Fillable Printable OPM Form 1496

Fillable Printable OPM Form 1496

OPM Form 1496

OMB No. 3206-0121

Form Approved

OPM Form 1496

Revised October 2002

Prior editions are not usable.

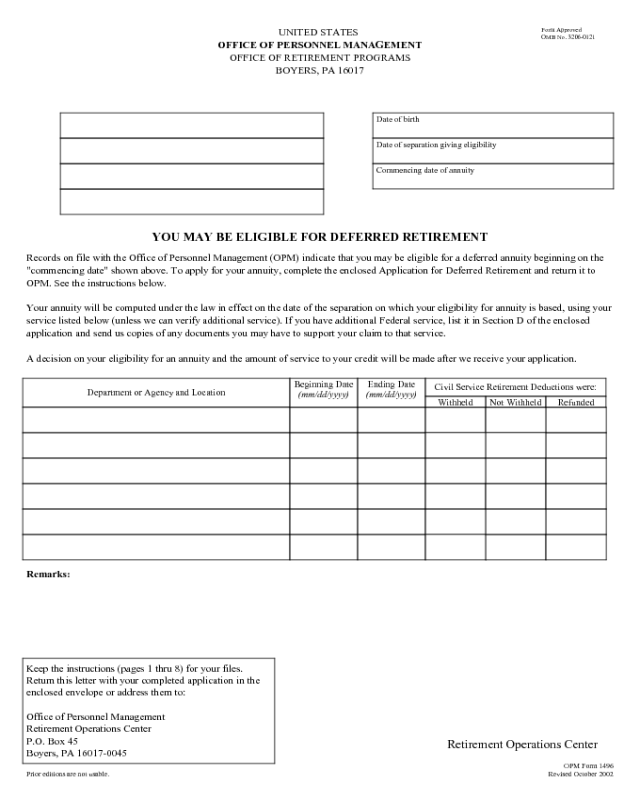

UNITED STATES

OFFICE OF PERSONNEL MANAGEMENT

OFFICE OF RETIREMENT PROGRAMS

BOYERS, PA 16017

Date of birth

Date of separation giving eligibility

Commencing date of annuity

YOU MAY BE ELIGIBLE FOR DEFERRED RETIREMENT

Records on file with the Office of Personnel Management (OPM) indicate that you may be eligible for a deferred annuity beginning on the

"commencing date" shown above. To apply for your annuity, complete the enclosed Application for Deferred Retirement and return it to

OPM. See the instructions below.

Your annuity will be computed under the law in effect on the date of the separation on which your eligibility for annuity is based, using your

service listed below (unless we can verify additional service). If you have additional Federal service, list it in Section D of the enclosed

application and send us copies of any documents you may have to support your claim to that service.

A decision on your eligibility for an annuity and the amount of service to your credit will be made after we receive your application.

Department or Agency and Location

Beginning Date

(mm/dd/yyyy)

Ending Date

(mm/dd/yyyy)

Civil Service Retirement Deductions were:

Withheld Not Withheld Refunded

Remarks:

Keep the instructions (pages 1 thru 8) for your files.

Return this letter with your completed application in the

enclosed envelope or address them to:

Office of Personnel Management

Retirement Operations Center

P.O. Box 45

Boyers, PA 16017-0045

Retirement Operations Center

Go to Form

APPLICATION FOR DEFERRED RETIREMENT

(Separations before October 1, 1956)

INTRODUCTION

This package is for your use if you are a separated Federal employee

who wants to apply for deferred annuity based on a separation from

service covered by Civil Service Retirement law before October 1,

1956. This package does not include any information on the

provisions of the Federal Employees Retirement System Act of 1986.

Review all information carefully before you complete the application.

Special information which applies only to certain separated Members

of Congress and congressional employees has not been included. Keep

the information sections of this package for future reference.

ELIGIBILITY FOR DEFERRED ANNUITY

If you die before attaining age 62, or after age 62 but before applying

for annuity, the only benefit payable will be your lump sum credit in

the retirement fund; monthly survivor annuity will not be available.

Deferred annuity is payable commencing the day the former Federal

employee is 62, provided an application has been submitted to the

Office of Personnel Management (OPM) and approved. Your

"retirement date" is your 62nd birthday even if you did not apply for

your annuity before you were 62.

Final separation on/after January 24, 1942, but before April 1,

1948, from service covered by the Civil Service Retirement law

entitles you to an annuity if:

1. You had at least 5 years of creditable civilian Federal service or a

combination of creditable civilian Federal service and military

service equaling 5 years, as of your final separation.

2.

You have not forfeited entitlement by drawing a refund of your

retirement deductions covering your final period of service.

If OPM determines that your final separation during the period

specified above was involuntary, not for cause, your annuity may

begin at age 55.

Final separation on/after April 1, 1948, but before October 1,

1956, from service covered by the Civil Service Retirement law

entitles you to an annuity if:

1. You had at least 5 years of creditable civilian Federal service as of

the date of your final separation.

2.

You have not forfeited entitlement by drawing a refund of your

retirement deductions covering your final period of service.

3.

In addition, if the final separation on which your entitlement is

based was on/after August 31, 1954, you must have been covered

by the retirement law for at least one year out of the two-year

period preceding your final separation.

If your final period of service does not meet the "one out of two"

requirement, it will be eliminated from consideration. Retirement deductions

withheld during the period will be refunded, and, if possible, entitlement will

be based on a previous separation.

INSTRUCTIONS FOR COMPLETING APPLICATION FOR

DEFERRED ANNUITY

Section A - Identifying Information

Item 1: Type or print your name clearly.

Item 2: List other names under which you have been employed in the

Federal government (such as a maiden name). This will make it

possible for us to locate and identify records maintained under

such names.

Item 3:

Enter the address to which correspondence should be mailed. (If

you want your payments sent to a bank, do NOT enter that address

here; refer to page 7 for information about how to do this.)

Item 4:

Give a telephone number where you can be reached in case more

information is needed.

Item 5:

Give your date of birth, showing the month, then the day, then the

year. Your retirement records are filed by your name and date of

birth. If your date of birth is not correct on the letter with this

package, send proof of your date of birth (such as your birth

certificate) with your application.

Item 6:

Enter your social security number. The Treasury Department

requires us to report, by social security number, the amount paid to

each annuitant.

Item 7:

Indicate your citizenship.

Section B - Marital Information

Item 1: Indicate whether or not you are married now. If you are married,

also complete Items 1a-1f with information about your current

marriage. Information about your marital status and your spouse is

necessary to assure that you get the survivor election that you want

and to which you are entitled by law.

Item 1a:

Enter your spouse's name.

Item 1b:

Enter your spouse's date of birth (month-day-year).

Item 1c:

Furnish your spouse's social security number.

Item 1d:

Enter the place of your marriage (town or city and state).

Item 1e:

Enter the date of your marriage (month-day-year).

Item 1f:

If you were married by a clergyman or justice of the peace, check

that box. If not, check the box marked "other" and explain how, or

by whom, you were married.

Item 2:

Indicate whether you have a living former spouse whose marriage

to you ended by divorce or annulment on or after May 7, 1985,

and to whom a court order gives a survivor annuity. If you answer

"yes," you must submit a certified copy of the court order and any

attachments or amendments.

Page 1

OPM Form 1496

Revised October 2002

Section C: Annuity Election

To be eligible for a survivor annuity after your death, your widow(er)

must have been married to you for a total of at least 9 months. The

marriage duration requirement does not apply if your death is accidental

(as defined under the retirement regulations) or your surviving spouse is

a parent of your child.

Box 1: Spouse Survivor Benefit

If you initial either Box 1A or Box 1B, your wife or husband will

receive a survivor annuity upon your death. The amount of this survivor

annuity and the amount of the reduction in your annuity to provide this

benefit depend on the box you initial. For a full discussion of the effect

of court orders, see Important Information About Annuity Election on

page 3.

Box 1A: Maximum Survivor Benefit

If you initial Box 1A, you are electing the maximum survivor benefit.

Your spouse's survivor annuity upon your death will be 55% of all of

your annuity. Your annuity will be reduced by 2-1/2% of the first

$3,600 and 10% of the remainder of your annual annuity to provide this

benefit upon your death.

Box 1B: Less than Maximum Survivor Benefit

If you initial Box 1B, you must complete and attach OPM Form 1496,

Schedule B, Spouse's Consent to Survivor Election. The law requires

consent of the spouse if a married person elects less than the maximum

survivor benefits. (See Important Information About Annuity Election

on page 3 for exceptions to the consent requirements.)

If you initial Box 1B, your spouse's survivor annuity upon your death

will be 55% of the annual amount you specify in the blank space (which

must be less than the full amount of your annual annuity). Your annuity

will be reduced by 2-1/2% of the first $3,600 and 10% of any additional

amount you specify.

Box 2: No Survivor Benefit

If you are married and initial Box 2, you must also complete and attach

to your application OPM Form 1496, Schedule B, Spouse's Consent to

Survivor Election. The law requires that your spouse consent if you

elect less than the maximum or no survivor annuity. (See Important

Information About Annuity Election on page 3 for exceptions to the

consent requirement.)

If you initial Box 2, you will receive an annuity payable only during

your lifetime, without monthly survivor annuity for your spouse. All

applicants, married and unmarried, may choose this type of annuity.

However, you should review carefully all information provided here

before making your election.

Box 3: Former Spouse or Combination Current/Former Spouse

Benefit

You are not eligible to elect a survivor annuity for a former spouse if the

dates of your 62nd birthday and of the divorce or annulment were both

before May 7, 1985.

If you initial Box 3, you must use OPM Form 1496, Schedule A,

Election of Former Spouse Survivor Annuity or Combination Current/

Former Spouse Annuity, to make your election. Read the information at the

bottom of Schedule A. You are not permitted to elect a benefit for a former

spouse who has remarried before reaching age 55. Complete OPM Form

1496, Schedule B, Spouse's Consent to Survivor Election, if you are

married and initial Box 3. (See Important Information About Annuity

Election for exceptions to the consent requirements.)

If you initial Box 3, after your death, the person(s) you elect will receive

the percentage of your annuity you select. Your annuity will be reduced by

2-1/2% of the first $3,600 and 10% of the remainder as you specify.

Box 4: Insurable Interest Survivor Benefit

If you were 62 before May 7, 1985, and you were married at age 62, you are

not eligible to check Box 4.

If you initial box 4, a person selected by you at retirement, who has an

insurable interest in you, will receive a survivor annuity upon your death.

Insurable interest exists if the person named (such as a close relative) may

reasonably expect to derive financial benefit from your continued life. Enter

the requested information about the person selected on your application.

You must submit medical evidence that you are in good health. If you

initial Box 4, we will send you a notice describing the medical evidence you

must submit.

If you choose this type of annuity, the amount of the reduction in your

annuity will depend upon the difference between your age and the age of

the person named as survivor annuitant, as shown in the table below. The

survivor's rate will be 50% of your reduced annuity.

Age of Person Named

in Relation to That of

Retiring Employee

Reduction in

Annuity of

Retiring Employee

Older, same age, or less than 5 years younger..................................10%

5 but less than 10 years younger......................................................15%

10 but less than 15 years younger.....................................................20%

15 but less than 20 years younger.....................................................25%

20 but less than 25 years younger.....................................................30%

25 but less than 30 years younger.....................................................35%

30 or more years younger.................................................................40%

If you were 62 on or after May 7, 1985, you may elect an insurable interest

survivor annuity for another person in addition to a regular survivor annuity

for a current or former spouse. However, if you elect an insurable interest

for your current spouse, you must both jointly waive the current spouse

annuity. If you elect the insurable interest annuity for a current spouse

because a court order awards (or you have elected) the regular survivor

annuity to a former spouse, the insurable interest election for your current

spouse can be converted to a current spouse annuity if the former spouse

loses entitlement to the regular annuity through death or remarriage prior to

reaching age 55. The marriage duration requirement does not apply to

insurable interest annuities.

Page 2

OPM Form 1496

Revised October 2002

Important Information About Annuity Election

If you are married at retirement and do not indicate your annuity

election, you will receive an annuity reduced to provide the maximum

survivor benefit (as though you had initialed Box 1A). If you are

married at retirement and elect less than the maximum survivor benefits

for your spouse (that is, you choose 1B, 2, 3, or 4, described above), the

law requires that your spouse consent on OPM Form 1496, Schedule B,

Spouse's Consent to Survivor Election, unless the consent requirement

does not apply to you. Your application will be processed on the basis

of maximum survivor benefits if this form is required but is not

attached.

May 7, 1985

Notice to Applicants Whose 62nd Birthday was Before

If your 62nd birthday was before May 7, 1985, you may not elect a

survivor annuity for a former spouse unless your marriage terminated

on or after May 7, 1985. Also, you do not need your spouse's consent to

elect an annuity without survivor benefit for your spouse or an annuity

with less than the full survivor benefit for your spouse.

If (1) your 62nd birthday was on or after January 5, 1981, (2) you are

still married to the person to whom you were married on your 62nd

birthday, and (3) you wish to elect an annuity with less than the full

survivor benefit or no survivor benefit for that spouse, you must enclose

with your application either--

A written declaration signed by your spouse and two witnesses to

the signature (you cannot be one of the witnesses) stating that he or

she is aware that you have elected an annuity without survivor

benefit (or with less than full survivor benefit) for your surviving

spouse; or

Your spouse's current or last-known mailing address.

are electing less than the maximum survivor annuity.

Use the attached Schedule C if you need to notify your spouse that you

Notice to Married Applicants Who Married After Age 62

Your current spouse is a spouse you married after retirement. If you

wish to elect him or her a survivor annuity, you may do so with this

application or within two years following the date of marriage. If that

two-year period has expired, this application is your last

opportunity to elect a survivor benefit for your present spouse.

If you were not married to your current spouse on your 62nd birthday,

you may elect an annuity with less than the full survivor benefit or with

no survivor benefit (or in most cases with survivor benefit to former

spouse, if that marriage terminated, or your 62nd birthday occurred, on

or after May 7, 1985), without the consent of, or notice to, your current

spouse or any prior spouse. If a former spouse has a court order, dated

on or after May 7, 1985, which properly awards him or her a survivor

annuity, the Office of Personnel Management (OPM) will honor the

court order.

Waiver of Spousal Consent Requirement

The spousal consent requirement may be waived if you show that your

spouse's whereabouts cannot be determined. A request for waiver on this

basis must be made in writing and accompanied by:

-

A judicial determination that your spouse's whereabouts cannot be

determined; OR

-

Affidavits by you and two other persons, at least one of whom is not

related to you, attesting to the inability to locate the current spouse and

stating the efforts made to locate the spouse. You must also give

documentary evidence, such as tax returns filed separately or newspaper

stories about the spouse's disappearance.

The spouse's consent requirement may also be waived if you present a

judicial determination regarding the current spouse that would warrant

waiver of the consent requirement based on exceptional circumstances.

(Illness or injury of the retiree is not justification for waiving the spousal

consent requirement.)

Court-Ordered Former Spouse Annuities

OPM must honor a court order/divorce decree on or after May 7, 1985, that

gives (awards or requires you to provide) a survivor annuity to a former

spouse. OPM cannot honor court-order modifications issued after the

retirement involving a former spouse survivor annuity. Your annuity will

be reduced to provide the survivor annuity for the former spouse. However,

a former spouse cannot receive a survivor annuity by a court order unless:

1. He or she was married to you for at least 9 months;

2. You have at least 18 months of service subject to retirement deductions;

3. He or she has not remarried before reaching age 55; and

4. The marriage ended on or after May 7, 1985.

If you are married and a court order has awarded a survivor annuity to your

former spouse, see the section Electing a Survivor Annuity for a Current

Spouse When a Court Order Gives a Survivor Annuity to Former Spouse

on page 4. This explains how you can protect your current spouse's future

survivor annuity rights.

Electing a Survivor Annuity For a Former Spouse or a

Combination of Survivor Annuities for Current and Former

Spouses

If your marriage ended on or after May 7, 1985, you may elect a reduced

annuity to provide a maximum (55% of your unreduced annuity) or

less-than-maximum survivor annuity for a former spouse (or spouses).

1. To make a former spouse annuity election, you must have been married

to the person for a total of at least 9 months and you must have at least

18 months of service that was subject to retirement deductions. A

former spouse who marries again before reaching age 55 is not eligible

for a former spouse survivor annuity.

2.

You may elect to provide a survivor annuity for more than one former

spouse. If you are married, you may elect a survivor annuity for your

current spouse as well as a survivor annuity for one or more former

spouses. However, the total of the survivor annuities may not exceed

55% of your unreduced annuity.

Page 3

OPM Form 1496

Revised October 2002

3. To elect a reduced annuity to provide a survivor annuity for a

former spouse or a combination of survivor annuities for current

and former spouse(s), complete and attach OPM 1496, Schedule A,

Election of Former Spouse Survivor Annuity or Combination

Current/Former Spouse Annuity.

Electing a Survivor Annuity for a Current Spouse When a

Court Order Gives a Survivor Annuity to a Former Spouse

1. If a court order has given a survivor annuity to a former spouse, you

must make your election concerning a survivor annuity for your

current spouse as if there were no court-ordered former spouse

annuity. By electing the maximum survivor benefits for your

current spouse at retirement, you can protect your spouse's

rights in case your former spouse loses entitlement in the future

(because of remarriage before age 55, under the terms of the court

order, or death). You can do this because the Civil Service

Retirement System (CSRS) must honor the terms of the court order

and you are not required to ELECT a survivor annuity for the

former spouse. (Note: The election you make now regarding a

survivor annuity for your current spouse cannot be changed

except as explained in the section titled "Annuity Election

Changes After Retirement.") The following paragraphs explain in

more detail how your election at the time of retirement can affect

your current spouse's future rights if the court has given a survivor

annuity to a former spouse.

2.

If a court order gives a survivor annuity to a former spouse, your

annuity will be reduced to provide it. If you elect a full or partial

survivor annuity for your current spouse (or another former spouse),

your annuity will be reduced no more than it would be to provide a

survivor annuity equal to 55% of your unreduced annuity.

3.

If you die before your current and former spouse, the total amount

of the survivor annuities paid cannot exceed 55% of your annuity,

and the CSRS must honor the terms of the court order before it can

honor your election. The former spouse having the court-ordered

survivor benefit would receive an annuity according to the terms of

the court order.

4.

If a court order gives the maximum survivor annuity to the former

spouse, your widow(er) would receive no survivor annuity until the

former spouse loses entitlement. Then your widow(er) would

receive a survivor annuity according to your election.

5.

If the court order gives less than the maximum survivor annuity to

the former spouse, your widow(er) would receive an annuity no

greater than the difference between the court-ordered survivor

annuity and 55% of your annuity. However, if the former spouse

loses entitlement to the survivor annuity (through remarriage before

age 55, under the terms of the court order, or death), your

widow(er)'s survivor annuity would be increased to the amount you

elected.

For example, if there is a court-ordered former spouse survivor

annuity that equals 40% of your annuity, you elect the maximum

survivor annuity for your current spouse, and you die before the

former spouse's entitlement to a survivor annuity ends, the former

spouse would receive a survivor annuity equal to 40% of your

annuity and your widow(er) would receive a survivor annuity equal

to 15% of your annuity.

However, if the former spouse later loses entitlement to the survivor

annuity (through remarriage before age 55, under the terms of the court

order, or death), your widow(er) would then receive a survivor annuity

equal to 55% of your annuity.

Electing an Insurable Interest Annuity For a Current Spouse

See the discussion on page 2 of these instructions for the definition of

Insurable Interest.

1. If a former spouse's court-ordered survivor annuity will prevent your

current spouse from receiving a survivor annuity that is sufficient to

meet his or her anticipated needs, you may want to elect an insurable

interest annuity for your current spouse.

2.

If you elect an insurable interest survivor annuity for your current

spouse, you and your current spouse must jointly waive the regular

survivor annuity. To accomplish this:

a. initial box 1B in Section C of the OPM Form 1496, and write

"none" in the space following that box (i.e., election to provide no

regular survivor annuity);

b. complete Section C, item 4 naming your current spouse (i.e.,

election to provide insurable interest benefit);

c. complete Part 1, item b of OPM Form 1496, Schedule B;

d. have Parts 2 and 3 of Schedule B completed (i.e., spouse's consent

to insurable interest benefit in lieu of regular survivor annuity).

3. If you elect an insurable interest survivor annuity for your current

spouse and your former spouse loses entitlement before you die, you

may request that the reduction in your annuity to provide the insurable

interest annuity be converted to the regular spouse survivor annuity;

this would result in a larger annuity. (See Annuity Election Changes

After Retirement.) Your current spouse would then be entitled to the

regular survivor annuity. In addition, if your former spouse loses

entitlement after you die, your widow(er) can ask the Office of

Personnel Management (OPM) to substitute the regular survivor

annuity for the insurable interest survivor annuity.

4.

If for any reason OPM cannot allow your insurable interest election for

your current spouse, your current spouse will be considered elected for

a maximum regular survivor annuity unless your current spouse signs

another form consenting to less than a maximum regular survivor

annuity or OPM approves a waiver of consent.

Annuity Election Changes After Retirement

1. Subject to the consent requirement, you may name a new survivor or

change your election if, not later than 30 days after the date of your

first regular monthly payment, you file a new election in writing. If the

person you named to receive a survivor annuity dies or your current

marriage ends through death, divorce or annulment, you should write

OPM immediately if you want to change your election. Your first

regular monthly payment is the first annuity check payable on a

recurring basis after OPM has initially adjudicated the regular rate of

annuity payable under CSRS and has paid the annuity accrued since

the time of retirement.

Page 4

OPM Form 1496

Revised October 2002

2. When the 30-day period following the date of your first regular

monthly payment has passed, you cannot change your election except

under the circumstances explained in the following paragraphs.

3. You may change your decision not to provide a survivor annuity for

your spouse at retirement or you may increase the survivor annuity

amount you elected for your spouse at retirement if you request the

change in writing no later than eighteen months after the

commencing date of your annuity, and if you pay a deposit

representing the difference between the reduction for the new

survivor election and the original survivor election, plus a charge of

$245.00 per each thousand-dollar change in the designated survivor

base. (Interest on the deposit must also be paid.) Such an election

would cancel any joint waivers made at retirement. However, the

total survivor annuity(ies) provided for former spouses (by court

order or election) and the current spouse cannot exceed 55% of your

annuity. You may not change your election to provide a lesser

survivor benefit for your spouse, except as discussed in item 1 above.

4.

The reduction in your annuity to provide a survivor annuity for your

current spouse stops if your marriage ends because of death, divorce,

or annulment. However, you may elect, within two years after the

marriage ends, to continue the reduction to provide a former spouse

survivor annuity for that person, subject to the restrictions in

paragraph 10. If you marry someone else before you make this

election, your new spouse must consent to your election.

5.

The reduction in your annuity to provide a survivor annuity for a

former spouse ends: (1) when the former spouse dies, (2) when the

former spouse remarries before reaching age 55, or (3) under the

terms of the court order that required you to provide the survivor

annuity for the former spouse when you retired. (Modifications of the

court order issued after you retire do not affect the former spouse

annuity.) However, if at retirement you had elected a survivor

annuity for your current spouse (or another former spouse), the

reduction will be continued to provide the survivor annuity for that

person. If you have not previously made an election regarding a

current spouse whom you married after retirement (or if your election

regarding a current spouse at retirement was based on a waiver of

spousal consent), you may, within two years after the former spouse

loses the right to a survivor annuity, elect a reduced annuity to

provide a survivor annuity for that current spouse. This election is

subject to the restrictions given in paragraph 10.

6.

If you were unmarried at retirement, you may elect, within two years

after a post-retirement marriage, a reduced annuity to provide a

maximum or less-than-maximum survivor annuity for your spouse,

subject to the restrictions given in paragraph 10. Your annuity will

be reduced no earlier than nine months after the date of your

marriage.

7.

If you were married at retirement, that marriage ends, and you marry

again, you may elect, within two years after the remarriage, a reduced

annuity to provide a survivor annuity for your new spouse, subject to

the restrictions given in paragraph 10. (However, if you remarry the

same person you were married to at retirement and that person had

previously consented to your election of no survivor annuity, you

may not elect to provide a survivor annuity for that person when you

remarry.) Your annuity will be reduced no earlier than nine months

after the date of your marriage.

8. If, at retirement, you received (by election or court order) a reduced

annuity to provide a survivor annuity for a former spouse and you

elected to provide an insurable interest survivor annuity for your

current spouse, you may change the insurable interest election to a

regular current spouse survivor annuity within two years after your

former spouse loses entitlement (because of remarriage before age 55,

the terms of the court order or death), subject to restrictions a and b

given in paragraph 10.

9.

The reduction in your annuity to provide an insurable interest annuity

ends if the person you named to receive the insurable interest annuity

dies or when the person you named is your current spouse and you

change your election as explained in paragraph 8. The reduction also

ends if, after you retire, you marry the insurable interest beneficiary

and elect to provide a regular survivor annuity for that person. If you

marry someone other than the insurable interest beneficiary after you

retire and elect to provide a regular survivor annuity for your new

spouse, you may elect to cancel the insurable interest reduction.

10.

Post-retirement survivor elections are subject to the following

restrictions:

a.

They cannot be honored to the extent that they conflict with

the terms of a court order that requires you to provide a

survivor annuity for a former spouse;

b.

They cannot be honored if they cause combined current and

former spouse survivor annuities to exceed 55% of your

unreduced annuity; and

c.

If, during any period after you retired, your annuity was not

reduced to provide a current or former spouse survivor

annuity, you must pay into the retirement fund an amount

equal to the amount your annuity would have been reduced

during that period plus 6% annual interest.

11. Insurable interest elections are not available after retirement.

Section D - Federal Service

The letter attached to this package includes a list of your Federal and Postal

service presently included in your retirement record. If you have any

additional civilian Federal or Postal service, before or after the date of final

separation, list it in the spaces provided. Attach additional sheets of paper if

more space is needed. Attach a copy of any available documentation you

may have to verify the additional service claimed. Documentation which

may be useful in verifying service includes notices of appointment,

separation or salary change. The Office of Personnel Management will

attempt to locate official records to verify your claim even if you cannot

supply documentation. If we are unable to do so, we will let you know.

Information you give will help us to assure proper credit for all service.

Federal service is service as an employee of the United States Government.

Generally, to be considered an employee of the United States Government

for civil service retirement purposes, a person must be:

a. engaged in the performance of Federal functions under the

authority of an act of Congress or an Executive Order,

b. appointed in the Civil Service by a Federal officer, and

c. under the supervision and direction of a Federal officer.

Page 5

OPM Form 1496

Revised October 2002

Section E - Military Service

Military service can be added to your civilian Federal service under

the circumstances outlined below:

Item 1: If you have performed active duty that terminated under

honorable conditions in the armed services or other uniformed services

of the United States, enter, for each period of active duty, (a) the

branch of service (Army, Navy, etc.), (b) your serial number for that

period of service, (c) the beginning and ending dates of active duty,

(d) your last grade or rank during that period of service, and (e) your

organization (company, division, etc.) at discharge. If available, attach

a copy of your discharge certificate or other documentation of the

active military service.

Active military service, generally rendered on a full-time basis with

military pay and allowances, includes the following:

a. Army, Navy, Marine Corps, Air Force or Coast Guard of the

United States.

b. Cadet or Midshipman of the United States Military Academy,

United States Air Force Academy, United States Coast Guard

Academy, or United States Naval Academy.

Service in reserve components and/or the National Guard is not

considered active Federal military service except when ordered to

active duty in the service of the Unites States and during an initial

training period.

Information about your active duty military service is needed so that

we can compare your claim with other records and request verification

of all claimed military service. This assures that you are credited with

the correct amount of active military service.

Item 2: Indicate whether or not you are receiving or have applied for

military retired pay.

If you are receiving military retired pay, your military service cannot

be used for civil service retirement purposes, unless:

a.

Your final separation was before April 1, 1948, and military

retired pay was based on disability, or under Chapter 67, Title

10 (formerly Title III, Public Law 80-810), or

b.

Your final separation was on/after April 1, 1948, and

on/before September 30, 1956, and military retired pay was

either on account of disability incurred in combat with an

enemy of the United States or which resulted from an explosion

of an instrumentality of war, or under Chapter 67, Title 10,

(formerly Title III, Public Law 80-810).

If you are receiving military retired pay, the conditions in a or b above

do not apply to you, and you wish to combine your military and

civilian service to compute your civil service annuity, you must waive

your military retired pay.

In order to waive military retired pay you should send a written

request, specifying the effective date of the waiver and your social

security number, directly to the Military Finance Center from which

you receive retired pay. Preferably this should be at least 60 days

before the commencing date of your civil service annuity (your 62nd

birthday). Your letter might say, "I, (full name, military serial number,

and social security number), hereby waive my military retired pay for

civil service retirement purposes, effective close of business (the day

before annuity commences)." If you wish, add "I authorize the Office

of Personnel Management to withhold from my civil service retirement

annuity any amount of military pay granted beyond the effective date of this

waiver due to any delay in receiving or processing this election." This

authorization may hasten the processing of your waiver and your retirement

application.

If you have already waived military retired pay in order to receive credit for

active duty military service for civil service retirement purposes, attach a

copy of your request for waiver and of any reply you have received.

Section F - Other Claims Information

Item 1: Indicate whether or not you have ever applied for retirement,

refund, deposit or redeposit, or voluntary contributions, under the Civil

Service Retirement System. If you have, indicate which in 1a and the

applicable claim numbers in 1b. This helps to assure that all of your records

are located and that proper credit is given for your service, and for any

deposit, redeposit, or voluntary contribution payments you have made.

Item 2: Indicate whether or not you have ever been employed under

another retirement system for Federal or District of Columbia employees. If

your answer is "yes," fill in the name of that retirement system in 2a and the

dates of services in 2b. This helps to assure proper consideration is given to

all of your service. The service you show here cannot be used to compute

your civil service annuity if the other retirement system is paying you

retirement based on the service.

Item 3: If you have applied for, or received, workers' compensation from

the Office of Workers' Compensation Programs, U.S. Department of Labor,

because of a job-related illness or injury sustained during Federal

employment, check the "yes" box and furnish your claim numbers and dates

of benefits in 3a and 3b.

The information requested regarding benefits from the Office of Workers'

Compensation Programs is needed because the law prohibits payment of

both civil service retirement annuity and compensation for total or partial

disability under the Federal Employees' Compensation Act at the same time.

In some cases, credit for service, particularly for periods of leave without

pay, may also be affected.

Section G - Certification of Applicant

Be sure to sign (do not print) and date your application, after reviewing the

warning.

FILING YOUR APPLICATION

Send your completed application, and any attachments requested in the

instructions or the letter, to Office of Personnel Management, Civil Service

Retirement System, Retirement Operations Center, Boyers, Pennsylvania,

16017.

WHAT HAPPENS AFTER YOU FILE YOUR APPLICATION

1.

The Office of Personnel Management will acknowledge receipt of your

application and give you an identification card. This card will give you

your claim number, which will begin with the letters "CSA." This

number will be very important to you as an annuitant, because you will

need to refer to it any time you write or call us in connection with your

annuity.

2.

We will search our files for all records and previous claims related to

your Federal service and place these with your application in your CSA

claim file.

Page 6

OPM Form 1496

Revised October 2002

3. We will determine if any additional information is needed to

adjudicate your claim and obtain it. For example, we may need to

obtain official records of service claimed by you but not recorded

in our files, certification of your military retired pay status, etc.

We can obtain most of this information from other Federal

agencies; we will let you know if any additional information is

needed from you. Finally, we will compute the amount of your

annuity.

4.

When we finish processing your application, we will send you a

(or payments sent to your bank) by the U.S. Department of the

booklet explaining your benefits. Checks will be mailed to you

Treasury.

WHAT TO DO IF YOUR ADDRESS CHANGES

BEFORE PROCESSING IS COMPLETED

If your address changes before you receive your acknowledgment and

identification card, write us over your personal signature, giving your

name, date of birth, social security number, and your new address. If

you have received your acknowledgment, remember to refer to your

claim number. In addition, you should promptly notify your old Post

Office of your forwarding address.

HOW TO HAVE YOUR ANNUITY PAYMENT SENT

TO A BANK OR FINANCIAL INSTITUTION

To have your annuity payments sent directly to a bank or financial

organization, contact us or complete Standard Form 1199A, Direct

Deposit Sign-Up Form. This form is available only from your bank or

financial organization. To complete it you will need the Civil Service

Annuity claim number we give you when we acknowledge receipt of

your application.

Having your annuity payments sent directly to your bank or financial

organization is both convenient and safe, and eliminates the possibility

of lost or stolen checks. It also assures that payments are deposited and

available for your use, even when you are away from home.

Informational material continues to be sent to your correspondence

address.

COST-OF-LIVING INCREASES

Cost-of-Living increases are effective on December 1 and are payable

in the January annuity payment. They are determined by the

percentage increase in the average Consumer Price Index for the "base

quarter" of the year in which they are effective over the "base quarter"

of the preceding year. The "base quarter" is July, August, and

September. The first cost-of-living increase you receive will be

prorated to reflect the number of months you are on the retirement

rolls before the increase is effective.

AMOUNT OF ANNUITY

The Office of Personnel Management will compute your annuity. See

Annuity Computation for more information.

LENGTH OF SERVICE

Add up the years, months and days of all your periods of Federal service,

including creditable military service, before your final separation from

civilian service covered by the retirement act. The total years and months

constitute your length of service. Any days left over, that don't make a full

month, are dropped.

If redeposit is not made for service which ended before October 1, 1990,

and your annuity commences on or after December 2, 1990, you will

receive credit for the period of service covered by the refund in your

annuity computation. However, if you do not pay the redeposit for this

service, your annuity will be permanently, actuarially reduced. You will be

given an opportunity to pay the redeposit.

AVERAGE PAY

Your "high-5" average pay, which is the highest average annual pay

produced by your basic pay rates during any 5 consecutive years of service,

each rate weighed by length of time it was in effect, is used in the

computation of your annuity. In most cases, the last five years of service

give the highest average pay, but any 5 consecutive years may be used.

Within-grade periodic pay increases are part of basic pay, but additional pay

such as overtime is not.

ANNUITY COMPUTATION

Separation between January 24, 1942, and March 31, 1948

You can estimate the amount of your annuity by first multiplying $30.00 by

your years of creditable service; then adding $8.00 for each $100.00 in your

retirement account. For example, if you had 12 years' service and $1,000 in

your retirement account, your basic annuity would be roughly ($30 x 12) +

$80, or $440 a year.

Separation on/after April 1, 1948 and before October 1, 1956

If your average pay (the average annual basic pay for the highest 5

consecutive years of your service) is less than $5,000, your basic annuity

will be 1% of your average pay, plus $25.00, multiplied by your total years

of service. If your average pay is $5,000 or more, your basic annuity will be

1-1/2% of your average pay, multiplied by your total years of creditable

service.

In no case may basic annuity exceed 80% of average pay.

If deductions were not withheld during creditable service on/after August 1,

1920, your basic annuity will be reduced by 10% of the unpaid deposit (the

amount of deductions plus interest) unless deposit is paid before

adjudication is completed. (This type of service is called noncontributory

service.)

Increase based on separation before October 20, 1969

Annuities based on final separation before October 20, 1969, are increased

by $20.00 per month beginning on the commencing date of annuity or

August 1, 1974, whichever is later.

Reduction for Survivor Annuity

This reduction is explained under INSTRUCTIONS FOR COMPLETING

APPLICATION, Section C, Annuity Election. Unmarried children under

age 18 are usually eligible for survivor annuity after your death. This

eligibility does not depend on the type of annuity you elect and does not

reduce the amount of your annuity.

Page 7

OPM Form 1496

Revised October 2002

ADDITIONAL ANNUITY

An employee who, in addition to the amounts withheld from salary,

has made voluntary contributions to the Retirement Fund will be paid,

in addition to the regular annuity, $7.00 plus $0.20 for each full year

the individual is over age 55 at retirement, for each $100.00 in his or

her voluntary contributions account. If an employee elects a voluntary

contributions survivor annuity, the additional annuity purchased will

be reduced based on the difference between the annuitant's age and the

survivor's age. The survivor's additional annuity is 50% of the

employee's additional reduced annuity.

Privacy Act Statement

Solicitation of this information is authorized by the Civil Service

Retirement law (Chapter 83, title 5, U.S. Code). The information you

furnish will be used to identify records properly associated with your

application for Federal benefits, to obtain additional information if

necessary, to determine and allow present or future benefits, and to

maintain a unique identifiable claim file for you. The information may be

shared and is subject to verification, via paper, electronic media, or through

the use of computer matching programs, with national, state, local or other

charitable or social security administrative agencies in order to determine

benefits under their programs, to obtain information necessary under this

program, or to report income for tax purposes. It may also be shared with

law enforcement agencies when they are investigating a violation or

potential violation of civil or criminal law. Public law 104-134 (April 26,

1996) requires that any person doing business with the Federal government

furnish a social security number or tax identification number. This is an

amendment to title 31, Section 7701. Failure to furnish the requested

information may delay or make it impossible for us to determine your

eligibility for benefits.

PAYMENT AND ACCRUAL OF ANNUITY

All annuities are payable in monthly installments on the first business

day of the month following the one for which the annuity has accrued.

Monthly annuity rates are rounded down to the next lower dollar. This

provision also applies to annuities that were redetermined and to

cost-of-living adjustments.

IF YOU NEED HELP TO COMPLETE THIS

APPLICATION -

* Write to:

Office of Personnel Management

Retirement Operations Center

P.O. Box 45

Boyers, PA 16017-0045

Public Burden Statement

We think this form takes an average 60 minutes per response to complete,

including the time for reviewing instructions, getting the needed data, and

reviewing the completed form. Send comments regarding our estimate or

any other aspect of this form, including suggestions for reducing

completion time, to the Office of Personnel Management, OPM Forms

Officer (3206-0121), Washington, DC 20415-7900. The OMB Number,

3206-0121 is currently valid. OPM may not collect this information, and

you are not required to respond, unless this number is displayed.

You may call our Retirement Information Office toll-free at

1-888-767-6738 Monday through Friday from 7:30 a.m. to 7:45 p.m.

That office is closed on Federal holidays. If you are calling within the

local Washington, DC, area, dial 202-606-0500. Callers who use TDD

equipment should call 1-800-878-5707 or within the local calling area

202-606-0551.

We also provide retirement brochures, forms, and other information on

the Internet at http://www.opm.gov/retire and respond to email sent to

Page 8

OPM Form 1496

Revised October 2002

Civil Service Retirement System

Form Approved

OMB No. 3206-0121

APPLICATION FOR DEFERRED RETIREMENT

(For Persons Separated Before October 1, 1956)

Please read the Instructions carefully before you complete this application.

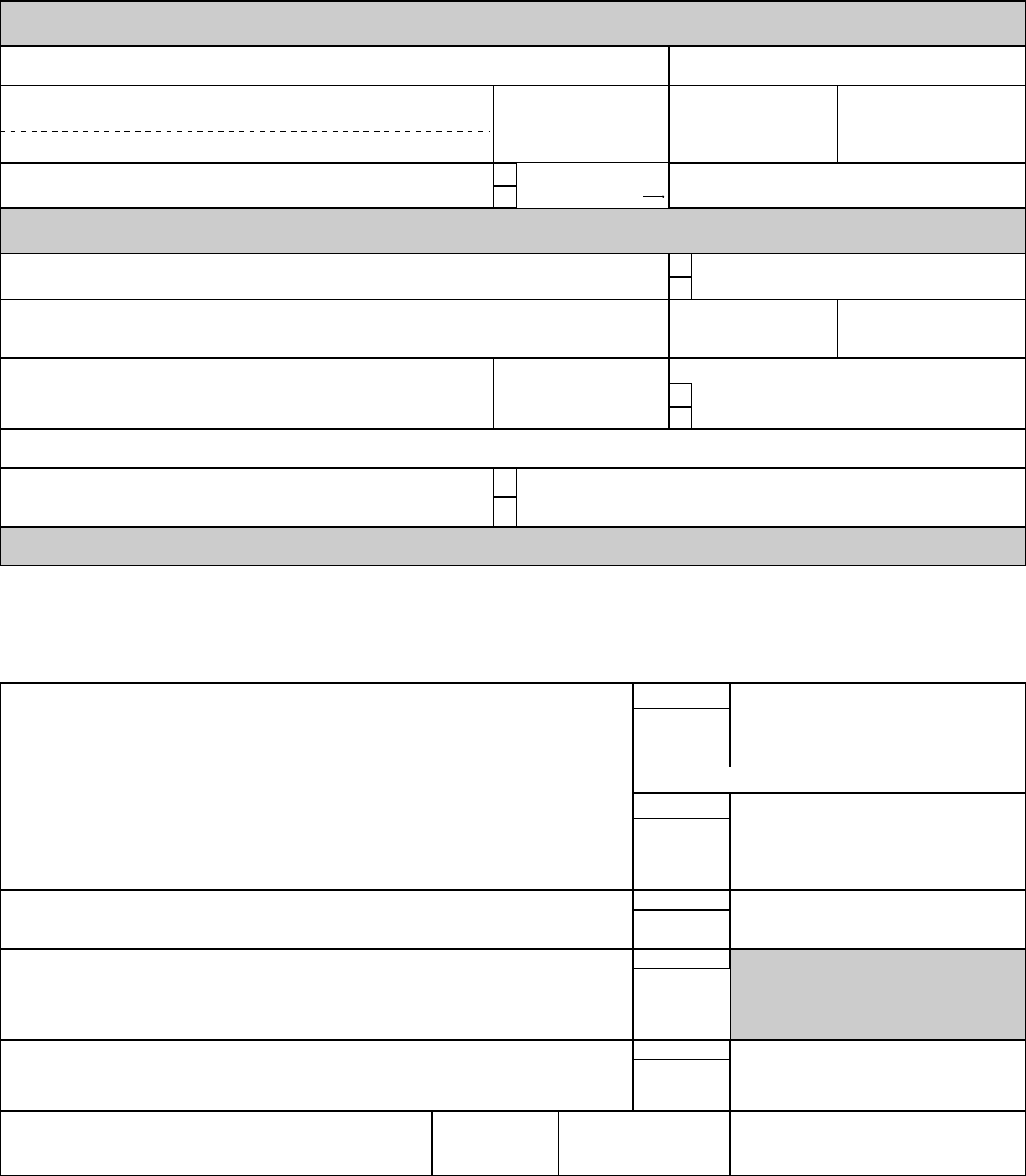

Section A - Identifying Information

1. Name (last, first, middle)

2. List all other names you have used

3. Address (number, street, city, state, ZIP code)

4. Telephone number

(including area code)

5. Date of birth

(mm/dd/yyyy)

6. Social Security Number

7. Are you a citizen of the United States of America?

Yes

No - If "No," give

7a. Name of country of which you are a citizen

Section B - Marital Information

1. Are you married now? (A marriage exists until ended by death, divorce or annulment.)

Yes (also complete items 1a - 1f below)

No

1a. Spouse's name (last, first, middle)

1b. Spouse's date of

birth (mm/dd/yyyy)

1c. Spouse's Social

Security Number

1d. Place of marriage (city, state) 1e. Date of marriage

(mm/dd/yyyy)

1f. Marriage performed by

Clergyman or Justice of the Peace

Other (explain):

STATEMENT REGARDING FORMER SPOUSES

All applicants must complete this statement if their annuities commence on or after May 7,

1985.

2. Do you have a living former spouse(s) whose marriage to you

ended by divorce or annulment on or after May 7, 1985, and to

whom a court order gives a survivor annuity?

Yes - Attach a certified copy of the court order(s) and any amendments.

No

Section C - Annuity Election

Make your election by initialing the box beside the type of annuity

you want to receive and give any other information requested.

Consider your election carefully. No change will be permitted after

your annuity is finally granted except as explained in the

instructions. If you are currently married and you do not elect

maximum survivor benefits, the law requires that your spouse

consent to your election as discussed in the attached instructions, you

must complete OPM Form 1496, Schedule B and attach it to this

application.

1. I choose a reduced annuity with survivor annuity for my

spouse equal to:

INITIALS

A) 55% OF ALL MY ANNUITY

OR

INITIALS

B) 55% OF $_______________ A YEAR

This amount must be less than your

yearly annuity.

2. I choose a self-only annuity.

INITIALS

All retiring former employees may

choose this type of annuity

3. I choose a reduced annuity to provide a former spouse

or combination current/former spouse survivor annuity.

The attached Schedule A gives my election.

INITIALS

4. I choose a reduced annuity with a survivor annuity

for the person named below who has an insurable

interest in me.

INITIALS

You must be healthy and willing to

undergo a physical examination if you

choose this type of annuity.

Name of person with insurable interest Relationship to

you

Date of birth

(mm/dd/yyyy)

Social Security Number

U.S. Office of Personnel Management OPM Form 1496

Previous editions are not usable Revised October 2002

(445) 454-5464

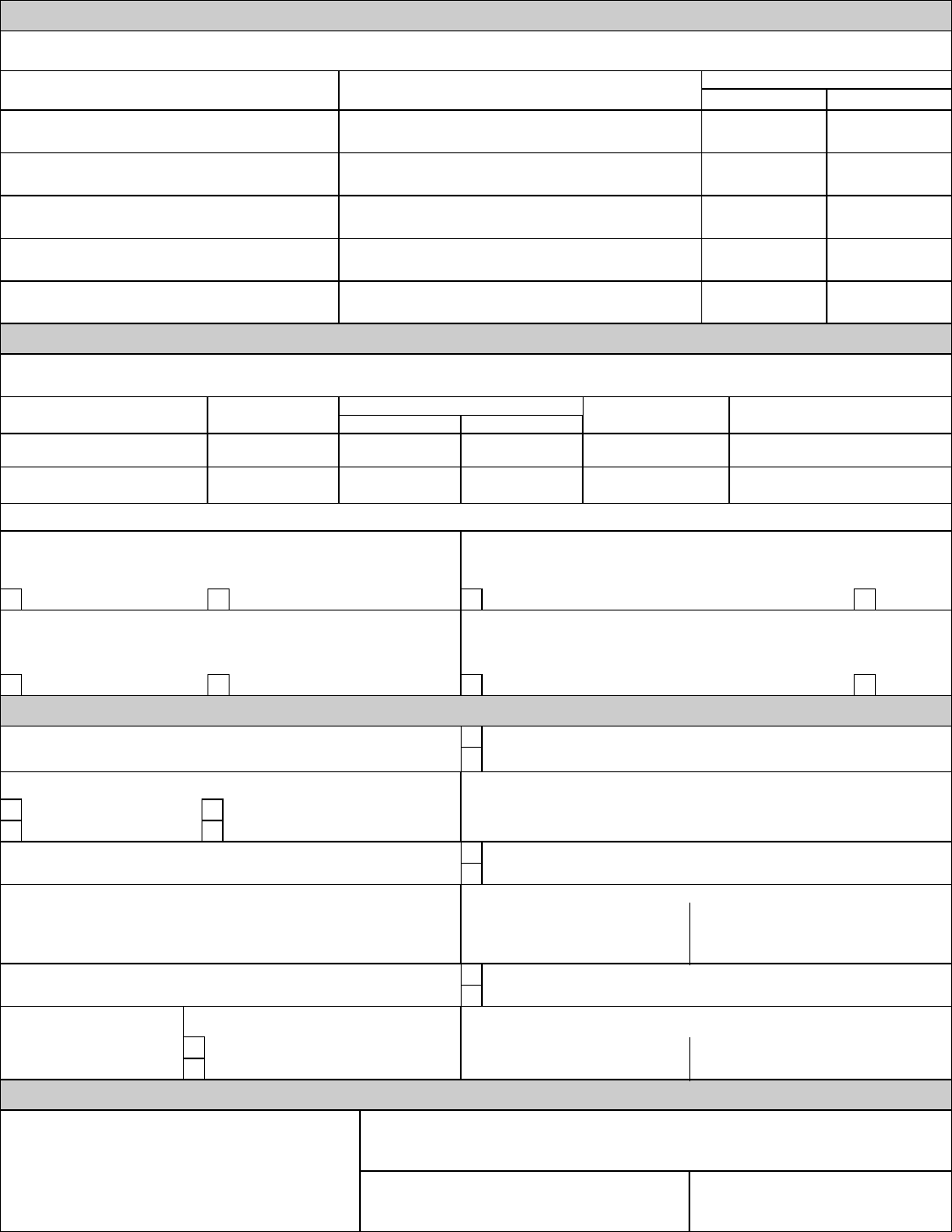

Section D - Federal Service

List below any Federal (or Postal) service you have performed that is NOT included in the list of your service on the form notifying you of your

eligibility for deferred retirement. Attach any documentation you may have to prove your claim to additional service.

Dept. or agency, including bureau or division Location (city and state)

Dates of service

From (mm/dd/yyyy) To (mm/dd/yyyy)

Section E - Military Service

1. If you have performed active, honorable service in the Armed Services or other uniformed services of the United States (see instructions for

definition), complete items 1a-1e below and attach a copy of your discharge certificate or other certificate of active military service (if available).

1a. Branch of service 1b. Serial number

1c. Dates of active duty

From (mm/dd/yyyy) To (mm/dd/yyyy)

1d. Last grade or

rank

1e. Organization at discharge

(Div., Co., etc.)

2. If you are receiving or have applied for military retired pay (including disability retired pay), complete items 2a-2d below.

2a. Are you receiving or have you ever applied for military retired or

retainer pay? (Answer "yes" if you are receiving payments from the

Department of Veterans Affairs instead of military retired pay.)

Yes

No

2b. Was your military retired or retainer pay awarded for disability

incurred in combat or caused by an instrumentality of war?

(If available, attach a

copy of notice of

Yes

award)

No

2c. Was your military retired or retainer pay awarded for reserve service

under Chapter 67, title 10? [Now Chapter 1223, title 10]

(If available, attach a copy of

Yes notice of award) No

2d. Are you waiving your military retired pay in order to receive

credit for military service for Civil Service Retirement Benefits?

(See instructions for information about how to

request a waiver and its effect on your annuity.

Yes

Attach a copy of your waiver request to this form.)

No

Section F - Other Claims Information

1. Have you previously filed any application under the Civil Service

Retirement System (for retirement, refund, deposit, or voluntary

contributions)?

Yes

(also complete items 1a and 1b below)

No

1a. Type of application

Retirement

Deposit or redeposit

Refund

Voluntary contributions

1b. Claim number(s)

2. Have you ever been employed under another retirement system for

Federal or District of Columbia employees?

Yes

(also complete items 2a and 2b below)

No

2a. Name of other retirement system 2b. Dates of service

From (mm/dd/yyyy) To (mm/dd/yyyy)

3. Have you ever received compensation under the Federal Employees

Compensation Act?

Yes

(also complete items 3a, 3b and 3c below)

No

3a. Compensation claim no. 3b. Description of benefit

Scheduled award

Total or partial disability compensation

3c. Dates benefits received

From (mm/dd/yyyy) To (mm/dd/yyyy)

Section G - Applicant's Certification

WARNING

Any intentionally false or willfully misleading statement, certification,

or response you provide in this application is a violation of the law

punishable by a fine of not more than $10,000 or imprisonment of

not more than 5 years, or both (18 U.S.C. 1001)

I hereby certify that all statements made in this application are true to the best of my

knowledge and belief. I have read and understand all of the information provided in the

instructions to this application.

Signature (do not print) Date (mm/dd/yyyy)

U.S. Office of Personnel Management OPM Form 1496

Previous edition

s are not usable

Revised October 2002