Fillable Printable Heating Oil Insurance Fee Return

Fillable Printable Heating Oil Insurance Fee Return

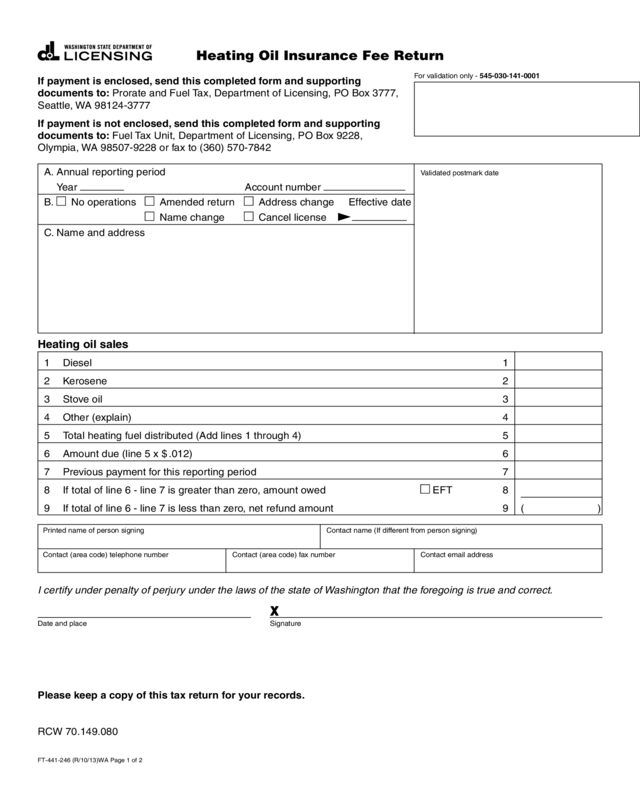

Heating Oil Insurance Fee Return

For validation only - 545-030-141-0001

Validated postmark date

X

Heating Oil Insurance Fee Return

If payment is enclosed, send this completed form and supporting

documents to: Prorate and Fuel Tax, Department of Licensing, PO Box 3777,

Seattle, WA 98124-3777

If payment is not enclosed, send this completed form and supporting

documents to: Fuel Tax Unit, Department of Licensing, PO Box 9228,

Olympia, WA 98507-9228 or fax to (360) 570-7842

A. Annual reporting period

Year Account number

B. No operations Amended return

Name change

Address change

Cancel license

Effective date

C. Name and address

Heating oil sales

1 Diesel 1

2 Kerosene 2

3 Stove oil 3

4 Other (explain) 4

5 Total heating fuel distributed (Add lines 1 through 4) 5

6 Amount due (line 5 x $ .012) 6

7 Previous payment for this reporting period 7

8 If total of line 6 - line 7 is greater than zero, amount owed EFT 8

9 If total of line 6 - line 7 is less than zero, net refund amount 9 ( )

Printed name of person signing Contact name (If different from person signing)

Contact (area code) telephone number Contact (area code) fax number Contact email address

I certify under penalty of perjury under the laws of the state of Washington that the foregoing is true and correct.

Date and place Signature

Please keep a copy of this tax return for your records.

RCW 70.149.080

FT-441-246 (R/10/13)WA Page 1 of 2

Click here to START or CLEAR, then hit the TAB button

When you have completed this form, please print it out and sign here.

General Information

If you sell heating oil, you must complete the Washington Heating Oil Insurance Fee Return. For the purposes of this

return, “Heating Oil” is defined as any petroleum product used for space heating in oil-fired furnaces, heaters, and boilers,

including stove oil, diesel fuel, or kerosene. Returns must be filed annually. Payment of the net amount due the state must

accompany the return.

• Returns are due January 25th of the year following the reporting period. The postal service postmark on the mailing

envelope is used as the day of receipt.

• Round all reported gallons to the nearest whole gallon. Convert liters to gallons at the rate of 3.785 liters per gallon.

• The person signing the return must be authorized by the company to do so.

Instructions

• No operations: If you had no activity during the reporting period, you must file a return in order to avoid revocation.

• Amended return: To report changes for a previous filing, use a new return and mark “Amended Return”. Complete

the entire return using the corrected figures. Record any payments made with the original return on line 7 and continue

filling out the return.

• Name change: Provide your current business name. If you purchased or incorporated your business, a new application

for license must be completed.

• Address change: Provide physical and mailing addresses.

• Cancel license and effective date: The effective date is the date you stopped business operations. Returns must be

filed through this date.

Line 1 - Line 4 Enter the total gallons sold for heating purposes in the appropriate lines.

Line 5 Add lines 1 through 4.

Line 6 Multiply the amount on line 5 by $ .012.

Line 7 Enter all payments you have previously made for this reporting period.

Line 8 If line 6 minus line 7 is greater than zero, this is the amount owed.

Line 9 If line 6 minus line 7 is less than zero, this is the refund amount.

Payments

• All payments must be made in U.S. funds.

• Payments are due January 25th of the year following the reporting period.

• If you are paying via electronic funds transfer (EFT), place an “X” in the EFT box.

Records

Records must be kept for five years for all heating oil received, sold, distributed, or used for own consumption. These

include invoices, bills of lading, and other papers. Information may be disclosed to the Internal Revenue Service.

Questions

For questions related to completing this form, call 360-664-1852.

For questions regarding legal requirements, contact Washington Pollution Liability Insurance Agency at:

Phone: (800) 822-3905 or (360) 407-0520.

Voice Mail: (360) 407-0516

Website: [email protected]

FT-441-246 (R/10/13)WA Page 2 of 2