Fillable Printable Tc-62Pr, Application For Purchaser Refund Of Utah Sales Tax

Fillable Printable Tc-62Pr, Application For Purchaser Refund Of Utah Sales Tax

Tc-62Pr, Application For Purchaser Refund Of Utah Sales Tax

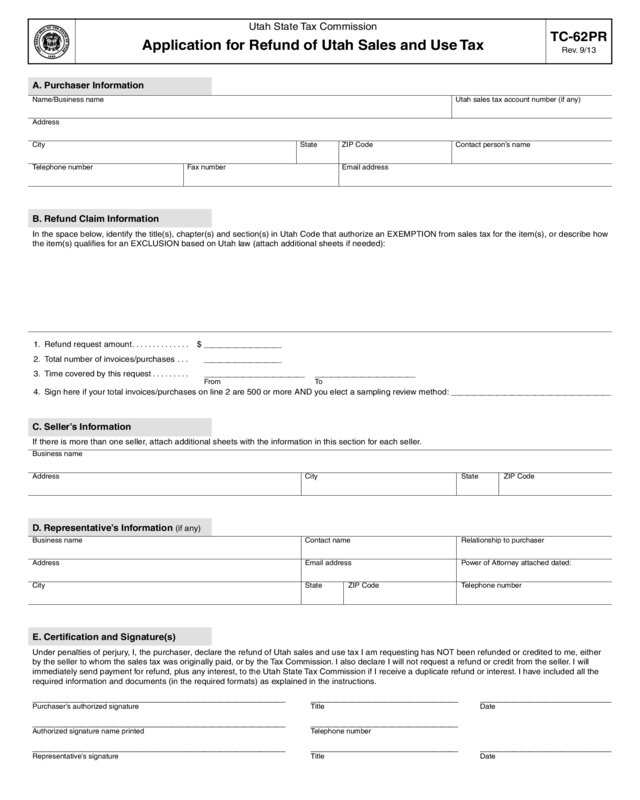

TC-62PR

Rev. 9/13

Utah State Tax Commission

Application for Refund of Utah Sales and Use Tax

A. Purchaser Information

Name/Business name Utah sales tax account number (if any)

Address

City State ZIP Code Contact person’s name

Telephone number Fax number Email address

B. Refund Claim Information

In the space below, identify the title(s), chapter(s) and section(s) in Utah Code that authorize an EXEMPTION from sales tax for the item(s), or describe how

the item(s) qualifies for an EXCLUSION based on Utah law (attach additional sheets if needed):

1.Refund request amount. . . . . . . . . . . . . .$

__________

2.Total number of invoices/purchases. . .

__________

3.Time covered by this request. . . . . . . . .

_____________

_____________

From To

4.Sign here if your total invoices/purchases on line 2 are 500 or more AND you elect a sampling review method:

_____________________

C. Seller’s Information

If there is more than one seller, attach additional sheets with the information in this section for each seller.

Business name

Address City State ZIP Code

D. Representative’s Information (if any)

Business name Contact name Relationship to purchaser

Address Email address Power of Attorney attached dated:

City State ZIP Code Telephone number

E. Certification and Signature(s)

Under penalties of perjury, I, the purchaser, declare the refund of Utah sales and use tax I am requesting has NOT been refunded or credited to me, either

by the seller to whom the sales tax was originally paid, or by the Tax Commission. I also declare I will not request a refund or credit from the seller. I will

immediately send payment for refund, plus any interest, to the Utah State Tax Commission if I receive a duplicate refund or interest. I have included all the

required information and documents (in the required formats) as explained in the instructions.

_______________________________ __________________ ________________

Purchaser’s authorized signature Title Date

_______________________________ __________________

Authorized signature name printed Telephone number

_______________________________ __________________ ________________

Representative's signature Title Date

Print Form

Clear form

Sign here after printing to elect this method.

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

Instructions for form TC-62PR

A purchaser may request a refund from the Utah State Tax Commission for

sales and use tax paid on purchases exempt or excluded from sales and

use tax.

The purchaser must sign this application, form TC-62PR.

To Qualify

• You have not and will not request a sales tax refund or credit directly from

the seller, -OR- you requested a sales tax refund or credit from the seller

and the seller would not allow or would not process your request.

• The period(s) covered in the refund request must be within the statute of

limitations for a refund as of the date you file the application.

• Your application must include ALL information and required documenta-

tion (see below) in the required format.

Required Documentation

• Copies of invoices or receipts that show items purchased and sales tax

charged.

• Proof of payment, such as copies of cancelled checks, bank statements,

credit card receipts, or a letter from the seller listing all the paid invoices.

• Copies of invoices and documentation of use tax paid with sales and use

tax return.

• Documentation that clearly and thoroughly verifies the items or transac-

tions qualify for exemption or exclusion from Utah sales and use tax.

(For example, if claiming a refund of sales and use tax on

manufacturing/mining equipment, repair or replacement parts, provide a

signed statement that the items have an economic life of three or more

years. See our website for more examples.)

• A power of attorney, if you are submitting the request on behalf of the

purchaser.

• Sales and Use Tax Refund Worksheet

Each TC-62PR must include a Sales and Use Tax Refund Worksheet.

This worksheet is an Excel template available on our website. The

worksheet must include the following NINE items for EACH

invoice/purchase:

1. Seller’s name

2. Invoice date

3. Invoice number

4. Taxable purchase amount

5. Sales and use tax rate applied to purchase amount

6. Sales and use tax paid

7. Sales and use tax overpaid

8. Detailed description of purchased item(s)

9. The title(s), chapter(s) and section(s) in Utah Code that allow the

exemption or exclusion of sales and use tax for the item(s), and an

explanation of how the item(s) qualifies for an exemption or exclusion

based on Utah law.

100% Review Method

A. 12 Purchases or Less

If you have 12 invoices/purchases or LESS:

1. Complete form TC-62PR.

2. Attach ALL of the required documentation (see above) for each

invoice/purchase, including the Sales and Use Tax Refund Worksheet.

B. More Than 12, Less Than 500 Purchases

If you have MORE THAN 12 and LESS THAN 500 invoices/purchases,

you must provide your worksheet electronically, on a compact disk (CD)

or USB flash drive.Your worksheet must have the same layout and

information as the Sales and Use Tax Refund Worksheet.

1. Complete form TC-62PR.

2. Complete your electronic version of the Sales and UseTax Refund

Worksheet.

3. Scan and save to a CD or USB flash drive ALL of the required

documentation (see above) for each invoice/purchase.

C. 500 or More Purchases

If you have 500 OR MORE invoices/purchases and you do not elect the

sampling review method (see below), follow the instructions for More

Than 12, Less Than 500 Purchases (above).

Incomplete 100% Review Application

If your application using the 100% Review Method is incomplete or does

not include ALL the required documentation, we will send you a notice

giving you 30 days to provide the missing documentation.

We will dismiss refund requests for which we do not receive the required

documentation and information by the due date of the 30-day notice.

Sampling Review Method

If your request involves 500 OR MORE invoices/purchases and you ELECT

the sampling review method:

1.Complete form TC-62PR and elect the sampling review method by

signing line 4 in Section B.

2.Complete an electronic version of the Sales and Use Tax Refund

Worksheet

(see B. More Than 12, Less Than 500 Purchases, above).

3.We will choose a sampling of invoices/purchases for review based on

your worksheet.

4.We will notify you of the invoices/purchases selected for review and give

you 30 days to provide the required documentation (see above) for the

selected items.You must provide the required documents electronically

on a CD or USB flash drive.

5.We will evaluate, calculate and project your refund based solely on the

information and documentation we receive by the due date.

6.We will consider missing or incomplete documentation for any requested

invoice/purchase to be an error. We will include these errors in the overall

sampling error rate and adjust the total refund based on the overall

sampling error rate.

7.If you do not agree to the selected sample, you must provide all

documentation for the 100% review method.

Requests Allowed, Denied or Dismissed

• We will notify you in writing the result of your refund request.

• If we approve your request, we will send your refund within 6 to 8 weeks

of our decision.

• If any portion of your claim is denied, you may file an appeal with the

Appeals Unit within 30 days of the written notice.

• If you do not appeal within 30 days, the decision will become final and the

items included in the refund request CANNOT be included in future

refund requests.

• If any portion of your refund request is dismissed or reduced because

you have not provided the required documentation by the due date, you

may file an appeal with the Appeals Unit. However, the only matter that

will be reviewed by the Commission is whether or not the required

documentation was received by the due date.

NOTE: We may take any tax refund, including interest, and apply it to any

outstanding tax the purchaser may owe.The balance of the refund,

if any, will be refunded within 6 to 8 weeks of our decision.

If you receive any refund or credit from the seller for items where the Tax

Commission has already sent you a sales and use tax refund, you must

immediately send the Tax Commission payment for the tax refund plus any

interest.

Questions

If you have questions, email [email protected]v, call 801-297-7705, fax

to 801-297-6357, or write to the address below.

Submitting the Application

Mail this application, the worksheet and ALL required documen-

tation to:

AUDITING DIVISION

UTAH STATE TAX COMMISSION

210 N 1950 W

SALT LAKE CITY, UT 84134

____________________

If you need an accommodation under the Americans with

Disabilities Act, call 801-297-3811 or TDD 801-297-2020.

Please allow three working days for a response.

TC-62PR_i