Fillable Printable Application for ABN Registration for Superannuation Entities

Fillable Printable Application for ABN Registration for Superannuation Entities

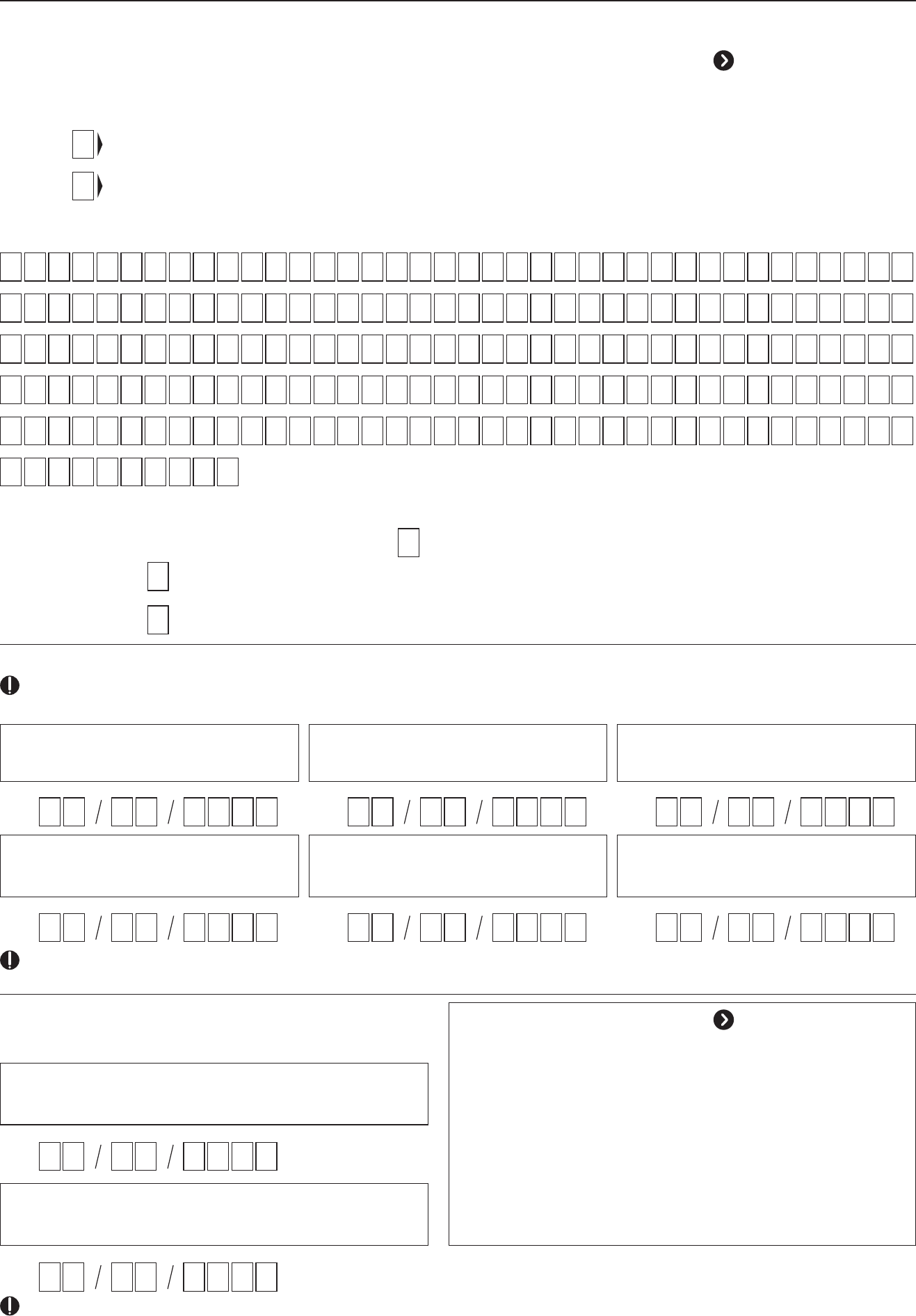

Application for ABN Registration for Superannuation Entities

IN-CONFIDENCE — when completed

Page 1

NAT 2944-07.2010

Section A: Entity information

Application for ABN registration

for superannuation entities

Complete this application if you need an Australian

business number (ABN) for a superannuation entity.

The fastest way to get an ABN is to apply online at www.abr.gov.au As long as we can validate your details against data in

our systems, your ABN will be issued immediately and written confi rmation of the ABN registration will follow.

See Instructions page 3

When the term ‘entity’ is used it refers to the superannuation fund or trust applying for this ABN.

1 Type of entity

(Place in one box only.)

X

Pooled superannuation trust

Go to question 4

Approved deposit fund

Go to question 4

ATO regulated self-managed

su per an nu a tion fund

Go to question 4

Australian Prudential Regulation Authority

(APRA) regulated superannuation fund

Go to question 2

Non-regulated superannuation fund

Go to question 3

3 Is the entity a government organisation?

No

X

Yes

What tier of government does the entity belong to? (Place in one box only.)

Commonwealth

Territory

State

Local

2 Type of APRA fund

(Place in one box only.)

X

Only complete this question if the entity applying for an ABN is an APRA regulated superannuation fund.

Public offer fund

Non-public offer fund

Public sector

superannuation scheme

Public sector fund

Small APRA fund

See Instructions page 4

4 What is the structure of the entity?

(Place in one box only.)

X

Accumulation fund

Defined benefit fund

If the entity is an APRA regulated

superannuation fund, how many defi ned

benefi t members does the entity have?

Both accumulation and

defined benefit fund

Do not include accumulation

members in this total.

See Instructions page 4

5 What is the entity’s legal name?

This should be the name of the entity that appears in the trust deed or governing rules. For example, The trustee for XYZ

superannuation fund.

See Instructions page 5

INSTRUCTIONS FOR COMPLETING THIS FORM

■ Refer to the Instructions to help you complete this application.

■ Check that the entity is entitled to an Australian business

number (ABN).

■ Print clearly using a black or dark blue pen.

■ Use BLOCK LETTERS and print one character in each box.

S M I T H S T

■ Place

X

in all applicable boxes.

■ Do not use correction fluid or covering stickers.

■ Do not use pins or staples to attach documentation.

IN-CONFIDENCE — when completed

Page 2

Section B: Address details

7 Does the entity have a tax fi le number (TFN)?

We may issue a TFN whenever it is necessary to do so under Australian tax laws.

No

Does the entity want to apply for a TFN?

Yes

Provide the TFN

No Yes

You are not required by law to quote a TFN, but quoting it will reduce the risk of administrative error or delays to this

registration. For more information see page 14 of the Instructions.

8 Where is the entity’s main business location or address?

This must be a street address, for example, 123 Smith St.

This cannot be a post offi ce box number, roadside mail bag, roadside delivery or other delivery point address.

Suburb/town/locality

Country if not Australia

State/territory Postcode

See Instructions page 5

Suburb/town/locality

Country if not Australia

State/territory Postcode

9 What is the entity’s postal address for service of notices and correspondence?

This is the address where government departments and agencies will send notices and correspondence.

The address will also be made publicily available on Super Fund Lookup at www.business.gov.au

As above If the entity’s postal address is the same as the business address, cross this box.

See Instructions page 5

10 What is the entity’s email address for service of notices and correspondence?

This is the address where government departments and agencies may send notices and correspondence.

Provide only one email address.

See Instructions page 5

6 What is the entity’s other name (if applicable)?

This ‘other name’ is not the name referred to in question 5. It is an additional name by which the entity may be commonly known, for

example, a name that is used in advertising.

As above If this name is the same as the name provided at question 5, cross this box.

If you want to add more than one name, provide the details on a separate sheet of paper and include with this application. Include the

name of the entity that is applying for this ABN (as provided at question 5) on each sheet. Title the additional sheets of paper with the

heading ‘Additional other names to be added’.

▲ Detach form here ▲

IN-CONFIDENCE — when completed

Page 3

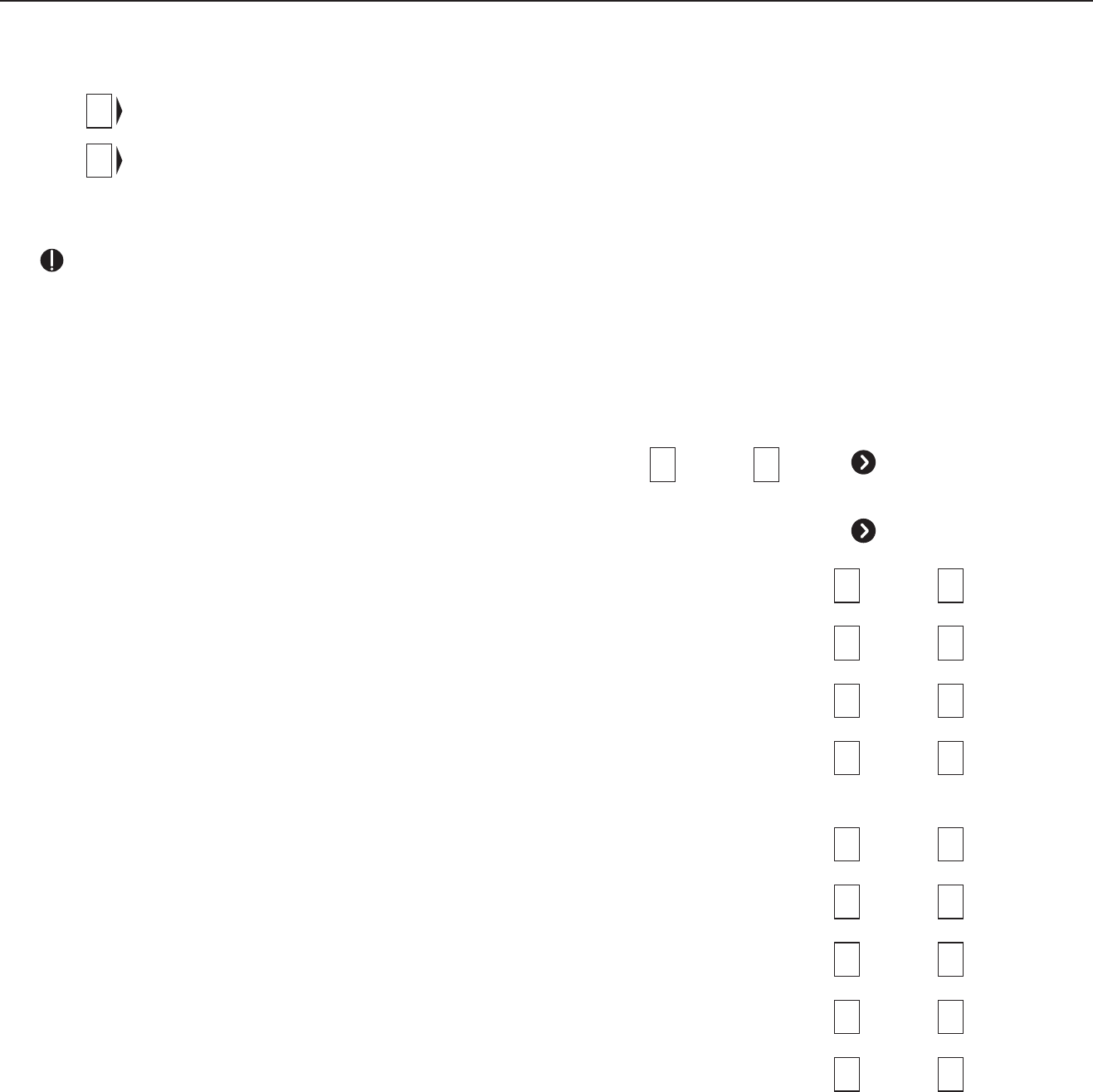

Section C: Contact details

11 Who is the authorised contact person for the entity?

Provide details of a person who may be contacted for further information. They must be authorised to make changes or update

information on behalf of the entity, for example, a registered tax agent.

Family name

Preferred name

Position held

Title: Mr Mrs Miss Ms Other

Business hours phone number

Mobile phone number

After hours phone number

Facsimile number

Email address of contact person (use BLOCK LETTERS)

Preferred language, if other than English. We may not be able to speak to the contact person in their preferred language.

13 Does the entity want to nominate more than one authorised contact?

No

Yes

Provide these details on a separate sheet of paper:

■

title each page with ‘Add authorised contacts’

■

the legal name of the entity that is applying for this ABN (as provided at question 2) on each page

■

all information we request at questions 11 and 12.

See Instructions page 6

12 If the entity’s registered tax agent is the authorised contact,

provide their registration number.

IN-CONFIDENCE — when completed

Page 4

16 In which states or territories does the entity have locations? (Place in all applicable boxes.)

X

Queensland

Australian Capital TerritoryNorthern TerritoryTasmaniaSouth Australia

VictoriaNew South WalesAll Western Australia

Section D: Entity activity details

15 Does the entity have more than one location in Australia?

No

Go to question 17.

Yes

14 On what date did the entity come into existence?

This is the date the trust is executed and property is set apart for benefi ciaries. It cannot be a future date.

Day Month Year

See Instructions page 6

Yes

17 Is the entity owned or controlled by Commonwealth,

state, territory or local government?

No

See Instructions page 6

Yes

18 Is the entity an Australian superannuation fund for tax purposes?

No

See Instructions page 6

▲ Detach form here ▲

IN-CONFIDENCE — when completed

Page 5

Section E: Goods and services tax (GST)

Entities cannot register for GST if they are not carrying on an enterprise.

Some entities are required by law to register, while others may choose to voluntarily register for GST.

You should read GST for small business (NAT 3014) if you are unfamiliar with GST.

For information on how to get this guide, see ‘Useful products and services’ on page 15 of the Instructions.

19 Is the entity required by law to register for GST?

An entity is required to register if it:

■

is carrying on an enterprise and its GST turnover (see page 7 of the Instructions for question 22) is $75,000 or more ($150,000 or

more if the entity is a non-profi t organisation)

■

supplies taxi or limousine travel for fares

■

is a representative of an incapacitated entity (where the incapacitated entity is registered or required to be registered), or

■

is a resident agent acting for a non-resident (where the non-resident is registered or required to be registered).

No

Go to question 21

Yes

20 If the entity is not required to register for GST, is the entity

volunteering to register?

An entity which is not required by law to register for GST can choose to register voluntarily for GST if it is carrying on an enterprise, or

intends to carry on an enterprise in the near future.

No

Go to Section G: Associates of the entity

Yes

See Instructions page 7

22 What is the entity’s GST turnover? (Place in one box only.)

The entity’s GST turnover is the greater of its current and projected GST turnovers.

■

Current GST turnover – the value of all supplies made or likely to be made in the current month plus the previous 11 months

■

Projected GST turnover – the value of all supplies made or likely to be made in the current month plus the next 11 months.

$0 to

$74,999

$75,000 to

$149,999

$150,000 to

$1,999,999

$2 million to

$19,999,999

$20 million

and over

X

See Instructions page 7

24 Does the entity intend to account for GST on a cash basis or non-cash (accruals) basis?

■ Cash basis – the entity accounts for the GST on its sales when it receives payment for them.

■ Non-cash (accruals) basis – the entity will account for GST on its sales when it has issued

an invoice or received any part of the payment, whichever occurs fi rst.

Cash Non-cash (accruals)

Not all entities are allowed to account for GST on a cash basis.

You must read page 8 of the Instructions before nominating the cash basis.

See Instructions page 8

Monthly Quarterly

See Instructions page 8

23 How often will the entity lodge its activity statements?

If the entity’s GST turnover is:

■

$20 million or more, it must lodge electronically each month (provide an email address at question 10).

■

less than $20 million, it can choose to lodge monthly or quarterly.

An entity that is registering voluntarily can choose to lodge either monthly, quarterly or annually.

Annually

25 Does the entity import goods or services into Australia?

No Yes

You may be eligible to defer GST on imports, see Instructions on page 9.

21 What is the entity’s date of registration for GST?

If an entity is required by law to register for GST, its date of registration is the date that:

■

its GST turnover met or exceeded the registration turnover threshold of $75,000 (or $150,000 for non-profi t organisations).

The turnover threshold is GST-exclusive

■

it commenced supplying taxi or limousine travel for fares

■

it commenced representation of an incapacitated entity, or

■

it commenced in its capacity as a resident agent for a non-resident.

An entity that is voluntarily registering for GST, can choose its date of registration.

Day Month Year

The date of registration for GST cannot be before the ABN registration date provided at question 14.

Date of registration

See Instructions page 7

See Instructions page 7

IN-CONFIDENCE — when completed

Page 6

Section F: Financial account details

26 What are the entity’s fi nancial institution account details for ATO refunds?

Refunds will only be paid directly into a recognised fi nancial institution account located in Australia. The

account details provided must be held by:

■ the entity (solely or jointly)

■ the entity’s registered tax agent, or

■ a legal practitioner acting as trustee or executor for the entity.

If you do not provide these details we cannot refund money owed.

BSB code (must be 6 digits) Account number

Full account name – for example, ABC Superannuation Fund. Do not show the account type, such as cheque, savings, mortgage offset.

Is the account held by:

the entity

the entity jointly

with others

a registered tax

agent for the entity

a legal practitioner as trustee

or executor for the entity

If the account you wish to nominate for refunds is not one of the four complying account options presented above, you can request

the Commissioner of Taxation to exercise his discretion to pay electronic funds into the account of a third party. For more information,

phone 13 28 66 between 8.00am and 6.00pm, Monday to Friday.

▲ Detach form here ▲

IN-CONFIDENCE — when completed

Page 7

Yes

28 Is the entity a self-managed superannuation fund?

No

Go to question 31.

29 Is there an individual trustee who is a legal personal representative, parent or

guardian acting on behalf of a member under a legal disability?

No Yes

30 Is there a director of a corporate trustee who is a legal personal representative,

parent or guardian acting on behalf of a member under a legal disability?

No Yes

Section G: Associates of the entity

These questions collect information about all corporate trustees and individuals associated with the entity.

All entities must provide details of their corporate trustees, individual trustees or legal representatives. Self-managed superannuation

funds must also provide details of all their members and the directors of their corporate trustees.

If this section is not completed correctly, we may return the form to you which will delay processing.

Trustee disclosure

Self-managed superannuation funds must also complete the trustee disclosure questions at Section I.

TFN disclosure

We are authorised by the Taxation Administration Act 1953 to ask for TFNs. You do not have to provide a TFN. However, providing a

TFN reduces the risk of administrative error and any delays to the processing of this form. If we cannot identify an associate from the

information you provide, we may contact you for more information.

If an individual who is a trustee, member or director chooses not to disclose their TFN, they must provide on a separate sheet of

paper their full name, residential address, sex and date of birth with the application. Title the separate sheet of paper with the heading,

‘Details of individual’.

If a corporate trustee chooses not to disclose its TFN, it must provide its business address and the date it commenced, registered

or became incorporated on a separate sheet of paper and include with this application. Title the separate sheet of paper with the

heading, ‘Details of corporate trustee’.

Ensure that any additional sheets of paper include the name of the entity that is applying for an ABN.

See Instructions page 9

27 Does the entity have a corporate trustee?

No

Provide details below

Yes

Full name of the corporate trustee

ACN/ARBN

Corporate trustees must provide their Australian Company Number (ACN) or

Australian Registered Body Number (ARBN).

See Instructions page 10

Tax file number

Refer to tax fi le number disclosure above.

A legal personal representative does not include a registered tax agent or accountant unless they meet the

defi nition on page 9 of the instructions.

IN-CONFIDENCE — when completed

Page 8

31 Who are the individuals associated with the entity?

Individuals associated with the entity must be provided here.

Individuals include:

■ trustees

■ members of the self-managed superannuation fund

■ directors of the corporate trustee (for self-managed superannuation funds only)

■ legal personal representatives.

See Instructions page 10

All position/s held (place in all applicable boxes)

Director of the

corporate trustee

Individual trustee

Member of self-managed

superannuation fund

Legal personal

representative

Family name

First given name Other given names

FemaleMaleSex:

Title: Mr Mrs Miss Ms Other

Date of

birth:

Day Month Year

X

Individual’s TFN (refer to the TFN disclosure on page 7 of this form)

All position/s held (place in all applicable boxes)

Director of the

corporate trustee

Individual trustee

Member of self-managed

superannuation fund

Legal personal

representative

Family name

First given name Other given names

FemaleMaleSex:

Title: Mr Mrs Miss Ms Other

Date of

birth:

Day Month Year

X

Individual’s TFN (refer to the TFN disclosure on page 7 of this form)

All position/s held (place in all applicable boxes)

Director of the

corporate trustee

Individual trustee

Member of self-managed

superannuation fund

Legal personal

representative

Family name

First given name Other given names

FemaleMaleSex:

Title: Mr Mrs Miss Ms Other

Date of

birth:

Day Month Year

X

Individual’s TFN (refer to the TFN disclosure on page 7 of this form)

All position/s held (place in all applicable boxes)

Director of the

corporate trustee

Individual trustee

Member of self-managed

superannuation fund

Legal personal

representative

Family name

First given name Other given names

FemaleMaleSex:

Title: Mr Mrs Miss Ms Other

Date of

birth:

Day Month Year

X

Individual’s TFN (refer to the TFN disclosure on page 7 of this form)

If you need to provide information for more individuals associated with the entity, provide the relevant details on a separate sheet of

paper and include with this application. Ensure that any additional pages include the name of the entity that is applying for this ABN.

IN-CONFIDENCE — when completed

Page 9

Section H: Notice of election

If there is insuffi cient space, provide each of the additional individual trustee signatures on a separate sheet of paper and include with

this application. Ensure that any additional sheets of paper include the name of the entity that is applying for an ABN.

Individual trustees

Date

Day Month Year

Date

Day Month Year

Date

Day Month Year

Date

Day Month Year

Date

Day Month Year

Date

Day Month Year

Corporate trustees

Signed and dated by, or on behalf of, the body corporate in a

way that is effective in law, and that binds the body corporate.

Date

Day Month Year

Common seal of corporation

See ‘Corporate trustees’

in the Instructions page 11

Date

Day Month Year

The date cannot be prior to the date the entity came into existence (provided at question 14).

Each individual trustee must sign and date below.

32 Is the entity electing to be regulated under the Superannuation Industry

(Supervision) Act 1993?

No

Go to Section J: Declaration

Yes

Complete this section

I/We, the trustee/s or director/s or secretary of the corporate trustee of

Name of entity (as provided at question 5)

elect that the Superannuation Industry (Supervision) Act 1993 is to apply in relation to the superannuation entity, and understand that the

election is irrevocable.

See Instructions page 11

X

Indicate the basis on which the entity is regulated (place in one or both boxes as appropriate)

Pensions power

The governing rules provide that the sole or primary purpose of the entity is the provision of age pensions.

Corporations power

The entity trustee is a constitutional corporation pursuant to a requirement contained in the governing rules.

and/or

This notice of election must be made if entities are electing to be regulated under the Superannuation Industry (Supervision) Act 1993

and are eligible for tax concessions.

If there is insuffi cient space, provide each of the additional director signatures on a separate sheet of paper and include with this

application. Ensure that any additional sheets of paper include the name of the entity that is applying for an ABN.

IN-CONFIDENCE — when completed

Page 10

Section I: Self-managed superannuation fund trustee disclosure

33 Is the entity a self-managed superannuation fund?

No

Go to Section J: Declaration

Yes

Complete this section

These questions must be answered on behalf of all individual trustees, legal representatives, corporate trustees and responsible

offi cers of corporate trustees.

The following questions help us determine your eligibility to be an individual trustee, legal representative, a corporate trustee, or a

responsible offi cer of a corporate trustee of a self-managed superannuation fund.

Privacy

We are authorised by the Superannuation Industry (Supervision) Act 1993 to collect the information in this section. This information

will be used to assess a person’s eligibility to be an individual trustee, a corporate trustee or a responsible offi cer of a corporate trustee

of a self-managed superannuation fund. This information will only be disclosed where permitted by law. Agencies we routinely disclose

this information to include APRA and the Australian Securities & Investments Commission.

34 Does the fund intend to be a self-managed

superannuation fund for 12 months or longer?

No Yes

See Instructions page 11

35 Trustee disclosure supplementary questions

Individual trustees of a self-managed superannuation fund

No

Yes

Have any of the trustees been convicted of an offence in respect of dishonest conduct

in the Commonwealth or any state, territory or foreign country?

No

Yes

Has a civil penalty order ever been made in relation to any of the trustees?

No

Yes

Are any of the trustees an undischarged bankrupt?

No

Yes

Have any of the trustees been notifi ed that they are a disqualifi ed person by a Regulator

(APRA or the Commissioner of Taxation)?

Corporate trustee of a self-managed superannuation fund

No

Yes

Does the company know or have reasonable grounds to suspect that a person who is,

or is acting as, a responsible offi cer of the body corporate is a disqualifi ed person?

No

Yes

Has a receiver, or a receiver and manager, of the company been appointed?

No

Yes

Has the company been placed under offi cial management?

No

Yes

Has a provisional liquidator of the company been appointed?

No

Yes

Is the company being wound-up?

See Instructions page 11

IN-CONFIDENCE — when completed

Page 11

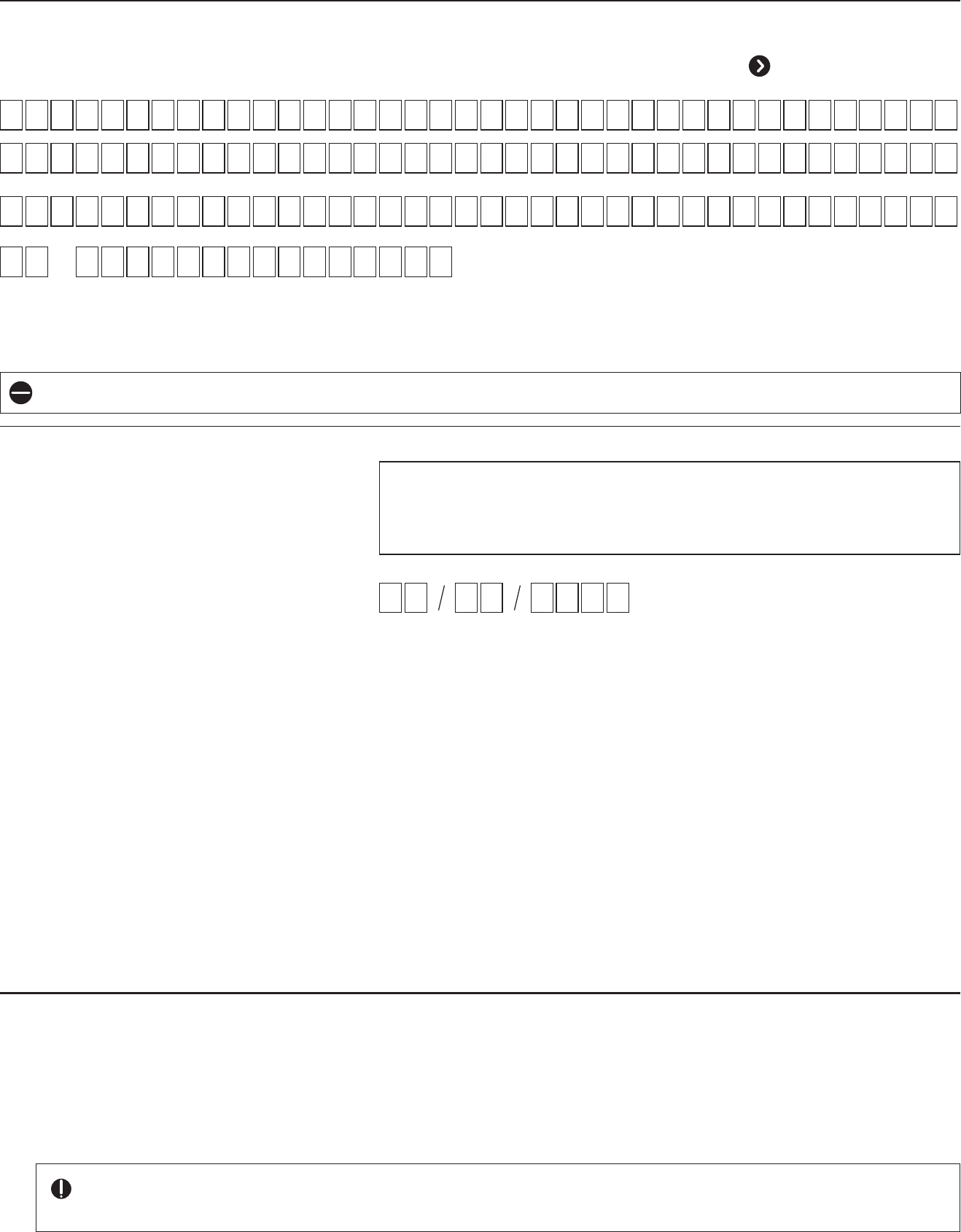

Make a copy of your application for your own records before you send it to:

Australian Business Register

PO Box 3373

PENRITH NSW 2740

We will aim to process this form within 28 days of receiving all the necessary information. If your form is incomplete, incorrect

or needs checking, it may take longer. We appreciate your patience, do not lodge another application during this time.

Lodging this form

Section J: Declaration – must be completed by an individual authorised by the entity

Position held (for example, trustee of the entity or a director or secretary of the corporate trustee)

Full name of signatory

Business hours phone number

36 Who is the authorised person signing this declaration? (Complete all of the fi elds below.)

Before you sign this form

Make sure you have answered all the relevant questions correctly and read the privacy statement below before you sign and date this page.

An incomplete form may delay processing and we may ask you to complete a new application.

We may impose penalties for giving false or misleading information.

Signature

I declare that:

■

I am authorised by the fund or trust to complete

this application on its behalf

■

the information given on this application is true

and correct

■

where the entity is a self-managed

superannuation fund, I am aware that all new

trustees or directors of the corporate trustee

appointed after 30 June 2007 must sign a trustee

declaration within 21 days of them becoming a

trustee or director of the corporate trustee of the

fund (see instructions page 3).

Day Month Year

You MUST SIGN here

See Instructions page 12

Privacy

We are authorised by the Australian Prudential Regulation Authority Act 1998, the Superannuation Industry (Supervision) Act 1993 and

taxation laws, including the Income Tax Assessment Act 1936, A New Tax System (Australian Business Number) Act 1999 and A New Tax

System (Goods and Services Tax) Act 1999 to collect the information requested on this form. We need this information to help us

administer these Acts and to help us maintain the details relating to you that are recorded in the Australian Business Register (ABR) and

other ATO systems.

Where authorised by law to do so, we may give this information to other government agencies including, law enforcement and assistance

agencies. Selected ABR information may be made publicly available and some may be passed to Commonwealth, state, territory and local

agencies, authorised by law to receive it.

You can find a list of these agencies at www.abr.gov.au or you can phone us on 13 28 66 between 8.00am and 6.00pm, Monday to Friday

and have a list of agencies sent to you.

Further details are provided on page 13 of the Instructions.