Fillable Printable Personal Financial Statement - US Bank

Fillable Printable Personal Financial Statement - US Bank

Personal Financial Statement - US Bank

PFS for CONFIDENTIAL Page 1 of 3

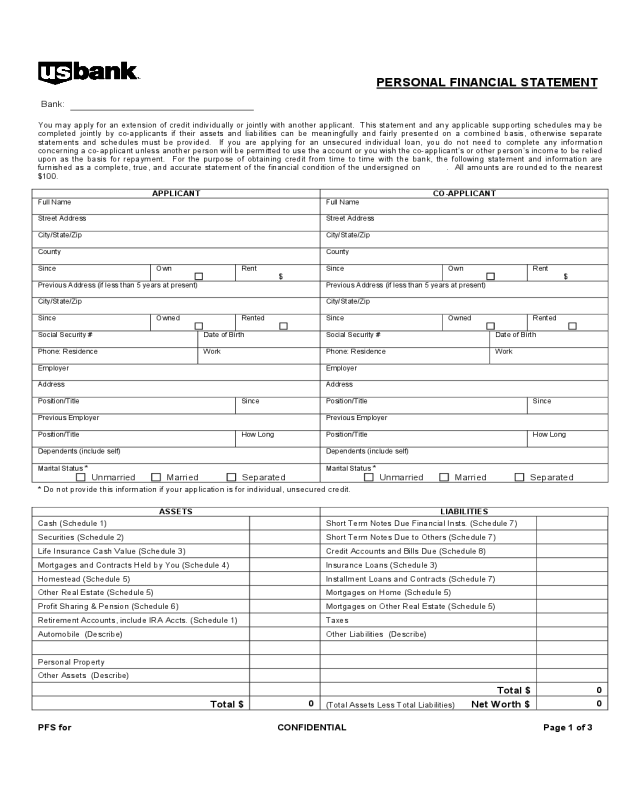

PERSONAL FINANCIAL STATEMENT

Bank:

You may apply for an extension of credit individually or jointly with another applicant. This statement and any applicable supporting schedules may be

completed jointly by co-applicants if their assets and liabilities can be meaningfully and fairly presented on a combined basis, otherwise separate

statements and schedules must be provided. If you are applying for an unsecured individual loan, you do not need to complete any information

concerning a co-applicant unless another person will be permitted to use the account or you wish the co-applicant’s or other person’s income to be relied

upon as the basis for repayment. For the purpose of obtaining credit from time to time with the bank, the following statement and information are

furnished as a complete, true, and accurate statement of the financial condition of the undersigned on . All amounts are rounded to the nearest

$100.

APPLICANT CO-APPLICANT

Full Name

Full Name

Street Address

Street Address

City/State/Zip

City/State/Zip

County

County

Since

Own Rent

$

Since

Own Rent

$

Previous Address (if less than 5 years at present)

Previous Address (if less than 5 years at present)

City/State/Zip

City/State/Zip

Since

Owned Rented Since

Owned Rented

Social Security #

Date of Birth

Social Security #

Date of Birth

Phone: Residence

Work

Phone: Residence

Work

Employer

Employer

Address

Address

Position/Title

Since

Position/Title

Since

Previous Employer

Previous Employer

Position/Title

How Long

Position/Title

How Long

Dependents (include self)

Dependents (include self)

Marital Status *

Unmarried Married Separated

Marital Status *

Unmarried Married Separated

* Do not provide this information if your application is for individual, unsecured credit.

ASSETS LIABILITIES

Cash (Schedule 1)

Short Term Notes Due Financial Insts. (Schedule 7)

Securities (Schedule 2)

Short Term Notes Due to Others (Schedule 7)

Life Insurance Cash Value (Schedule 3)

Credit Accounts and Bills Due (Schedule 8)

Mortgages and Contracts Held by You (Schedule 4)

Insurance Loans (Schedule 3)

Homestead (Schedule 5)

Installment Loans and Contracts (Schedule 7)

Other Real Estate (Schedule 5)

Mortgages on Home (Schedule 5)

Profit Sharing & Pension (Schedule 6)

Mortgages on Other Real Estate (Schedule 5)

Retirement Accounts, include IRA Accts. (Schedule 1)

Taxes

Automobile (Describe)

Other Liabilities (Describe)

Personal Property

Other Assets (Describe)

Total $

0

Total $

0

(Total Assets Less Total Liabilities) Net Worth $

0

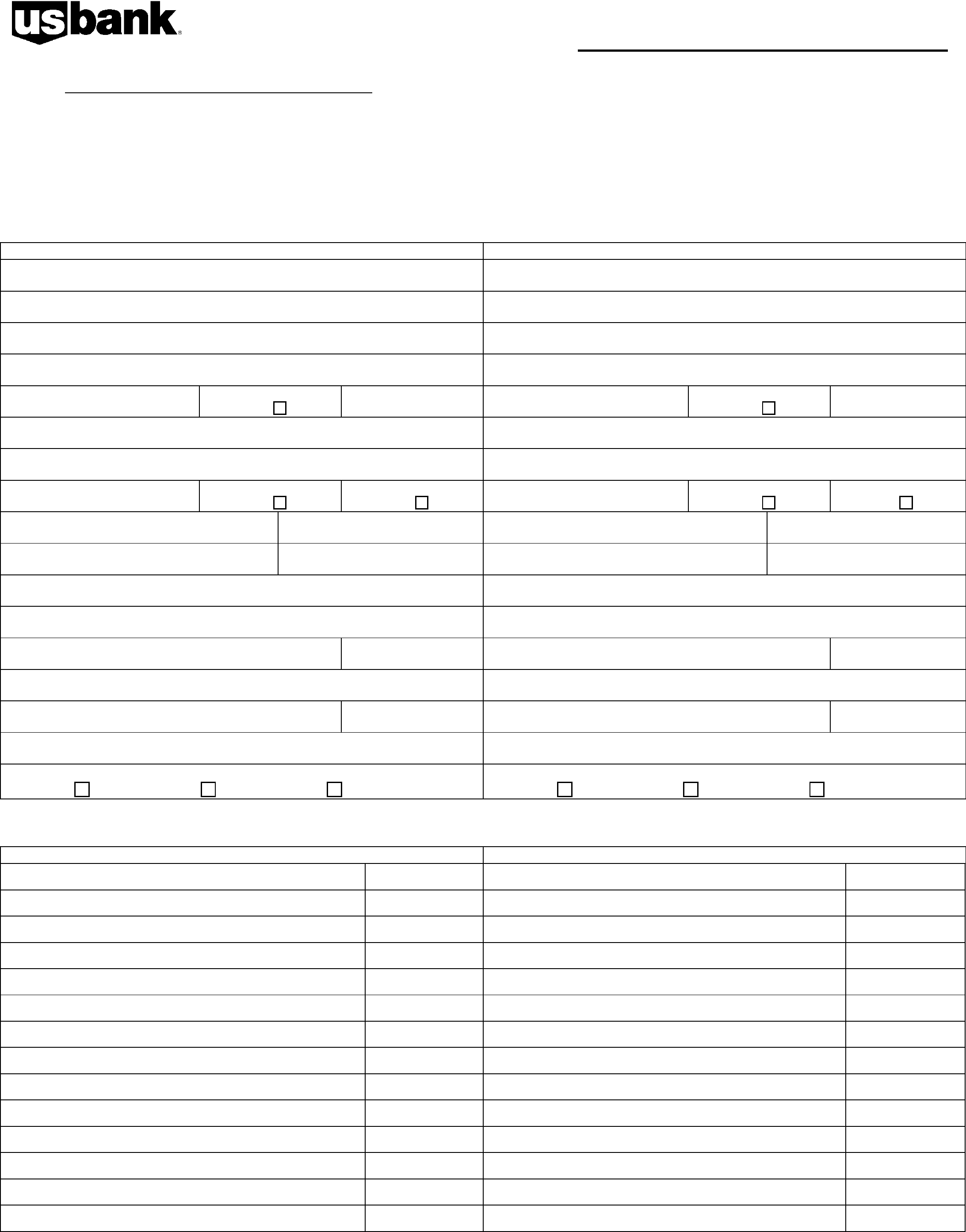

PFS for CONFIDENTIAL Page 2 of 3

Please contact your banker if you need assistance with completing these schedules. Round all amounts to the nearest $100.

* ANNUAL INCOME APPLICANT CO-APPLICANT PLEASE ANSWER EACH QUESTION (Yes / No) APP. CO-APP

Salary

Bonuses/Commissions

Are you a Co-Maker, Endorser or Guarantor of

any other person’s debt?

Dividends/Interest

Net Real Estate Income

Are you a defendant in any suit or legal action?

* Income from alimony, child support, or

maintenance payments need not be entered

unless you want it considered as a base for

repayment.

Have you ever gone through bankruptcy or had a

judgment against you?

Other (List)

Total 0 0

Have you made a will?

SCHEDULE 1 / CASH, SAVINGS, CERTIFICATES AND IRA ACCOUNTS

Name of Bank or Financial Institution Type of Account Acct. Balance

Total $ 0

SCHEDULE 2 / SECURITIES OWNED

Par Value or

No. of Shares Description

Registered in

Name(s) of

Listed or

Unlisted

Current Market

Value

Total $ 0

SCHEDULE 3 / LIFE INSURANCE

Insurance Company Insured Beneficiary

Face Value

of Policy

Cash Value

of Policy Loans

Total $ 0 0

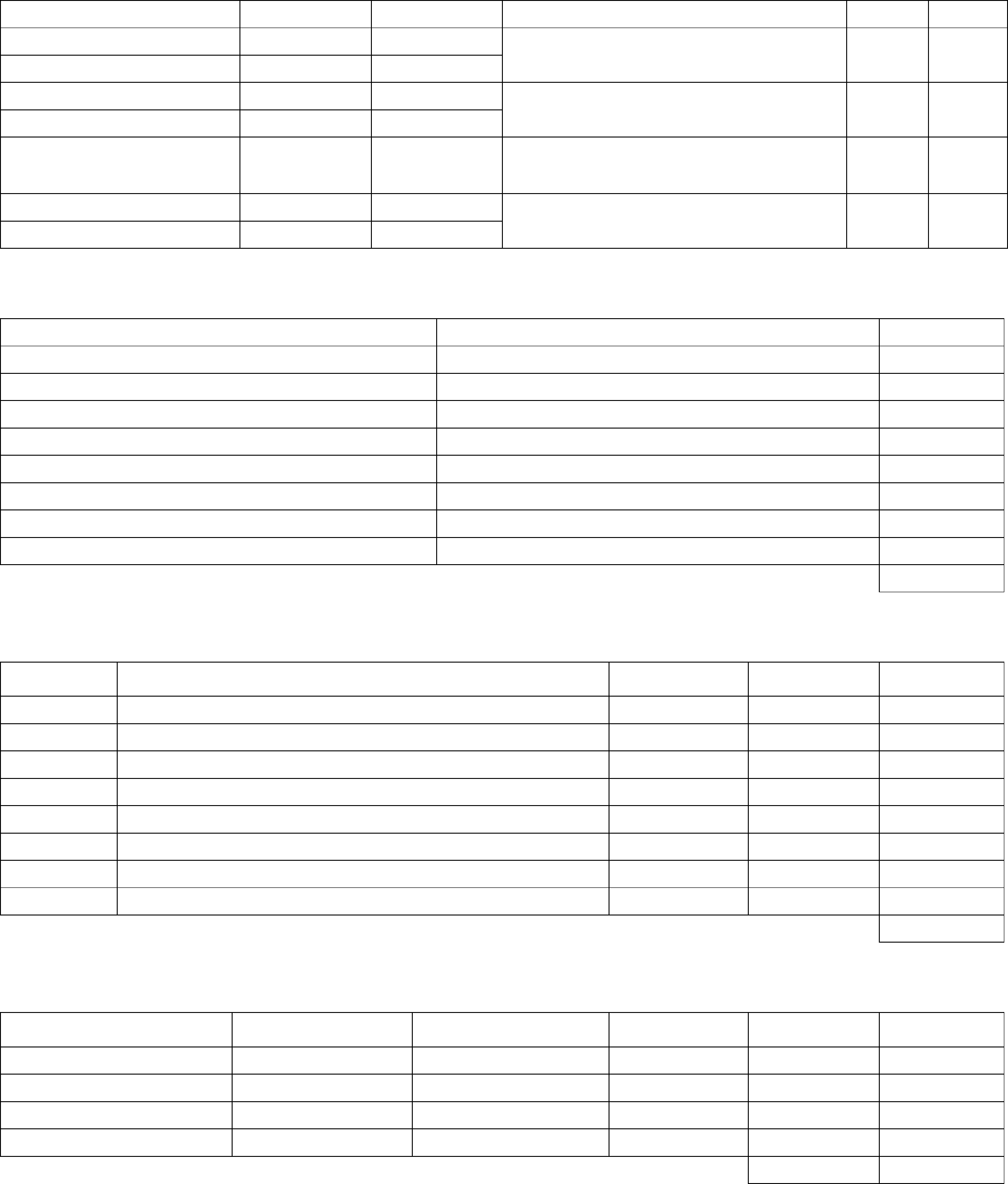

PFS for CONFIDENTIAL Page 3 of 3

SCHEDULE 4 / RECEIVABLES DUE TO ME ON MORTGAGES AND CONTRACTS I OWN

Name of Debtor Description of Property

First Lien or

Second Lien

Date of

Maturity Repayment Terms Balance Due

per

per

per

Total $ 0

SCHEDULE 5 / REAL ESTATE OWNED

Property Description Name of Creditor

Year

Acquired

Purchase

Price

Mortgage

Balance

Date of

Maturity Repayment Terms

Current Market

Value

per

per

per

per

per

per

Insurance Co.: Agent:

Total $ 0

SCHEDULE 6 / PROFIT SHARING AND PENSION

Name of Institution Type of Account

Account

Balance

Amount Totally

Vested Loans

Total $000

SCHEDULE 7 / INSTALLMENTS, CREDIT LINES AND NOTES

Name of Creditor Collateral

Date of

Maturity Repayment Terms Balance Due

per

per

per

per

Total $ 0

SCHEDULE 8 / CREDIT ACCOUNTS, BILLS DUE, ALIMONY/CHILD SUPPORT, DAYCARE, ETC.

Name of Company Repayment Terms Balance Due

per

per

per

per

per

Total $ 0

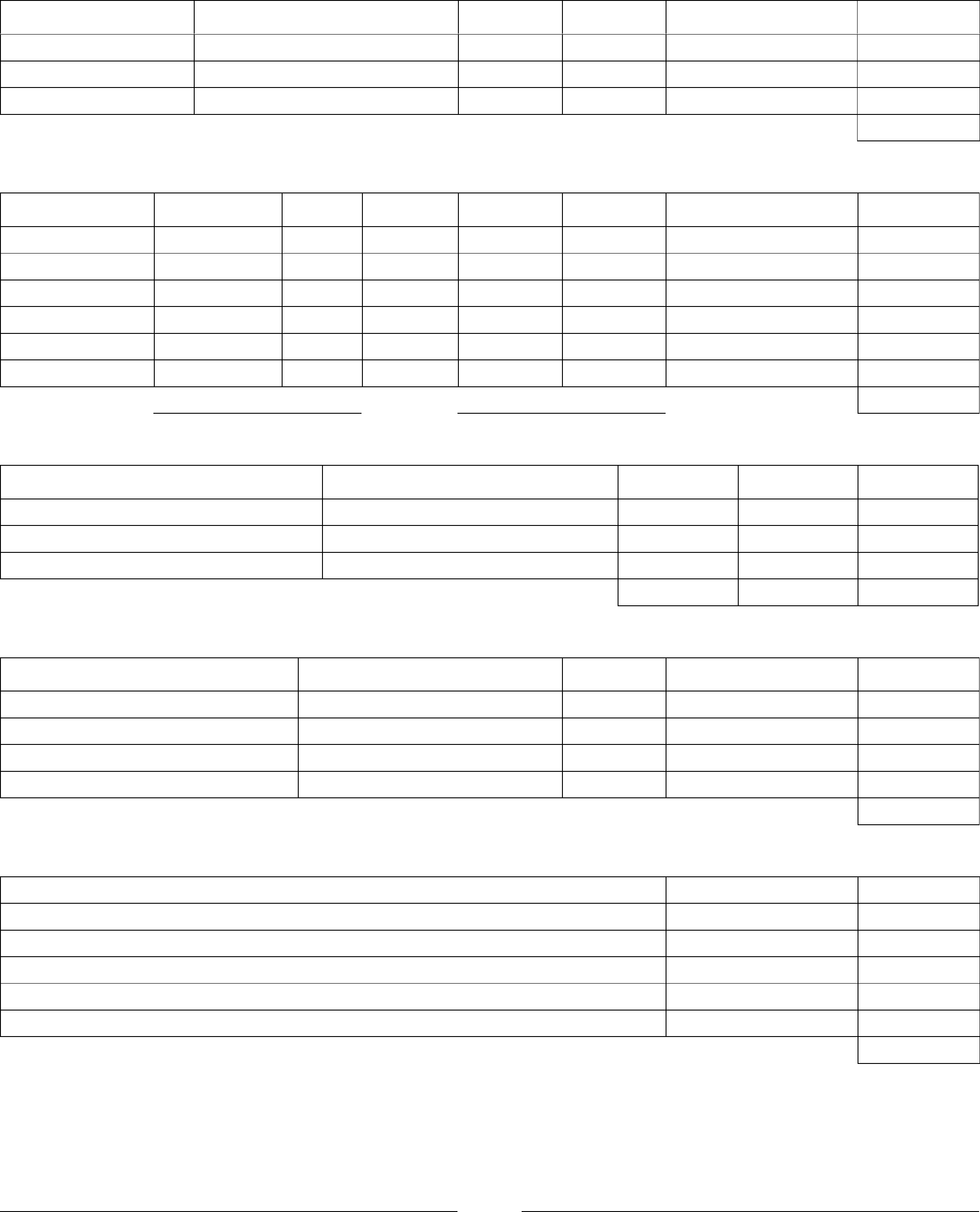

You certify that the information provided in this statement is true and correct. So long as you owe any sums to the bank, you agree to give the bank

prompt written notice of any material change in your financial condition and, upon request, you agree to provide the bank with an updated personal

financial statement. The bank is authorized to retain this personal financial statement whether or not credit is approved and is further authorized to verify

your credit and employment history or any other information in this statement. This application does not obligate the bank to make any loan even if you

meet the normal standards the bank considers in determining whether to approve or deny the application.

Applicant’s Signature Date Co-Applicant’s Signature Date