Fillable Printable Application for Extension for Filing Individual Income Tax Return

Fillable Printable Application for Extension for Filing Individual Income Tax Return

Application for Extension for Filing Individual Income Tax Return

Application for Extension for Filing Individual Income Tax Return

North Carolina Department of Revenue

Mail to: N.C. Department of Revenue

P.O. Box 25000, Raleigh, N.C. 27640-0635

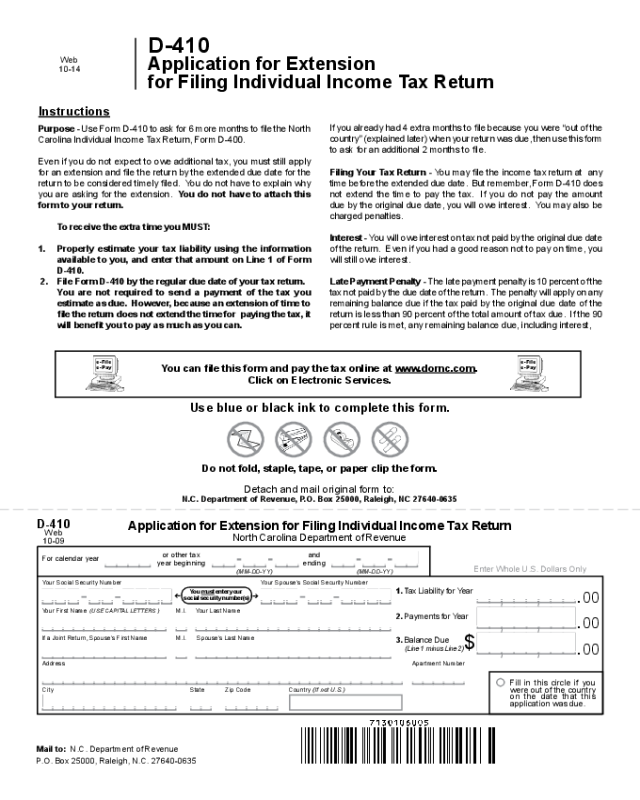

You can le this form and pay the tax online at www.dornc.com.

Click on Electronic Services.

Use blue or black ink to complete this form.

Do not fold, staple, tape, or paper clip the form.

Detach and mail original form to:

N.C. Department of Revenue, P.O. Box 25000, Raleigh, NC 27640-0635

e-File

e-Pay

e-File

e-Pay

Web

10-09

D-410

Enter Whole U.S. Dollars Only

For calendar year

(MM-DD-YY)(MM-DD-YY)

Your Social Security Number Your Spouse’s Social Security Number

You must enter your

social security number(s)

Fill in this circle if you

were out of the country

on the date that this

application was due.

00

.

2. Payments for Year

00

.

1. Tax Liability for Year

00

.

$

3.

Balance Due

(Line 1 minus Line 2)

or other tax

year beginning

and

ending

Your First Name

(USE CAPITAL LETTERS )

M.I. Your Last Name

If a Joint Return, Spouse’s First Name M.I. Spouse’s Last Name

Address Apartment Number

State Zip Code Country (If not U.S.)

City

,

,

,

,

,

,

Instructions

Purpose - Use Form D-410 to ask for 6 more months to le the North

Carolina Individual Income Tax Return, Form D-400.

Even if you do not expect to owe additional tax, you must still apply

for an extension and le the return by the extended due date for the

return to be considered timely led. You do not have to explain why

you are asking for the extension. You do not have to attach this

form to your return.

To receive the extra time you MUST:

1. Properly estimate your tax liability using the information

available to you, and enter that amount on Line 1 of Form

D-410.

2. File Form D-410 by the regular due date of your tax return.

You are not required to send a payment of the tax you

estimate as due. However, because an extension of time to

le the return does not extend the time for paying the tax, it

will benet you to pay as much as you can.

If you already had 4 extra months to le because you were “out of the

country” (explained later) when your return was due, then use this form

to ask for an additional 2 months to le.

Filing Your Tax Return - You may le the income tax return at any

time before the extended due date. But remember, Form D-410 does

not extend the time to pay the tax. If you do not pay the amount

due by the original due date, you will owe interest. You may also be

charged penalties.

Interest - You will owe interest on tax not paid by the original due date

of the return. Even if you had a good reason not to pay on time, you

will still owe interest.

Late Payment Penalty - The late payment penalty is 10 percent of the

tax not paid by the due date of the return. The penalty will apply on any

remaining balance due if the tax paid by the original due date of the

return is less than 90 percent of the total amount of tax due. If the 90

percent rule is met, any remaining balance due, including interest,

Web

10-14

Application for Extension

for Filing Individual Income Tax Return

D-410

Page 2

D-410

Web

10-14

must be paid with the income tax return on or before the expiration of

the extension period to avoid the late payment penalty.

Late Filing Penalty - A penalty is usually charged if your return is led

after the due date (including extensions). It is 5 percent of the tax for

each month, or part of a month, that your return is late (maximum 25

percent).

If you do not le the application for extension by the original due date

of the return, you are subject to both the 5 percent per month late ling

penalty and the 10 percent late payment penalty on the remaining

tax due.

How To Claim Credit For Payments Made With This Form - When

you le your return, include the amount paid with this extension on

Line 21b of Form D-400. If you and your spouse each le a separate

Form D-410, but le a joint return for taxable year, enter the total paid

with the two Forms D-410 on Line 21b of your return.

If you and your spouse jointly led Form D-410, but le separate returns

for the taxable year, you may enter the total amount paid with Form

D-410 on either of your separate returns. Or, you and your spouse may

divide the payment in any agreed amounts. Be sure each separate

return has the social security numbers of both spouses.

Specic Instructions

Name, Address, and Social Security Numbers - Enter your name,

address, and social security number and your spouse’s name and

social security number if ling a joint return.

Line 1 - Enter on this line the amount you expect to enter on Line 15

of Form D-400. If you do not expect to owe tax, enter zero.

Line 2 - Enter on this line any North Carolina income tax withheld,

estimated tax payments (including any overpayment applied from the

previous year), and any other payments and credits you expect to

show on your return.

Out of the Country - If you were a U. S. citizen or resident and were

out of the country on the due date of your return, you are granted an

automatic 4-month extension to le your return. You do not have to

le this form on April 15. Instead, ll in the “Out of the Country” circle

on page 1 of Form D-400 to indicate you were out of the country on

April 15. If you need an additional two months to le your return, ll in

the circle located at the bottom right of this form and le the form on

or before August 15. For this purpose, “Out of the Country” means

either (1) you live outside the United States and Puerto Rico, AND

your main place of work is outside the United States and Puerto Rico,

or (2) you are in military or naval service outside the United States

and Puerto Rico.

Important: Do not use this form to request extensions of time for ling

partnership, estate, trust, corporate income, or franchise tax returns.