Fillable Printable Limited Power of Attorney and Tax Information Authorization - Nevada

Fillable Printable Limited Power of Attorney and Tax Information Authorization - Nevada

Limited Power of Attorney and Tax Information Authorization - Nevada

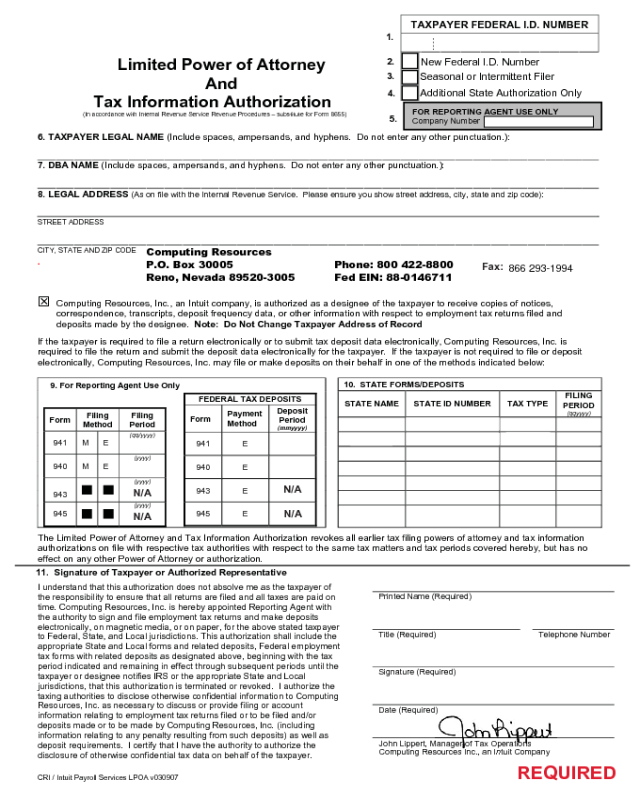

TAXPAYER FEDERAL I.D. NUMBER

New Federal I.D. Number

1.

Limited Power of Attorney

2.

3.

Seasonal or Intermittent Filer

And

Additional State Authorization Only

4.

Tax Information Authorization

CRI / Intuit Payroll Services LPOA v030907

(In accordance with Internal Revenue Service Revenue Procedures – substitute for Form 8655)

6. TAXPAYER LEGAL NAME (Include spaces, ampersands, and hyphens. Do not enter any other punctuation.):

FOR REPORTING AGENT USE ONLY

Company Number

5.

7. DBA NAME (Include spaces, ampersands, and hyphens. Do not enter any other punctuation.):

8. LEGAL ADDRESS (As on file with the Internal Revenue Service. Please ensure you show street address, city, state and zip code):

STREET ADDRESS

CITY, STATE AND ZIP CODE

7Computing Resources, Inc., an Intuit company, is authorized as a designee of the taxpayer to receive copies of notices,

correspondence, transcripts, deposit frequency data, or other information with respect to employment tax returns filed and

deposits made by the designee. Note: Do Not Change Taxpayer Address of Record

If the taxpayer is required to file a return electronically or to submit tax deposit data electronically, Computing Resources, Inc. is

required to file the return and submit the deposit data electronically for the taxpayer. If the taxpayer is not required to file or deposit

electronically, Computing Resources, Inc. may file or make deposits on their behalf in one of the methods indicated below:

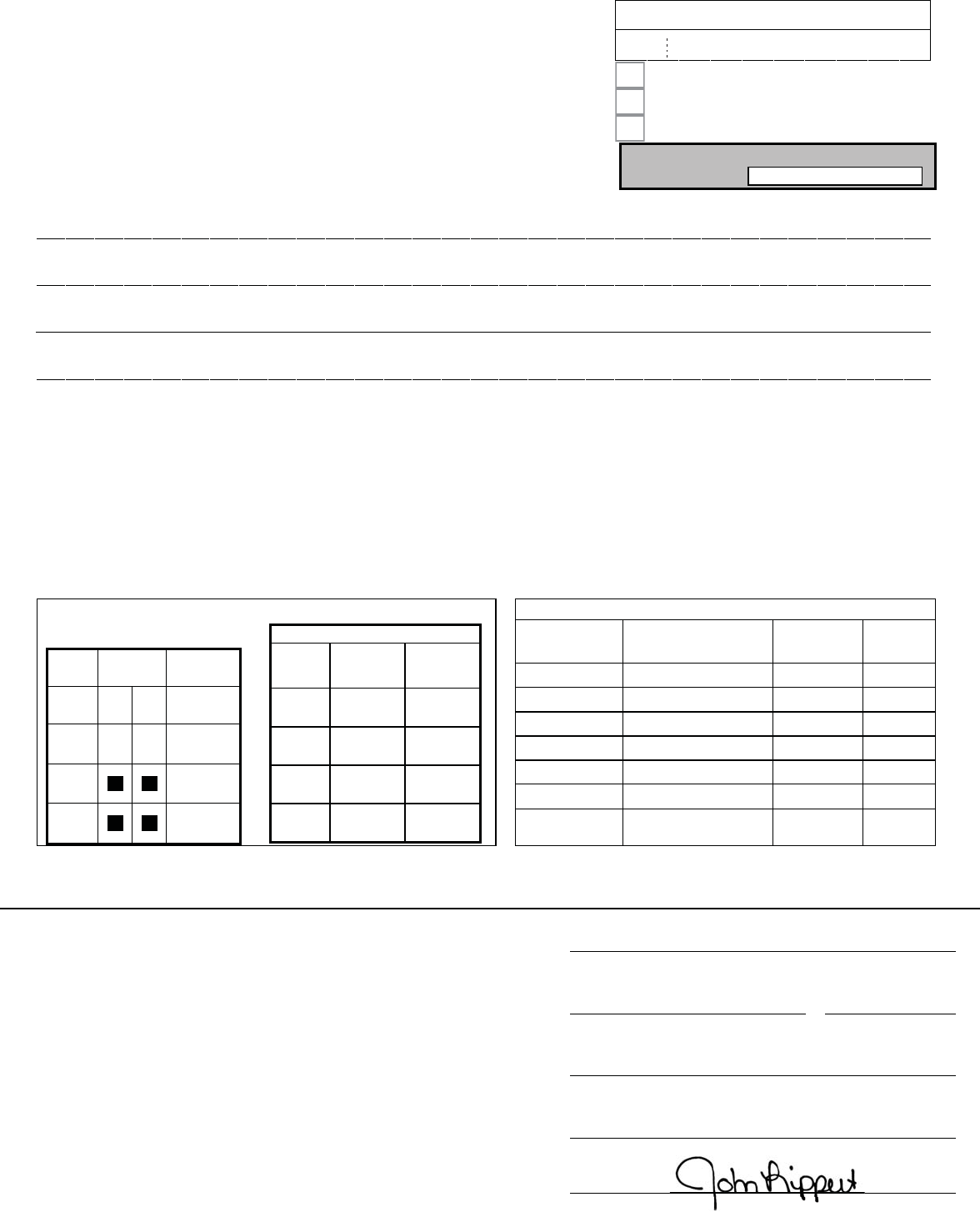

10. STATE FORMS/DEPOSITS

STATE NAME STATE ID NUMBER TAX TYPE

FILING

PERIOD

(qqyyyy)

The Limited Power of Attorney and Tax Information Authorization revokes all earlier tax filing powers of attorney and tax information

authorizations on file with respective tax authorities with respect to the same tax matters and tax periods covered hereby, but has no

effect on any other Power of Attorney or authorization.

11. Signature of Taxpayer or Authorized Representative

Printed Name (Required)

Title (Required) Telephone Number

Signature (Required)

Date (Required)

I understand that this authorization does not absolve me as the taxpayer of

the responsibility to ensure that all returns are filed and all taxes are paid on

time. Computing Resources, Inc. is hereby appointed Reporting Agent with

the authority to sign and file employment tax returns and make deposits

electronically, on magnetic media, or on paper, for the above stated taxpayer

to Federal, State, and Local jurisdictions. This authorization shall include the

appropriate State and Local forms and related deposits, Federal employment

tax forms with related deposits as designated above, beginning with the tax

period indicated and remaining in effect through subsequent periods until the

taxpayer or designee notifies IRS or the appropriate State and Local

jurisdictions, that this authorization is terminated or revoked. I authorize the

taxing authorities to disclose otherwise confidential information to Computing

Resources, Inc. as necessary to discuss or provide filing or account

information relating to employment tax returns filed or to be filed and/or

deposits made or to be made by Computing Resources, Inc. (including

information relating to any penalty resulting from such deposits) as well as

deposit requirements. I certify that I have the authority to authorize the

disclosure of otherwise confidential tax data on behalf of the taxpayer.

Form

Filing

Method

Filing

Period

941 M E

(qq/yyyy)

940 M E

(yyyy)

943

(yyyy)

945

(yyyy)

FEDERAL TAX DEPOSITS

Form

Payment

Method

Deposit

Period

(mmyyyy)

941 E

940 E

943 E

945 E

9. For Reporting Agent Use Only

REQUIRED

-RKQ/LSSHUW, 0DQDJHU of Tax Operations

Computing Resources Inc., an Intuit Company

Fax:

)

0DQ

DJH

U

of Tax Operations

U

sources Inc an Intuit Company

-

-

-

-

N/A

N/A

N/A

N/A

Computing Resources

P.O. Box 30005 Phone: 800 422-8800

Reno, Nevada 89520-3005 Fed EIN: 88-0146711

866 293-1994