Fillable Printable Form RI 76-10

Fillable Printable Form RI 76-10

Form RI 76-10

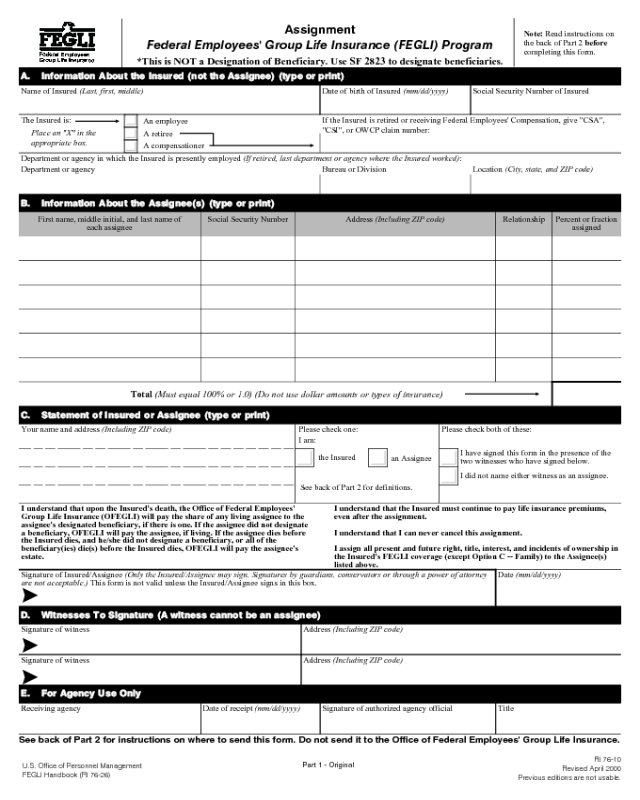

Name of Insured (Last, first, middle)

If the Insured is retired or receiving Federal Employees' Compensation, give "CSA",

"CSI", or OWCP claim number:

Assignment

Federal Employees' Group Life Insurance (FEGLI) Program

*This is NOT a Designation of Beneficiary. Use SF 2823 to designate beneficiaries.

A. Information About the Insured (not the Assignee) (type or print)

Date of birth of Insured (mm/dd/yyyy) Social Security Number of Insured

The Insured is:

Place an "X" in the

appropriate box.

Note: Read instructions on

the back of Part 2 before

completing this form.

An employee

A retiree

A compensationer

Department or agency in which the Insured is presently employed (If retired, last department or agency where the Insured worked):

Department or agency Bureau or Division Location (City, state, and ZIP code)

B. Information About the Assignee(s) (type or print)

C. Statement of Insured or Assignee (type or print)

Percent or fraction

assigned

RelationshipFirst name, middle initial, and last name of

each assignee

Social Security Number Address (Including ZIP code)

Total (Must equal 100% or 1.0) (Do not use dollar amounts or types of insurance)

Your name and address (Including ZIP code) Please check both of these: Please check one:

I am:

the Insured

an Assignee

See back of Part 2 for definitions.

I have signed this form in the presence of the

two witnesses who have signed below.

I did not name either witness as an assignee.

I understand that upon the Insured's death, the Office of Federal Employees'

Group Life Insurance (OFEGLI) will pay the share of any living assignee to the

assignee's designated beneficiary, if there is one. If the assignee did not designate

a beneficiary, OFEGLI will pay the assignee, if living. If the assignee dies before

the Insured dies, and he/she did not designate a beneficiary, or all of the

beneficiary(ies) die(s) before the Insured dies, OFEGLI will pay the assignee's

estate.

I understand that the Insured must continue to pay life insurance premiums,

even after the assignment.

I understand that I can never cancel this assignment.

I assign all present and future right, title, interest, and incidents of ownership in

the Insured's FEGLI coverage (except Option C -- Family) to the Assignee(s)

listed above.

Signature of witness

Address (Including ZIP code)

Address (Including ZIP code)

Signature of Insured/Assignee (Only the Insured/Assignee may sign. Signatures by guardians, conservators or through a power of attorney

are not acceptable.) This form is not valid unless the Insured/Assignee signs in this box.

E. For Agency Use Only

Receiving agency Date of receipt (mm/dd/yyyy) Title

Signature of authorized agency official

D. Witnesses To Signature (A witness cannot be an assignee)

Signature of witness

Date (mm/dd/yyyy)

>

>

>

See back of Part 2 for instructions on where to send this form. Do not send it to the Office of Federal Employees' Group Life Insurance.

RI 76-10

U.S. Office of Personnel Management

Revised April 2000

FEGLI Handbook (RI 76-26)

Previous editions are not usable.

Part 1 - Original

CLEAR

SAVE

PRINT

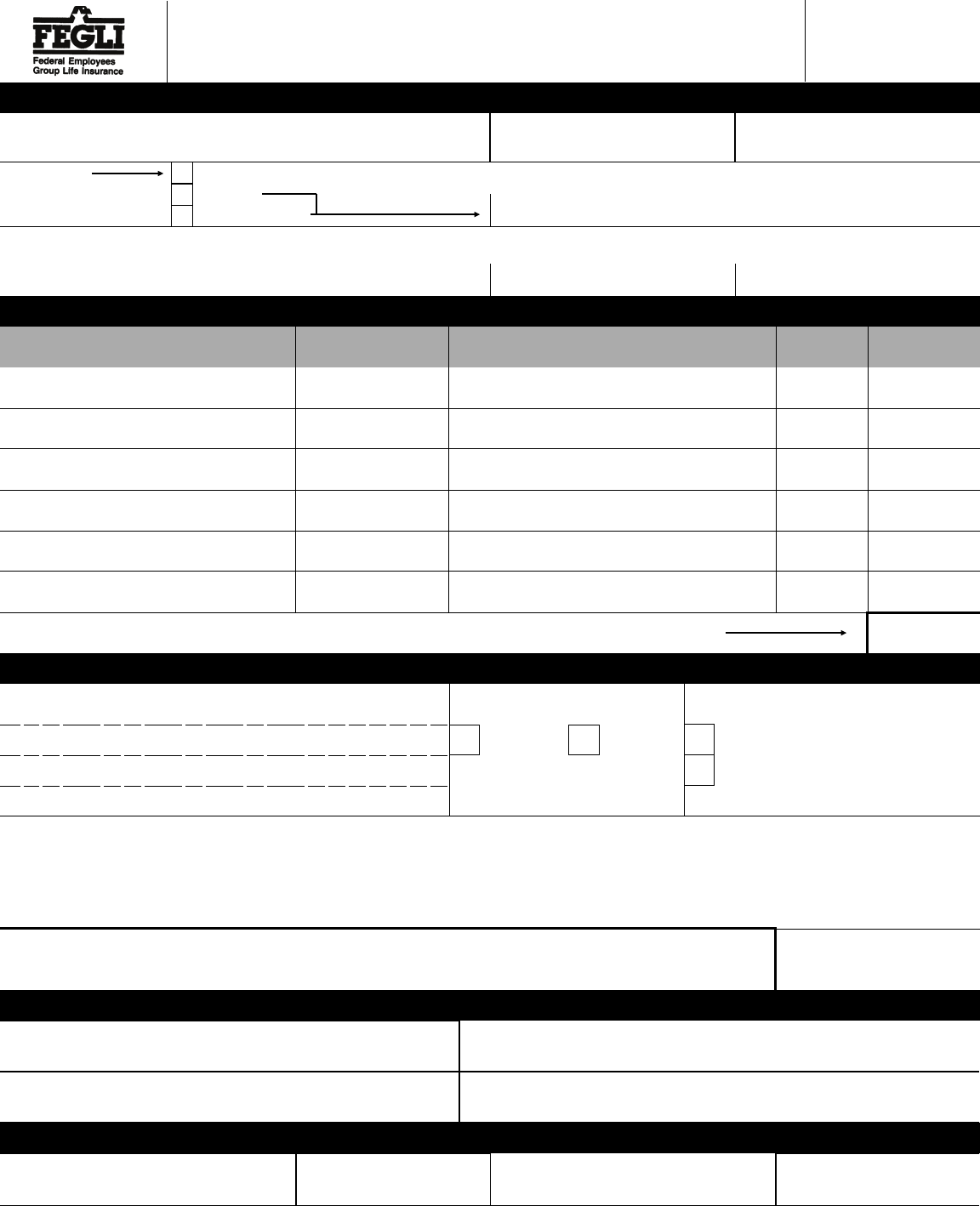

Examples of Assignments

1. How to assign to one individual Show assignee's full name. Do not write names as M.E. Brown or as Mrs. John H. Brown.

First name, middle initial, and last name of

each assignee

Social Security Number Address (Including ZIP code) Relationship Percent or fraction

assigned

Mary E. Brown 000-00-0000

214 Central Avenue

Muncie, IN 47303

Niece

100%

2. How to assign to more than one individual Be sure that the shares add up to 100 percent or 1.0.

First name, middle initial, and last name of

each assignee

Social Security Number Address (Including ZIP code) Relationship Percent or fraction

assigned

Jose P. Lopez

111-11-1111

360 Williams Street

Red Bank, NJ 07701

Nephew

one-half

Rosa L. Rowe

222-22-2222

792 Broadway

Whiting, IN 46394

Mother one-half

3. How to assign to a trust

First name, middle initial, and last name of

each assignee

Social Security Number Address (Including ZIP code) Relationship Percent or fraction

assigned

Trustee(s) or Successor Trustee(s) as

provided in the John Q. Public Trust

Agreement dated 02/18/2000

Not Applicable Not Applicable

Trustee 100%

4. How to assign to a firm Show the firm's Taxpayer Identification Number instead of a Social Security Number.

First name, middle initial, and last name of

each assignee

Social Security Number Address (Including ZIP code) Relationship Percent or fraction

assigned

XYZ Corporation

Attn: John Smith

TIN 999-99-9999

5909 Pacific Avenue, NW

Washington, DC 20019

Corporation 100%

Your Rights

Information for the Person Completing This Form

(Either the Insured or an Assignee Who Is Reassigning Coverage)

The "Insured" is the employee, annuitant or compensationer.

The "Assignee" is the person(s), firm(s), or trust(s) (usually named on an Assignment form, RI 76-10) who owns and controls the Insured's life insurance

coverage. An assignment is

not

the same as a designation of beneficiary.

General

What Is An Assignment?

An assignment of life insurance is the transfer of

ownership and control of life insurance coverage from the Insured person to one or

more persons, firms or trusts. The assignee receives the death benefits when the

Insured dies, or may designate someone else to receive those benefits.

How Does An Assignment Differ From A Designation Of Beneficiary?

An

assignment transfers ownership and control of life insurance coverage. A

designation does not. An assignee has the right to reassign the coverage to someone

else. A designated beneficiary does not. The Insured can cancel a designation of

beneficiary at any time, but cannot cancel an assignment. You should use this form

(RI 76-10) to make an assignment and SF 2823 to make a designation.

How Does This Assignment Affect My Rights?

By assigning the insurance, you

give up:

1. The right to cancel the insurance coverage;

2. The right to designate and change beneficiaries;

3. The right to port (continue) Option B, if eligible, after the Insured resigns or

ends 12 months nonpay status;

4. The right to convert to a private insurance policy when the FEGLI coverage

terminates for any reason other than cancellation;

5. The right to change the post-65 reduction schedule for Basic insurance after

the Insured makes the original election when he/she retires or begins to

receive compensation. If the Insured chose No Reduction or 50% Reduction,

the Assignee(s) can change it to 75% Reduction (unless the Insured received

a Living Benefit). No one can change an election of No Reduction to 50%

Reduction. See the SF 2818, Continuation of Life Insurance Coverage as a

Retiree or Compensationer, for more information.

6. The right to change the post-65 reduction schedule for Option B insurance

after the Insured makes the original election when he/she retires or begins to

receive compensation, under certain circumstances. If the Insured chose No

Reduction, the assignee(s) can change it to Full Reduction. If the Insured

chose Full Reduction, the assignee cannot change it. See the SF 2818,

Continuation of Life Insurance Coverage as a Retiree or Compensationer,

for more information.

What Reduction Elections Can The Insured Make At Retirement?

The Insured

has the right to make the original election on how much Basic and Option B

coverage he/she wishes to retain after he/she is age 65 and retired.

The Insured can elect either 75% Reduction, 50% Reduction or No Reduction for

Basic (see the SF 2818 for more information about these choices).

The Insured can elect either Full Reduction or No Reduction for Option B (see the

SF 2818 for more information about these choices). The Insured can change an

election of Full Reduction to No Reduction, as applicable.

What Reduction Elections Can The Assignee(s) Make?

The assignee(s) can

change the Insured's Basic election to 75% Reduction (if the Insured did not

already elect 75% Reduction). The assignee(s) can change the Insured's Option B

election to Full Reduction (if the Insured did not already elect Full Reduction).

Can I Cancel This Assignment?

No. This is an irrevocable assignment of life

insurance coverage. For example, you should not make an assignment as collateral

for a bank loan which you intend to repay in full. Even though you repay the loan,

that assignment will remain in effect.

When Is An Assignment Cancelled?

An assignment is void 31 days after the

Insured's FEGLI coverage end

s.

Should I Consult A Tax Attorney Or Other Professional Before Making This

Assignment?

You may want to. It is possible that assignment to a trust may not

exclude FEGLI benefits from your estate. It is also possible that you could inherit

the FEGLI coverage through designation or death of your assignee(s).

Is There Anything I Cannot Assign?

Yes. You cannot assign: (1) Family

optional insurance coverage (Option C). However, if the assignee(s) cancel(s) Basic

insurance, such cancellation automatically cancels all other FEGLI coverage,

including Option C. (2) The right to elect more insurance coverage. The Insured

retains this right. However, all of the insurance (except for Option C) that the

Insured elects will automatically be subject to the existing assignment. (This

applies to employees only; annuitants and compensationers cannot elect more

insurance coverage.)

Who Can Cancel The Premiums

? The assignee(s) can cancel the coverage. If

they do so, the premiums also stop. The Insured cannot cancel the premiums or the

coverage.

Completing the Form

Can I Name A Contingent Assignee?

No. You cannot name a contingent

assignee (for example, you cannot assign to Maria if she is living; otherwise to

Jose.)

What If I Make A Mistake?

If you erase or change anything on the form, you

should start again with a new form. Do not submit a form with erasures or

cross-outs.

What If The Insured Has Several Types Of FEGLI (Like Basic And Option

A)?

You must assign all of the insurance, although you do not have to assign it all

to the same person. You must assign percentages or fractions of the total insurance

that add up to 100% or 1, respectively.

Can I Assign Basic To Someone And Optional To Someone Else?

No. You

cannot assign types of coverage.

Can I Assign Dollar Amounts?

No.

Can I Assign Coverage To Myself?

No.

What If I Don't Have An Assignee's Social Security Number?

If you don't

know the number, leave it blank. We ask for the number because having it

sometimes helps to identify and locate the proper assignee

.

Other Information

Where Should I Send This Form?

If the Insured:

• is an employee; or

• has been receiving compensation payments from the Office of Workers'

Compensation Programs for less than 12 months and is still on the agency's

rolls as an employee, then

send it to the Insured's employing agency.

If the Insured:

• is a retiree; or

• is receiving compensation payments from the Office of Workers'

Compensation Programs and is not still employed or has been receiving

compensation payments for at least 12 months; then

send it to: Office of Personnel Management

Retirement Operations Center

P.O. Box 45

Boyers, PA 16017-0045

When Is The Assignment Effective?

The assignment is effective on the date that

the Insured's employing office or retirement system, as appropriate, receives the

properly completed, signed and witnessed form.

You cannot cancel this assignment.

The Insured cannot cancel life insurance premium withholdings for assigned FEGLI coverage.

No one can assign Option C.

Privacy Act Statement

Title 5, U.S. Code, chapter 87, Life Insurance, authorizes solicitation of this information. The data

you furnish will be used to determine ownership of the Insured's Federal Employees' Group Life

Insurance. This information will be shared with the Office of Federal Employees' Group Life

Insurance in the event of the Insured's death. It will also be shared with the Office of Personnel

Management and be placed in the Insured's Official Personnel Folder or retirement file. This

information may be disclosed to other Federal agencies or Congressional offices which may have

a need to know it in connection with your application for a job, license, grant or other benefit. It

may also be shared and is subject to verification, via paper, electronic media, or through the use of

computer matching programs, with national, state, local or other charitable or social security

administrative agencies to determine and issue benefits under their programs. In addition, to the

extent this information indicates possible violation of civil or criminal law, it may be shared and

verified, as noted above, with an appropriate Federal, state, or local law enforcement agency.

We also request that you provide the Insured's Social Security Number so that it may be used as

an individual identifier in the Federal Employees' Group Life Insurance Program. Public Law

104-134 (April 26, 1996) requires that any person doing business with the Federal government

furnish a Social Security Number or tax identification number. This is an amendment to title 31,

Section 7701.

While the law does not require you to supply all the information requested on this form, doing so

will assist in the prompt processing of your assignment.

Agencies other than the Office of Personnel Management may have further routine uses for

disclosure of information from the records systems in which they file copies of this form. If this is

the case, they should provide you with any such uses which are applicable at the time you

complete this form.

Information for Agencies and Retirement Systems

To process an Assignment:

1. If the Insured signed the form in Item C, check to see whether 4. Certify receipt of the assignment form in Item E.

the Insured already has a current, valid assignment on file. If so,

write

VOID

across the front of this form and return it to the

5. Separate the form. Give the person filing the form Part 2. Give

Insured. The Insured cannot assign coverage twice.

each

assignee named in Item B a copy of Part 3, along with a

blank SF 2823, Designation of Beneficiary, and RI 76-21,

2.

If an assignee signed the form in Item C, check to see whether

FEGLI Booklet (or RI 76-20 if the Insured is a Postal employ-

he/she is a current assignee of the Insured's life insurance. If

ee) or RI 76-12, FEGLI pamphlet, if the Insured is an annuitant

not, write

VOID

across the front of this form and return it to the

or compensationer. Give

each

assignee the name and address of

person who signed the form. Only a current assignee can

the employing office or retirement system where he/she should

reassign life insurance coverage.

return the completed SF 2823.

3.

Verify that the Insured/assignee properly completed the form

6.

File Part 1 of the assignment form with the Insured's other

and that two witnesses signed the form. The form must be free

FEGLI forms. Attach the original to the SF 2821, Agency

of erasures or cross-outs. If the assignment is to two or more

Certification of Insurance Status, when the Insured separates,

individuals, make sure specified percentages or fractions add

dies, retires, or ends 12 months in nonpay status.

up to 100 percent or 1, respectively. Dollar amounts or types of

insurance are not acceptable.

Information for Assignees

General

You are responsible for keeping your current address on file with 4. Convert your share of the insurance to an individual policy on

the office where the assignment is filed. As the owner of the the Insured's life when the Insured's FEGLI coverage termi-

Insured's Federal Employees' Group Life Insurance coverage, you nates other than by voluntary cancellation or by porting Option

have the right to: B.

1. Designate and change the beneficiary(ies) for the assigned

If there is more than one assignee, each assignee has the right to

insurance. Unless you submit a designation of beneficiary,

convert all or part of his or her share of the insurance.

you will be the beneficiary of the Insured's coverage. If you

do designate a beneficiary and the beneficiary survives the

5.

Port (continue) the Insured's Option B coverage after he/she

Insured, the beneficiary will receive the insurance benefit.

separates from service or ends 12 months in nonpay status, if

applicable.

2.

Change the Insured's original election of No Reduction or

50% Reduction for Basic insurance to 75% Reduction (unless

6.

Cancel the insurance. When the insurance is assigned to two or

the Insured received a Living Benefit).

more people, these assignees must all agree to the cancella-

tion. A cancellation of Basic insurance cancels all insurance.

3.

Change the Insured's original election of No Reduction for

Option B insurance to Full Reduction.

7.

Assign your share of the insurance to another person(s), firm(s)

or trust(s).

You cannot cancel this assignment of FEGLI coverage.

You may, however, cancel the Insured's FEGLI coverage or reassign the Insured's FEGLI coverage.

Designation of Beneficiary

1. You may wish to designate a beneficiary as soon as you If you die before the Insured and you did not designate a

are notified that the Insured has assigned his/her insurance contingent beneficiary, your estate will receive benefits when

to you. You should use an SF 2823, Designation of the Insured dies.

Beneficiary. You may obtain a blank SF 2823 from the

Insured's employing office or retirement system or on our

3.

When insurance is assigned to more than one assignee, an

web site, www.opm.gov/insure/life.

assignee's designation only applies to his/her share of the

Insured's coverage.

2.

You may want to designate yourself, if living, and then

someone else (a contingent beneficiary) to receive the death

benefits if you die before the Insured.

More Information

You can read more information in the RI 76-21,

FEGLI Booklet (or RI 76-20 for Postal employees) and the RI 76-26, FEGLI Handbook at

www.opm.gov/insure/life.