Fillable Printable OPM Form 1562

Fillable Printable OPM Form 1562

OPM Form 1562

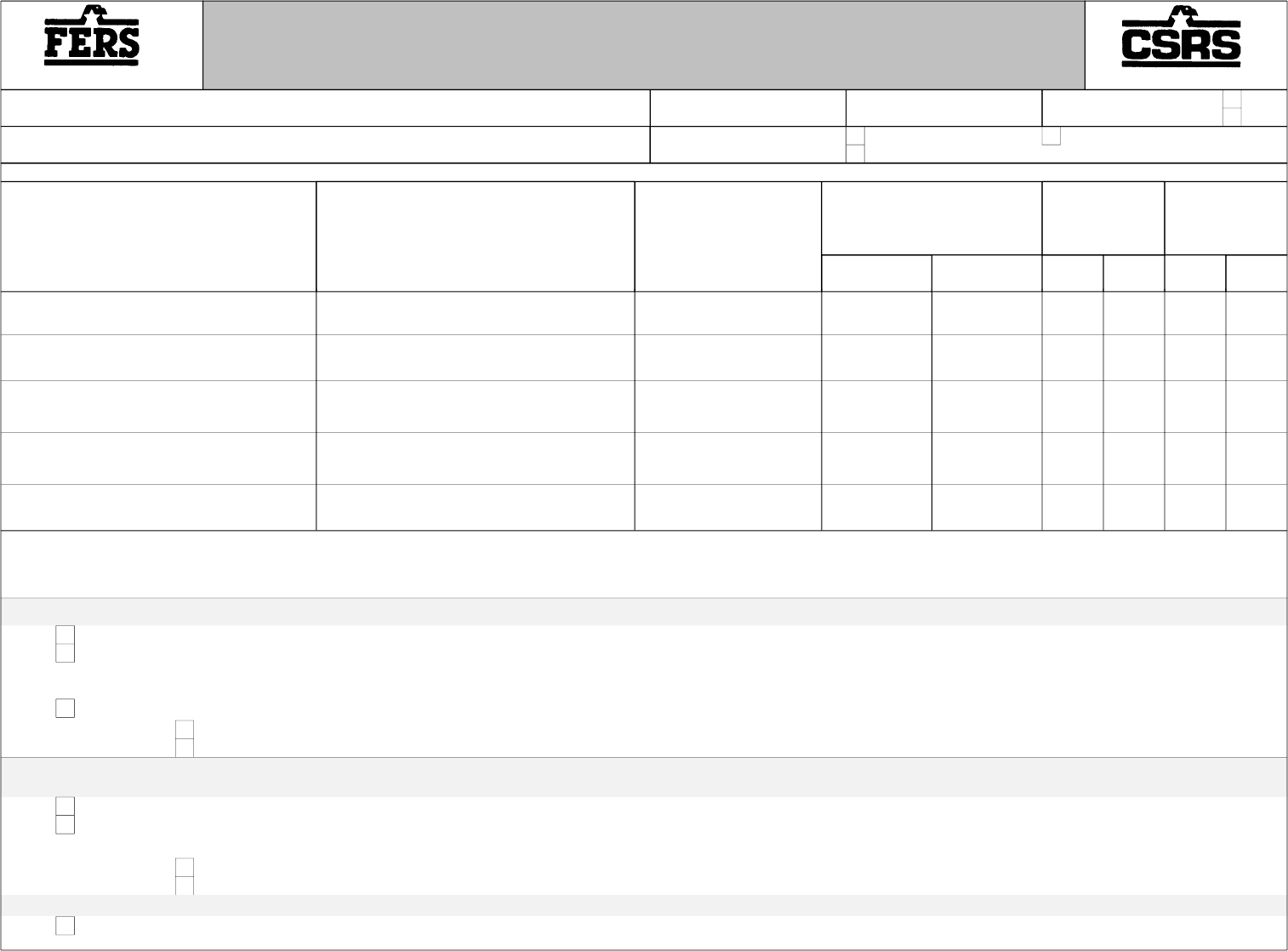

Application For Return of Excess Retirement Deductions

Federal Employees Retirement System

To avoid delay in payment:

Federal Employees

Civil Service

(1) Complete application in full; (2) Type or print in ink; (3) Read the instructions and tax information included with this form.

Retirement System

Retirement System

1. Name (last, first, middle) 2. Date of birth (mm/dd/yyyy) 3. Social Security Number

4. Are you a citizen of the

Yes

United States of America?

No

5. List all other names you have used (including maiden name, if applicable.) 6. Previous applications filed

Retirement Annuity Deposit

(indicate by "X")

Refund

7. List below all of your civilian and military service for the United States Government

Indicate whether

H

a

ve you paid

retirement

deposit for any

deductions were period including

Periods of Service

Department or Agency

Location of Employment

Title of Position

withheld from your military service?

(Including bureau, branch, or division

(City, State and ZIP Code)

salary. (Check One) (Check one)

where employed)

Fully or

Beginning Date Ending Date Not Not

Partially

Withheld

(mm/dd/yyyy) (mm/dd/yyyy) Withheld Paid

Paid

8. Indicate how you wish to have your excess deductions paid to you if the amount is $200 or more. If your payment is less than $200, the Office of Personnel Management (OPM) cannot roll it over. It will be paid directly to you.

Please carefully read all of the information provided with this form, including the Special Tax Notice Regarding Rollovers, before you make your decision. An error in completing this form could delay your payment or cause

payment in a manner you did not intend. If you elect to roll over less than 100% of your excess deductions, the total amount you roll over to any one organization must be at least $500. Make one choice in each section below,

unless you need additional information. If you need additional information before making this election, check the last box below.

Pay the INTEREST PORTION (Taxable Portion) of my Excess Deductions Refund –

Pay ALL by check made payable to me, with 20% Federal Income Tax Withholding.

Pay ALL by check made payable to my Individual Retirement Arrangement (IRA) or Eligible Employer Plan. (Your financial institution or employer plan must complete the financial institution certification form in this

package.)

Name of Financial Institution or Employer Plan________________________________________________________________________________________________________________________________

Pay ALL to my Thrift Savings Plan Account. (You must sign and submit form TSP-60, Request for a Transfer Into the TSP, to OPM. Form TSP-60 is available on the internet at http://www.tsp.gov.)

Mail the check

to the above institution or plan.

to me. I will deliver the check to the above institution or plan.

Pay the CONTRIBUTION PORTION (After-Tax Portion) of my Excess Deductions Refund –

(The Thrift Savings Plan will not accept this portion of your excess deductions refund.)

Pay ALL by check made payable to me.

Pay ALL by check made payable to my IRA or Eligible Employer Plan. (Your financial institution or employer plan must complete the financial institution certification form in this package.)

Name of Financial Institution or Employer Plan________________________________________________________________________________________________________________________________

Mail the check

to the above institution or plan.

to me. I will deliver the check to the above institution or plan.

I Need Additional Information Before I Decide

I elect to have my excess deductions refund computed and a rollover package with all my options sent to me before I decide how it should be paid. (Electing this option delays your payment at least an additional 30

days.)

U.S. Office of Personnel Management OPM Form 1562

Previous edition is not usable.

Reproduce Locally

Revised April 2005

WARNING:

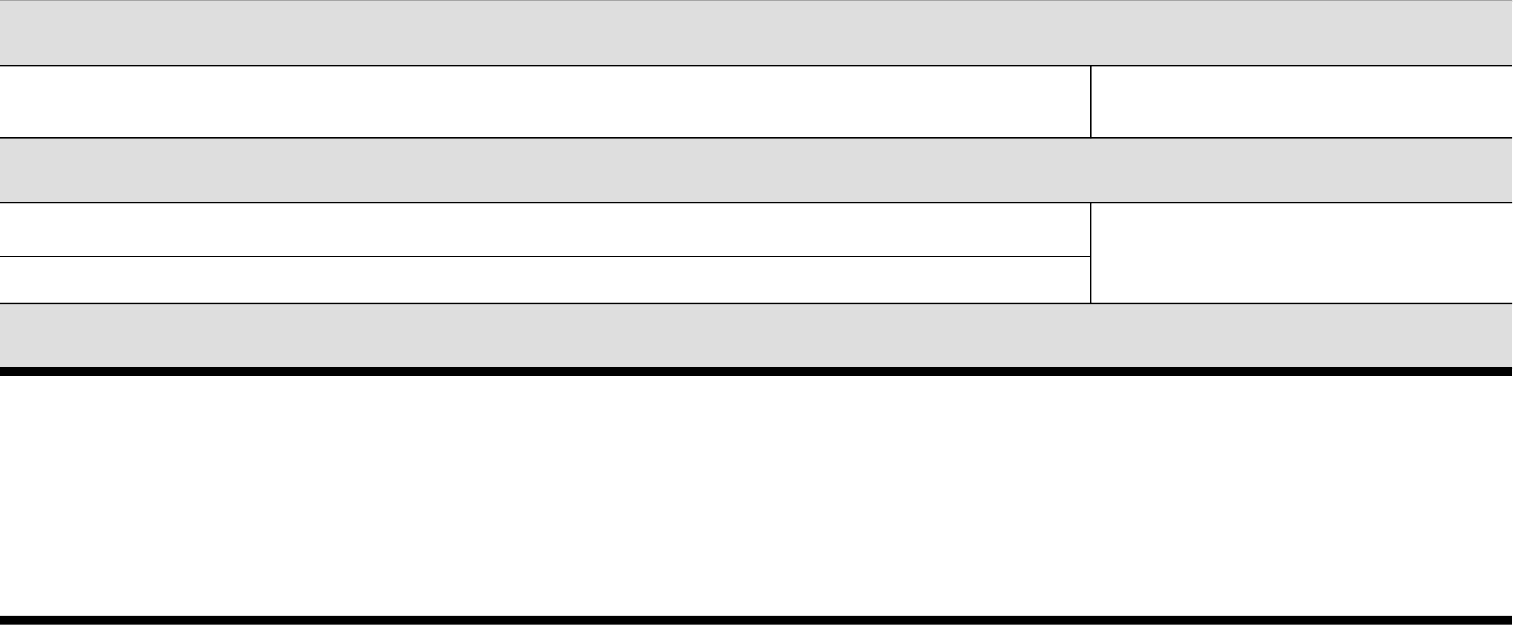

9.

APPLICANT CERTIFICATION:

Your Signature

Date (mm/dd/yyyy)

Telephone Number

NOTE:

( )

Any intentional false statement in this application or willful misrepresentation relative thereto is a violation of the law punishable by a fine of not more than $10,000 or

imprisonment of not more than 5 years, or both. (18 U.S.C. 1001)

I hereby certify that all statements in this application, including any information I have given, are true to the best of my belief and knowledge and that the tax

withholding election made here reflects my wishes.

(Do not print)

10. Address for mailing refund check (number, street, city, state, ZIP Code) We cannot authorize payment if this address is erased or otherwise changed

(including area code)

This application should not be offered to a financial institution or other person as collateral or security for a loan. An employee must apply for payment personally and payment must be

made directly to him or her. However, outstanding debts to the U.S. Government can, at the Government's request, be withheld from a payment provided all legal requirements are met.

Privacy Act Statement

Solicitation of this information is authorized by the Civil Service Retirement law (Chapter 83, title 5, U.S. Code) and the Federal Employees Retirement law (Chapter 84, title 5, U.S. Code). The information you furnish will be used to

identify records properly associated with your application for Federal benefits, to obtain additional information if necessary, to determine and allow present or future benefits, and to maintain a uniquely identifiable claim file. The

information may be shared and is subject to verification, via paper, electronic media, or through the use of computer matching programs, with national, state, local or other charitable or social security administrative agencies in order to

determine benefits under their programs, to obtain information necessary for determination or continuation of benefits under this program, or to report income for tax purposes. It may also be shared and verified, as noted above, with

law enforcement agencies when they are investigating a violation or potential violation of civil or criminal law.

Executive Order 9397 (November 22, 1943) authorizes the use of the Social Security Number. The Government may use your number in collecting and reporting amounts that you owe the Government. Failure to provide information

may delay or prevent our determination of your eligibility to receive a refund of your excess retirement deductions.

Where to File your Application

1.

If you are employed or have been separated 30 days or less, this application should be forwarded to the office in which you were last employed.

2. If you have been separated more than 30 days and want a refund of your total deductions, use form SF 3106; otherwise, forward this application to the Office of Personnel Management, Federal

Employees Retirement System, P.O. Box 45, Boyers, PA 16017-0045.

OPM Form 1562

Revised April 2005

PRINT

CLEAR FORM

SAVE AS

Instructions to Employee

Do not complete this application if you had more than 5 years of civilian

service as of the effective date of your Federal Employees Retirement

System (FERS) coverage. (Service after 1983 covered by both Civil Service

Retirement System (CSRS) and social security deductions does not count

toward the 5 year limit.) The notice of personnel action concerning your

transfer to FERS will generally indicate if you are eligible for a refund. If

your personnel office determines that you are not eligible for a return of

excess deductions because you had 5 years of creditable civilian service,

your application will be returned to you. If your application is returned to

you, your service will be credited under the Civil Service Retirement

System. You may request, in writing, your personnel office to reevaluate

your application if you believe you have less than five years of creditable

civilian service. If your agency again determines that you are not eligible

Applicants are permitted to roll over their excess retirement deductions

payment to an individual retirement arrangement (IRA) or an eligible

employer plan. The actual retirement deductions are not taxable. However,

any interest paid on the deductions is taxable. If OPM pays the interest to

you, 20% Federal income tax must be withheld. If the taxable portion is

rolled over, we will not withhold any Federal income tax. If you roll all of

your excess deductions into an IRA, you are responsible for accounting

separately for the taxable and non-taxable portions. If you want to roll all of

your excess deductions into an eligible employer plan, you are responsible

for selecting a plan that accounts separately for the taxable and non-taxable

portions. Please note that the Federal Retirement Thrift Savings Plan will

accept the taxable portion (interest portion), but will not accept the

non-taxable portion (actual retirement deductions).

If your excess deductions are less than $200, we are not required to withhold

20% of the interest for Federal income tax and we cannot roll over any of the

amount. You can still roll over an amount equal to the excess deductions

personally after we send the payment to you.

You must complete Question 8 on this application, instructing us how to pay

any excess deductions refund you may be due to receive. Since we cannot

tell you the amount of your excess deductions until we receive your

application and complete the calculations, you can instruct us to prepare an

election form telling you the amount you can roll over (if it is over $200)

after we compute the benefit. If you ask for this detailed information, your

Federal Tax Information

of excess deductions, the Office of Personnel Management (OPM) will

reconsider your application.

If you have less than 5 years of creditable civilian service (excluding service

after 1983 that was simultaneously subject to both CSRS and Social Security

[SSA] deductions) on the effective date of your FERS coverage, you may

request a return of any excess military deposit you may have made, as well

as any excess CSRS deductions. Your service will still be credited under

FERS. You may elect a return while you are an employee. Use this form to

elect such a return. By law, interest is not paid on excess military deposits.

Interest is paid on excess civilian deductions at a rate of 3% through 1984

and a variable, market based rate, thereafter.

case will be held until we send and receive your written election, usually a

delay of payment of at least 30 days.

If you elect to roll over any portion of the excess deductions into an IRA or

eligible employer plan, your financial institution or employer plan must

complete the certification found in this package, before we can process your

election. Two certification forms are provided, since you can roll your

excess deductions over to two different institutions. If you elect to roll over

less than 100% of your excess deductions, the total amount you roll over to

any one organization must be at least $500.

More information is given in the Special Tax Notice Regarding Rollovers,

found in this package. Consult a qualified tax advisor or the Internal

Revenue Service if you need more information on tax matters. OPM cannot

provide you with tax publications or tax advice. You should be aware that

distributions made from the plan to which the rollover is made may be

subject to different restrictions and tax consequences than those that apply to

distributions from OPM.

If you do not complete an election, and your excess deductions are $200 or

more, we will pay the amount directly to you and will withhold 20% of any

interest payable for Federal income tax. You have the option to roll over

part or all of the excess deductions yourself within 60 days after you receive

the payment. If the amount of your excess deductions is less than $200, we

will pay the amount directly to you and no tax will be withheld.

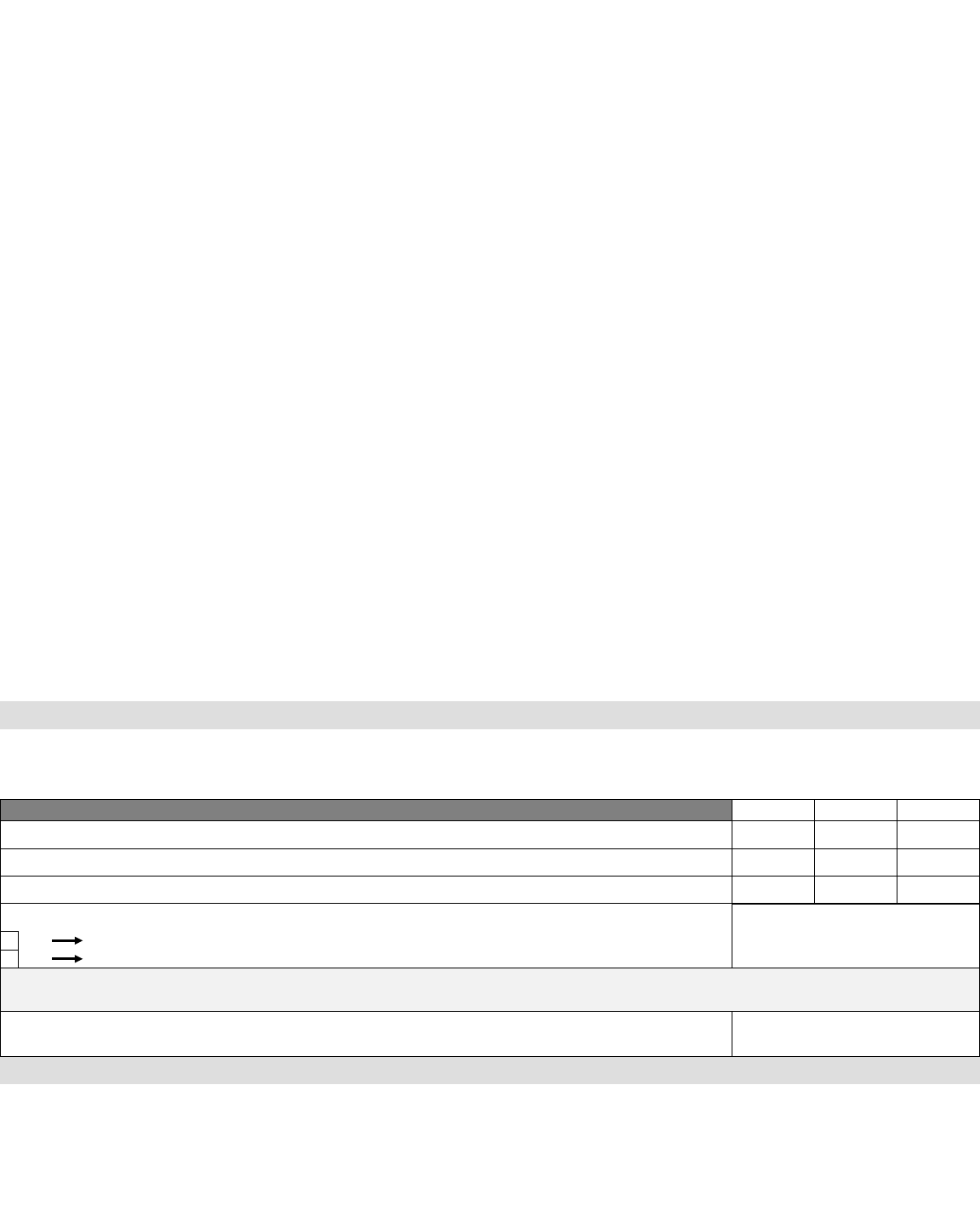

Part 2 - To be completed by employing office

Instructions to Employing Office

Review service listed in item #7 on page 1 of this form and the applicant's personnel folder and complete the following:

1. Eligibility for Return of Excess Contributions

DaysMonthsYears

1a. Total civilian service subject to full CSRS or Foreign Service retirement deductions

1b. Total creditable civilian service not subject to retirement deductions (other than Social Security)

1c. Enter total of 1a. and 1b. (Exclude service subject to SSA and partial retirement deductions)

1d. Does item 1c. show at least 5 years service?

2. Effective date of FERS coverage

Employee is entitled to return of excess deductions

No

Employee is not entitled to return of excess deductions. Return application to employee.

Yes

3. I certify that this individual has less than 5 years of creditable civilian service (excluding service after 1983 subject to both CSRS and Social

Security coverage), is covered by FERS, and is eligible for this refund

.

Signature Date

Part 3 - Instructions to Payroll Office

Please forward the original of this application along with the employee's redesignated civilian or military SF 2806 to OPM under cover of a FERS Register of

Separations and Transfers (SF 3103) separate from regular SF 3103's. Do not intermingle these retirement records with other FERS retirement records being

sent to OPM. If a return of excess military service deductions only is due the employee, follow the instructions in Payroll Office Letter 87-9. If the employee

is eligible for a return of excess civilian deductions only, refer to Payroll Office Letter 87-10 for instructions. If eligibility for both types of refunds has been

established, the associated civilian and military service retirement records should be transmitted to OPM together, along with the original of the application

using the same SF 3103.

Amount of excess military deductions paid by the Payroll Office: $_______________.

(Reproduce Locally)

OPM Form 1562

Revised April 2005

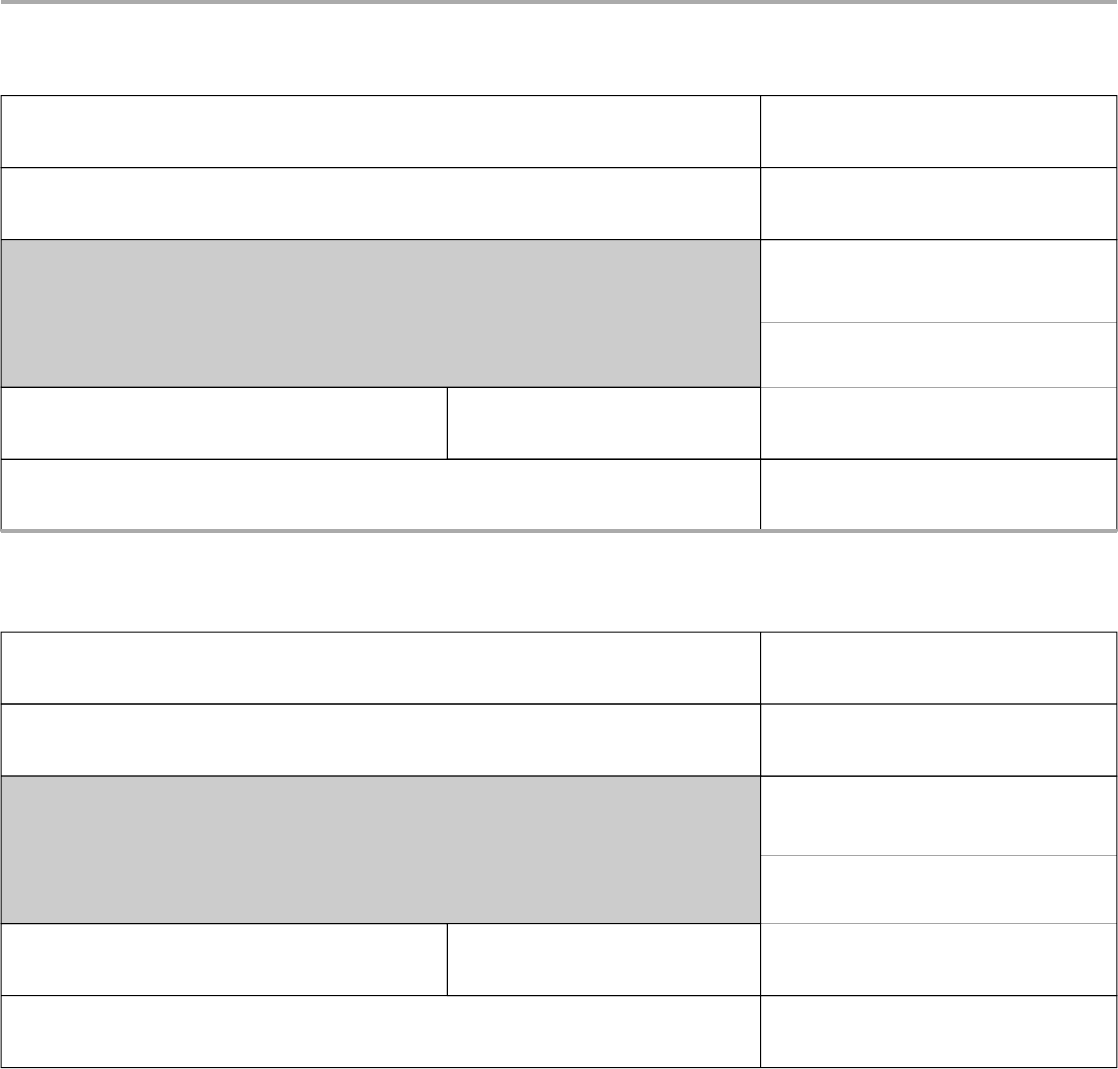

Certification by Financial Institution or Eligible Employer Plan

If Applicant Elects to Roll Over a Refund of Excess Deductions

This must be completed by your financial institution or eligible employer plan.

Name of applicant (last, first, middle) Social Security Number

Name of institution or employer plan

Account number

Certification: My signature below confirms the account number for the individual named in item 1 on the first

page of this form. As a representative of the financial institution or plan named above, I certify that this

institution or plan agrees to accept the funds described above as a direct trustee-to-trustee transfer from the Office

of Personnel Management, to deposit them in an eligible IRA or eligible employer plan as defined in the Internal

Revenue Code, and to account for these monies in compliance with the Internal Revenue Code. I understand that

my signature below authorizes the transfer of taxable and/or non-taxable funds as indicated above.

Address of institution or employer plan

Typed or printed name of certifying representative Phone number (including area code)

( )

Signature of certifying representative

Date of certification (mm/dd/yyyy)

Certification by Financial Institution or Eligible Employer Plan

If Applicant Elects to Roll Over a Refund of Excess Deductions

This must be completed by your financial institution or eligible employer plan.

Name of applicant (last, first, middle) Social Security Number

Name of institution or employer plan Account number

Certification: My signature below confirms the account number for the individual named in item 1 on the first

page of this form. As a representative of the financial institution or plan named above, I certify that this

institution or plan agrees to accept the funds described above as a direct trustee-to-trustee transfer from the Office

of Personnel Management, to deposit them in an eligible IRA or eligible employer plan as defined in the Internal

Revenue Code, and to account for these monies in compliance with the Internal Revenue Code. I understand that

my signature below authorizes the transfer of taxable and/or non-taxable funds as indicated above.

Address of institution or employer plan

Typed or printed name of certifying representative Phone number (including area code)

( )

Signature of certifying representative

Date of certification (mm/dd/yyyy)

Instructions for Rollover to the Federal Retirement Thrift Savings Plan

The Thrift Savings Plan (TSP) will not accept non-taxable (post-tax) monies. You must have an open TSP account. Before the Office of Personnel

Management (OPM) can complete a rollover to your Thrift Savings account, you must sign and submit Form TSP-60, Request for a Transfer Into the

TSP, to OPM. Submit both the TSP-60 and this form, OPM Form 1562, at the same time. OPM will complete its portion of the form and fax it to the

Thrift Savings office for processing. The form must be approved by the Thrift Savings Board and the Board must notify OPM to transfer the funds.

Form TSP-60 is available on the internet at http://www.tsp.gov/forms.

Special Tax Notice Regarding Rollovers

Your excess retirement deductions payment consists of a taxable

portion (any interest payable) and an after-tax portion (the actual

retirement contributions that you paid into the retirement system).

This notice explains how you can continue to defer federal income

tax on the interest payable on your excess deductions payment from

the Federal Employees Retirement System (FERS) and contains

important information you will need before you decide how to

receive your excess retirement deductions payment.

This notice is provided to you because your excess retirement

deductions payment is eligible for rollover by you or the Office of

Personnel Management (OPM) to a traditional Individual Retirement

Arrangement (IRA) or an eligible employer plan. A rollover is a

payment by you or OPM of all or part of your benefit to another plan

or IRA that allows you to continue to postpone taxation of that

benefit until it is paid to you. Your payment cannot be rolled over to

a Roth IRA, a SIMPLE IRA, or a Coverdell Education Savings

Account (formerly known as an education IRA). An "eligible

employer plan" includes a plan qualified under section 401(a) of the

Internal Revenue Code, including a 401(k) plan, profit-sharing plan,

defined benefit plan, stock bonus plan and money purchase plan; a

section 403(a) annuity plan; a section 403(b) tax-sheltered annuity;

and an eligible section 457(b) plan maintained by a governmental

employer (governmental 457 plan).

An eligible employer plan is not legally required to accept a rollover.

Before you decide to roll over your payment to an employer plan, you

should find out whether the plan accepts rollovers and, if so, the types

of distributions it accepts as a rollover. You should also find out

about any documents that are required to be completed before the

receiving plan will accept a rollover. Even if a plan accepts rollovers,

it might not accept rollovers of certain types of distributions, such as

after-tax amounts. The portion of your payment that represents your

actual retirement contributions, is an after-tax amount. (The interest

payable on this amount is a taxable amount.) If this is the case, you

may wish instead to roll your payment over to a traditional IRA or

split your rollover amount between the employer plan in which you

will participate and a traditional IRA. If an employer plan accepts

your rollover, the plan may restrict subsequent distributions of the

rollover amount or may require your spouse's consent for any

subsequent distribution. A subsequent distribution from the plan that

accepts your rollover may also be subject to different tax treatment

than distributions from OPM. Check with the administrator of the

plan that is to receive your rollover prior to making the rollover.

If you have a Federal Retirement Thrift Savings Plan account, you

may roll over the taxable portion (interest portion) of your payment

into that account. The Thrift Savings Plan (TSP) will not accept

non-taxable monies (the actual retirement contributions that are being

paid). To accomplish a rollover to the TSP, you will need to submit

form TSP-60 to us. See Part II, Direct Rollover for more

information.

Summary

There are two ways you may be able to receive an excess deductions

payment that is eligible for rollover.

1) Your payment can be made directly to a traditional IRA that you

establish or to an eligible employer plan that will accept it and hold

it for your benefit ("DIRECT ROLLOVER"); or

2) The payment can be PAID TO YOU.

If you choose a DIRECT ROLLOVER of your excess deductions

payment

•

The interest portion of your payment (the taxable portion) will not

be taxed in the current year and no income tax will be withheld.

•

You choose whether your payment will be made directly to your

traditional IRA or to an eligible employer plan that accepts your

rollover. Your payment cannot be rolled over to a Roth IRA, a

SIMPLE IRA, or a Coverdell Education Savings Account because

these are not traditional IRAs.

•

The interest portion of your payment (the taxable portion) will be

taxed later when you take it out of the traditional IRA or the eligible

employer plan. Depending on the type of plan, the later distribution

may be subject to different tax treatment than it would be if you

received a taxable distribution from OPM.

If you choose to have your excess deductions PAID TO YOU:

• You will receive 80% of the interest portion (taxable amount) of the

payment, because OPM is required to withhold 20% of that amount

and send it to the IRS as income tax withholding to be credited

against your taxes. You will receive all of your actual retirement

contributions, since taxes have already been paid on this amount.

• The interest portion of your payment will be taxed in the current

year unless you roll it over. If you receive the payment before age

59-1/2, you may have to pay an additional 10% tax.

• You can roll over all or part of the refund payment by paying it to

your traditional IRA or to an eligible employer plan that accepts

your rollover within 60 days after you receive the payment. The

amount of the interest portion rolled over will not be taxed until

you take it out of the traditional IRA or the eligible employer plan.

• If you want to roll over 100% of the payment to a traditional IRA or

an eligible employer plan, you must find other money to replace the

20% of the taxable portion (interest amount) that was withheld. If

you roll over only the 80% of the interest amount that you received,

you will be taxed on the 20% that was withheld and that is not

rolled over.

Your Right to Waive the 30-Day Notice Period

Generally, neither a direct rollover nor a payment to you can be made

until at least 30 days after your receipt of this notice. Thus, after

receiving this notice, you have at least 30 days to consider whether or

not to have your withdrawal directly rolled over. If you do not wish to

wait until this 30-day notice period ends before forwarding your

application to your former agency or OPM, you may waive the notice

period by making an election indicating whether or not you wish to

make a direct rollover.

More Information

I. Payments That Can and Cannot Be Rolled Over

Excess deductions payments are "eligible rollover distributions." This

means that they can be rolled over to a traditional IRA or to an eligible

employer plan that accepts rollovers. They cannot be rolled over to a

Roth IRA, a SIMPLE IRA, or a Coverdell Education Savings Account.

Both the taxable portion (interest) and the after-tax portion (actual

retirement contributions) can be rolled over.

After-tax Contributions. After-tax contributions (your actual retirement

contributions, excluding any interest paid) may be rolled into either a

traditional IRA or to certain employer plans that accept rollovers of the

after-tax contributions. The following rules apply:

a) Rollover into a Traditional IRA. You can roll over your after-tax

contributions to a traditional IRA either directly or indirectly. The

actual retirement contributions being refunded to you are after-tax

contributions. You do not owe any tax on this amount. Only the

interest portion is taxable.

If you roll over after-tax contributions to a traditional IRA, it is your

responsibility to keep track of, and report to the IRS on the

applicable forms, the amount of these after-tax contributions. This

will enable the nontaxable amount of any future distributions from

the traditional IRA to be determined.

Once you roll over your after-tax contributions to a traditional IRA,

those amounts CANNOT later be rolled over to an employer plan.

b) Rollover into an Employer Plan. You can roll over after-tax

contributions to an employer plan using a direct rollover if the other

plan provides separate accounting for amounts rolled over,

including separate accounting for the after-tax employee

contributions and earnings on those contributions. You CANNOT

roll over after-tax contributions to a governmental 457 plan. If you

want to roll over your after-tax contributions to an employer plan

that accepts these rollovers, you cannot have the after-tax

contributions paid to you first. You must instruct OPM to make a

direct rollover on your behalf. Also, you cannot first roll over

after-tax contributions to a traditional IRA and then roll over that

amount into an employer plan.

OPM Form 1562

Revised April 2005

II.II. DirectDirect RolloverRollover

A DIRECT ROLLOVER is a direct payment of your excess deductions

to a traditional individual retirement arrangement (IRA) or an eligible

employer plan that will accept it. You can choose a DIRECT

ROLLOVER of all or any portion of your payment, as described in

Part I above. You are not taxed on the taxable portion of your payment

(interest amount) for which you choose a DIRECT ROLLOVER until

you later take it out of the traditional IRA or eligible employer plan. In

addition, no income tax withholding is required for any taxable portion

of your payment for which you choose a DIRECT ROLLOVER. You

cannot choose a DIRECT ROLLOVER if your excess deductions

payment is less than $200.

DIRECT ROLLOVER to a Traditional IRA. You can open a traditional

IRA to receive the direct rollover. If you choose to have your excess

deductions paid directly to a traditional IRA, contact an IRA sponsor

(usually a financial institution) to find out how to have your payment

made in a direct rollover to a traditional IRA at that institution. If you

are unsure of how to invest your money, you can temporarily establish

a traditional IRA to receive the payment. However, in choosing a

traditional IRA, you may want to make sure that the traditional IRA

you choose will allow you to move all or a part of your payment to

another traditional IRA at a later date, without penalties or other

limitations. See IRS Publication 590, Individual Retirement

Arrangements, for more information on traditional IRAs (including

limits on how often you can roll over between IRAs).

DIRECT ROLLOVER to an Eligible Employer Plan. If you want a

direct rollover to an eligible employer plan, ask the plan administrator

of that plan whether it will accept your rollover. An eligible employer

plan is not legally required to accept a rollover. Even if the employer's

plan does not accept a rollover, you can choose a DIRECT

ROLLOVER to a traditional IRA. If the employer plan accepts your

rollover, the plan may provide restrictions on the circumstances under

which you may later receive a distribution of the rollover amount or

may require spousal consent to any subsequent distribution. Check

with the plan administrator of that plan before making your decision.

Change in Tax Treatment Resulting from a DIRECT ROLLOVER. The

tax treatment of any payment from the eligible employer plan or

traditional IRA receiving your DIRECT ROLLOVER might be

different than if you received your payment in a taxable distribution

directly from the Office of Personnel Management (OPM).

Direct Rollover to the Thrift Savings Plan (TSP). If you choose to

roll part or all of the taxable portion of your payment into your TSP

account, you need to submit form TSP-60, Request for Transfer

Into the TSP, along with your Application for Return of Excess

Retirement Deductions. This form is available on the internet at

http://www.tsp.gov. Fill out your portion of the form; we will complete

our portion and fax it to the TSP office for processing. The form must

be approved by the Thrift Savings Board and the Board must notify

OPM to transfer the funds.

III. Payment Paid to You

If your payment can be rolled over (see Part I on the previous page) but

the payment is made directly to you, the interest portion is subject to

20% federal income tax withholding (state tax withholding may also

apply). The payment is taxed in the year you receive it unless, within

60 days, you roll it over to a traditional IRA or an eligible employer

plan that accepts rollovers. If you do not roll it over, special tax rules

may apply.

Income Tax Withholding:

Mandatory Withholding. If any portion of your payment can be rolled

over under Part I above and you do not elect to make a DIRECT

ROLLOVER, OPM is required by law to withhold 20% of the interest

portion (taxable amount). This amount is sent to the Internal Revenue

Service (IRS) as federal income tax withholding. For example, if you

can roll over a taxable payment of $10,000, only $8,000 will be paid to

you because OPM must withhold $2,000 as income tax. However,

when you prepare your income tax return for the year, unless you make

a rollover within 60 days (see "Sixty-Day Rollover Option" below), you

must report the full $10,000 as a taxable payment from OPM. You

must report the $2,000 as tax withheld, and it will be credited against

any income tax you owe for the year. There will be no income tax

withholding if your payments for the year are less than $200.

Sixty-Day Rollover Option. If you receive a payment that can be rolled

over under Part I above, you can still decide to roll over all or part of it

to a traditional IRA or to an eligible employer plan that accepts

rollovers. If you decide to roll it over, you must contribute the amount

of the payment you received to a traditional IRA or eligible employer

plan within 60 days after you receive the payment. The portion of your

payment that is rolled over will not be taxed until you take it out of the

traditional IRA or the eligible employer plan.

You can roll over up to 100% of your payment that can be rolled over

under Part I above, including an amount equal to the 20% of the taxable

portion that was withheld. If you choose to roll over 100%, you must

find other money within the 60-day period to contribute to the

traditional IRA or the eligible employer plan, to replace the 20% that

was withheld. On the other hand, if you roll over only the 80% of the

taxable portion that you received, you will be taxed on the 20% that

was withheld.

Example: The taxable portion of your payment that can be rolled over

under Part I above, is $10,000, and you choose to have it paid to you.

You will receive $8,000, and $2,000 will be sent to the IRS as income

tax withholding. Within 60 days after receiving the $8,000, you may

roll over the entire $10,000 to a traditional IRA or an eligible employer

plan. To do this, you roll over the $8,000 you received from OPM, and

you will have to find $2,000 from other sources (your savings, a loan,

etc.). In this case, the entire $10,000 is not taxed until you take it out of

the traditional IRA or an eligible employer plan. If you roll over the

entire $10,000, when you file your income tax return you may get a

refund of part or all of the $2,000 withheld.

If, on the other hand, you roll over only $8,000, the $2,000 you did not

roll over is taxed in the year it was withheld. When you file your

income tax return, you may get a refund of part of the $2,000 withheld.

(However, any refund is likely to be larger if you roll over the entire

$10,000.)

Additional 10% Tax If You Are under Age 59-1/2. If you receive a

payment before you reach age 59-1/2 and you do not roll it over, then,

in addition to the regular income tax, you may have to pay an extra tax

equal to 10% of the taxable portion of the payment. The additional

10% tax generally does not apply to (1) payments that are paid after

you separate from service with your employer during or after the year

you reach age 55, (2) payments that are paid because you retire due to

disability, (3) payments that are paid directly to the government to

satisfy a Federal tax levy, (4) payments that are paid to an alternate

payee under a qualified domestic relations order, or (5) payments that

do not exceed the amount of your deductible medical expenses. See

IRS Form 5329 for more information on the additional 10% tax.

Additional Tax Information

This notice summarizes only the federal (not state and local) tax rules

that might apply to your payment. The rules described above are

complex and contain many conditions and exceptions that are not

included in this notice. Therefore, you may want to consult with the

IRS or a professional tax advisor before you take a payment of your

excess deductions from OPM. You can find more specific information

on the tax treatment of payments from qualified employer plans in IRS

Publication 575, Pension and Annuity Income, and IRS Publication

590, Individual Retirement Arrangements. For an overview of the tax

consequences of payments from the Civil Service Retirement System

and Federal Employees Retirement System, you can also consult IRS

Publication 721, Tax Guide to U.S. Civil Service Retirement Benefits .

These publications are available from your local IRS office, on the

IRS's Internet Web Site at www.irs.gov, or by calling

1-800-TAX-FORMS.

OPM Form 1562

Revised April 2005