Fillable Printable Power of Attorney Declaration - California EDD

Fillable Printable Power of Attorney Declaration - California EDD

Power of Attorney Declaration - California EDD

DE 48 Rev. 7 (5-13) (INTERNET) Page 1 of 2 CU

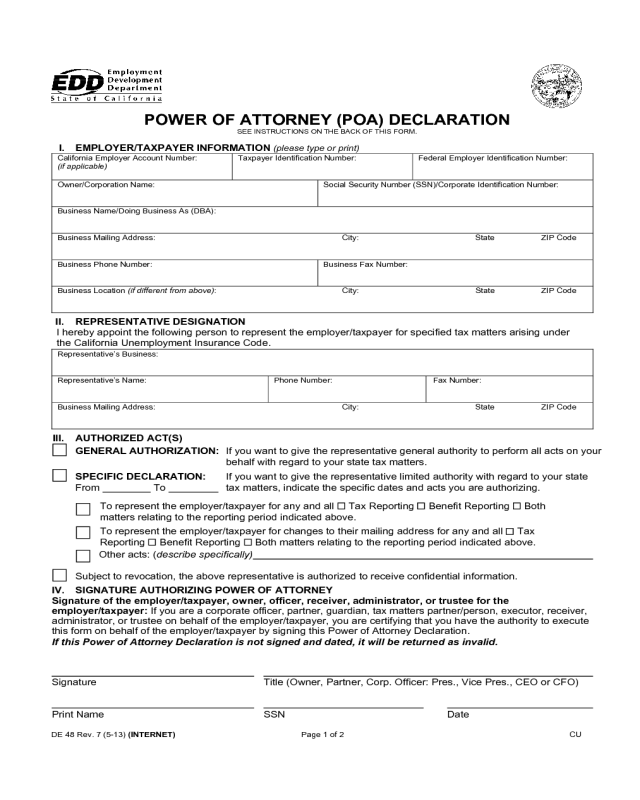

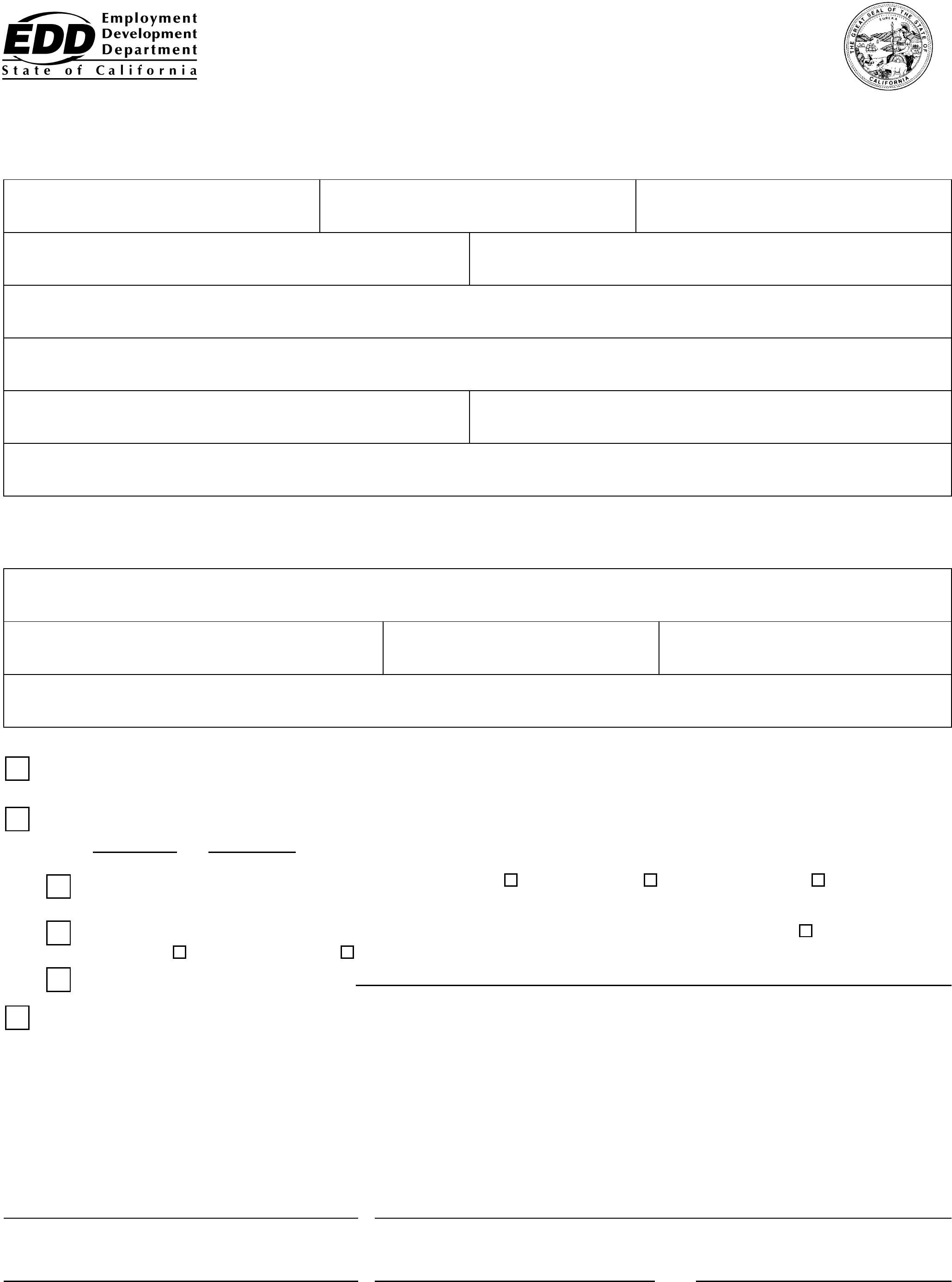

POWER OF ATTORNEY (POA) DECLARATION

SEE INSTRUCTIONS ON THE BACK OF THIS FORM.

I. EMPLOYER/TAXPAYER INFORMATION (please type or print)

California Employer Account Number:

(if applicable)

Taxpayer Identification Number:

Federal Employer Identification Number:

Owner/Corporation Name:

Social Security Number (SSN)/Corporate Identification Number:

Business Name/Doing Business As (DBA):

Business Mailing Address: City: State ZIP Code

Business Phone Number:

Business Fax Number:

Business Location (if different from above): City: State ZIP Code

II. REPRESENTATIVE DESIGNATION

I hereby appoint the following person to represent the employer/taxpayer for specified tax matters arising under

the California Unemployment Insurance Code.

Representative’s Business:

Representative’s Name:

Phone Number:

Fax Number:

Business Mailing Address: City: State ZIP Code

III. AUTHORIZED ACT(S)

GENERAL AUTHORIZATION: If you want to give the representative general authority to perform all acts on your

behalf with regard to your state tax matters.

SPECIFIC DECLARATION: If you want to give the representative limited authority with regard to your state

From To tax matters, indicate the specific dates and acts you are authorizing.

Other acts: (describe specifically)

Subject to revocation, the above representative is authorized to receive confidential information.

IV. SIGNATURE AUTHORIZING POWER OF ATTORNEY

Signature of the employer/taxpayer, owner, officer, receiver, administrator, or trustee for the

employer/taxpayer: If you are a corporate officer, partner, guardian, tax matters partner/person, executor, receiver,

administrator, or trustee on behalf of the employer/taxpayer, you are certifying that you have the authority to execute

this form on behalf of the employer/taxpayer by signing this Power of Attorney Declaration.

If this Power of Attorney Declaration is not signed and dated, it will be returned as invalid.

Signature Title (Owner, Partner, Corp. Officer: Pres., Vice Pres., CEO or CFO)

Print Name SSN Date

To represent the employer/taxpayer for any and all Tax Reporting Benefit Reporting Both

matters relating to the reporting period indicated above.

To represent the employer/taxpayer for changes to their mailing address for any and all Tax

Reporting Benefit Reporting Both matters relating to the reporting period indicated above.

DE 48 Rev. 7 (5-13) (INTERNET) Page 2 of 2

Instructions for Completing the Power of Attorney (POA) Declaration (DE 48)

General Information:

This Power of Attorney (POA) Declaration (DE 48) is your written authorization for an

individual or other entity to act on your behalf in tax and/or benefit reporting matters,

and will remain in effect until it is rescinded or revoked. When a new POA is filed with

the Employment Development Department (EDD), the new POA will automatically

revoke any prior declaration(s) on file unless you attach a copy of each POA that you

want to remain in effect. In addition, if you need to limit the term of a POA, you must

specify the date it will expire as outlined in Section III below. For general information,

call the Account Services Group at 916-654-7263.

I. EMPLOYER/TAXPAYER INFORMATION - Enter your California Employer

Account Number (if applicable), Taxpayer Identification Number, Federal

Employer Identification Number, Owner or Corporation Name, Owner(s) Social

Security Number or Corporate Identification Number, Business Name/Doing

Business As (DBA), mailing address, business phone and fax number(s), and

business location if different than the mailing address.

II. REPRESENTATIVE DESIGNATION - Enter the representative’s business,

representative’s name, phone number, fax number, and address.

III. AUTHORIZED ACT(S) - If you want to authorize your representative to perform

any and all acts on your behalf, check the “General Authorization” box. If you

want to limit this authorization, check the boxes that apply under “Specific

Declaration.” Enter the beginning and ending dates of each interval/period for

which you are making the declaration.

IV. SIGNATURE AUTHORIZING POWER OF ATTORNEY - The POA must be

signed and dated by the business owner, partner, or corporate officer (i.e.,

President, Vice President, CEO, or CFO). Please submit an updated list of

corporate officers/owners with this document, if applicable. If the declaration is

submitted without a signature or with an unauthorized signature, it will be

returned.

Please return your completed DE 48 to the EDD representative with whom you are

working. If you are not working with a particular representative, send the form to:

Employment Development Department

Account Services Group, MIC 28

P.O. Box 826880

Sacramento, CA 94280-0001

If you have questions or need assistance completing this form, please call:

Department Representative:

Phone Number: