Invoice Template

- DOCUMENTS

- GUIDANCE

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

Edit & Download

What is an invoice?

If you are associated with a limited company, you must have heard of invoices. These are essential elements that record liability of a purchaser to his seller regarding products and services. Invoices allow you to have a good control over your business and assess profitability. Here’s detailed information on what an invoice is. Read on!Invoice Definition:

An invoice is a bill or a document that identifies a transaction between the buyer and the seller. The bill contains the individual prices of products or services sold to a buyer and the total cost he is liable to pay to his seller. Another invoice definition is that you can call it as a written authentication of the agreement regarding goods and services made between the two parties. It is also known as sales invoice.Information on an invoice:

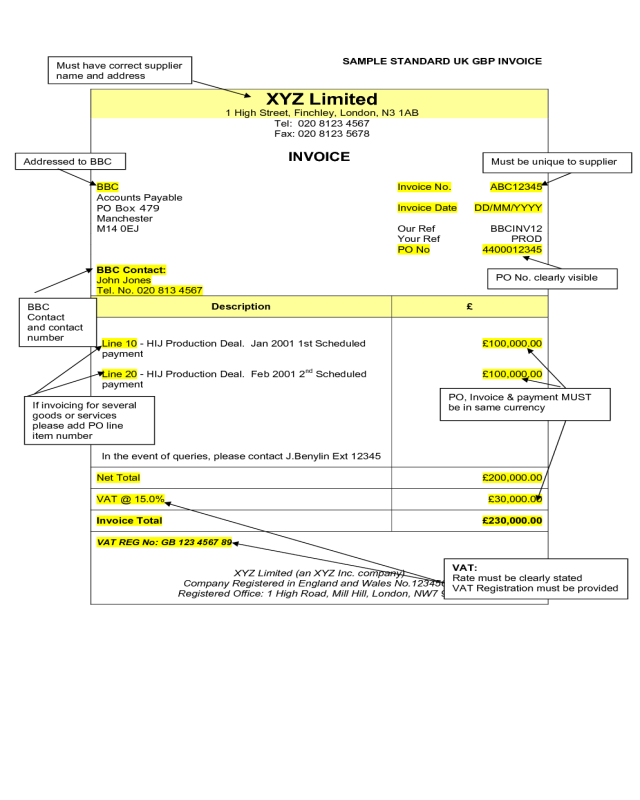

As this bill contains the total record of transaction, so, typically, it contains the following information.- “Invoice” – The word

- Invoice number

- Buyer’s name and address

- Seller’s name and address

- Registration details of company

- Date of delivery (When goods were shipped)

- Items purchased (With complete description)

- Total costs of individual item

- Quantity

- Grand total owed by the seller

- Sales taxes if involved

- Terms and conditions of payment (Ex – “net 15 days” would denote the payment has to be made within 15 days)

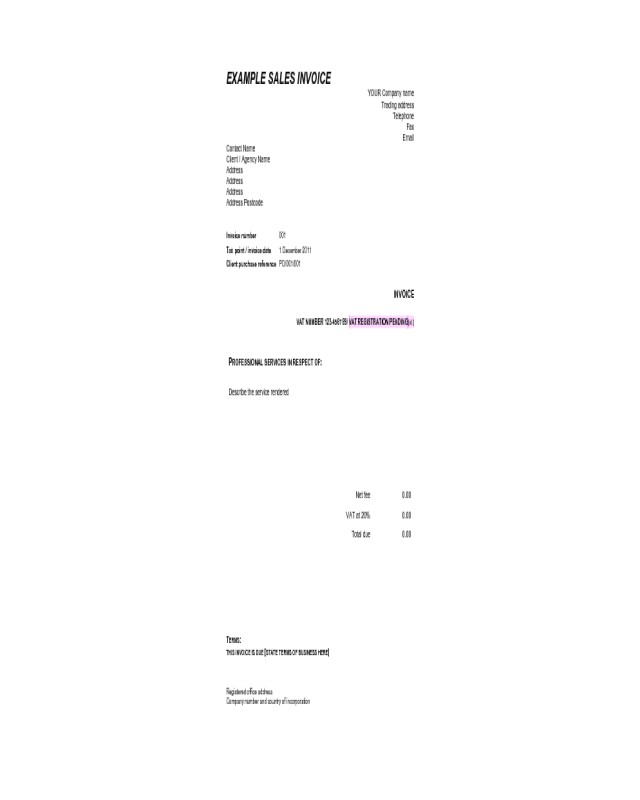

Sales invoice and Purchase invoice:

An invoice that contains the details of sale of goods and services to a customer is a sales invoice. This is from the vendor’s point of view.Again, an invoice that is for the cost of products and services that the purchaser is liable to pay to the seller is a purchase invoice. This is from the buyer’s point of view.Note: Do not confuse with purchase orders. Purchase orders contain the records of the orders a customer places to his supplier. Whereas, invoice is the receipt of the goods or services delivered.Invoices: Their importance in businesses

You might be wondering what if you don’t keep invoices for your company! Well, here are the reasons why you should create these bills and how can they ultimately help in the success of your business.Evidence of transactions

Record keeping

Accounting

Clarification to the client

Control payment cycles

Taxation

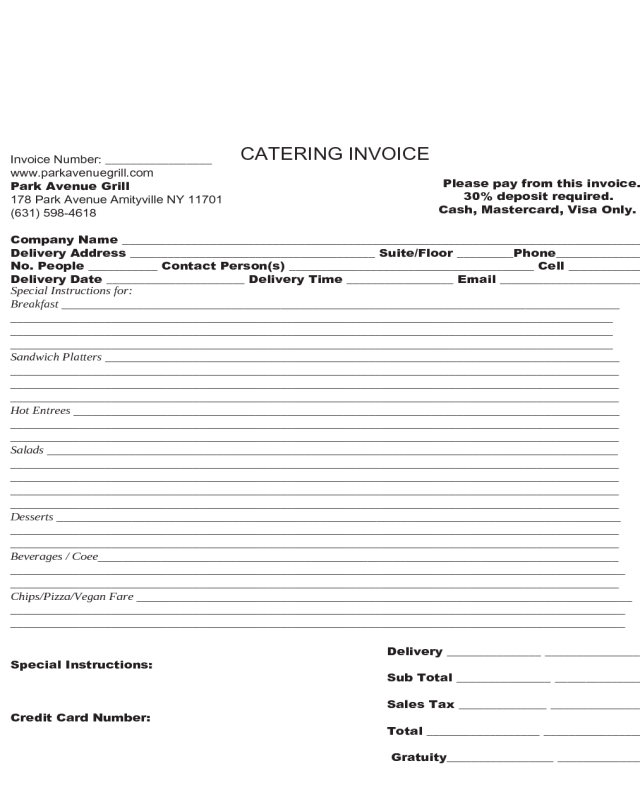

The various types of invoices

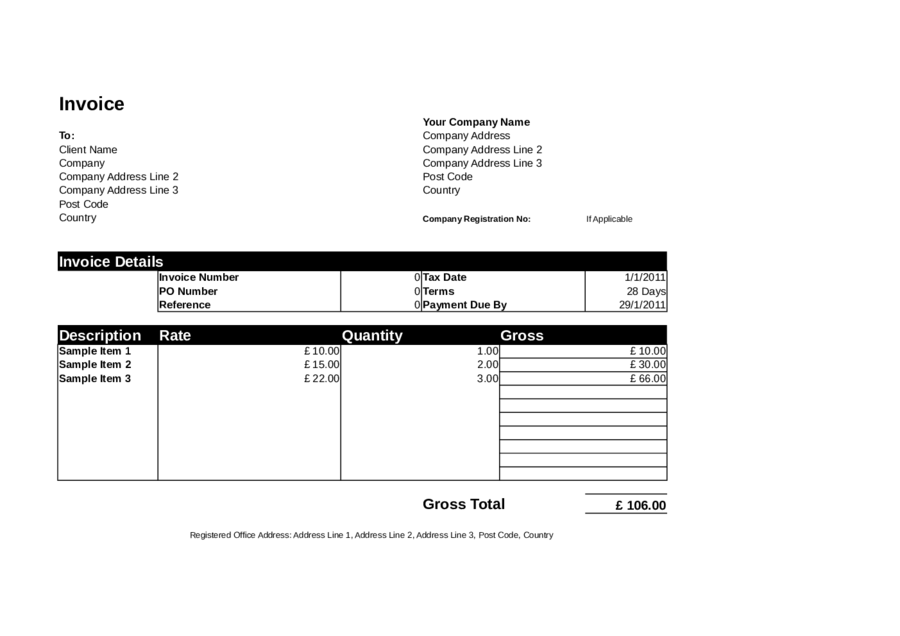

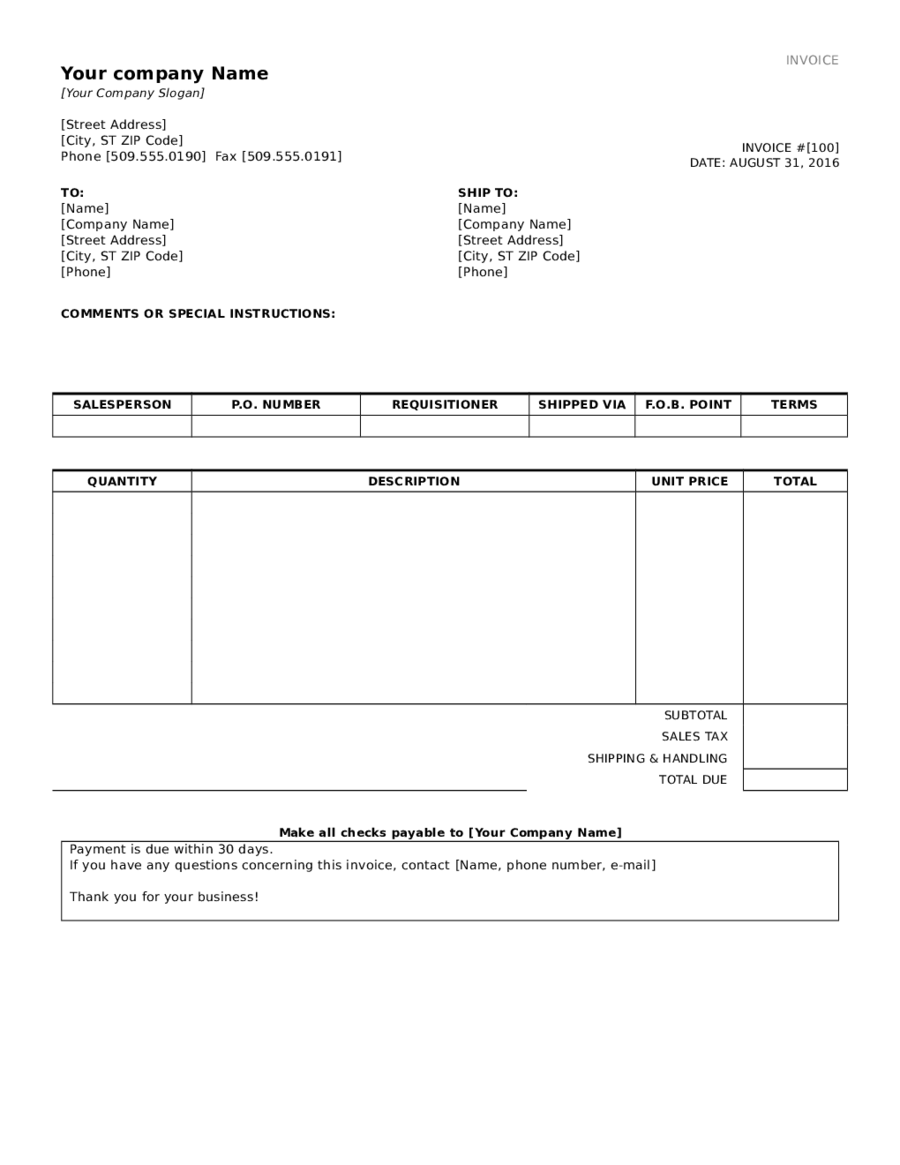

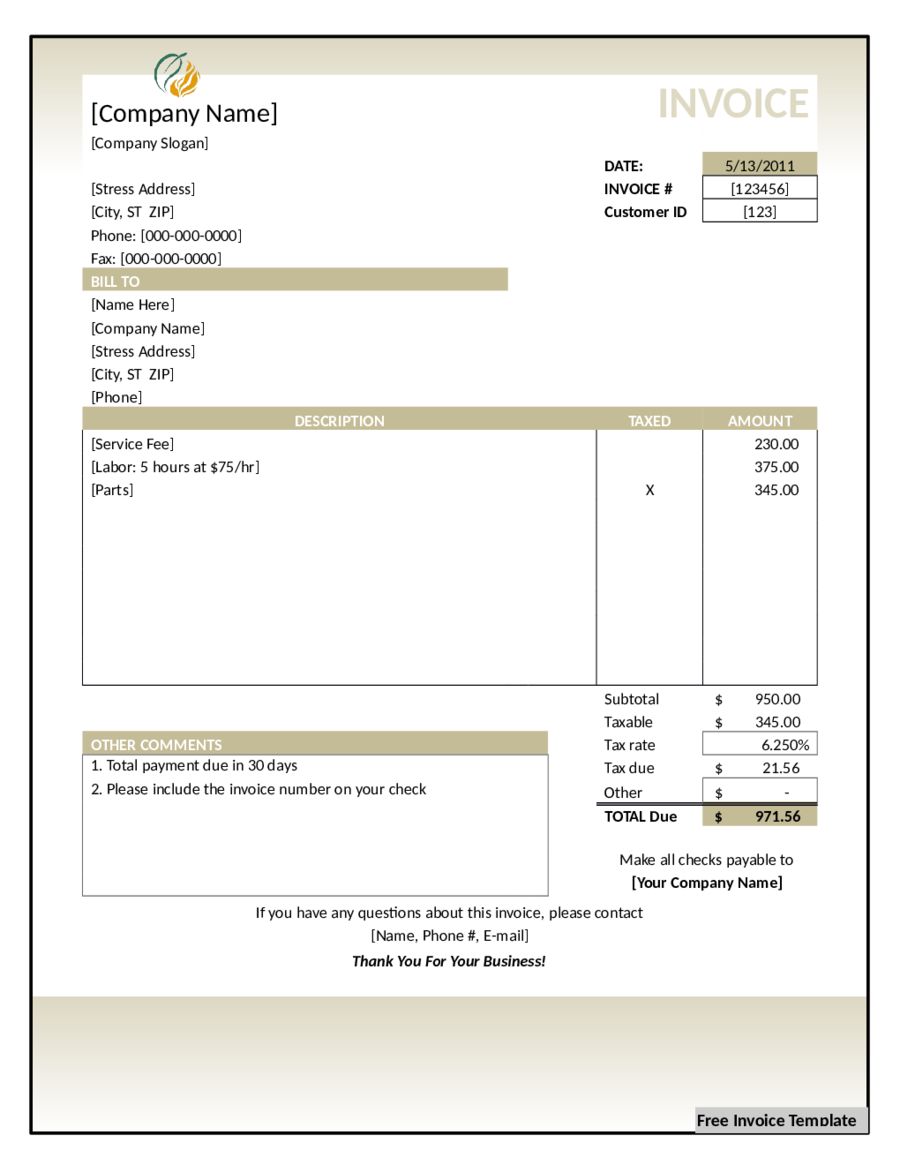

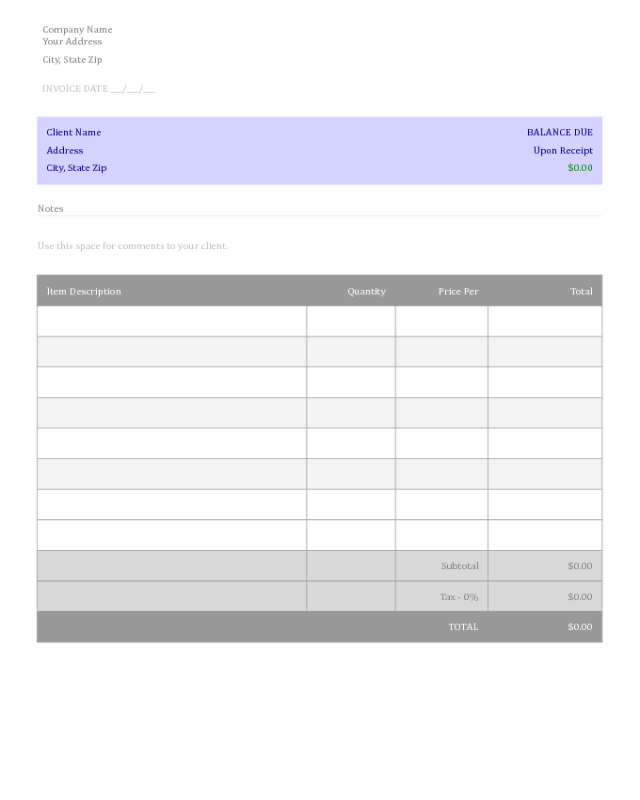

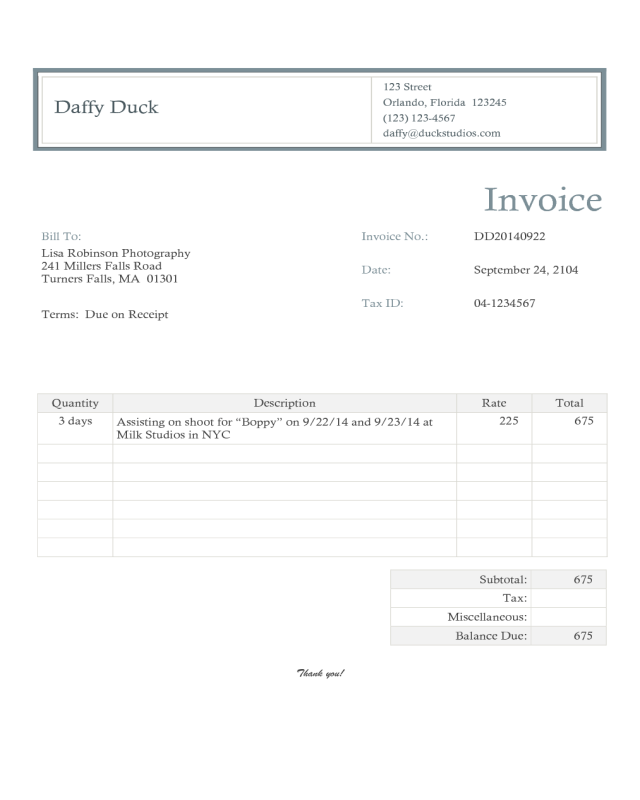

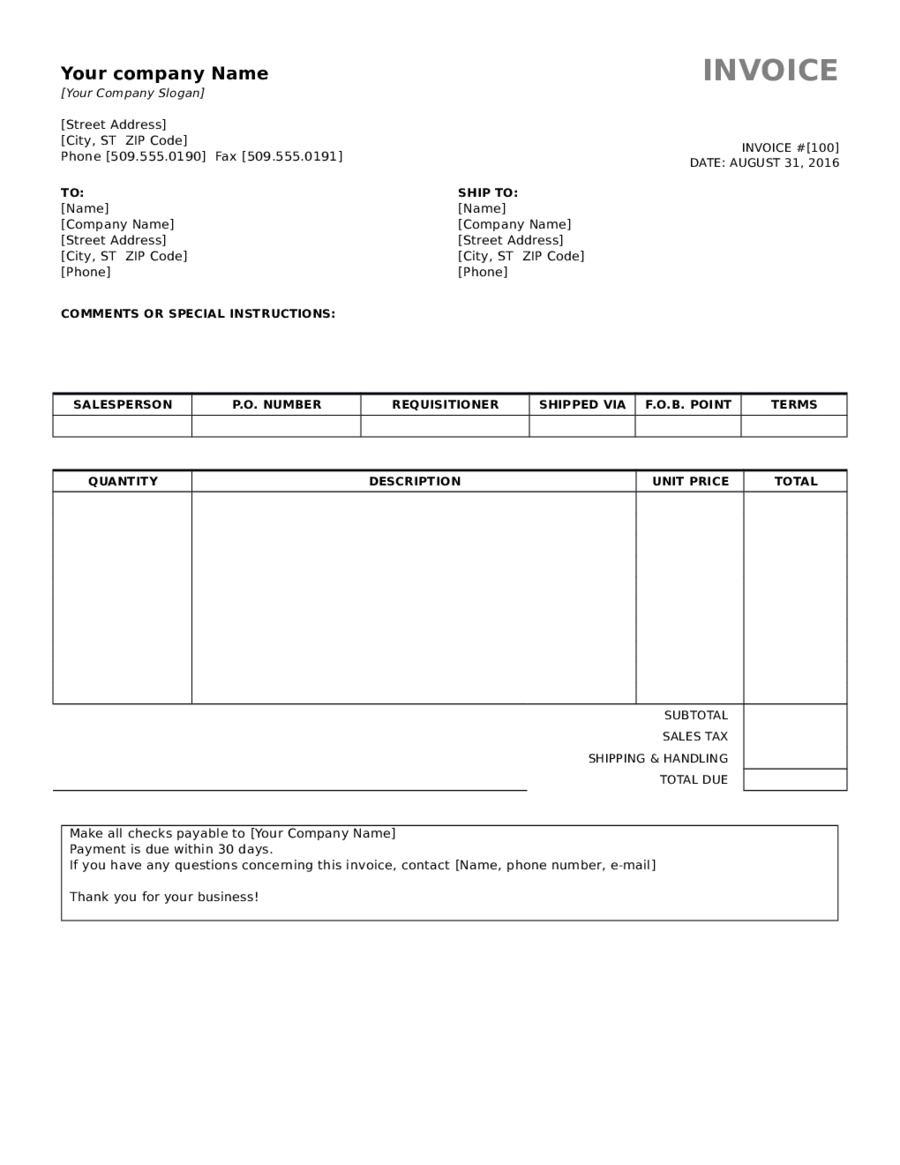

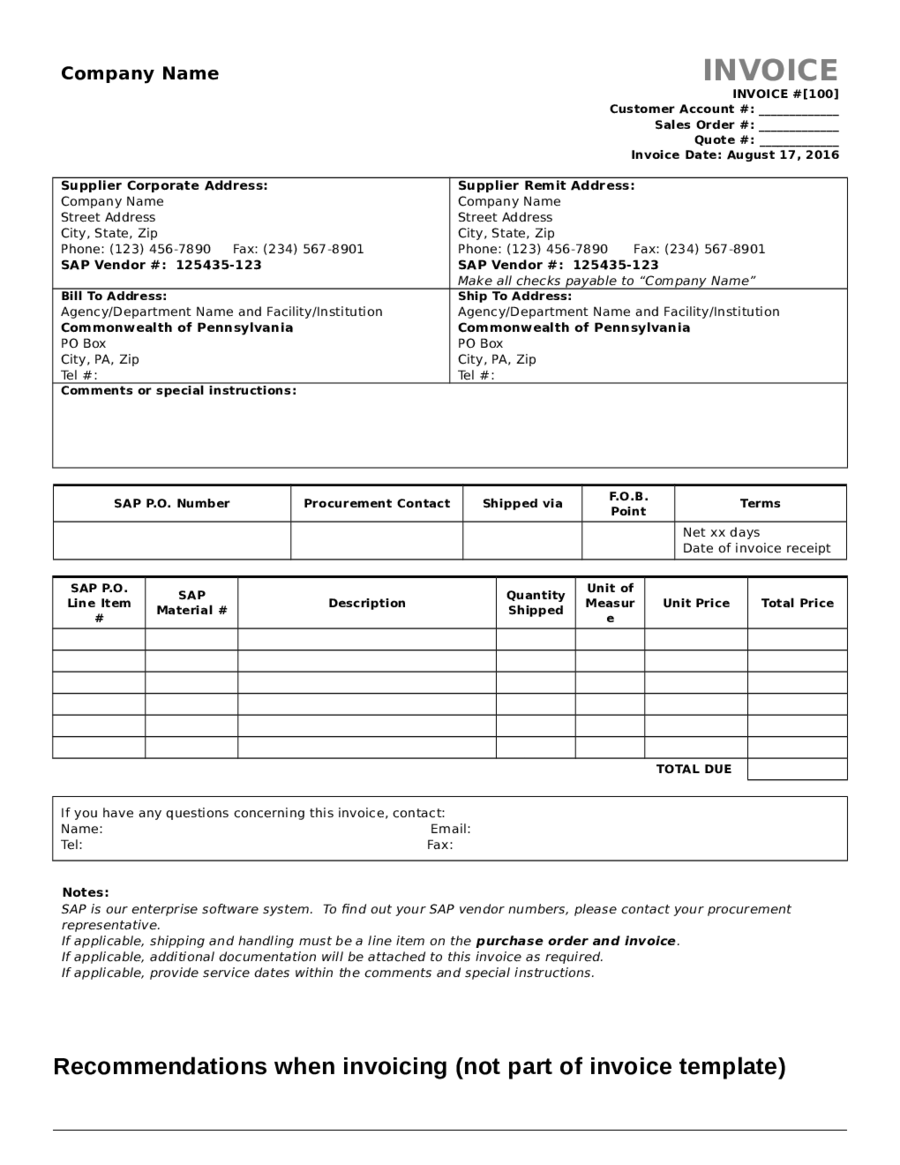

Now, these invoices are of various types based on their formats.Standard Invoice:

Standard invoices are the basic structures of billing and this very format can be used for different transactions of your company. These invoices contain all the basic information of the agreement details including name, date, product details, costs, etc. As it is a standard format, so multiple industries from agriculture to retail as well as wholesale trade can use it.Proforma Invoice:

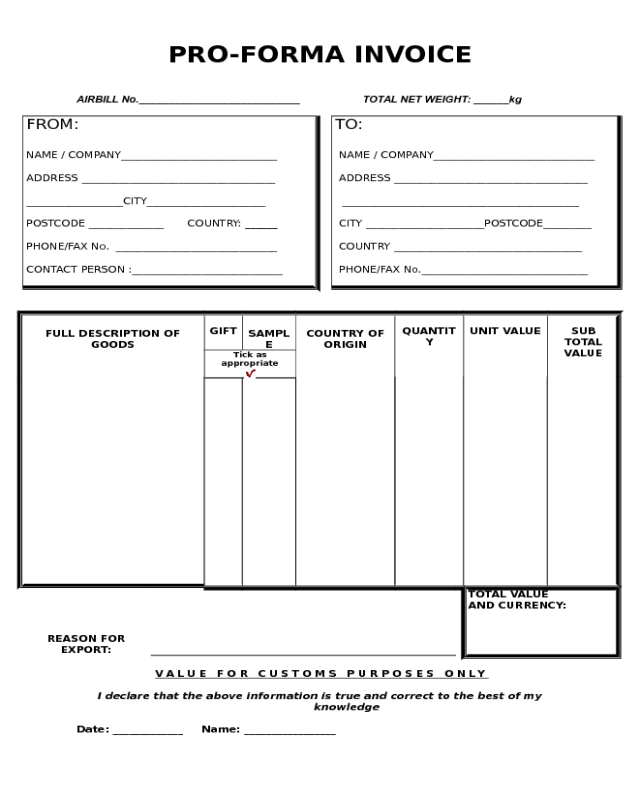

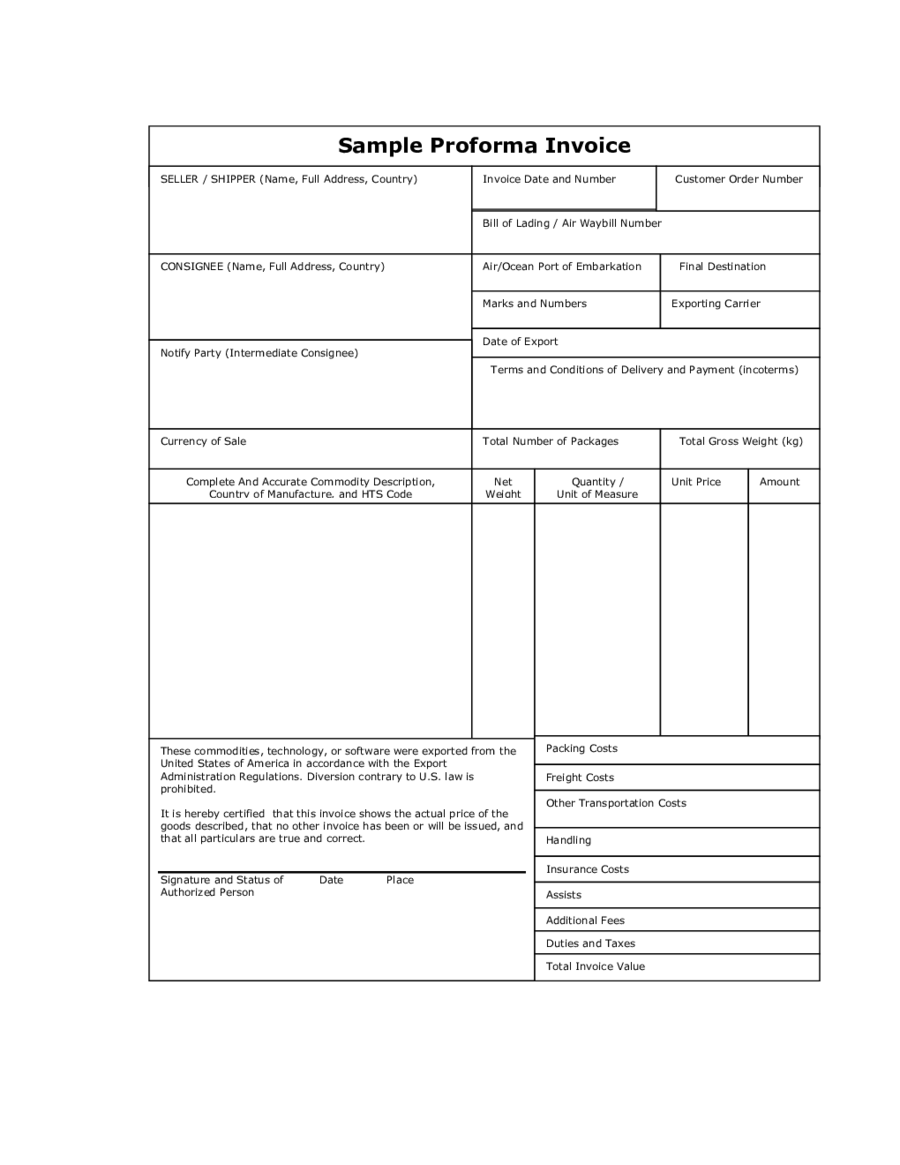

This type of invoice states the commitment of a seller to his buyer for delivering specified services and products at a specific price. While this is not the actual bill, a proforma invoice is issued only after the deal or terms of order have been agreed upon by both the parties.Also, a proforma invoice is issued for requesting advanced payments, may be to start the production or for security of products. These invoices should not be registered as accounts receivable or accounts payable.When is it used?

Usually, a proforma invoice is used in two cases –- When products have not been delivered yet and you need to provide a document to your client.

- When you have to declare the products’ values in customs.

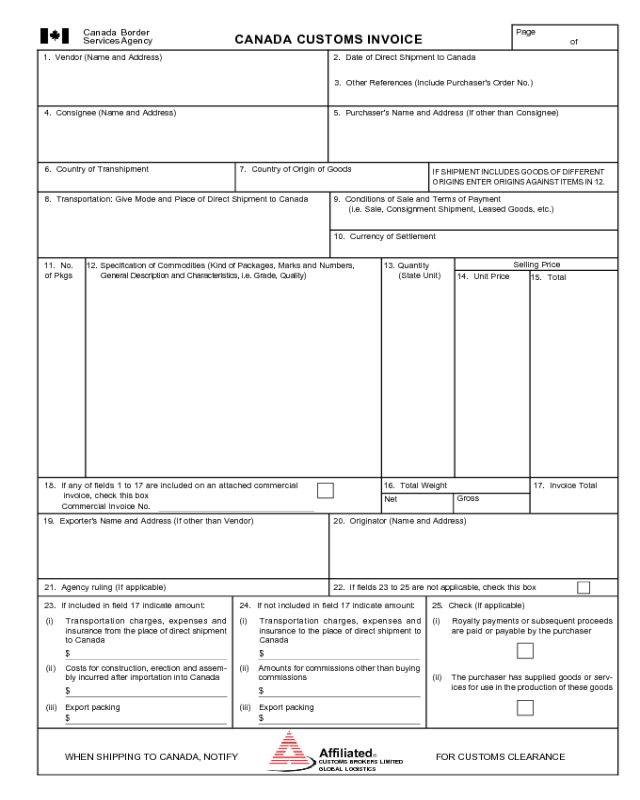

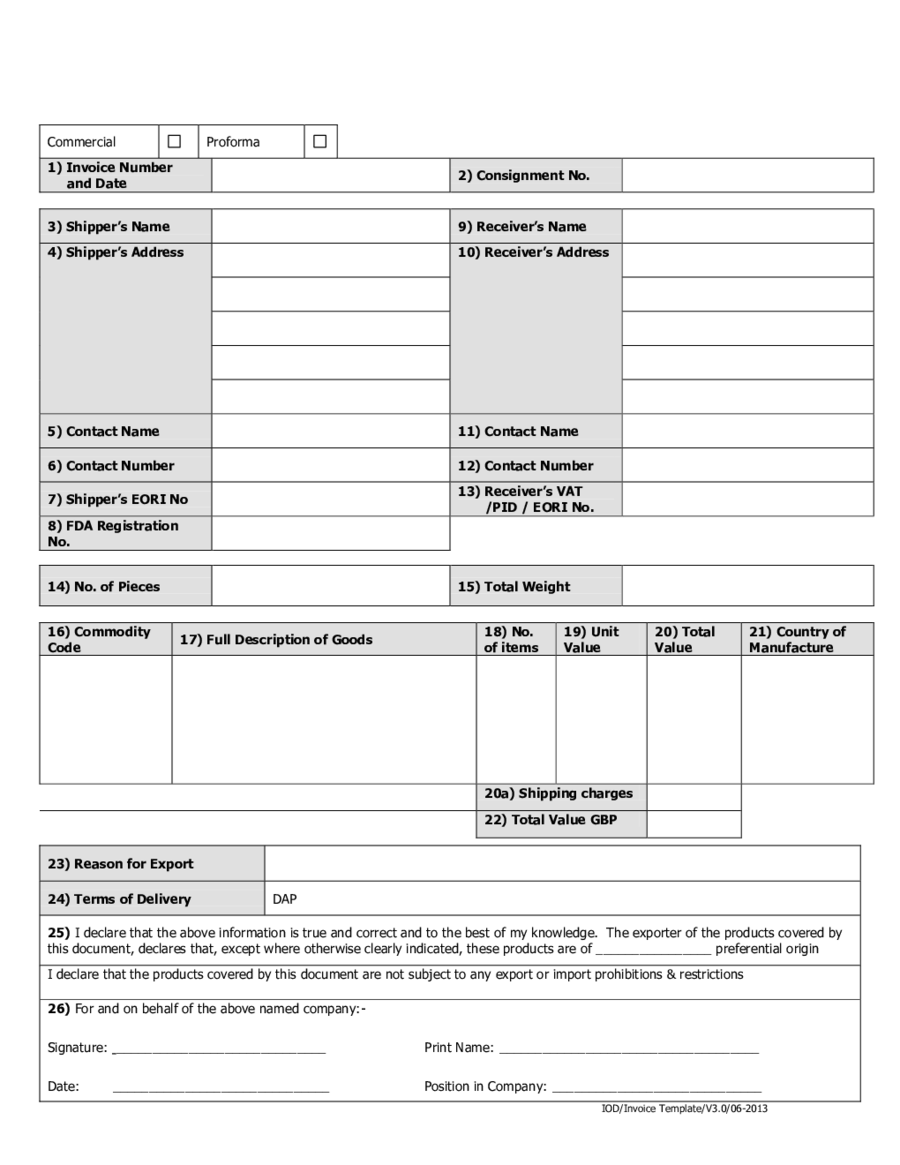

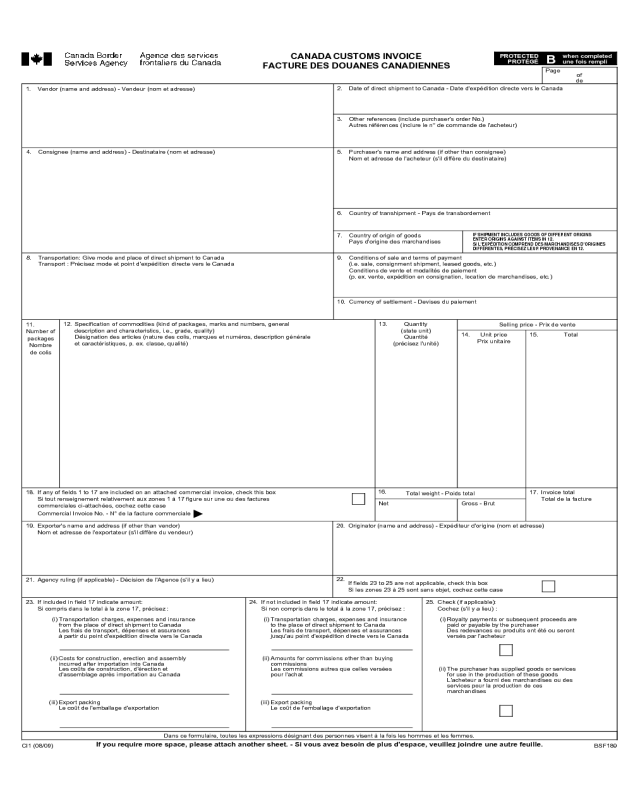

Commercial Invoice

This is certainly not the regular invoice that you receive from any departmental store. Rather a commercial invoice is a specially designed format used in foreign trade for documenting information like- Products shipped (detailed description)

- Quantity and weight

- Value of goods

- Parties involved

- Packaging type

- Insurance and other charges, etc.

Utility Invoice

This is something companies usually don’t take into notice, but again utility invoices are an important part. These are related to bills for using the internet, cable, telephone, and electricity that you are liable to pay to the service provider.If you are a service provider, these bills are sent to clients requesting for payments of any public service they are using.The format of a utility invoice is different from the others as billing period, due date, penalty amount after due date, previous amounts, etc. are included. The importance is that these invoices help you to track your expenses and chances of late payments. And for service providers, it helps you to document the amount received or due.Progress Invoice

Progress invoice, as you can guess by the name, is used in those works that stretch over a long period of time. It is basically a series of invoices. Usually, in case of construction industry, the work continues for a long period of time and is also very expensive. Here, contractors need to send progress invoice for showing the work progressing from time to time.This invoice contains the amount required for expenses of the on-going work and paying other workers or employees involved in the project. It typically contains details like:- The original contract amount

- Payment made till date

- Changes made in the agreement, if any

- Total percentage of work completed (till date)

- Amount due presently, etc.

Invoice Template: Importance

However, just putting details of the products and their payments with a due date does not make it an invoice. At least the accounting department of your client and legal authorities won’t accept it as an invoice. There are certain things and especially the format you have to keep in mind that will differentiate your invoice with other documents.Thankfully, there are already prepared templates available online that reduces your hassle of wasting time on drawing up documents. You can now focus more on the cores of your business and make money systematically. With these invoice templates, you can rest assure that all previous, as well as current essential data, are included.Can be downloaded easily:

With everything today available at the click of the mouse, you can also get templates similarly. Different types of invoice templates are available in various formats (Word, Excel, PDF) to cater to your business needs. You can also check out the sample invoice given here.The benefits with these templates are –- Fully free; can be easily downloaded

- Can be customized

- Design based on professional standards

- All ready for invoicing templates

- Convenient to use

Few tips you should remember

However, while invoicing your clients, it is essential to set up customer accounts through a procedure. Or else, no matter how good the templates are, you might end up being in a complicated situation.So, there are few things you must keep in mind:- Use a bookkeeping software to manage customer sales efficiently

- Get sufficient information from your client regarding their contact details before sending invoice

- Before emailing or sending the invoice, make sure to double check all the details, especially the address. Nothing can be more embarrassing than sending it to the wrong customer

- Also, check the payment details very carefully.

- What is the mode of payment? Make sure to decide on that beforehand.

- When your products have been delivered, verify with your customers if the products are all in good state. This will help you avoid any sort of dispute or payment delay.

- And lastly, check for typing mistakes. This can sound silly, but a mistyped number can distort the whole value of the products.

Subcategories

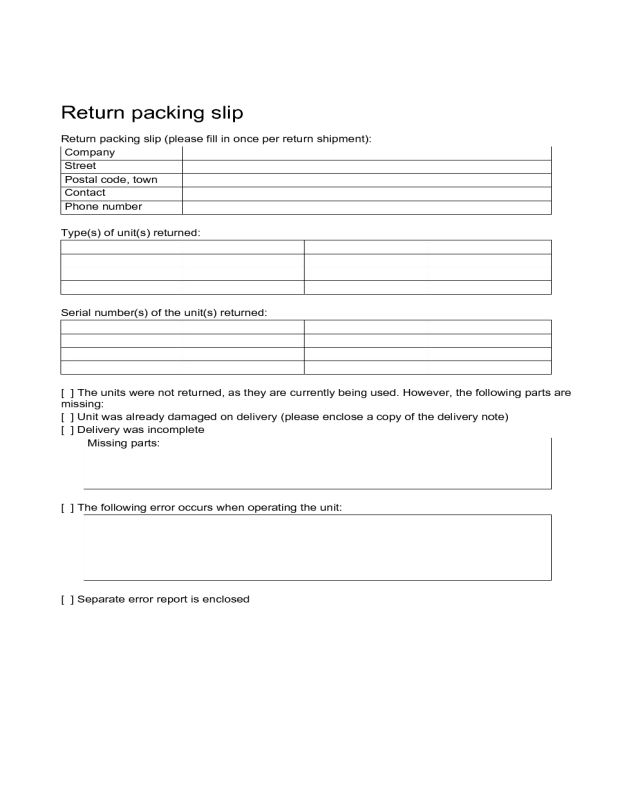

Blank Invoice TemplateSample Invoice TemplateContractor Invoice TemplatePhotography InvoiceService Invoice TemplatePacking SlipBilling Invoice TemplateConsulting Invoice TemplatePro Forma Invoice TemplateCatering Invoice TemplateGeneral Invoice TemplateBasic Invoice TemplateGraphic Design InvoiceSales InvoiceAuto Repair InvoiceBusiness Invoice TemplateCanada Customs InvoiceCustomer ListFreelance Invoice TemplateSimple Invoice TemplateStandard InvoiceTax Invoice TemplateVAT InvoiceProforma Invoice