Fillable Printable Form RI 92-022

Fillable Printable Form RI 92-022

Form RI 92-022

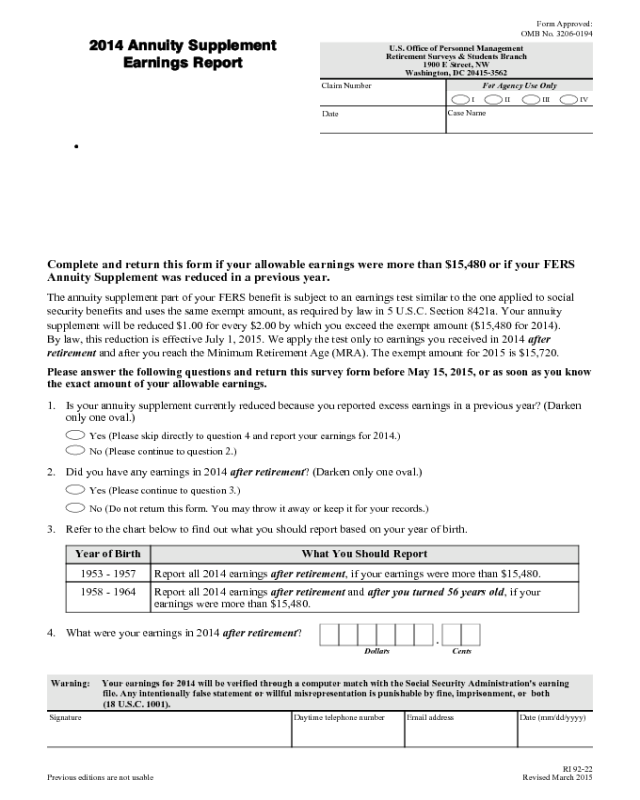

Form Approved:

OMB No. 3206-0194

2014 Annuity Supplement

U.S. Office of Personnel Management

Retirement Surveys & Students Branch

Earnings Report

1900 E Street, NW

Washington, DC 20415-3562

For Agency Use Only

I II III IV

Case Name

Date

Claim Number

Complete and return this form if your allowable earnings were more than $15,480 or if your FERS

Annuity Supplement was reduced in a previous year.

The annuity supplement part of your FERS benefit is subject to an earnings test similar to the one applied to social

security benefits and uses the same exempt amount, as required by law in 5 U.S.C. Section 8421a. Your annuity

supplement will be reduced $1.00 for every $2.00 by which you exceed the exempt amount ($15,480 for 2014).

By law, this reduction is effective July 1, 2015. We apply the test only to earnings you received in 2014 after

retirement and after you reach the Minimum Retirement Age (MRA). The exempt amount for 2015 is $15,720.

Please answer the following questions and return this survey form before May 15, 2015, or as soon as you know

the exact amount of your allowable earnings.

1. Is your annuity

supplement currently reduced because you reported excess earnings in a previous year? (Darken

only one oval.)

Yes (Please skip directly to question 4 and report your earnings for 2014.)

No (Please continue to question 2.)

2. Did you have any earnings in 2014 after retirement? (Darken only one oval.)

Yes (Please continue to question 3.)

No (Do not return this form. You may throw it away or keep it for your records.)

3.

Refer to the chart below to find out what you should report based on your year of birth.

Year of Birth What You Should Report

1953 - 1957 Report all 2014 earnings after retirement, if your earnings were more than $15,480.

1958 - 1964 Report all 2014 earnings after retirement and after you turned 56 years old, if your

earnings were more than $15,480.

4.

What were your earnings in 2014 after retirement?

.

Dollars Cents

Warning: Your earnings for 2014 will be verified through a computer match with the Social Security Administration's earning

file. Any intentionally false statement or willful misrepresentation is punishable by fine, imprisonment, or both

(18 U.S.C. 1001).

Signature Daytime telephone number Email address Date (mm/dd/yyyy)

RI 92-22

Previous editions are not usable

Revised March 2015

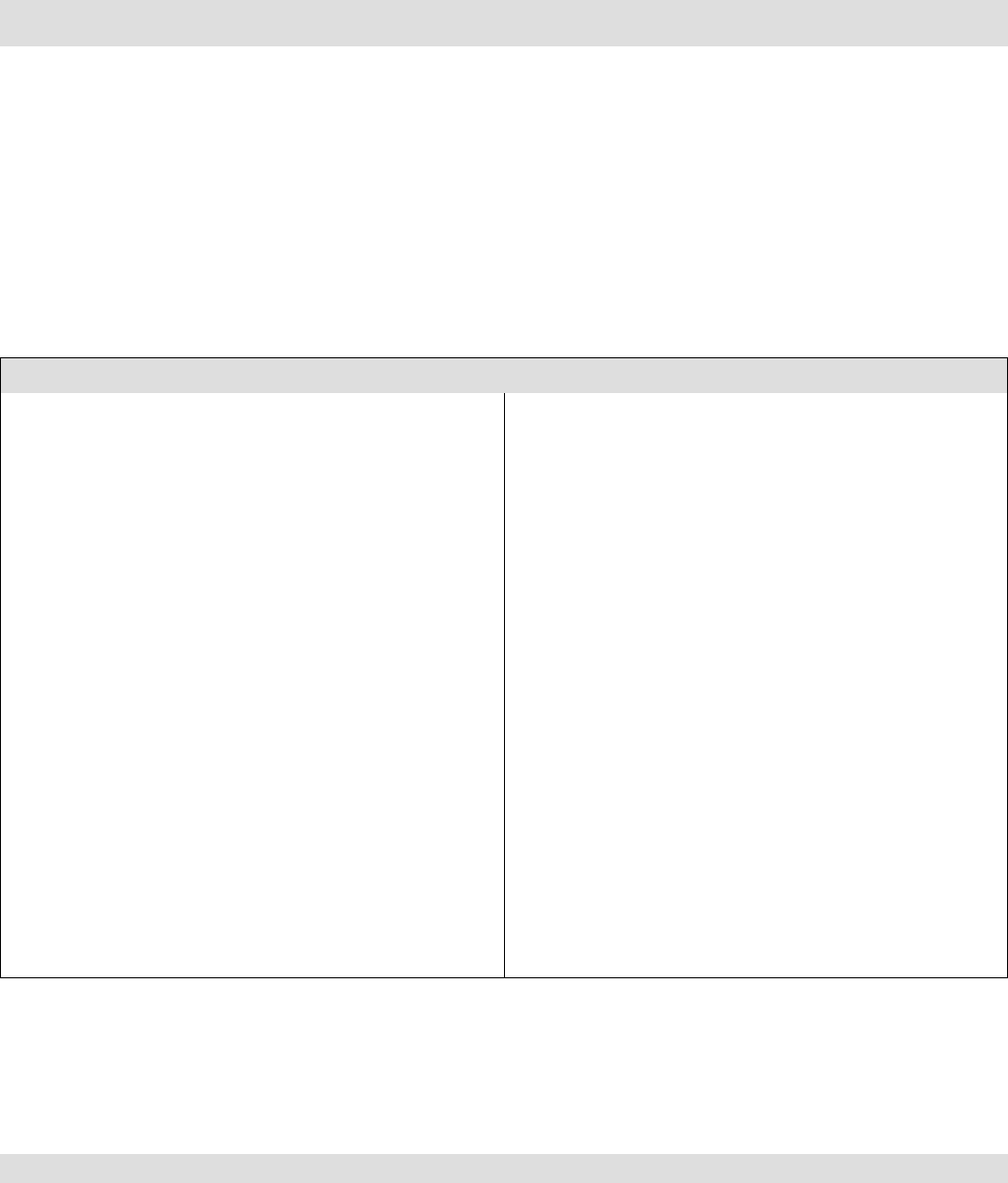

Instructions:

1. Read the section below entitled: How To Determine The Amount of Earnings You Should Report. If you have questions,

please telephone (202) 606-0249 Monday through Friday between 9:30 AM and 5:00 PM, Eastern Time. If you use TTY

equipment, call 1-855-887-4957.

2. Provide clear and legible information. Do not detach any portion of this form.

3. Fill in, sign, and mail this report in the envelope provided, or mail the report to: U.S. Office of Personnel Management,

Retirement Surveys and Students Branch, FERS Annuity Supplement Survey, 1900 E St., NW, Washington, DC

20415-3562 or fax your response to (202) 606-0022.

4. Retain copies of evidence supporting your claimed earnings in the event you are required to furnish documentation of

earnings.

5. DO NOT include your annuity payments from OPM. Include, as earnings, all income from wages and self-employment that

you actually received plus deferred income you actually earned during 2014.

How To Determine The Amount of Earnings You Should Report

Include as earnings: Do not include as earnings:

- All wages from employment covered by social security. - Pensions or annuities paid as retirement income, including

your FERS benefit or any benefits received as a survivor.

- All cash pay for agricultural work, domestic work in a

private home, service not in the course of your employer's

- Monies which you earned before entitlement for annuity

trade or business.

supplement and/or received for annual leave upon

retirement. This includes separation incentives.

- All pay, cash or

non-cash, for work as a home worker for a

non-profit organization, no matter the amount. (The social

- Unemployment compensation.

security $100.00 tax test

does not apply.)

- Gifts, insurance proceeds,

inheritances, scholarships,

alimony, capital gains, net business losses, prize winnings.

is done in the United States, including

pay for:

- All pay for

work not covered by social security, if the work

- Payments-in-kind for domestic

service in the employer's

private home, for agricultural labor, for work not in the

Family employment,

Work as a student, student nurse, intern, newspaper

course of

the employer's trade or business, or the value of

and magazine vendor,

meals and

lodging.

Work for States or foreign governments or

- Rentals

from real estate which cannot be counted in

instrumentalities, and

Work covered by the Railroad Retirement Act.

earnings from self-employment because, for instance, you

were not a real estate

dealer.

- Interest and dividends

not resulting from trade or business.

Regardless of what income is called or who receives it, if it

is actually wages for services you performed or net earnings

- Pay for Veteran's

training and for jury duty.

from self-employment you secured, it must be included in

- Payments

by an employer which are reimbursement

applying the earnings test.

specifically for your travel expenses and which are so

identified by the employer at the time of payment and/or

reimbursement or allowance for moving expenses, if they

are not counted as wages for social security purposes.

For more information about the Annuity Supplement, refer to Information for FERS Annuitants, RI 90-8. Information begins

in Part B. If you would like a copy of this booklet, call the Retirement Information Office toll free at 1-888-767-6738; (TTY)

1-855-887-4957; or write: U.S. Office of Personnel Management, Post Office Box 45, Boyers, Pennsylvania 16017. This booklet

is also available on the OPM website at

www.opm.gov/retirement-services/publications-forms/pamphlets/#url=Retirement-Insurance. Remember your annuity

supplement will stop at the end of the month you reach age 62 or the month before you become entitled to social security

benefits, whichever is earlier.

Privacy Act Statement/Public Burden Statement

Information you furnish will be used to determine your eligibility to continue receiving the annuity supplement and the amount of the supplement. Information

may be shared and is subject to verification via paper, electronic media, or through use of computer matching programs, with national, state, local, or other benefit

paying agencies in order to determine and issue benefits under their programs, to obtain information necessary for continuation of benefits under this program, or

to report income for tax purposes. It may also be shared and verified, as noted above, with law enforcement agencies when they are investigating a violation or

potential violation of civil or criminal law. Solicitation of this information is authorized by the Federal Employees' Retirement Law (Chapter 84, title 5, U.S.

Code). Provision of this information is voluntary; however, failure to supply accurate information may result in suspension of your annuity benefit.

We estimate providing this information takes an average 15 minutes per response, including the time for reviewing instructions, getting the needed data, and

reviewing the requested information. Send comments regarding our estimate or any other aspect of this form, including suggestions for reducing completion time,

to the United States Office of Personnel Management, Retirement Services Publications Team, (3206-0194), Washington, DC 20415-3430. The OMB Number,

3206-0194, is currently valid. OPM may not collect this information, and you are not required to respond, unless the number is displayed.

Reverse of RI 92-22

Revised March 2015