Fillable Printable Real Estate Sale and Purchase Agreement - Texas

Fillable Printable Real Estate Sale and Purchase Agreement - Texas

Real Estate Sale and Purchase Agreement - Texas

Seller: _______ Seller: _______ Buyer _______ Buyer _______

1

Real Estate Sale and Purchase Agreement - Contract Of Sale

Texas

NOTICE: DUE TO THE SUBSTANTIAL FINANCIAL RISKS AND LEGAL CONSEQUENCES INVOLVED IN ANY REAL ESTATE

TRANSACTION, BOTH/ALL PARTIES ARE ADVISED TO SEEK LEGAL AND TAX COUNSEL.

TIME IS OF THE ESSENCE - Time is of the essence of this Sale and Purchase Agreement.

DATE OF OFFER: ______________________________________________

Seller: ___________________________________, whose address is ___________________________________________________

Buyer: ___________________________________, whose address is ___________________________________________________

Seller and Buyer hereby agree that the Seller shall sell and the Buyer shall buy the following described property UPON THE TERMS AND

CONDITIONS HEREINAFTER SET FORTH, which shall include the STANDARDS FOR REAL ESTATE TRANSACTIONS set forth within

this contract.

DATE OF ACCEPTANCE (EFFECTIVE DATE): The effective date shall be the day on which the last party signed or initialed acceptance of

the final offer.

NOTICES: All notices herein required shall be in writing and shall be served upon the parties at the addresses shown above. Any offer,

acceptance or notice made by registered or certified mail, return receipt requested, hand-delivered, or transmitted by facsimile shall be

sufficient service.

PROPERTY LOCATION: Seller does sell to Buyer and Buyer does purchase from Seller, all of the following described real estate and or

property (hereinafter "Property") known as and / or located at ________________________________________________________, in the

City of _____________________________, County of ___________________________, State of Texas together with the improvements

thereon, and all rights and appurtenances thereto belonging.

LEGAL PROPERTY DESCRIPTION:

APN: City:

County: State:

Zip: Mailing Currier Route:

Legal Book/Page: Legal Lot:

Block No.: Subdivision:

Municipality:

CONVEYANCE: The Property is being conveyed:

[ ] In fee simple.

[ ] Subject to an annual ground rent, now existing or to be created, in the amount of __________________________________________

Dollars ($ _______________________) payable semi-annually, as now or to be recorded among the Land Records of

________________________________________________ City/County, State of Texas. If the Property is subject to ground rent and the

ground rent is not timely paid, the owner of the reversionary interest (i.e., the person to whom the ground rent is payable) may bring an

action of ejectment against the leasehold owner pursuant to any applicable Texas laws, statutes or codes. As a result of this action, the

owner of the reversionary interest may obtain title to the Property in fee, discharged from the lease.

PURCHASE PRICE: The purchase price is ___________________________________________ Dollars ($ _______________________).

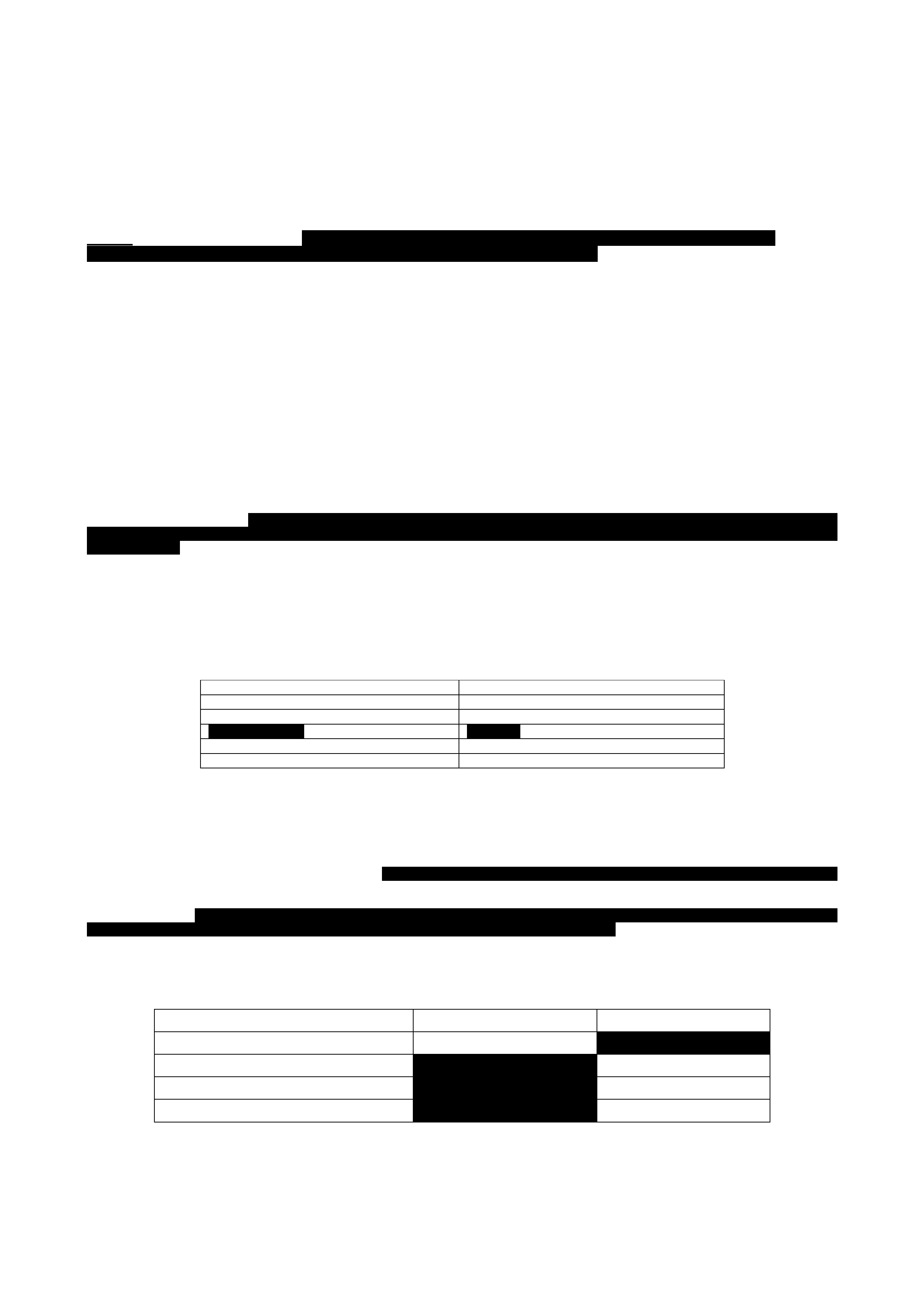

PAYMENT TERMS: Buyer shall make the payment of the purchase price as follows:

AMOUNT AMOUNT

Purchase Price

$__________________

Initial Deposit / Earnest Money

$__________________

Additional Deposit

$__________________

New Loan

$__________________

Seller: _______ Seller: _______ Buyer _______ Buyer _______

2

Assumption of Existing Loan

$__________________

Seller Financing

$__________________

Cash at Closing

$__________________

TOTAL (Both columns should equal)

$__________________ $__________________

DEPOSIT / EARNEST MONEY: Upon execution of this Contract by both parties, Buyer shall deposit $_________________ as earnest

money with _____________________________________ (the “Escrow Agent”), for the mutual benefit of the parties. Buyer shall deposit

$_________________ as additional earnest money with the Escrow Agent within _______ days after the Date of Acceptance of this

Contract. If Buyer fails to deposit the earnest money as required by this Contract, Buyer will be in default. Escrow Agent shall not disburse

the earnest money until Buyer's check has cleared Buyer's bank, and, after Date of Acceptance, until Closing or until the parties hereto have

otherwise agreed in writing regarding disbursement of such funds.

PERMANENTLY ATTACHED FIXTURES: Included in the purchase price are all permanently attached fixtures, including all smoke

detectors.

DEPOSIT: Buyer hereby authorizes and directs the Escrow Officer or institution specified in the paragraph entitled PAYMENT TERMS to

hold the initial deposit instrument without negotiation or deposit until the parties have executed and accepted this Contract. Upon

acceptance, the initial deposit shall be expeditiously placed in escrow as provided below. If Seller does not execute and accept this

Contract, the initial deposit instrument shall be promptly returned to the Buyer. At closing, the Escrow Officer shall disburse the deposit. In

the event this Contract shall be terminated or closing does not occur. Buyer and Seller agree that the deposit shall be disbursed by Escrow

Officer only in accordance with a release of deposit agreement executed by both Buyer and Seller.

PRORATIONS AND ADJUSTMENTS: Taxes, insurance, interest, homeowner's association fees, rents, including water rent and ground rent

and other expenses and revenue of said property shall be prorated as of the day of closing. All taxes, general or special, and all other public

or governmental charges or assessments against the Property which are or may be payable on a periodic basis, including sanitation or other

benefit charges, assessments, liens or encumbrances for sewer, water, drainage, paving, or other public improvements completed or

commenced on or prior to the date hereof, or subsequent thereto, are to be adjusted and apportioned as of the date of closing and are to be

assumed and paid thereafter by Buyer, whether assessments have been levied or not as of date of closing if applicable by local law. Any

heating or cooking fuels remaining in supply tank(s) at time of closing shall become the property of the Buyer.

CLOSING / SETTLEMENT: This Contract shall be settled / closed and the deed shall be delivered on or before the _____ day of

__________________, 20_____, unless extended by other provisions of this Contract (“Closing”). Closing shall be held at the office of

_________________ (e.g., Seller’s attorney, Buyer’s lender, the Escrow Agent, title insurance office or as otherwise agreed upon). Any

extension of Closing shall be agreed to by the parties in writing. In this Contract, the terms “Settlement” and “Closing” shall be deemed

identical in meaning and used interchangeably and the same shall apply to “settlement” and “closing”.

The fee for Closing shall be paid by: (initial appropriate option)

_____

Buyer;

or

_____

Seller:

or

_____

shared equally.

CLOSING COSTS: Except where otherwise agreed to in this Contract, Buyer agrees to pay all closing costs and charges including, but not

limited to, all Lender’s fees in connection herewith, including title examination and title insurance fees, notary fees, all document preparation

and recording fees, survey fees where required, and all recording charges, except those incident to clearing existing encumbrances or title

defects. If Buyer is obtaining FHA financing or if Buyer is a Veteran obtaining VA financing, those costs and charges prohibited to be paid

by a Buyer obtaining FHA financing or a Veteran obtaining VA financing shall be paid by Seller.

TRANSFER AND RECORDING CHARGES: Unless otherwise provided by an addendum to this Contract, the costs of state and local

transfer and recordation taxes (other than agricultural land transfer taxes, if any) shall be shared equally by Buyer and Seller.

RESTRICTIONS, EASEMENTS, LIMITATIONS: Buyer shall take title subject to: (a) Zoning, restrictions, prohibitions and requirements

imposed by governmental authority, (b) Restrictions and matters appearing on the plat or common to the subdivision, (c) Public utility

easements of record. Seller warrants that there shall be no violations of building or zoning codes at the time of closing.

Seller: _______ Seller: _______ Buyer _______ Buyer _______

3

FINANCING: This Contract is contingent upon buyer obtaining a written commitment for a loan secured by the Property as follows: (check)

[ ] Conventional Loan Assumption Addendum

[ ] Conventional Loan as follows:

Loan Amount $ ________________________

Term of Note __________________________ Years

Interest Rate __________________________ %

Amortization ___________________________Years

Loan Program _____________________________

[ ] No Financing Contingency

[ ] Gift of Funds Addendum

[ ] Attached VA Financing Addendum

[ ] Attached FHA Financing Addendum

[ ] Attached Assumption Addendum

[ ] Owner Financing as follows:

Loan Amount $ ________________________

Term of Note __________________________ Years

Interest Rate __________________________ %

Amortization ___________________________Years

NOTICE TO BUYER: The monthly payments, interest rates or other terms of some loans may be adjusted by the lender at or after

closing. If you are concerned about the possibility of future adjustments, do not sign the contract without examining the notes and

deeds of trust.

NOTICE TO SELLER: Your liability to pay the note assumed by Buyer will continue unless you obtain a release of liability from the

lender. If you are concerned about future liability, you should obtain a release of liability from the lender.

CONVENTIONAL LOAN LENDER FEES/CHARGES: Buyer agrees to pay to the Lender loan origination/loan discount fees of

__________%

of the loan amount and Seller agrees to pay loan origination/loan discount fees of

__________

% of the loan amount. Buyer shall pay all loan

insurance premiums required by Lender.

REDUCTION OF LOAN LENDER FEES/CHARGES: Buyer shall receive the benefit of any reduction in loan origination/loan discount fees

as specified herein.

FEES FOR TRANSFER OF EXISTING LOAN: In the event an existing loan is to be transferred to/assumed by Buyer, Buyer agrees to pay

all fees and charges required by Lender.

FINANCING CONTINGENCY - APPLICATION AND COMMITMENT:

_____

Buyer agrees to make written application for the financing as herein described within

______________________ (_____) days from the date of Contract acceptance. If such written financing

commitment is not obtained by Buyer within ______________________ (_____) days from the date of

Contract acceptance and Buyer provides written notice of such to Seller within that time, this Contract of

Sale shall be null and void and of no further legal effect, and all deposits hereunder shall be disbursed in

accordance with the terms of this Contract; provided that Seller may, within ______________________

(_____) days following Buyer's written notice, obtain such a commitment for Buyer or notify Buyer that

Seller will accept a purchase money mortgage upon the same terms, whereupon this Contract shall

remain in full force and effect. If Buyer does not serve written notice within the time specified herein, Buyer

shall be deemed to have waived this contingency and this Contract shall remain in full force and effect. If a

written financing commitment is not obtained, Seller will not accept a purchase money mortgage and

Buyer has complied with all of Buyer’s obligations under this Contract, including those with respect to

applying for financing and seeking to obtain financing, then the release of deposit agreement shall provide

that all monies on deposit shall be returned to Buyer.

or

_____ This Contract is not contingent upon Buyer obtaining any kind of mortgage commitment, and Buyer hereby

notifies Seller that Buyer possesses sufficient cash or liquid assets to close on the purchase of the

Property.

ALTERNATE FINANCING: If Buyer obtains a written commitment for financing in which the amount of loan, terms of payment, interest or

any one of these differs from the financing conditions herein, the preceding financing conditions of the Contract shall be deemed to have

been fully satisfied. This alternate financing may not increase costs to Seller or exceed the time allowed to secure the financing commitment

as stated herein. Nothing in this paragraph shall relieve Buyer of the obligation to apply for and diligently pursue the financing described in

the paragraphs entitled FINANCING and FINANCING APPLICATION AND COMMITMENT.

APPRAISAL CONTINGENCY: (Initial appropriate option)

______

This Contract is contingent upon Buyer obtaining an appraisal of the Property. Buyer shall, at Buyer’s

expense, engage an appraiser to establish the Property’s appraised value and obtain the Property’s appraised

value within _______ calendar days after the Date of Acceptance (the “Appraisal Deadline”), which shall be a

minimum of fourteen (14) days. After obtaining the Property’s appraised value, Buyer shall provide notice to

Seller: _______ Seller: _______ Buyer _______ Buyer _______

4

Seller by the Appraisal Deadline which shall provide one of the following:

(a) The Purchase Price is equal to or less than the Property’s appraised value. This contingency has been

satisfied and removed. The parties shall proceed to Closing; or

(b) Buyer elects to proceed with the consummation of this Contract without regard to the Property’s appraised

value and the parties shall proceed to Closing; or

(c) The Purchase Price exceeds the Property’s appraised value and Buyer elects not to proceed to Closing,

unless Seller reduces the Purchase Price to an amount equal to the Property’s appraised value. After receipt

of such notice from Buyer, Seller may, at Seller’s discretion, elect to reduce the Purchase Price to an amount

equal the Property’s appraised value, in which case Seller and Buyer shall immediately amend this Contract,

make necessary changes and proceed to Closing. If Seller elects not to reduce the Purchase Price, Seller

shall notify the same to Buyer, in which case the parties may agree upon mutually agreeable terms. In either

case, the Seller shall make the appropriate election by notifying Buyer within three (3) days of receipt of

Buyer’s notice. If the parties fail to reach such mutual agreement, this Contract shall terminate and all earnest

money shall be refunded to Buyer.

This contingency will continue even if Buyer fails to send the required notice to Seller by the Appraisal

Deadline, unless Seller, at Seller’s option, notifies Buyer that this Contract will become void. If Seller so

notifies Buyer, this Contract shall become void on the third (3

rd

) day after such notification, unless prior to such

date and time, Buyer delivers the required notice to Seller.

or

______

This Contract is not contingent upon Buyer obtaining an appraisal of the Property.

SALE OR LEASE OF OTHER REAL ESTATE: Buyer shall not apply for or accept a financing loan commitment which is contingent upon or

requires as a precondition to funding that any other real estate be sold, settled and/or leased, unless this Contract is expressly contingent

upon the sale, closing and/or lease of any other real estate. Neither this Contract nor the granting of Buyer’s loan referred to herein is to be

conditioned or contingent in any manner upon the sale, closing and/or lease of any other real estate unless a contingency for the sale,

closing and/or lease of other real estate is contained in an addendum to this Contract.

OWNER FINANCING - NOTICE TO BUYER: BUYER HAS THE RIGHT TO SELECT BUYER’S OWN TITLE INSURANCE COMPANY,

SETTLEMENT COMPANY, TITLE LAWYER, ESCROW COMPANY, FINANCIAL INSTITUTION OR MORTGAGE LENDER AS DEFINED

IN APPLICABLE STATE LAW, STATUTE OR CODE. BUYER ACKNOWLEDGES THAT SELLER MAY NOT BE PROHIBITED FROM

OFFERING OWNER FINANCING AS A CONDITION OF SETTLEMENT.

BUYER'S DUTIES AND RESPONSIBILITIES: Buyer understands and agrees that Buyer shall be in default and Seller may elect by written

notice to Buyer, to terminate this Contract and/or pursue the remedies set forth under the paragraph entitled DEFAULT if:

(a) Buyer makes any misrepresentations in any document relating to financing, or

(b) If this Contract is contingent upon Buyer securing a written commitment for financing and Buyer fails to apply for such financing within

the specified time herein, or

(c) If Buyer has misrepresented Buyer’s financial ability to consummate the purchase of the Property, or

(d) If Buyer fails to pursue financing diligently and in good faith, or

(e) If Buyer takes or fails to take any action which causes Buyer’s disqualification for financing.

SELLER'S DUTIES AND RESPONSIBILITIES: At the date of closing of this Contract, Seller agrees to have complied with all violation

notices or requirements issued or noted by any governmental authority, or actions in any court on account thereof, against or affecting the

Property and convey the Property free thereof. Seller agrees to keep existing mortgages free of default until closing.

CONDITION OF PROPERTY AND POSSESSION: At the time of closing, Seller shall deliver possession of the Property and shall deliver the

Property broom clean and in substantially the same condition as existed on the date of Contract Acceptance. Seller shall deliver the

property vacant and clear of trash and debris. Seller shall deliver all mechanical systems included in this Contract, including all electrical,

heating, air conditioning (if any), plumbing (including well and septic) and related equipment, appliances and smoke detector(s) in working

condition. Buyer reserves the right to inspect the Property within five (5) days prior to closing. EXCEPT AS OTHERWISE SPECIFIED IN

THIS CONTRACT, INCLUDING THIS PARAGRAPH, THE PROPERTY IS SOLD "AS IS".

WALKTHROUGH: Within _______ hours before Closing, Buyer or Buyer’s Agent shall have the right to inspect the Property to verify that the

same is in substantially the same condition in which it existed on the Date of Acceptance of this Contract, ordinary wear and tear excepted,

and that any corrections or repairs agreed to by Seller have been completed.

WARRANTIES TRANSFER: At Closing, Seller shall transfer to Buyer any interest Seller may have in any manufacturer’s warranties, service

contracts, and other guarantees and/or warranties which are transferable to Buyer. Fees for such transfer, if any, shall be borne by Buyer.

DEFAULT: Buyer and Seller are required and agree to make full closing in accordance with the terms of this Contract and acknowledge that

failure to do so constitutes a breach hereof. If Buyer fails to make full closing or if Buyer is in default due to Buyer's failure to perform or

comply with the covenants, conditions or terms of this contract, the deposit may be retained by or for the account of Seller as long as a

release of deposit agreement is signed and executed by all parties, expressing that said deposit may be retained by Seller. In the event that

the parties do not agree to execute a release of deposit, Buyer and Seller shall have all legal and equitable remedies. If Seller fails to make

full closing or if Seller is in default due to Seller's failure to perform or comply with the covenants, conditions or terms of this contract, Buyer

shall be entitled to pursue such rights and remedies as may be available, at law or in equity, including, without limitation, an action for

Seller: _______ Seller: _______ Buyer _______ Buyer _______

5

specific performance of this Contract and/or monetary damages. In the event of any litigation or dispute between Seller and Buyer

concerning the release of the deposit, Escrow Officer may pay the deposit into the court in which such litigation is pending or pay the deposit

into the court of proper jurisdiction by an action of interpleader and Escrow Officer, having so paid the deposit to the court, shall have met

his sole responsibility. Upon Escrow Officer's payment of the deposit into court, Buyer and Seller agree that, neither Buyer nor Seller shall

have any further right, demand, claim or action against Escrow Officer regarding the release of the deposit and Buyer and Seller, jointly and

severally, shall indemnify and hold the Escrow Officer harmless from any and all such rights, demands, claims or actions. In the event of

such dispute and election by the Escrow Officer to file an action of interpleader as herein provided, Buyer and Seller further agree and

hereby expressly and irrevocably authorize the Escrow Officer to deduct from the deposit all costs incurred by the Escrow Officer in the filing

and maintenance of such action of interpleader including but not limited to court costs, service of process fees, filing fees and attorneys’

fees, provided that the amount deducted shall not exceed the lesser of $500 or the amount of the deposit held by the Escrow Officer.

Escrow Officer may deduct all such fees and costs authorized herein from the deposit prior to paying the balance of the deposit to the court.

Buyer and Seller further agree and expressly declare that all such fees and costs so deducted shall be the exclusive property of the Escrow

Officer. If the Escrow Officer deducts an amount less than the total of all of the costs incurred by the Escrow Officer in maintaining and filing

the interpleader action, then Seller and Buyer jointly, and severally, agree to reimburse the Escrow Officer for all such excess costs upon the

conclusion of the interpleader action.

INCLUSIONS/EXCLUSIONS: Certain existing items, which may be considered personal property, whether installed or stored upon the

property, are included or excluded, as follows (if no box is checked, item shall be considered excluded):

Included

Yes

Included

Yes

Included

Yes

Included

Yes

[ ] Refrigerator(s) #_____ [ ] Sprinkler System [ ] Water Filter [ ] Storage Shed

[ ] Stove or Range [ ] Window Fan(s) #_____ [ ] Water Softener [ ] Lawn Mower

[ ] Trash Compactor [ ] Storm Windows [ ] Screens [ ] Garage Opener

[ ] Microwave Oven [ ] Storm Doors [ ] Window A/C unit(s) #____ [ ] Dog House(s) #_____

[ ] Garbage Disposal [ ] Clothes Washer [ ] W/W carpeting (existing) [ ] TV antenna

[ ] Freezer [ ] Clothes Dryer [ ] Exhaust Fan(s) [ ] Drapery/Curtains

[ ] Dishwasher [ ] Intercom [ ] Furnace Humidifier [ ] Blinds/Shades

[ ] Cook top [ ] Satellite Dish [ ] Electronic Air Filter [ ] Entertain Cntr Cabinet

[ ] Ceiling Fan(s) #____ [ ] Pool, cover & equipment [ ] Outdoor Playground

Equip.

[ ] Fireplace Screen/Doors

[ ] Wall Oven(s) #____ [ ] Hot Tub, cover & equip. [ ] Central Vacuum

[ ] Safe #_____ [ ] Alarm System

ADDITIONAL INCLUSIONS (SPECIFY): _________________________________________________________________________

ADDITIONAL EXCLUSIONS (SPECIFY): _________________________________________________________________________

PROPERTY INSURANCE AND RISK OF LOSS: Until legal title has passed to Buyer or possession has been given to Buyer, the Property is

to be held at the risk of Seller. If, prior to the time legal title has passed to Buyer or possession has been given to Buyer, whichever shall

occur first, all or a substantial part of the Property is destroyed or damaged, without fault of Buyer, then this Contract, at the option of Buyer,

upon written notice to Seller, shall be null and void and of no further effect, and all deposits hereunder shall be returned to Buyer in

accordance with the terms of this Contract.

LEASES: Seller, not less than 15 days before closing, shall furnish to Buyer copies of all written leases and estoppel letters from each

tenant specifying the nature and duration of the tenant's occupancy, rental rates and advanced rent and security deposits paid by tenant. If

Seller is unable to obtain such letters from tenants, Seller shall furnish the same information to Buyer within said time period in the form of a

seller's affidavit, and Buyer may contact tenants thereafter to confirm such information. At closing, Seller shall deliver and assign all original

leases to Buyer and all rental collections shall be prorated. In addition, Seller shall transfer all security deposits, if any, to Buyer. Seller may

not negotiate new leases or renew existing leases on the Property which extend beyond closing or possession date without Buyer’s written

consent.

NON-ASSIGNABLE: This Contract may not be assigned without the effective written consent of the Buyer and the Seller. If the Buyer and

the Seller agree in writing to an assignment of this Contract, the original parties to this Contract remain obligated hereunder until closing.

TITLE POLICY: Seller agrees to furnish to Buyer at (initial appropriate option)

a. ______ Seller’s expense; a title insurance policy issued in the amount of the Sales Price, dated at or after closing,

insuring Buyer against loss under the provisions of the Title Policy.

or

b. ______ Buyer’s expense; a title insurance policy issued in the amount of the Sales Price, dated at or after closing,

insuring Buyer against loss under the provisions of the Title Policy.

The title insurance policy will be subject to all exclusions, including existing building and zoning ordinances, and the

following exceptions:

Seller: _______ Seller: _______ Buyer _______ Buyer _______

6

Restrictive covenants common to platted subdivision in which the Property is located.

Standard exception for standby fees, taxes and assessments.

Liens created as part of financing.

Utility easements created by the dedication deed or plat of the subdivision in which the Property is located.

Reservations or exceptions otherwise permitted by this Contract or as may be approved by Buyer in writing.

Standard exception as to marital rights.

Standard exception as to waters, tidelands, beaches, streams, and related matters.

Standard exception as to discrepancies, conflicts, shortages in area or boundary lines, encroachments or

protrusions, or overlapping improvements. Buyer, at Buyer’s expense, may have the exception amended to read:

"shortages in area."

SURVEY: A Survey of the Property shall be made by a registered professional land surveyor acceptable to the Title Company and any

lender. (Initial appropriate option)

a. ______

Seller shall furnish to Buyer and Title Company, within _____ days after the Date of Acceptance of this

Contract, an existing survey of the Property and a Residential Real Property Affidavit promulgated by the

Texas Department of Insurance. If the existing survey of the Property is unacceptable to title company and/or

to Buyer’s lender, Buyer shall obtain a new survey at the expense of _____ (Buyer or Seller) no later than 3

days prior to Closing Date.

or

b. ______

Seller at Seller’s expense shall furnish a new survey of the Property to Buyer within _____ days after the

Effective Date of this Contract.

or

c. ______

Buyer at Buyer’s expense shall obtain a new survey of the Property within _____ days after the Effective

Date of this Contract. Buyer is deemed to receive the survey on the date of actual receipt or the date

specified in this clause, whichever is earlier.

COMMITMENT for TITLE INSURANCE: Seller agrees to furnish to Buyer, at Buyer's expense, within 20 days after the Title Company

receives a copy of this Contract, a Commitment for title insurance and legible copies of restrictive covenants and documents evidencing

exceptions in the Commitment other than standard printed exceptions. Seller authorizes the title company to mail or hand deliver the

Commitment and documents evidencing exceptions to Buyer at Buyer's address. If the Commitment and documents evidencing exceptions

are not delivered to Buyer within the specified time, the time for delivery will be automatically extended up to 15 days or the Closing date,

whichever is earlier.

OBJECTIONS: Buyer shall have the right to object to defects, exceptions, or encumbrances to title disclosed on the survey and in the

Commitment, other than items contained in clause entitled Title Policy or which prohibit the following use or activity:

_______________________________________________. The objection must be in writing and must be taken by Buyer not later than (a)

Closing date or (b) within _____ days after receiving of the Commitment, documents evidencing exceptions and the Survey, whichever is

earlier. Buyer's failure to object within the given timeframe will constitute a waiver of Buyer’s right to object; except that the requirements in

the Commitment are not waived. Seller shall cure the objections of Buyer within 15 days after Seller receives the objections and the Closing

date will be extended as necessary. If Seller fails to cure the objections within such 15 days’ period, this Contract will terminate, and Seller

shall forthwith refund the earnest money to Buyer unless Buyer waives the objections.

TITLE NOTICES:

a. Abstract or Title Policy: Buyer is hereby advised to have the abstract covering the real estate that is the subject of this

Contract examined by an attorney chosen by Buyer; or Buyer should be provided with or obtain a title insurance policy.

b. Owners' Association Membership: (Initial appropriate option)

_____

The Property is subject to mandatory membership in an owner’s association and Seller is required to give

notice as prescribed under the Texas Property Code, Title 2, Chapter 5, Subchapter A, Section 5.012.

or

_____ The Property is not subject to mandatory membership in an owner’s association and Seller is not required to

give notice as prescribed under the Texas Property Code, Title 2, Chapter 5, Subchapter A, Section 5.012.

c. Tax Districts: (Initial appropriate option)

_____ The Property is situated in a utility district or other statutorily created district providing, or proposing to provide,

as the district's principal function, water, sanitary sewer, drainage, and flood control or protection facilities or

services, or any of these facilities or services that have been financed or are proposed to be financed with

bonds of the district payable in whole or part from taxes of the district, or by imposition of a standby fee, if any,

to household or commercial users, other than agricultural, irrigation, or industrial users, and which district

Seller: _______ Seller: _______ Buyer _______ Buyer _______

7

includes less than all the territory in at least one county and which, if located within the corporate area of a city,

includes less than 75 percent of the incorporated area of the city or which is located outside the corporate area

of a city in whole or in substantial part, and Seller is required to give a notice to Buyer, prior to execution of this

Contract as prescribed under the Water Code, Title 4, Chapter 49, Subchapter M, Section 49.452.

or

_____ The Property is not situated in a utility district or other statutorily created district providing, or proposing to

provide, as the district's principal function, water, sanitary sewer, drainage, and flood control or protection

facilities or services, or any of these facilities or services that have been financed or are proposed to be

financed with bonds of the district payable in whole or part from taxes of the district, or by imposition of a

standby fee, if any, to household or commercial users, other than agricultural, irrigation, or industrial users, and

which district includes less than all the territory in at least one county and which, if located within the corporate

area of a city, includes less than 75 percent of the incorporated area of the city or which is located outside the

corporate area of a city in whole or in substantial part, and Seller is not required to give notice to Buyer as

prescribed under the Water Code, Title 4, Chapter 49, Subchapter M, Section 49.452.

d. Tide Waters: (Initial appropriate option)

_____ The Property does not share a common boundary with the tidally influenced submerged lands of the State of

Texas and Seller is not required to give notice to Buyer as prescribed under the Texas Natural Resources

Code, Title 2, Subtitle C, Chapter 33, Subchapter D, Section 33.135.

or

_____

The Property adjoins and shares a common boundary with the tidally influenced submerged lands of the State

of Texas, and

_____

The Property does not share a common boundary with the tidally influenced submerged lands of

the State of Texas and Seller is not required to give notice to Buyer as prescribed under the

Texas Natural Resources Code, Title 2, Subtitle C, Chapter 33, Subchapter D, Section 33.135.

_____

the interest transferred or conveyed in the Property is not a mineral, leasehold or security interest,

and Seller is required to give notice to Buyer, as a part of a written executory contract for the sale,

transfer, or conveyance as prescribed under the Texas Natural Resources Code, Title 2, Subtitle

C, Chapter 33, Subchapter D, Section 33.135.

e. Possible Annexation: Seller is required to give notice to Buyer, prior to execution of this Contract, as prescribed under the

Texas Property Code, Title 2, Chapter 5, Subchapter A, Section 5.011, that the Property, if located outside the limits of a

municipality, may now or later be included in the extraterritorial jurisdiction of a municipality and may now or later be subject

to annexation by the municipality. Contact all municipalities located in the general proximity of the property for further

information.

f. Property Located in Certified Service Area of a Utility Service Provider: (Initial appropriate option)

_____

The Property is located in certified service area of a utility service provider and Seller is required to give notice

to Buyer, at or before the execution of a binding contract for the purchase of the Property, as prescribed under

the Water Code, Title 2, Subtitle B, Chapter13, Subchapter G, Section 13.257.

or

_____ The Property is not located in certified service area of a utility service provider and Seller is not required to give

notice to Buyer as prescribed under the Water Code, Title 2, Subtitle B, Chapter13, Subchapter G, Section

13.257.

g. Public Improvement District (Initial appropriate option)

_____

The Property is in a public improvement district under Chapter 372, the Local

Government Code, and

_____ consists of not more than one dwelling unit and Seller is required to give notice to Buyer as

prescribed under the Property Code, Title 2, Chapter 5, Subchapter A, Section 5.014.

_____ consists of more than one dwelling unit and Seller is not required to give notice to Buyer as

prescribed under the Property Code, Title 2, Chapter 5, Subchapter A, Section 5.014.

or

_____

The Property is not in a public improvement district under Chapter 372, Local

Government Code and Seller is not required to give notice to Buyer as prescribed under the Property Code,

Seller: _______ Seller: _______ Buyer _______ Buyer _______

8

Title 2, Chapter 5, Subchapter A, Section 5.014.

h. Agricultural Development District: (Initial appropriate option)

_____

The Property is located in a Texas Agricultural Development District and Seller is required to give notice to

Buyer, prior to execution of a binding contract of sale and purchase of the Property, either separately or as an

addendum or paragraph of a purchase contract, under the Agriculture Code, Title 4, Chapter 60, Subchapter C,

Section 60.063 (a), subject to sub-section (c) thereof.

or

_____ The Property is not located in a Texas Agricultural Development District and Seller is not required to give

notice to Buyer under the Agriculture Code, Title 4, Chapter 60, Subchapter C, Section 60.063.

ARBITRATION: In the event of any dispute arising out of or relating to this Contract, or the breach thereof, it is hereby agreed the same shall

be settled by a neutral binding arbitration to be held in ___________________________ County, State of Texas, in accordance with the

rules of the American Arbitration Association (AAA) by one or more arbitrators appointed in accordance with the said rules. The notice of

demand for Arbitration shall be made by the aggrieved party within three hundred and sixty five (365) days after the said party knew, or

should have known, of the existence of the said claim or claims. The decision arrived at through the process of arbitration shall be final and

legally binding and judgment on the award rendered by the arbitrator(s) may be entered in any court having jurisdiction thereof. Each party

shall be responsible for its share of the arbitration fees in accordance with the said rules. If a party fails to proceed with arbitration,

unsuccessfully challenges the arbitrator's award, or fails to comply with the arbitrator's award, the other party is entitled to costs of suit,

including reasonable attorney's fees for having to compel arbitration or defend or enforce the award.

ATTORNEY’S FEES: In any action or proceeding between the Buyer and the Seller based, in whole or in part, upon the performance or

non-performance of the terms and conditions of this Contract, including, but not limited to: breach of contract, negligence, misrepresentation

or fraud, the prevailing party in such action or proceeding shall be entitled to receive reasonable attorney’s fees from the other party as

determined by the court or arbitrator.

TERMITE INSPECTION: Within a period of _____ business days after the Date of Acceptance, Buyer, at Buyer's expense, (if VA financed,

then Seller's expense) is authorized and shall have the right to obtain a written report from a state licensed pest control company that, based

on a careful visual inspection, there is no evidence of termite or other wood-destroying insect infestation in the residence and/or garage(s)

within the Property (excluding fences or shrubs not abutting garage(s) or dwelling(s) ) and damage due to previous infestation has been

repaired. If there is evidence of present infestation as described above, or if damage caused by present or prior infestation is discovered,

Buyer may, within _____ business days of receiving the report, either proceed with the purchase or cancel this Contract.

RADON GAS DISCLOSURE: As required by law, Seller makes the following disclosure: "Radon Gas" is a naturally occurring radioactive

gas that, when it has accumulated in a building in sufficient quantities, may present health risks to persons who are exposed to it over time.

Levels of radon that exceed federal and state guidelines have been found in buildings in within this state. Additional information regarding

radon and radon testing may be obtained from your county public health unit.

Seller has: (Initial appropriate option)

_____ knowledge that the Property has been tested for radon gas and radon progeny and shall provide Buyer

with a copy of the results of such test and evidence of any subsequent mitigation or treatment;

or

_____

no knowledge that the Property has been tested for radon gas and radon progeny.

HOME AND/OR ENVIRONMENTAL INSPECTION CONTINGENCY: Buyer’s obligation to close this Contract: (Initial appropriate option)

_____

Is subject to the contingency of inspection of the Property. Within a period of ______ business days after

the Date of Acceptance, Buyer may secure at Buyer’s own expense (unless otherwise provided by law)

and Seller agrees to permit, a licensed home inspection service of Buyer’s choice to inspect the major

components of the Property to determine if they are in acceptable operating condition. Major components

include, without limitation, central heating, central cooling, plumbing (including well and septic) and electric

systems; structural components consisting of roofs, walls, windows, ceilings, floors, and foundations; and

all mechanical system, including appliances. Any major component that performs the function for which it

is intended and does not constitute a health or safety threat shall be deemed to be in acceptable operating

condition. Buyer may further secure at Buyer’s own expense and Seller agrees to permit inspection for any

environmental, lead-based paint and/or lead-based paint hazards (unless waived separately), radon,

asbestos, urea-formaldehyde, wood infestation, and mold on the premises by one or more certified home

inspection services of Buyer’s choice. Buyer shall indemnify Seller and shall hold Seller harmless from and

against any loss or damage to the Property or personal injury caused by acts of negligence of Buyer or

Buyer's inspectors.

If any defect(s) is/are revealed by an inspection report, Buyer shall deliver the report to Seller within _____

calendar days of the receipt of the same. Seller shall within _____ calendar days of receipt of the report

Seller: _______ Seller: _______ Buyer _______ Buyer _______

9

notify Buyer in writing of Seller’s option to either rectify the defect(s) at Seller’s expense prior to Closing, or

not to rectify the defect(s). If Seller elects not to repair the defect(s), Buyer shall, within _____ calendar

days of receipt of Seller’s notice not to repair the defect(s), have the option to either accept the Property

with the said defect(s) as revealed by the inspection report or void this Contract. If Buyer chooses to void

this Contract, Seller shall return all the monies received from Buyer on account of the Purchase Price of

Property and there shall be no further obligation on either of the parties hereto and this Contract shall

become void. Buyer agrees that repairs which do not exceed

________________________________________ Dollars ($________) in aggregate shall not be

considered to be within the purview of this section and Buyer agrees to assume those repairs at Buyer’s

own expense. The parties agree that the following items are accepted by Buyer “as is” and shall not be

made a part of Buyer’s request for repairs: _________________________________________. Where

there is a delay in the receipt of the inspection report due solely to the inspector's inability to complete the

inspection, the inspection completion date set forth in this Contract shall be extended for a reasonable

time not to exceed seven (7) calendar days. The inspector shall provide Buyer with an explanation of the

delay, which shall be made available to Seller.

or

_____ is not subject to the contingency of inspection of the Property.

FLOOD HAZARD: During the inspection period, Buyer shall determine by survey, through the lender and all appropriate government

agencies whether the Property is situated in an area identified as having any special flood hazards, whether flood insurance is required and

what restrictions apply to improving the Property and rebuilding in the event of casualty. If the Property is situated in an area identified as

having any special flood hazards by any governmental entity, the lender may require the purchase of flood hazard insurance. Special flood

hazards may also affect the ability to encumber or improve the Property.

INTERNAL REVENUE SERVICE FILING: Buyer and Seller each agree to cooperate with the person responsible for closing by providing all

necessary information so that a report can be filed with the Internal Revenue Service, as required by Section 6045 of the IRS Code. To the

extent permitted by law, the Seller will pay any fees incurred as a result of such filing.

FOREIGN INVESTMENT TAXES - FIRPTA: Section 1445 of the United States Internal Revenue Code of 1986 provides that a buyer of a

residential real property located in the United States must withhold federal income taxes from the payment of the purchase price if (a) the

purchase price exceeds Three Hundred Thousand Dollars ($300,000.00) and (b) the seller is a foreign person. Unless otherwise stated in an

addendum attached hereto, if the purchase price is in excess of Three Hundred Thousand Dollars ($300,000.00), Seller represents that

Seller is not a non-resident alien, foreign corporation, foreign partnership, foreign trust or foreign estate (as those terms are defined by the

Internal Revenue Code and applicable regulations) and agrees to execute an affidavit to this effect at the time of closing.

LEAD PAINT DISCLOSURE: As required by Title X, Section 1018, the Residential Lead-Based Paint Hazard Reduction Act of 1992, "Every

purchaser of any interest in residential real property on which a residential dwelling was built prior to 1978 is notified that such property may

present exposure to lead from lead-based paint that may place young children at risk of developing lead poisoning. Lead poisoning in young

children may produce permanent neurological damage, including learning disabilities, reduced intelligence quotient, behavioral problems

and impaired memory. Lead poisoning also poses a particular risk to pregnant women. The seller of any interest in residential real estate is

required to provide the buyer with any information on lead-based paint hazards from risk assessments or inspection in the seller's

possession and notify the buyer of any known lead-based paint hazards. A risk assessment or inspection for possible lead-based paint

hazards is recommended prior to purchase." The Seller, however, is not required to conduct or pay for any lead-based paint risk

assessment or inspection. Seller is required to provide buyer with a ten (10) day period in which Buyer may procure a risk assessment or

inspection at Buyer's expense.

a) Seller and Buyer agree, represent and warrant, each unto the other, that no binding and enforceable contract shall be deemed to

exist or to have been formed unless the requirements of the Residential Lead-Based Paint Hazard Reduction Act have been

complied with prior to the execution of this Contract by Seller and Buyer. Seller and Buyer represent and warrant that each

intended, as a material term of the offer and acceptance, that the requirements of the Act be complied with as an express

condition of the formation of a binding and enforceable contract by and between the parties. Buyer and Seller acknowledge by

their respective initials below that they have read and understand the provisions of this of this section entitled, LEAD PAINT

DISCLOSURE.

b) Seller represents and warrants to Buyer, intending that Buyer rely upon such warranty and representation, that the property:

(Seller to initial applicable line): _____________was constructed prior to 1978 OR _____________was not constructed prior to

1978 OR ______________ the date of construction is uncertain.

A SELLER WHO FAILS TO GIVE THE REQUIRED LEAD-BASED PAINT DISCLOSURE FORM AND EPA PAMPHLET MAY BE LIABLE

UNDER THE RESIDENTIAL LEAD-BASED PAINT HAZARD REDUCTION ACT FOR THREE TIMES THE AMOUNT OF DAMAGES AND

MAY BE SUBJECT TO BOTH CIVIL AND CRIMINAL PENALTIES.

c) If the Property was constructed prior to 1978 or if the date of construction is uncertain, as indicated by Seller’s initial above, Seller

and Buyer mutually agree that the requirements of the Act shall apply to the sale of the Property.

Seller: _______ Seller: _______ Buyer _______ Buyer _______

10

OTHER DISCLOSURES:

In addition to those disclosures contained herein, Buyer hereby certifies that the following disclosures were delivered to Buyer by Seller prior

to the date of execution of this Contract: (check all applicable)

[ X ] Seller’s Disclosure Notice

[ X ] Seller's Disclosure Regarding Potential Annexation

[ ] Notice of Property Condition

[ ] Notice Regarding Membership In A Property Owners Association

[ ] Disclosure of Location of Conditions Under Surface of Unimproved Real Property

[ ] Seller's Disclosure of Tax Payments and Insurance Coverage

[ ] Seller’s Disclosure of Financing Terms

[ ] Lead Paint Disclosure

[ ] Lead Paint Pamphlet

NOTICE TO SELLER: This Contract should not be executed if the disclosures indicated above were not presented to Buyer, and

additionally, signed and dated by Buyer prior to today’s date. The above-indicated, applicable disclosures should be delivered to, signed

and dated by Buyer prior to the date of execution of this Contract.

NOTICE OF ADDITIONAL TAX LIABILITY: (check one)

1. [ ] This is not a transaction for vacant land.

2. [ ] This is a transaction for vacant land. Seller hereby provides Buyer the following notice:

NOTICE REGARDING POSSIBLE LIABILITY FOR ADDITIONAL TAXES. If for the current ad valorem tax year the taxable value of the

land that is the subject of this contract is determined by a special appraisal method that allows for appraisal of the land at less than its

market value, the person to whom the land is transferred may not be allowed to qualify the land for that special appraisal in a subsequent tax

year and the land may then be appraised at its full market value. In addition, the transfer of the land or a subsequent change in the use of

the land may result in the imposition of an additional tax plus interest as a penalty for the transfer or the change in the use of the land. The

taxable value of the land and the applicable method of appraisal for the current tax year is public information and may be obtained from the

tax appraisal district established for the county in which the land is located.

TYPEWRITTEN OR HANDWRITTEN PROVISIONS: Typewritten or handwritten provisions inserted in this form shall control all printed

provisions in conflict therewith.

PARAGRAPH HEADINGS: The headings of particular paragraphs and subparagraphs are inserted only for convenience and are not part of

this Agreement and are not to act as a limitation on the scope of the particular paragraph to which the heading refers.

USE OF PRONOUNS: The use of the neuter singular pronoun to refer to the Parties described in this Agreement shall be deemed a proper

reference even though the Parties may be an individual, a partnership, a corporation, or group of two or more individuals, partnerships or

corporations. The necessary grammatical changes required to make the provisions of this Agreement apply in the plural sense where there

is more then one party to this Agreement, and to either corporations, partnerships or individuals, males or females, shall in all instances be

assumed as though in each case fully expressed.

INDEMNIFICATION: Each party shall indemnify and hold the other party harmless from any and all violations, claims, losses, damages,

injuries and liabilities arising from or in connection with the operations of this Agreement, transaction of sale, false, misleading or

misrepresentation of any certifications, warrantees or information, violation of federal and state laws, breach of contract or any acts and/or

omissions caused by the harming party.

BINDING PARTIES: This Contract shall be binding upon and inure to the benefit of the parties hereto, their respective heirs, executors,

administrators, successors and assigns.

NO ORAL AGREEMENTS: This executory contract represents the final agreement between the seller and purchaser and may not be

contradicted by evidence of prior, contemporaneous, or subsequent oral agreements of the parties. There are no unwritten oral agreements

between the parties.

FORUM AND CHOICE OF LAW. This Agreement in all matter and issues collateral thereto shall be governed by, and construed and

interpreted in accordance with the laws of the State of Texas with respect to the determination fo any claim, dispute or disagreement, which

may arise out of the interpretation, performance or breach of this Agreement, ad will be subject to enforcement and interpretation solely in

the appropriate courts of the State of Texas, without reference to principles of conflict of laws.

ENTIRE AGREEMENT: This document and any Addenda constitutes the final and entire Agreement between the parties hereto, and no

promises or representations, other than those contained here and those implied by law, have been made by Seller or Buyer. Neither Seller

or Buyer shall be bound by any terms, conditions, statements, warranties or representations, oral or written, not herein contained unless

made in writing and signed by both Seller and Buyer.

Seller: _______ Seller: _______ Buyer _______ Buyer _______

11

SEVERABILITY: The provisions of this Contract are severable and in the event any provision, clause, sentence, section or part thereof is

held to be invalid, illegal, unconstitutional, inapplicable or unenforceable to any person or circumstances, such invalidity, illegality,

unconstitutionality, inapplicability or unenforceability shall not affect or impair any of the remaining provisions, sentences, clauses, sections,

parts of the contract or their application to Seller or Buyer or other persons or circumstances. It is understood and agreed that the terms,

conditions and covenants of this Contract would have been made by both parties if such invalid, illegal, unconstitutional, inapplicable or

unenforceable provision, sentence, clause, section or part had not been included therein to the extent that portion of this agreement may be

invalid by striking of certain words or phrases, such words or phrases shall be deemed to be stricken and the remainder of the provisions

and the remainder of the other portions of this Contract agreement shall remain in full force and effect. It is further agreed that this Contract

may be executed in counterparts, each of which when considered together shall constitute the original contract.

ADDITIONAL PROVISIONS:

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

YOU, THE PURCHASER, MAY CANCEL THIS CONTRACT AT ANY TIME DURING THE NEXT TWO WEEKS. THE DEADLINE FOR

CANCELING THE CONTRACT IS _____________ (DATE).

SIGNED, ACCEPTED, AND AGREED TO on __ day of _________, 20__ (“effective date”) by the undersigned parties, who acknowledge

that they have read and understand this Agreement and the Attachments to it and they execute this legal document voluntarily and of their

own free will.

Buyer: Date:

Address: Tax ID/SSN:

Buyer: Date:

Address: Tax ID/SSN:

Seller: Date:

Address: Tax ID/SSN:

Seller: Date:

Address: Tax ID/SSN:

WITNESSES:

Witness: Date:

Witness: Date: