Fillable Printable SF 2801

Fillable Printable SF 2801

SF 2801

Application for Immediate Retirement

Civil Service Retirement System (CSRS)

Introduction

If you are a current Federal or Postal Service employee covered

by the Civil Service Retirement System and you wish to apply

for retirement with an immediate annuity (annuity commencing

within one month after the date of separation on which title to

annuity is based), this package is for you! If you are covered

by the Federal Employees Retirement System, you must use

SF 3107 to apply for an immediate annuity retirement.

If you are applying for disability retirement, you must

complete both this application and Standard Form 3112,

Application for Disability Retirement. Ask your agency for

this form. You, your physician, and your agency must

complete the various portions of SF 3112. The Office of

Personnel Management (OPM) must receive the SF 3112

within one year after the date you separate.

Do not use this package or the forms it contains to apply for

deferred annuity. If you want to apply for a deferred annuity

(generally beginning at age 62), you should request an

application from the Office of Personnel Management, Civil

Service Retirement System, Retirement Operations Center,

Boyers, PA 16017.

Keep the information section of this package for future

reference.

Where to Obtain Additional Information

This package presents basic retirement information about

matters affecting most retiring employees. Contact the Human

Resources Office at the agency where you work for retirement

counseling, detailed information, and other assistance you

need to prepare for retirement. Your agency must certify that

you are eligible for an immediate annuity. OPM employees

cannot advise you before you are separated and your certified

records are forwarded to OPM.

General Information

This package contains the following:

1) Instructions for the completion and submission of the

SF 2801, Schedules A, B, C, and SF 2801-2.

2) Additional information about retirement, including:

•

Post-1956 Military Service, page 4

•

Important Information About Survivor Annuity

Elections, page 5

•

Survivor Annuity Election Changes After Retirement,

page 7

•

How Annuities Are Computed, page 8

•

Cost-of-Living Increases, page 10

•

Payment and Accrual of Annuity, page 10

•

Filing Your Application, page 10

•

What Happens After You File Your Retirement

Application, page 11

•

What To Do If Your Address Changes Before

Processing Is Completed, page 11

4) Schedules A, B, and C to be completed by the retiring

employee if he or she has (1) active duty military service,

(2) has ever applied for military retired pay and/or pension

or compensation from the Department of Veterans Affairs

in lieu of military retired pay, or (3) has applied for

compensation benefits from the Office of Workers'

Compensation Programs, U.S. Department of Labor.

5) SF 2801-2, Spouse's Consent to Survivor Election, to be

completed by the retiring employee, his or her current

spouse, and a notary public (or other person authorized to

administer oaths) in cases where a married applicant elects

less than the maximum survivor annuity for the spouse.

6) SF 2801-1, Certified Summary of Federal Service, to be

completed by the employing agency and signed by the

applicant after reviewing the information the employing

agency enters.

7) Agency Checklist of Immediate Retirement Procedures, to

be completed by the employing agency and, to the extent

possible, reviewed by the retiring employee to help assure

completeness and correctness of the submission.

Instructions for Completing Application

for Immediate Retirement

Type or print clearly. If you need more space in any section,

use a plain piece of paper with your name and date of birth

written at the top. If you do not know an answer write

“unknown.” If you are not sure (for example, if you do not

know an exact date), answer to the best of your ability,

followed by a question mark (?).

Refer to the pamphlet SF 2801A, Applying for Immediate

Retirement Under the Civil Service Retirement System, for

additional information about those questions on the

application which are not entirely self-explanatory.

Section A - Identifying Information

Item 2: List other names under which you have been

employed in the Federal government (such as a

maiden name). This will help OPM locate and

identify records maintained under these names.

Item 3: Enter the address to which correspondence should be

mailed. If you want your payments sent to a bank or

other financial institution, do not enter the bank

address here; see Section H of the application form.

Item 6: List all social security numbers you have used.

Section B - Federal Service

Item 2: Enter the date of final separation for retirement.

Leave blank if applying for disability retirement and

not yet separated. Please note that if you are currently

serving in more than one appointive or elective

position in the Federal Government, you must

separate from all such positions before you can

qualify for an immediate retirement.

3) SF 2801, Application for Immediate Retirement, to be

completed and signed by the retiring employee.

U.S. Office of Personnel Management

(See page 11 for the Privacy Act Statement.)

Standard Form 2801

CSRS/FERS Handbook for Personnel and Payroll Office

2801-111

Revised June 2013

NSN 7540-00-634-4250 Previous editions are not usable.

Item 4: Indicate whether or not you have performed active

duty that terminated under honorable conditions in

the armed forces or other uniformed services of the

United States, including the following:

(a) Army, Navy, Marine Corps, Air Force, or

Coast Guard of the United States,

(b) Regular Corps or Reserve Corps of the

Public Health Service after June 30, 1960,

(c) Commissioned Officer of the National

Oceanic and Atmospheric Administration or

a predecessor entity in function after June

30, 1961.

(d) Cadet at the U.S. Military Academy, U.S.

Air Force Academy, U.S. Coast Guard

Academy, or Midshipman at the U.S. Naval

Academy.

(e) Excluding the National Guard, active service

in the reserve components of the uniformed

services, including active duty for training, is

military service. Service as a National Guard

member does not meet the definition of

military service for purposes of civil service

retirement, except when the member is

ordered to active duty in the service of the

United States or performs full-time National

Guard Duty (as such term is defined in

section 101(d) of title 10) if the National

Guard duty interrupts creditable civilian

service under subchapter III of chapter 83 of

title 5, and is followed by reemployment in

accordance with chapter 43 of title 38 that

occurs on or after August 1, 1990.

If you have performed such service, complete

and attach Schedule A, furnishing the requested

information from the military for each period of

active duty. Provide evidence of active duty you

claim. You are responsible for obtaining this

information and submitting it to OPM to substantiate

your claim. OPM may verify the information with the

military service.

Item 5: If you are receiving, or have applied for, any form of

military retired pay and/or pension or compensation

from the Department of Veterans Affairs in lieu of

military retired pay, answer “yes” to item 5, then

complete and attach Schedule B - Military Retired

Pay. Important: Military retired pay includes

disability pay and reserve retainer pay.

Section C - Other Claim Information

Item 2: Indicate whether or not you have ever applied for

retirement, refund, deposit or redeposit, return of

excess deductions, or voluntary contributions under

the Civil Service Retirement System. If you have,

indicate which type in 2a and the applicable claim

numbers in 2b. This helps to assure that all of your

records are located and that proper credit is given

for your service, and for any deposit, redeposit or

voluntary contribution payments you may have

made.

Section D- Insurance Information

If you want to continue your Federal Employees Health

Benefits (FEHB) and/or Federal Employees' Group Life

Insurance (FEGLI) coverage as a retiree, you must meet the

following basic requirements. You must be retiring on an

immediate annuity, and you must have been enrolled in the

program for the five years of Federal service immediately

preceding your annuity commencing date, or if enrolled less

than five years, for the full period(s) of service during which

coverage was available. FEHB coverage as a family member

(and coverage under TRICARE) counts toward the five-year

requirement for health benefits.

If you do not meet the enrollment requirement for continuing

your FEHB coverage as a retiree, you may be eligible for

temporary continuation of coverage as a separated employee.

Your employing office will provide information about

whether you can temporarily continue your FEHB coverage

and how to enroll for it.

If you appear eligible to continue your FEHB coverage, your

agency will automatically transfer your enrollment to OPM.

You do not need to do anything unless you want to make

some change in your coverage.

If you are enrolled in the Federal Dental and Vision Program

(FEDVIP), you may be billed for the premiums from the time

you separate for retirement until OPM completes work on

your retirement application. You must pay these bills in order

to keep your FEDVIP coverage. After work on your

retirement application is completed, OPM will deduct your

FEDVIP premiums from your monthly annuity payments. If

you retire on an immediate annuity, you can enroll in FEDVIP

during any Federal Benefits Open Season.

The FEGLI Program booklet (RI 76-21) has information

about eligibility to continue your FEGLI coverage as a retiree

and the cost of coverage. If you are eligible to continue your

FEGLI basic coverage, you MUST complete an SF 2818,

Continuation of Life Insurance Coverage as an Annuitant or

Compensationer. Any optional FEGLI coverage you have

and are eligible to retain as a retiree will automatically be

continued unless you make some change. You may also want

to file a FEGLI Designation of Beneficiary form (SF 2823).

If you are under age 65 and elect to continue Basic life

insurance coverage into retirement, you must pay the same

premium as active employees until you reach age 65. If you

elect either the 50% or No Reduction schedule (for coverage

after reaching age 65) on the SF 2818, you must pay not only

the regular insurance premium but also the additional premium

required for the extra coverage you will have after age 65.

Premiums for the additional coverage after age 65 continue for

life or for as long as you maintain the extra coverage.

Based on the documentation your employing agency is

required to submit with your retirement application, OPM will

determine whether you are eligible to continue your health

and life insurance coverage as a retiree. However, if you have

any questions about your eligibility, ask your employing office

for assistance before you retire.

Section E - Marital Information

Item 2: You must complete this item. Indicate whether or

not you have a living former spouse from whom you

were divorced on or after May 7, 1985, and to whom

a court order gives a survivor annuity or awards a

portion of your retirement benefit based on your

Federal employment.

If you answer yes, attach a certified copy of the court

order/divorce decree in its entirety and any

attachments or amendments. Failure to complete

this item will delay the processing of your

application.

Standard Form 2801

-2-

Previous editions are not usable. Revised June 2013

Section F - Annuity Election

Read “Important Information About Survivor Annuity

Elections,” page 5, before making your election. If you initial

either Box 1 or Box 2, your wife or husband will receive a

survivor annuity upon your death. The amount of this survivor

annuity, and the amount of the reduction in your annuity to

provide this benefit, will depend on which election you initial.

If your spouse is not elected to receive a monthly survivor

annuity, his or her health benefits coverage as a family

member on your FEHB enrollment will terminate when you

die.

For information on the effect of court orders on your spouse's

eligibility to receive survivor benefits, see page 5.

Box 1: If you initial box 1, your spouse's survivor annuity

upon your death will be 55% of your unreduced

annuity. Your annuity will be reduced by 2½ percent

of the first $3,600 and 10% of the remainder of your

annual annuity to provide this benefit upon your death.

Box 2: If you initial box 2, your spouse's survivor annuity

upon your death will be 55% of the annual amount

you specify in the blank space (which must be less

than the full amount of your annual annuity). Your

annuity will be reduced by 2½ percent of the first

$3,600 and 10% of any additional amount you

specify.

If you initial box 2, you must complete and attach

SF 2801-2, Spouse's Consent to Survivor Election,

to your application. The law requires consent of the

spouse if a married person elects less than the

maximum survivor benefit.

Box 3: If you initial box 3 you will receive an annuity

payable only during your lifetime, without a monthly

survivor annuity for your spouse. All retiring

employees, married and unmarried, may choose this

type of annuity. However, you should carefully

review all information provided before making your

election.

If you are married at retirement and choose this type

of annuity, you must also complete and attach to

your application SF 2801-2, Spouse's Consent to

Survivor Election. The law requires that your

spouse consent if you elect less than maximum

survivor benefits.

Box 4: If you initial box 4, a person selected by you, who

has an insurable interest in you, will receive a

survivor annuity upon your death. Insurable interest

exists if the person named (such as a former spouse

or a close relative) may reasonably expect to derive

financial benefit from your continued life.

To choose this type of annuity, you must provide

medical documentation showing that you are in good

health. You are responsible for arranging and paying

the costs of the medical examination. The medical

report of the examination should be attached to your

retirement application. You will be notified if

additional evidence is required. Note: If you are

retiring on the basis of disability, you are not eligible

to choose this type of annuity.

You may elect this insurable interest survivor annuity

in addition to a regular survivor annuity for a current

or former spouse. However, if the person you select

to receive the insurable interest survivor annuity is

your current spouse, you both must waive the

current spouse annuity by completing and attaching

SF 2801-2 to your application. Your current spouse

cannot receive both a regular survivor annuity and

an insurable interest survivor annuity.

If you elect the insurable interest annuity for a

current spouse because a court order awards (or you

have elected) the regular survivor annuity to a former

spouse, the insurable interest election for your

current spouse can be converted to a current spouse

annuity if the former spouse loses entitlement to the

regular annuity through death or remarriage prior to

reaching age 55. The marriage duration requirement

(see item c on page 5) does not apply to insurable

interest annuities.

If you choose to provide an insurable interest

survivor annuity, the amount of the reduction in your

annuity will depend upon the difference between

your age and the age of the person named as survivor

annuitant, as shown in the table below. The

survivor's rate will be 55% of your reduced annuity.

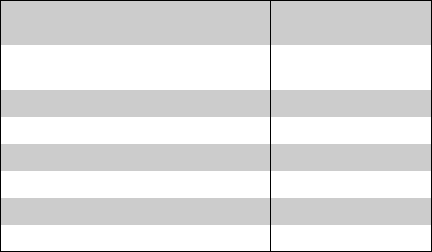

Age of Person Named in Relation

to that of Retiring Employee

Reduction in Annuity

of Retiring Employee

Older, same age,

or less than 5 years younger

10%

5 but less than 10 years younger

15%

10 but less than 15 years younger

20%

15 but less than 20 years younger

25%

20 but less than 25 years younger

30%

25 but less than 30 years younger

35%

30 or more years younger

40%

Box 5: If you initial box 5, you must complete the remainder

of Section F. Read item f. on page 5 before making

your election. If you are married and initial box 5,

you must also complete and attach SF 2801-2,

Spouse's Consent to Survivor Election, to your

application.

If you initial box 5, after your death, the person(s)

you elect will receive the percentage of the annuity

you select. Your annuity will be reduced by 2½

percent of the first $3,600 of all or a specified

amount of your annual self-only annuity and further

reduced by 10% for any portion of the base used

over $3,600 a year. If your annual annuity is $3,600

or less, only a 2½ percent reduction applies.

Section G - Information About Children

Information about your children in your annuity claim file

may help to expedite the processing of claims for survivor

benefits in the event of your death. Therefore, you may, if

you wish, complete Section G by providing the names and the

dates of birth of your unmarried dependent children under the

age of 22. List any child who is between 18 and 22 and is a

full-time student. List any child who is over the age of 18 and

incapable of self-support because of a mental or physical

disability incurred before age 18. Check the box headed

“disabled” by the name of each child to whom this applies.

Completion of Section G is optional; the processing of your

annuity application will not be delayed or otherwise affected

if you do not complete it. Children will not be denied benefits

after your death solely because they were not identified on

your retirement application.

Standard Form 2801

-3-

Previous editions are not usable. Revised June 2013

Section H - Direct Deposit/Direct Express and

Tax Withholding Information

The U.S. Department of the Treasury pays all federal benefits

electronically. If you are not enrolled in the Direct Deposit

program, you will need to enroll or to arrange for a Direct

Express debit card provided by the Department of Treasury.

To enroll in the Direct Deposit program, contact your

financial institution or OPM. To obtain a debit card, go to

www.godirect.org. If your payments are not electronically

deposited to your account and you do not have a Direct

Express card, you must contact the Department of the

Treasury at 1-800-333-1795 to discuss your options. This

does not apply if your permanent payment address is outside

the United States in a country not accessible via Direct

Deposit/Direct Express. Use Section H, items 1 through 3c

to tell OPM how to make payment to you.

Use Section H, item 4 to give OPM instructions regarding

Federal income tax withholding. If you do not give any

instructions, the Internal Revenue Service has instructed OPM

to withhold at the rate for a married person with three

exemptions.

After your application is processed, as discussed on page 11,

item 6, you will be able to instruct OPM to withhold State

income tax, provided your State participates in OPM's State

Tax Withholding Program.

Section I - Applicant's Certification

Be sure to sign (do not print) and date your application after

reviewing the warning.

Schedule A - Military Service Information

Item 2: Post-1956 Military Service -- If you performed

military service on or after January 1, 1957, you may

pay a deposit of 7% of your military basic pay (plus

interest, if applicable) to cover that service. The

military service deposit must be paid to your agency

while you are still employed. If the deposit is not

paid, your post-1956 military service will be credited

as described below.

If you were first employed in a position subject to

CSRS coverage before October 1, 1982: If you do

not make the deposit and you are eligible for Social

Security benefits at age 62, your annuity will be

recomputed (at age 62) to eliminate credit for the

post-1956 military service. If you are age 62 or older

when you retire and are eligible for Social Security

benefits, no credit for post-1956 military service will

be allowed in the computation of your annuity unless

you pay the deposit before you separate.

If you were first employed in a position subject to

CSRS coverage on or after October 1, 1982: You

will not receive any retirement credit for your

post-1956 military service if you do not make the

deposit for it before you separate.

The amount of a CSRS military deposit may be

different for an employee who has been absent from

civilian employment to perform honorable, active

military service that interrupted Federal civilian

service. Under certain conditions, the amount of the

military deposit for such a period of military service

would equal the amount of retirement deductions that

would have been withheld from Federal civilian basic

pay if the military service had not interrupted the

civilian service. Ask your benefits office about this

alternative military deposit calculation referenced in

5 U.S.C. 8334(j) if you think it may apply to you.

If you have questions concerning the crediting of

your post-1956 military service and how to make the

deposit, contact your employing agency. Failure to

pay the deposit to your agency voids any further

right to pay it at a later date.

Schedule B - Military Retired Pay

This information is needed to assure correct credit for military

service. Receipt of military retired pay or pension or

compensation from the Department of Veterans Affairs in

lieu of military retired pay may affect the computation of

your annuity rate. You cannot receive retirement credit for

military service if you receive military retired pay, unless

you were awarded the retired pay (a) due to a disability

incurred in combat with an enemy of the United States or

(b) under the provisions of Chapter 1223, title 10, U. S.

Code, Sections 12731 through 12739 (pertaining to

retirement from a reserve component of the armed forces).

If you are waiving military retired pay for civil service

retirement purposes, your agency can help you prepare your

request for waiver. Attaching a copy of your waiver request

and a copy of the finance center acknowledgment (if

available) to your application may help us to process your

claim more quickly. Even if you have already waived your

military retired pay to receive benefits from the Department of

Veterans Affairs, you also need to file a waiver of your

military pay for civil service retirement purposes.

Schedule C - Federal Employee's Compensation

Item 3:

Indicate whether you agree to notify us if the status

of your workers' compensation claim changes.

Important: You may not legally receive both

retirement annuity and workers' compensation

(except for a scheduled award) for the same period

of time. Any overpayment of workers' compensation

or retirement annuity you receive is subject to

collection by OPM or the Office of Workers'

Compensation Programs (OWCP).

The information requested regarding benefits from

OWCP is needed because the law prohibits the dual

compensation which would exist if you received both

a civil service retirement annuity and compensation

for total or partial disability under the Federal

Employees' Compensation Act. Note: The

Department of Labor has determined that the

alternative annuity lump sum payment is a payment

within the terms of the dual compensation provision.

If you receive the alternative annuity lump sum

payment and later elect compensation from OWCP,

no compensation would be payable until the amount

of the lump sum payment and all annuity paid is

returned to the Retirement Fund.

If you are applying for disability retirement, please

include, as part of your SF 3112 submission, all

medical evidence submitted to OWCP in connection

with your compensation claim and any OWCP

decision or evaluation of your claim.

Standard Form 2801

-4-

Previous editions are not usable. Revised June 2013

Important Information About

e.

Survivor Annuity Elections

The election you make at retirement is for the person named in

Section E. No one else can benefit even if you allow the

annuity reduction to continue after your marriage ends.

a. Married Employees. If you are married at retirement

and do not indicate your annuity election or your

spouse does not consent to an election of less than

the maximum survivor annuity, your application will

be processed on the basis of maximum survivor

benefits for your spouse.

b.

Spousal Consent Requirement.

(1) If you are married and you do not elect to

provide the maximum survivor annuity

benefit for your spouse by initialing Section

F, box 1 of the application, you must attach

a completed SF 2801-2, Spouse's Consent to

Survivor Election. This is required even if a

former spouse will be awarded a survivor

annuity by court order. See “Court-Ordered

Former Spouse Annuities” under item e.

(2) OPM may waive the spousal consent

requirement if you show that your spouse's

whereabouts cannot be determined. A

request for waiver on this basis must be

f.

accompanied by:

•

A judicial determination that your

spouse's whereabouts cannot be

determined; or

•

Affidavits by you and two other

persons, at least one of whom is not

related to you, attesting to the

inability to locate the current

spouse and stating the efforts made

to locate the spouse. You must

also give documentary evidence,

such as tax returns filed separately

or newspaper stories about the

spouse's disappearance.

(3) OPM may waive the spousal consent

requirement if you present a judicial

determination regarding the current spouse

that would warrant waiver of the consent

requirement based on exceptional

circumstances.

c. Marriage Duration Requirement. To be eligible for

survivor annuity after your death, your widow(er)

must have been married to you for a total of at least 9

months or be a parent of your child, provided all

other requirements are met. The marriage duration

requirement does not apply if your death is

accidental.

d. Survivor Annuity for Children. The eligibility of

your children for survivor annuity after your death

does not depend on your marital status or the type of

g.

annuity you elect. Your unmarried dependent

children may qualify for survivor annuity until age

18. Benefits may be payable to an unmarried child

after age 18 if the child is a full-time student at a

recognized educational institution or is incapable of

self-support due to a disability incurred before age

18. Benefits for a student child are generally not

payable after the child attains age 22.

-5-

Court-Ordered Former Spouse Annuities. If your

annuity begins on or after May 7, 1985, and a

qualifying court order gives (awards or requires you

to provide) a survivor annuity to a former spouse

from whom you were divorced on or after that date,

OPM must honor the terms of the court order, except

as discussed below. Your annuity will be reduced to

provide the survivor annuity for the former spouse if

he or she is eligible for this benefit. However, a

former spouse cannot receive a survivor annuity by

court order unless:

(1) He or she was married to you for at least 9

months;

(2) You have at least 18 months of service

subject to retirement deductions; and

(3) He or she has not remarried before reaching

age 55. This does not apply if you and your

former spouse were married for 30 years or

longer.

If you are married and a court has awarded a survivor

annuity to a former spouse, see item g. below, which

explains how you can protect your current spouse's

future survivor annuity rights.

Electing a Survivor Annuity For a Former Spouse

or a Combination of Survivor Annuities For

Current and Former Spouses.

(1) To make a former spouse annuity election,

you must have been married to the person

for a total of at least 9 months and you must

have at least 18 months of service that was

subject to retirement deductions. A former

spouse who marries again before reaching

age 55 is not eligible for a former spouse

survivor annuity, unless you and your

former spouse were married for 30 years

or longer.

(2) You may elect to provide a survivor annuity

for more than one former spouse whether or

not you are currently married. If you are

married, you may elect a survivor annuity

for your current spouse as well as a survivor

annuity for one or more former spouses.

However, the total of the survivor annuities

may not exceed 55% of your unreduced

annuity. Also, if you are married, you must

have your spouse's consent if you do not

elect the maximum current spouse survivor

annuity.

(3) To elect a reduced annuity to provide a

survivor annuity to a former spouse or a

combination of survivor annuities

for current and former spouse(s), complete

Section F, box 5.

Electing a Survivor Annuity For a Current Spouse

When a Court Order Gives a Survivor Annuity to a

Former Spouse.

(1) If a court order has given a survivor annuity

to a former spouse, you must make your

election concerning a survivor annuity for

your current spouse as if there were no

Standard Form 2801

Previous editions are not usable. Revised June 2013

court-ordered former spouse annuity. By (6) FEHB coverage for your widow(er) can

electing the maximum survivor benefit for continue only if he or she is elected to

your current spouse at retirement, you can receive a survivor annuity.

protect your spouse's rights in case your

former spouse loses entitlement in the future

h. Electing an Insurable Interest Annuity For a

(because of remarriage before age 55 or

Current Spouse.

death). You can do this because OPM must

Note: Disability annuitants cannot elect an insurable

honor the terms of the court order and you

interest survivor annuity.

are not required to elect a survivor annuity

for the former spouse. (Note: The election

(1) If a former spouse's court-ordered survivor

you make now regarding a survivor annuity

annuity will prevent your current spouse

for your current spouse cannot be changed

from receiving a survivor annuity that is

except as explained in “Survivor Annuity

sufficient to meet his or her anticipated

Election Changes After Retirement,” see

needs, you may want to elect an insurable

page 7.) The following paragraphs explain in

interest annuity for your current spouse.

more detail how your election at the time of

(2) If you elect an insurable interest survivor

retirement can affect your current spouse's

annuity for your current spouse, you and

future rights if the court has given a survivor

your current spouse must both waive the

annuity to a former spouse.

regular survivor annuity. To do this:

(2) If a court order gives a survivor annuity to a

(a) initial and complete box 4 in

former spouse, your annuity will be reduced

Section F of the SF 2801 naming

to provide it. If you elect a full or partial

survivor annuity for your current spouse (or

your current spouse;

another former spouse), your annuity will be

reduced no more than it would be reduced to

(b) complete Part 1 of SF 2801-2 and

check box b;

provide a survivor annuity equal to 55% of

your unreduced annuity.

(c) have Parts 2 and 3 of SF 2801-2

(3) If you die before your current and former

spouses, the total amount of the survivor

properly completed (i.e., spouse's

consent to insurable interest benefit

annuities paid cannot exceed 55% of your

in lieu of regular survivor annuity).

annuity. OPM must honor the terms of the

(3) If you elect an insurable interest survivor

court order before it can honor your election.

annuity for your current spouse and your

The former spouse having the court-ordered

former spouse loses entitlement before you

survivor benefit would receive an annuity

die, you may request that the reduction in

according to the terms of the court order.

your annuity to provide the insurable

(4) If the court order gives the maximum

interest annuity be converted to the regular

survivor annuity to the former spouse, your

spouse survivor annuity. (See “Survivor

widow(er) would receive no survivor

Annuity Election Changes After

annuity until the former spouse loses

Retirement,” see page 7.) Your current

entitlement. Then your widow(er) would

spouse would then be entitled to the regular

receive a survivor annuity according to your

survivor annuity. If your former spouse

election.

loses entitlement after you die, your

widow(er) can substitute the regular

(5) If the court order gives less than the

maximum survivor annuity to the former

survivor annuity for the insurable interest

survivor annuity.

spouse, your widow(er) would receive an

(4) If for any reason OPM cannot allow your

annuity no greater than the difference

insurable interest election for your current

between the court-ordered survivor annuity

spouse, your current spouse will be

and 55% of your annuity. However, if the

considered elected for a maximum regular

former spouse loses entitlement to the

survivor annuity, unless your current spouse

survivor annuity (through remarriage before

signs another SF 2801-2 consenting to less

age 55 or death), your widow(er)'s survivor

than a maximum regular survivor annuity.

annuity would be increased to the amount

you elected.

i. Voluntary Contributions and Survivor Annuity

For example, if there is a court-ordered

Election.

former spouse survivor annuity that equals

The following information applies only to employees

40% of your annuity, you elect the

who have made voluntary contributions to purchase

maximum survivor annuity for your current

additional annuity (see page 10), or who are using

spouse, and you die before the former

excess retirement deductions (see “80% Limitation on

spouse's entitlement to a survivor annuity

Basic Annuity” on page 8) as voluntary contributions.

ends, the former spouse would receive a

(1) Survivor annuity that is purchased by

survivor annuity equal to 40% of your

voluntary contributions is not subject to the

annuity and your widow(er) would receive a

spousal consent requirement discussed on

survivor annuity equal to 15% of your

page 5, nor is it subject to court orders

annuity. However, if the former spouse later

awarding survivor benefits to former

loses entitlement to the survivor annuity

spouses. Therefore, regardless of your

(through remarriage before age 55 or death),

marital status at retirement or the type of

your widow(er) would then receive a

survivor election you make for your regular

survivor annuity equal to 55% of your

annuity:

annuity.

Standard Form 2801

-6-

Previous editions are not usable. Revised June 2013

(a) You may elect not to provide a

survivor annuity based on the

voluntary contributions, or

(b) You may name any individual you

want to receive the voluntary

contributions survivor annuity.

That is, the individual you name to

receive the voluntary contributions

survivor annuity does not need to

be the same person you name as

survivor annuitant under the

regular survivor election made in

Section F of SF 2801.

(2) If you are married and elect to provide a

regular survivor annuity for your spouse

(by checking box 1, box 2, or box 4 of

Section F on the SF 2801), your voluntary

contributions annuity will automatically be

reduced to provide an additional survivor

annuity for your spouse, unless you attach a

signed statement to your application for

retirement in which (a) you state that you do

not want to provide a survivor annuity based

on the voluntary contributions or (b) you

name another person to receive this benefit

as explained in (4) below.

(3) If you are single and elect an annuity

payable only during your lifetime or if you

are married and with your spouse's consent

elect an annuity payable only during your

lifetime (by checking box 3 of Section F on

the SF 2801), your additional annuity

purchased by voluntary contributions will

not be reduced to provide a survivor

annuity, unless you elect otherwise as

explained below.

(4) If you want to designate an individual to

receive a survivor annuity based on your

voluntary contributions, you must submit a

signed statement which names the person

who is to receive the voluntary contributions

survivor annuity. (Only one person may be

named.) The signed statement must be

attached to your application for retirement.

If you are electing a survivor annuity for a

person other than a current spouse, the

statement must include that person's full

name, date of birth, social security number,

and mailing address. (In this instance, you

must also provide proof of the person's date

of birth, such as a certified birth certificate.)

(5) The reduction in your voluntary

contributions annuity to provide a survivor

annuity based on your voluntary

contributions depends upon the difference

between your age and the age of the person

named to receive the survivor annuity as

shown in the table on page 3.

The survivor's rate is 50% of your additional

annuity after it is reduced to provide a

survivor benefit. Important: The reduction

to provide the voluntary contributions

survivor annuity will not be eliminated if the

person you elect to receive this benefit dies,

nor can you substitute another individual to

receive the benefit.

Survivor Annuity Election Changes

After Retirement

a.

You may name a new survivor or change your

election if, not later than 30 days after the date of

your first regular monthly payment, you file a new

election in writing. If the person you named to

receive a survivor annuity dies or your current

marriage ends in death, divorce or annulment, you

should write OPM, Retirement Operations Center,

Boyers, PA 16017. (Note: If your marriage to the

spouse you had at retirement continues, you must

have his or her consent to any election that does not

provide the maximum current spouse survivor

annuity.)

Your first regular monthly payment is the first

recurring annuity payment (other than an estimated

payment or an adjustment) after OPM has determined

your regular rate of annuity payable under CSRS and

has paid the annuity accrued since the time you

retired.

b.

When the 30-day period following the date of your

first regular monthly payment has passed, you cannot

change your election except under the circumstances

explained in the following paragraphs.

c.

You may change your decision not to provide a

survivor annuity for your spouse at retirement or you

may increase the survivor annuity amount for your

spouse at retirement if you request the change in

writing no later than eighteen months after the

commencing date of your annuity. You must also

pay a deposit with interest representing the difference

between the reduction for the new survivor election

and the original survivor election, plus a charge of

$245.00 for each thousand-dollar change in the

designated survivor's base. Such an election would

cancel any joint waivers made at retirement.

However, the total survivor annuity(ies) provided for

former spouses (by court order or election) and the

current spouse cannot exceed 55% of your annuity.

Note, you can make a contingent election of 55% for

your current spouse even if there is a court order.

d.

The reduction in your annuity to provide a survivor

annuity for your current spouse stops if your

marriage ends because of death, divorce, or

annulment. However, you may elect, within 2 years

after the marriage ends, to continue the reduction to

provide a former spouse survivor annuity for that

person, subject to the restrictions in paragraph j.

If you marry someone else before you make this

election, your new spouse must consent to your

election.

e.

The reduction in your annuity to provide a survivor

annuity for a former spouse ends (1) when the former

spouse dies, (2) when the former spouse remarries

before reaching age 55, or (3) under the terms of the

court order that required you to provide the survivor

annuity for the former spouse when you retired.

(Modifications of the court order issued after you

retire do not affect the former spouse annuity.) If

you and your former spouse were married for 30

years or longer, the reduction does not end.

However, if at retirement, you had elected a survivor

annuity for your current spouse (or another former

spouse), the reduction will be continued to provide

Standard Form 2801

-7-

Previous editions are not usable. Revised June 2013

annuity for that person. If you have not previously

made an election regarding a current spouse whom

you married after retirement (or if your election

regarding a current spouse at retirement was based

on a waiver of spousal consent), you may, within 2

years after the former spouse is no longer eligible

because of remarriage before age 55 or death, elect

a reduced annuity to provide a survivor annuity for

that current spouse. This election is subject to the

restrictions given in paragraph j.

f. If you were not married at retirement, you may

elect, within 2 years after a post-retirement marriage,

a reduced annuity to provide a maximum or

less-than-maximum survivor annuity for your spouse,

subject to the restrictions given in paragraph j.

g. If you were married at retirement, that marriage ends,

and you marry again, you may elect a reduced annuity

to provide a maximum or less-than-maximum survivor

annuity for your new spouse, subject to the restrictions

given in paragraph j. Please note that the survivor

annuity elections automatically terminate upon

divorce. You must make a new election within

2 years after the divorce to provide a survivor annuity

for a former spouse. Continuing a survivor reduction,

by itself, is not a former spouse survivor election. If

you remarry the same person you were married to

at retirement and that person had previously consented

to your election of no survivor annuity, you may not

elect to provide a survivor annuity for that person

when you remarry.

h. If, at retirement, you received (by election or court

order) a reduced annuity to provide a survivor

annuity for a former spouse and you elected to

provide an insurable interest survivor annuity for

your current spouse, you may change the insurable

interest election to a regular current spouse survivor

annuity within 2 years after your former spouse loses

entitlement (because of remarriage before age 55,

death, or the terms in the court order), subject to

restrictions (1) and (2) given in paragraph j.

i. The reduction in your annuity to provide an insurable

interest survivor annuity ends if the person you

named to receive the insurable interest annuity dies

or when the person you named is your current spouse

and you change your election as explained in

paragraph h. The reduction also ends if, after you

retire, you marry the insurable interest beneficiary

and elect to provide a regular survivor annuity for

that person. If you marry someone other than the

insurable interest beneficiary after you retire and

elect to provide a regular survivor annuity for your

new spouse, you may elect to cancel the insurable

interest reduction.

j. Post-retirement survivor elections are subject to the

following restrictions:

(1) They cannot be honored to the extent that

they conflict with the terms of a qualifying

court order that requires you to provide a

survivor annuity for a former spouse.

(2) They cannot be honored if they cause

combined current and former spouse

survivor annuities to exceed 55% of

your unreduced annuity; and

(3) If, during any period after you retired, your

annuity was not reduced to provide a current

or former spouse survivor annuity, you must

pay into the retirement fund an amount

equal to the amount your annuity would

have been reduced during that period plus

6% annual interest.

k.

Insurable interest elections are not available after

retirement.

How Annuities Are Computed

The following discussion is not detailed enough to answer

every question you may have. Your agency is responsible for

giving you an annuity estimate and specific advice about your

individual circumstances.

Basic Annuity Computation — The amount of your annuity

depends primarily on your “high-3” average pay and length of

service.

Unused Sick Leave — An employee who retires with unused

sick leave will have the number of working days represented

by such leave added to the years of service for the purpose of

computing the annuity. Additional annuity earned thereby

will not be subject to the 80% limitation on basic annuity.

Days of unused sick leave may not be used in determining

average pay or length of service for annuity eligibility.

High-3 Average Pay — The “high-3” average pay is the

highest pay obtainable by averaging the rates of basic pay in

effect during any 3 consecutive years of service with each rate

weighted by the time it was in effect.

Basic Annuity Formula — For employees generally, (a)

take: 1½ percent of the “high-3” average pay and multiply the

result by 5 years of service; (b) add: 1¾ percent of the

“high-3” average pay multiplied by years of service between 5

and 10; and (c) add: 2% of the “high-3” average pay

multiplied by all service over 10 years.

Formula for Law Enforcement and Firefighter Personnel

— The basic annuity of an employee who retires under the

special provision covering law enforcement, firefighter and

nuclear materials courier personnel is 2½ percent of the

“high-3” average pay multiplied by 20 years of law

enforcement, firefighter and/or nuclear materials courier

service, plus 2% of the “high-3” average pay multiplied by all

service over 20 years.

Other Special Computations — Information concerning

other special computations, such as those for certain air traffic

controllers, customs and border protection officers, nuclear

materials couriers, Members of Congress, Congressional

employees, retirement under provisions of the Panama Canal

Treaty, etc., must be obtained from your employing agency.

80% Limitation on Basic Annuity — The basic annuity may

not be more than 80% of the employee's “high-3” average

pay. Retirement deductions withheld after the month the 80%

limitation is reached are, at separation, set aside as a special

credit. At retirement, this special credit is applied to any

unpaid deposit or redeposit. Any balance, or the entire special

credit if no deposit is due, is refundable before annuity has

been granted or may be used as voluntary contributions to

purchase additional annuity as explained below.

Standard Form 2801

-8-

Previous editions are not usable. Revised June 2013

Guaranteed Minimum Disability Annuity — An employee

retiring before age 60 on account of total disability is

guaranteed a minimum basic annuity which amounts to the

lesser of (a) 40% of the “high-3” average pay or (b) the sum

obtained by using the basic annuity formula above, but

increasing the length of actual service by the period between

the date of the employee's separation for retirement and the

date age 60 is reached.

If the basic annuity is greater than the guaranteed minimum,

the basic annuity is paid instead. Persons receiving military

retired pay or pension or compensation from the Department

of Veterans Affairs in lieu of military retired pay are generally

not eligible for the guaranteed minimum annuity computation.

Reductions to the Basic Annuity — There are several

possible reductions to the basic annuity. These include:

a. Service You Have Not Paid For — Civilian service

during which no retirement deductions were withheld

from your salary is called “nondeduction” service.

A “deposit” is a payment to the retirement fund to

cover a period of nondeduction service. You do not

have to make a deposit if you do not wish to do so.

This can affect the amount of your monthly annuity.

However, this service is creditable for title to annuity

and may be used as needed in computing your

“high-3” average salary, even if the deposit is not

paid.

Non-Deduction Service On or After October 1, 1982

— If you have performed creditable civilian service

on or after October 1, 1982, during which no

retirement deductions were withheld and for which

you have not paid a deposit, that service will not be

included in computing your annuity. If you have

such service, you will be given an opportunity to pay

the deposit, with interest, before we complete our

action on your application. If you are eligible for and

elect an alternative annuity, the deposit will be

“deemed” paid.

Reduction for Non-Deduction Service Performed

Before October 1, 1982 — An employee who

performed creditable civilian service before October

1, 1982, during which no retirement deductions were

withheld from salary and for which no deposit has

been made will have his or her annual annuity

reduced by 10% of the amount due as deposit. The

deposit consists of the amount which would have

been withheld as retirement deductions, plus interest.

Retiring employees who want information on paying

such a deposit should attach a signed statement to

that effect to the application for retirement. If you

are eligible for and elect an alternative annuity, the

amount due as deposit for civilian service will

generally be “deemed” paid.

b. Refunded Service — Civilian service for which

retirement deductions were withheld from your

salary and later refunded to you is called “refunded”

service. A “redeposit” is a payment to the retirement

fund to cover a period of refunded service.

Generally, you do not have to make a redeposit if you

do not wish to do so. However, this can affect the

amount of your monthly annuity.

Refunded Service Which Ended On or After March 1,

1991 — You will receive no credit in the computation

of your annuity for the period of refunded service.

This usually results in a reduction in the amount of

your annuity, or, in the event of your death, your

eligible widow's (or widower's) annuity. The period

of service will be creditable for title and average

salary purposes whether or not a redeposit is made.

If you are eligible for and elect an alternative annuity,

the redeposit will be “deemed” paid.

Refunded Service Which Ended Before March 1,

1991 — If you separated from service on or after

October 28, 2009, you will receive credit in your

annuity computation for the period of refunded

service. If you do not pay the redeposit for this

service, your annuity will be permanently, actuarially

reduced because the redeposit is not paid. The

amount of the reduction will be based on factors

which will be divided into the amount of redeposit

and interest you owe at retirement. Annuities based

on separations for disability are not subject to the

actuarial reduction and any redeposit due must be

paid at retirement. If you are eligible for and elect an

alternative annuity, the redeposit will be “deemed”

paid.

c. Reduction for Unpaid Post - 1956 Military Service —

See the discussion on page 4, instructions for

completing Schedule A.

d. Reduction for Early Retirement — Unless

retirement is based on disability or under the special

provision for law enforcement, firefighter, nuclear

materials courier or customs and border protection

officer personnel, the annuity of an employee who

retires before age 55 will be reduced by 1/6 of 1%

(2% a year) for each full month, if any, under age 55.

e. Reduction for Alternative Annuity — An employee

who separates for a non-disability retirement with a

life threatening medical condition and a life

expectancy of 2 years or less is eligible to elect an

alternative annuity benefit. The employee will receive

a lump-sum payment of his or her unrefunded

retirement contributions, including post-1956 military

deposits, and a reduced monthly annuity. Deposits and

redeposits that are “deemed” paid are not included as

part of the lump-sum payment. The amount of the

reduction in annuity is based on the employee's age at

retirement and amount of retirement contributions.

Employees retiring on disability or who have a former

spouse who is entitled by court order to receive a

portion of the employee's annuity or a survivor

annuity cannot elect an alternative annuity. Married

employees must obtain their current spouse's consent

in order to elect an alternative annuity.

f. Reduction for Survivor Annuity — This reduction is

explained under Section F - Annuity Election starting

on page 3.

Standard Form 2801

-9-

Previous editions are not usable. Revised June 2013

Additional Annuity (Voluntary Contributions) — An

employee who, in addition to the amounts withheld from

salary, has made voluntary contributions to the retirement

fund will be paid, in addition to the regular annuity, $7.00 per

year, plus $0.20 for each full year the individual is over age

55 at retirement, for each $100.00 in his or her voluntary

contributions account. If, with respect to voluntary

contributions, an employee elects a survivor annuity, the

additional annuity purchased will be reduced based on the

difference between the annuitant's age and the survivor's age

as shown in the table on page 3. The survivor's annuity will be

50% of the employee's additional reduced annuity. Note: The

additional annuity purchased by voluntary contributions is not

increased by cost-of-living adjustments.

Cost-of-Living Increases

1. Limitation on amount of increase. An annuity may

not be increased by a cost-of-living adjustment to an

amount that exceeds the greater of (a) the maximum

pay for a GS-15 thirty days before the effective date

of the adjustment or (b) the final pay (or average pay

if higher) of the retired employee, increased by the

overall annual percentage adjustments (compounded)

in General Schedule rates of pay since the employee's

retirement.

2. Determination of amount of increase and effective

date. Cost-of-living increases are effective on

December 1 and are payable in the January annuity

payment. They are determined by the percentage

increase in the average Consumer Price Index for the

"base quarter" of the year in which they are effective

over the "base quarter" of the preceding year in

which an increase occurred. The “base quarter" is

July, August, and September. The first cost-of-living

increase you receive will be prorated to reflect the

number of months you are on the retirement rolls

before the increase is effective.

Payment and Accrual of Annuity

All annuities are payable in monthly installments on the first

business day of the month following the one for which the

annuity has accrued. All annuities are adjusted to the next

lower dollar.

The commencing date of most annuities is the first day of the

month after pay ceases and all other requirements for title to

annuity are met. There are three exceptions, however:

(1) disability annuities, (2) annuities based on involuntary

separations, and (3) annuities based on voluntary retirement

of employees who are in pay status for three days or less in

the month of retirement. In these three instances, annuities

commence no later than the day after pay ceases and all other

requirements for title to annuity are met.

Filing Your Application

Submit the completed application to your agency. Your

agency must then complete the Agency Checklist of Immediate

Retirement Procedures (SF 2801 - Schedule D) and Certified

Summary of Federal Service (SF 2801-1) which are included

in this package. These forms were included in this package so

that you would have an opportunity to review and become

familiar with the type of information and procedures your

agency will need to process your application. After you

submit your application, your agency will complete the

SF 2801-1 and return it to you for your review and signature.

If you are applying for disability retirement, you and your

agency will also need to complete SF 3112. (Be sure to ask

your employing agency what documentation and evidence are

necessary if you are applying for disability retirement.)

Important: You and your employing agency are jointly

responsible for the completeness and correctness of the Certified

Summary of Federal Service (SF 2801-1). You should review it

carefully before signing it. If you have already signed a

summary (for example, during pre-retirement counseling), ask

your agency to let you review it again. Any errors, omissions,

or discrepancies will delay the processing of your application

and may result in incomplete credit for service in the initial

adjudication of your application.

What Happens After You File Your

Retirement Application

1.

Your Employing Office

Your employing office will close out your records,

using the Agency Checklist to assure that all

necessary steps are taken. When this process (which

includes paying you any unpaid compensation, such

as for unpaid annual leave) has been completed, the

agency will forward your application and records to

OPM.

2. OPM Acknowledgment

Within a few days after receiving your application

OPM will send you an acknowledgment. This

acknowledgment will show your claim number,

which will begin with the letters “CSA.” This

number will be very important to you as an annuitant

because you will need to refer to it any time you

write or call us in connection with your annuity.

Important: OPM cannot begin the processing of

your application for retirement until we receive your

application and retirement records from your agency.

If you need to contact OPM about your application

before you receive your retirement (CSA) claim

number, contact your former payroll office. Your

former payroll office can tell you if your application

and records were sent to OPM. If the records were

sent, you should provide OPM with the payroll office

number and the number and date of the Register of

Separations and Transfers on which your retirement

package was sent. Only your payroll office can

provide this information. Do not contact OPM

unless your retirement package has been sent to us.

Management

and Payroll Office Payroll Office

U.S. OfficeU.S. Office ofof PersonnelPersonnel Managemen

CSRS/FERS HandbookCSRS/FERS Handbook forfor PersonnelPersonnel an

Standard Form 2801

NSN 7540-00-634-4250NSN 7540-00-634-4250

-10-

Previous editions are not usable. Revised June 2013

3. Interim Annuity Payments 6. After Your Application Is Processed

The next action OPM takes is a preliminary review of When we finish processing your application, we will

the records available at the time your application is send you a booklet explaining your benefits and any

received. If your entitlement to annuity is clear at monthly survivor benefits payable after your death.

this point, OPM may authorize interim annuity The booklet contains information you will need after

payments as a means of preventing undue financial you retire, including how to contact OPM to make

hardship while we process your application. These various changes (tax withholding, address, health

interim payments may be lower than your actual benefits, etc.).

annuity rate. When interim payments are authorized,

you will receive a notice showing the amount of your

payments.

What To Do If Your Address Changes

Before Processing Is Completed

4. Alternative Annuity (Lump-Sum Refund)

Employees who separate for non-disability

retirement, have a life threatening medical condition

and a life expectancy of 2 years or less are eligible to

If your address changes before you receive your claim

number, first contact your agency to find out if your

application has been forwarded to OPM.

elect an “alternative” annuity (lump-sum refund of

If your agency has forwarded your application or if you have

retirement contributions with a reduced monthly

received your claim number, you can telephone, use email, or

benefit). OPM will send you specific information

write to report your new address. If you know your claim

about this election during the processing of your

number, please refer to it in any correspondence. If you do

application. If you are retiring because of a

not yet have a claim number, please give your name, Social

disability or if you have a former spouse entitled to

Security number, date of birth, the date of retirement, and the

court-ordered benefits, you are not eligible to elect

agency you retired from.

an alternative annuity.

You can call OPM at 1-888-767-6738. If you use TTY

5. Disability and Special Retirement Applications

Applications for disability retirement and special

retirements are processed differently. For disability

retirements, your agency will forward your

application, evidence supporting your claim of

disability, and preliminary records to OPM for

disability determination based on review of both

medical and non-medical evidence. Interim annuity

equipment, call 1-855-887-4957. The Internet address is

www.opm.gov/retirement-services. The email address is

[email protected]. If you prefer to write to us, you should

report your new address to:

U. S. Office of Personnel Management

Attn: Change of Address

P. O. Box 440

Boyers, PA 16017-0440

payments can be authorized only if and after the

In addition, you should notify the Postal Service of your

disability has been approved and your last day in a

forwarding address.

pay status is known to OPM. For law enforcement,

firefighter, air traffic controllers, customs and border

protection officers, and nuclear materials couriers,

your agency will forward evidence concerning your

entitlement to the special provisions. Interim annuity

payments can be authorized only if and after OPM

has verified your entitlement to the benefit.

Privacy Act Statement

Solicitation of this information is authorized by the Civil Service Retirement law, the Federal Employees' Group Life Insurance law, and the Federal Employees

Health Benefits law (Chapters 83, 87, and 89, of title 5, U.S. Code). The information you furnish will be used to identify records properly associated with your

application for Federal benefits, to obtain additional information if necessary, to determine and allow present or future benefits, and to maintain a uniquely identifiable

claim file. The information may be shared, and is subject to verification, via paper, electronic media, or through the use of computer matching programs, with national,

state, local or other charitable or social security administrative agencies in order to determine benefits under their programs, to obtain information necessary for

determination or continuation of benefits under this program, or to report income for tax purposes. It may also be shared and verified as noted above with law

enforcement agencies when they are investigating a violation or potential violation of civil or criminal law. Executive Order 9397 (November 22, 1943) authorizes the

use of the Social Security number. Furnishing the Social Security number, as well as other data, is voluntary, but failure to do so may delay or prevent action on your

application. Information you provide about your unmarried dependent children may be used to expedite their claims after you die; however, your failure to supply

such information will not affect any future rights they may have to benefits.

U.S. Office of Personnel Management Standard Form 2801

CSRS/FERS Handbook for Personnel and Payroll Offices

NSN 7540-00-634-4250

-11-

Revised June 2013

Previous editions are not usable.