Fillable Printable Application for Disability Benefits - Quebec

Fillable Printable Application for Disability Benefits - Quebec

Application for Disability Benefits - Quebec

Application for Disability Benefits

Information

Disability benefits

If you are under age 65, have sufficiently contributed to the

Québec Pension Plan and are disabled, you could be entitled

to disability benefits under the Plan. There are two pensions:

the disability pension;

the pension for a disabled person’s child.

The Régie des rentes du Québec can deem you to be disabled

if your disability is severe and if it prevents you from doing any

type of work on a full-time basis. In addition, your disability

must be permanent, which means it is of indefinite duration

with no possibility of improvement.

However, if you are between ages 60 and 65 and your state

of health prevents you from doing the usual work you left when

you became disabled, you could be entitled to a disability

pension. You will have to prove that you recently worked,

that is, that you contributed to the Plan for at least four of

the last six years in your contributory period. The contributory

period ends in the year in which the Régie deems a person

to be disabled.

If you are under 65 years of age, a beneficiary of a

retirement pension under the Québec Pension Plan and

we can no longer cancel your retirement pension, you could

receive an additional amount for disability if you are unable to

do any type of work on a full-time basis. Note that you must

show that you recently worked.

Important: You must notify the Régie if you return to

work while your application for disability benefits is being

studied.

Disability pension or additional amount

for disability

A disability pension or an additional amount for disability is:

payable as of the fourth month following the one in

which the Régie considers a person to be disabled.

Thus, a person who is deemed to be disabled as

of January receives a first pension payment in May.

The last payment is made in the month of the person’s

65th birthday. The disability pension is automatically

replaced by a retirement pension at that time;

increased each year in January, according to the cost

of living;

subject to income tax.

Pension for a disabled person’s child

If you are granted a disability pension, your children could

be entitled to a pension for a disabled person’s child until

age18, if an application is filed.

1

They are eligible for the

pension if they:

are your biological or adopted children; or

have been living with you for at least one year and you

serve as mother or father to them.

Children are not eligible for this pension if they were

placed in your home in foster care and you are receiving

amounts for them.

The pension for a disabled person’s child is paid on a

priority basis to the disabled person who provides for the

children’s needs. Otherwise, the pension is paid to the person

responsible for the children. Regardless of who is receiving

the pension for a disabled person’s child, it does not reduce

the amount of the disability pension.

The pension for a disabled person’s child is paid monthly.

Payment ends when the child turns 18 or the disability pension

stops being paid. The person receiving the pension must notify

the Régie if he or she is no longer responsible for the children.

Impact on other benefits

If you are already receiving a surviving spouse’s pension under

the Québec Pension Plan, that pension could be reduced

once a disability pension becomes payable. Please note that

you cannot receive disability benefits under the Plan if you

are already receiving disability benefits under the Canada

Pension Plan.

The Régie’s criteria for determining if a person is disabled

are not the same as those of the Commission de la santé et

de la sécurité du travail (CSST), the Société de l’assurance

automobile du Québec (SAAQ) or the Ministère de l’Emploi

et de la Solidarité sociale. The criteria used by insurance

companies may also differ from those of the Régie.

If you receive or expect to receive benefits from other public or

private sources, you should find out from those other sources

whether or not receiving disability benefits under the Québec

Pension Plan would cause such benefits to be reduced.

1

Children for whom an orphan’s pension or a pension for a disabled person’s

child is already being paid under the Québec Pension Plan or the Canada

Pension Plan are not entitled to a second pension.

A pension for a disabled person’s child is not payable where a beneficiary

of a retirement pension is receiving an additional amount for disability.

Continued on other side

B-071-1A (14-01)

How to apply

Fill out the form and return it to the Régie immediately. Do not

wait for the Medical Report. The date the Régie receives

your application may affect the date you begin receiving

your benefits, since the maximum retroactivity possible

is 12months from the date we receive the application, even

if you were disabled before that time.

You must have the Medical Report completed by your

physician. Be sure to ask him or her to send it back to the

Régie as soon as possible. Your physician may charge you

a fee for filling out the Medical Report. You are responsible

for paying that fee.

Work outside Canada

If you participated in a social security plan in another country,

you could be entitled to a pension under that plan. Benefits

paid under the Québec Pension Plan are not reduced if you

are receiving a pension from another country.

Instructions – Application for Disability

Benefits

1. Answer all the questions on the Application for Disability

Benefits and sign it.

2. Fill out and sign the Consent Regarding the Release

of Medical, Psychosocial and Administrative

Information.

3. Include a copy of all medical reports and test results that

you have in your possession that concern your disability.

(Do not send X-ray films.)

4. Be sure to use sufficient postage, and mail it to the

following address as soon as possible:

Régie des rentes du Québec, Case postale 5200

Québec (Québec) G1K 7S9

Instructions – Medical Report form

1. You (the applicant) must fill out section 1 of the Medical

Report, Information about the applicant’s identity.

2. Have the other sections completed by your physician.

He or she will send the report directly to the Régie.

Access to documents held by public bodies

and the protection of personal information

The information requested on this form is needed in order

for the Régie to study your application. Failure to provide the

information may result in delays in processing the application

or in the application being rejected. Only authorized

employees at the Régie will have access to the information.

The information can be provided to other persons or agencies

or verified with them only in the cases provided for by law. It

could also be used for research, assessments, enquiries or

surveys. Under the Act respecting Access to documents held

by public bodies and the Protection of personal information,

you may consult the information and have your personal

information corrected.

Time required to render a decision

In our Service Statement, we are committed to replying to

an application for disability benefits within a maximum of

150days, if the information received initially is sufficient to render

a decision. However, three times out of four, applicants did not

have to wait more than 82days (results obtained between

November2012 and October2013). The time period begins

once we have received your application and the Medical Report.

In addition, to check the status of your application, consult the

My Account online service at any time.

Main steps in processing your application

When processing your application for disability benefits, the

Régie will carry out the following steps:

When your application is received, it will be studied.

Your application will be checked against administrative

criteria in order to determine your eligibility for benefits

under the Québec Pension Plan (the number of years

you contributed to the Plan, the date you stopped

working, etc.). Any missing information will be obtained,

as required.

If you are eligible from an administrative standpoint, your

application moves on to the next steps:

Your file will be sent to the Régie’s medical advisors.

The medical information in your application and the

Medical Report will be verified. In order to complete

your medical file, additional medical information may

be obtained, as required, from your attending physician,

medical specialists, hospitals, insurance companies

or government agencies with which you have been

in contact.

A medical advisor at the Régie will review your medical

file to determine whether you can be deemed to be

disabled under the Act respecting the Québec Pension

Plan. Under certain circumstances, you may be asked

to undergo a medical examination.

The Régie will render a decision with regard to your

application.

For more information

Online

By telephone

Québec region: 418 643-5185

Montréal region: 514 873-2433

Toll-free: 1 800 463-5185

B-071-1A (14-01)

1

area codearea code

year month day

Application for Disability Benefits

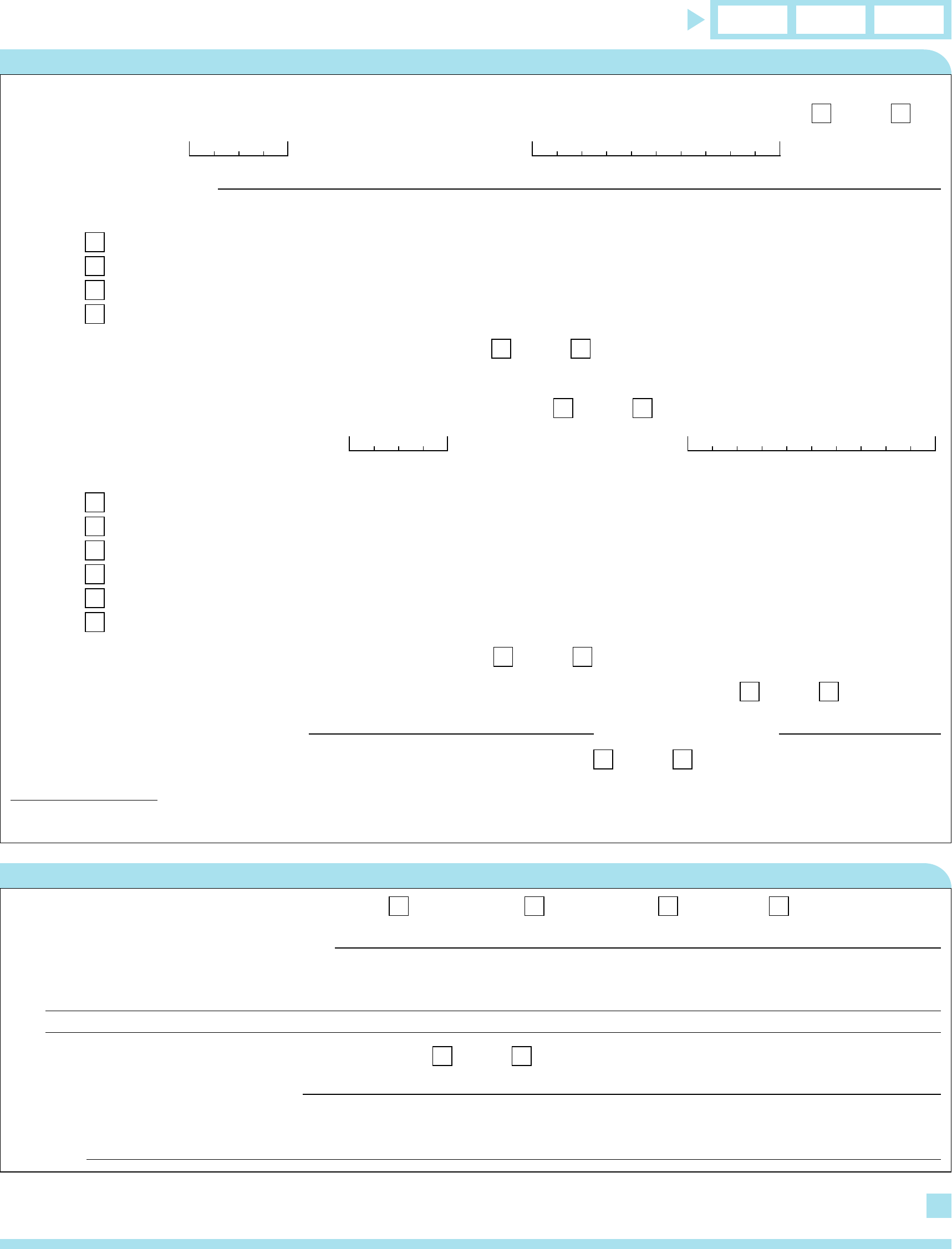

1. Identification

Indicate your social insurance number

2. Participation in other plans

Régie des rentes du Québec B-071A (14-01)

0100002 LE

Sex Family name Given name

Family name at birth, if different Given name at birth, if different

Date of birth Place of birth (

city, province, country)

Your mother’s family name at birth Your mother’s given name

Your father’s family name Your father’s given name

Language of correspondence French English

Your address (number, street, apt.)

City Province Country Postal code

Telephone

Home Other Extension

If you live outside Canada, what was your last province of residence in Canada?

Please print

Have you ever participated in the social security plan of another country? Yes No

If so, in which country or countries?

Please indicate your foreign social insurance numbers.

Important: You must provide your social insurance number where requested to avoid delays in processing your application.

If you need more space, use a separate sheet. Be sure to indicate your social insurance number on it and indicate the number

of the question to which the information pertains.

Please complete the form and return it to:

Régie des rentes du Québec, Case postale 5200, Québec (Québec) G1K 7S9

F

M

2

Child born

outside

Canada

Child born

outside

Canada

Child born

outside

Canada

Child born

outside

Canada

year month day

year month day

year month day

year month day

year month

year month

year month

year month

year month

year month

year month

year month

year month

year month

year month

year month

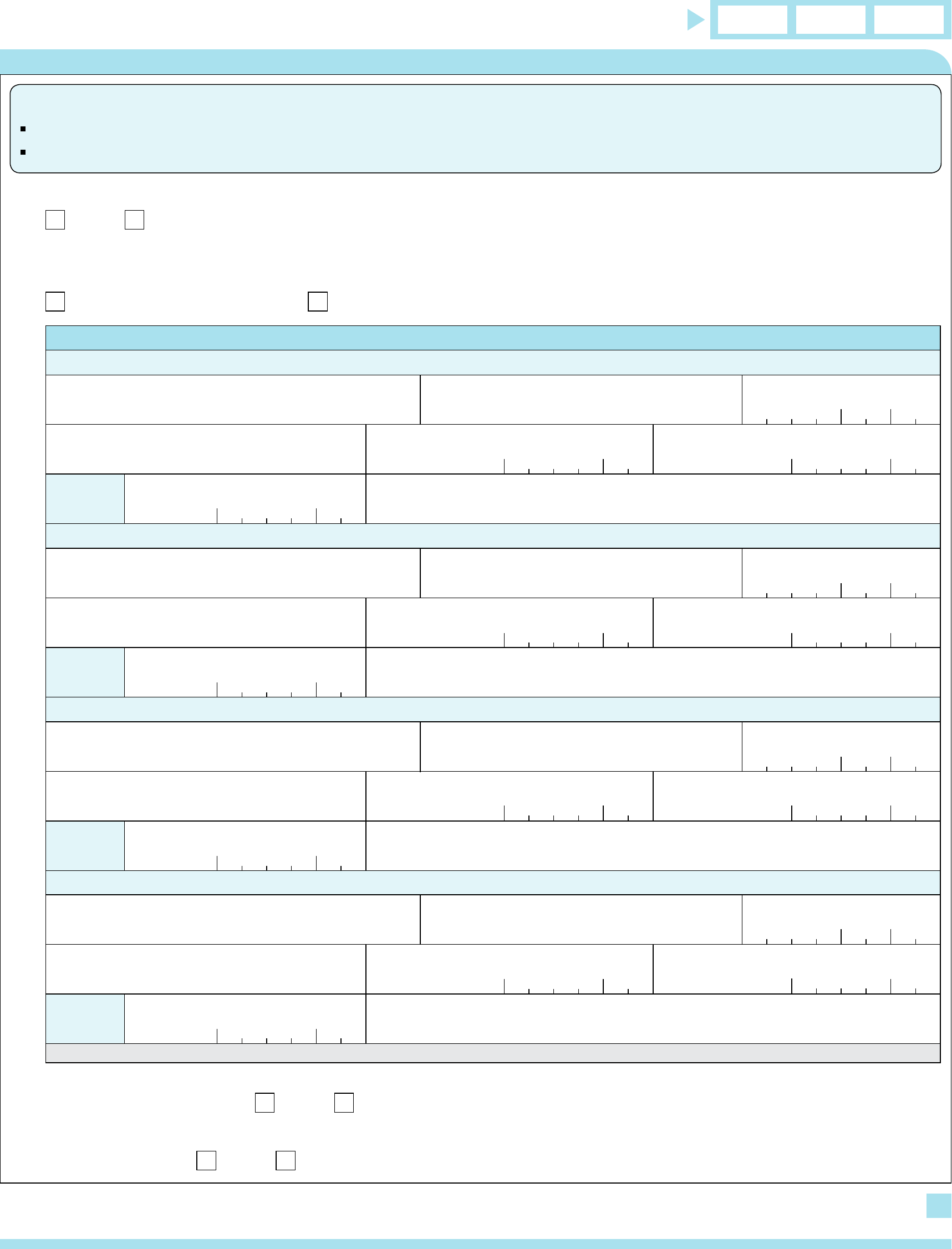

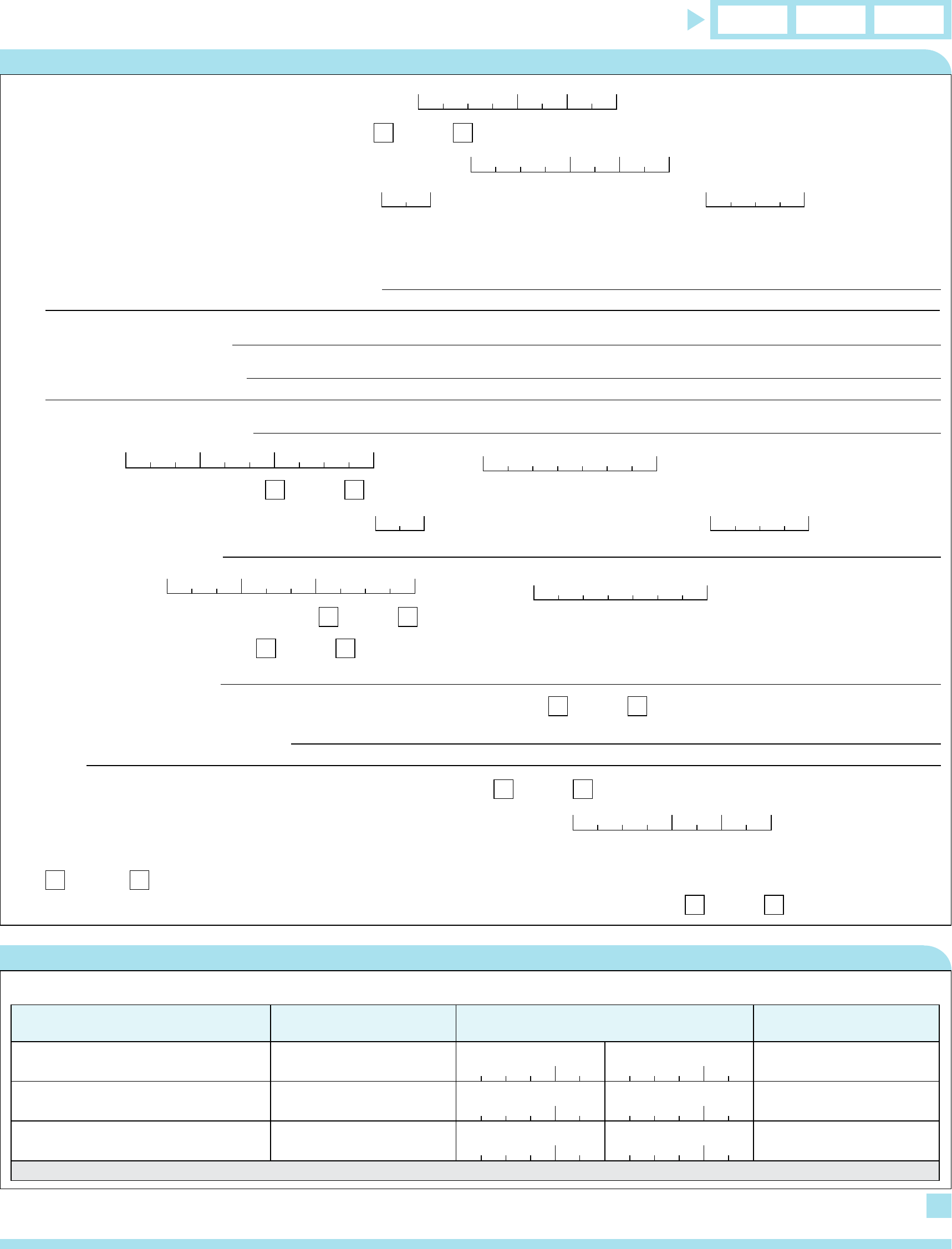

3. Information about your children

Régie des rentes du Québec B-071A (14-01)

3.1 Did you have children or become responsible for any children?

Yes No. Go to section 4.

3.2 Did you receive family benefits paid in your name for any children OR, if you did not, was it because your family income was

too high? (Benefits are usually paid to the mother.)

Yes. Complete the following. No. Go to section 4.

Information about your children

1st child

Family name at birth Given name Date of birth

Place of birth (province, country)

Date of adoption or date child became

Date of death (if child died before age 7)

(i

your dependent

f applicable)

Date of arrival in Canada Province of residence at time of arrival in Canada

2nd child

Family name at birth Given name Date of birth

Place of birth (province, country)

Date of adoption or date child became

Date of death (if child died before age 7)

(i

your dependent

f applicable)

Date of arrival in Canada Province of residence at time of arrival in Canada

3rd child

Family name at birth Given name Date of birth

Place of birth (province, country)

Date of adoption or date child became

Date of death (if child died before age 7)

your dependent

(if applicable)

Date of arrival in Canada Province of residence at time of arrival in Canada

4th child

Family name at birth Given name Date of birth

Place of birth (province, country)

Date of adoption or date child became

Date of death (if child died before age 7)

y

(if

our dependent

applicable)

Date of arrival in Canada Province of residence at time of arrival in Canada

If there are more than four children, provide the additional information on a separate sheet.

3.3 Between the birth and the 7th birthday of each of these children, were there any periods during which family benefits were

not paid in your name? Yes No

3.4 Between each child’s birth or arrival in Canada and that child’s 7th birthday, did each of these children always live with

you in Canada? Yes No

Certain situations could help you become eligible for benefits or increase the amount:

if you received family benefits for any children (Québec child assistance, Québec family allowance or Canada Child Tax Benefit);

if you were entitled to family benefits but did not receive any because your family income was too high.

Indicate your social insurance number

3

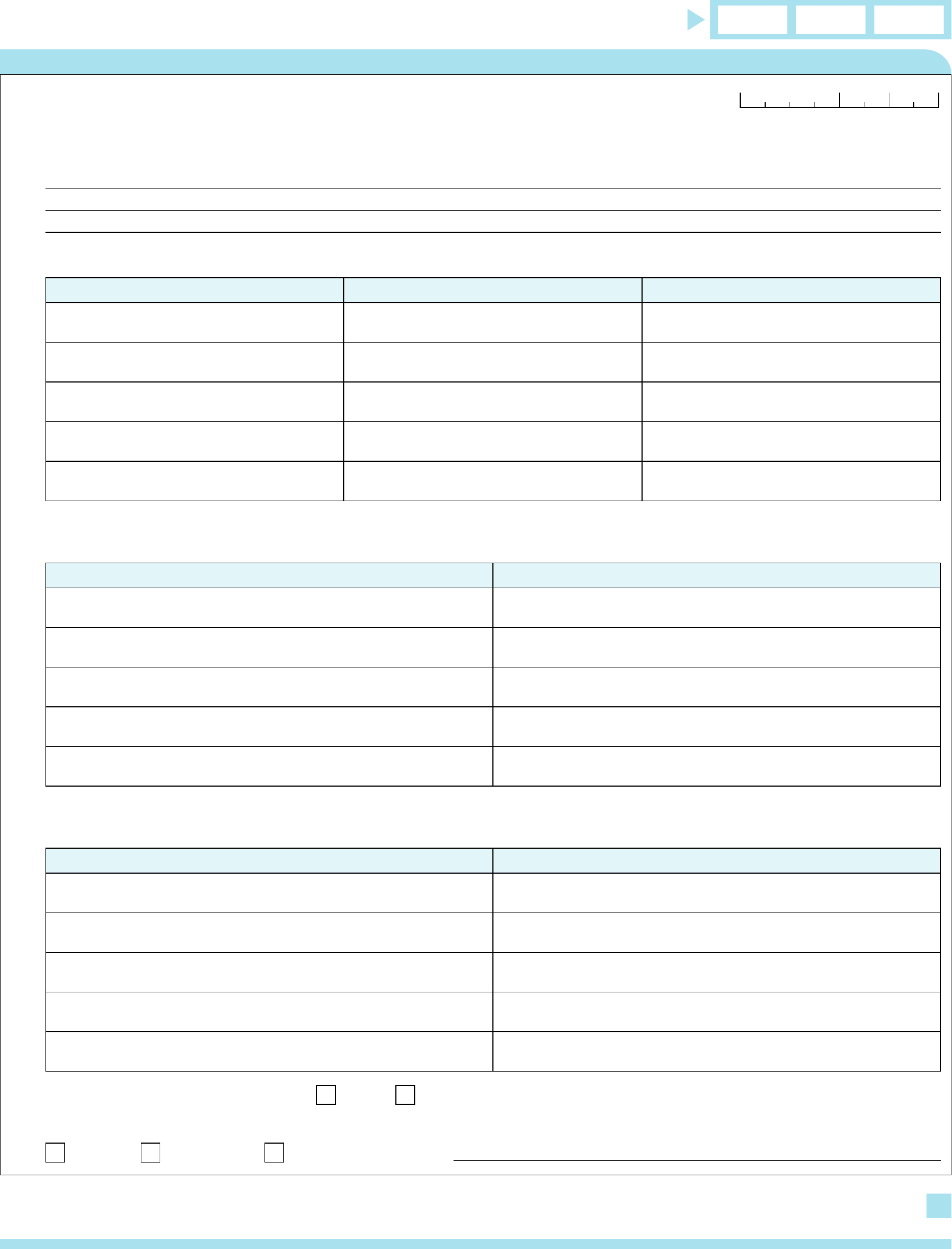

4. Benefits from other agencies

5. Education and training

Régie des rentes du Québec B-071A (14-01)

Indicate your social insurance number

4.1 Have you ever applied for an indemnity from the Commission de la santé et de la sécurité du travail (CSST) following a work-

related accident or an occupational disease (whether or not it was related to your current disability)? Yes No

If so, in what year? Give your CSST file number.

For what reason?

What is the current status of your file at the CSST?

I have not yet received an answer from the CSST.

I am currently receiving an indemnity from the CSST.

I was receiving an indemnity from the CSST but have stopped receiving it.

The CSST rejected my application.

Did the CSST ask for an expert medical opinion?

1

Yes No

4.2 Have you ever applied for an indemnity from the Société de l’assurance automobile du Québec (SAAQ) following an automobile

accident (whether or not it was related to your current disability)? Yes No

If so, in

what year did the accident occur?

Give your SAAQ file number.

What is the current status of your file at the SAAQ?

I have not yet received an answer from the SAAQ.

I am currently receiving an indemnity from the SAAQ.

I have received an indemnity from the SAAQ in the last 12 months but have stopped receiving it.

I was receiving an indemnity from the SAAQ but stopped receiving it more than 12 months ago.

The SAAQ is currently reviewing my application.

The SAAQ rejected my application.

Did the SAAQ ask for an expert medical opinion?

1

Yes No

4.3 Have you ever applied for benefits from an insurance company because of your disability? Yes No

If so, indicate the company’s name. Give your file number.

Did the insurance company ask for an expert medical opinion?

1

Yes No

1

By “expert medical opinion,” we mean an appointment with a physician or a health care professional at the request of a third party (e.g. CSST, SAAQ, insurance

company, employer or other). Unlike the attending physician, the physician or health care professional does not treat the person he or she is asked to examine.

5.1 What level of education did you complete? Elementary Secondary

College University

What is the last diploma you received?

5.2 Please list any other training and development (including workplace training, special interest classes, etc.).

5.3 Do you have a driver’s license in good standing? Yes No

If so, indicate the class or classes:

If there are any restrictions indicated on your license, please list them.

4

6. Work situation

7. Work history

Régie des rentes du Québec B-071A (14-01)

6.1 Date you started your current job or your last job

year month day

6.2 Have you completely stopped working? Yes No

If so, what is the date of the last day you went to work?

year month day

If not, how many hours a week do you work?

Hours

What is your gross weekly salary?

$

Note: If you return to work or your work hours increase before the Régie has finished studying your application for disability benefits,

please notify us.

6.3 Why did you totally or partially stop working?

6.4 What is or was your job?

Briefly describe your work.

Name of your last employer:

Telephone

area code

Extension

6.5 Do you have another job? Yes No

If so, how many hours a week do you work?

Hours

What is your gross weekly salary? $

Employer’s name:

Telephone E

area code

xtension

6.6 Are you currently self-employed? Yes No

6.7 Do you own a business? Yes No

If so, indicate its name:

Are you still involved in any way in the business’s activities? Yes No

If so, what are your duties?

6.8 Have you ever been self-employed or owned a business? Yes No

If so, please give the date the business was sold, dissolved or closed.

year month day

6.9 Have you ever been or are you responsible for a family-type or intermediate resource (foster home or family)?

Yes No

If so, did or do you take in nine or fewer users at your principal place of residence? Yes No

List the other jobs you held before the job described in section 6.

Employer Type of work

Duration

Reason for leaving

year month year month

year month year month

year month year month

If there is not enough space, provide the additional information on a separate sheet.

From To

Indicate your social insurance number

5

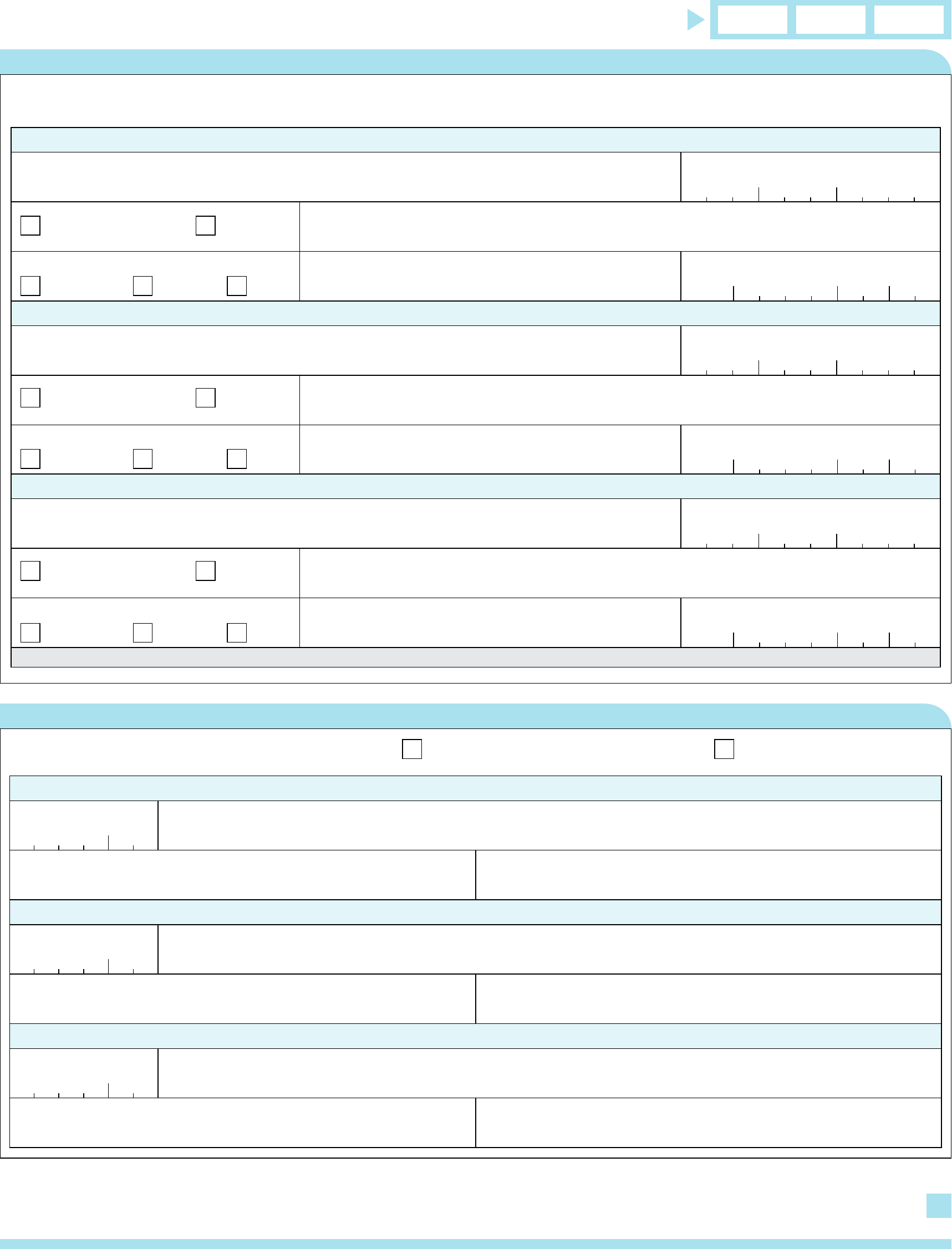

8. Information on your state of health

Régie des rentes du Québec B-071A (14-01)

Indicate your social insurance number

8.1 Since when have you been unable to work on a regular basis because of your state of health?

year month day

8.2 List the illnesses or impairments that prevent you from working or limit you in your work. If you do not know the exact medical

terms, describe the problem in your own words.

8.3 List all the medications that you are currently taking.

Name of the medication The dose you take How often you take it

8.4 Indicate any other treatment (physiotherapy, psychotherapy, etc.) that you are currently receiving and the place where

you are treated.

Treatment Place

8.5 Indicate, if possible, any special tests you have had during the past six months that are related to the health problem

causing your disability (x-rays, treadmill exercise, magnetic resonance imaging, respiratory test, etc.).

Type of test Hospital or clinic where the test was done

8.6 Can you get around without aid? Yes No

If you answered no, which of the following do you use?

Cane Crutches Wheelchair Other:

6

year month

year month

year month

area code

area code

area code

year month day

year month day

year month day

9. Information about your physicians

10. Information on hospital stays

Régie des rentes du Québec B-071A (14-01)

Name the physicians currently caring for you and any physicians you have seen because of your disability. Also indicate the type

and name of the institution at which you consulted the physician.

1st physician

Physician’s name Telephone

Family physician

Specialist

In the case of a specialist, please indicate in which field.

Type of establishment Name of establishment Date you last saw that physician

Hospital CLSC Clinic

2nd physician

Physician’s name Telephone

Family physician

Specialist

In the case of a specialist, please indicate in which field.

Type of establishment Name of establishment Date you last saw that physician

Hospital CLSC Clinic

3rd physician

Physician’s name Telephone

Family physician

Specialist

In the case of a specialist, please indicate in which field.

Type of establishment Name of establishment Date you last saw that physician

Hospital CLSC Clinic

If there is not enough space, provide the additional information on a separate sheet.

Have you been hospitalized in the last five years? Yes. Give the following information. No

1st hospitalization

Approximate date Reason

Name of the hospital Location

2nd hospitalization

Approximate date Reason

Name of the hospital Location

3rd hospitalization

Approximate date Reason

Name of the hospital Location

Indicate your social insurance number

7

Régie des rentes du Québec B-071A (14-01)

year month day

year month day

11. Application for a pension for a disabled person’s child

Indicate your social insurance number

For information on the eligibility requirements, refer to the accompanying information sheet.

11.1 Complete the following for each child for whom you wish to apply for a pension for a disabled person’s child. Be sure to

indicate the child’s social insurance number, if any.

11. 2 Is an orphan’s pension or a pension for a disabled person’s child being paid under the Québec Pension Plan or the Canada

Pension Plan for any of the children named above? Yes No

If so, please indicate under which social insurance number.

11. 3 If the children are yours, but do not live with you, indicate the amounts that you provide each month for their needs (support

payments, if any, school fees, medical or dental expenses, clothing, school supplies, etc.).

$ a month

1st child

Sex Family name at birth Given name Social insurance number

Date of birth Place of birth (city, province, country)

His or her mother’s given and family names at birth His or her father’s given and family names

Child’s address

Same as the disabled person’s address

Other address:

Is this child your biological or adopted child? Yes No

If so, for an adopted child, indicate the date of adoption.

year month day

If not, please indicate when the child began living with you, if applicable.

year month day

If the child does not live with you, please specify the reason.

2nd child

Sex Family name at birth Given name Social insurance number

Date of birth Place of birth (city, province, country)

His or her mother’s given and family names at birth His or her father’s given and family names

Child’s address

Same as the disabled person’s address

Other address:

Is this child your biological or adopted child? Yes No

If so, for an adopted child, indicate the date of adoption.

year month day

If not, please indicate when the child began living with you, if applicable.

year month day

If the child does not live with you, please specify the reason.

If there is not enough space, provide the additional information on a separate sheet.

If the child was born outside Québec,

p

o

rovide proof of birth issued by an officer

f civil status from his or her place of birth.

If the child was born outside Québec,

p

o

rovide proof of birth issued by an officer

f civil status from his or her place of birth.

F

M

F

M

8

year month day

area code area code

year month day

13. Declaration and signature

12. Payment by direct deposit

Please provide your banking information to sign up for direct deposit. Your benefits will be paid directly into your bank account

at a financial institution in Canada.

The account provided must be in your name or that of the beneficiary if you are applying on his or her behalf.

If you already receive a pension from the Régie by direct deposit, your benefits will be deposited in the same bank account.

If so, you do not need to fill out this section.

Name of your financial institution

Address of your financial institution

Branch number

(transit)

Bank or caisse

number

Account number

(folio)

Régie des rentes du Québec B-071A (14-01)

I declare that all information given on this application is true and correct.

I agree to inform the Régie des rentes du Québec if there is any change in my work situation or my state of health between now

and the time a decision is rendered.

Signature Date

If you completed and signed the form for the person applying for the benefits, please provide the following information.

Why was the person unable to complete and sign the application?

Are you related to the applicant?

No Yes

. If so, how?

In what capacity did you sign (guardian, mandatary, etc.)?

Sex Family name Given name

Address (number, street, apt.)

City Province Country Postal code

Telephone

Home Other Extension

If you are an individual, you must also provide the following information:

Your social insurance number

Your date of birth Your mother’s family name at birth

In order to avoid delays in processing your application, be sure you have:

duly completed all sections of the form;

provided your social insurance number where indicated;

signed this form;

completed and signed the enclosed Consent Regarding the Release of Medical, Psychosocial and Administrative

Information form.

F

M

Indicate your social insurance number

0100009 LA

Régie des rentes du Québec B-077A (13-04)

Consent Regarding the Release of Medical, Psychosocial and Administrative

Information

1. Identifi cation

2. Consent and signature

Indicate your social insurance number

Indicate your health insurance number

Sex Family name Given name Date of birth

Family name at birth, if different

Given name at birth, if different

Your mother’s family name at birth Her given name

Your father’s family name His given name

Please print

I am providing consent authorizing any physician, health professional, health care facility or social services institution to release

to the Régie des rentes du Québec any pertinent medical, psychosocial or administrative information concerning me so that the

Régie will have all the information needed to process my application for disability benefi ts.

This consent is also given with respect to my employers, the Commission de la santé et de la sécurité du travail, the Société

de l’assurance automobile du Québec, the Secrétariat du Conseil du trésor, the Secrétariat de la santé et des services sociaux,

the Services conseils aux gestionnaires des réseaux de l’éducation, the Commission administrative des régimes de retraite et

d’assurances as well as any administrator of an insurance plan to which I have applied for benefi ts related to my state of health.

Unless revoked by me in writing, this consent shall be in effect, even in the event of my death, until a final decision is

rendered by the Régie. The consent covers all the medical, psychosocial and administrative information held before the date

of the consent and any obtained between the date of the consent and the date of the fi nal decision.

Signature Date

year month day

Note:

The original consent remains on fi le at the Régie. A certifi ed true copy

of the original shall be considered to be authentic, pursuant to section

25 of the Act respecting the Québec Pension Plan.

year month day

F

M