Fillable Printable Application for a Vehicle Registration Certificate

Fillable Printable Application for a Vehicle Registration Certificate

Application for a Vehicle Registration Certificate

Application for a vehicle

registration certificate

For more information go to www.gov.uk/vehicle-registration

V62

7/14

Please read these notes carefully.

When you should use this form

A

Use this form to apply for a vehicle registration certificate (V5C):

• if you have bought the vehicle but have not received the V5C in your

name, (you should allow four weeks from the date you bought the

vehicle before you use this form), or

• because the original V5C has been lost, stolen, damaged or destroyed.

If you have previously had a V5C in your name for this vehicle, and

there is no change to the vehicle or your personal details, you can

apply for a duplicate by phoning 0300 790 6802. If you are deaf or hard

of hearing and have a textphone, phone 0300 123 1279. (This number

will not respond to ordinary phones.) Please have a debit card or credit

card to hand when you phone, as you may have to pay the £25 fee (see

section D).

If you do not give the following details, we will not be able to deal with

your application and will return it for you to fill in:

• all the vehicle details in section 1

• your full names in section 2 and do not use initials or give joint

names (for example, a husband and wife’s or a father and son’s).

• a United Kingdom (UK) address in section 2

(PO box addresses are only acceptable for applications

in a company name with a full postal address).

The following information will help us deal with your application.

• Date of birth. (Not needed with a company name and address).

• Contact phone number and email address.

When filling in section 3, a motor trader can be a:

• motor dealer

• motor vehicle auctioneer

• motor vehicle insurer you have settled a claim with

• motor vehicle dismantler (salvage dealer), or

• finance company with a financial interest in the vehicle.

You must also sign this form in section 5.

The fee for this application is £25 (at time of printing).

If sending this form directly to DVLA please make cheques or postal

orders payable to ‘DVLA, Swansea’. Do not send cash or blank postal

orders. Send this form to DVLA, Swansea, SA99 1DD.

If you are also taxing your vehicle see section F.

You do not have to pay a fee in the following circumstances:

• If you are the new keeper and the previous keeper failed to tell us

about the change, you must have the ‘New keeper’s details’ section

(V5C/2) from the V5C and send it to us with this application form.

• If the vehicle has been categorised as C salvage (repairs would

cost more than the vehicle was worth) by the insurance company

and they have destroyed the V5C. However if you are also taxing

your vehicle at a Post Office branch that deals with vehicle tax you

will need to pay the fee which will be refunded after DVLA have

carried out checks.

You have to pay for the following categories:

A = scrap only, B = break for spare parts only, and D = repairable.

You can get more information on salvage categories from the

insurance company.

You should receive the V5C within:

• two weeks if you are already recorded as the registered keeper, or

• four weeks if there has been a change of keeper.

However, if you do not receive it in this time, please allow

six weeks before contacting us.

Note: the address on the V5C will be in the format Royal Mail prefer.

It may not be identical to that given on your application.

If you have bought the vehicle and you want to drive it on the road you

must tax it immediately. If you have the V5C/2 ‘New keeper’s details’

section you can tax online at www.gov.uk/vehicletax or

You can tax your vehicle at a Post Office

®

branch that deals with

vehicle tax by using your V5C/2. You may also need to fill in this form if

you only have the V5C/2.

If you do not have a V5C or the V5C/2 you will need to fill in this

form and pay a fee. You can pay by cash, direct debit, debit card,

credit card, cheque or postal order (made out to Post Office Ltd.),

Post Office budget card or by traveller’s cheques (in pounds sterling).

If you are not the registered keeper of the vehicle you may not be able

to tax until you get a V5C in your name.

If you have changed your address you must fill in your previous postcode

in the box under your signature on the front of this form.

If you are keeping the vehicle off the road, you need to make a SORN

with this application. If you have recently bought the vehicle, SORN

cannot be transferred from the previous keeper. You will need to

make a new SORN. If you do not make a SORN, legal action could

be taken against you. If you are the registered keeper when we receive

your SORN you will automatically be issued a refund of vehicle tax for

any remaining full paid months. If you have paid by Direct Debit (DD)

your DD will be cancelled.

To make a SORN, fill in a Statutory Off Road Notification (SORN)

(V890), which you can get from:

• the website at www.gov.uk/sorn

• DVLA Customer Enquiries (see contact details in section I).

Please make sure you attach the V890 to this form.

We will store your details on our vehicle register. We can release these

details if we must do so by law. You can get more information on how

and when we can release your details by visiting the website at

www.gov.uk/data-protection

You can get more information at www.gov.uk

If you are unhappy with the service you receive, please visit

www.gov.uk/dvla for information on our complaints procedure.

You can contact us in the following ways:

By phone: 0300 790 6802 (Phone lines are open between 8am and

7pm, Monday to Friday, and between 8am and 2pm on Saturdays.

Some calls will be monitored for quality and training purposes.)

By textphone (for people who are deaf or hard of hearing):

0300 123 1279. (This number will not respond to ordinary phones.)

By fax: 0300 123 0798.

By writing to: Customer Enquiries (Vehicles), DVLA, Swansea SA6 7JL.

Find out about DVLA’s online services at

www.gov.uk/browse/driving

Filling in this form

B

When you should receive the V5C

E

What to do if you also need to make a Statutory

Off Road Notification (SORN)

G

When there is no fee

D

16733

Data protection – releasing information

H

Further information

I

What to do if you also need to tax

your vehicle

F

How to pay and where to send this form

C

Official use only V62

7/14

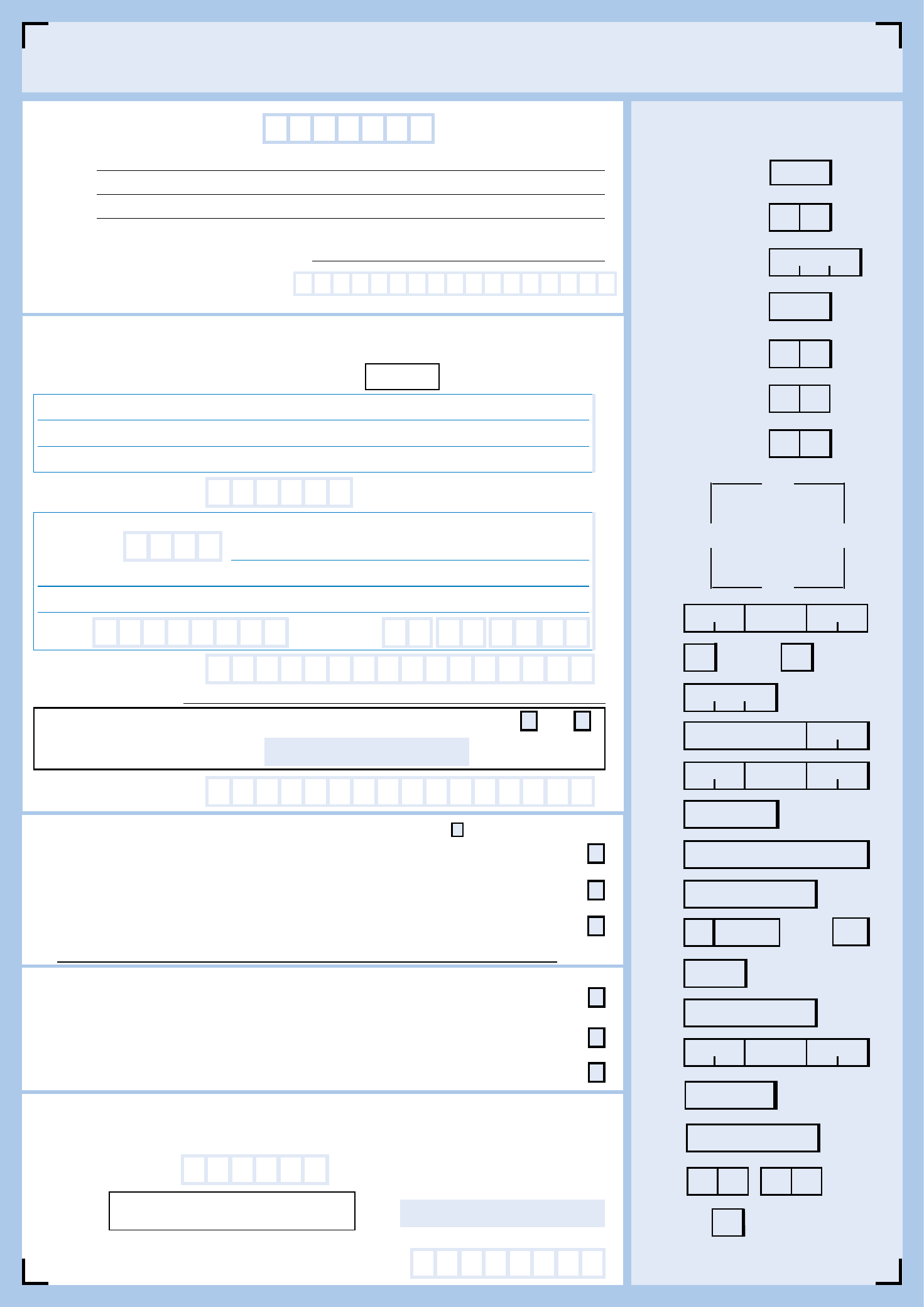

Read the guidance notes over the page before filling in this form.

Please write clearly in black ink using CAPITAL LETTERS.

1. Vehicle details

2. Keeper details

Business or organisation not registered as PLC or LTD should also provide the name of the person

responsible for the vehicle in the boxes below.

Make:

Model:

Colour:

Tax class: (for example,

Private/Light Goods, Petrol Car, Disabled):

VIN, chassis or frame number:

(usually shown on a plate near the engine)

If you do not give this information, it will be returned to you.

4. Fee

• I enclose the fee of £25

✖

• I do not enclose the fee because:

– I am the new keeper and I have enclosed the new keeper’s details section (V5C/2); or

✖

– an insurance company destroyed the V5C because they considered it to be category C

salvage (see section D over the page).

✖

5. Declaration

I have checked the information on this application and as far as I know it is correct.

If I find the V5C or the previous keeper gives it to me, I will send it to DVLA, Swansea.

Signature: Date:

Previous postcode

Fill in previous postcode if address has changed

Vehicle registration number:

Title: Mr Mrs Miss Ms

Other (for

example, Dr)

Contact email address:

Contact phone number:

MKE

MDL

CLR

TC

V10/V85/V70

Proc

Independent

3

4

5

6

7

8

Date Stamp

VC

L

0

/

DOE

CD FI

ISC

UW

DOW

SC

PWR

EN

CC

W/BT

AM

RW

15

17

18

19

20

SP

29

30

21

22

23

24

25

26

DOP

27

ID N A

F

16

DUP V5

Have you had a vehicle registration certificate (V5C) for this vehicle in your name? Yes

✖

No

✖

If no, when did you get the vehicle?

■■ ■■ ■■■■

D D M M Y Y Y Y

2

14

V62-0714

Business or organisation name:

First names:

Surname:

9

10

Current address

House number: Full address:

C

Post town:

Postcode

Date of birth

M M Y Y Y YD D

11

12

13

31

3. Why don’t you have a V5C?

✖

✖

✖

(Please put a

✖

against any that apply)

• I bought the vehicle from the previous keeper or motor trader and I have not received a V5C yet.

You should allow four weeks from the date you bought the vehicle before you use this form.

• It has been lost, stolen, damaged or destroyed.

• I cannot produce it for another reason. (Give the reason below)

Mile age:

(By law you do not have to

provide the present mileage.)

28

(to the last complete mile)

Your driving licence number

(not required by law):

For company use only

DVLA/DVA Fleet number

32

■■ ■■ ■■■■

D D M M Y Y Y Y