- Limited Durable Power of Attorney - New Mexico Motor Vehicle Division

- Limited Power of Attorney - British Columbia

- Limited Power of Attorney Form - Florida

- Limited Power of Attorney - Prince Edward Island

- Limited Power of Attorney - Manitoba

- Limited Power of Attorney for Vehicle and Watercraft Transactions - Indiana

Fillable Printable Limited Power of Attorney Example - Wyoming

Fillable Printable Limited Power of Attorney Example - Wyoming

Limited Power of Attorney Example - Wyoming

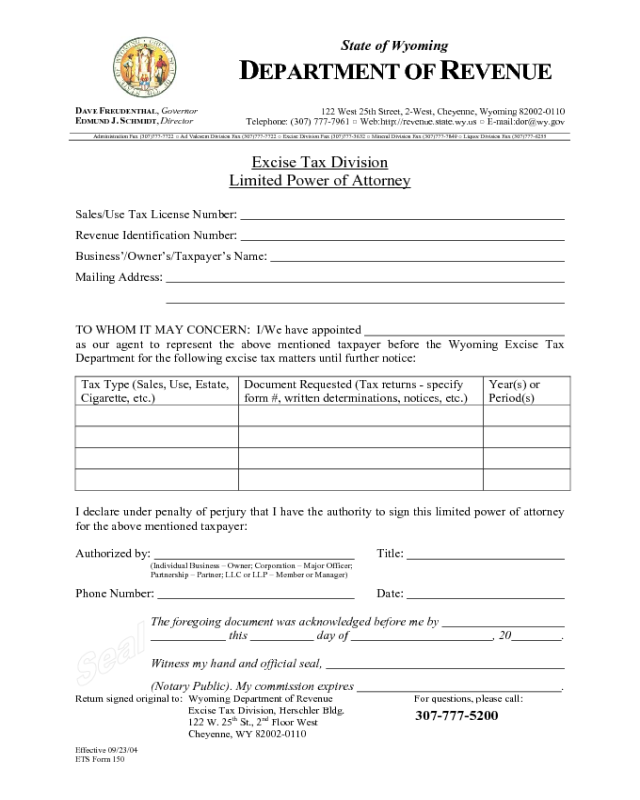

DAVE FREUDENTHAL, Governor

E

DMUND J. SCHMIDT, Director

State of Wyoming

DEPARTMENT OF REVENUE

122 West 25th Street, 2-West, Cheyenne, Wyoming 82002-0110

Telephone: (307) 777-7961 ○ Web:http://revenue.state.wy.us ○ E-mail:dor@wy.gov

Administration Fax (307)777-7722 ○ Ad Valorem Division Fax (307)777-7722 ○ Excise Division Fax (307)777-3632 ○ Mineral Division Fax (307)777-7849 ○ Liquor Division Fax (307)777-6255

Effective 09/23/04

ETS Form 150

Excise Tax Division

Limited Power of Attorney

Sales/Use Tax License Number:

Revenue Identification Number:

Business’/Owner’s/Taxpayer’s Name:

Mailing Address:

TO WHOM IT MAY CONCERN: I/We have appointed

as our agent to represent the above mentioned taxpayer before the Wyoming Excise Tax

Department for the following excise tax matters until further notice:

Tax Type (Sales, Use, Estate,

Cigarette, etc.)

Document Requested (Tax returns - specify

form #, written determinations, notices, etc.)

Year(s) or

Period(s)

I declare under penalty of perjury that I have the authority to sign this limited power of attorney

for the above mentioned taxpayer:

Authorized by: Title:

(Individual Business – Owner; Corporation – Major Officer;

Partnership – Partner; LLC or LLP – Member or Manager)

Phone Number: Date:

The foregoing document was acknowledged before me by

this day of , 20 .

Witness my hand and official seal,

(Notary Public). My commission expires .

Return signed original to: Wyoming Department of Revenue For questions, please call:

Excise Tax Division, Herschler Bldg.

122 W. 25

th

St., 2

nd

Floor West

Cheyenne, WY 82002-0110

307-777-5200

DAVE FREUDENTHAL, Governor

EDMUND J. SCHMIDT, Director

State of Wyoming

DEPARTMENT OF REVENUE

122 West 25th Street, 2-West, Cheyenne, Wyoming 82002-0110

Telephone:(307) 777-7961 ? Web:http://revenue.state.wy.us ? E-mail:dor@wy.gov

Administration Fax (307)777-7722 ? Ad Valorem Division Fax (307)777-7722 ? Excise Division Fax (307)777-3632 ? Mineral Division Fax (307)777-7849 ? Liquor Division Fax (307)777-6255

Revised 03/22/05

Excise Tax Division

Limited Power of Attorney Instruction Sheet

What is a Limited Power of Attorney form? The Excise Tax Division’s Limited Power of Attorney form

allows taxpayers to authorize someone else, be it attorney, CPA or a new bookkeeper, access to the

taxpayer’s information.

Who must fill one out? The taxpayer fills out the form, and designates who may access the taxpayer’s

records. This is common when the taxpayer wants his/her attorney or CPA to have access to the

taxpayer’s Wyoming sales, use, cigarette or estate tax information.

Where does the Excise Tax Division get its authority for this requirement? The Excise Tax Division is

statutorily prohibited from releasing information without the taxpayer’s permission. The relevant statutes

are W.S. 39-11-102 and W.S. 39-15-102(e).

What is the cost associated with getting the requested records? Per WY Dept of Rev Rules, Chap 1, Sec.

4(a), reproduction fees are structured as follows:

(i) $0.50 per page for the first ten pages;

(ii) $0.15 per page for each additional page over ten pages;

(iii) If certification of a document is requested, there shall be an additional charge of $3.00 per

document;

(iv) Notwithstanding the rates in paragraphs (i), (ii) and (iii), a minimum fee of $10.00 per

request.

How long does it take to get the requested information? The Excise Tax Division needs a minimum of

twenty-four (24) hours lead time to process the request and pull the records. Extensive record requests

may take additional time.

Why was my Limited Power of Attorney form rejected? All applicable areas must be completed, the form

must be notarized, and the original must be submitted to the Excise Tax Division. Copies or facsimiles

are not acceptable.

Why didn’t I get the information I requested? Either you forgot to include payment for the reproduction

fees, or the information requested did not match the boundaries listed on the Limited Power of Attorney

Form. Information released to the designated party is limited to exactly what was listed on the form. If

you requested sales tax returns from June 2000 through July of 2001, but the form authorized only sales

tax returns from January of 2003 through January 2005, your request can not be completed. Contact the

taxpayer and have him/her complete a new limited power of attorney form.

What must I do if the taxpayer changes bookkeepers, or wants to add another person to the list of those

authorized to request the taxpayer’s records? The taxpayer must complete and return a new limited

power of attorney form before that person is allowed access to the taxpayer’s records.