Fillable Printable Vba 26 8513 Are

Fillable Printable Vba 26 8513 Are

Vba 26 8513 Are

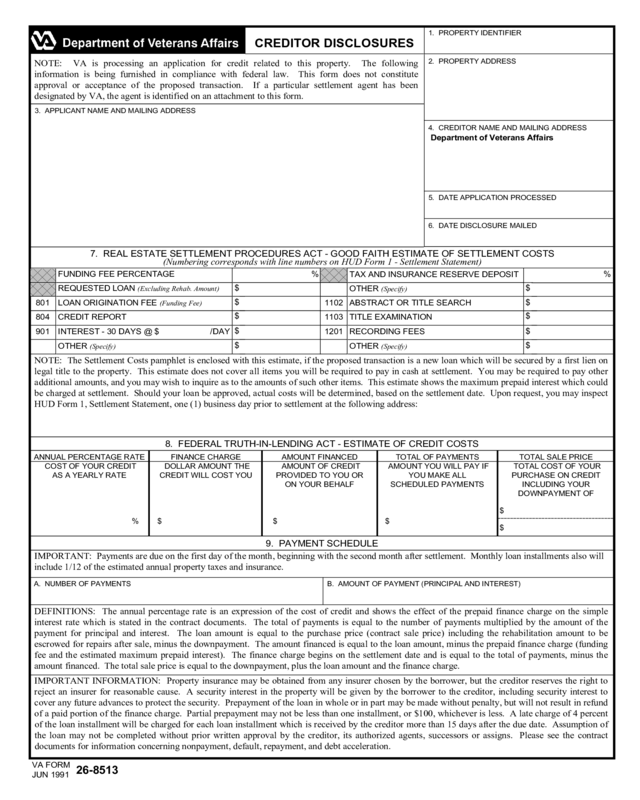

CREDITOR DISCLOSURES

1. PROPERTY IDENTIFIER

NOTE: VA is processing an application for credit related to this property. The following

information is being furnished in compliance with federal law. This form does not constitute

approval or acceptance of the proposed transaction. If a particular settlement agent has been

designated by VA, the agent is identified on an attachment to this form.

2. PROPERTY ADDRESS

3. APPLICANT NAME AND MAILING ADDRESS

4. CREDITOR NAME AND MAILING ADDRESS

Department of Veterans Affairs

5. DATE APPLICATION PROCESSED

6. DATE DISCLOSURE MAILED

7. REAL ESTATE SETTLEMENT PROCEDURES ACT - GOOD FAITH ESTIMATE OF SETTLEMENT COSTS

(Numbering corresponds with line numbers on HUD Form 1 - Settlement Statement)

801

804

901

FUNDING FEE PERCENTAGE

REQUESTED LOAN (Excluding Rehab. Amount)

LOAN ORIGINATION FEE (Funding Fee)

CREDIT REPORT

INTEREST - 30 DAYS @ $ /DAY

OTHER (Specify)OTHER (Specify)

RECORDING FEES

TITLE EXAMINATION

ABSTRACT OR TITLE SEARCH

OTHER (Specify)

TAX AND INSURANCE RESERVE DEPOSIT

%

$

$

$

$

$

1201

1103

1102

$

$

$

$

$

%

NOTE: The Settlement Costs pamphlet is enclosed with this estimate, if the proposed transaction is a new loan which will be secured by a first lien on

legal title to the property. This estimate does not cover all items you will be required to pay in cash at settlement. You may be required to pay other

additional amounts, and you may wish to inquire as to the amounts of such other items. This estimate shows the maximum prepaid interest which could

be charged at settlement. Should your loan be approved, actual costs will be determined, based on the settlement date. Upon request, you may inspect

HUD Form 1, Settlement Statement, one (1) business day prior to settlement at the following address:

8. FEDERAL TRUTH-IN-LENDING ACT - ESTIMATE OF CREDIT COSTS

ANNUAL PERCENTAGE RATE

COST OF YOUR CREDIT

AS A YEARLY RATE

FINANCE CHARGE

DOLLAR AMOUNT THE

CREDIT WILL COST YOU

AMOUNT FINANCED

AMOUNT OF CREDIT

PROVIDED TO YOU OR

ON YOUR BEHALF

TOTAL OF PAYMENTS

AMOUNT YOU WILL PAY IF

YOU MAKE ALL

SCHEDULED PAYMENTS

TOTAL SALE PRICE

TOTAL COST OF YOUR

PURCHASE ON CREDIT

INCLUDING YOUR

DOWNPAYMENT OF

$$$

$

$

9. PAYMENT SCHEDULE

IMPORTANT: Payments are due on the first day of the month, beginning with the second month after settlement. Monthly loan installments also will

include 1/12 of the estimated annual property taxes and insurance.

DEFINITIONS: The annual percentage rate is an expression of the cost of credit and shows the effect of the prepaid finance charge on the simple

interest rate which is stated in the contract documents. The total of payments is equal to the number of payments multiplied by the amount of the

payment for principal and interest. The loan amount is equal to the purchase price (contract sale price) including the rehabilitation amount to be

escrowed for repairs after sale, minus the downpayment. The amount financed is equal to the loan amount, minus the prepaid finance charge (funding

fee and the estimated maximum prepaid interest). The finance charge begins on the settlement date and is equal to the total of payments, minus the

amount financed. The total sale price is equal to the downpayment, plus the loan amount and the finance charge.

A. NUMBER OF PAYMENTSB. AMOUNT OF PAYMENT (PRINCIPAL AND INTEREST)

IMPORTANT INFORMATION: Property insurance may be obtained from any insurer chosen by the borrower, but the creditor reserves the right to

reject an insurer for reasonable cause. A security interest in the property will be given by the borrower to the creditor, including security interest to

cover any future advances to protect the security. Prepayment of the loan in whole or in part may be made without penalty, but will not result in refund

of a paid portion of the finance charge. Partial prepayment may not be less than one installment, or $100, whichever is less. A late charge of 4 percent

of the loan installment will be charged for each loan installment which is received by the creditor more than 15 days after the due date. Assumption of

the loan may not be completed without prior written approval by the creditor, its authorized agents, successors or assigns. Please see the contract

documents for information concerning nonpayment, default, repayment, and debt acceleration.

VA FORM

JUN 1991

26-8513

%