Fillable Printable 2016, Form Or-19, Pass-Through Entity Owner Payments And Oregon Affidavit, 150-101-182, 150-101-175

Fillable Printable 2016, Form Or-19, Pass-Through Entity Owner Payments And Oregon Affidavit, 150-101-182, 150-101-175

2016, Form Or-19, Pass-Through Entity Owner Payments And Oregon Affidavit, 150-101-182, 150-101-175

150-101-182 (Rev. 12-15)

1

New for 2016

Form OR-19, Pass-Through Entity Owner Payments, 150-101-

182, Oregon Affidavit, 150-101-175, and estimated tax pay-

ments can now be submitted through Revenue Online. If

you use Revenue Online to submit Form OR-19, you can see

the estimated payments that are posted on the account and

owner transfers will be processed the same day. Visit www.

oregon.gov/dor for more information.

Introduction

Purpose of form

A pass-through entity (PTE) with distributive income from

Oregon sources must withhold tax from its nonresident

owners who don’t elect to join in a composite filing, Form

OC, Oregon Composite Return, 150-101-154, and haven’t filed

an affidavit unless the owner is exempt. The payment is a

prepayment of estimated Oregon income and excise tax for

nonresident owners of pass-through entities. For composite

filing information, see Form OC instructions.

Qualifying publicly traded partnerships, estates, and most

trusts aren’t required to withhold on their nonresident owners.

Definitions

Throughout these instructions, the following terms are used:

“Distributive income” is generally the net taxable income or

loss of a PTE. See page 2 for a complete definition.

“Electing owner” is a nonresident owner who chooses to

join in the filing of a composite return.

“FEIN” means federal employer identification number.

“Nonelecting owner” is a nonresident owner who chooses

not to join in the filing of a composite return, is required to

file an Oregon tax return, and has Oregon-source distribu-

tive income.

“Owner” is a partner of a partnership or limited liability

partnership (LLP), shareholder of an S corporation, member

of a limited liability company (LLC), or beneficiary of a trust.

“Pass-through entity (PTE)” is a partnership, S corpora-

tion, LLP, LLC, or certain trusts. Note: Single-member LLCs

owned by an individual or a corporation and grantor trusts

are disregarded for tax purposes and aren’t PTEs. For this

purpose only: Estates aren’t PTEs.

Owner payment requirements

A PTE is required to pay tax to the department on behalf of

the nonelecting owner unless the owner:

• Has estimated or actual Oregon-source distributive income

from the PTE that is less than $1,000 for the PTE’s tax year;

Pass-Through Entity Owner Payments

and Oregon Affidavit

• Has made estimated tax payments the prior tax year based

on the owner’s share of Oregon-source distributive income

from the PTE and continues to make estimated tax pay-

ments for the current tax year; or

• Files the Oregon Affidavit.

Don’t withhold if the owner is another PTE, except for

entities that are disregarded for tax purposes. Two common

examples of disregarded entities are:

• Grantor trust: A grantor trust (usually called a revocable

trust or living trust) is where the grantor has control. If

the grantor is a nonresident, withhold for the grantor the

same as any other individual. On Form OR-19, use the

name, Social Security number (SSN), and address of the

individual owner. Don’t use the name, FEIN, and address

of the grantor trust.

• Single member LLC: Withhold if the member is a non-

resident individual or C corporation. Withhold for the

member the same as any other individual or C corporation

owner using the individual’s or corporation’s information.

If the PTE expects the total Oregon-source distributive

income of a nonresident owner to exceed $1,000 during the

tax year, the PTE should begin submitting payments as of

the first quarter that includes Oregon-source income. Tax

payments are required on the entire nonresident owner’s

share of Oregon-source income, not just the amount exceed-

ing $1,000.

These payments are prepayments of tax by the PTE on behalf

of the owners. The requirement to submit payments isn’t

dependent on whether the PTE makes any distributions to

its owners. A PTE with distributive income that didn’t pay

any money to its owners will still submit Oregon tax pay-

ments for its nonresident owners. A PTE with no distributive

income that pays a distribution from capital or retained earn-

ings, won’t submit Oregon tax payments for its nonresident

owners.

Instructions for Oregon Affidavit

The PTE must withhold tax from the nonelecting owner’s

Oregon-source distributive income unless the nonelecting

owner files an Oregon Affidavit or is an owner for which the

PTE isn’t required to withhold, such as another PTE.

To be exempt from the payment requirement, the nonelecting

owner must also file an Oregon Affidavit with the department

as soon as it is known that the owner will receive Oregon-

source distributive income from the PTE. The nonelecting

owner must provide a copy of the completed affidavit to the

PTE so the PTE won’t withhold tax from the Oregon-source

distributive income.

The affidavit is valid until it is replaced by a subsequent

affidavit. The affidavit is on page 6 of these instructions.

Form

OR-19

2016

150-101-182 (Rev. 12-15)

2

Revoking or changing an affidavit

To revoke a previously filed affidavit, submit an affidavit (or

a copy of the original) with the revocation section completed

to the department and the PTE.

An affidavit should be updated if there is a change in the

entity information or if the ownership percentage of an

owner that has filed an affidavit changes by 10 percent or

more. The owner doesn’t need to send an updated affidavit

solely for address changes. Addresses are updated when

the owner files their tax return. If an affidavit is revoked or

updated, be sure the correct address is on the form. When

sending us an updated affidavit or revocation, be sure to

send a copy to the entity as well.

Oregon-source distributive income

For estimated tax purposes, distributive income is the net

amount of income, gain, deduction, or loss of a pass-through

entity for the tax year. It includes items directly related to the

PTE that are considered in determining the federal taxable

income of the nonresident owner. It also includes modifica-

tions provided in Oregon Revised Statute (ORS) Chapter 316

and other Oregon laws that directly relate to the PTE.

Examples of the modifications allowed that relate to the

PTE’s income include adjustments for depreciation, deple-

tion, gain or loss difference on the sale of depreciable prop-

erty, and U.S. government interest. Modifications don’t

include the federal tax subtraction, itemized deductions, and

the Oregon standard deduction.

Oregon-source distributive income doesn’t include return

of capital, income sourced in another state, or other distri-

butions not taxable by Oregon. Oregon-source distributive

income is the portion of the entity’s modified distributive

income that is derived from or connected with Oregon

sources.

If the PTE has business activity only in Oregon, multiply the

distributive income of the PTE by the ownership percentage

of the nonresident owner.

Apportionable income

PTEs with business activity both inside and outside Oregon

during the year must calculate Oregon-source distributive

income for nonresident owners. Fill out Schedule AP-1 to

figure the apportionment percentage. Fill out Schedule AP-2

using the PTE’s modified distributive income to apportion

the income between Oregon and other states. While most

PTEs don’t complete Schedule AP-2 for their own return, it

can be useful for apportioning distributive income flowing

through to the owners.

Multiply line 11 on the Schedule AP-2 by the ownership

percentage of each nonresident owner to get their share of

Oregon-source distributive income to calculate their tax

payment.

Example: Charlie, an Oregon nonresident, owns 20 percent

of ACME Partnership. For the year, the partnership had

$710,000 in ordinary income, $40,000 in capital gains, and

$70,000 in domestic production activity deductions. ACME

estimated Charlie’s Oregon source income for each period at

$3,750 and withheld $371 (9.9 percent). On Charlie’s Sched-

ule K-1, Distributive Share of Income, Deductions, Credits, etc.,

150-101-002, and attachments, ACME reported his distribu-

tive income, ACME’s Oregon apportionment percentage (10

percent), and the tax paid to Oregon on his behalf ($1,484)

which will also match the Form OR-19 annual report ACME

submitted.

On his Oregon return in the federal column, Charlie will

report his income of $142,000 ($710,000 x 20%) from federal

Schedule E and $8,000 ($40,000 x 20%) from federal Schedule

D and deduction of $14,000 ($70,000 x 20%). In the Oregon

column, he will multiply those amounts by 10 percent

($14,200, $800, and $1,400). Since Oregon is disconnected

from the domestic production activities deduction, these

same amounts ($14,000 in the federal column and $1,400 in

the Oregon column) will also be added back in the additions

section of Charlie’s Oregon return.

Guaranteed payments

Guaranteed payments are treated as a business income

component of the PTE’s distributive income and attributed

directly to the owner receiving the payment. See Oregon

Administrative Rule (OAR) 150-316.124(2).

Deductions

Individual tax deduction

Deductions normally allowed to individuals (itemized

deductions or the standard deduction) aren’t allowed in

determining the income amount upon which owner pay-

ments are based and remitted.

Self-employment tax deduction

Each PTE must calculate the self-employment tax deduction

for each electing member that is subject to self-employment

tax. The self-employment tax deduction that is attributable to

the Oregon-source distributive income is subtracted from the

Oregon-source distributive income to determine the amount

upon which the owner’s estimated payments are based.

Credits

Credits normally allowed on owners’ tax returns, such as

the credit for income taxes paid to another state, aren’t taken

into account in determining the income amount upon which

owner payments are based and remitted.

150-101-182 (Rev. 12-15)

3

Form TP19-V tax payment

instructions

Calculate the amount of tax to be withheld and remitted to

the department as follows:

• Individual owners: Use the highest individual tax rate on

the nonelecting owner’s share of Oregon-source distribu-

tive income. For 2016, the rate is 9.9 percent.

• C corporation owners: Use the corporate tax rates on the

nonelecting owner’s share of Oregon-source distributive

income. For 2016, the rate is 6.6 percent on the first $1 mil-

lion and 7.6 percent on the amount over $1 million.

Once you calculate the total payment for the owners, enter

the amount on voucher Form TP19-V. Enter the PTE’s infor-

mation on the voucher and submit it with the payment. You

will reconcile how much of each payment goes to each owner

when you file the annual report at the end of the year.

Due dates for tax payments

Tax payments for the Oregon-source distributive income

of nonelecting owners must be remitted for the period in

which the distributive income is earned or estimated. Use

the entity’s tax year.

New for 2016

Estimated tax payments can now be submitted through

Revenue Online. Visit www.oregon.gov/dor for more

information.

For calendar year entities, the due dates for 2016 are:

• April 18, 2016 (1st period).

• June 15, 2016 (2nd period).

• September 15, 2016 (3rd period).

• December 15, 2016 (4th period).

For fiscal-year filing entities, the due dates are the 15th day

of the fourth, sixth, ninth, and 12th months of the tax year.

Exception: Fiscal-year filing entities with only noncorporate

owners who file using a calendar tax year may elect to use

the due dates applicable to the owners instead.

For example, Beachside LLC has a 2015 fiscal tax year ending

September 30, 2016. The LLC would normally send in pay-

ments on the following due dates: January 15, 2016; March

15, 2016; June 15, 2016; and September 15, 2016. Their owners

are all individuals who file using a calendar tax year, so the

LLC chooses to use the exception. Because the owners report

this income in their 2016 calendar tax year as required by IRS

and Oregon laws, the payment due dates are April 18, 2016;

June 15, 2016; September 15, 2016; and January 16, 2017.

Use Form TP19-V to remit the payments.

Form OR-19 instructions

Use Form OR-19 at the end of the tax year to show how

much of each payment belongs to each nonresident owner.

Don’t include owners who are exempt, joining a composite

return, or filed an affidavit. Complete Form OR-19, identify-

ing the entity that paid the tax and each nonresident owner’s

information. Remember to use the individual or corpora-

tion owner’s information for disregarded entities. Each line

should be only one taxpayer, so enter spouses separately.

You must complete the name, tax identification number, and

address for each owner receiving a portion of the payment.

Incomplete forms won’t be processed.

Enter the date and amount of each payment sent in during

the tax year. Up to four payments can be reported on a Form

OR-19. Use whole dollars for all amounts. If the amounts in

any of the columns don’t match the corresponding payment

that was made, the form won’t be processed. Remember

that the owners won’t receive credit for the payment made

on their behalf until the PTE has submitted a correct Form

OR-19 annual report.

The Form OR-19 is due by the end of the second month after

the end of the entity’s tax year. For tax year 2016, the due

date for entities using a calendar year is February 28, 2017.

Important: Provide each owner with their total payments in

column (h) so they can claim the payment on their Oregon

return when they file.

Use additional Form OR-19s as needed to divide a payment

among all owners and enter the total for each column on the

last form. The total must match the payment as listed above

in the heading.

For example, Partnership ABC made only one payment of

$3,500 during the year. They have 15 nonresident owners

getting a portion of that payment. They will use three Form

OR-19s for their annual report and the total in column (d)

on the third form must be $3,500.

If the PTE wants any portion of a payment to go to its Form

OC account because some or all of the owners will be join-

ing the composite return, enter “Form OC” and the amount

from each payment.

For example, XYZ LLC sent in payments using voucher

Form TP19-V and now determines that all the nonresident

owners will be joining the Form OC. On their Form OR-19

annual report, they will enter “Form OC” in column (b) and

enter the amount of each payment to be transferred to the

Form OC account.

Send voucher TP19-V and the payment to: Oregon Department of Revenue

P.O. Box 14950

Salem OR 97309-0950

Important addresses

Mail the payment voucher, Form TP19-V, with payment by

each payment due date to:

Oregon Department of Revenue

PO Box 14950

Salem, OR 97309-0950

You can submit the Form OR-19 online at www.oregon.gov/

dor, or mail it by the end of the second month after the end

of the entity’s tax year to:

Oregon Department of Revenue

PO Box 14950

Salem, OR 97309-0950

You can submit the Oregon Affidavit online at www.oregon.

gov/dor, or mail it to:

Oregon Department of Revenue

Attn: Processing Center

955 Center Street NE

Salem, OR 97301-2555

Have questions? Need help?

General tax information ...................... www.oregon.gov/dor

Salem ............................................................... (503) 378-4988

Toll-free from an Oregon prex ................1 (800) 356-4222

Asistencia en español:

En Salem o fuera de Oregon ........................(503) 378-4988

Gratis de prejo de Oregon .......................1 (800) 356-4222

TTY (hearing or speech impaired; machine only):

Salem area or outside Oregon .....................(503) 945-8617

Toll-free from an Oregon prex ................1 (800) 886-7204

Americans with Disabilities Act (ADA): Call one of the help

numbers above for information in alternative formats.

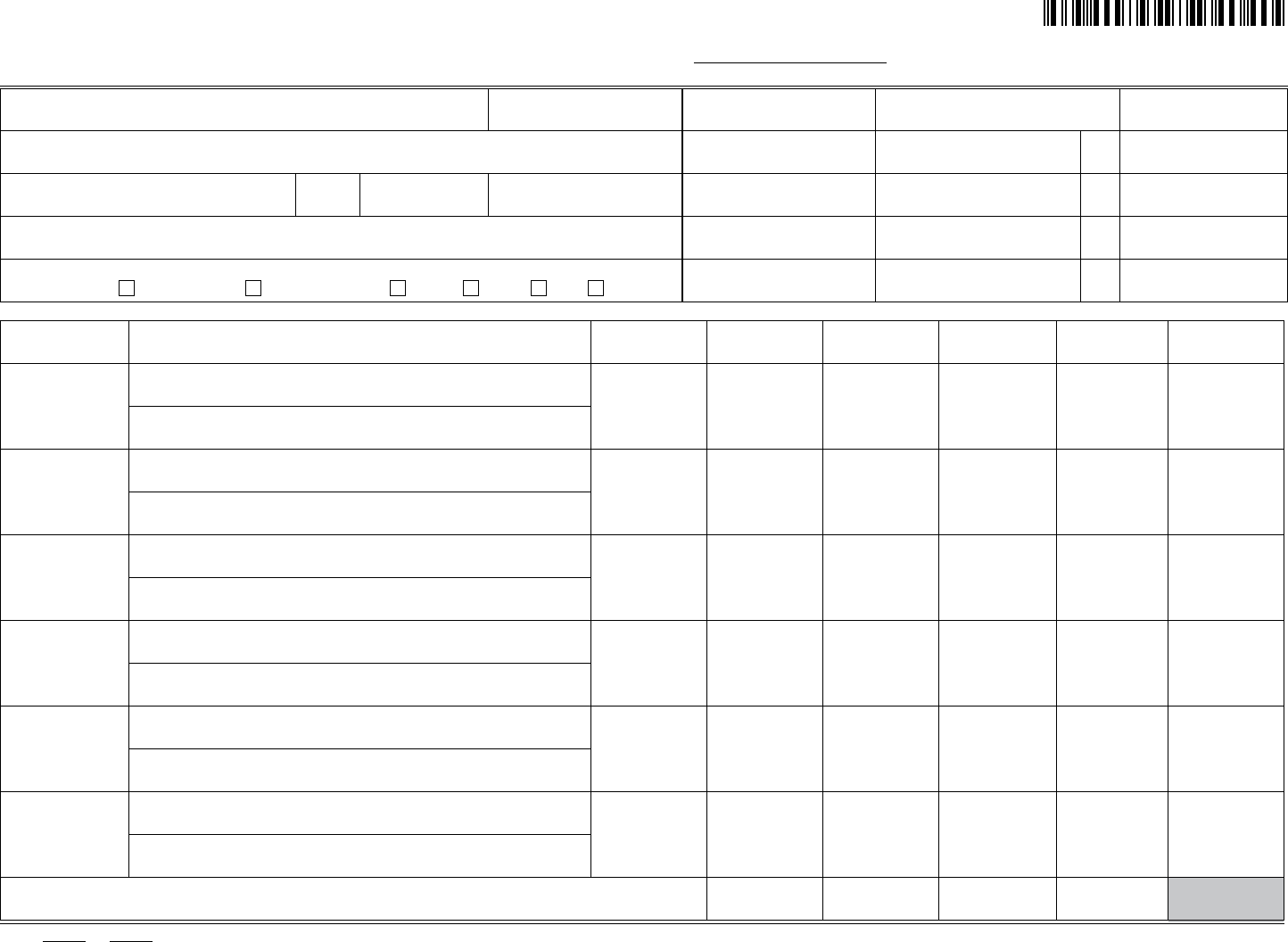

Tax for Nonresident Owners Payment Voucher

150-101-185 (Rev. 12-15)

•

FEIN:

Department of Revenue use only

•

Enter payment amount

.

0 0

$

Begins:

Ends:

Name of filer on tax return

Filer address

•

Tax year:

City State Contact phoneZIP code

Contact name

Form

TP19-V

✂

Visit www.oregon.gov/dor/forms to print more vouchers.

Clear This Page

150-101-182 (Rev. 12-15)

Annual Report of Nonresident Owner Tax Payments

Entity tax year end date

Pass-through entity information

Pass-through entity (PTE) name PTE FEIN

Estimated payments Amount of payment

Check date

(mm/dd/yyyy)

PTE address

Payment 1 .00

City State ZIP code Contact phone

Payment 2 .00

Name of contact person

Payment 3 .00

Type of entity: Partnership S corporation LLC LLP LP Trust Payment 4 .00

FEIN/SSN

(a)

Name and address

(b)

Owner type

(c)

Payment 1

(d)

Payment 2

(e)

Payment 3

(f)

Payment 4

(g)

Total for

owner (h)

1.

$ .00 $ .00 $ .00 $ .00 $ .00

2.

$ .00 $ .00 $ .00 $ .00 $ .00

3.

$ .00 $ .00 $ .00 $ .00 $ .00

4.

$ .00 $ .00 $ .00 $ .00 $ .00

5.

$ .00 $ .00 $ .00 $ .00 $ .00

6.

$ .00 $ .00 $ .00 $ .00 $ .00

Total payments

(Enter on last page only. Must match payments 1–4 listed above.) $

.00

$

.00

$

.00

$

.00

Page of Submit this form online at www.oregon.gov/dor or mail to: Oregon Department of Revenue, P.O. Box 14950 Salem, OR 97309-0950

This form is due by the end of the second month after the end of the entity’s tax year. The due date for entities using a calendar 2016 tax year is February 28, 2017.

Form

OR-19

2016

15771601010000

Clear This Page

■

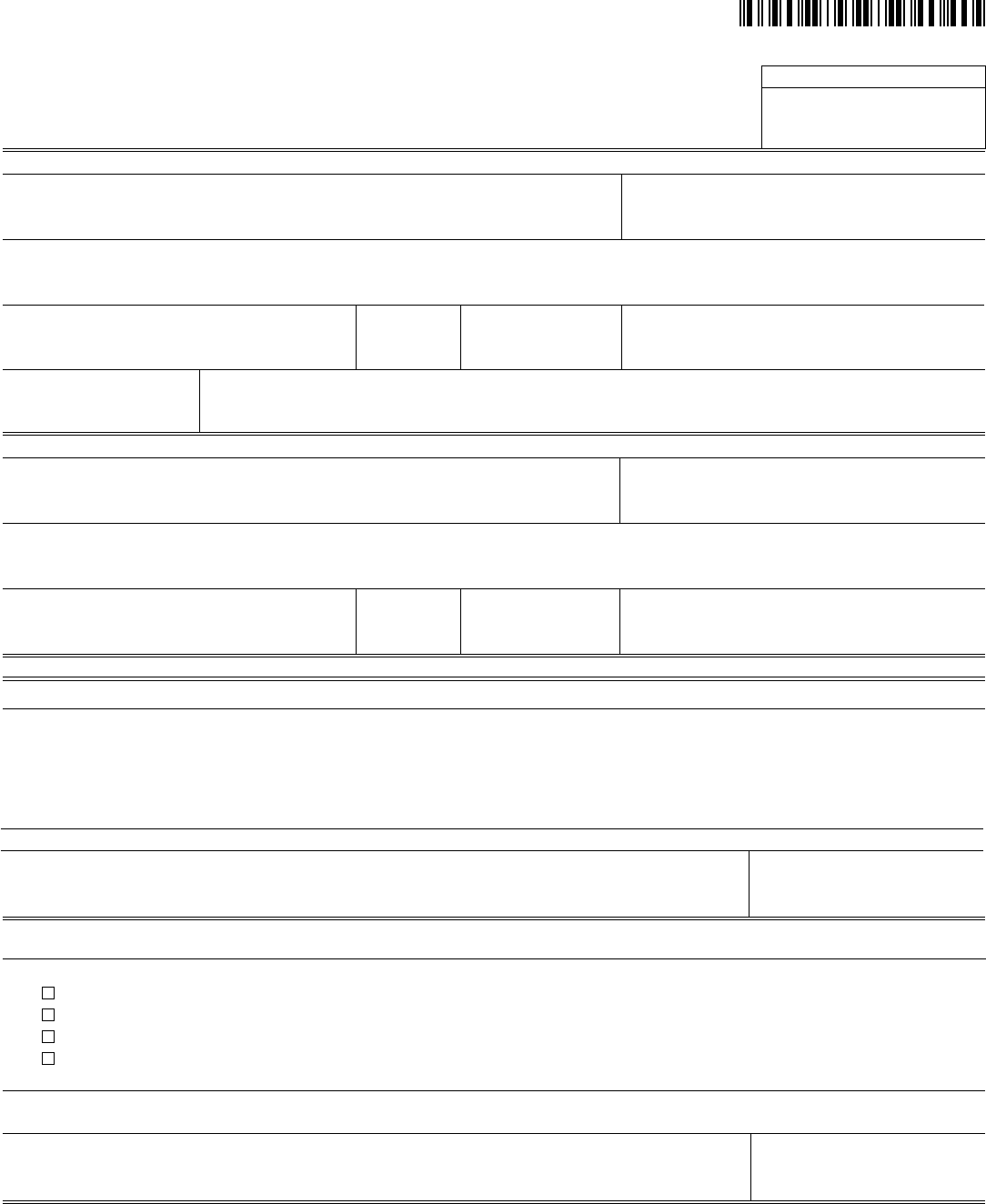

150-101-175 (Rev. 12-15)

For offi ce use only

Oregon Affi davit

for a nonresident owner of a pass-through entity

Beginning with tax year: 2016

Date received

Nonresident owner information

Name of nonresident owner Social Security no. or federal employer identifi cation no. (FEIN)

Street or mailing address

City

Ownership percentage

State

Estimated Oregon-source distributive income each year

ZIP code

Phone

%

$

Pass-through entity information

Name of pass-through entity (PTE) FEIN

Street or mailing address

City

State ZIP code

Phone

I agree to timely fi le all required Oregon income or excise tax return(s) and to make timely payments of all taxes imposed by

the state of Oregon with respect to my share of the Oregon distributive income from the pass-through entity named above. I

understand that I am subject to the jurisdiction of the state of Oregon for purposes of the collection of unpaid income

tax, together with related penalties and interest.

Agreement to fi le

This form must be resubmitted if the PTE information entered above changes or ownership changes by 10% or more. See Form OR-19 and Oregon Affi davit instructions.

Taxpayer’s or authorized agent’s signature

X

Date

Signature

Submit this form at www.oregon.gov/dor or mail to: Oregon Department of Revenue

Attn: Processing Center

955 Center St NE

Salem OR 97301-2555

By signing below, I declare that:

Revocation of this affi davit

I am an Oregon resident;

I am subject to tax on the income from the above-listed PTE;

I am no longer an owner in the above-listed PTE; or

I am joining in the fi ling of an Oregon composite return.

Taxpayer’s or authorized agent’s signature

X

Date

Signature

15231601010000

Clear This Page