Fillable Printable Account Statement Disclosure - Bank of the Orient

Fillable Printable Account Statement Disclosure - Bank of the Orient

Account Statement Disclosure - Bank of the Orient

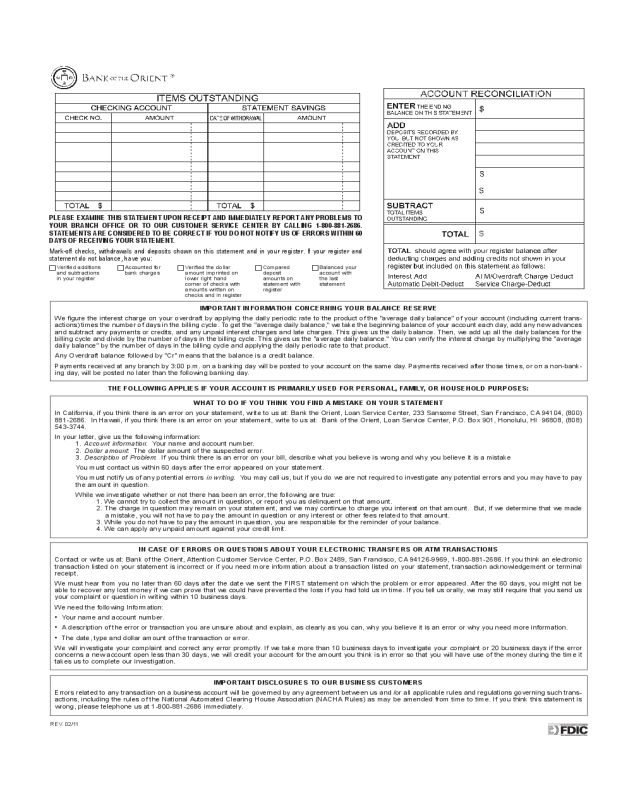

THE FOLLOWING APPLIES IF YOUR ACCOUNT IS PRIMARILY USED FOR PERSONAL, FAMILY, OR HOUSEHOLD PURPOSES:

PLEASE EXAMINE THIS STATEMENT UPON RECEIPT AND IMMEDIATELY REPORT ANY PROBLEMS TO

YOUR

BRANCH OFFICE OR TO OUR CUSTOMER SERVICE CENTER BY CALLING 1-800-881-2686.

STATEMENTS ARE CONSIDERED TO BE CORRECT IF YOU DO NOT NOTIFY US OF ERRORS WITHIN 60

DAYS OF RECEIVING YOUR STATEMENT.

Mark-o

ff checks, withdrawals and deposits shown on this statement and in your register. If your register and

statement

do not balance, have you:

Verified additions

and subtractions

in your register

Accounted for

bank charges

Verified the dollar

amount imprinted on

lower right hand

corner

of checks with

amounts written on

checks and in register

Compared

deposit

amounts on

statement with

register

Balanced your

account with

the last

statement

IMPORTANT INFORMATION CONCERNING YOUR BALANCE RESERVE

We figure the interest charge on your overdraft by applying the daily periodic rate to the product of the "average daily balance" of your account (including current trans-

actions) times the number of days in the billing cycle.

To get the "average daily balance," we take the beginning balance of your account each day, add any new advances

and

subtract any payments or credits, and any unpaid interest charges and late charges. This gives us the daily balance. Then, we add up all the daily balances for the

billing cycle and divide by the number of days in the billing cycle. This gives us the "average daily balance." You can verify the interest charge by multiplying the "average

daily balance" by the number of days in the billing cycle and applying the daily periodic rate to that product.

Any

Overdraft balance followed by "Cr" means that the balance is a credit balance.

Paymen

ts received at any branch by 3:00 p.m. on a banking day will be posted to your account on the same day. Payments received after those times, or on a non-bank-

ing

day, will be posted no later than the following banking day.

WHAT TO DO IF YOU THINK YOU FIND A MISTAKE ON YOUR STATEMENT

In

California, if you think there is an error on your statement, write to us at: Bank the Orient, Loan Service Center, 233 Sansome Street, San Francisco, CA 94104, (800)

881-2686. In

Hawaii, if you think there is an error on your statement, write to us at: Bank of the Orient, Loan Service Center, P.O. Box 901, Honolulu, HI 96808, (808)

543-3744.

In

your letter, give us the following information:

1. Account

information: Your name and account number.

2. Dollar

amount: The dollar amount of the suspected error.

3. Description

of Problem: If you think there is an error on your bill, describe what you believe is wrong and why you believe it is a mistake

You must contact us within 60 days after the error appeared on your statement.

You must notify us of any potential errors in writing. You may call us, but if you do we are not required to investigate any potential errors and you may have to pay

the

amount in question.

While

we investigate whether or not there has been an error, the following are true:

1.

We cannot try to collect the amount in question, or report you as delinquent on that amount.

2.

The charge in question may remain on your statement, and we may continue to charge you interest on that amount. But, if we determine that we made

a mistake, you will not have to pay the amount in question or any interest or other fees related to that amount.

3.

While you do not have to pay the amount in question, you are responsible for the reminder of your balance.

4.

We can apply any unpaid amount against your credit limit.

IN CASE OF ERRORS OR QUESTIONS ABOUT YOUR ELECTRONIC TRANSFERS OR ATM TRANSACTIONS

Con

tact or write us at: Bank of the Orient, Attention Customer Service Center, P.O. Box 2489, San Francisco, CA 94126-9969, 1-800-881-2686. If you think an electronic

transaction

listed on your statement is incorrect or if you need more information about a transaction listed on your statement, transaction acknowledgement or terminal

receipt.

We must hear from you no later than 60 days after the date we sent the FIRST statement on which the problem or error appeared. After the 60 days, you might not be

able

to recover any lost money if we can prove that we could have prevented the loss if you had told us in time. If you tell us orally, we may still require that you send us

your

complaint or question in writing within 10 business days.

We need the following Information:

• Your name and account number.

• A description of the error or transaction you are unsure about and explain, as clearly as you can, why you believe it is an error or why you need more information.

• The date, type and dollar amount of the transaction or error.

We will investigate your complaint and correct any error promptly. If we take more than 10 business days to investigate your complaint or 20 business days if the error

concerns

a new account open less than 30 days, we will credit your account for the amount you think is in error so that you will have use of the money during the time it

takes us to complete our investigation.

IMPORTANT DISCLOSURES TO OUR BUSINESS CUSTOMERS

Errors

related to any transaction on a business account will be governed by any agreement between us and /or all applicable rules and regulations governing such trans-

actions,

including the rules of the National Automated Clearing House Association (NACHA Rules) as may be amended from time to time. If you think this statement is

wrong,

please telephone us at 1-800-881-2686 immediately.

REV. 02/11