Fillable Printable Academic Student Employee (ASE) Child Care Reimbursement Form - California

Fillable Printable Academic Student Employee (ASE) Child Care Reimbursement Form - California

Academic Student Employee (ASE) Child Care Reimbursement Form - California

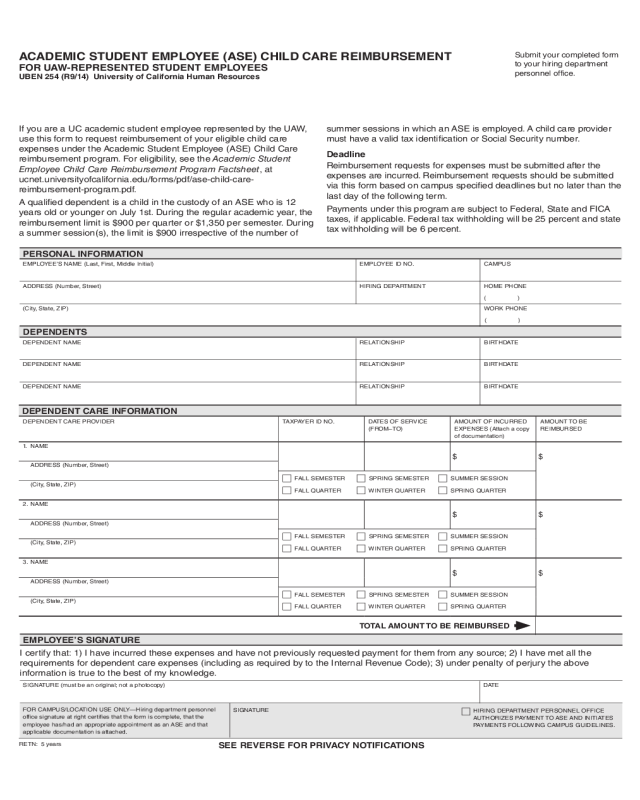

ACADEMIC STUDENT EMPLOYEE (ASE) CHILD CARE REIMBURSEMENT

FOR UAW-REPRESENTED STUDENT EMPLOYEES

UBEN 254 (R9/14) University of California Human Resources

Submit your completed form

to your hiring department

personnel office.

SEE REVERSE FOR PRIVACY NOTIFICATIONS

RETN: 5 years

EMPLOYEE’S SIGNATURE

I certify that: 1) I have incurred these expenses and have not previously requested payment for them from any source; 2) I have met all the

requirements for dependent care expenses (including as required by to the Internal Revenue Code); 3) under penalty of perjury the above

information is true to the best of my knowledge.

SIGNATURE (must be an original; not a photocopy) DATE

TOTAL AMOUNT TO BE REIMBURSED

( )

PERSONAL INFORMATION

EMPLOYEE’S NAME (Last, First, Middle Initial) EMPLOYEE ID NO. CAMPUS

ADDRESS (Number, Street) HIRING DEPARTMENT HOME PHONE

(City, State, ZIP) WORK PHONE

DEPENDENTS

DEPENDENT NAME RELATIONSHIP BIRTHDATE

DEPENDENT NAME RELATIONSHIP BIRTHDATE

DEPENDENT NAME RELATIONSHIP BIRTHDATE

DEPENDENT CARE INFORMATION

( )

FOR CAMPUS/LOCATION USE ONLY—Hiring department personnel

office signature at right certies that the form is complete, that the

employee has/had an appropriate appointment as an ASE and that

applicable documentation is attached.

If you are a UC academic student employee represented by the UAW,

use this form to request reimbursement of your eligible child care

expenses under the Academic Student Employee (ASE) Child Care

reimbursement program. For eligibility, see the Academic Student

Employee Child Care Reimbursement Program Factsheet, at

ucnet.universityofcalifornia.edu/forms/pdf/ase-child-care-

reimbursement-program.pdf.

A qualied dependent is a child in the custody of an ASE who is 12

years old or younger on July 1st. During the regular academic year, the

reimbursement limit is $900 per quarter or $1,350 per semester. During

a summer session(s), the limit is $900 irrespective of the number of

summer sessions in which an ASE is employed. A child care provider

must have a valid tax identication or Social Security number.

Deadline

Reimbursement requests for expenses must be submitted after the

expenses are incurred. Reimbursement requests should be submitted

via this form based on campus specied deadlines but no later than the

last day of the following term.

Payments under this program are subject to Federal, State and FICA

taxes, if applicable. Federal tax withholding will be 25 percent and state

tax withholding will be 6 percent.

DEPENDENT CARE PROVIDER TAXPAYER ID NO. DATES OF SERVICE

(FROM–TO)

AMOUNT OF INCURRED

EXPENSES (Attach a copy

of documentation)

AMOUNT TO BE

REIMBURSED

1. NAME

$

$

ADDRESS (Number, Street)

FALL SEMESTER SPRING SEMESTER SUMMER SESSION

FALL QUARTER WINTER QUARTER SPRING QUARTER

(City, State, ZIP)

2. NAME

$

$

ADDRESS (Number, Street)

FALL SEMESTER SPRING SEMESTER SUMMER SESSION

FALL QUARTER WINTER QUARTER SPRING QUARTER

(City, State, ZIP)

3. NAME

$

$

ADDRESS (Number, Street)

FALL SEMESTER SPRING SEMESTER SUMMER SESSION

FALL QUARTER WINTER QUARTER SPRING QUARTER

(City, State, ZIP)

SIGNATURE

HIRING DEPARTMENT PERSONNEL OFFICE

AUTHORIZES PAYMENT TO ASE AND INITIATES

PAYMENTS FOLLOWING CAMPUS GUIDELINES.

PRIVACY NOTIFICATIONS

STATE

The State of California Information Practices Act of 1977 (effective July 1, 1978) requires the University to provide the following information to

individuals who are asked to supply information about themselves.

The principal purpose for requesting information on this form, including your Social Security number, is to verify your identity, and/or for benets

administration, and/or for federal and state income tax reporting. University policy and state and federal statutes authorize the maintenance of

this information.

Furnishing all information requested on this form is mandatory. Failure to provide such information will delay or may even prevent completion of

the action for which the form is being lled out. Information furnished on this form may be transmitted to the federal and state governments when

required by law.

Individuals have the right to review their own records in accordance with University personnel policy and collective bargaining agreements. Infor-

mation on applicable policies and agreements can be obtained from campus or Office of the President Staff and Academic Personnel Offices.

The officials responsible for maintaining the information contained on this form are the Office of the President and campus Academic and Staff

Personnel Managers or campus Accounting Offices.

FEDERAL

Pursuant to the Federal Privacy Act of 1974, you are hereby notied that disclosure of your Social Security number is mandatory. The University’s

record keeping system was established prior to January 1, 1975 under the authority of The Regents of the University of California under Article

IX, Section 9 of the California Constitution. The principal uses of your Social Security number shall be for state tax and federal income tax (under

Internal Revenue Code sections 6011.6051 and 6059) reporting, and/or for benets administration, and/or to verify your identity.