Fillable Printable Form WH-501

Fillable Printable Form WH-501

Form WH-501

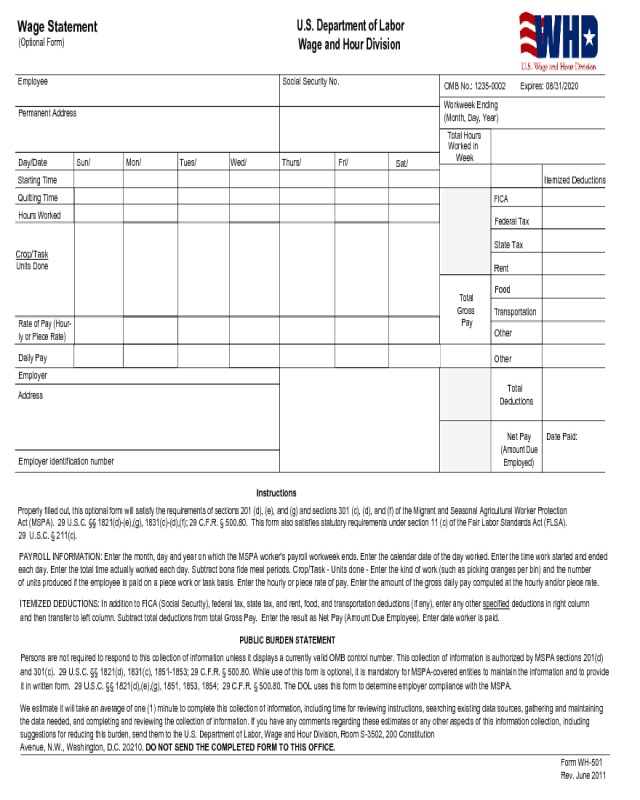

Wage Statement

(Optional Form)

U.S. Department of Labor

Wage and Hour Division

Total Hours

Worked in

Week

Itemized Deductions

Crop/Task

Units Done

Total

Gross

Pay

Rate of Pay (Hour-

ly or Piece Rate)

Daily Pay

Other

Employer

Address

Employer identification number

Employee

Social Security No.

Permanent Address

Expires: 08/31/2020

OMB No.: 1235-0002

Workweek Ending

(Month, Day, Year)

Day/Date

Sun/

Mon/

Tues/

Wed/

Thurs/

Fri/

Sat/

Starting Time

Quitting Time

Hours Worked

FICA

Federal Tax

State Tax

Rent

Food

Transportation

Other

Total

Deductions

Net Pay

(Amount Due

Employed)

Date Paid:

Instructions

Properly filled out, this optional form will satisfy the requirements of sections 201 (d), (e), and (g) and sections 301 (c), (d), and (f) of the Migrant and Seasonal Agricultural Worker Protection

Act (MSPA). 29 U.S.C. §§ 1821(d)-(e),(g), 1831(c)-(d),(f); 29 C.F.R. § 500.80. This form also satisfies statutory requirements under section 11 (c) of the Fair Labor Standards Act (FLSA).

29 U.S.C. § 211(c).

PAYROLL INFORMATION: Enter the month, day and year on which the MSPA worker's payroll workweek ends. Enter the calendar date of the day worked. Enter the time work started and ended

each day. Enter the total time actually worked each day. Subtract bona fide meal periods. Crop/Task - Units done - Enter the kind of work (such as picking oranges per bin) and the number

of units produced if the employee is paid on a piece work or task basis. Enter the hourly or piece rate of pay. Enter the amount of the gross daily pay computed at the hourly and/or piece rate.

ITEMIZED DEDUCTIONS: In addition to FICA (Social Security), federal tax, state tax, and rent, food, and transportation deductions (if any), enter any other specified deductions in right column

and then transfer to left column. Subtract total deductions from total Gross Pay. Enter the result as Net Pay (Amount Due Employee). Enter date worker is paid.

Persons are not required to respond to this collection of information unless it displays a currently valid OMB control number. This collection of information is authorized by MSPA sections 201(d)

and 301(c). 29 U.S.C. §§ 1821(d), 1831(c), 1851-1853; 29 C.F.R. § 500.80. While use of this form is optional, it is mandatory for MSPA-covered entities to maintain the information and to provide

it in written form. 29 U.S.C. §§ 1821(d),(e),(g), 1851, 1853, 1854; 29 C.F.R. § 500.80. The DOL uses this form to determine employer compliance with the MSPA.

PUBLIC BURDEN STATEMENT

We estimate it will take an average of one (1) minute to complete this collection of information, including time for reviewing instructions, searching existing data sources, gathering and maintaining

the data needed, and completing and reviewing the collection of information. If you have any comments regarding these estimates or any other aspects of this information collection, including

suggestions for reducing this burden, send them to the U.S. Department of Labor, Wage and Hour Division, Room S-3502, 200 Constitution

Avenue, N.W., Washington, D.C. 20210. DO NOT SEND THE COMPLETED FORM TO THIS OFFICE.

Form WH-501

Rev. June 2011