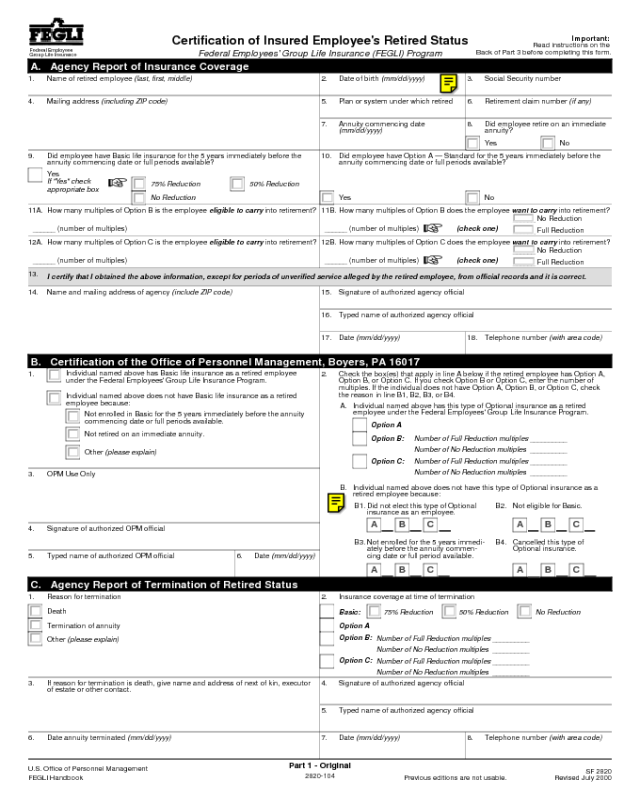

Fillable Printable SF 2820

Fillable Printable SF 2820

SF 2820

Part 1 - Original

2820-104

SF 2820

Previous editions are not usable. Revised July 2000

U.S. Office of Personnel Management

FEGLI Handbook

13.

I certify that I obtained the above information, except for periods of unverified service alleged by the retired employee, from official records and it is correct.

Important:

Read instructions on the

Back of Part 3 before completing this form.

Federal Employees

Group Life Insurance

Name of retired employee (last, first, middle)1. Date of birth (mm/dd/yyyy)2. Social Security number3.

Plan or system under which retired5. Retirement claim number (if any)6.

Annuity commencing date

(mm/dd/yyyy)

7. Did employee retire on an immediate

annuity?

8.

Mailing address (including ZIP code)4.

NoYes

Did employee have Basic life insurance for the 5 years immediately before the

annuity commencing date or full periods available?

9. Did employee have Option A — Standard for the 5 years immediately before the

annuity commencing date or full periods available?

10.

Yes

If "Yes" check

appropriate box

75% Reduction

No Reduction

50% Reduction

NoYes

How many multiples of Option B is the employee eligible to carry into retirement?11A. How many multiples of Option B does the employee want to carry into retirement?11B.

______ (number of multiples)

______ No Reduction

______ Full Reduction

(check one)______ (number of multiples)

How many multiples of Option C does the employee want to carry into retirement?12B.

______ (number of multiples)

______ No Reduction

______ Full Reduction

(check one)

How many multiples of Option C is the employee eligible to carry into retirement?12A.

______ (number of multiples)

Name and mailing address of agency (include ZIP code)14. Signature of authorized agency official15.

Typed name of authorized agency official16.

17.

B. Certification of the Office of Personnel Management, Boyers, PA 16017

Date (mm/dd/yyyy) 18.

C. Agency Report of Termination of Retired Status

Date annuity terminated (mm/dd/yyyy)6. 7. Date (mm/dd/yyyy) 8. Telephone number (with area code)

5. Typed name of authorized agency official

4. Signature of authorized agency officialIf reason for termination is death, give name and address of next of kin, executor

of estate or other contact.

3.

2.

Individual named above does not have this type of Optional insurance as a

retired employee because:

B.

Did not elect this type of Optional

insurance as an employee.

B1. Not eligible for Basic.B2.

Individual named above has this type of Optional insurance as a retired

employee under the Federal Employees' Group Life Insurance Program.

A.

Option A

Option B:

Number of Full Reduction multiples __________

Number of No Reduction multiples __________

Option C:

Number of Full Reduction multiples __________

Number of No Reduction multiples __________

A

Not enrolled for the 5 years immedi-

ately before the annuity commen-

cing date or full period available.

B3. Cancelled this type of

Optional insurance.

B4.

Signature of authorized OPM official4.

Typed name of authorized OPM official5. Date (mm/dd/yyyy)6.

Reason for termination1.

Death

Termination of annuity

Other (please explain)

2. Insurance coverage at time of termination

Basic: 75% Reduction No Reduction50% Reduction

Option A

Option B:

Option C:

Number of Full Reduction multiples __________

Number of No Reduction multiples __________

Number of Full Reduction multiples __________

Number of No Reduction multiples __________

B C A B C

A B C A B C

1.

Individual named above has Basic life insurance as a retired employee

under the Federal Employees' Group Life Insurance Program.

Individual named above does not have Basic life insurance as a retired

employee because:

Not enrolled in Basic for the 5 years immediately before the annuity

commencing date or full periods available.

Not retired on an immediate annuity.

OPM Use Only3.

Other (please explain)

Check the box(es) that apply in line A below if the retired employee has Option A,

Option B, or Option C. If you check Option B or Option C, enter the number of

multiples. If the individual does not have Option A, Option B, or Option C, check

the reason in line B1, B2, B3, or B4.

Telephone number (with area code)

A. Agency Report of Insurance Coverage

Certification of Insured Employee's Retired Status

Federal Employees' Group Life Insurance (FEGLI) Program

Clear Form

Print Form

Save Form

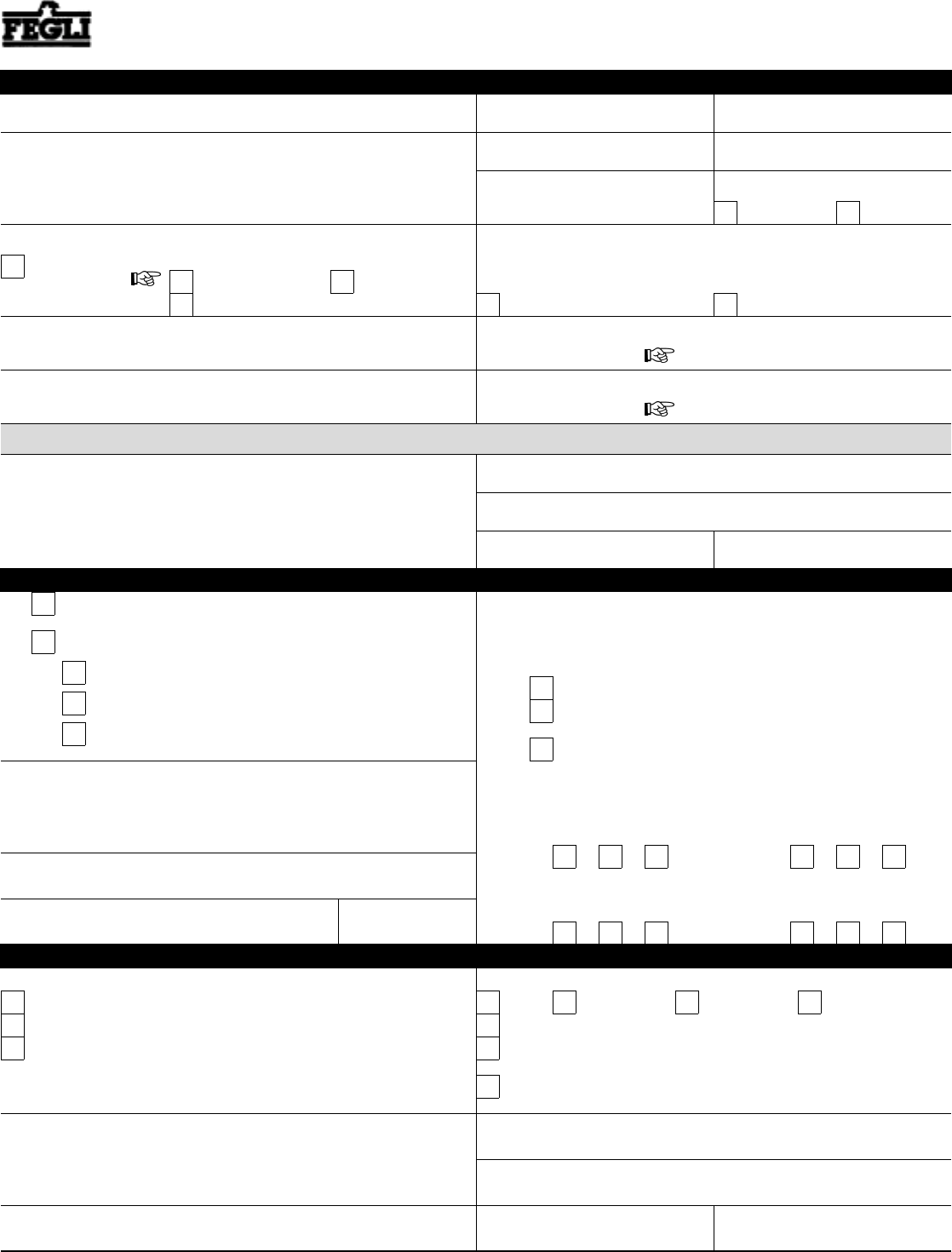

Part 2 - Agency Copy

2820-104

SF 2820

Previous editions are not usable. Revised July 2000

U.S. Office of Personnel Management

FEGLI Handbook

13.

I certify that I obtained the above information, except for periods of unverified service alleged by the retired employee, from official records and it is correct.

Important:

Read instructions on the

Back of Part 3 before completing this form.

Federal Employees

Group Life Insurance

Name of retired employee (last, first, middle)1. Date of birth (mm/dd/yyyy)2. Social Security number3.

Plan or system under which retired5. Retirement claim number (if any)6.

Annuity commencing date

(mm/dd/yyyy)

7. Did employee retire on an immediate

annuity?

8.

Mailing address (including ZIP code)4.

NoYes

Did employee have Basic life insurance for the 5 years immediately before the

annuity commencing date or full periods available?

9. Did employee have Option A — Standard for the 5 years immediately before the

annuity commencing date or full periods available?

10.

Yes

If "Yes" check

appropriate box

75% Reduction

No Reduction

50% Reduction

NoYes

How many multiples of Option B is the employee eligible to carry into retirement?11A. How many multiples of Option B does the employee want to carry into retirement?11B.

______ (number of multiples)

______ No Reduction

______ Full Reduction

(check one)______ (number of multiples)

How many multiples of Option C does the employee want to carry into retirement?12B.

______ (number of multiples)

______ No Reduction

______ Full Reduction

(check one)

How many multiples of Option C is the employee eligible to carry into retirement?12A.

______ (number of multiples)

Name and mailing address of agency (include ZIP code)14. Signature of authorized agency official15.

Typed name of authorized agency official16.

17.

B. Certification of the Office of Personnel Management, Boyers, PA 16017

Date (mm/dd/yyyy) 18.

C. Agency Report of Termination of Retired Status

Date annuity terminated (mm/dd/yyyy)6. 7. Date (mm/dd/yyyy) 8. Telephone number (with area code)

5. Typed name of authorized agency official

4. Signature of authorized agency officialIf reason for termination is death, give name and address of next of kin, executor

of estate or other contact.

3.

2.

Individual named above does not have this type of Optional insurance as a

retired employee because:

B.

Did not elect this type of Optional

insurance as an employee.

B1. Not eligible for Basic.B2.

Individual named above has this type of Optional insurance as a retired

employee under the Federal Employees' Group Life Insurance Program.

A.

Option A

Option B:

Number of Full Reduction multiples __________

Number of No Reduction multiples __________

Option C:

Number of Full Reduction multiples __________

Number of No Reduction multiples __________

A

Not enrolled for the 5 years immedi-

ately before the annuity commen-

cing date or full period available.

B3. Cancelled this type of

Optional insurance.

B4.

Signature of authorized OPM official4.

Typed name of authorized OPM official5. Date (mm/dd/yyyy)6.

Reason for termination1.

Death

Termination of annuity

Other (please explain)

2. Insurance coverage at time of termination

Basic: 75% Reduction No Reduction50% Reduction

Option A

Option B:

Option C:

Number of Full Reduction multiples __________

Number of No Reduction multiples __________

Number of Full Reduction multiples __________

Number of No Reduction multiples __________

B C A B C

A B C A B C

1.

Individual named above has Basic life insurance as a retired employee

under the Federal Employees' Group Life Insurance Program.

Individual named above does not have Basic life insurance as a retired

employee because:

Not enrolled in Basic for the 5 years immediately before the annuity

commencing date or full periods available.

Not retired on an immediate annuity.

OPM Use Only3.

Other (please explain)

Check the box(es) that apply in line A below if the retired employee has Option A,

Option B, or Option C. If you check Option B or Option C, enter the number of

multiples. If the individual does not have Option A, Option B, or Option C, check

the reason in line B1, B2, B3, or B4.

Telephone number (with area code)

A. Agency Report of Insurance Coverage

Certification of Insured Employee's Retired Status

Federal Employees' Group Life Insurance (FEGLI) Program

Clear Form

Print Form

Save Form

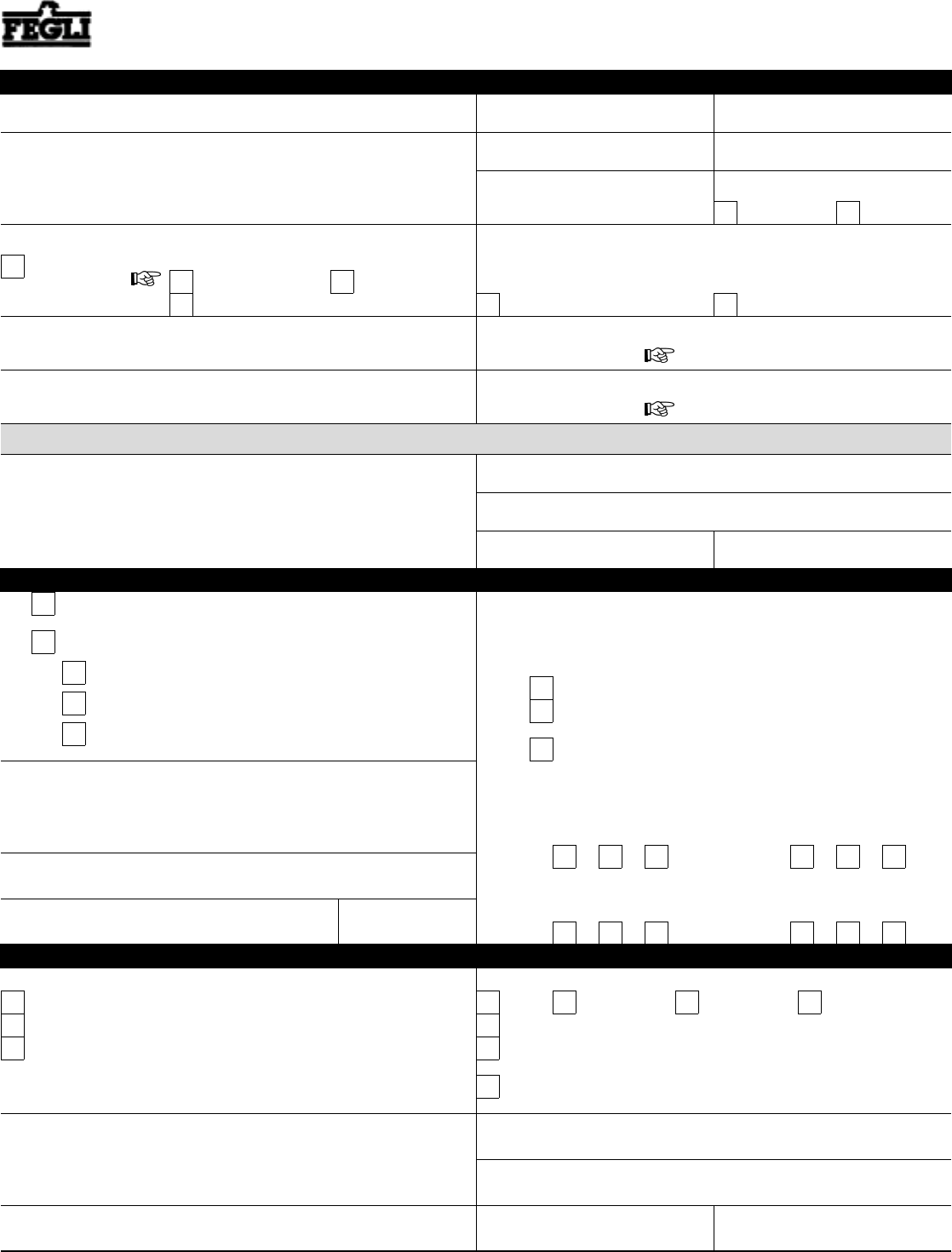

Part 3 - File Copy

2820-104

SF 2820

Previous editions are not usable. Revised July 2000

U.S. Office of Personnel Management

FEGLI Handbook

13.

I certify that I obtained the above information, except for periods of unverified service alleged by the retired employee, from official records and it is correct.

Important:

Read instructions on the

Back of Part 3 before completing this form.

Federal Employees

Group Life Insurance

Name of retired employee (last, first, middle)1. Date of birth (mm/dd/yyyy)2. Social Security number3.

Plan or system under which retired5. Retirement claim number (if any)6.

Annuity commencing date

(mm/dd/yyyy)

7. Did employee retire on an immediate

annuity?

8.

Mailing address (including ZIP code)4.

NoYes

Did employee have Basic life insurance for the 5 years immediately before the

annuity commencing date or full periods available?

9. Did employee have Option A — Standard for the 5 years immediately before the

annuity commencing date or full periods available?

10.

Yes

If "Yes" check

appropriate box

75% Reduction

No Reduction

50% Reduction

NoYes

How many multiples of Option B is the employee eligible to carry into retirement?11A. How many multiples of Option B does the employee want to carry into retirement?11B.

______ (number of multiples)

______ No Reduction

______ Full Reduction

(check one)______ (number of multiples)

How many multiples of Option C does the employee want to carry into retirement?12B.

______ (number of multiples)

______ No Reduction

______ Full Reduction

(check one)

How many multiples of Option C is the employee eligible to carry into retirement?12A.

______ (number of multiples)

Name and mailing address of agency (include ZIP code)14. Signature of authorized agency official15.

Typed name of authorized agency official16.

17.

B. Certification of the Office of Personnel Management, Boyers, PA 16017

Date (mm/dd/yyyy) 18.

C. Agency Report of Termination of Retired Status

Date annuity terminated (mm/dd/yyyy)6. 7. Date (mm/dd/yyyy) 8. Telephone number (with area code)

5. Typed name of authorized agency official

4. Signature of authorized agency officialIf reason for termination is death, give name and address of next of kin, executor

of estate or other contact.

3.

2.

Individual named above does not have this type of Optional insurance as a

retired employee because:

B.

Did not elect this type of Optional

insurance as an employee.

B1. Not eligible for Basic.B2.

Individual named above has this type of Optional insurance as a retired

employee under the Federal Employees' Group Life Insurance Program.

A.

Option A

Option B:

Number of Full Reduction multiples __________

Number of No Reduction multiples __________

Option C:

Number of Full Reduction multiples __________

Number of No Reduction multiples __________

A

Not enrolled for the 5 years immedi-

ately before the annuity commen-

cing date or full period available.

B3. Cancelled this type of

Optional insurance.

B4.

Signature of authorized OPM official4.

Typed name of authorized OPM official5. Date (mm/dd/yyyy)6.

Reason for termination1.

Death

Termination of annuity

Other (please explain)

2. Insurance coverage at time of termination

Basic: 75% Reduction No Reduction50% Reduction

Option A

Option B:

Option C:

Number of Full Reduction multiples __________

Number of No Reduction multiples __________

Number of Full Reduction multiples __________

Number of No Reduction multiples __________

B C A B C

A B C A B C

1.

Individual named above has Basic life insurance as a retired employee

under the Federal Employees' Group Life Insurance Program.

Individual named above does not have Basic life insurance as a retired

employee because:

Not enrolled in Basic for the 5 years immediately before the annuity

commencing date or full periods available.

Not retired on an immediate annuity.

OPM Use Only3.

Other (please explain)

Check the box(es) that apply in line A below if the retired employee has Option A,

Option B, or Option C. If you check Option B or Option C, enter the number of

multiples. If the individual does not have Option A, Option B, or Option C, check

the reason in line B1, B2, B3, or B4.

Telephone number (with area code)

A. Agency Report of Insurance Coverage

Certification of Insured Employee's Retired Status

Federal Employees' Group Life Insurance (FEGLI) Program

Clear Form

Print Form

Save Form

Completion of Form — Complete Section A of this form for each insured employee who has retired under any system

other than the Civil Service Retirement System (CSRS) or Federal Employees' Retirement System (FERS) and who

submits a completed Agency Certification of Insurance Status (SF 2821).

Disposition of Form — Send Part 1 and Part 2 of this form and all life insurance forms (SF 2817, SF 2818, SF 2819,

SF 2821, SF 2823, RI 76-10, RI 76-27, FE-8C, etc.) and applicable court order(s), if any, to the Office of Personnel

Management (OPM), P.O. Box 45, Boyers, PA 16017-0045. Keep Part 3 in the annuitant's file. We will complete

Section B and send you a copy for your records, indicating whether the retired annuitant is insured.

Immediate Annuity — See item 8 of Section A. This means an annuity which begins to accrue no later than 1 month after

the date that the insurance would otherwise stop. (You can find this date on the Agency Certification of Insurance Status

[SF 2821] that the retiring employee submitted to you.)

Reduction or Cancellation of Insurance — An annuitant can cancel Basic and/or Optional insurance at any time, unless

he/she assigned the coverage. In that case only the assignee(s) may cancel the coverage. Cancellation of Basic

automatically cancels all Optional insurance.

In order to cancel, the annuitant (or assignee(s), as applicable) should write to you requesting the change, so that you can

reduce or stop deductions. The change is effective at the end of the month in which you receive the request. You should

send the original letter to OPM, P.O. Box 45, Boyers, PA 16017-0045. Keep a copy in the annuitant's file.

Changing Post-Retirement Basic to 75% Reduction — An annuitant can change Basic from No Reduction or 50%

Reduction to 75% Reduction at any time, unless he/she assigned the coverage. In that case, only the assignee(s) can

change the Basic. The annuitant (or assignee(s), as applicable) should write to you to request the change. The change is

effective at the end of the month in which you receive the request. You should send the original letter to OPM at the

above address. Keep a copy in the annuitant's file. The annuitant is not entitled to a refund of withholdings you already

made.

Neither the annuitant nor the assignee(s) can change from No Reduction to 50% Reduction or vice versa, nor from 75%

Reduction to either 50% or No Reduction.

Changing Post-Retirement Option B or Option C — An annuitant can change all multiples of Option B and/or Option

C from Full Reduction to No Reduction or vice versa at any time before reaching age 65, unless he/she assigned the

coverage. In that case, only the assignee(s) can change Option B from No Reduction to Full Reduction. The annuitant

(or assignee(s), as applicable) should write you to request the change. The change is effective at the end of the month in

which you receive the request. You should send the original letter to OPM at the above address. Keep a copy in the

annuitant's file. (Of course such changes before age 65 have no practical meaning. Annuitants continue to pay for Option

B and Option C coverage until they reach age 65. Whether they continue to pay premiums after age 65 depends on their

choice of No Reduction or Full Reduction.)

Age 65 Birthday Letter — You need to send a letter to all annuitants shortly before they reach age 65, or shortly after they

retire if they retire after age 65. This letter should give the annuitant a choice to mix and match Option B and Option C

multiples with No Reduction and Full Reduction. You may also need to write to assignees. Please contact us if you need

more information about this.

After reaching age 65, the annuitant can only change some or all multiples from No Reduction to Full Reduction,

unless he/she assigned the coverage. In that case, only the assignee(s) can change Option B from No Reduction to

Full Reduction. The annuitant is not entitled to a refund of withholdings you already made. Neither the annuitant nor

assignee(s) can change from Full Reduction to No Reduction.

Reporting Terminations of Annuity — When the annuitant dies or the annuity terminates, complete Section C and send

the form to OPM. If you receive a completed Claim for Death Benefits (Form FE-6) and/or certified death certificate, also

send them to OPM.

Back of Part 3

SF 2820

Revised July 2000

Instructions and Definitions