Fillable Printable SF 3110

Fillable Printable SF 3110

SF 3110

When properly completed, this form is considered a part of

the employee's election and must be attached to the election

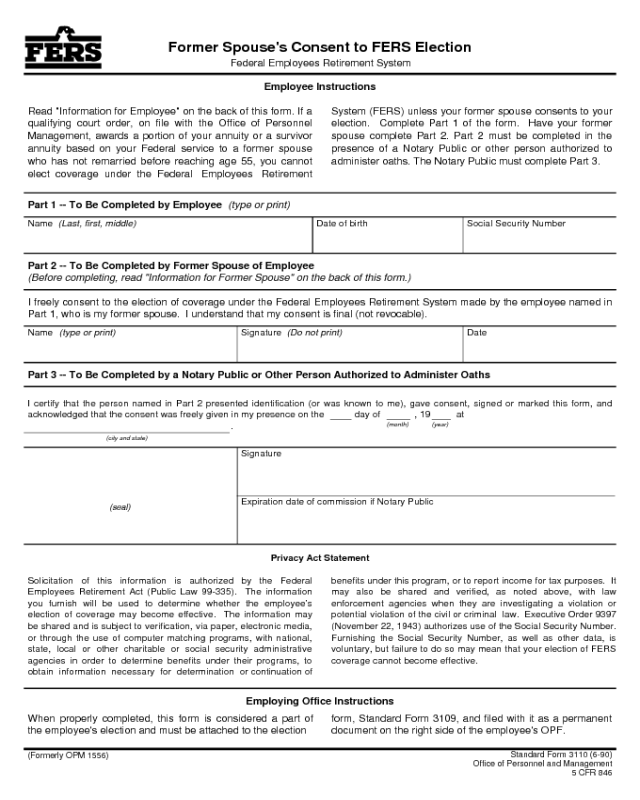

Former Spouse's Consent to FERS Election

Federal Employees Retirement System

Employee Instructions

I certify that the person named in Part 2 presented identification (or was known to me), gave consent, signed or marked this form, and

acknowledged that the consent was freely given in my presence on the day of , 19 at

.

Signature

Read "Information for Employee" on the back of this form. If a

qualifying court order, on file with the Office of Personnel

Management, awards a portion of your annuity or a survivor

annuity based on your Federal service to a former spouse

who has not remarried before reaching age 55, you cannot

elect coverage under the Federal Employees Retirement

System (FERS) unless your former spouse consents to your

election. Complete Part 1 of the form. Have your former

spouse complete Part 2. Part 2 must be completed in the

presence of a Notary Public or other person authorized to

administer oaths. The Notary Public must complete Part 3.

Part 1 -- To Be Completed by Employee

(type or print)

Name

(Last, first, middle)

Date of birth Social Security Number

Part 2 -- To Be Completed by Former Spouse of Employee

(Before completing, read "Information for Former Spouse" on the back of this form.)

I freely consent to the election of coverage under the Federal Employees Retirement System made by the employee named in

Part 1, who is my former spouse. I understand that my consent is final (not revocable).

Name

(type or print)

Signature

(Do not print)

Date

Part 3 -- To Be Completed by a Notary Public or Other Person Authorized to Administer Oaths

(city and state)

(month) (year)

Expiration date of commission if Notary Public

Privacy Act Statement

Solicitation of this information is authorized by the Federal

Employees Retirement Act (Public Law 99-335). The information

you furnish will be used to determine whether the employee’s

election of coverage may become effective. The information may

be shared and is subject to verification, via paper, electronic media,

or through the use of computer matching programs, with national,

state, local or other charitable or social security administrative

agencies in order to determine benefits under their programs, to

obtain information necessary for determination or continuation of

benefits under this program, or to report income for tax purposes. It

may also be shared and verified, as noted above, with law

enforcement agencies when they are investigating a violation or

potential violation of the civil or criminal law. Executive Order 9397

(November 22, 1943) authorizes use of the Social Security Number.

Furnishing the Social Security Number, as well as other data, is

voluntary, but failure to do so may mean that your election of FERS

coverage cannot become effective.

Employing Office Instructions

form, Standard Form 3109, and filed with it as a permanent

document on the right side of the employee's OPF.

(seal)

(Formerly OPM 1556)

Standard Form 3110 (6-90)

Office of Personnel and Management

5 CFR 846

Information for Employee

If you are unable to obtain the consent of your former spouse,

you may request OPM to:

You do not need your former spouse’s consent to your election

if:

Information for Former Spouse

Your former spouse has an opportunity to transfer to the

Federal Employees Retirement System (FERS) or stay in the

Civil Service Retirement System (CSRS). If the terms of your

divorce give you a portion of your former spouse’s annuity or a

survivor annuity, and a copy of this court order is on file with

OPM, he or she cannot elect FERS without your consent.

FERS is a three-part program composed of the Basic Benefit

Plan, Social Security, and the Thrift Savings Plan. Employ-

ees who stay in CSRS may also participate in the Thrift Plan.

OPM administers only the Basic Benefit Plan of FERS. The

same requirements that OPM honor court orders apply to both

CSRS benefits and FERS basic benefits.

Future benefits to which you are entitled may be affected if the

Federal employee changes from CSRS to FERS. An annuity

under the FERS basic benefit plan is generally smaller than

an annuity under CSRS; therefore, if the court order awards

you a percentage of the employee’s annuity, the amount you

receive may be smaller if the employee changes to FERS

coverage.

Under CSRS, former spouses may be entitled to a survivor

annuity of up to 55% of the employee’s retirement benefit

(depending on the terms of the court order). Under FERS, a

survivor annuity for a former spouse cannot normally exceed

50% of the amount of the employee’s annuity.

grant a waiver of the consent requirement if you

cannot determine where the former spouse is

located, or

give you additional time so that you can get a

modification of the court order.

If you are not sure whether a qualifying court order is on file at

OPM, you may request that OPM make a determination as to

whether a court order is on file. Ask your employing office for

Standard Form 3111, which has the information about how to

make any of these requests of OPM.

There is no qualifying court order on file at the Office

of Personnel Management that gives a portion of your

annuity or survivor annuity to your former spouse.

You are legally separated, but there is no final divorce

decree.

After your divorce your former spouse remarried

before reaching age 55. (It does not matter whether

the former spouse is still married.)

You are staying in CSRS.

Under FERS, no monthly spousal survivor annuity is payable on

the death of an employee unless the employee has 10 years of

creditable government service. However, a lump sum survivor

benefit may be payable after 18 months of service. The lump

sum payment is equal to $15,000, which is adjusted for inflation,

plus half the amount of the employee’s annual pay at the time of

death. In addition, an employee under FERS is also covered by

Social Security. Therefore, if your marriage to the employee

lasted for at least 10 years, you may become eligible for Social

Security benefits for divorced spouses.

NOTE:

You are not required to obtain a modification of

the court order now on file at OPM if the employee

changes to FERS. The terms of the court order will be

applied to Basic Benefits that become payable under

FERS, except that the amount of benefits paid cannot

exceed the amount payable under FERS. However, in

the case of benefits from the Thrift Savings Plan (TSP),

a court order must specify that it applies to the TSP and

it must be filed with the Thrift Savings Board at the

following address:

Federal Retirement Thrift Investment Board

Ben Franklin Station, P.O. Box 511

Washington, D.C. 20044

SF 3110 (back)

.

.

.

.

.

.