Fillable Printable Power of Attorney - Missouri Department of Revenue

Fillable Printable Power of Attorney - Missouri Department of Revenue

Power of Attorney - Missouri Department of Revenue

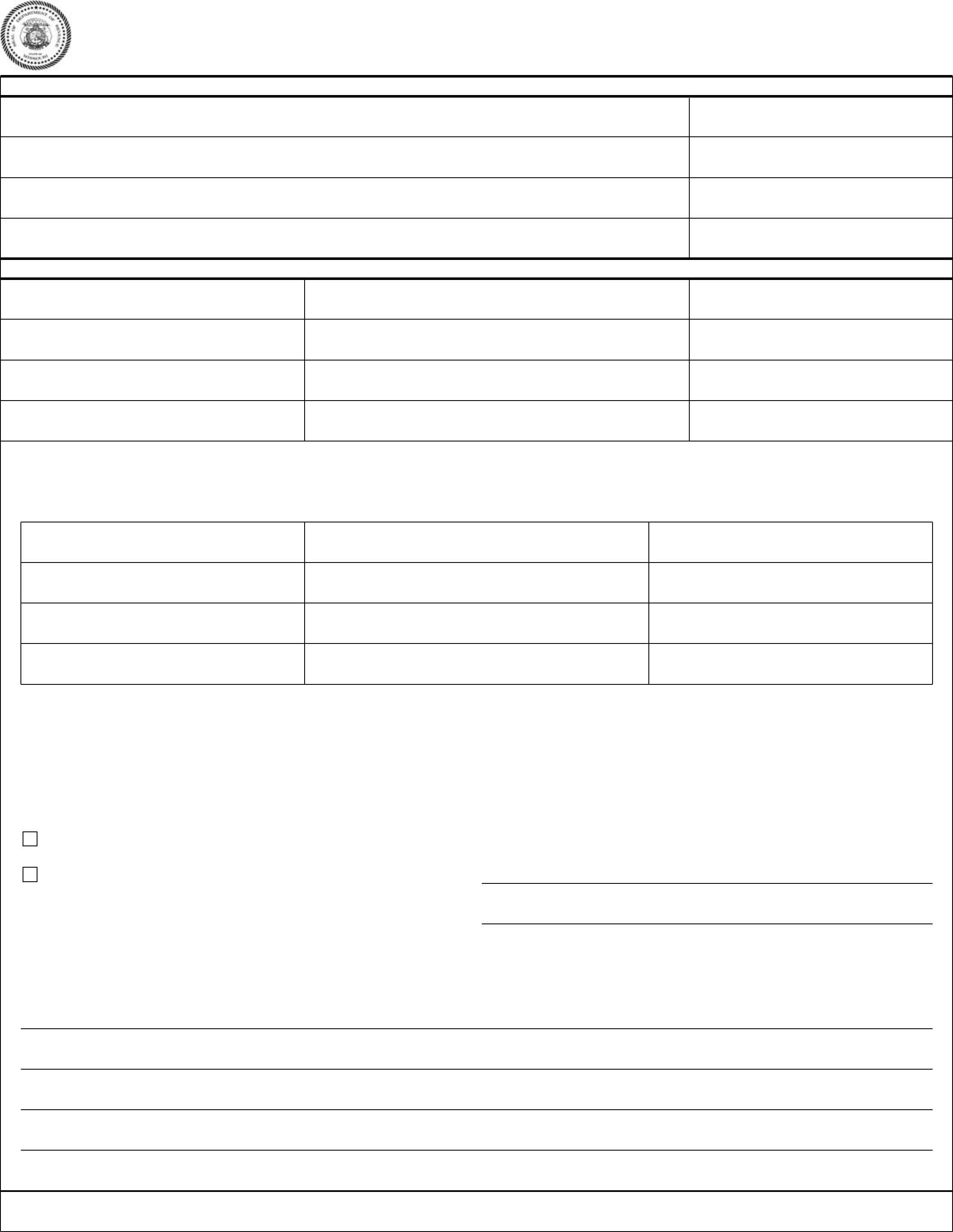

The attorney(s)-in-fact (or either of them) are authorized, subject to revocation, to receive confidential information and perform

any and all acts that the taxpayer(s) can perform with respect to the above specified tax matters, but not the power to endorse or

receive checks in payment of any refunds.

Copies of notices and other written communications addressed to taxpayer(s) in proceedings involving the above tax matters

should be sent to:

1. the representative first named above; or

2. the following named representative(s) (no more than two):

By execution of this power of attorney, all earlier powers of attorney on file with the Department of Revenue, state of Missouri, for

the same tax matter(s) and years or periods covered by this power of attorney are revoked, except the following (specify to whom

power of attorney was granted, date and address, or refer to attached copies of earlier powers of attorney and authorizations.):

MO 860-1723 (10-2005)

DOR-2827 (10-2005)

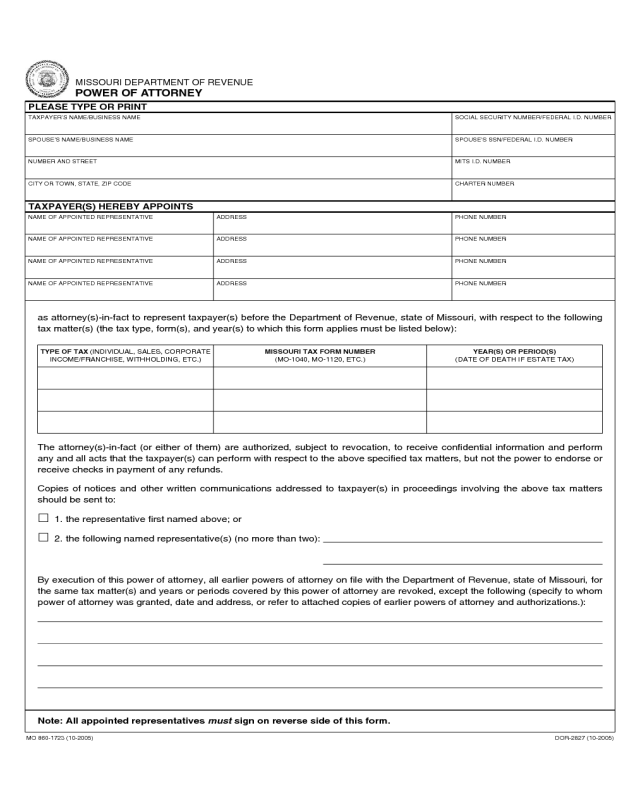

MISSOURI DEPARTMENT OF REVENUE

POWER OF ATTORNEY

TAXPAYER’S NAME/BUSINESS NAME SOCIAL SECURITY NUMBER/FEDERAL I.D. NUMBER

SPOUSE’S NAME/BUSINESS NAME SPOUSE’S SSN/FEDERAL I.D. NUMBER

NUMBER AND STREET MITS I.D. NUMBER

CITY OR TOWN, STATE, ZIP CODE CHARTER NUMBER

TAXPAYER(S) HEREBY APPOINTS

PLEASE TYPE OR PRINT

NAME OF APPOINTED REPRESENTATIVE ADDRESS PHONE NUMBER

NAME OF APPOINTED REPRESENTATIVE ADDRESS PHONE NUMBER

NAME OF APPOINTED REPRESENTATIVE ADDRESS PHONE NUMBER

NAME OF APPOINTED REPRESENTATIVE ADDRESS PHONE NUMBER

as attorney(s)-in-fact to represent taxpayer(s) before the Department of Revenue, state of Missouri, with respect to the following

tax matter(s) (the tax type, form(s), and year(s) to which this form applies must be listed below):

TYPE OF TAX (INDIVIDUAL, SALES, CORPORATE

INCOME/FRANCHISE, WITHHOLDING, ETC.)

MISSOURI TAX FORM NUMBER

(MO-1040, MO-1120, ETC.)

YEAR(S) OR PERIOD(S)

(DATE OF DEATH IF ESTATE TAX)

Note: All appointed representatives

must

sign on reverse side of this form.

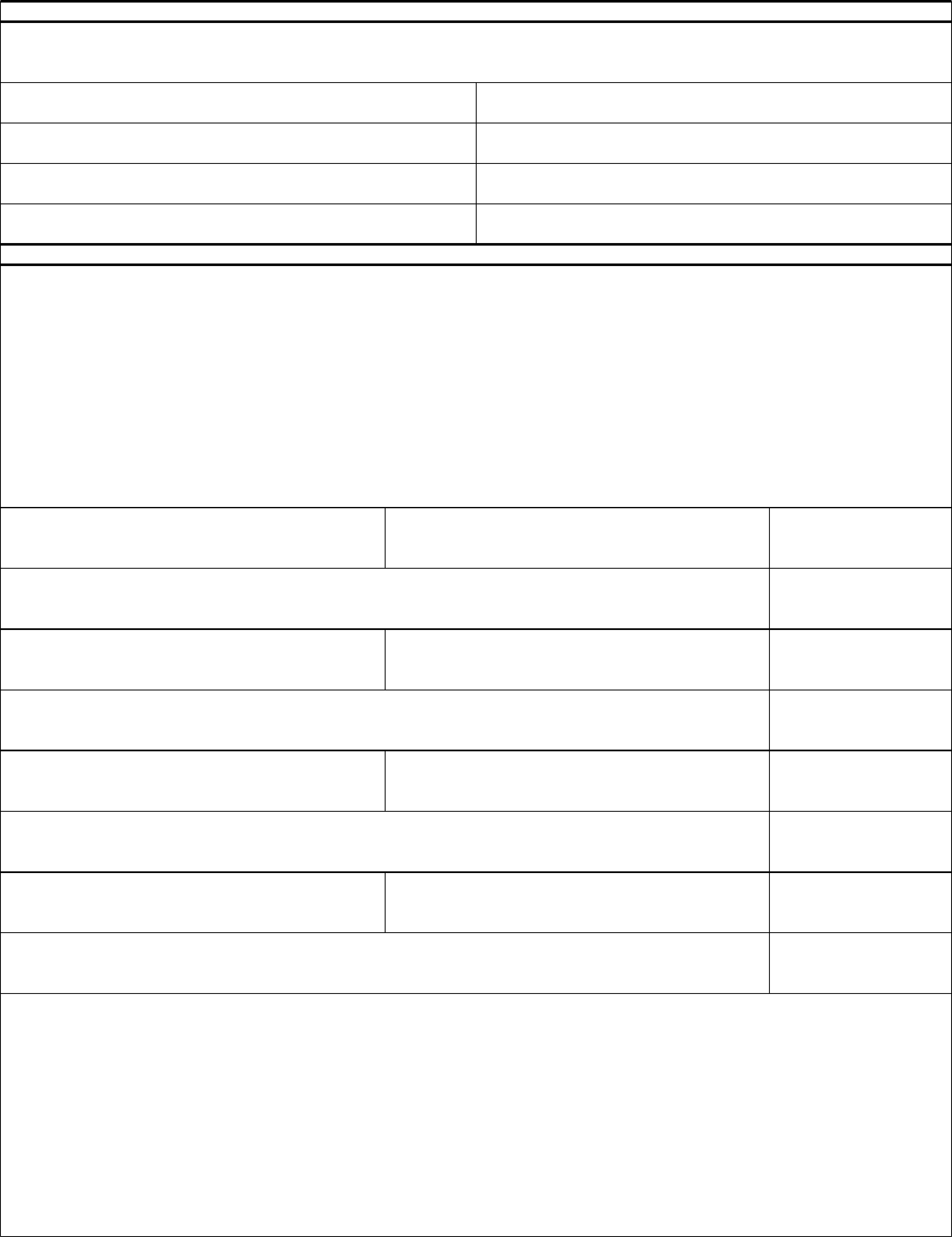

This publication is available upon request in alternative accessible format(s).

MO 860-1723 (10-2005) DOR-2827 (10-2005)

SIGNATURE OF, OR FOR, TAXPAYER(S)

I (we) hereby certify that I (we) am (are) the taxpayer(s) named herein or that I have the authority to execute this power of

attorney on behalf of the taxpayer(s). Submission of a DOR-2827, Power of Attorney by a taxpayer will not in itself suffice as an

official notification of a mailing address change with the Department of Revenue.

NAME TITLE (IF APPLICABLE)

SIGNATURE DATE

NAME TITLE (IF APPLICABLE)

SIGNATURE DATE

I declare that I am aware of Regulation 12 CSR 10-41.030 and that I am one of the following:

1. a member in good standing of the bar of the highest court of the jurisdiction indicated below;

2. a certified public accountant duly qualified to practice in the jurisdiction indicated below;

3. an officer of the taxpayer organization;

4. a full-time employee of the taxpayer;

5. a fiduciary for the taxpayer;

6. an enrolled agent; or

7. other

and that I am authorized to represent the taxpayer identified above for the tax matters there specified.

Note: All appointed representatives

must

sign below.

DECLARATION OF REPRESENTATIVE

NAME OF REPRESENTATIVE SIGNATURE OF REPRESENTATIVE DATE

DESIGNATION (PLEASE CIRCLE APPROPRIATE NUMBER FROM LIST ABOVE) JURISDICTION (STATE, ETC.)

1. 2. 3. 4. 5. 6. 7. OTHER __________________________________________________

NAME OF REPRESENTATIVE SIGNATURE OF REPRESENTATIVE DATE

DESIGNATION (PLEASE CIRCLE APPROPRIATE NUMBER FROM LIST ABOVE) JURISDICTION (STATE, ETC.)

1. 2. 3. 4. 5. 6. 7. OTHER __________________________________________________

NAME OF REPRESENTATIVE SIGNATURE OF REPRESENTATIVE DATE

DESIGNATION (PLEASE CIRCLE APPROPRIATE NUMBER FROM LIST ABOVE) JURISDICTION (STATE, ETC.)

1. 2. 3. 4. 5. 6. 7. OTHER __________________________________________________

NAME OF REPRESENTATIVE SIGNATURE OF REPRESENTATIVE DATE

DESIGNATION (PLEASE CIRCLE APPROPRIATE NUMBER FROM LIST ABOVE) JURISDICTION (STATE, ETC.)

1. 2. 3. 4. 5. 6. 7. OTHER __________________________________________________

Please send completed forms to:

Missouri Department of Revenue Missouri Department of Revenue

Taxation Bureau Taxation Bureau

P.O. Box 358 P.O. Box 2200

Jefferson City, MO 65105-0358 Jefferson City, MO 65105-2200

Fax: (573) 522-1722 Fax: (573) 751-2195

(If reporting Business Tax) (If reporting Personal Tax)