Fillable Printable New And Noteworthy, How To Fill Out Form Or-Otc, 150-206-552

Fillable Printable New And Noteworthy, How To Fill Out Form Or-Otc, 150-206-552

New And Noteworthy, How To Fill Out Form Or-Otc, 150-206-552

150-206-552 (Rev. 12-17)

Oregon Department of Rev e nue

PO Box 14800

Salem OR 97309-0920

Make check payable to:

TOTAL PAYMENT (add all the boxes at left)

Workers’ Benet Fund Assessment

Lane Transit District Excise

TriMet District Excise

State Withholding

State Unemployment

➥

Enter quarter payroll was paid

to employees: (1, 2, 3, or 4)

➙

YEAR BUSINESS ID NO.

Date Received

➥

➥

➥

➥

Payment Coupon 150-211-053 (Rev. 10-17)

Form OR-OTC, Oregon Combined Payroll Tax

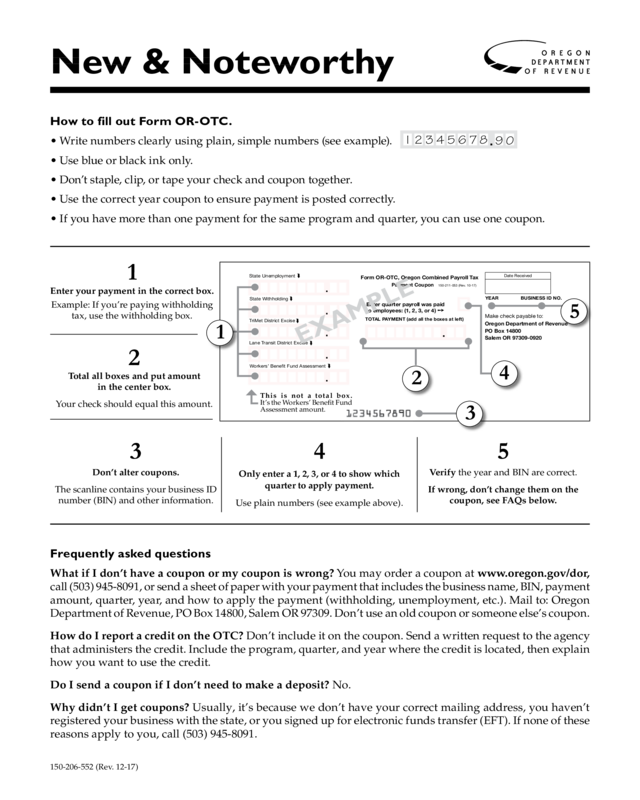

How to fill out Form OR-OTC.

• Write numbers clearly using plain, simple numbers (see example).

• Use blue or black ink only.

• Don’t staple, clip, or tape your check and coupon together.

• Use the correct year coupon to ensure payment is posted correctly.

• If you have more than one payment for the same program and quarter, you can use one coupon.

l

8

2345

67

90

New & Noteworthy

Frequently asked questions

What if I don’t have a coupon or my coupon is wrong? You may order a coupon at www.oregon.gov/dor,

call (503) 945-8091, or send a sheet of paper with your payment that includes the business name, BIN, payment

amount, quarter, year, and how to apply the payment (withholding, unemployment, etc.). Mail to: Oregon

Department of Revenue, PO Box 14800, Salem OR 97309. Don’t use an old coupon or someone else’s coupon.

How do I report a credit on the OTC? Don’t include it on the coupon. Send a written request to the agency

that administers the credit. Include the program, quarter, and year where the credit is located, then explain

how you want to use the credit.

Do I send a coupon if I don’t need to make a deposit? No.

Why didn’t I get coupons? Usually, it’s because we don’t have your correct mailing address, you haven’t

registered your business with the state, or you signed up for electronic funds transfer (EFT). If none of these

reasons apply to you, call (503) 945-8091.

EXAMPLE

This is not a total box.

It’s the Workers’ Benefit Fund

Assessment amount.

2

3

4

5

1

3

Don’t alter coupons.

The scanline contains your business ID

number (BIN) and other information.

4

Only enter a 1, 2, 3, or 4 to show which

quarter to apply payment.

Use plain numbers (see example above).

5

Verify the year and BIN are correct.

If wrong, don’t change them on the

coupon, see FAQs below.

1

Enter your payment in the correct box.

Example: If you’re paying withholding

tax, use the withholding box.

2

Total all boxes and put amount

in the center box.

Your check should equal this amount.

150-206-552 (Rev. 12-17)

Payments using Form OR-OTC

(sent with any payment made by check)

•You must include Form OR-OTC with each

combined payroll tax payment you make, including

payments made with your Oregon Quarterly Tax

Report (Form OQ) or Annual Reconciliation

(Form OR-WR).

• If you amend Form OQ and have a payment due,

include Form OR-OTC with your payment and

amended form.

New required reporting

• Employers are required to report each employee’s

state withholding amount on Form 132 every

quarter.

• Effective July 1, 2018, employers are required

to report a Statewide Transit Tax, an employee

paid transit tax. For more information visit www.

oregon.gov/dor.

Payment due dates

• Oregon’s due dates for withholding-tax payments

are the same as federal due dates.

Electronic funds transfer (EFT) information

• You can make EFT payments (ACH Debit) through

Revenue Online, our self-service site, or through

your financial institution. To learn more about

Revenue Online, visit www.oregon.gov/dor.

•You can also make EFT payments (Credit and

Debit) through the Oregon Tax Payment system

using our secure internet site, your phone or

through your financial institution.

•If you don’t meet the federal requirements for

mandatory EFT payments, you can still make

voluntary EFT payments.

Updating your address or phone number?

• Fill out the Business Contact Change Form or email

the information to: payroll.tax@ oregon.gov.

Tax tables

•We annually review Oregon withholding tax

tables. Revised tables are posted on listserv and

www.oregon.gov/dor/business.

Transit information—TriMet and LTD

• Transit payments are due quarterly when you file

your report.

•To check transit rates, zip code boundaries, or

determine if you are subject to the transit tax,

go to www.oregon.gov/dor/business or call

(503) 945-8091.

Electronic filing options

•Electronic filing options for employers are

available at www.oregon.gov/employ/tax or call

(503) 947-1544.

•Electronic payment options for employers are

available through Revenue Online or EFT. See the

EFT section.

• Form OR-WR is required even if you are reporting

a zero tax. Form OR-WR is now due January 31st

of the following year.

• The deadline for filing W-2s and 1099s is January

31, as we follow federal deadlines. For more

information, go towww.oregon.gov/dor/business.

Oregon Retirement Savings Plan

• OregonSaves, the new Oregon retirement savings

program, is an easy way for Oregonians to save

for retirement through payroll deductions. Oregon

employers that don’t currently offer an employer-

sponsored retirement plan will begin to facilitate

OregonSaves for its employees. Employers

with 100 or more employees should either have

registered to facilitate the program or, if they offer

their own retirement plan, claimed exemption by

Nov. 15, 2017. The deadline for employers with 50-

99 employees is May 15, 2018, and the deadline for

employers with 20-49 employees is Dec. 15, 2018.

The program will roll out to smaller employers in

2019 and 2020. For more information, to register

your business, or claim exemption, even if you

missed your deadline, go to www.oregonsaves.

com or call 844-661-1256.

Do you have questions or need help?

www.oregon.gov/dor

(503) 945-8100 or (800) 356-4222

Contact us for ADA accommodations or assistance in

other languages.