Fillable Printable Template of Mortgage Deed

Fillable Printable Template of Mortgage Deed

Template of Mortgage Deed

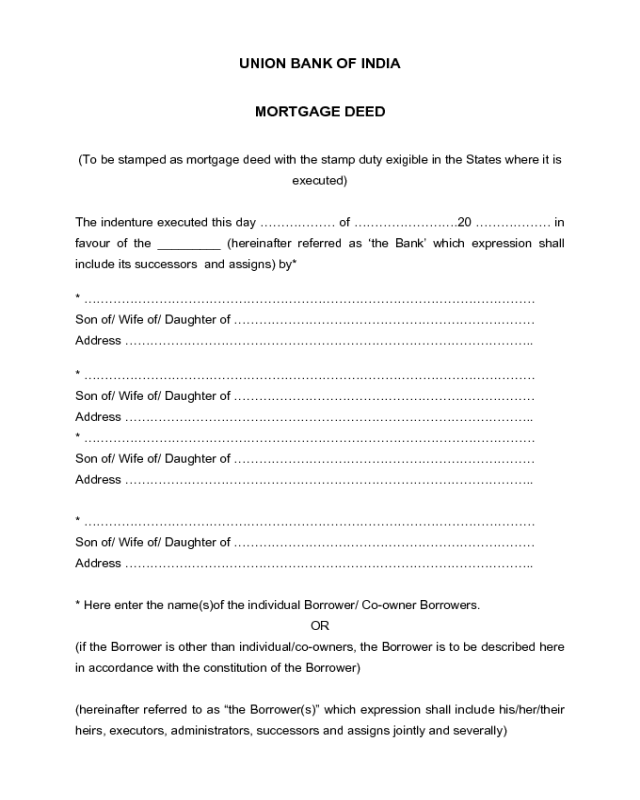

UNION BANK OF INDIA

MORTGAGE DEED

(To be stamped as mortgage deed with the stamp duty exigible in the States where it is

executed)

The indenture executed this day ……………… of …………………….20 ……………… in

favour of the _________ (hereinafter referred as ‘the Bank’ which expression shall

include its successors and assigns) by*

* ………………………………………………………………………………………………

Son of/ Wife of/ Daughter of ………………………………………………………………

Address ……………………………………………………………………………………..

* ………………………………………………………………………………………………

Son of/ Wife of/ Daughter of ………………………………………………………………

Address ……………………………………………………………………………………..

* ………………………………………………………………………………………………

Son of/ Wife of/ Daughter of ………………………………………………………………

Address ……………………………………………………………………………………..

* ………………………………………………………………………………………………

Son of/ Wife of/ Daughter of ………………………………………………………………

Address ……………………………………………………………………………………..

* Here enter the name(s)of the individual Borrower/ Co-owner Borrowers.

OR

(if the Borrower is other than individual/co-owners, the Borrower is to be described here

in accordance with the constitution of the Borrower)

(hereinafter referred to as “the Borrower(s)” which expression shall include his/her/their

heirs, executors, administrators, successors and assigns jointly and severally)

WHEREAS the Borrower(s) is/are the absolute and exclusive

owner(s)/Khatedar/Bhumidar/Sardar in possession and/or is/are otherwise well and

sufficiently entitled to the piece or parcel of land specified in the Schedule 1 hereto,

together with all trees and buildings thereon (hereinafter referred as “the Land”), which

is free from encumbrances, attachments, charges and liens whatsoever other than the

following :

(Here enter prior encumbrances, etc. including those in favour of the Bank, if any, if

there are no prior encumbrances, write ‘NIL’)

AND WHEREAS at the request of the Borrower(s), the Bank has granted/ agreed to

grant from time to time to the Borrower(s) accommodation to the aggregate extent of

Rs. ……………………. (Rupees ………………………….. only), inter alia, by way of :

Delete if in applicable

(i) *Cash Credits at any one time upto the limit of Rs. …………………………………..

(Rupees ……………………………………………………………………… only)

(ii) *Overdrafts at any one time to the extent of Rs. …………………………….………..

(Rupees ……………………………………………………………………… only)

(iii) *Demand loans at any one time for Rs. ………………………………………………..

(Rupees ……………………………………………………………………… only)

(iv) *Term loans at any time of Rs. ……………………………………………………….

(Rupees ……………………………………………………………………… only)

(hereinafter collectively and individually referred to as “the loans”) for the purpose of

farming/ rearing of cattle and/or flock/fishing/sericulture to be secured, inter alia, by a

simple mortgage of the land by the borrower(s) in favour of the Bank.

1. NOW, THEREFORE, THIS INDENTURE WITNESS AS FOLLOWS :

In condition of the promises aforesaid, Borrower(s) hereby covenant(s) with the as

follows :

I. The Borrower(s) shall repay to the Bank :-

(a) the amount due tin respect of the said Cash Credits/ Overdrafts/ Demand Loans

forthwith upon demand by the Bank. However, in a case where for any reason

cash credit or overdraft is permitted by the Bank at its absolute discretion to he

repaid in installments and on such terms as may be stipulated by the Bank, the

security as held hitherto shall continue to be subsisting and the conditions as to

terms loans herein shall apply to the said loan subject to such changes as may

be stipulated by the Bank.

(b) the amount due under the said Terms Loans according to installments specified

in Schedule II hereunder written; or as modified from time to time by exchange of

letters between the borrower(s) and the Bank.

2. That the Borrower(s) shall pay interest on the Loans to be calculated on the daily

balances in the loan account(s) with monthly/quarterly/half-yearly/yearly or other rests

according to the practice of the Bank in the case of :

(a) Cash credits at the rate of……………….% above/ below the …………..PLR/RBI

Rate rising and falling therewith with a minimum of ……………..% per annum.

(b) Overdrafts at the rate of ………………% above/ below the ……………..PLR/ RBI

Rate rising and falling therewith with a minimum of ……………..% per annum.

(c) Demand loans at the rate of ……………% above/ below the ……..……..PLR/ RBI

Rate rising and falling therewith with a minimum of ……………..% per annum.

(d) Term at the rate of ……..………………% above/ below the ……………..PLR/ RBI

Rate rising and falling therewith with a minimum of ……………..% per annum.

Provided that in the event of there not being any prime lending rate or otherwise the

Bank shall at any time and from time to time be entitled to change the rate of interest

and such revised rate of interest shall always be construed as agreed to be paid by the

Borrower(s) and hereby secured. Borrower(s) shall be deemed to have notice of change

in the rate of interest whenever the changes in Prime Lending Rate (PLR)

displayed/notified at/by the branch/published in newspaper/made through entry of

interest charged in the pass book Statement of accounts sent to the borrower(s).

Further, without prejudice to the Bank's other rights and remedies the Bank shall be

entitled to charge at its own discretion enhanced rates of interest on the outstanding in

the loan account(s) or a portion thereof for any default or irregularity on the part of the

Borrower(s) which in the opinion of the Bank warrants charging of such enhanced rates

of interest for such period as the Bank may deem fit.

THIS INDENTURE FURTHER WITNESSES THAT IN pursuance of the agreement be-

tween the Borrower(s) and the Bank and in consideration of the premises aforesaid the

Borrower(s) as absolute owner/ Khatedar/ Bhumidar/ Sardar in possession hereby

GRANT(s) and TRANSFER(S) unto the Bank by way of Simple Mortgage as security for

the loans all his/their right, title and interest in 1he Land together with all trees and other

growths thereon and buildings, erections, structures, fixtures fittings, equipments and

machinery which now are or hereafter may at any time during the continuance of this

security be erected or standing on or attached to or affixed to the land or any part

thereof including all rights liberties and easements in respect thereof AND all the estate,

right, title, interest claim and demand whatsoever of the Borrower(s) into and upon the

Land and the said premises (hereinafter all referred to as "the mortgaged premises").

III. The Borrower(s) hereby convenant(s) with Bank as follows:

(a) The Bank shall not be required to make or continue any of the loans otherwise

than at the Bank's discretion.

(b) The Borrower(s) shall at all time keep such items of mortgaged premises as are

of insurable nature, insured against loss or damage by tire and other risks as

may be required by the Bank and shall deliver to the Bank all such policies. It

shall be also lawful for but not obligatory upon the Bank to insure and keep

insured by debit to the Borrower(s} account(s) the mortgaged premises as are of

insurable nature. The proceeds of such insurance shall at the option of the Bank

either be applied towards replacement of the mortgaged premises or towards the

satisfaction of the Bank's dues hereunder.

(c) The Borrower(s) shall permit the Bank and its servants and agents either alone

or with workmen and others from time to time and at all reasonable times and

without notice to the Borrower(s) but at the risk and expenses of the Borrower(s)

and if so required as Attorney for and in the name of the Borrower(s) to enter into

and upon the mortgaged premises and to inspect the same.

IV. IT IS HEREBY AGREED AND DECLARED by the Borrower(s) as follows:

1. In addition to the security over the mortgaged premises created hereunder the

Borrower(s) shall be also personally liable to pay the loans to the Bank.

2. Without prejudice to the other rights of and recourse available to the Bank hereunder.

(i) If default shall be made by the Borrower(s) in payment of any moneys for the time

being owing on the security of these presents or in payment of interest at the rate and in

the manner aforesaid or in performance and observance of any covenant condition or

provision herein contained and on his/their part to be performed and observed.

(ii) If in the opinion of the Bank circumstances exist under which the Bank's interests are

in jeopardy, or the whole or part of its security is/are likely to be adversely

affected/reduced/lost/diminished by or in consequence of any act or omission of the

Borrower(s) or for any other reason whatsoever then and in anyone or more of such

cases the moneys for the time being owing on the security of these presents shall at the

option of the Bank immediately become payable to the Bank and Bank shall be entitled

to exercise any of its rights and remedies in its discretion for realisation of the mortgage

debt by sale of mortgaged property and the decision of the Bank as to whether anyone

or more of the aforesaid circumstances exist shall be conclusive and binding upon the

Borrower(s). In the event of the amount due to the Bank hereunder not being fully

satisfied out of the sale proceeds of the mortgaged premises the Borrower(s) shall be

liable personally to repay the balance to the bank.

3. All the obligations of the Borrower(s) as Mortgagor and all the rights and remedies

and powers of the Bank as Mortgage under the law for the time being in force except so

far as they may be expressly varied or may be inconsistent with these presents shall be

deemed to be incorporated in these presents. PROVIDED THAT the provisions of,

Section 61, 65A, and 67 A, respectively, of the Transfer & Property Act 1882, shall not

apply to these presents or to the Borrower(s) as Mortgagor or the Bank as Mortgagee

interse and this all be deemed a contract to the contrary for the purpose of these

sections.

4. The Borrower(s) shall bear and pay all out of pocket expenses of such inspection(s)

as may be carried out by the Bank in respect of the mortgaged premises.

6. That the borrower hereby gives his consent for the loans being recovered as a public

demand/moneys in terms of any legislation relating to recoveries thereof, where such

consent is necessary under such legislation.

V. That this mortgage is intended to and shall operate as a continuing security for the

loans indebtedness and liabilities of the Borrower(s) to the Bank at all times during the

subsistence of this mortgage notwithstanding :-

a) the existence of a credit balance or "NIL" balance in the loan accounts at any

time or any partial payment or fluctuation of accounts or

b) any loans or any part thereof have been repaid either after demand has been

made by the bank or otherwise or has not been so repaid on demand.

VI. If the Borrower be more than one individual, each one or any of them is authorised

and empowered by the others of them to admit and acknowledge their liability to the

Bank by any payment into the account or by way of express writing in any manner or

otherwise and any such admission and acknowledgement of the liability by one or more

of them shall be construed to have been made on behalf of each of them.

VII. The Borrower/s agree/s not to lease out or part with possession of the land hereby

mortgaged in favour of any person without the consent in writing of the bank.

VIII. This mortgage is in addition to and not in substitution of earlier mortgages, if any,

created by the Borrower{s) in favour of the Bank.

THE SCHEDULE-I REFERRED TO ABOVE

(here enter particulars of land including the nature/share of Borrower(s) interest in Land)

THIS SCHEDULE-I REFERRED TO ABOVE

(here enter repayment of installment of Term Loans)

Due date Amount

The contents of the indenture have been read over and translated into and explained to

the. Borrower(s) and he/she/they having understood the contents thereof subscribe(s)

to these presents.

IN WITNESS WHEREOF the Borrower(s) has/have set his/her/their hand(s) to these

presents on this day and yea (first above written in the presence of each of the attesting

witnesses mentioned below and each of the attesting witnesses have put in their

signature in' the presence of the Borrower(s).

………………………………

………………………………

………………………………

………………………………

SIGNED AND DELIVERED by the above names in the presence of

1. Signature ……………………………………………………..

Name …………………………………………………………..

Address ………………………………………………………..

2. Signature ……………………………………………………..

Name …………………………………………………………..

Address ………………………………………………………..