Fillable Printable OPM Form 2809

Fillable Printable OPM Form 2809

OPM Form 2809

Health Benefits Election Form

Form Approved:

OMB No. 3206-0141

Who May Use OPM Form 2809

•

Annuitants retired under the Civil Service Retirement System

(CSRS) or Federal Employees Retirement System (FERS)

•

Survivor annuitants under CSRS or FERS

•

Former spouses

•

Children and former spouses who are eligible for temporary

continuation of coverage

Instructions for Completing OPM 2809

Type or print firmly.

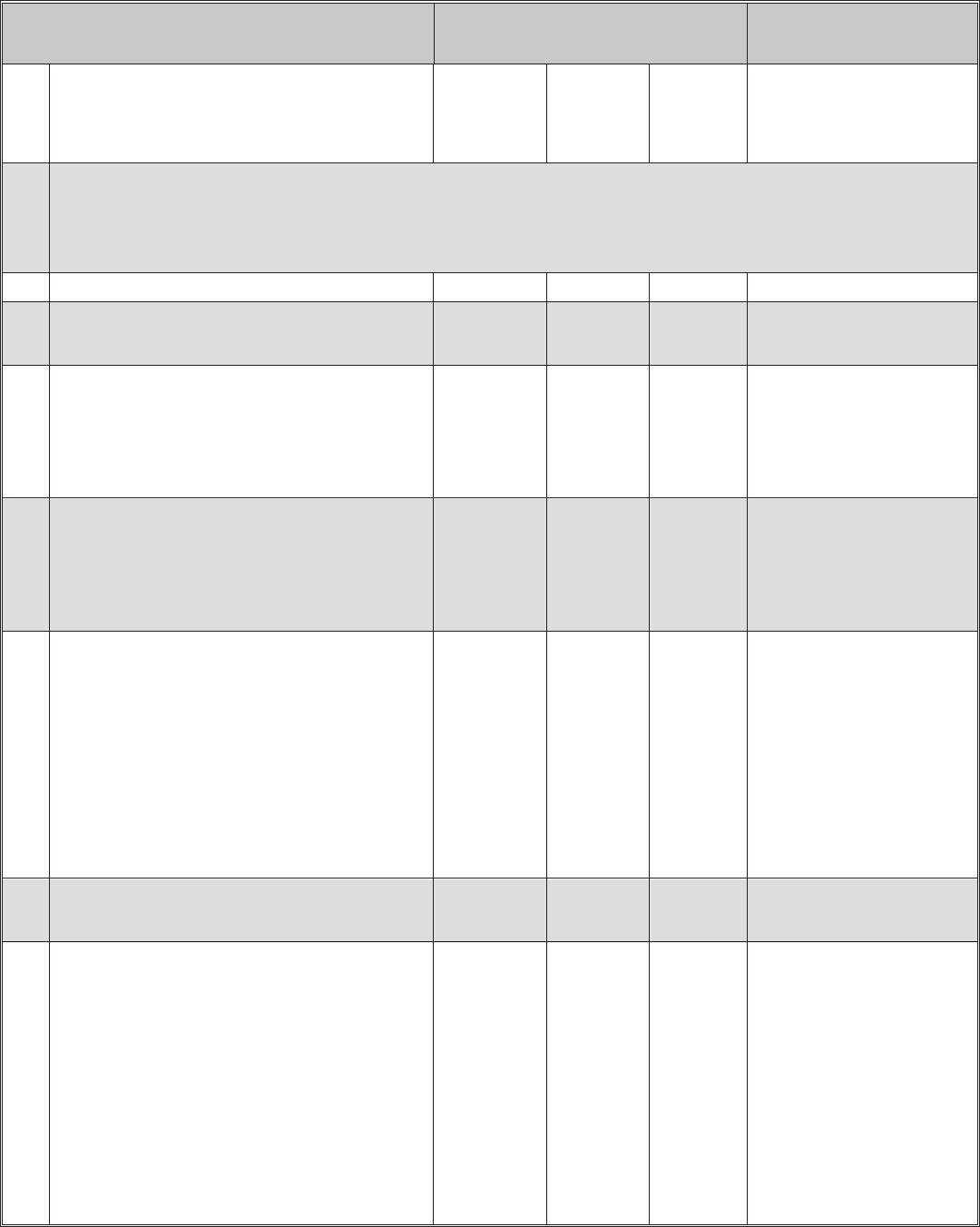

Part A — Enrollee and Family Member Information.

You must complete this part.

Item 1. Enter your legal name.

Item 2. Provide your Social Security number.

Item 3. Enter your date of birth.

Item 4. Enter your sex.

Item 5. If you are separated but not divorced, you are still married.

Item 6. Enter your emailing address.

Item 7. If you have Medicare, check which Parts you have, including

prescription drug coverage under Medicare Part D.

Item 8. If you have Medicare, enter your Medicare Claim Number.

This number is on your Medicare card.

Item 9. If you are covered by other health insurance (private, state,

Medicaid, Peace Corps, TRICARE, CHAMPVA, or another

FEHB enrollment), either in your name or under a family

member’s policy, check yes and complete item 10.

TRICARE is a health care program for active duty and retired

members of the uniformed services, their families, and

survivors. This includes TRICARE for Life for members age

65 and older.

Item 10. Select or write the name of any other insurance that covers

you.

Item 11. If applicable, provide your email address.

Item 12. Provide your day time telephone number.

If your enrollment is for Self and Family, complete information for your

family members. (If you need extra space for additional family members,

list them on a separate sheet and attach.)

The instructions for completing items 13 through 24 for your initial

family member also apply to the information you provide for additional

family members in items 25 through 48.

Item 14. Please provide Social Security numbers for your dependents,

if they have one. If your dependents do not have Social

Security numbers, leave blank; benefits will not be withheld.

(See Privacy Act Statement on page 4.)

Item 15. Provide the date of birth of the family member.

Item 16. Provide sex of family member.

Item 17. Provide the code which indicates the relationship of each

family member to you.

Code Family Relationship

01

Spouse

19 Child under age 26

09

Adopted Child

17 Stepchild

10 Foster Child

99

Disabled child age 26 or older who is incapable of self-support

because of a physical or mental disability that began before his/her

26th birthday.

Item 18.

If your family member does not live with you, enter his/her

home address.

Item 19. If a family member has Medicare, check which Parts he/she

has, including prescription drug coverage under Medicare

Part D.

Item 20. If your family member has Medicare, enter his/her Medicare

Claim Number. This Number is on his/her Medicare card.

Item 21. Indicate whether the family member has health coverage

other than Medicare.

Item 22. If a family member has TRICARE (see item 9), or other

group insurance (private, state, Medicaid, Peace Corps, or

another FEHB enrollment), check the box. Give the name and

policy number of any other insurance this family member

has.

Item 23. Enter email address, if applicable, for your spouse or adult

child.

Item 24. Enter the preferred telephone number, if applicable, of your

spouse or adult child.

Family Members Eligible for Coverage

Unless you are a former spouse or survivor annuitant, family members

eligible for coverage under your Self and Family enrollment include

your spouse and your children under age 26. Eligible children include

your legitimate or adopted children, step children, recognized natural

children, or foster children, who live with you in a regular parent-child

relationship.

Other relatives (for example, your parents) are not eligible for coverage

even if they live with you and are dependent upon you.

If you are a former spouse or survivor annuitant, family members

eligible for coverage under your Self and Family enrollment are the

natural or adopted children under age 26 of both you and your former

or deceased spouse.

OPM Form 2809

Previous editions are not usable.

1

Revised December 2013

In some cases, a disabled child age 26 or older is eligible for coverage

under your Self and Family enrollment if you provide adequate medical

certification of a mental or physical disability that existed before his/her

26th birthday and renders the child incapable of self-support.

Note: The Office of Personnel Management can give you additional

details about family member eligibility including any certification or

documentation that may be required for coverage.

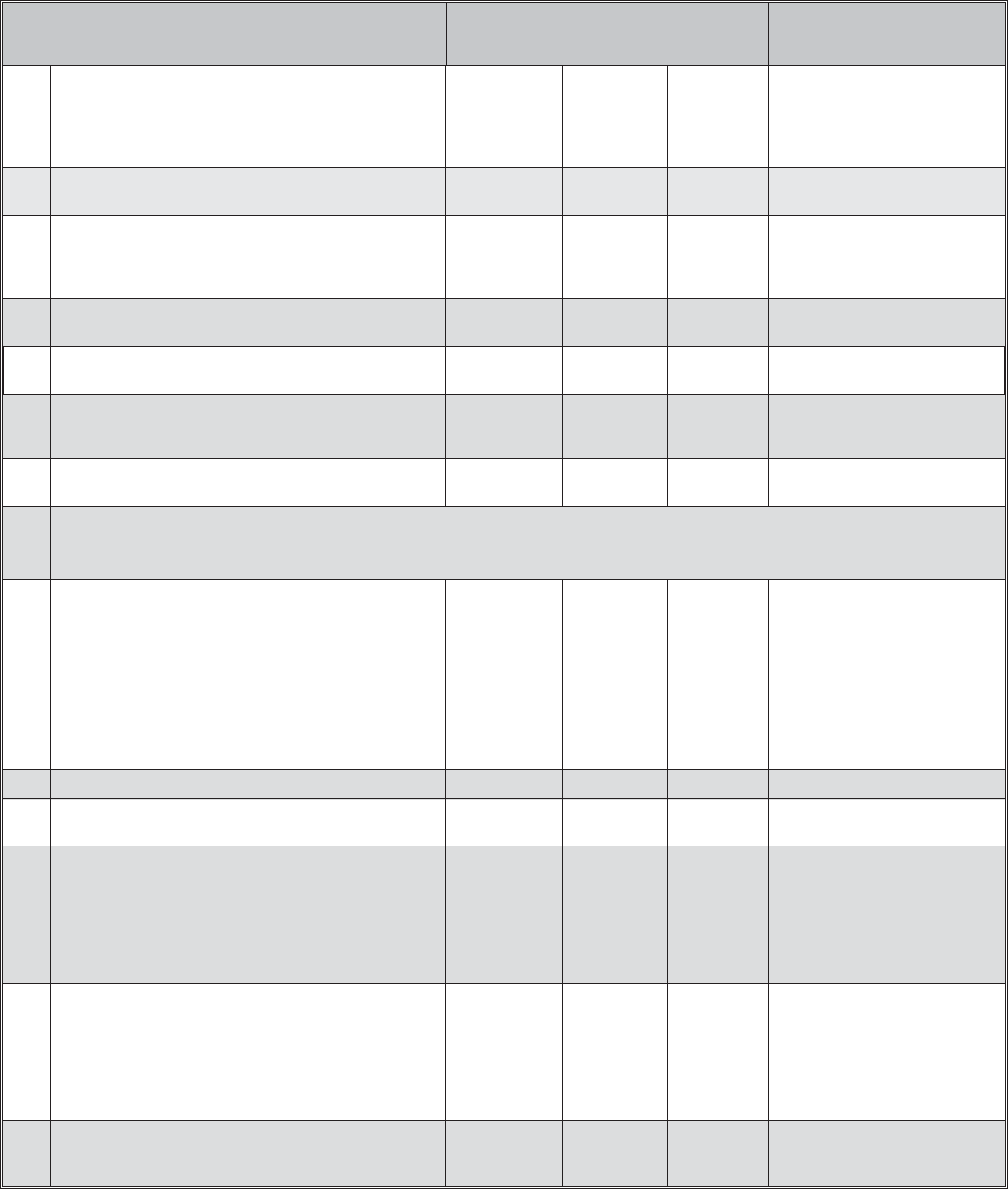

Part B — FEHB Plan You Are Currently Enrolled In.

You must complete this part if you are changing, canceling, or

suspending your enrollment.

Item 1. Enter the name of the plan you are enrolled in, from the front

cover of the plan brochure.

Item 2. Enter the present enrollment code from your plan or ID card.

Part C — FEHB Plan You Are Enrolling In or

Changing To.

Complete this part to enroll or change your enrollment in the FEHB.

Item 1. Enter the name of the plan you are enrolling in or changing

to. The plan name is on the front cover of the brochure of the

plan you want to be enrolled in.

Item 2. Enter the enrollment code of the plan you are enrolling in or

changing to. The enrollment code is on the front cover of the

brochure of the plan you want to be enrolled in, and shows

the plan and option you are electing and whether you are

enrolling for Self Only or Self and Family.

To enroll in a Health Maintenance Organization (HMO), you must live

(or in some cases work) in the geographic area specified by the carrier.

To enroll in an employee organization plan, you must be or become a

member of the plan’s sponsoring organization, as specified by the

carrier.

Your signature in Part F authorizes deductions from your annuity to

cover your cost of the enrollment you elect in this item, unless you are

required to make direct payments.

Part D — Event That Permits You to Enroll, Change

or Cancel.

Item 1. Enter the event code that permits you to enroll, change, or

cancel based on a Qualifying Life Event (QLE) from the

Table of Permissible Changes in Enrollment starting on page

5.

Explanation of Table of Permissible Changes in Enrollment

The tables on pages 5 through 8 illustrate when an annuitant, former

spouse, or person eligible for Temporary Continuation of Coverage

(TCC) may enroll or change enrollment. The tables show those

permissible events that are found in the FEHB regulations at 5 CFR

Part 890.

The tables have been organized by enrollee category. Each category is

designated by a number, which identifies the enrollee group, as follows:

2 Annuitants

3 Former spouses eligible for coverage under the Spouse Equity

provisions of FEHB law.

4 TCC enrollees.

Following each number is a letter which identifies a specific Qualifying

Life Event (QLE); for example, the event code 2A refers to open season.

Item 2. Enter the date of the QLE using numbers to show month, day,

and complete year; e.g., 06/30/2011. If you are electing to

enroll, enter the date you became eligible to enroll (for

example, the date your annuity was restored). If you are

making an open season enrollment or change, enter the date

on which the open season begins.

Part E — Suspension/Cancellation.

Check a box only if you wish to suspend or cancel your FEHB

enrollment. Also enter your present enrollment code in Part B.

You may suspend your FEHB enrollment because you are enrolling in

one of the following programs:

•

A Medicare HMO or Medicare Advantage plan,

•

Medicaid or similar State-sponsored program of medical assistance

for the needy,

•

TRICARE (including Uniformed Services Family Health Plan or

TRICARE for Life),

•

Peace Corps, or

•

CHAMPVA

You can reenroll in the FEHB Program if your other coverage ends.

If your coverage ends involuntarily, you can reenroll 31 days before

through 60 days after loss of coverage. If you want to reenroll in the

FEHB Program for a reason other than an involuntary loss of coverage,

you may do so during the next open season.

You must submit documentation of eligibility for coverage under the

non-FEHB Program to the Office of Personnel Management.

Initial the last box only if you wish to cancel your FEHB enrollment.

Also enter your present enrollment code in Part B. Be sure to read the

information below in the paragraph titled “Annuitants Who Cancel

Their Enrollment.”

Annuitants Who Cancel Their Enrollment

Generally, you cannot reenroll as an annuitant unless you are

continuously covered as a family member under another person’s

enrollment in the FEHB Program during the period between your

cancellation and reenrollment. OPM can advise you on events that allow

eligible annuitants to reenroll. If you cancel your enrollment because you

are covered under another FEHB enrollment, you can reenroll from 31

days before through 60 days after you lose that coverage under the other

enrollment.

If you cancel your enrollment for any other reason, you cannot

reenroll, and you and any family members covered by your enrollment

are not entitled to a 31-day temporary extension of coverage or to

convert to an individual policy.

Former Spouses (Spouse Equity) Who Cancel Their Enrollment

Generally, if you cancel your enrollment in the FEHB Program, you

cannot reenroll as a former spouse. However, if you cancel the

enrollment because you become covered under FEHB as a new spouse,

your eligibility for FEHB coverage under the Spouse Equity provisions

continues. You may reenroll as a former spouse from 31 days before

through 60 days after you lose coverage under the other FEHB

enrollment.

OPM Form 2809

2

Revised December 2013

If you cancel your enrollment for any other reason, you cannot

If you are registering for someone else under a written authorization

reenroll, and you and any family members covered by your enrollment from that person to do so, sign your name in Part F and attach the written

are not entitled to a 31-day temporary extension of coverage or to

authorization.

convert to an individual policy.

If you are registering as the court-appointed guardian for a former

Part F — Signature.

spouse eligible for coverage under the Spouse Equity provisions or for

Your retirement system cannot process your request unless you complete

an individual eligible for TCC, sign your name in Part F and attach

this part.

evidence of your court-appointed guardianship.

General Information

Dual Enrollment

No person (enrollee or family member) is entitled to receive benefits

under more than one enrollment in the Federal Employees Health

Benefits (FEHB) Program. Normally, you are not eligible to enroll if

you are covered as an annuitant under your own enrollment and as a

family member under someone else’s enrollment in the FEHB Program.

However, such dual enrollments may be permitted under certain

circumstances in order to:

•

Protect the interests of children who otherwise would lose coverage

as family members, or

•

Enable an employee who is under age 26 and covered under a

parent’s enrollment and who becomes the parent of a child to

enroll for Self and Family coverage.

(Each enrollee must notify his or her plan of the names of the persons to

be covered under his or her enrollment who are not covered under the

other enrollment.)

Enrollment in an HMO (Prepaid) Plan

To enroll in an HMO plan, you must live in the plan’s enrollment area as

stated in the plan brochure.

Enrollment in a Fee-for-Service Plan

If you enroll in a fee-for-service plan sponsored by an employee

organization, you must be (or become) a member of the organization that

sponsors the plan. Your membership will be verified.

Self Only Enrollment

A Self Only enrollment provides benefits just for you.

Self and Family Enrollment

A Self and Family enrollment provides benefits for you and your family

as described on page 1.

If your present enrollment is Self Only, you must change to a Self and

Family enrollment if you want to provide coverage for a new eligible

family member. See the table starting on page 5 for events which allow

you to change to a Self and Family enrollment.

Changes in Enrollment

After the Office of Personnel Management (OPM) processes your

request to enroll or change your enrollment, OPM will send you written

confirmation. Your health plan will mail a new identification (I.D.) card

to you as soon as possible. (OPM does not issue I.D. cards.) If you

should need health services before you receive your new I.D. card, show

the written confirmation you receive from OPM to the doctor or hospital.

They can then verify your new coverage with the plan.

Suspension or Cancellation of Enrollment

You may suspend or cancel your enrollment at any time for one of

several reasons.

If you cancel your enrollment because you are going to be continuously

covered as a family member under another person’s FEHB enrollment

during the period between your cancellation and reenrollment, you will

be eligible to reenroll when you lose coverage under that family

member’s enrollment.

If you suspend your FEHB Program enrollment to be covered by

a Medicare Advantage plan, Medicaid or a similar State-sponsored

program of medical assistance for the needy, TRICARE (including

Uniformed Services Family Health Plan or TRICARE for Life), Peace

Corps, or CHAMPVA, you will be eligible to enroll in the FEHB

Program if any of the above coverage ends.

Reenrollment Eligibility

If you cancel or suspend your enrollment as described above, you may

voluntarily reenroll in the FEHB Program during an annual open season.

If you involuntarily lose your Medicare Advantage plan, Medicaid or a

similar State-sponsored plan, TRICARE, Peace Corps, or CHAMPVA

coverage, you can reenroll in the FEHB Program effective the day after

your coverage ends. Your request to reenroll must be received at OPM

within the period beginning 31 days before and ending 60 days after

your coverage ends. Otherwise, you must wait until open season to

reenroll.

If you cancel your FEHB enrollment for a reason other than your

becoming covered under another FEHB enrollment, you cannot later

reenroll, and you and any family members will not be entitled to a

temporary extension of coverage or conversion to individual coverage.

Effective Dates of Changes

1. Open Season changes for annuitants take effect January 1.

2. Non-Open Season changes (except cancellations) take effect the first

day of the month following the month in which the Office of

Personnel Management (OPM) receives your OPM Form 2809.

Note: A change from Self Only to Self and Family due to the birth

of a child or addition of a child as a new family member is effective

the first day of the month in which the child is born or becomes an

eligible family member.

3. Cancellations: Your cancellation will take effect the end of the

month in which OPM receives your completed OPM Form 2809.

OPM Form 2809

3

Revised December 2013

Future Changes in Your Status

When your home or mailing address changes, you need to notify the

Office of Personnel Management immediately. Call our toll-free

number 1-888-767-6738 (TTY: 1-855-887-4957). Or, write to the

Change-of-Address Section, P.O. Box 440, Boyers, PA 16017-0440. Be

sure to include your new address, your name, and your retirement claim

number. You also need to notify your health benefits plan. If the family

member(s) covered by your health benefits enrollment change, you must

inform your health benefits plan. You must notify the Office of

Personnel Management immediately if you become the only person

covered by a Self and Family enrollment so that your enrollment can

be changed to Self Only. You must also inform the Office of Personnel

Management if you change your name or add family members.

For more information call our toll-free number 1-888-767-6738,

write to us, visit our web site, or send email.

Mailing Address: Office of Personnel Management

Retirement Operations Center

P.O. Box 45

Boyers, PA 16017-0045

Website: www.opm.gov/retirement-services/

Email: [email protected]

Privacy Act and Public Burden Statements

The information you provide on this form is needed to document your enrollment in the Federal Employees Health Benefits (FEHB) Program

under Chapter 89, title 5, U.S. Code. This information will be shared with the health insurance carrier you select so that it may (1) identify

your enrollment in the plan, (2) verify your and/or your family’s eligibility for payment of a claim for health benefits services or supplies, and

(3) coordinate payment of claims with other carriers with whom you might also make a claim for payment of benefits. This information may

be disclosed to other Federal agencies or Congressional offices which may have a need to know it in connection with your application for a

job, license, grant, or other benefit. It may also be shared and is subject to verification, via paper, electronic media, or through the use of

computer matching programs, with national, state, local, or other charitable or social security administrative agencies to determine and issue

benefits under their programs or to obtain information necessary for determination or continuation of benefits under this program. In addition,

to the extent this information indicates a possible violation of civil or criminal law, it may be shared and verified, as noted above, with an

appropriate Federal, state, or local law enforcement agency. While the law does not require you to supply all the information requested on this

form, doing so will assist in the prompt processing of your enrollment.

We request that you provide your Social Security Number so that it may be used as your individual identifier in the FEHB Program.

Executive Order 9397 (November 22, 1943) as amended by Executive Order 13478 (November 18, 2009), allows Federal agencies to use the

Social Security Number as an individual identifier to distinguish between people with the same or similar names. In addition, a mandatory

Insurer Reporting Law (Section 111 of Public Law No. 110-173) requires your health insurance carrier to report, as directed by the Secretary

of the Department of Health and Human Services (“Secretary”), information that the Secretary requires for purposes of coordination of

benefits between your health plan and Medicare. In order to properly coordinate Medicare payments with other insurance and/or workers’

compensation benefits, Medicare relies on your health insurance carrier to collect Medicare Claim Numbers or Social Security Numbers from

you and your eligible dependents. We therefore request that you provide a Medicare Claim Number or a Social Security Number for yourself

and each of your eligible dependents. Failure to furnish the requested information may result in the U.S. Office of Personnel Management’s

(OPM) inability to ensure the prompt payment of your and/or your family’s claims for health benefits services or supplies.

We estimate this form takes an average of 30 minutes to complete, including the time for reviewing instructions, getting the needed data, and

reviewing the completed form. Send comments regarding our time estimate or any other aspect of this form, including suggestions for

reducing completion time, to the Office of Personnel Management, Retirement Services Publications Team, (3206-0141), Washington, D.C.

20415-3430. The OMB number 3206-0141 is currently valid. OPM may not collect this information, and you are not required to respond,

unless this number is displayed.

OPM Form 2809

Revised December 2013

4

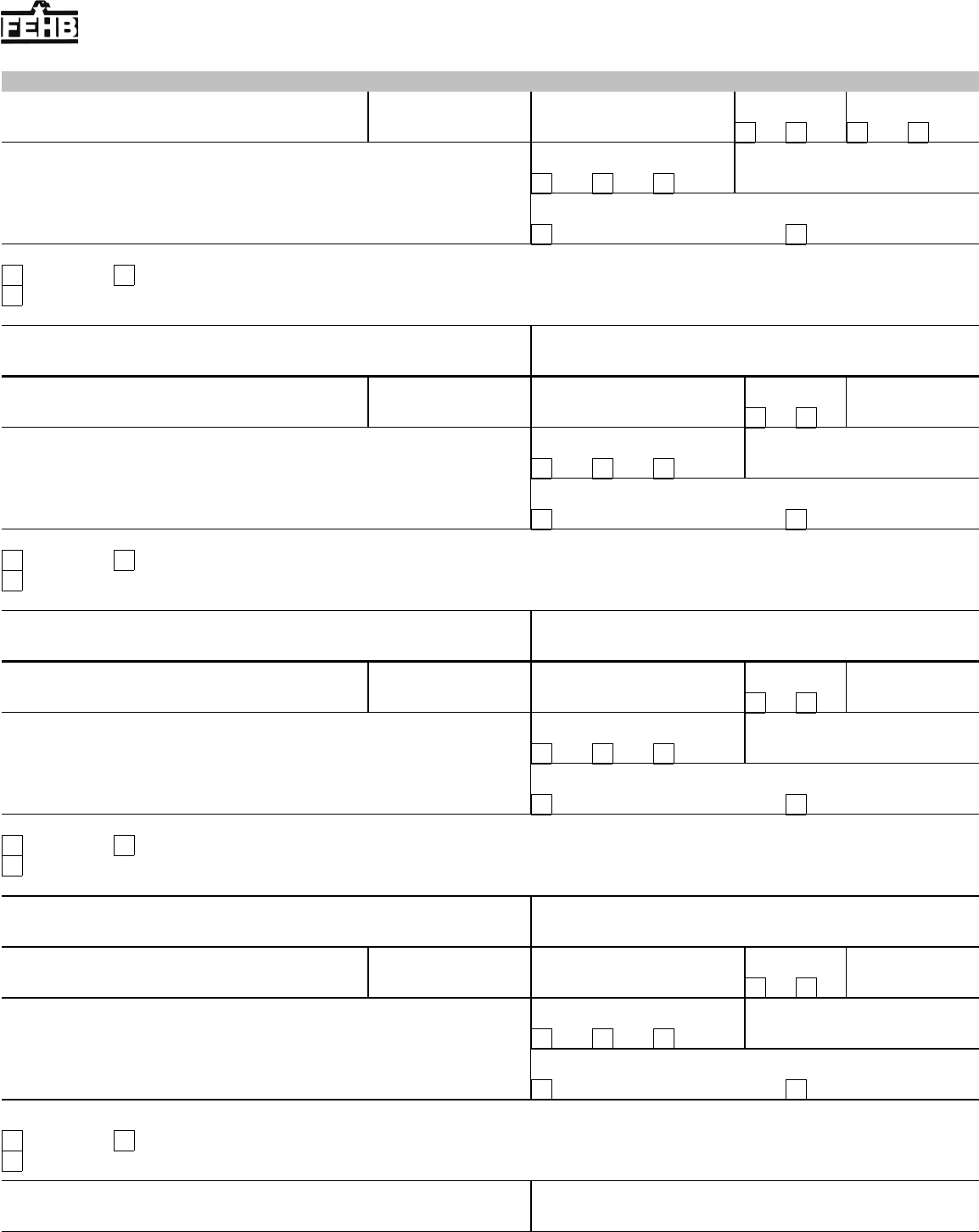

Tables of Permissible Changes in FEHB Enrollment

Enrollment May Be Cancelled or Changed From Family to Self Only at Any Time

QLE’s That Permit

Enrollment or Change

Change Permitted Time Limits

Event

Code

Event

From Not

Enrolled to

Enrolled

From Self

Only to Self

and Family

From One

Plan or

Option to

Another

When You Must File Health

Benefits Election Form With

the Office of Personnel

Management

2 Annuitant/Survivor Annuitant

Note for enrolled survivor annuitants: A change in family status based on additional family members can only occur if the additional

eligible family members are family members of the deceased employee or annuitant.

2A Open Season No Yes Yes As announced by OPM.

2B Change in family status; for example: marriage, birth or death

of family member, adoption, or divorce. Note: Survivors

cannot change plans because of the death of the annuitant.

No Yes Yes From 31 days before through 60

days after the event.

2C Reenrollment of annuitant who suspended FEHB enrollment

to enroll in a Medicare Advantage plan, Medicaid or similar

State-sponsored program, or to use TRICARE (including

Uniformed Services Family Health Plan and TRICARE for

Life), Peace Corps, or CHAMPVA, and who later

involuntarily loses this coverage under one of these

programs.

May reenroll N/A N/A From 31 days before through 60

days after involuntary loss of

coverage.

2D Reenrollment of annuitant who suspended FEHB enrollment

to enroll in a Medicare Advantage plan, Medicaid or similar

State-sponsored program, or to use TRICARE (including

Uniformed Services Family Health Plan or TRICARE for

Life), Peace Corps, or CHAMPVA, and who wants to reenroll

in the FEHB Program for any reason other than an involuntary

loss of coverage.

May reenroll N/A N/A During open season.

2E Restoration of annuity payments; for example:

•

Disability annuitant who was enrolled in FEHB, and whose

annuity terminated due to restoration of earning capacity or

recovery from disability, and whose annuity is restored;

•

Surviving spouse who was covered by FEHB immediately

before survivor annuity terminated because of remarriage

and whose annuity is restored;

•

Surviving child who was covered by FEHB immediately

before survivor annuity terminated because student status

ended and whose survivor annuity is restored;

•

Surviving child who was covered by FEHB immediately

before survivor annuity terminated because of marriage and

whose survivor annuity is restored.

Yes N/A N/A Within 60 days after the retirement

system mails a notice of insurance

eligibility.

2F Annuitant or eligible family member loses FEHB coverage

due to termination, cancellation, or change to Self Only of the

covering enrollment.

Yes Yes Yes From 31 days before through 60

days after date of loss of coverage.

2G Annuitant or eligible family member loses coverage under

another group insurance plan; for example:

•

Loss of coverage under another federally-sponsored health

benefits program;

Note: Annuitants who previously suspended FEHB to use a

Medicare Advantage Plan, TRICARE, Peace Corps, or

CHAMPVA, see codes 2C and 2D.

•

Loss of coverage under Medicaid or similar

State-sponsored program;

Note: Annuitants who previously suspended FEHB to use

Medicaid or a similar State-sponsored program, see codes

2C and 2D.

•

Loss of coverage due to termination of membership in the

employee organization sponsoring the FEHB plan;

•

Loss of coverage under a non-Federal health plan.

No Yes Yes From 31 days before through 60

days after loss of coverage.

5

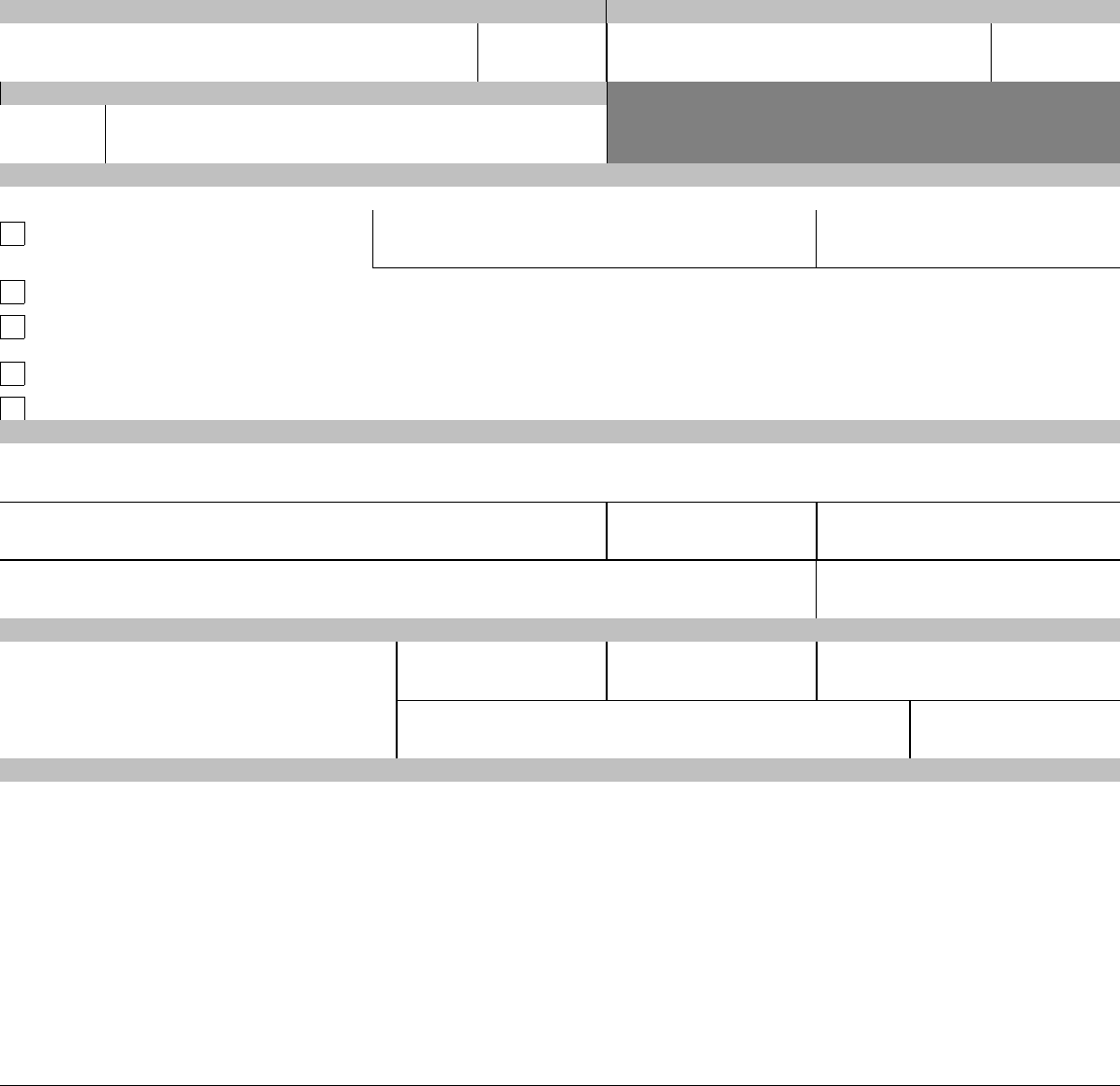

QLE’s That Permit

Enrollment or Change

Change Permitted Time Limits

Event

Code

Event

From Not

Enrolled to

Enrolled

From Self

Only to Self

and Family

From One

Plan or

Option to

Another

When You Must File Health

Benefits Election Form With

the Office of Personnel

Management

2H Annuitant or eligible family member loses coverage due to the

discontinuance, in whole or part, of an FEHB plan.

N/A Yes Yes During open season, unless OPM

sets a different time.

2I Annuitant or covered family member in a Health Maintenance

Organization (HMO) moves outside the geographic area from

which the carrier accepts enrollments, or if already outside this

area, moves further from this area.

N/A Yes Yes When you or a family member

notify OPM of a change of address

outside the plan’s service area.

2J Employee in an overseas post of duty retires or dies. No Yes Yes Within 60 days after retirement or

death.

2K An enrolled annuitant separates from duty after serving 31

days or more in a uniformed service.

N/A Yes Yes Within 60 days after separation

from the uniformed service.

2L On becoming eligible for Medicare.

(This change may be made only once in a lifetime.)

N/A No Yes At any time beginning on the 30th

day before becoming eligible for

Medicare.

2M Annuity is not sufficient to make withholdings for plan in

which enrolled.

N/A No Yes OPM will advise annuitant of the

options.

3 Former Spouse Under The Spouse Equity Provisions

Note: Former spouse may change to Self and Family only if family members are also eligible family members of the annuitant.

3A Initial opportunity to enroll. Former spouse must be eligible to

enroll under the authority of the Civil Service Retirement

Spouse Equity Act of 1984 (P.L. 98-615), as amended, the

Intelligence Authorization Act of 1986 (P.L. 99-569), or the

Foreign Relations Authorization Act, Fiscal Years 1988 and

1989 (P.L. 100-204).

Yes N/A N/A Generally, must apply within 60

days after dissolution of marriage.

However, if a retiring employee

elects to provide a former spouse

annuity or insurable interest annuity

for the former spouse, the former

spouse must apply within 60 days

after OPM’s notice of eligibility for

FEHB. May enroll any time after

OPM establishes eligibility.

3B Open Season. No Yes Yes As announced by OPM.

3C Change in family status based on addition of family members

who are also eligible family members of the annuitant.

No Yes Yes From 31 days before through 60

days after change in family status.

3D Reenrollment of former spouse who suspended FEHB

enrollment to enroll in a Medicare Advantage plan, Medicaid

or similar State-sponsored program, or to use TRICARE

(including Uniformed Services Family Health Plan or

TRICARE for Life), Peace Corps, or CHAMPVA, and who

later involuntarily loses this coverage under one of these

programs.

May reenroll N/A N/A From 31 days before through 60

days after involuntary loss of

coverage.

3E Reenrollment of former spouse who suspended FEHB

enrollment to enroll in a Medicare Advantage plan, Medicaid

or similar State-sponsored program, or to use TRICARE

(including Uniformed Services Family Health Plan or

TRICARE for Life), Peace Corps, or CHAMPVA, and who

wants to reenroll in the FEHB Program for any reason other

than an involuntary loss of coverage.

May reenroll N/A N/A During open season.

3F Former spouse or eligible child loses FEHB coverage due

to termination, cancellation, or change to Self Only of the

covering enrollment.

Yes Yes Yes From 31 days before through 60

days after date of loss of coverage.

6

QLE’s That Permit

Enrollment or Change

Change Permitted Time Limits

Event

Code

Event

From Not

Enrolled to

Enrolled

From Self

Only to Self

and Family

From One

Plan or

Option to

Another

When You Must File Health

Benefits Election Form With

the Office of Personnel

Management

3G Enrolled former spouse or eligible child loses coverage under

another group insurance plan; for example:

•

Loss of coverage under another federally-sponsored health

benefits program;

Note: Former spouses who previously suspended FEHB to

use a Medicare Advantage plan, TRICARE, Peace Corps,

or CHAMPVA, see codes 3D and 3E.

•

Loss of coverage under Medicaid or similar

State-sponsored program;

Note: Former spouses who previously suspended FEHB to

use Medicaid or a similar State-sponsored program, see

codes 3D and 3E.

•

Loss of coverage due to termination of membership in the

employee organization sponsoring the FEHB plan;

•

Loss of coverage under a non-Federal health plan.

N/A Yes Yes From 31 days before through 60

days after loss of coverage.

3H Former spouse or eligible family member loses coverage due

to the discontinuance, in whole or part, of an FEHB plan.

N/A Yes Yes During open season, unless OPM

sets a different time.

3I Former spouse or covered family member in a Health

Maintenance Organization (HMO) moves outside the

geographic area from which the carrier accepts enrollments,

or if already outside this area, moves further from this area.

N/A Yes Yes When you or a family member

notify OPM of a change of address

outside the plan’s service area.

3J On becoming eligible for Medicare

(This change may be made only once in a lifetime.)

N/A No Yes At any time beginning the 30th

day before becoming eligible for

Medicare.

3K Former spouse’s annuity is not sufficient to make FEHB

withholdings for plan in which enrolled.

No No Yes Retirement system will advise

former spouse of options.

4 Temporary Continuation of Coverage (TCC) For Eligible Former Spouses and Children.

Note: Former spouse may change to Self and Family only if family members are also eligible family members of the annuitant.

4A Opportunity to enroll for continued coverage under TCC

provisions:

•

Former spouse

•

Child who ceases to qualify as a family

member

Yes

Yes

N/A

N/A

N/A

N/A

Within 60 days after the qualifying

event, or receiving notice of

eligibility, whichever is later.

4B Open Season:

•

Former spouse

•

Child who ceases to qualify as a family

member

No

No

Yes

Yes

Yes

Yes

As announced by OPM.

4C Change in family status (except former spouse); for example,

marriage, birth or death of family member, adoption, or

divorce.

No Yes Yes From 31 days before through 60

days after event.

4D Change in family status of former spouse, based on addition

of family members who are eligible family members of the

employee or annuitant.

No Yes Yes From 31 days before through 60

days after event.

4E Reenrollment of a former spouse or child whose TCC

enrollment was terminated because of other FEHB coverage

and who loses the other FEHB coverage before the TCC

period of eligibility (18 or 36 months) expires.

May reenroll N/A N/A From 31 days before through 60

days after the event. Enrollment is

retroactive to the date of the loss of

the other FEHB coverage.

7

QLE’s That Permit

Enrollment or Change

Change Permitted Time Limits

Event

Code

Event

From Not

Enrolled to

Enrolled

From Self

Only to Self

and Family

From One

Plan or

Option to

Another

When You Must File Health

Benefits Election Form With

the Office of Personnel

Management

4F Enrollee or eligible family member loses coverage under

FEHB or another group insurance plan; for example:

•

Loss of coverage under another FEHB enrollment due to

termination, cancellation, or change to Self Only of the

covering enrollment (but see event 4E);

•

Loss of coverage under another federally-sponsored health

benefits program;

•

Loss of coverage due to termination of membership in the

employee organization sponsoring the FEHB plan;

•

Loss of coverage under Medicaid or similar

State-sponsored program;

•

Loss of coverage under a non-Federal health plan.

No Yes Yes From 31 days before through 60

days after loss of coverage.

4G Enrollee or eligible family member loses coverage due to the

discontinuance, in whole or part, of an FEHB plan.

N/A Yes Yes During open season, unless OPM

sets a different time.

4H Enrollee or covered family member in a Health Maintenance

Organization (HMO) moves outside the geographic area from

which the carrier accepts enrollments, or if already outside

this area, moves further from this area.

N/A Yes Yes When you or a family member

notify OPM of a change of address

outside the plan’s service area.

4I On becoming eligible for Medicare.

(This change may be made only once in a lifetime.)

N/A No Yes At any time beginning on the 30th

day before becoming eligible for

Medicare.

8

Form Approved:

Health Benefits Election Form

OMB No. 3206-0141

For Use By Annuitants and Former Spouses of Annuitants

Federal Employees

Health Benefits Program

8. Medicare Claim Number

7. If you are covered by Medicare,

check all that apply.

6. Mailing address (including ZIP Code)

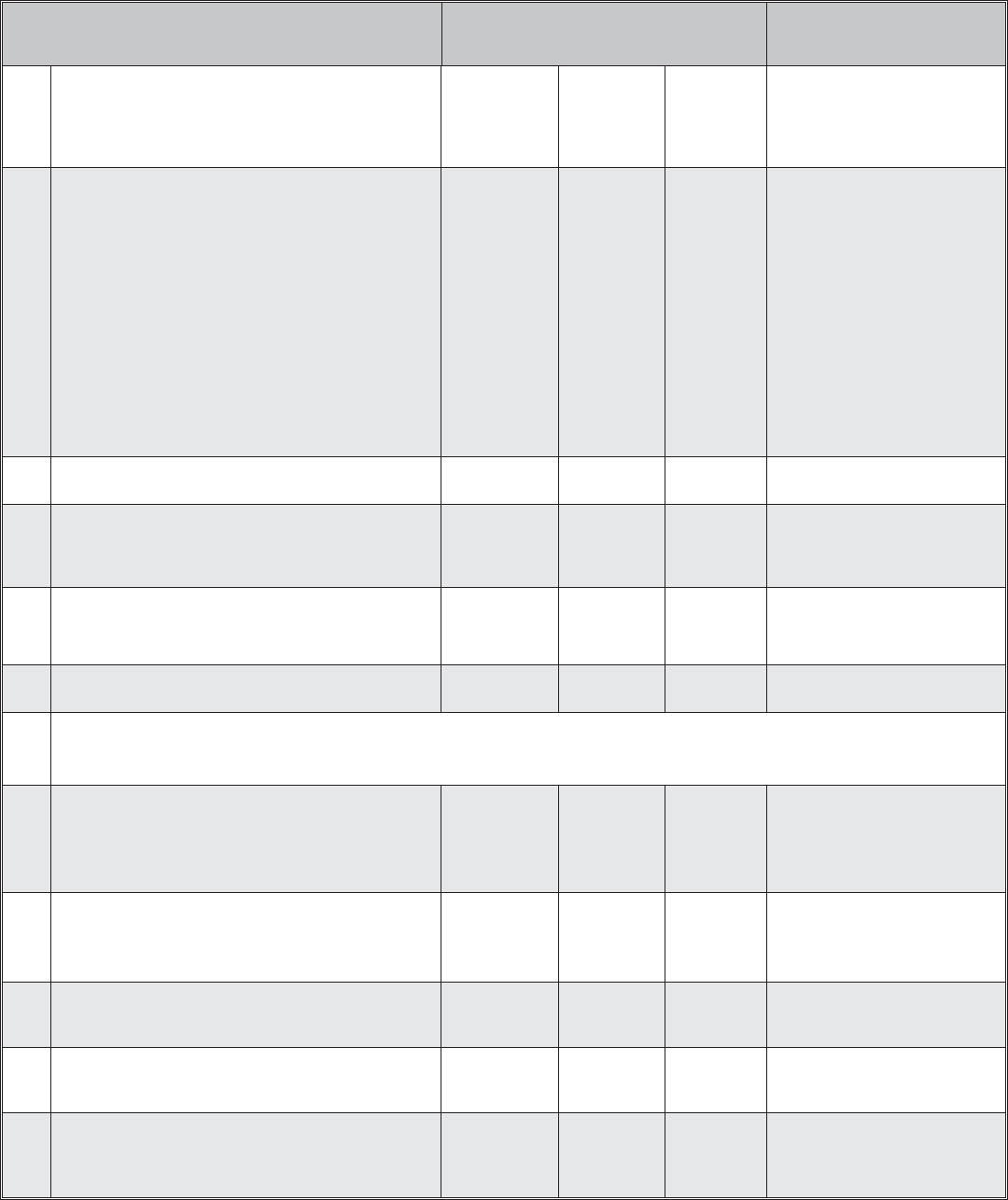

Part A - Enrollee and Family Member Information (for additional family members attach a separate sheet)

1. Enrollee name (last, first, middle initial) 2. Social Security Number 3. Date of birth (mm/dd/yyyy) 4. Sex

M F

5. Are you married?

Yes No

A B

_ _ / _ _ / _ _ _ _

D

9. Are you covered by insurance other than Medicare?

Yes, indicate in item 10 below. No

10. Indicate the type(s) of other insurance

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

TRICARE Other Name of other insurance: __________________________________________ Policy Number: _____________________

FEHB An FEHB self and family enrollment covers all eligible family members. No person may be covered under more than one FEHB enrollment. See instructions for

item 9 on page 1.

11. Email address 12. Preferred telephone number

_ _ / _ _ / _ _ _ _

13. Name of family member (last, first, middle initial) 14. Social Security Number 15. Date of birth (mm/dd/yyyy)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

16. Sex 17. Relationship code

M F

19. If this family member is covered

18. Address (if different from enrollee) 20. Medicare Claim Number

by Medicare, check all that apply.

A B D

21. Is this family member covered by insurance other than Medicare?

Yes, indicate in item 22 below. No

22. Indicate the type(s) of other insurance

TRICARE Other Name of other insurance: ______________________________________________ Policy Number: _____________________

FEHB An FEHB self and family enrollment covers all eligible family members. No person may be covered under more than one FEHB enrollment. See instructions for

item 9 on page 1.

23. Email address (if applicable, enter email address of your spouse or adult child) 24. Preferred telephone number (if applicable, enter preferred phone number of

your spouse or adult child)

25. Name of family member (last, first, middle initial) 26. Social Security Number 27. Date of birth (mm/dd/yyyy)

_ _ / _ _ / _ _ _ _

28. Sex

M F

29. Relationship code

30. Address (if different from enrollee)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

31. If this family member is covered

by Medicare, check all that apply.

A B D

32. Medicare Claim Number

33. Is this family member covered by insurance other than Medicare?

Yes, indicate in item 34 below. No

34. Indicate the type(s) of other insurance

TRICARE Other Name of other insurance: ______________________________________________ Policy Number: _____________________

FEHB An FEHB self and family enrollment covers all eligible family members. No person may be covered under more than one FEHB enrollment. See instructions for

item 9 on page 1.

35. Email address (if applicable, enter email address of your spouse or adult child)

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

36. Preferred telephone number (if applicable, enter preferred phone number of

your spouse or adult child)

_ _ / _ _ / _ _ _ _

37. Name of family member (last, first, middle initial) 38. Social Security Number 39. Date of birth (mm/dd/yyyy) 40. Sex 41. Relationship code

M F

43. If this family member is covered

42. Address (if different from enrollee) 44. Medicare Claim Number

by Medicare, check all that apply.

A B D

45. Is this family member covered by insurance other than Medicare?

Yes, indicate in item 46 below. No

46. Indicate the type(s) of other insurance

TRICARE Other Name of other insurance: ______________________________________________ Policy Number: _____________________

FEHB

An FEHB self and family enrollment covers all eligible family members. No person may be covered under more than one FEHB enrollment. See instructions for

item 9 on page 1.

47. Email address (if applicable, enter email address of your spouse or adult child) 48. Preferred telephone number (if applicable, enter preferred phone number of

your spouse or adult child)

Page 1 of 2

U.S. Office of Personnel Management OPM Form 2809

Previous edition is not usable. Revised December 2013

PRINT

Copy 1 - Enrollee

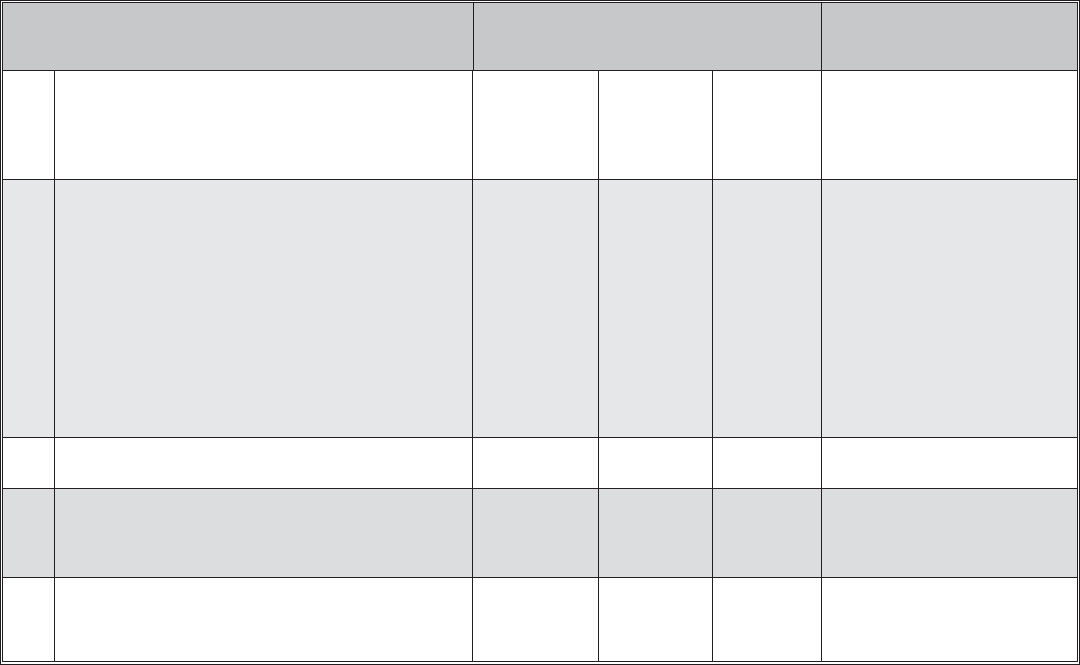

Part B - FEHB Plan You Are Currently Enrolled In (if applicable)

Part E - Election to Suspend/Cancel (fill in this part if you wish to suspend/cancel your enrollment in the FEHBP. See page 2 of the instructions.)

I elect to suspend or cancel my enrollment and have initialed the appropriate box below.

1. Plan name 2. Enrollment code

Part C - FEHB Plan You Are Enrolling In or Changing To

1. Plan name

2. Enrollment code

Part D - Event That Permits You To Enroll, Change, or Cancel (see page 2)

1. Event code 2. Date of event

_ _ / _ _ / _ _ _ _

Name

Social Security Number

I will be covered under the FEHB enrollment of:

I am covered by a Medicare Advantage plan, Medicaid or a similar State-sponsored program of medical assistance for the needy. I am enclosing evidence of my coverage.

I will be using CHAMPVA, TRICARE, or TRICARE for Life (enrollees over age 65 with Medicare Parts A and B). I am enclosing copies of my CHAMPVA authorization

card or my Uniformed Services identification card and, if over age 65, my Medicare card showing Parts A and B.

I am or will be covered by Peace Corps volunteer health benefits. I am enclosing evidence of my coverage.

Part F - Signature (all who register or cancel must fill in this part)

I am cancelling my enrollment for reasons other than the three situations shown above. I understand I can never reenroll in the FEHBP.

WARNING: Any intentionally false statement on this application or willful misrepresentation relative thereto is a violation of the law punishable by a fine of not more

than $10,000 or imprisonment of not more than 5 years, or both. (18 U.S.C. 1001.)

4. Payroll office number

6. Date

2. Date received in OPM 3. Effective date of action

5. Signature of authorized agency official

_ _ / _ _ / _ _ _ _ _ _ / _ _ / _ _ _ _

1. Your signature (do not print) 3. Retirement Claim Number 2. Date (mm/dd/yyyy)

_ _ / _ _ / _ _ _ _

Part G - To be Completed by OPM

1. Name and address

U.S. Office of Personnel Management

Retirement Services

Washington, D.C. 20415

24 90 0002

_ _ / _ _ / _ _ _ _

Remarks (For use by OPM only.)

5. Preferred telephone number 4. Email Address

Page 2 of 2

OPM Form 2809

Revised December 2013

PRINT

SAVE

CLEAR

Copy 1 - Enrollee