Fillable Printable Annual Reconciliation Statement (De 7)

Fillable Printable Annual Reconciliation Statement (De 7)

Annual Reconciliation Statement (De 7)

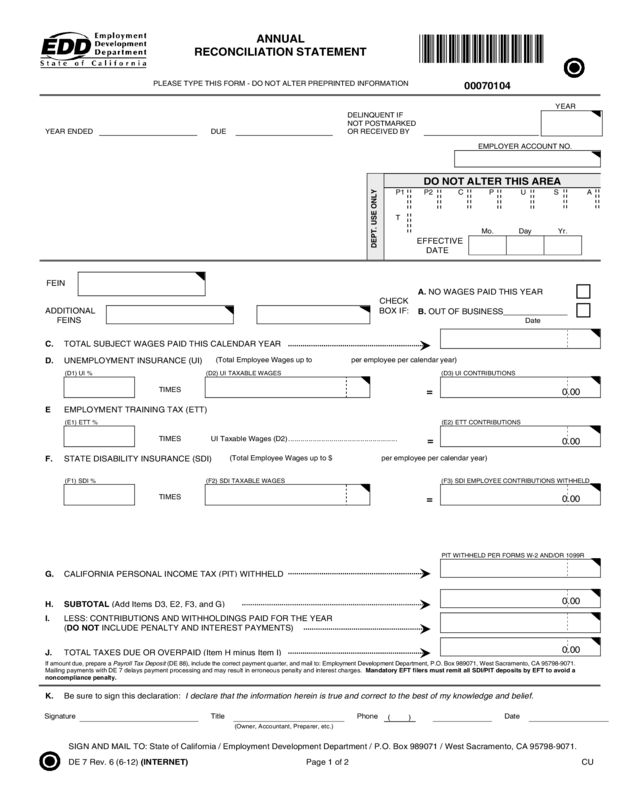

ANNUAL

RECONCILIATION STATEMENT

PLEASE TYPE THIS FORM - DO NOT ALTER PREPRINTED INFORMATION

00070104

YEAR

YEAR ENDED

DUE

DELINQUENT IF

NOT POSTMARKED

OR RECEIVED BY

EMPLOYER ACCOUNT NO.

DO NOT ALTER THIS AREA

P1 P2 C P U S A

T

Mo. Day Yr.

EFFECTIVE

DATE

FEIN

A. NO WAGES PAID THIS YEAR

CHECK

ADDITIONAL

FEINS

BOX IF:

B. OUT OF BUSINESS

Date

C. TOTAL SUBJECT WAGES PAID THIS CALENDAR YEAR

D.UNEMPLOYMENT INSURANCE (UI)

(Total Employee Wages up toper employee per calendar year)

(D1) UI % (D2) UI TAXABLE WAGES(D3) UI CONTRIBUTIONS

TIMES

=

E EMPLOYMENT TRAINING TAX (ETT)

(E1) ETT % (E2) ETT CONTRIBUTIONS

TIMES UI Taxable Wages (D2) .....................................................

=

F.STATE DISABILITY INSURANCE (SDI)

(Total Employee Wages up to $ per employee per calendar year)

(F1) SDI % (F2) SDI TAXABLE WAGES(F3) SDI EMPLOYEE CONTRIBUTIONS WITHHELD

TIMES

=

PIT WITHHELD PER FORMS W-2 AND/OR 1099R

G. CALIFORNIA PERSONAL INCOME TAX

(

PIT

)

WITHHELD

H.SUBTOTAL

(

Add Items D3

,

E2

,

F3

,

and G

)

I.LESS: CONTRIBUTIONS AND WITHHOLDINGS PAID FOR THE YEAR

(DO NOT INCLUDE PENALTY AND INTEREST PAYMENTS)

J. TOTAL TAXES DUE OR OVERPAID

(

Item H minus Item I

)

If amount due, prepare a Payroll Tax Deposit (DE 88), include the correct payment quarter, and mail to: Employment Development Department, P.O. Box 989071, West Sacramento, CA 95798-9071.

Mailing payments with DE 7 delays payment processing and may result in erroneous penalty and interest charges. Mandatory EFT filers must remit all SDI/PIT deposits by EFT to avoid a

noncompliance penalty.

K. Be sure to sign this declaration: I declare that the information herein is true and correct to the best of my knowledge and belief.

Signature

Title

Phone

(

)

Date

(Owner, Accountant, Preparer, etc.)

SIGN AND MAIL TO: State of California / Employment Development Department / P.O. Box 989071 / West Sacramento, CA 95798-9071.

DE DE 7 Rev. 6 (6-12) (INTERNET)Page 1 of 2 CU

DEPT. USE ONLY

0.00

0.00

0.00

0.00

0.00

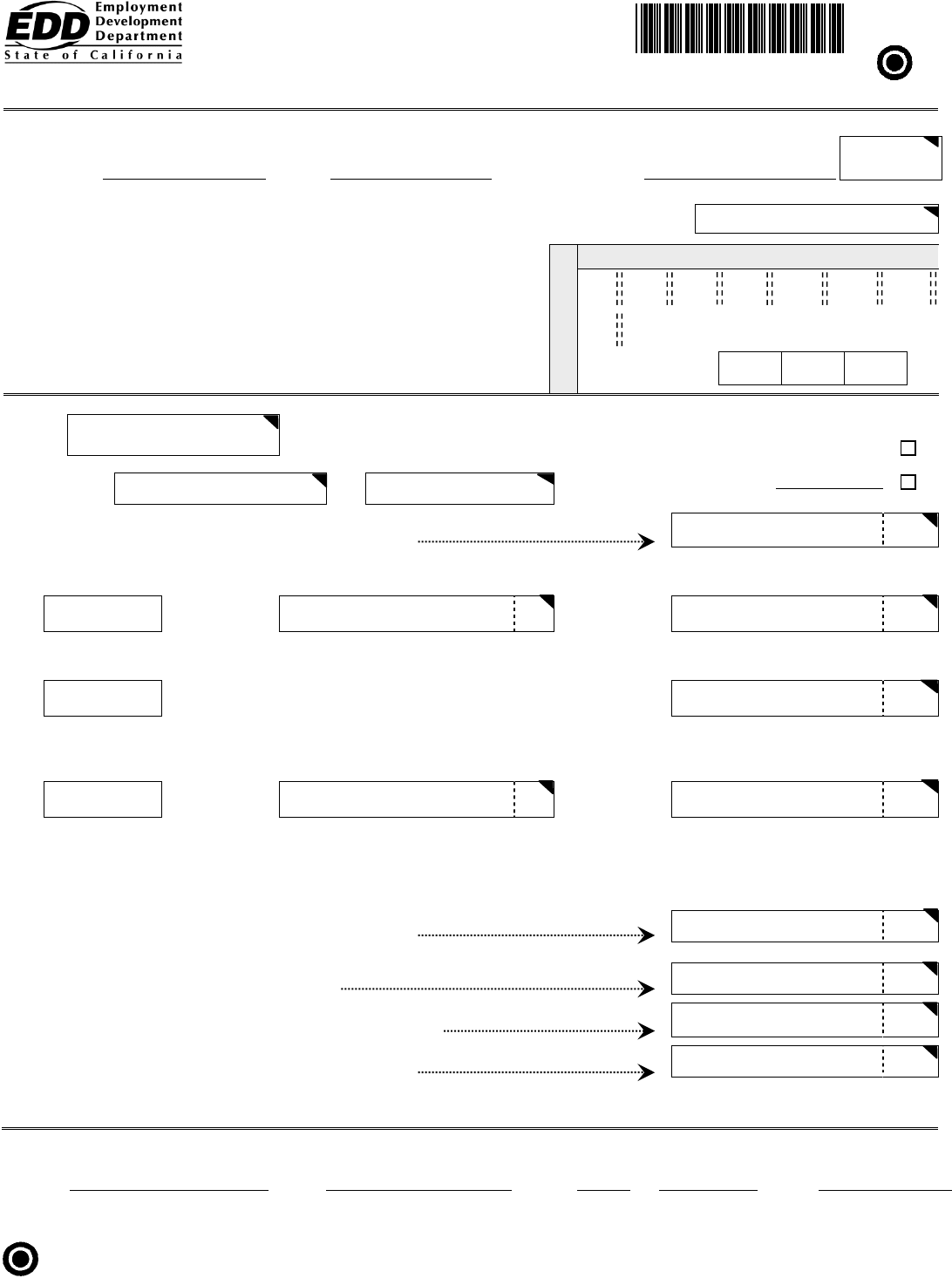

INSTRUCTIONS AND INFORMATION FOR COMPLETING ANNUAL RECONCILIATION STATEMENT

FOR ASSISTANCE IN COMPLETING THIS FORM, obtaining additional forms or any information, contact

our Taxpayer Assistance Center at 1-888-745-3886. For TTY (non verbal) access, call 1-800-547-9565

PLEASE TYPE ALL INFORMATION.

INSTRUCTIONS

You must file this return even though you had no payroll. If you had no

payroll, check the box for Item A and complete Item K.

When reporting dollar amounts, use DOLLARS AND CENTS. Do not

use dashes or slashes.

Verify/enter your Federal Employer Identification Number (FEIN): The

number should be the same as your federal account number. If the number is not

correct, line it out and enter correct number. If you have more than one FEIN

relating to the state number, enter the additional FEINs in spaces indicated.

LINE A. No Wages Paid This Year - Check this box if you did not pay

subject wages during the calendar year.

LINE B. Out of Business (Date) - Check this box if you quit business and

this is your final statement. Show the out of business date.

NOTE: IF YOU QUIT BUSINESS, YOU MUST FILE THIS FINAL

STATEMENT AND THE QUARTERLY WAGE AND WITHHOLDING

REPORT AND PAY ANY AMOUNTS DUE WITHIN 10 DAYS OF QUITTING

BUSINESS TO AVOID PENALTY AND INTEREST.

LINE C. Total Subject Wages - Enter the total subject wages paid to each

employee during the year. Generally, most wages are considered “subject”

wages.

LINE D. Unemployment Insurance (UI)

D1. UI Rate - Note: If you had a rate change which was not effective for the

entire year, you will need to file a separate Annual Reconciliation Statement

for the period of time covered by each rate. For tax rate or benefit charge

information, call 916-653-7795.

D2. UI Taxable Wages - Enter total UI taxable wages for the year. DO NOT

INCLUDE EXEMPT WAGES.

D3. Employer’s UI taxes - Multiply D1 by the amount entered in D2 and enter

this calculated amount in D3.

LINE E. Employment Training Tax (ETT)

E1. ETT rate E2. Employment Training Tax - Multiply E1 by the amount

entered in D2 and enter this calculated amount in E2.

LINE F. State Disability Insurance (SDI)

F1. SDI Rate (Includes Paid Family Leave amount)

F2. SDI Taxable Wages – Enter the total SDI taxable wages for the year.

DO NOT INCLUDE EXEMPT WAGES.

F3. Multiply F1 by the amount entered in F2 and enter this calculated

amount in F3.

LINE G. California Personal Income Tax (PIT) Withheld

Enter total California Personal Income Tax withheld, as reported on Forms

W-2, and/or 1099-R. NOTE: DO NOT SEND W-2s TO THE EDD.

CAUTION: TO AVOID A POTENTIAL ASSESSMENT, DO NOT ENTER

TOTAL WAGES, FEDERAL WITHHOLDING, OR TOTAL PAYMENTS MADE

FOR THE YEAR.

All magnetic media of 1099-R must be submitted to:

Franchise Tax Board ATTN: Magnetic Media Coordination, #599

P.O. Box 942840 Sacramento, CA 94240-6090

LINE H. Subtotal - Add Items D3, E2, F3, and G, enter in the SUBTOTAL box.

LINE I. Taxes and Withholdings paid for the year - Total of all payments

of UI, ETT, SDI and PIT paid for this calendar year.

NOTE: Do not include any payments made during the year for any prior

years, or payments for penalty and interest.

LINE J. Total Taxes Due or Overpaid - Item H minus Item I (this should be

zero if all payments have been properly paid). If amount is due, prepare a

Payroll Tax Deposit coupon (DE 88). The payroll date, payment type, and

payment quarter must be completed in order to process your payment

coupon correctly. Failure to complete these items may result in your

payment being posted to the wrong quarter/year and interest and penalty

may be assessed. If taxes are overpaid, a refund will be generated.

LINE K. Signature of preparer or responsible individual, including title,

phone number, and date.

THIRD-PARTY SICK PAY

Third-Party Payers of Sick Pay: Include withholdings for Third-Party Sick

Pay in Item G. Attach a copy of the third-party sick pay statement provided to

the employer.

Employers: Include third-party sick pay in lines C, D, and E. DO NOT

include third-party sick pay withholdings in lines G or H. Attach a copy of

third-party sick pay statement provided by the payer.

INFORMATION

FILING THIS STATEMENT - This statement must report all UI/SDI subject

California wages paid and California Personal Income Tax withheld during

the calendar year as shown on the Forms W-2 and/or 1099-R.

NOTE: DO NOT SEND W-2s TO THE EDD.

PENALTY of $1,000.00or five percent (5%) of the taxes required to be

reconciled will be imposed for failure to file this statement within 30 days of

notice to the employer because of his/her failure to file. Interest accrues from

the delinquent date of January 31st of the following year.

QUARTERLY PAYMENTS: UI, ETT, and SDI and PIT withholdings are

required to be paid at least quarterly throughout the year (SDI and PIT may

be paid more often—see below). If you desire to remit these taxes more

often you may do so by sending your payment with a Payroll Tax Deposit

coupon (DE 88).

NEXT BANKING DAY/SEMIWEEKLY/MONTHLY DEPOSITS:

Deposits of withheld employee SDI taxes and PIT may be required

throughout the year, depending upon the amount of PIT withheld and federal

deposit requirements. Penalty and interest will be charged on late deposits.

If business was discontinued or if a change in ownership occurred during the

period covered by this Annual Reconciliation Statement, each ownership

must file a separate statement covering only that part of the year during

which the particular ownership operated.

TAXABLE WAGE LIMITS - Individual employee wages are taxable to specific

limits per calendar year for UI/ETT and SDI. Wages for each employee in

excess of the taxable wage limit are exempt. For example, if the UI taxable

wage limit is $7,000 per employee, individual employee wages exceeding

$7,000 are exempt from UI/ETT taxes. For current and past taxable wage

limits for UI/ETT and SDI, refer to our publication Tax Rates, Wage Limits,

and Value of Meals and Lodging (DE 3395) or our website at

//www.edd.ca.gov/pdf_pub_ctr/de3395.pdf.

If an active business was taken over and continued, wages paid by the

former ownership shall be counted toward the UI, ETT, and SDI taxable limits

by the new ownership. Otherwise, wages paid by other employers are not to

be counted toward the taxable limits.

If an employer paid wages to the same employee for work in another state

and reported the wages to the other state for UI purposes, the out-of-state

wages shall also be counted toward the UI taxable limits. These wages are

NOT used in computing the taxable limit for SDI.

Employers who would like to participate in Electronic Funds Transfer (EFT)

filing, contact the EDD’s e-Pay Unit at 916-654-9130.

FOR MORE INFORMATION ABOUT COMPLETING THIS FORM, PLEASE

REFER TO THE CALIFORNIA EMPLOYER’S GUIDE (DE 44) OR

CONTACT OUR TAXPAYER ASSISTANCE CENTER AT THE NUMBER

ABOVE.

DE 7 Rev. 6 (6-12) (INTERNET)Page 2 of 2