tax withholding.

Pay ALL by check made payable to my Individual Retirement Arrangement (IRA) or Eligible Employer Plan. (Your financial institution

Name of the financial institution or employer plan ___________________________________________________________

or employer plan must complete the financial institution certification on page 3.)

Are you putting this in a Roth IRA?

No Yes

Do you elect to have 20% Federal income tax withheld from your Roth IRA rollover?

No Yes

Mail check to

to the above institution or plan.

to me. I will deliver the check to the above institution or plan.

Pay ALL to my Thrift Savings Plan Account.

(You must sign and submit form TSP-60, Request for a Transfer Into the TSP, to OPM. Form TSP-60 is available on the internet at

http://www.tsp.gov.)

Contribution Portion (after tax portion) of my VC refund --

(The Thrift Savings Plan will not accept this portion of your VC refund.)

Pay ALL by check made payable to me.

Pay ALL by check made payable to my Individual Retirement Arrangement (IRA) or Eligible Employer Plan. (Your financial

Name of the financial institution or employer plan ___________________________________________________________

institution or employer plan must complete the financial institution certification on page 3.)

Mail check to

to the above institution or plan.

to me. I will deliver the check to the above institution or plan.

I need additional information before I decide.

I elect to have my VC refund computed and a rollover package with all my options sent to me before I decide how it should be paid.

(Electing this option delays payment for at least an additional 30 days.)

My signature below certifies that I have made the election shown above and that I understand that distributions from the plan to which

rollover is made may be subject to different restrictions and tax consequences than those that apply to distributions from OPM. I also

understand that if I roll over non-taxable funds into an IRA, I am responsible to account separately for the taxable and non-taxable

portions of the amount rolled over.

Signature (If you elect a rollover, Part 4 must be completed.) Date (mm/dd/yyyy) Daytime Telephone Number (including

area code)

(continued on Page 3)

Page 2 of RI 38-124

Revised July 2010

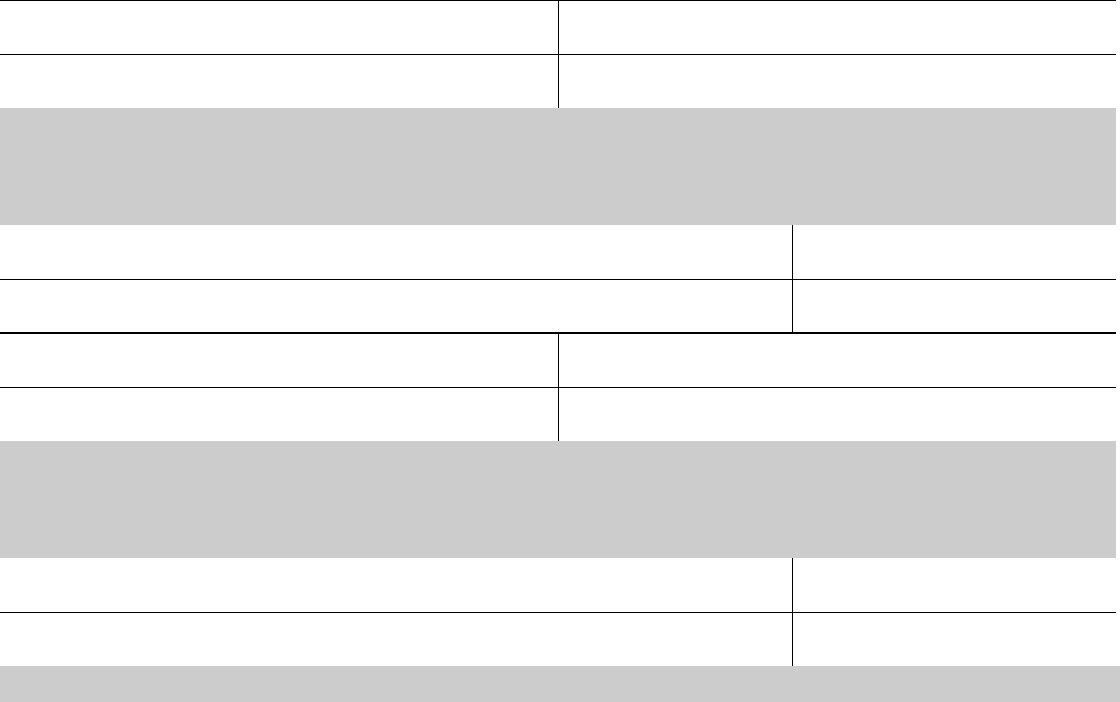

4. Certification from Financial Institutions or Eligible Employer Plans

Name of institution or eligible employer plan Address of institution or plan

IRA account number or plan identification

Certification: My signature below confirms the account number for the individual named on page 1. As a representative of the financial

institution or plan name above, I certify that this institution or plan agrees to accept the funds described above as a direct

trustee-to-trustee transfer from the Office of Personnel Management, to deposit them in an eligible IRA or eligible employer plan as

defined in the Internal Revenue Code, and to account for these monies in compliance with the Internal Revenue Code. I understand that

my signature below authorizes the transfer of taxable and/or non-taxable funds as indicated on page 2.

Typed or printed name of certifying representative

Telephone number (including area code)

Signature of certifying representative

Date of certification (mm/dd/yyyyy)

Name of institution or eligible employer plan Address of institution or plan

IRA account number or plan identification

Certification: My signature below confirms the account number for the individual named on page 1. As a representative of the financial

institution or plan name above, I certify that this institution or plan agrees to accept the funds described above as a direct

trustee-to-trustee transfer from the Office of Personnel Management, to deposit them in an eligible IRA or eligible employer plan as

defined in the Internal Revenue Code, and to account for these monies in compliance with the Internal Revenue Code. I understand that

my signature below authorizes the transfer of taxable and/or non-taxable funds as indicated on page 2.

Typed or printed name of certifying representative

Telephone number (including area code)

Signature of certifying representative

Date of certification (mm/dd/yyyyy)

Instructions for Rollover to the Federal Retirement Thrift Savings Plan

The Thrift Savings Plan (TSP) will not accept non-taxable (post-tax) monies. You must have an open TSP account. Before the Office of

Personnel Management (OPM) can complete a rollover to your TSP account, you must sign and submit Form TSP-60, Request for a

Transfer Into the TSP, to OPM. Submit both the TSP-60 and this form at the same time. OPM will complete its portion of the TSP-60 and

fax it to the Thrift Savings office for processing. The form must be approved by the Federal Retirement Thrift Investment Board and the

Board must notify OPM to transfer the funds. This process can take two to three weeks. Form TSP-60 is available on the internet at

http://www.tsp.gov/forms.

Page 3 of RI 38-124

Revised July 2010

PRINT

SAVE

CLEAR